24 November 2022 Afternoon Session Analysis

Pound Sterling jumped, supported by bullish economic data.

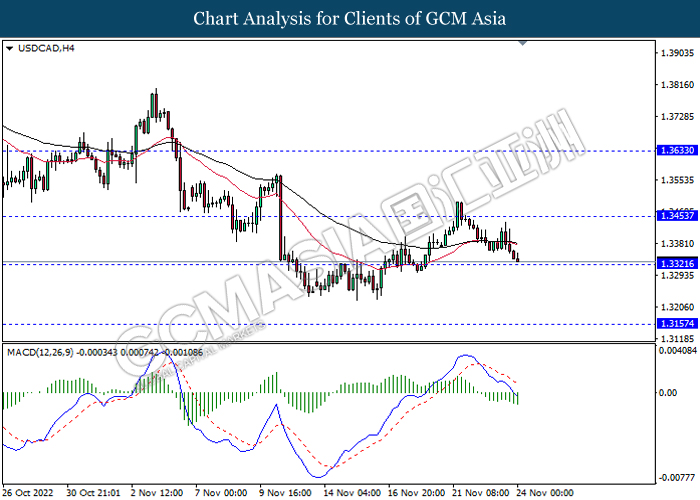

The GBP/USD, which widely traded by global investors surged on yesterday following the upbeat economic data has been announced. A series of UK data such as UK Composite Purchasing Managers’ Index (PMI), Manufacturing Purchasing Managers Index (PMI) as well as Services Purchasing Managers Index (PMI) has given a higher-than-expected reading, which dialed up the market confidence to invest in UK currency. Nonetheless, the figures that lower than 50 indicated that contraction in economic sector, while it led part of investors to remain concerns toward UK economic progression. On the other hand, the USD/CAD slumped throughout yesterday trading session amid the hawkish speech from Bank of Canada (BoC) member. According to Reuters, the BoC Governor Tiff Macklem claimed on Wednesday that higher interest rate was is needed in order to restore price stability, as the inflationary risk faced by Canada remained strong. Despite the inflationary data – CPI in Canada was cooled down to 6.9% since August, but it still far from the 2% target that set by the central bank. As of writing, GBPUSD appreciated by 0.42% to 1.2098 while USDCAD eased by 0.13% to 1.3334.

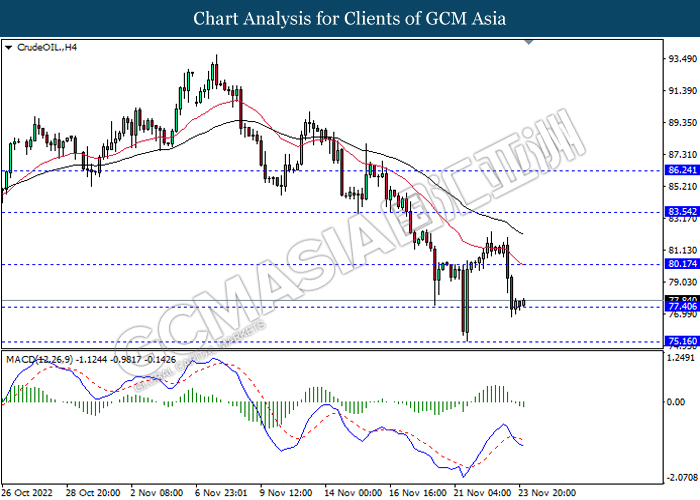

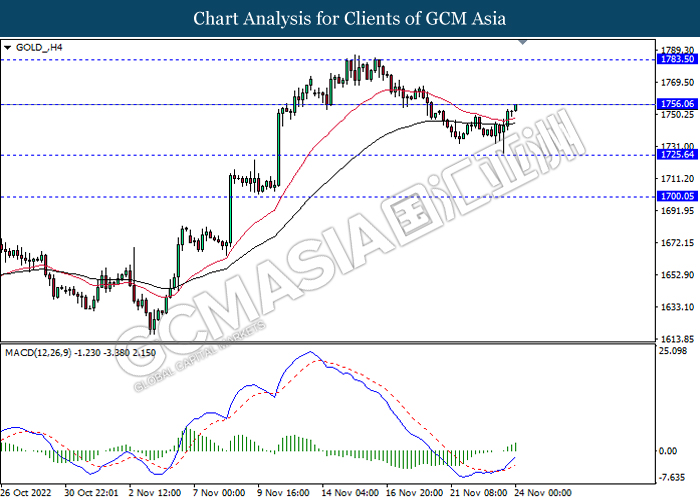

In the commodities market, the crude oil price dropped by 0.06% to $77.88 per barrel as of writing as the spiking Covid-19 cases in China keep threatening the demand of oil. In addition, the gold price rose by 0.55% to $1755.15 per troy ounce as of writing over the weakening of US Dollar.

