24 July 2023 Afternoon Session Analysis

UK released upbeat Retail Sales, sign of rebound in Pound appeared.

Pound Sterling (GBP), which was widely traded by global investors, rebounded after the announcement of upbeat retail sales data. According to the Office for National Statistics, the Core Retail Sales (MoM) rose from 0.1% to 0.8%, exceeded the market forecast of 0.2%. The Retail Sales (MoM) rose from 0.1% to 0.7% this month, which also exceeded the market forecast of 0.2%. Since both of the data outperformed the market forecast and prior reading, this means that the UK still has strong consumer spending in June. With that, the strong consumer spending in UK might revert the inflationary pressures from the point of easing back to a higher level in the upcoming month. Besides that, investors were mixed about the pace at how high the interest rates will be hiked by BoE Governor Andrew Bailey on August 3. Most investors expect the interest rate by the BoE would peak around 6.5%, due to UK inflation remaining high. As of writing, the GBP/USD rose 0.10% to 1.2865.

In the commodities market, crude oil prices dropped -0.23% to $76.85 per barrel after spiking for more than 1% last Friday amid the supply shortages in the coming months and rising tensions between Russia and Ukraine that could further hit supplies. Besides, gold prices dropped -0.02% to $1961.25 per troy amid the strengthening of US dollar.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Event | Previous | Forecast | Actual |

