24 July 2020 Afternoon Session Analysis

Deadlock of Post-Brexit negotiation limited pound gains.

Pound sterling which act one of the major currency was having mixed pattern at the recent high level as negotiation between UK and EU faced stumble while they are approaching the deadline of transition period, which is on 31th December 2020. According to the reported news from The Guardian, Michael Barnier revealed that their trade and security deal with UK are unlikely to be reached by the end of this year as both parties are insisting their own hard stance to strive for the best future trade deal for themselves. In details, EU complained that UK refuse to back down from demanding ‘near total exclusion’ of EU vessels in UK, leaving with no progress in the latest round of negotiation. Besides, UK Prime Minister Boris Johnson hopes over a principle draft of Post Brexit deal can be outlined by the end of this month has been ‘extinguished’. As of now, investors are eyeing on the next week informal talks before a formal round of negotiation in Mid of August to gauge the direction of pound. During Asian trading session, GBP/USD inched up 0.11% to 1.2750.

In the commodities market, crude oil price appreciated by 0.44% to $41.25 per barrel while heightening of US-China tensions and virus reported cases increased continue weigh on the black commodity product. As of now, market participant will put their attention on the vaccine development as it will further determine the direction of oil price. Besides, gold price rose 0.02% to $1888.55 a troy ounce as market worries over the pandemic heightened.

Today’s Holiday Market Close

Time Market Event

All Day JPY National Sports Day

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 14:00 | GBP – Retail Sales (MoM) (Jun) | 12.0% | 8.0% | – |

| 15:30 | EUR – German Manufacturing PMI (Jul) | 45.2 | 48.0 | – |

| 16:30 | GBP – Composite PMI | 47.7 | – | – |

| 16:30 | GBP – Manufacturing PMI | 50.1 | – | – |

| 16:30 | GBP – Services PMI | 47.1 | – | – |

| 22:00 | USD – New Home Sales (Jun) | 676K | 700K | – |

Technical Analysis

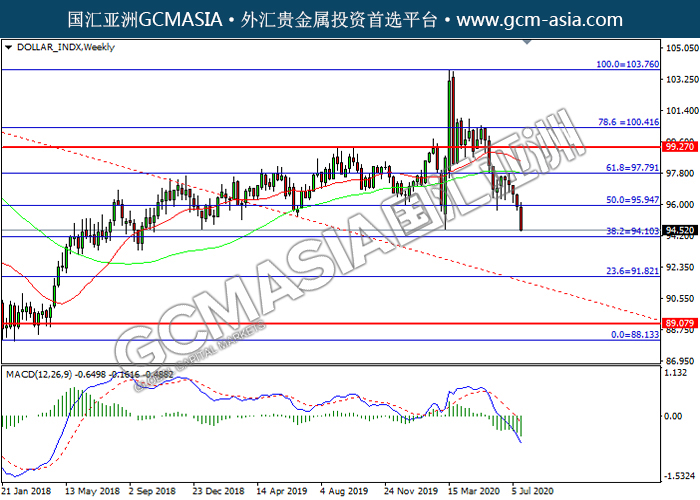

DOLLAR_INDX, Weekly: Dollar index was traded lower following prior breakout below the previous support level at 95.95. MACD which illustrated increasing bearish momentum suggest the index to extend its gains toward support level at 94.10.

Resistance level: 95.95, 97.80

Support level: 94.10, 91.80

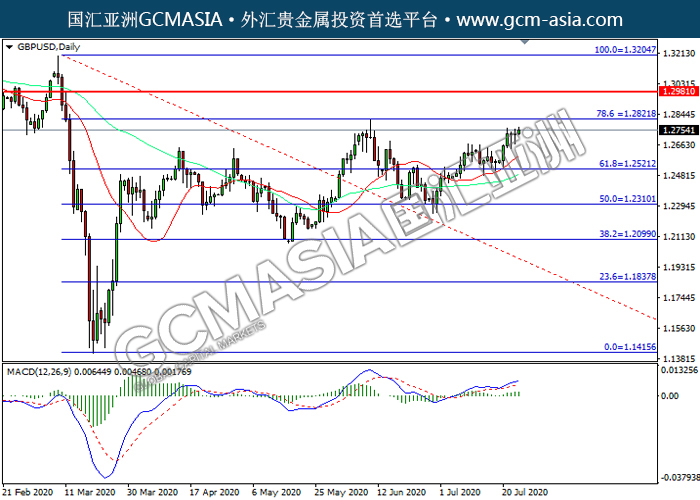

GBPUSD, Daily: GBPUSD was traded higher following prior rebound from the support level at 1.2520. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains toward resistance level at 1.2820.

