24 June 2020 Morning Session Analysis

Positive economic data spurred demand for Euro.

The euro surged to one-week high over the backdrop of the positive economic data from the European region. Besides, the demand for riskier currencies was boosted following the U.S. officially confirmed that the trade deal between U.S and China is remained intact. According to Markit Economics, the Germany Manufacturing Purchasing Managers Index (PMI) spiked up from the preliminary reading of 36.6 to 44.6, confounding market forecast for a reading of up to 41.5. Similarly, the France Manufacturing Purchasing Managers Index notched up from the previous reading of 40.6 to 52.1, unexpectedly much better than the market forecast at 46.0. Such better-than-expected economic data had dialled up the market optimism toward the economic progression in the European region while outweighing against the fears of the second wave coronavirus infections across the globe, which insinuating demand for the euro currency. Moreover, the euro received further bullish momentum amid accelerating risk appetite in the FX market following the U.S. President Donald Trump wrote in a tweet that the deal with China was “fully intact”. As of writing, EUR/USD appreciated by 0.02% to 1.1307.

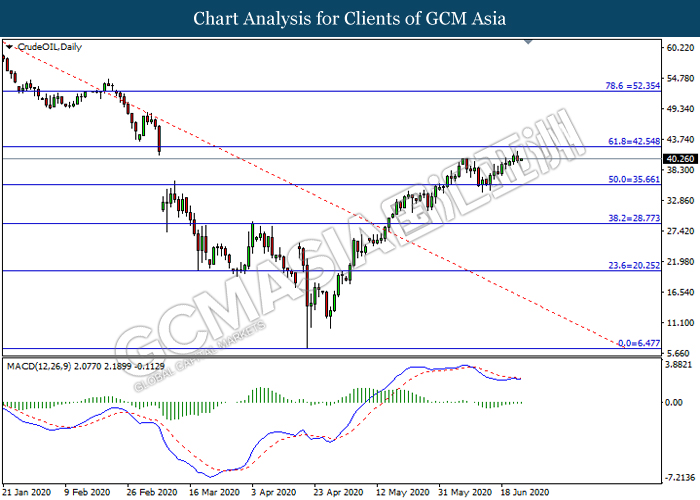

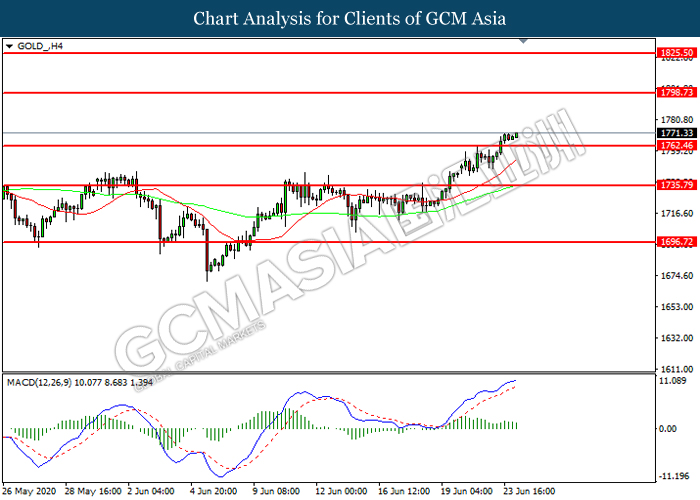

In the commodities market, the crude oil price slumped 0.25% to $40.02 per barrel. The oil market edged lower following the crude oil data was released. According to American Petroleum Institute (API), the crude stockpiles came in at 1.749M, much higher than the market forecast at 0.300M. Nonetheless, at this time investors would scrutinize the crude oil inventory data which will be released tonight in order to gauge the likelihood movement for the commodity. On the other hand, the gold price appreciated by 0.04% to $1768.90 per troy ounces amid the spike of the coronavirus infections in the United States, which stoked a shift in sentiment toward the safe-haven commodity.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

10:00 NZD RBNZ Rate Statement

11:00 NZD RBNZ Press Conference

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 10:00 | NZD – RBNZ Interest Rate Decision | 0.25% | 0.25% | – |

| 16:00 | Euro – German Ifo Business Climate Index (Jun) | 79.5 | 85.0 | |

| 22:30 | CrudeOIL – Crude Oil Inventories | 1.215M | -0.152M |

Technical Analysis

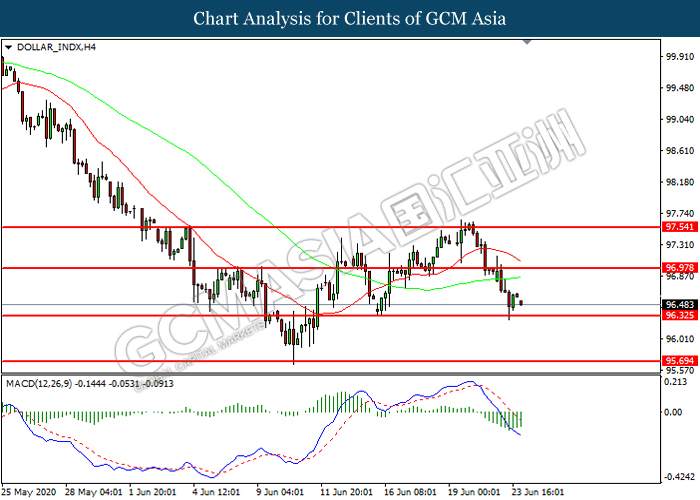

DOLLAR_INDX, H4: Dollar index was traded lower while currently testing the support level at 96.35. However, MACD which illustrated diminishing bearish momentum suggest the index to be traded higher in short-term as technical correction.