| 15:30 | EUR – Germany Manufacturing PMI (Jul) | 40.6 | 40.3 | – |

| 16:30 | GBP – UK Manufacturing PMI | 46.5 | 45.9 | – |

| 21:45 | USD – US Manufacturing PMI (Jul) | 46.3 | 46.4 | – |

Technical Analysis

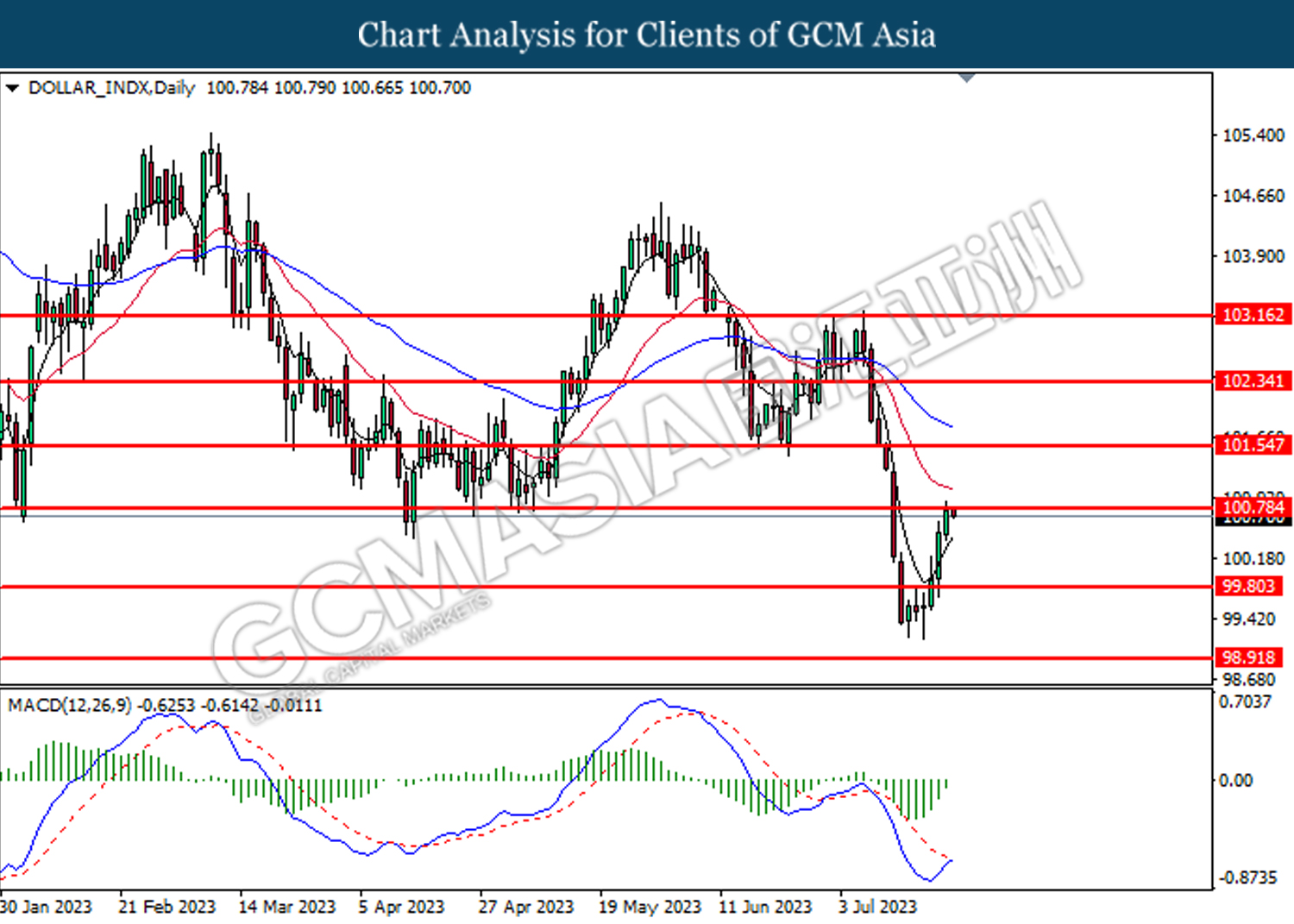

DOLLAR_INDX, Daily: Dollar index was traded higher while testing the resistance level at 100.80. MACD which illustrated diminishing bearish momentum suggests the index to extend its gains after it breakout the resistance level.

Resistance level: 100.80, 101.55

Support level: 99.80, 98.90

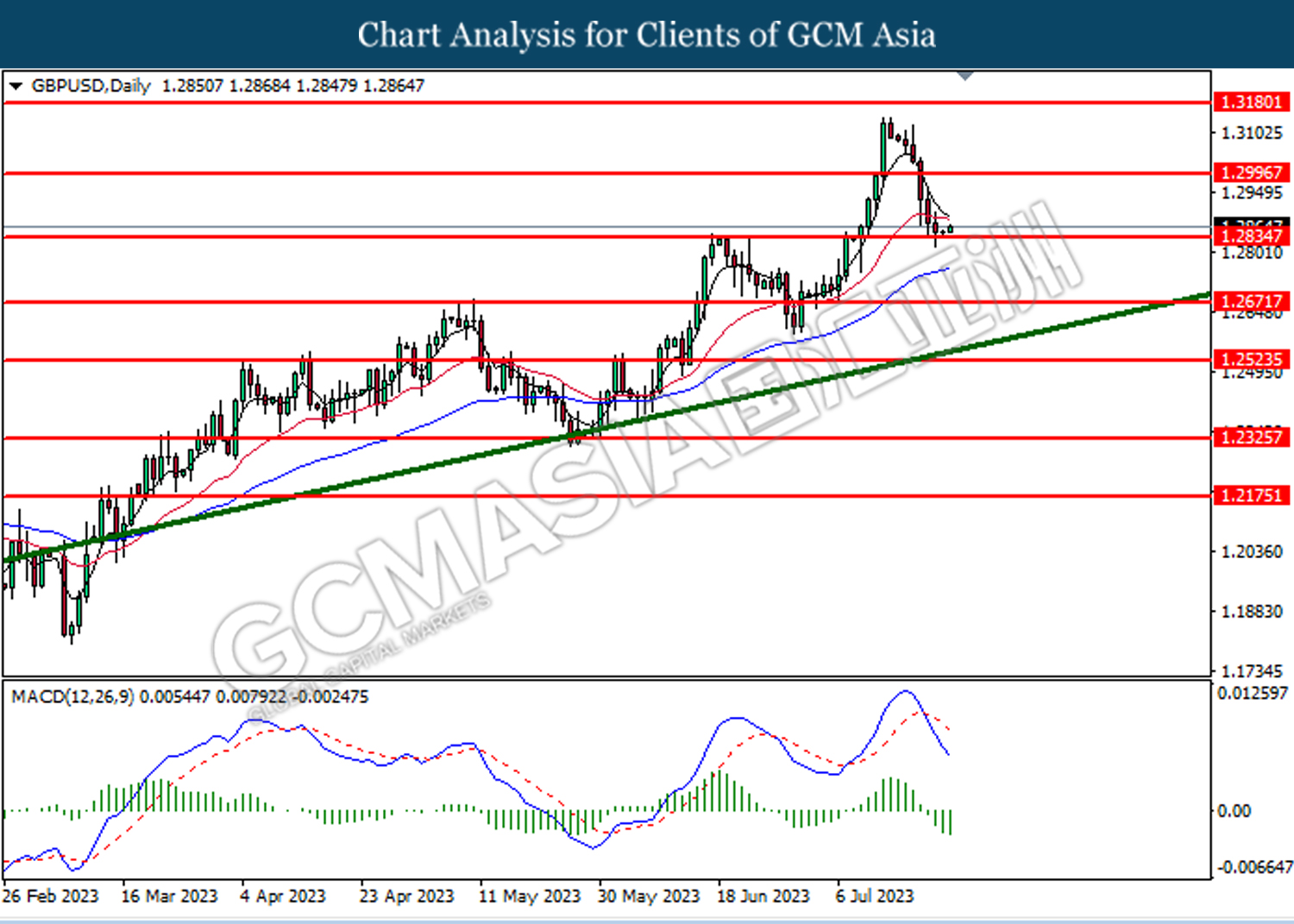

GBPUSD, Daily: GBPUSD was traded higher following the prior rebound from the support level at 1.2835. However, MACD which illustrated increasing bearish momentum suggest the pair to undergo a technical correction in short term.

