24 November 2022 Morning Session Analysis

Greenback plunged amid dovish Fed meeting minutes.

The dollar index, which gauges its value against a basket of six major currencies, extended its losses during the previous trading session as dovish meeting minutes and downbeat economic data suppressed the sentiment of dollar’s market. Earlier today, the minutes of the Fed’s November meeting has showed that the officials agreed that a smaller interest rate hike should happen soon as the tightening monetary policy is expected to have effect on the US economy. According to the minutes, a majority of the Fed members nod their head a smaller rate hikes as it gives a chance to the policymakers to take a breath while evaluating the impact policy is having on the economy Despite, the officials said they still see few signs of inflation abating. On the other hand, the number of people filing for the unemployment benefit in the US has risen from 223K to 240K, missing the forecast of the consensus at 225K. The downbeat employment data has dampened the appeal of the Greenback as it is reflecting that the US labor market turned fragile. As of writing, the dollar index plummeted -1.01% to 106.15.

In the commodities market, the crude oil price plunged by -4.66% to $78.05 per barrel as the Group of Seven (G7) nations considered a price cap on Russian oil above the current market level. Besides, the gold prices edged up by 0.01% to $1749.75 per troy ounce amid the dollar weakened.

Today’s Holiday Market Close

Time Market Event

All Day USD Thanksgiving Day

Today’s Highlight Events

Time Market Event

20:30 EUR ECB Publishes Account of Monetary Policy Meeting

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 17:00 | EUR – German Ifo Business Climate Index (Nov) | 84.3 | 85.0 | – |

