24 June 2022 Afternoon Session Analysis

Euro slumped amid bearish economic data.

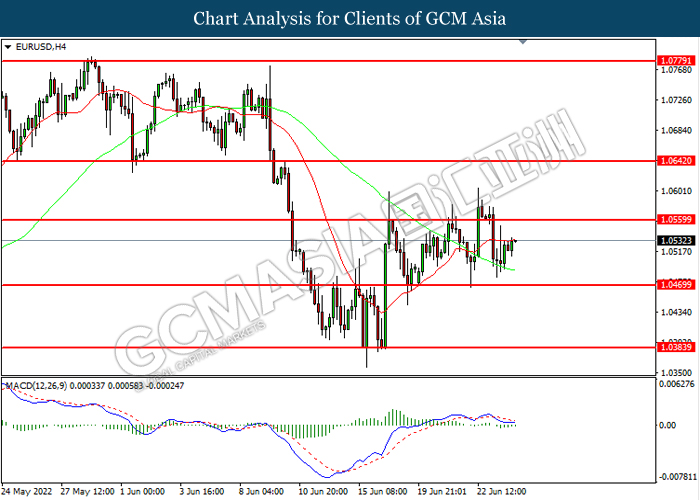

The Euro slumped significantly over the backdrop of bearish economic data from German and French region, spurring negative prospect toward the economic progression in the European region. According to Markit Economics, Germany Manufacturing Purchasing Managers Index (PMI) notched down significantly from the previous reading of 54.8 to 52.0, missing the market forecast at 54.0. Meanwhile, France Manufacturing Purchasing Managers Index (PMI) came in at 51.0, which also fared worse-than-expectation at 54.0. Following the release of bearish economic data, money market is currently pricing bout 30 basis point of rate hike in July compared to 34 bps on Monday. Nonetheless, investors would continue to scrutinize the latest updates with regards of the future monetary policy to receive further trading signal. As of writing, EUR/USD depreciated by 0.05% to 1.0530.

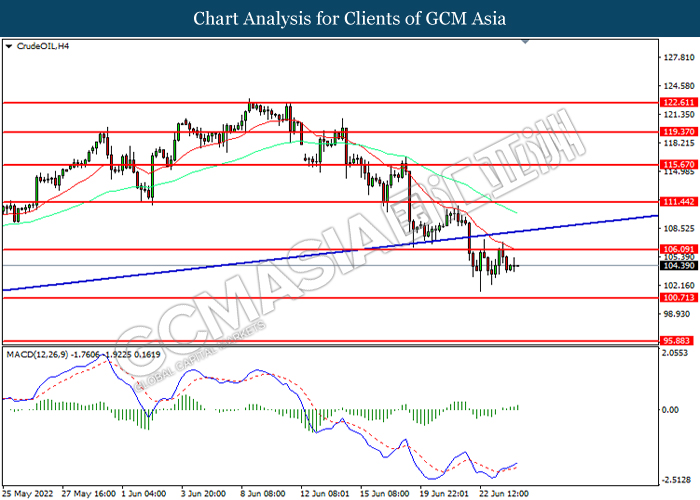

In the commodities market, the crude oil price slumped 0.04% to $104.30 per barrel as of writing. The oil market retreated following market participants speculated that the OPEC and allied producing countries including Russia will likely to stick to a plan for accelerated output increases in August. On the other hand, the gold price depreciated by 0.01% to $1824.95 per troy ounces amid hawkish expectation from Federal Reserve.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

18:00 EUR EU Leaders Summit

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 14:00 | GBP – Retail Sales (MoM) (May) | 1.4% | -0.9% | – |