Today’s Holiday Market Close

Time Market Event

All Day USD Thanksgiving Day

Today’s Highlight Events

Time Market Event

20:30 EUR ECB Publishes Account of Monetary Policy Meeting

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 17:00 | EUR – German Ifo Business Climate Index (Nov) | 84.3 | 85.0 | – |

Technical Analysis

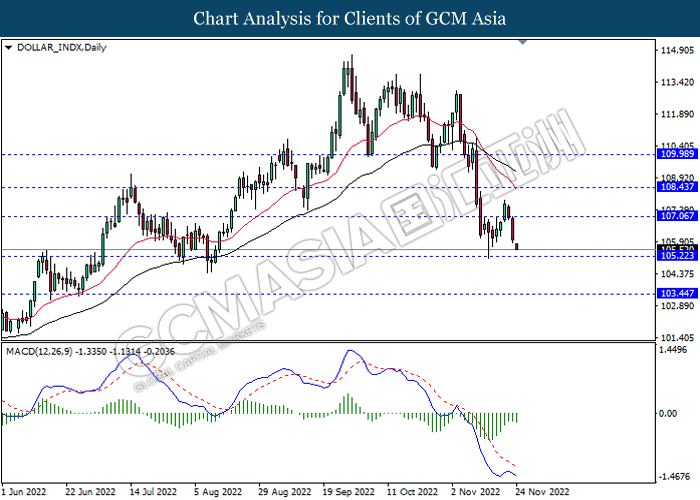

DOLLAR_INDX, Daily: Dollar index was traded lower while currently testing the support level. MACD which illustrated increasing bearish momentum suggest the index to extend its losses of successfully breakout the support level.

Resistance level: 107.05, 108.45

Support level: 105.20, 103.45

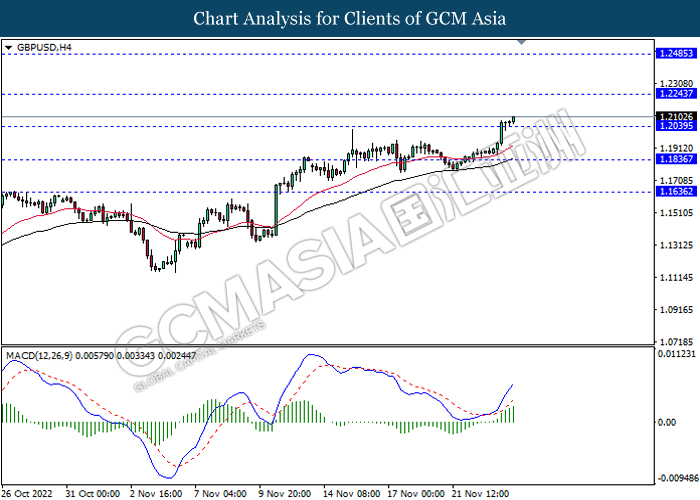

GBPUSD, H4: GBPUSD was traded higher following prior breakout above the previous resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains.

Resistance level: 1.2245, 1.2485

Support level: 1.2040, 1.1835

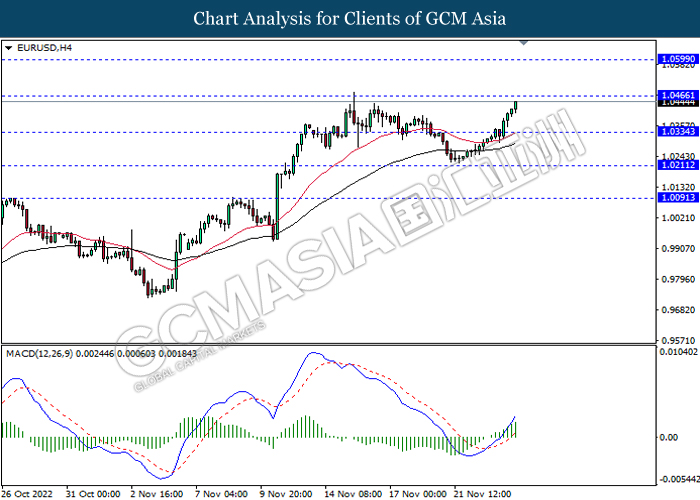

EURUSD, H4: EURUSD was traded higher while currently testing the resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains if successfully breakout the resistance level.

Resistance level: 1.0465, 1.0600

Support level: 1.0335, 1.0210

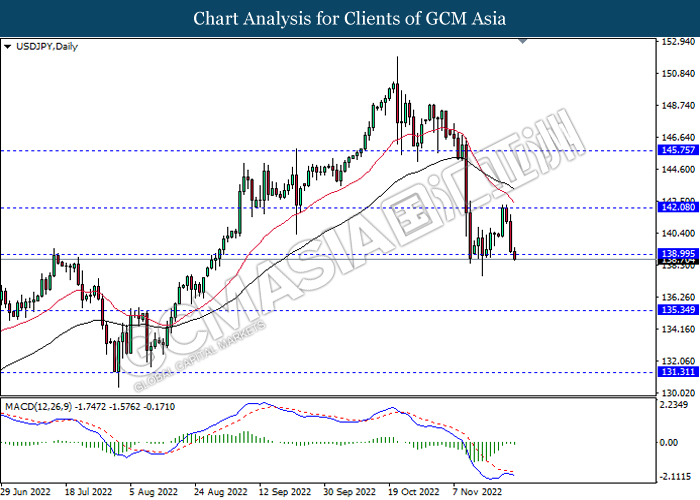

USDJPY, Daily: USDJPY was traded lower following prior breakout below the previous support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses.