Technical Analysis

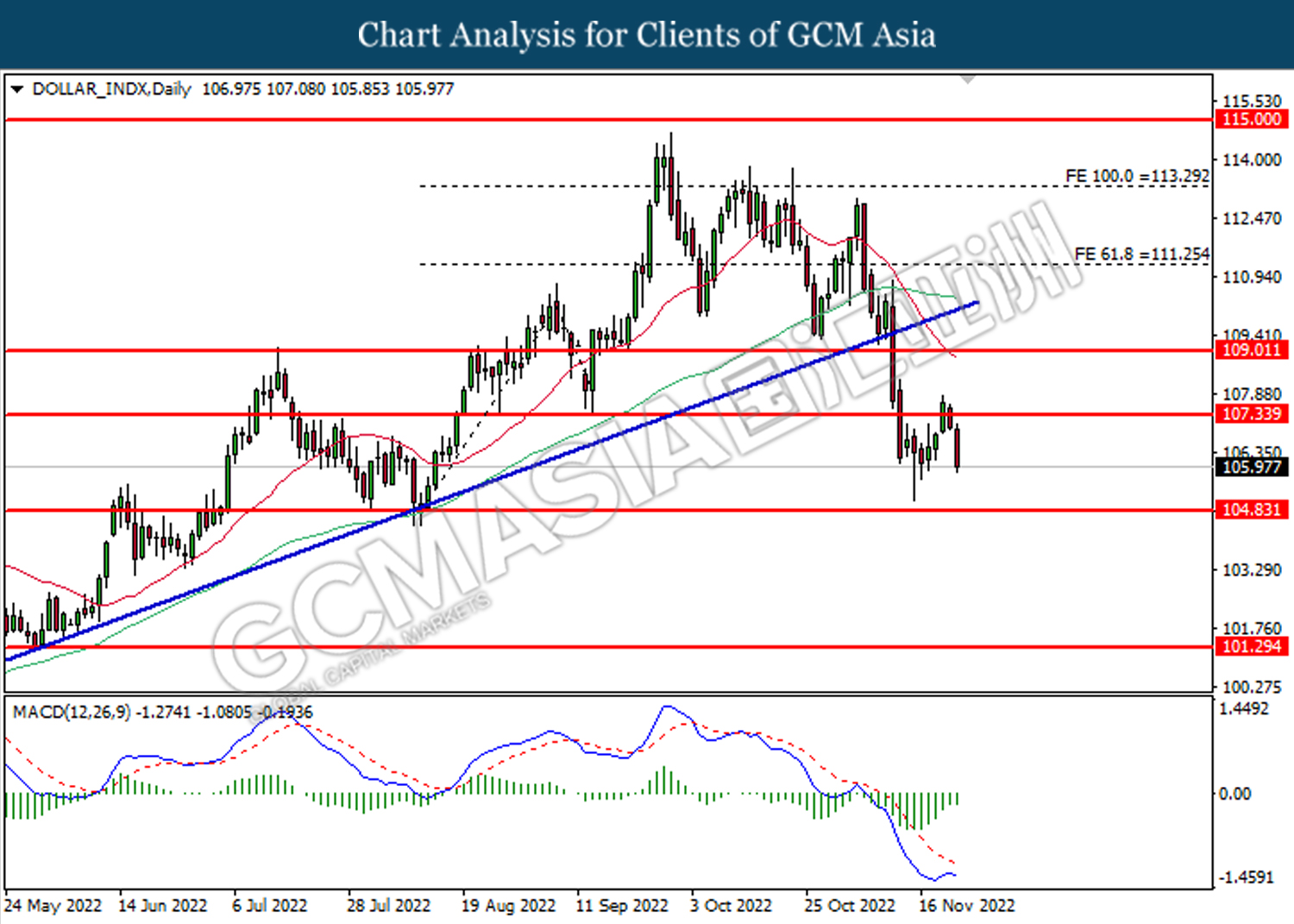

DOLLAR_INDX, Daily: Dollar index was traded lower following prior breakout below the previous support level at 107.35. MACD which illustrated bearish bias momentum suggests the index to extend its losses toward the support level at 104.85.

