24 July 2023 Morning Session Analysis

With the BoJ not expected to change policy, the yen fell and the dollar recovered.

The dollar index, which was traded against a basket of six major currencies, managed to close its last week’s trading session with gains as a Reuters report stated that the Bank of Japan (BoJ) is leaning towards maintaining its current key yield control policy in the upcoming week. Sources familiar with the matter revealed that BoJ policymakers prefer to carefully analyze additional data to ensure that wages and inflation continue to rise before making any changes to the current policy. The report further mentioned that there is no unanimous agreement within the central bank, making the decision a potentially close call. As a result, it disappointed the market participants and caused a huge selling pressure in the Yen market, spurred the Us dollar. Besides, the market participants are now focusing on the upcoming Fed interest rate decision, whereby the Federal Reserve is anticipated to raise interest rates in the upcoming week and is likely to counter against speculations that it won’t proceed with another increase. The combination of slowing US inflation and robust US economic activity is currently having a negative impact on the dollar. The Federal Reserve’s two-day meeting will commence on Wednesday, and there is a strong consensus among traders, with about 99% of them expecting a 0.25% rate hike, according to Fed Rate Monitor Tool. This move comes after a pause in rate adjustments during the June meeting. As of writing, the dollar index ticked up by 0.02% to 101.05.