| 16:00 | EUR – German Ifo Business Climate Index (Jun) | 93.0 | 92.9 | – |

| 22:00 | USD – New Home Sales (May) | 591K | 585K | – |

Technical Analysis

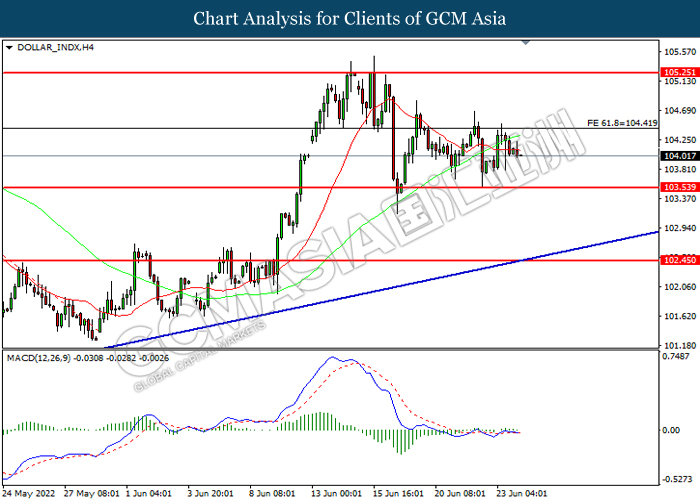

DOLLAR_INDX, H4: Dollar index was traded lower following prior retracement from the resistance level. MACD which illustrated diminishing bullish momentum suggest the index to extend its losses toward support level.

Resistance level: 104.40, 105.25

Support level: 103.55, 102.45

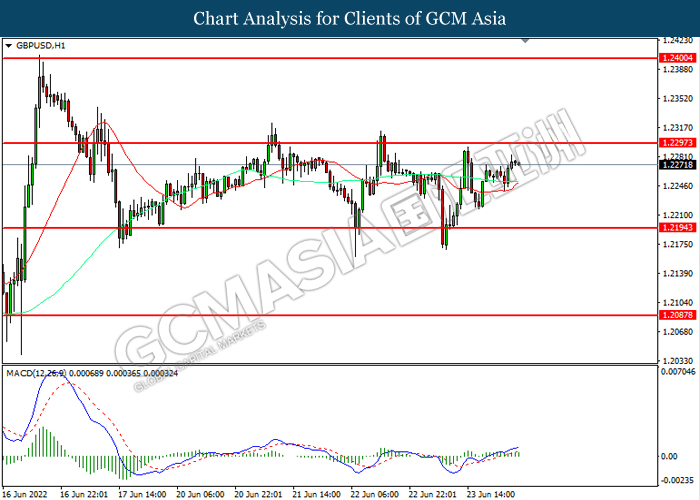

GBPUSD, H1: GBPUSD was traded higher while currently testing the resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains toward resistance level.

Resistance level: 1.2295, 1.2400

Support level: 1.2195, 1.2085

EURUSD, H4: EURUSD was traded higher while currently testing the resistance level. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains after breakout.

Resistance level: 1.0560, 1.0640

Support level: 1.0470, 1.0385

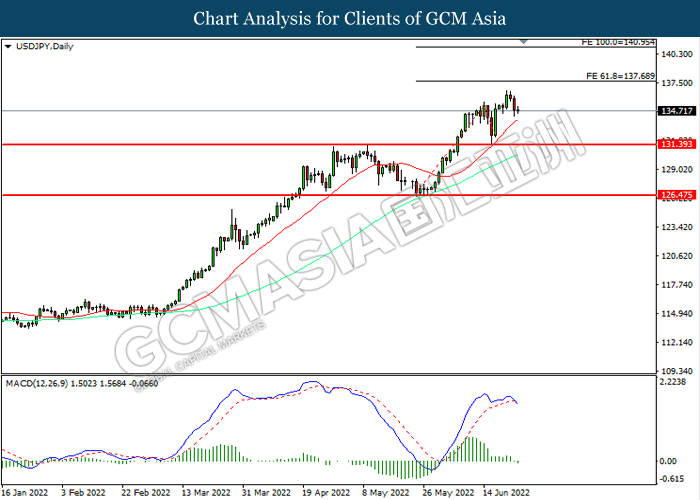

USDJPY, Daily: USDJPY was traded higher while currently testing the resistance level. However, MACD which illustrated diminishing bullish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 137.70, 140.95