Resistance level: 107.35, 109.00

Support level: 104.85, 101.30

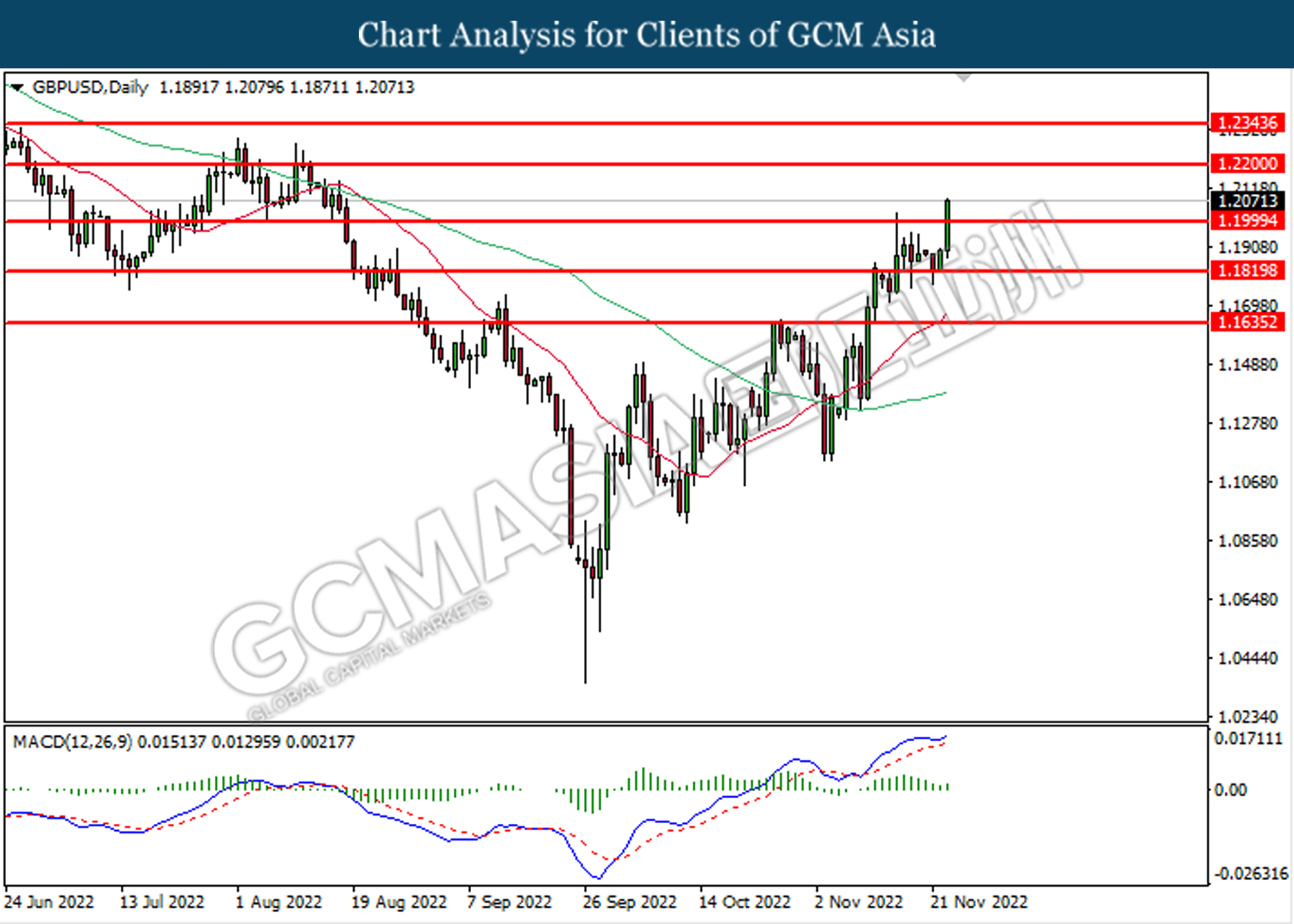

GBPUSD, Daily: GBPUSD was traded higher while currently testing the resistance level at 1.2000. MACD which illustrated bullish bias momentum suggest the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 1.2000, 1.2200