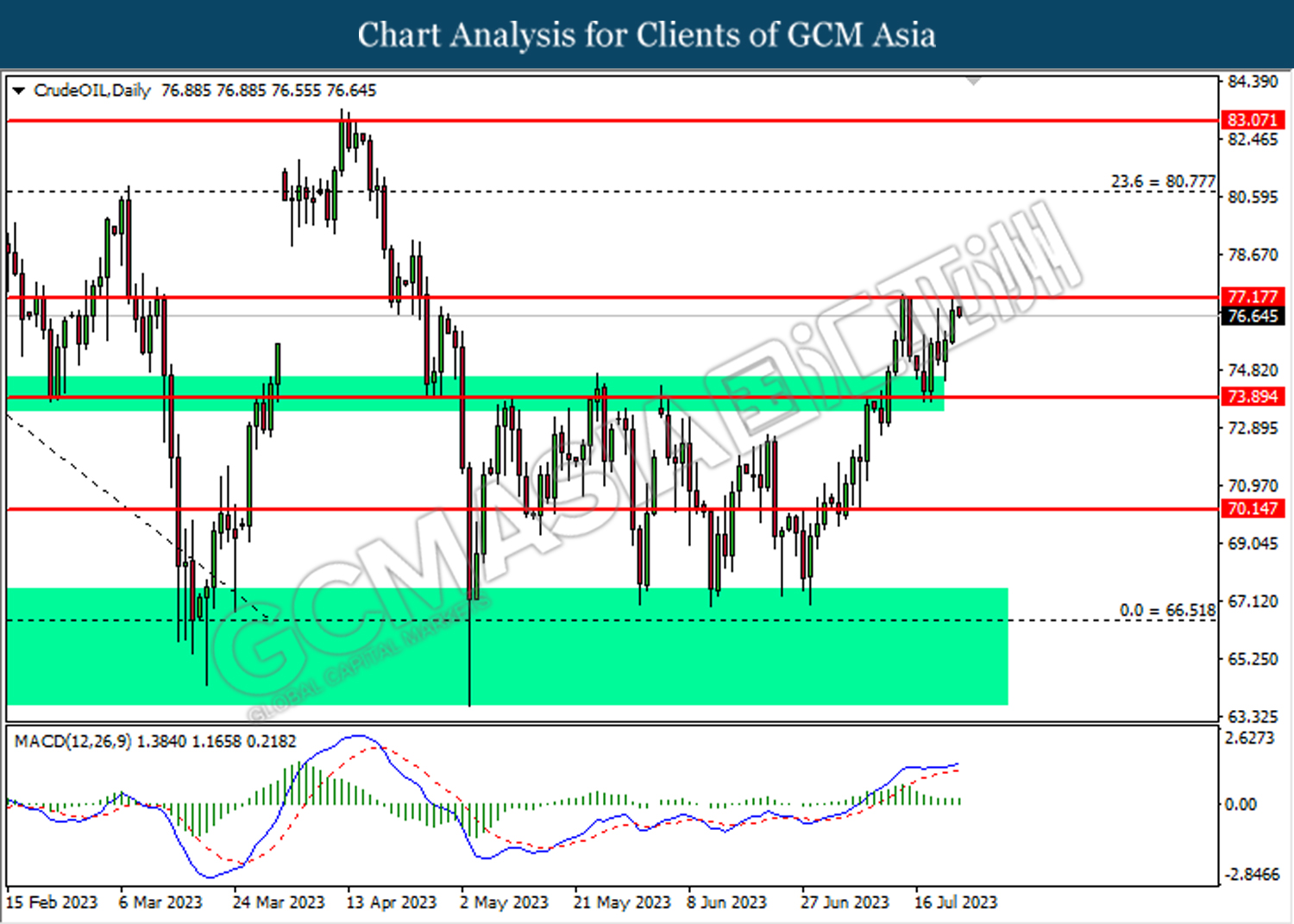

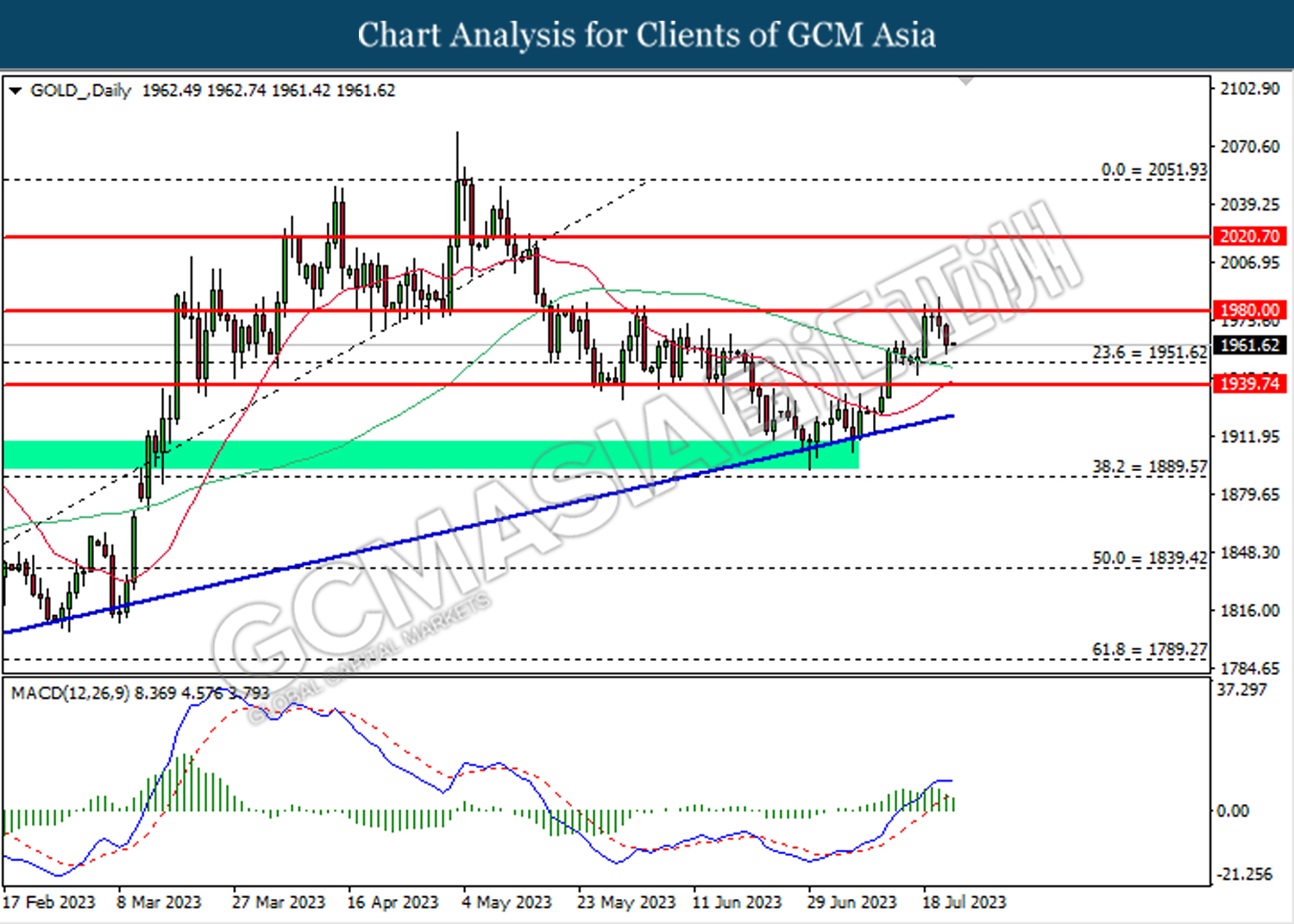

In the commodities market, crude oil prices were up by 0.02% to $76.85 per barrel there was growing evidence that oil supplies will run short in the coming months, while tensions between Russia and Ukraine could further hit supplies. Besides, gold prices dropped by -0.02% to $1962.25 per troy ounce alongside the temporarily recovery of the dollar index.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 15:30 | EUR – Germany Manufacturing PMI (Jul) | 40.6 | 40.3 | – |