Resistance level: 1.3000, 1.3180

Support level: 1.2835, 1.2670

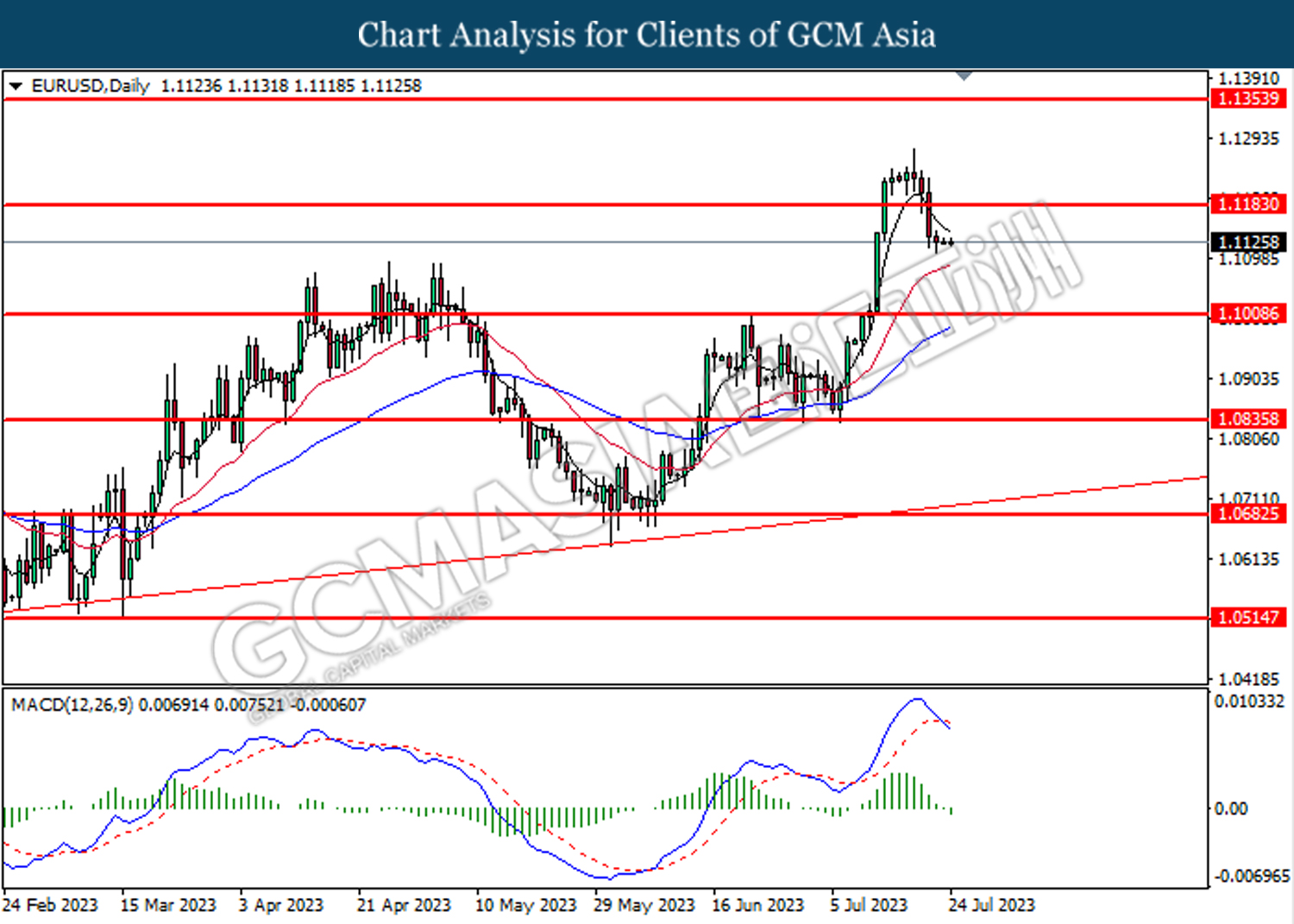

EURUSD, Daily: EURUSD was traded lower following the prior breakout below the previous support level at 1.1185. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses toward the support level at 1.1010