Resistance level: 1.2820, 1.2980

Support level: 1.2520, 1.2310

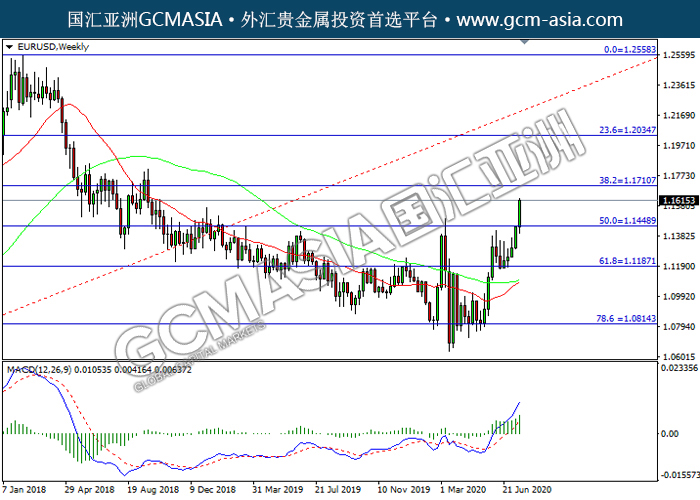

EURUSD, Weekly: EURUSD was traded higher following prior breakout above the previous resistance level at 1.1450. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains toward resistance level at 1.1710.

Resistance level: 1.1710, 1.2035

Support level: 1.1450, 1.1185

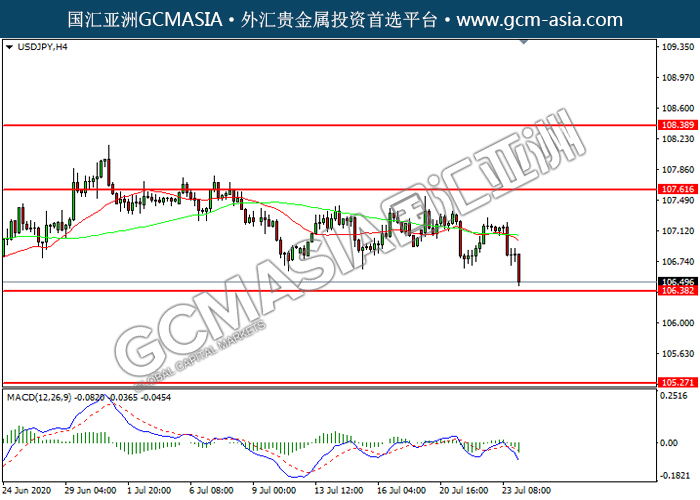

USDJPY, H4: USDJPY was traded lower while currently testing the support level at 106.40. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 107.40, 107.80

Support level: 106.75, 106.40

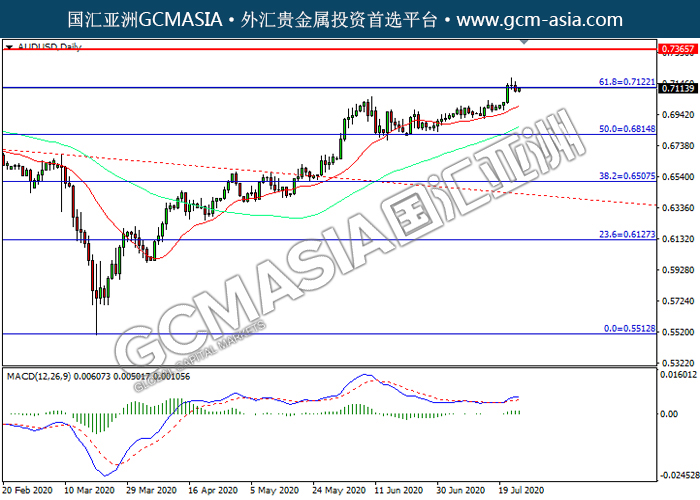

AUDUSD, Daily: AUDUSD was traded higher while currently testing the resistance level at 0.7120. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains after its successfully breakout above the resistance level.

Resistance level: 0.7120, 0.7365

Support level: 0.6815, 0.6505

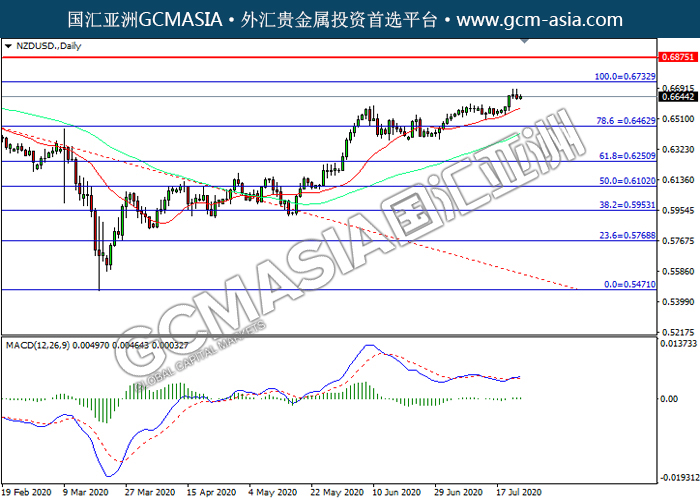

NZDUSD, Daily: NZDUSD was traded higher while currently near the resistance level at 0.6735. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 0.6735, 0.6875