| 16:30 | GBP – UK Manufacturing PMI | 46.5 | 45.9 | – |

| 21:45 | USD – US Manufacturing PMI (Jul) | 46.3 | 46.4 | – |

Technical Analysis

DOLLAR_INDX, Daily: Dollar index was traded higher while currently testing the resistance level at 100.65. MACD which illustrated diminishing bearish momentum suggests the index to extend its gains after it successfully breakout above the resistance level.

Resistance level: 100.65, 103.00

Support level: 99.40, 97.75

GBPUSD, Daily: GBPUSD was traded lower following the prior breakout below the previous support level at 1.2875. MACD which illustrated bearish bias momentum suggest the pair to extend its losses toward the support level at 1.2765.

Resistance level: 1.2875, 1.2970

Support level: 1.2765, 1.2605

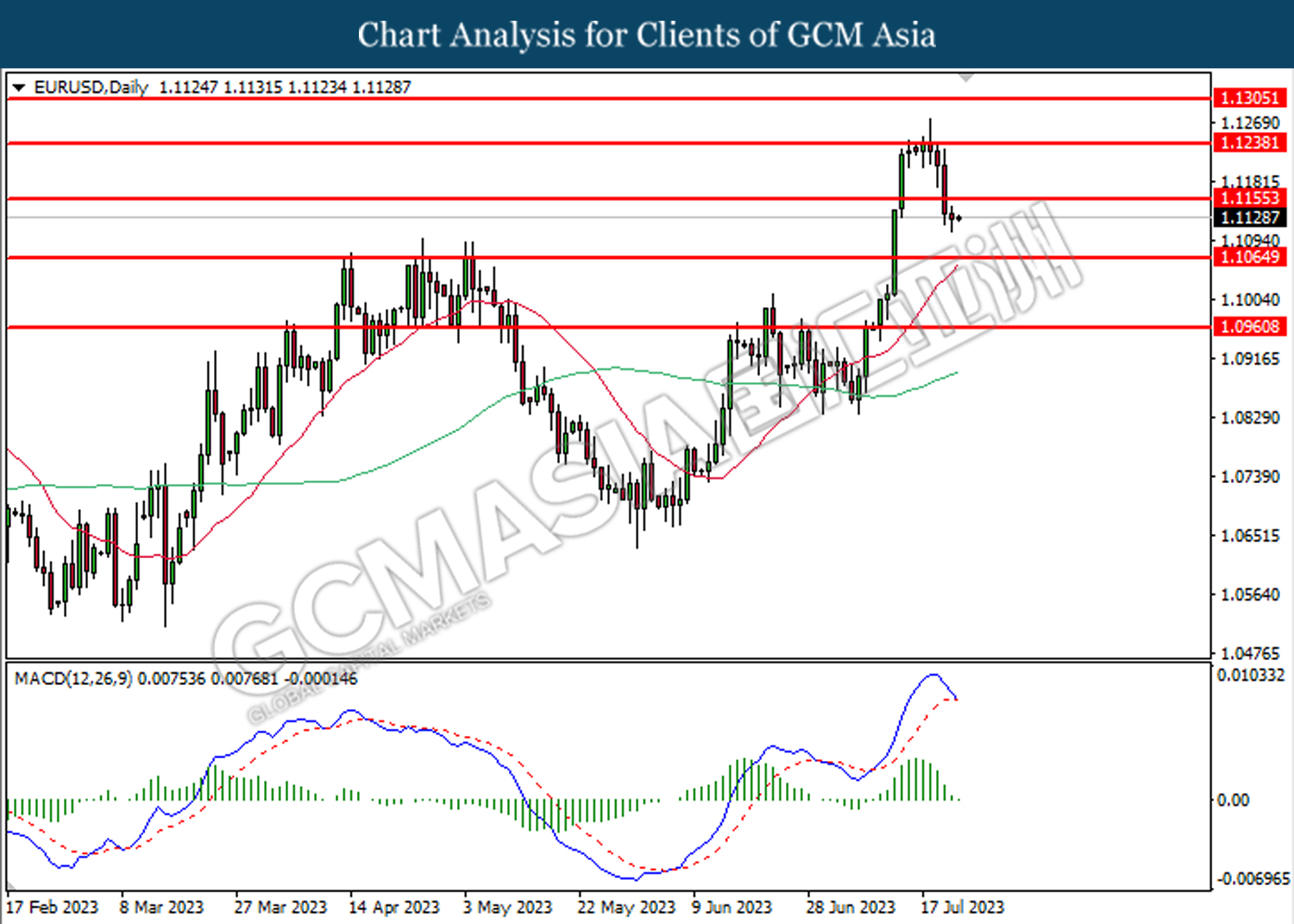

EURUSD, Daily: was traded lower following the prior breakout below the previous support level at 1.1155. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses toward the support level at 1.1065.

Resistance level: 1.1155, 1.1240

Support level: 1.1065, 1.0960

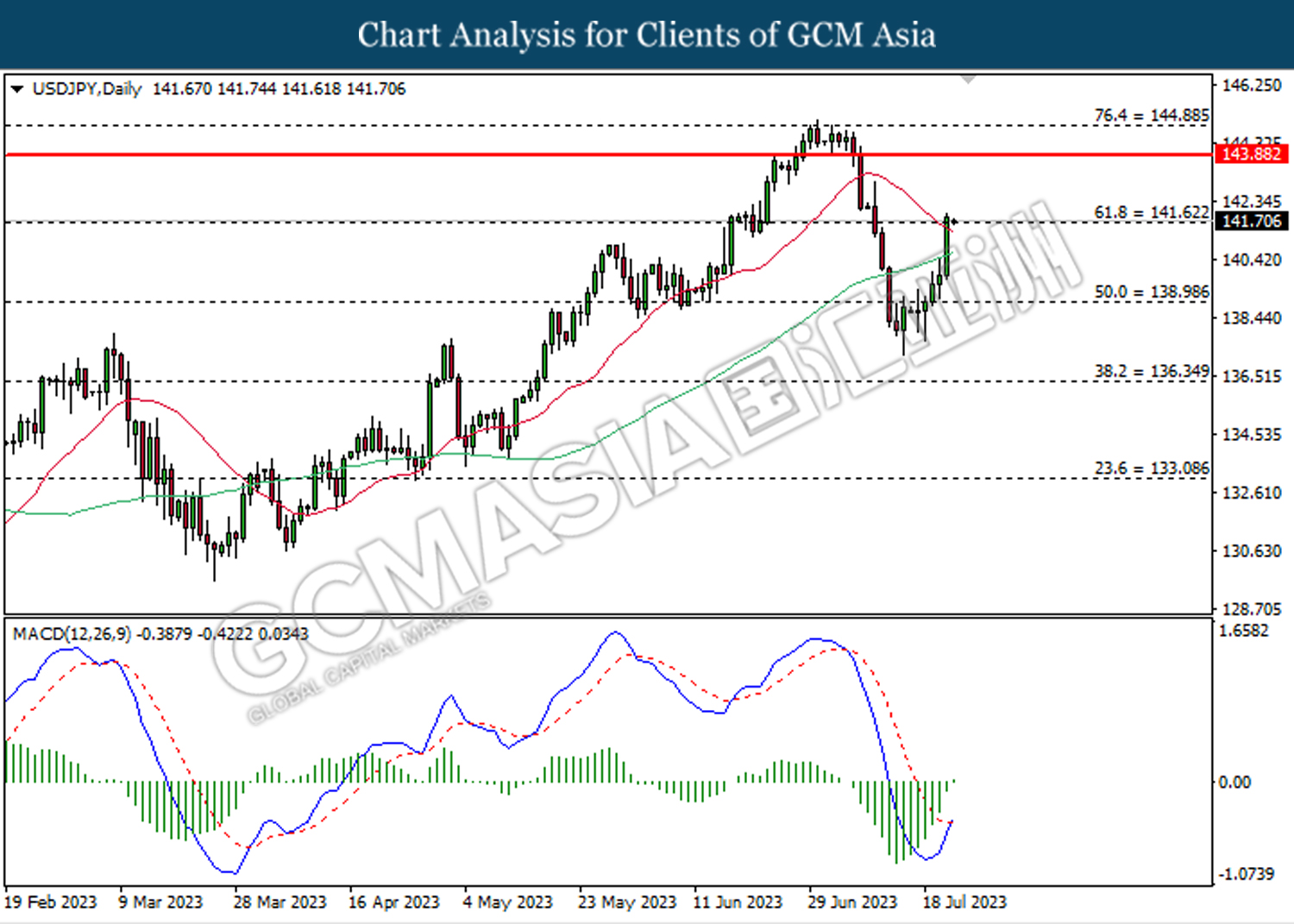

USDJPY, Daily: USDJPY was traded higher while currently testing the resistance level at 141.60. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 141.60, 143.90