Support level: 1.1820, 1.1635

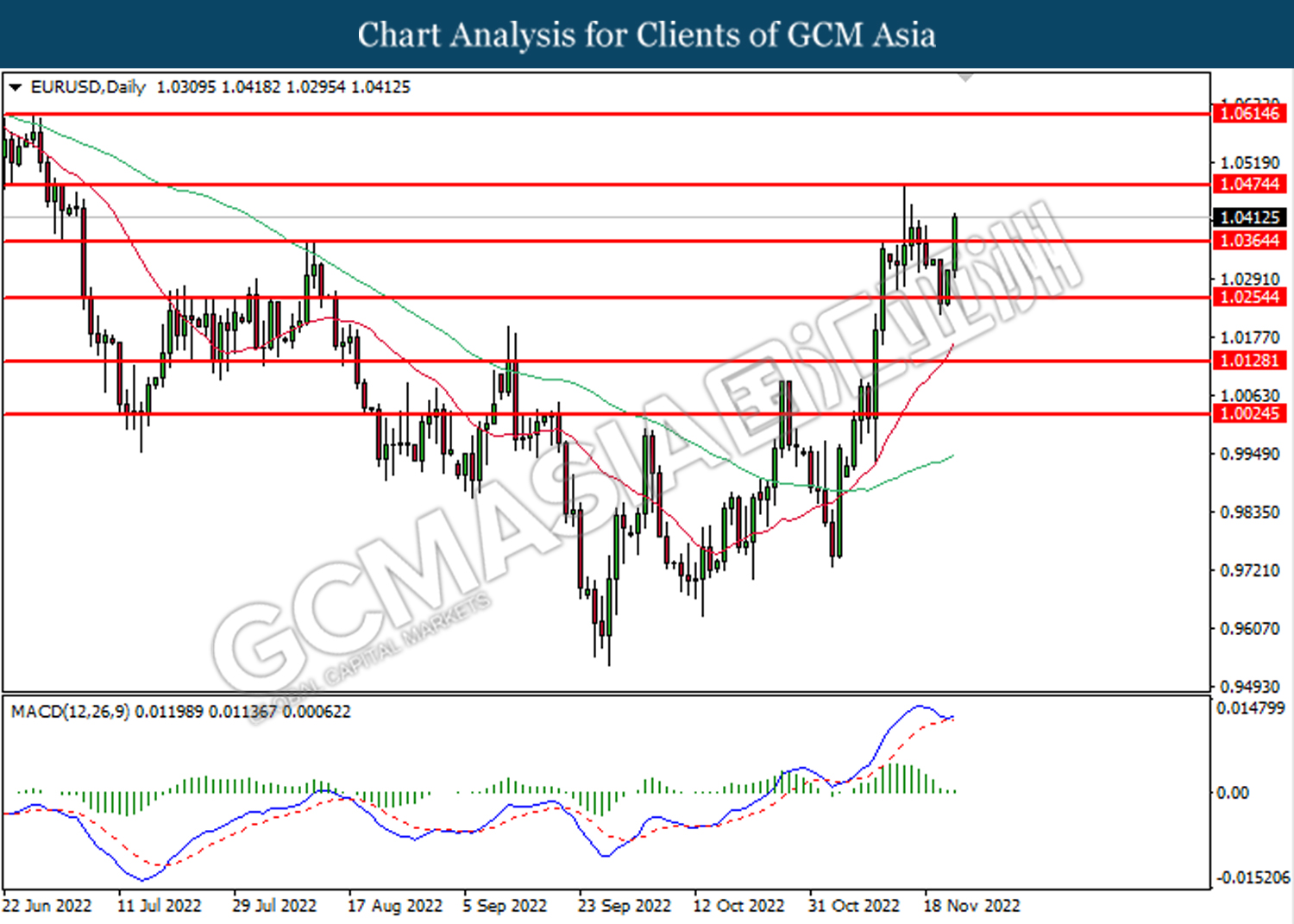

EURUSD, Daily: EURUSD was traded higher while currently testing the resistance level at 1.0365. MACD which illustrated bullish bias momentum suggest the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 1.0365, 1.0475

Support level: 1.0255, 1.0130

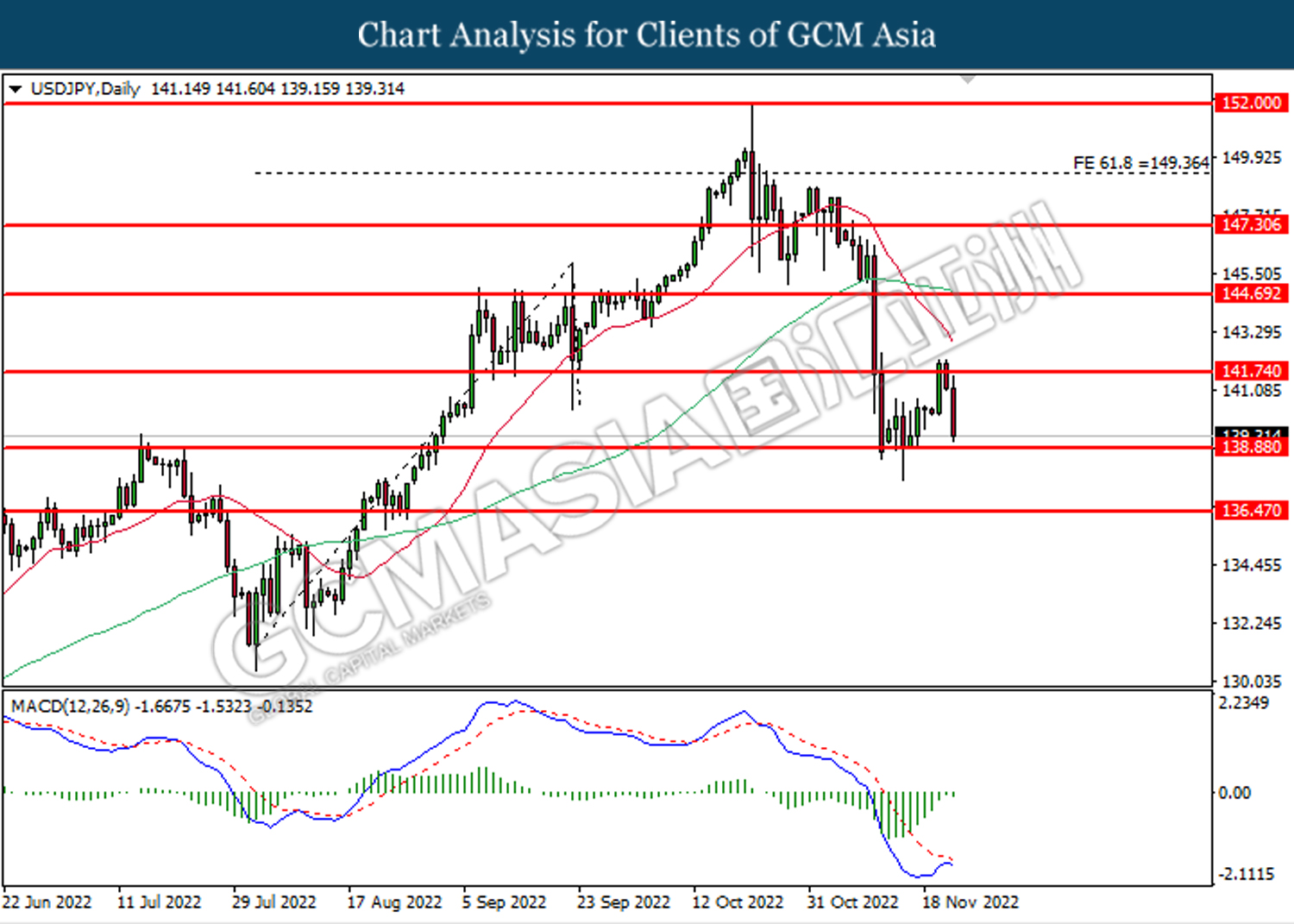

USDJPY, Daily: USDJPY was traded lower following prior retracement from the resistance level at 141.75. MACD which illustrated bearish bias momentum suggest the pair to extend its losses toward the support level at 138.90.