Resistance level: 1.1185, 1.1355

Support level: 1.1010, 1.0835

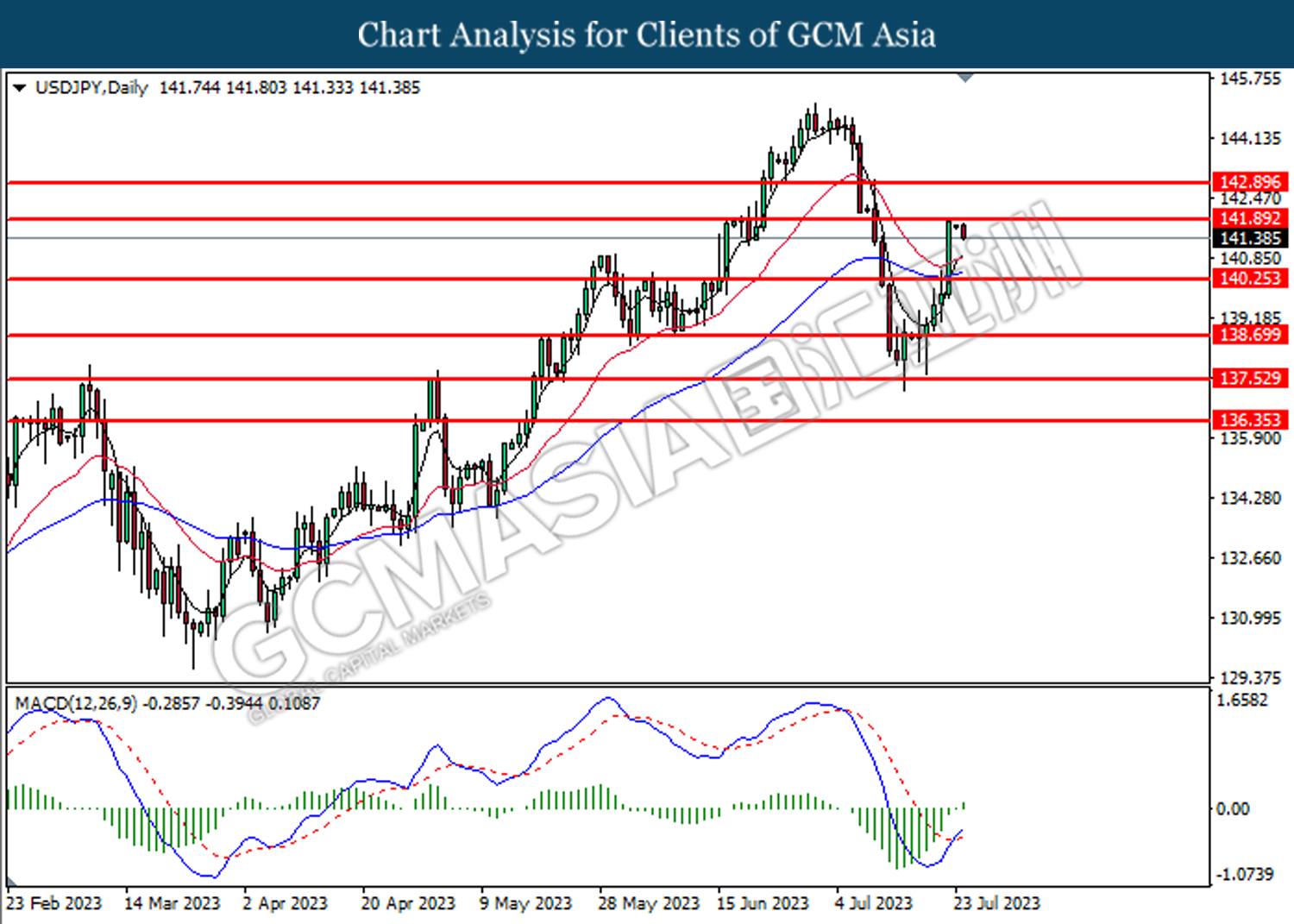

USDJPY, Daily: USDJPY was traded lower following the prior retracement from the resistance level at 141.90. However, MACD which illustrated increasing bullish momentum suggest the pair to undergo a technical correction in short term.

Resistance level: 141.90, 142.90

Support level: 140.25, 138.70

AUDUSD, Daily: AUDUSD was traded lower following the prior breakout below the previous support level at 0.6785. MACD which illustrated increasing bearish momentum suggests the pair to extend its losses toward its support level at 0.6695.