Support level: 139.00, 136.35

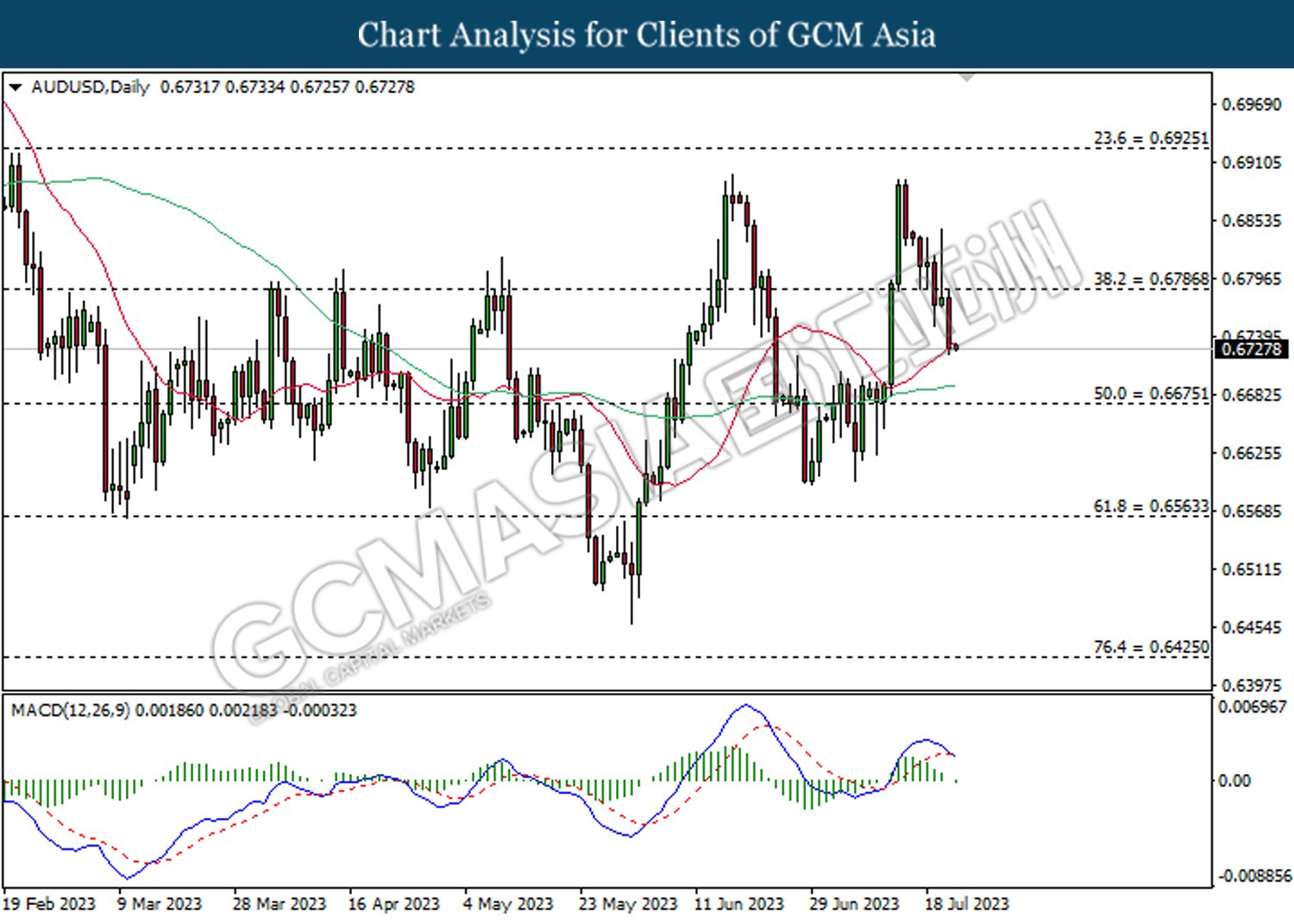

AUDUSD, Daily: AUDUSD was traded lower following the prior breakout below the previous support level at 0.6785. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses toward the support level at 0.6675.