Resistance level: 141.75, 144.70

Support level: 138.90, 136.45

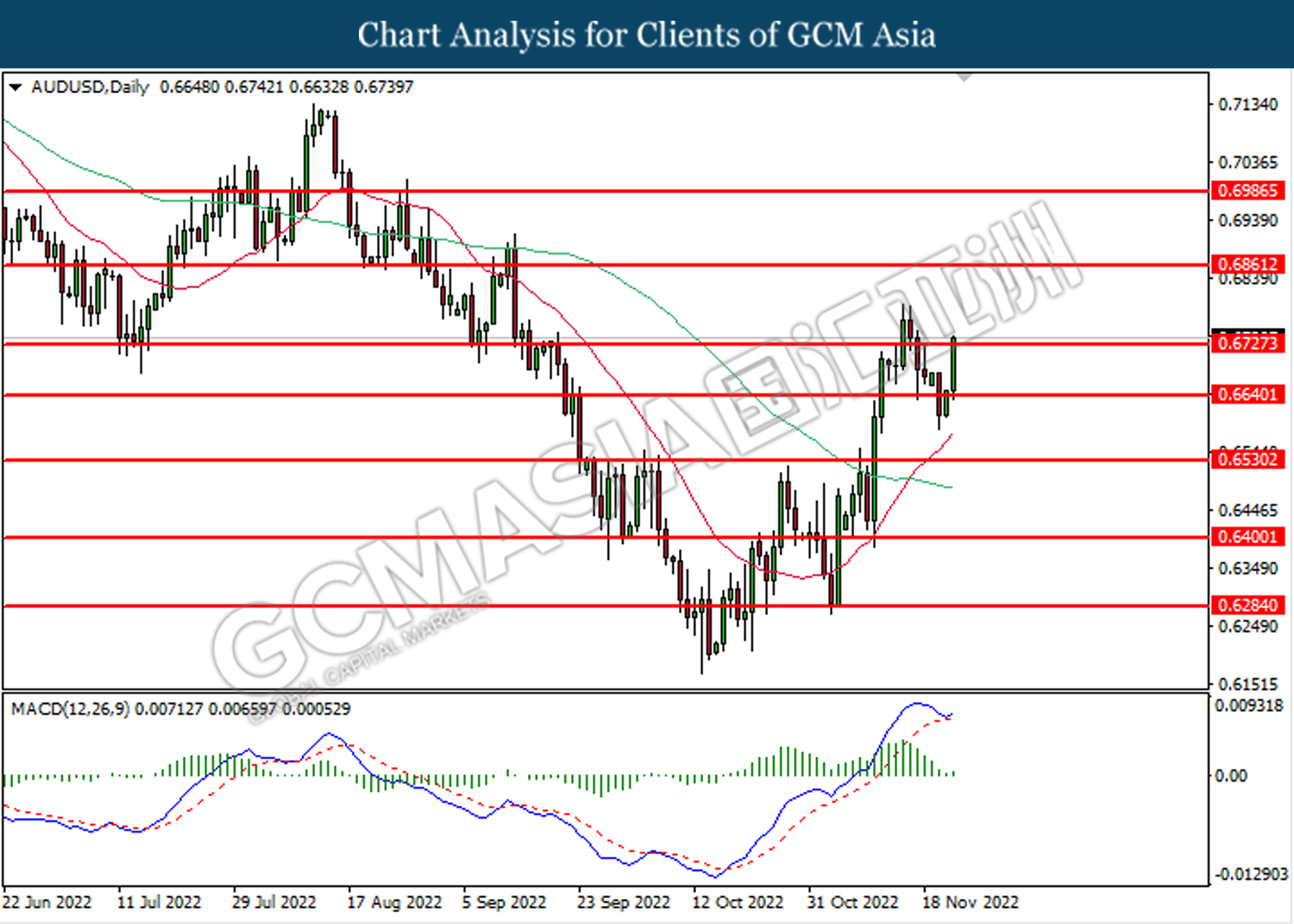

AUDUSD, Daily: AUDUSD was traded higher while currently testing the resistance level at 0.6725. MACD which illustrated bullish bias momentum suggest the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 0.6725, 0.6860