Support level: 0.6465, 0.6250

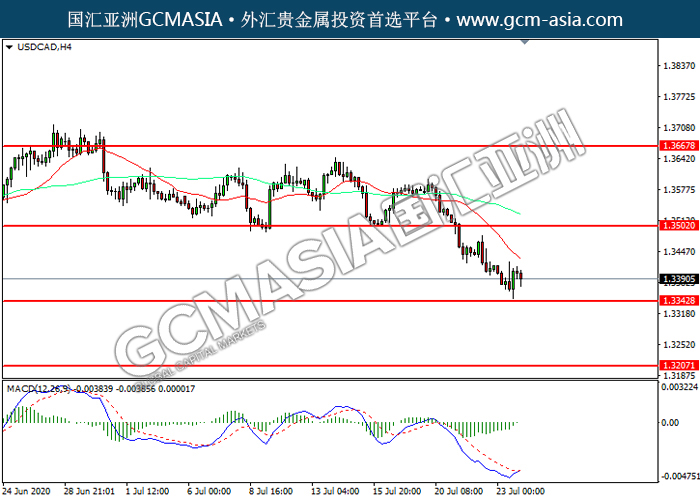

USDCAD, H4: USDCAD was traded lower while currently near the support level ta 1.3345. However, MACD which illustrated diminishing bearish momentum suggest the pair to be traded higher in short-term as technical correction.

Resistance level: 1.3500, 1.3665

Support level: 1.3345, 1.3205

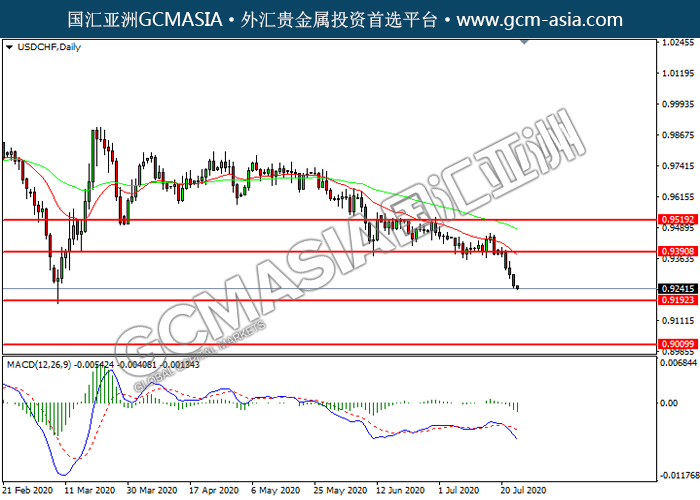

USDCHF, Daily: USDCHF was traded lower following prior breakout below the previous support level at 0.9390. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses toward support level at 0.9190.

Resistance level: 0.9390, 0.9520

Support level: 0.9190, 0.9010

CrudeOIL, H4: Crude oil price was traded lower while currently testing the support level at 41.05. MACD which illustrated increasing bearish momentum suggest the commodity to extend its losses after it successfully breakout below the support level.

Resistance level: 42.10, 43.05

Support level: 41.05, 40.05

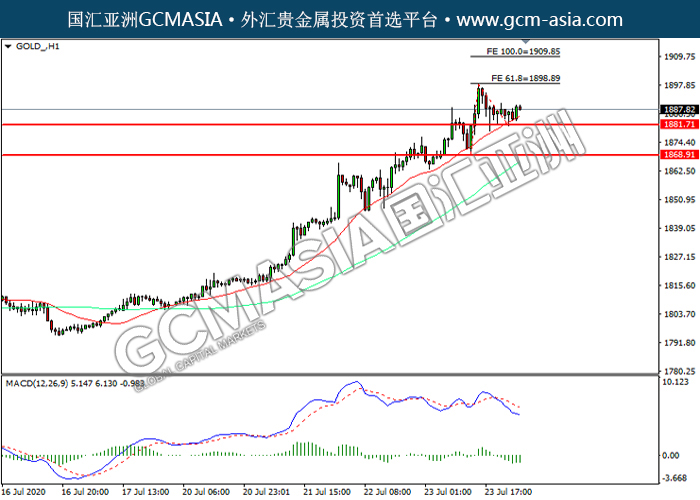

GOLD_, H1: Gold price was traded lower while currently testing the support level at 1881.70. however, MACD which illustrated diminishing bearish momentum suggest the commodity to be traded higher in short-term as technical correction.

Resistance level: 1898.90, 1909.85

Support level: 1881.70, 1868.90