Resistance level: 139.00, 142.10

Support level: 135.35, 131.30

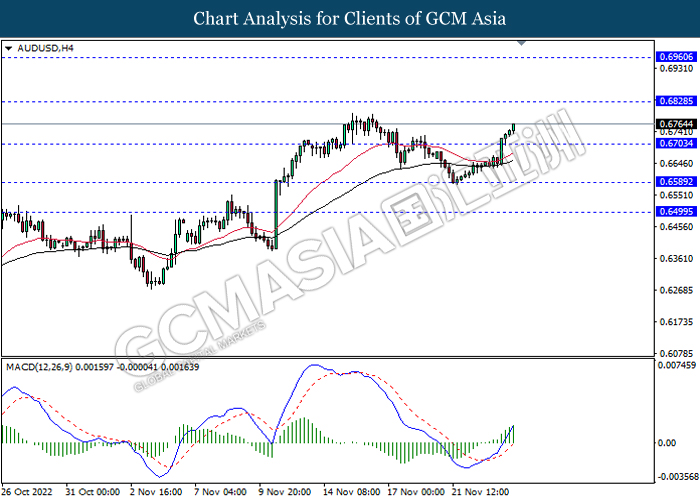

AUDUSD, H4: AUDUSD was traded higher following prior breakout above the previous resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains.

Resistance level: 0.6830, 0.6960

Support level: 0.6705, 0.6590

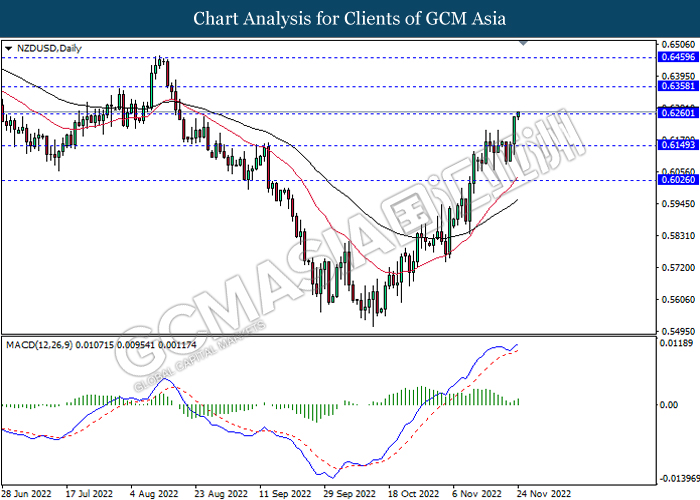

NZDUSD, Daily: NZDUSD was traded higher following prior breakout above the previous resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains.

Resistance level: 0.6360, 0.6460

Support level: 0.6260, 0.6150

USDCAD, H4: USDCAD was traded lower while currently testing the support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses if successfully breakout the support level.

Resistance level: 1.3455, 1.3635

Support level: 1.3320, 1.3155

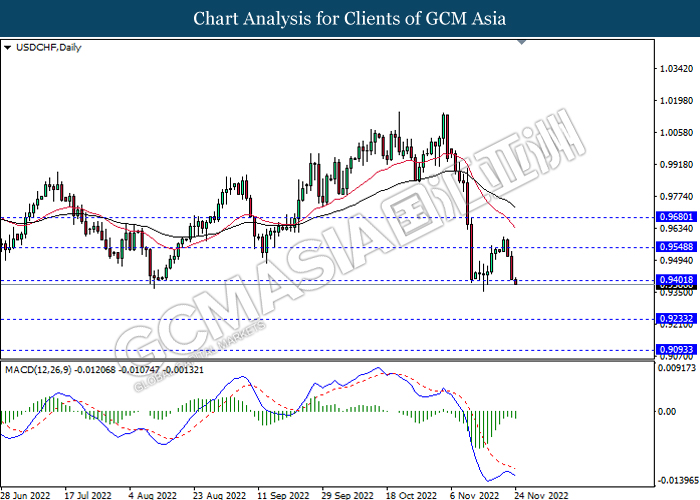

USDCHF, Daily: USDCHF was traded lower following prior breakout below the previous support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses.

Resistance level: 0.9400, 0.9550

Support level: 0.9235, 0.9095

CrudeOIL, H4: Crude oil price was traded lower while currently testing the support level. MACD which illustrated increasing bearish momentum suggest the commodity to extend its losses if successfully breakout the support level.

Resistance level: 80.15, 83.55

Support level: 77.40, 75.15

GOLD_, H4: Gold price was traded higher while currently testing the resistance level. MACD which illustrated increasing bullish momentum suggest the commodity to extend its gains if successfully breakout the resistance level.

Resistance level: 1756.05, 1783.50

Support level: 1725.65, 1700.05