Resistance level: 0.6785, 0.6880

Support level: 0.6695, 0.6595

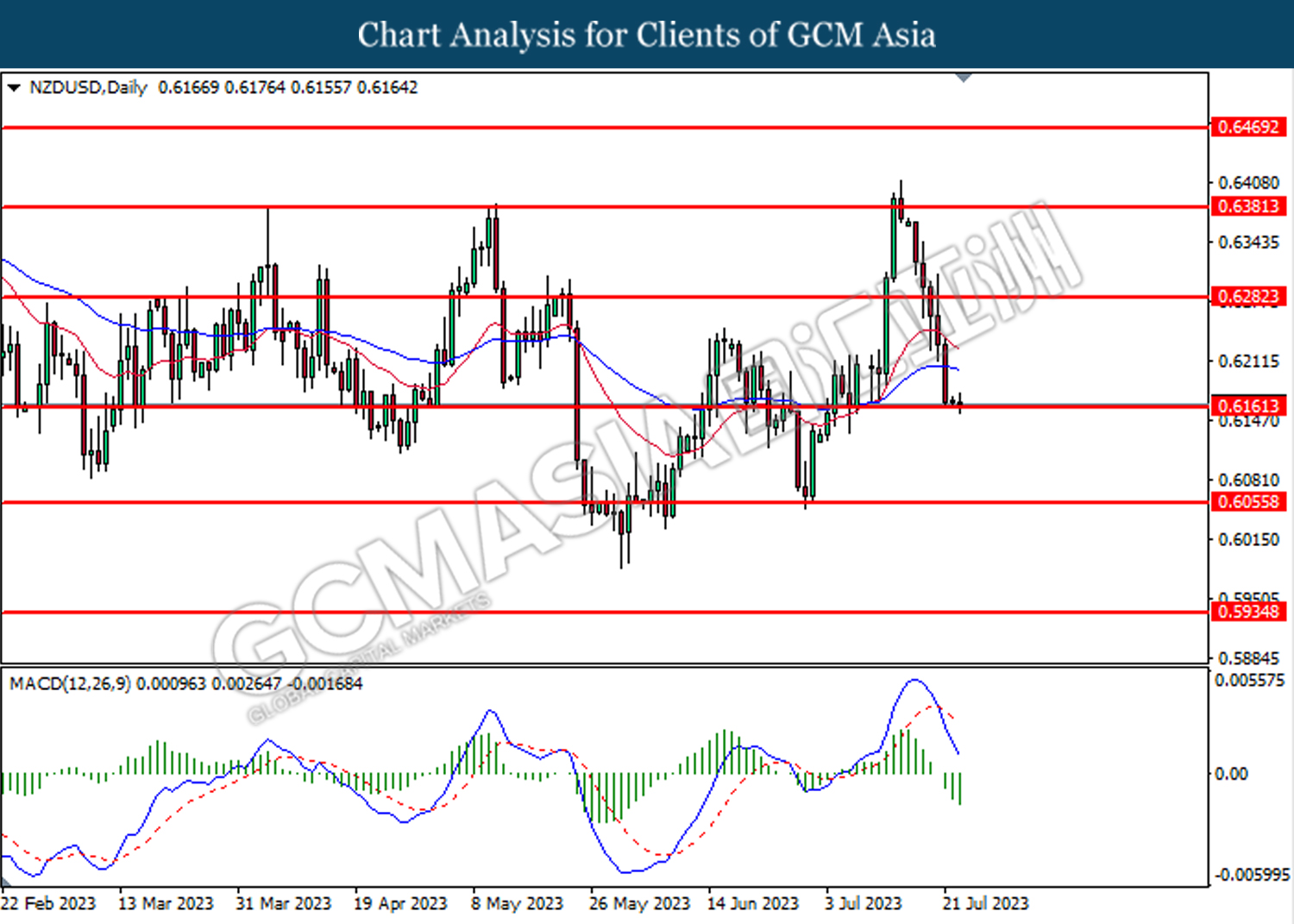

NZDUSD, Daily: NZDUSD was traded lower while testing the support level at 0.6160. MACD which illustrated increasing bearish momentum suggests the pair to extend its losses after its breakout the support level.