Support level: 131.40, 126.45

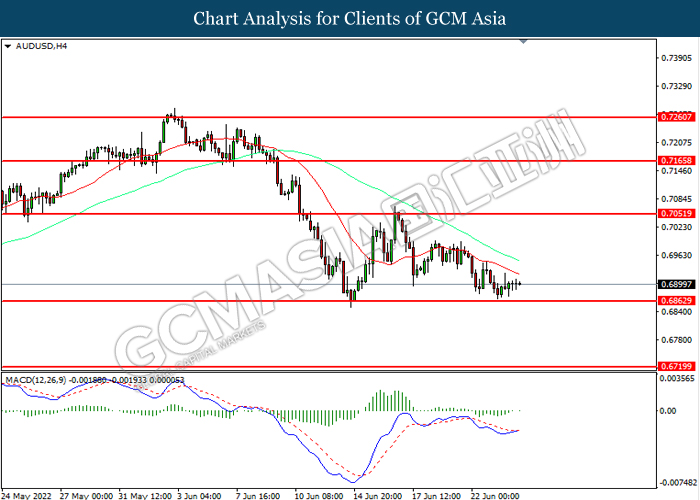

AUDUSD, H4: AUDUSD was traded lower while currently near the support level. Namun, MACD which illustrated increasing bullish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 0.7050, 0.7165

Support level: 0.6865, 0.6720

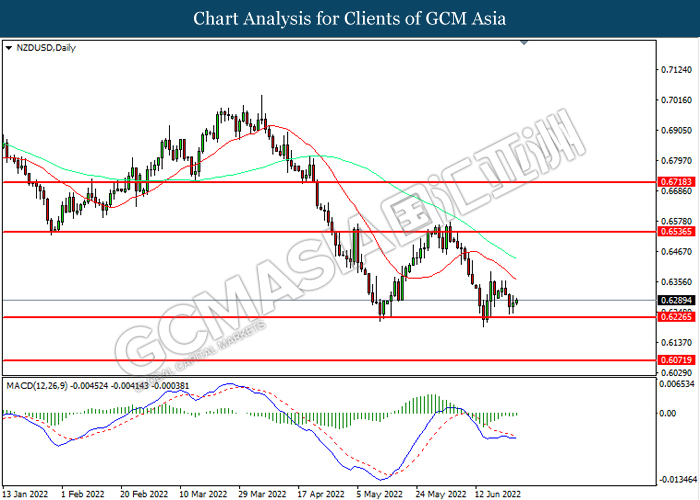

NZDUSD, Daily: NZDUSD was traded lower while currently testing the support level. However, MACD which illustrated diminishing bearish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 0.6535, 0.6720

Support level: 0.6225, 0.6070

USDCAD, H1: USDCAD was traded lower following prior retracement from the resistance level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses toward support level.

Resistance level: 1.3005, 1.3070

Support level: 1.2915, 1.2865

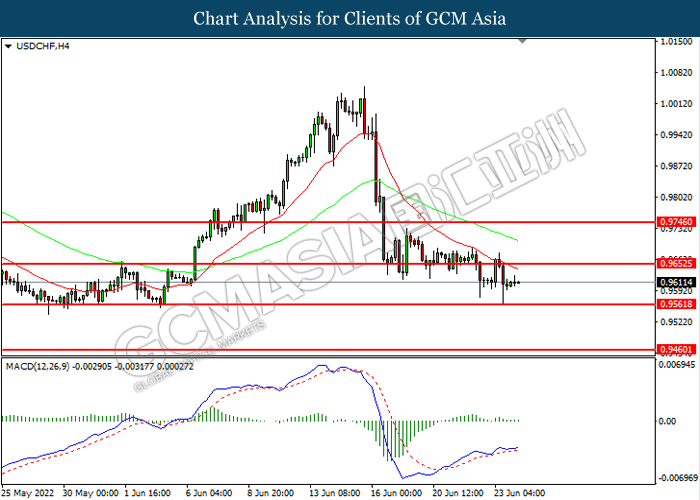

USDCHF, H4: USDCHF was traded lower following prior breakout below the previous support level. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses toward support level.

Resistance level: 0.9655, 0.9745

Support level: 0.9560, 0.9460

CrudeOIL, H4: Crude oil price was traded lower following prior breakout below the previous support level. However, MACD which illustrated increasing bullish momentum suggest the commodity to be traded higher as technical correction.

Resistance level: 106.10, 111.45

Support level: 100.70, 95.90

GOLD_, H1: Gold price was traded lower while currently testing the support level. However, MACD which illustrated diminishing bearish momentum suggest the commodity to be traded higher as technical correction.

Resistance level: 1835.15, 1844.00

Support level: 1818.80, 1807.95