Support level: 0.6640, 0.6530

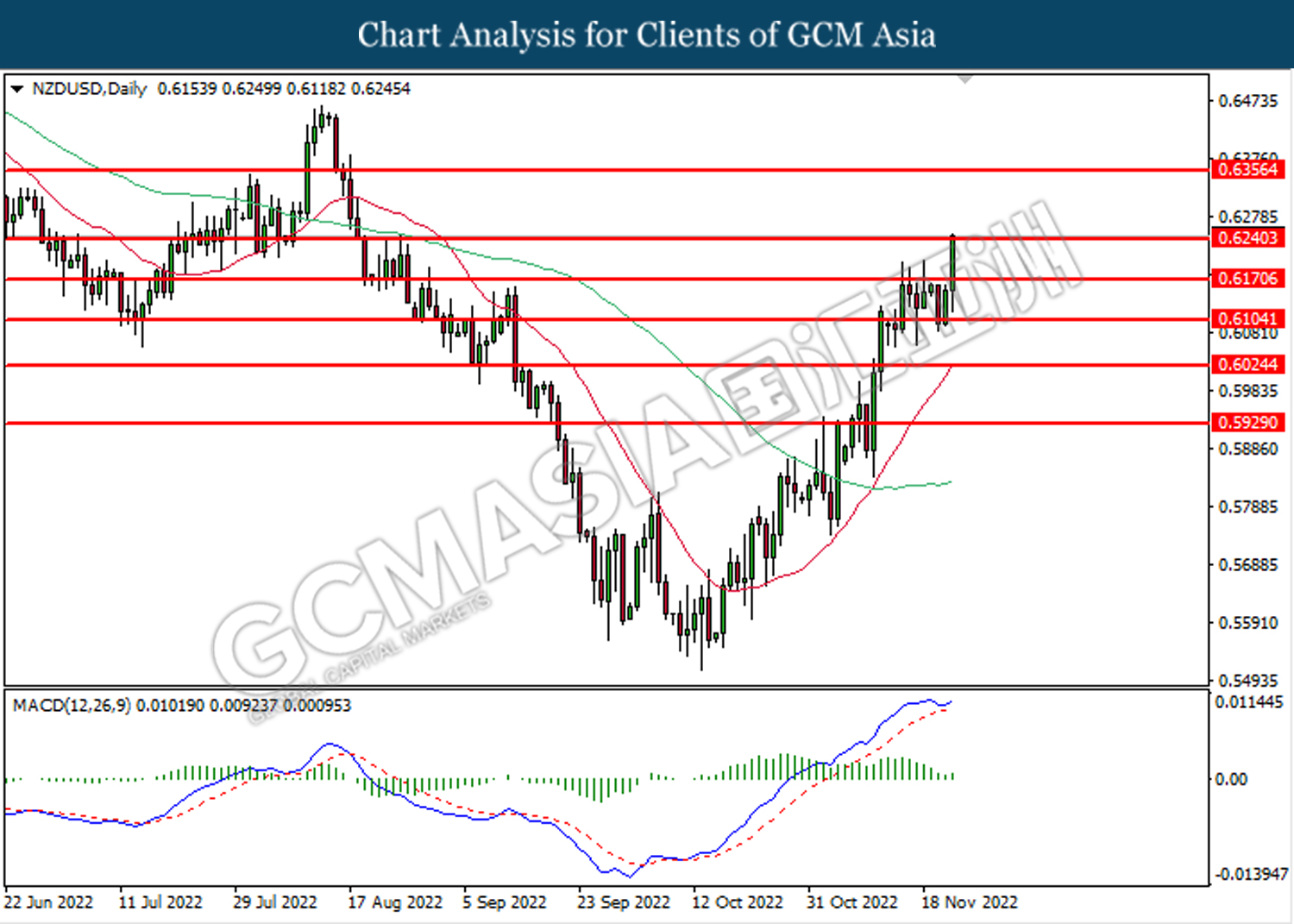

NZDUSD, Daily: NZDUSD was traded higher while currently testing the resistance level at 0.6240. MACD which illustrated bullish bias momentum suggest the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 0.6240, 0.6355