Resistance level: 0.6280, 0.6380

Support level: 0.6160, 0.6055

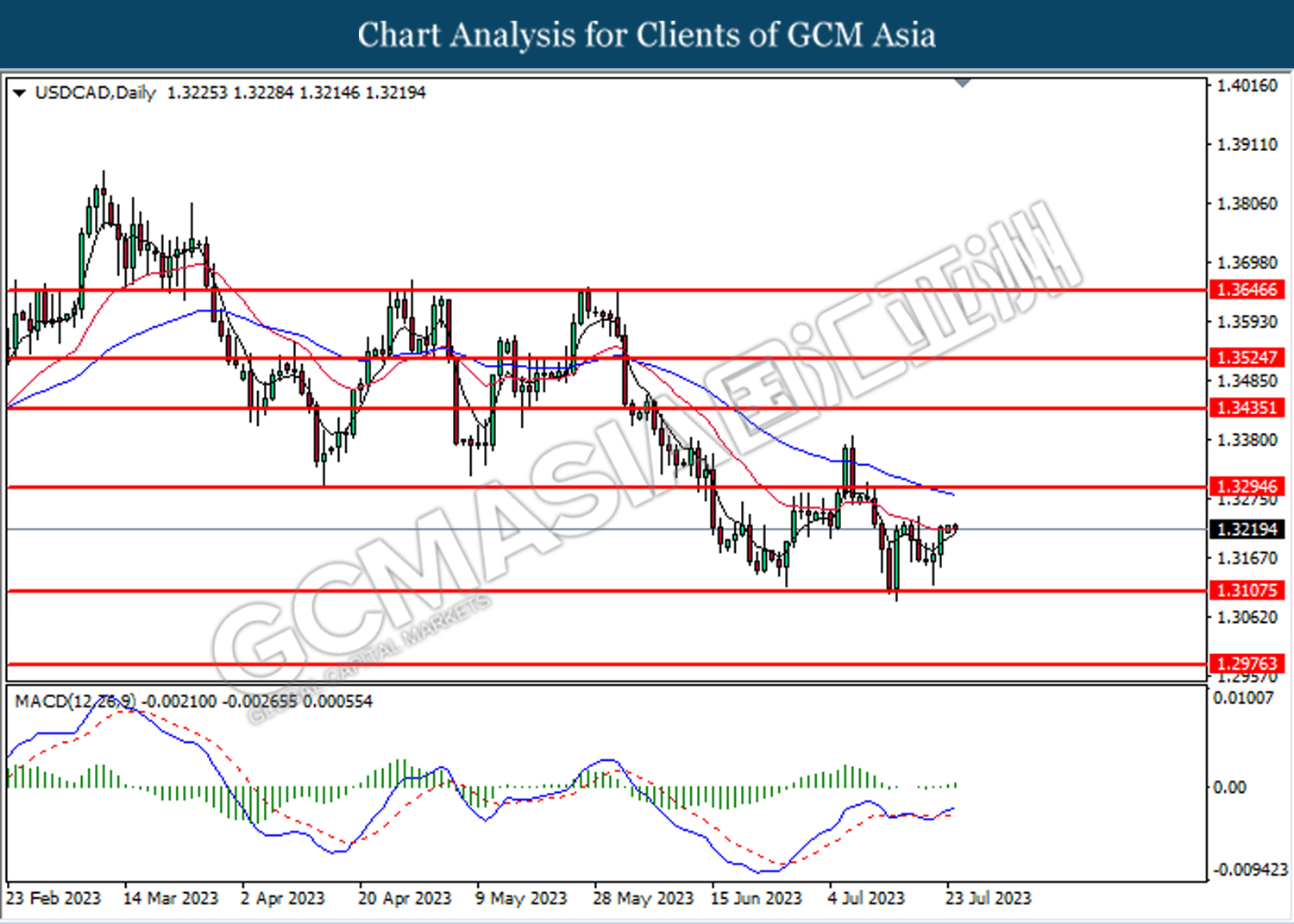

USDCAD, Daily: USDCAD was traded higher following the prior rebound from the support level at 1.3110. MACD which illustrated increasing bullish momentum suggests the pair to extend its gains toward the resistance level at 1.3295