Resistance level: 0.6785, 0.6925

Support level: 0.6675, 0.6565

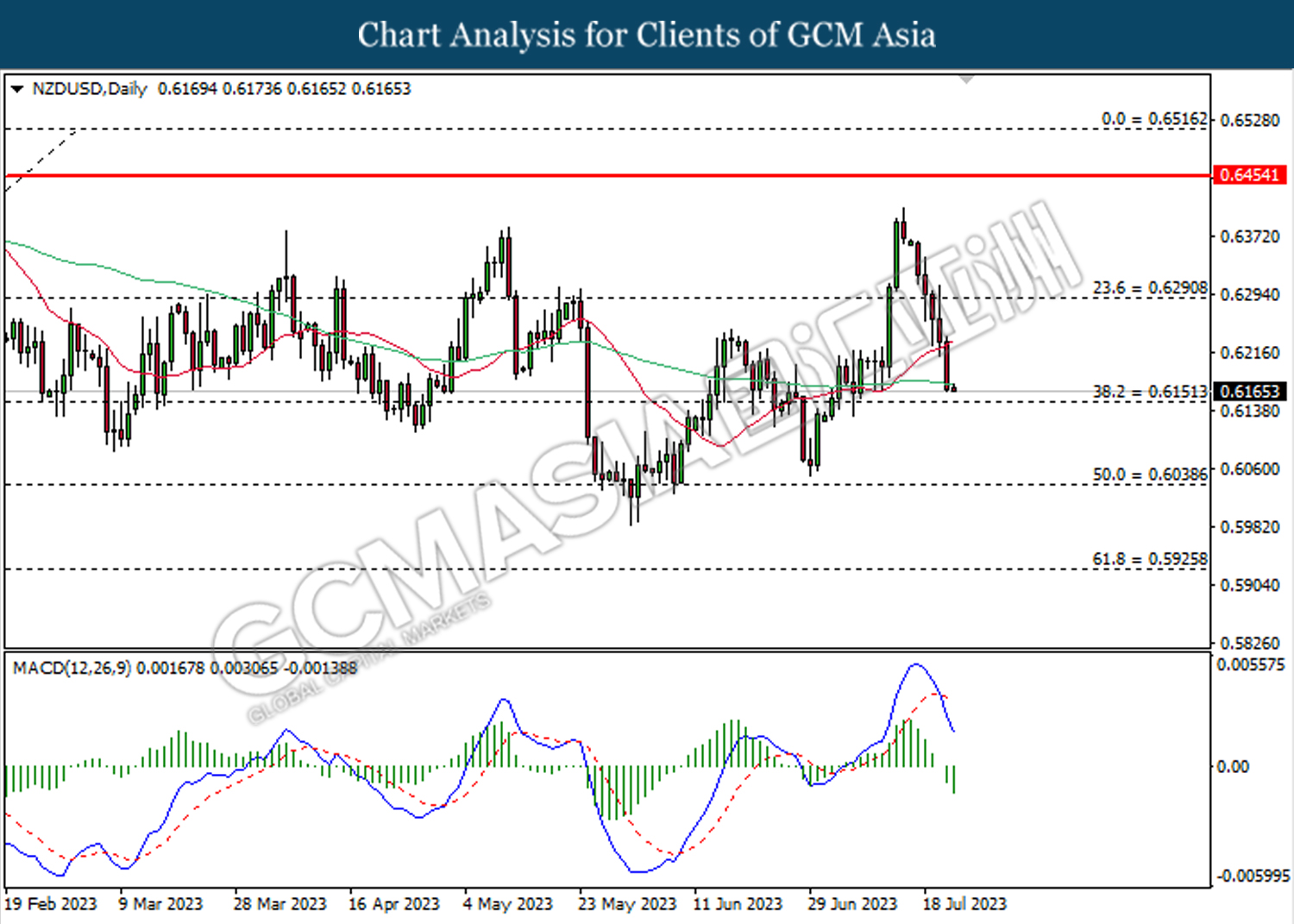

NZDUSD, Daily: NZDUSD was traded lower following the prior breakout below the previous support level at 0.6290. MACD which illustrated bearish bias momentum suggest the pair to extend its losses toward the support level at 0.6150.