Resistance level: 96.95, 97.55

Support level: 96.35, 95.70

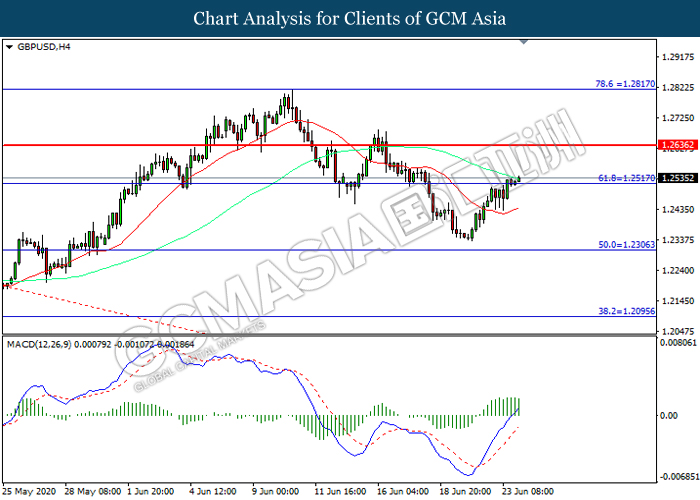

GBPUSD, H4: GBPUSD was traded higher following prior breakout above the previous resistance level at 1.2515. However, MACD which illustrated diminishing bullish momentum suggest the pair to be traded lower in short-term as technical correction.

Resistance level: 1.2635, 1.2815

Support level: 1.2515, 1.2305

EURUSD, Daily: EURUSD was traded higher following prior breakout above the resistance level at 1.1275. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains toward resistance level at 1.1400.

Resistance level: 1.1400, 1.1500

Support level: 1.1275, 1.1170

USDJPY, H4: USDJPY was traded higher following prior rebound from the support level at 106.15. However, MACD which illustrated increasing bearish momentum suggest the pair to be traded lower in short-term as technical correction.

Resistance level: 106.80, 107.45

Support level: 106.15, 105.45

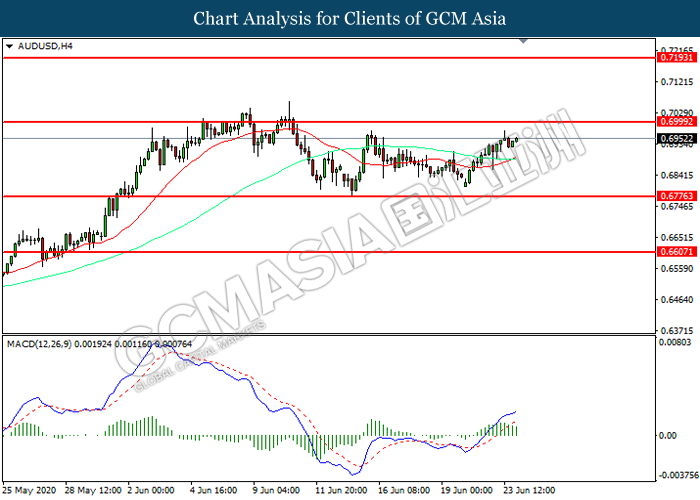

AUDUSD, H4: AUDUSD was traded higher while currently near the resistance level at 0.7000. However, MACD which illustrated diminishing bullish momentum suggest the pair to be traded lower in short-term as technical correction.

Resistance level: 0.7000, 0.7195

Support level: 0.6775, 0.6605

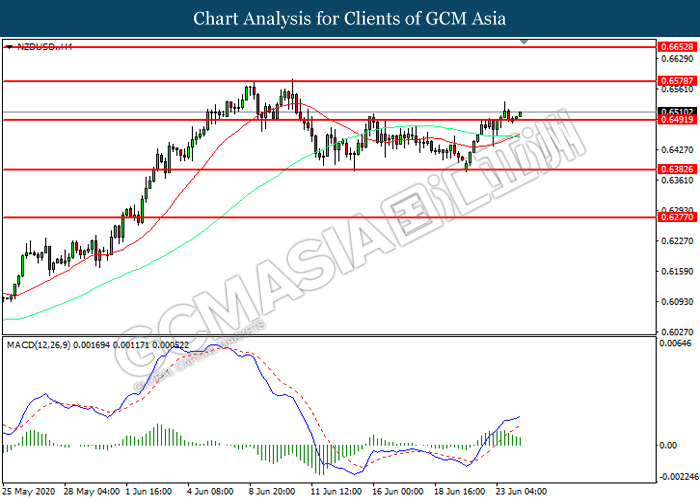

NZDUSD, H4: NZDUSD was traded higher following prior breakout above the previous resistance level at 0.6490. However, MACD which illustrated diminishing bullish momentum suggest the pair to be traded lower in short-term as technical correction.

Resistance level: 0.6580, 0.6655

Support level: 0.6490, 0.6385

USDCAD, H4: USDCAD was higher following prior rebound from the support level at 1.3490. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains toward resistance level at 1.3635.

Resistance level: 1.3635, 1.3770

Support level: 1.3490, 1.3360

USDCHF, Daily: USDCHF was traded lower while currently testing the support level at 0.9430. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 0.9520, 0.9605

Support level: 0.9430, 0.9330

CrudeOIL, Daily: Crude oil price was traded higher while currently near the resistance level at 42.55. MACD which illustrated diminishing bearish momentum suggest the commodity to extend its gains after it successfully breakout above the resistance level.

Resistance level: 42.55, 52.35

Support level: 35.65, 28.75

GOLD_, H4: Gold price was traded higher following prior breakout above the previous resistance level at 1762.45. However, MACD which illustrated diminishing bullish momentum suggest the commodity to be traded lower in short-term as technical correction.

Resistance level: 1798.75, 1825.50

Support level: 1762.45, 1735.80