Resistance level: 1.3295, 1.3435

Support level: 1.3110, 1.2975

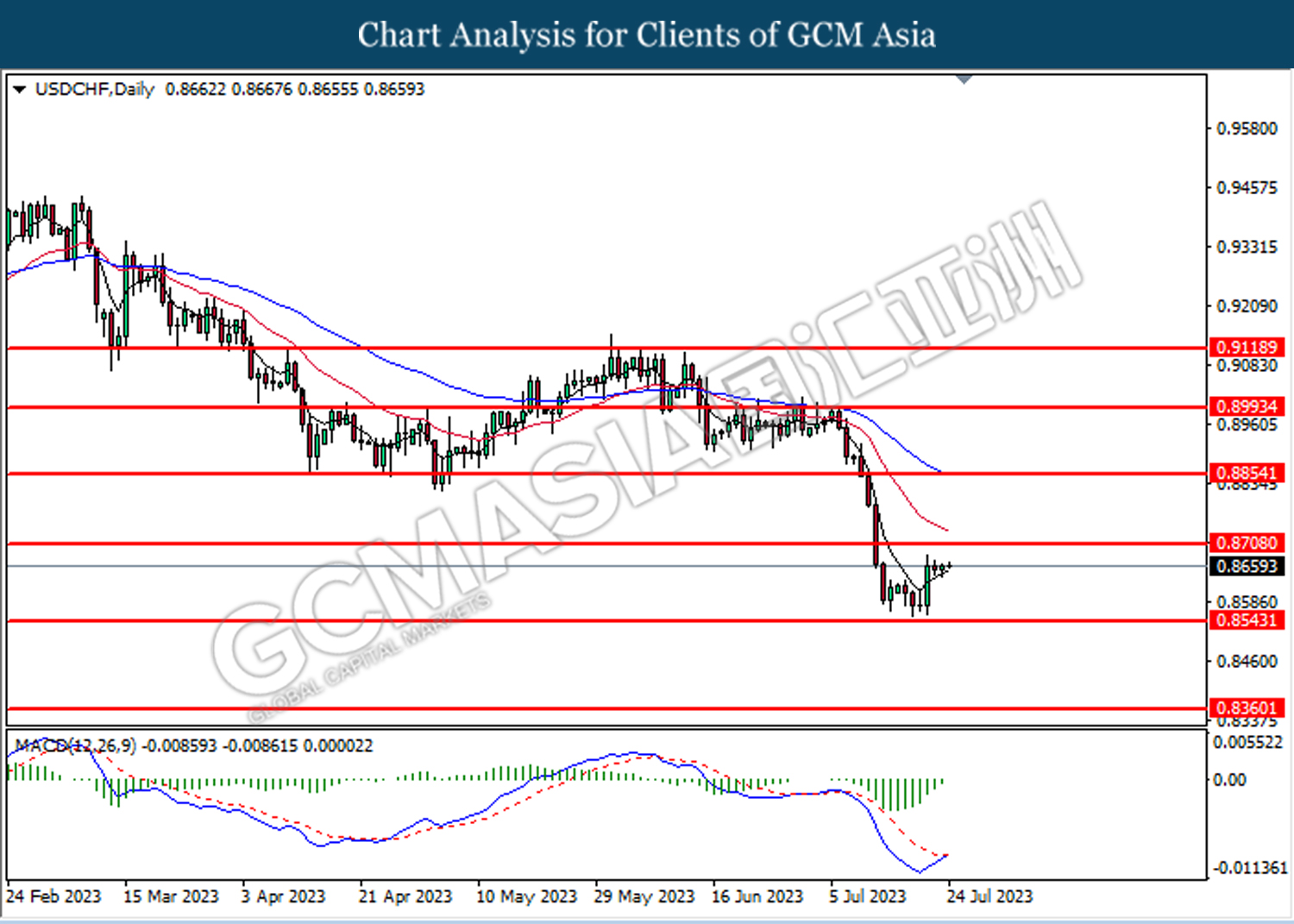

USDCHF, Daily: USDCHF was traded higher following the prior rebound from the support level at 0.8545. MACD which illustrated diminishing bearish momentum suggests the pair to extend its gains toward the resistance level at 0.8710.

Resistance level: 0.8710, 0.8855

Support level: 0.8545, 0.8360

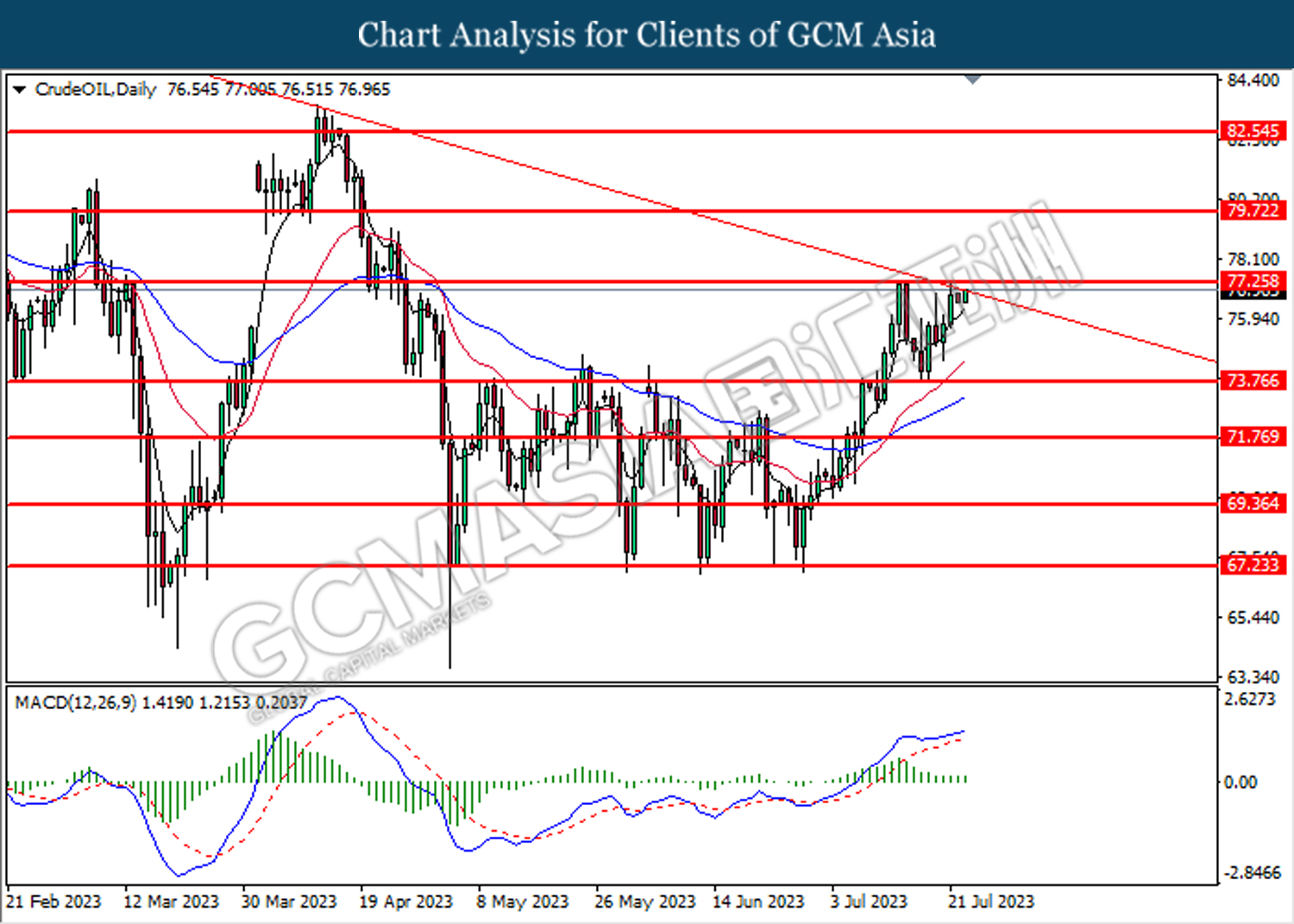

CrudeOIL, Daily: Crude oil price was traded higher while testing the resistance level at 77.25. MACD which illustrated increasing bullish momentum suggests the commodity to extend its gains after it breakout the resistance level.