Resistance level: 0.6290, 0.6455

Support level: 0.6150, 0.6040

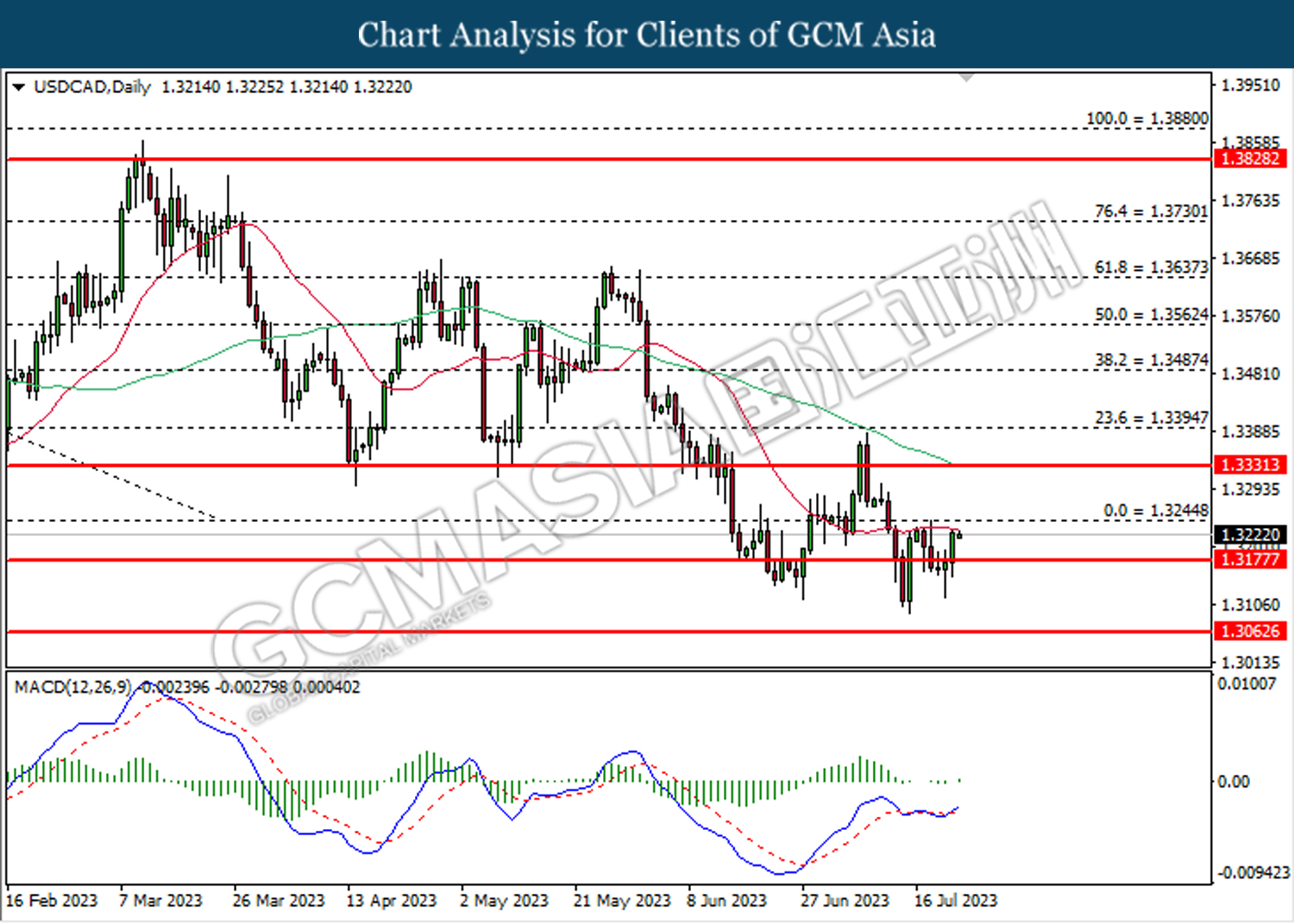

USDCAD, Daily: USDCAD was traded higher following the prior breakout above the previous resistance level at 1.3175. MACD which illustrated bullish bias momentum suggests the pair to extend its gains toward the resistance level at 1.3245.