Resistance level: 77.25, 79.70

Support level: 73.75, 71.80

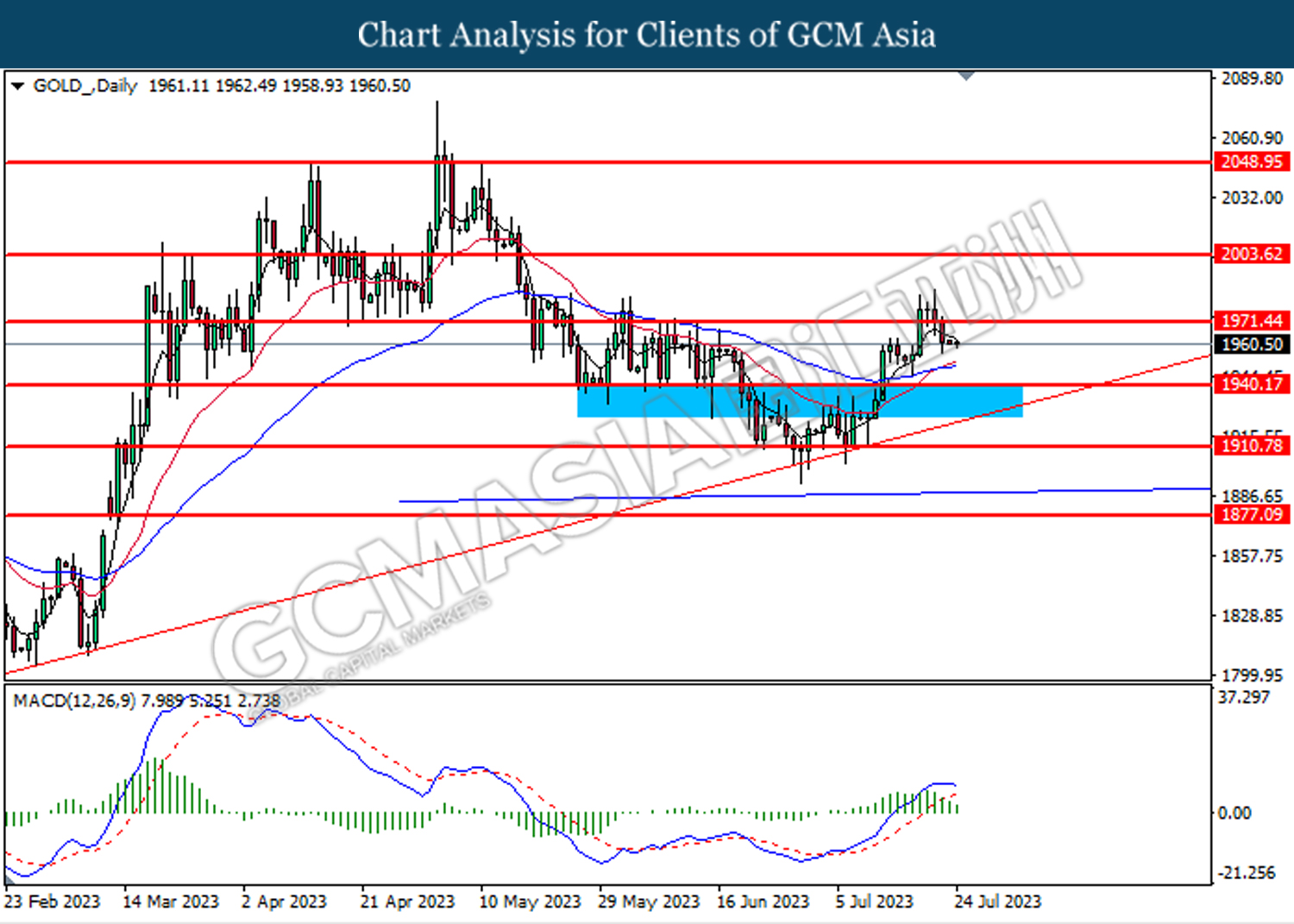

GOLD_, Daily: Gold price was traded lower following the prior breakout below the previous support level at 1971.40. MACD which illustrated diminishing bullish momentum suggests the commodity to extend its losses toward the support level at 1940.20.

Resistance level: 1971.40, 2003.60

Support level: 1940.20, 1910.80