Resistance level: 1.3245, 1.3330

Support level: 1.3175, 1.3065

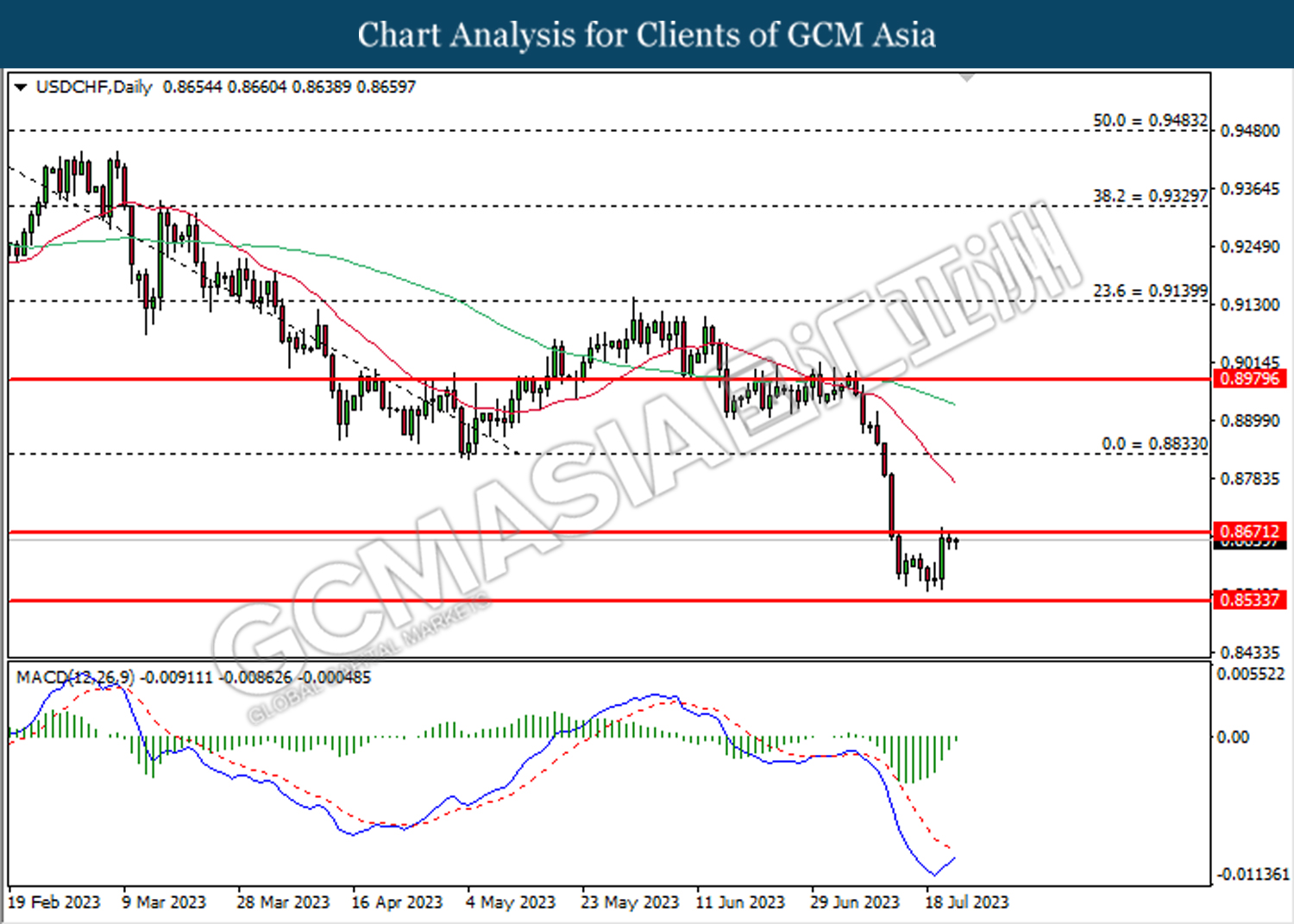

USDCHF, Daily: USDCHF was traded higher while currently testing the resistance level at 0.8670. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 0.8670, 0.8775

Support level: 0.8535, 0.8355

CrudeOIL, Daily: Crude oil price was traded higher while currently testing the resistance level at 77.15. MACD which illustrated bullish bias momentum suggest the commodity to extend its gains after it successfully breakout above the resistance level.

Resistance level: 77.15, 80.75

Support level: 73.90, 70.15

GOLD_, Daily: Gold price was traded lower following the prior retracement from the resistance level at 1980.00. MACD which illustrated diminishing bullish momentum suggests the commodity to extend its losses toward the support level at 1951.60.

Resistance level: 1980.00, 2020.70

Support level: 1951.60, 1939.75