Support level: 0.6170, 0.6105

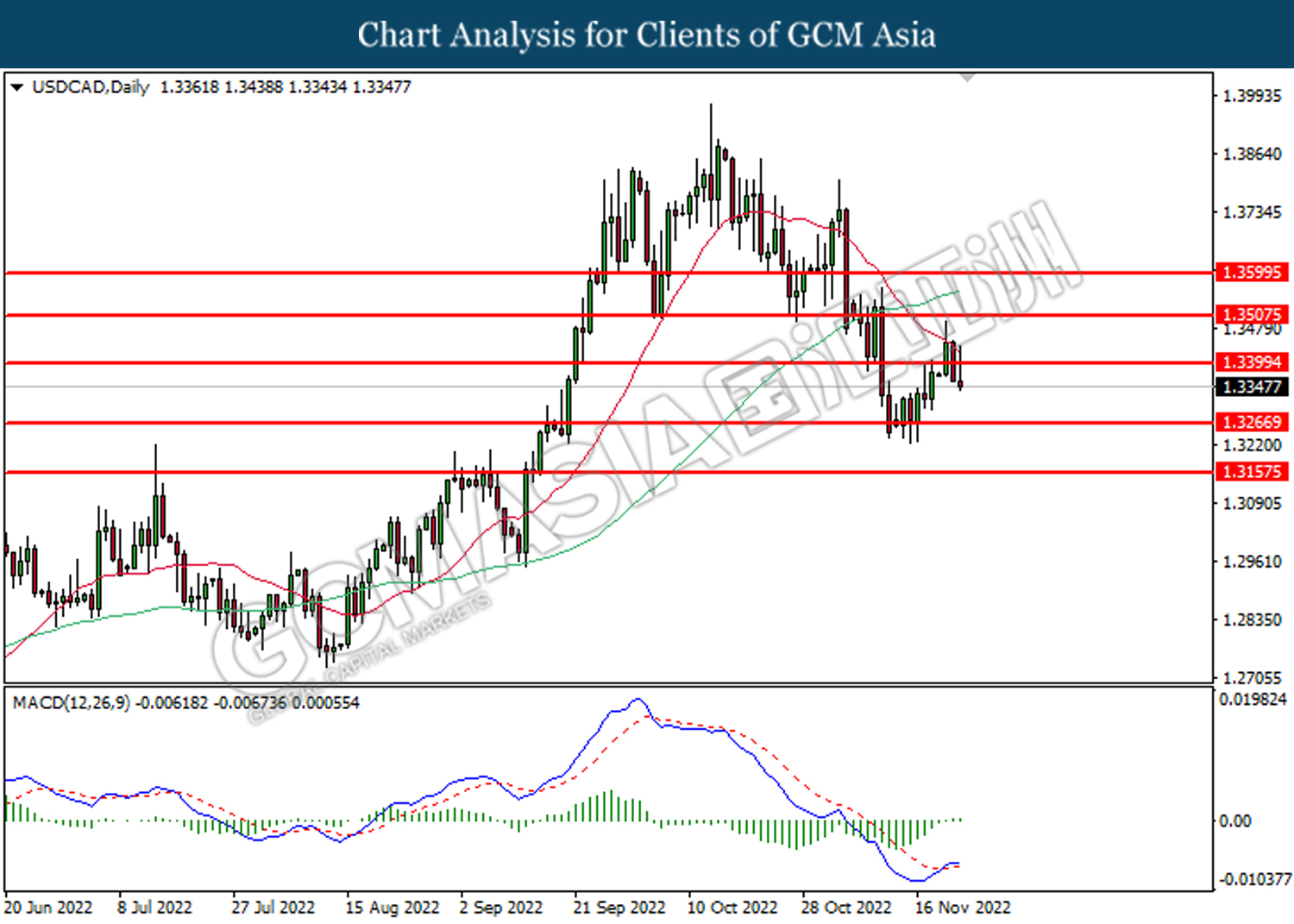

USDCAD, Daily: USDCAD was traded lower following prior breakout below the previous support level at 1.3400. MACD which illustrated bearish bias momentum suggests the pair to extend its losses toward the support level at 1.3265.

Resistance level: 1.3400, 1.3505

Support level: 1.3265, 1.3155

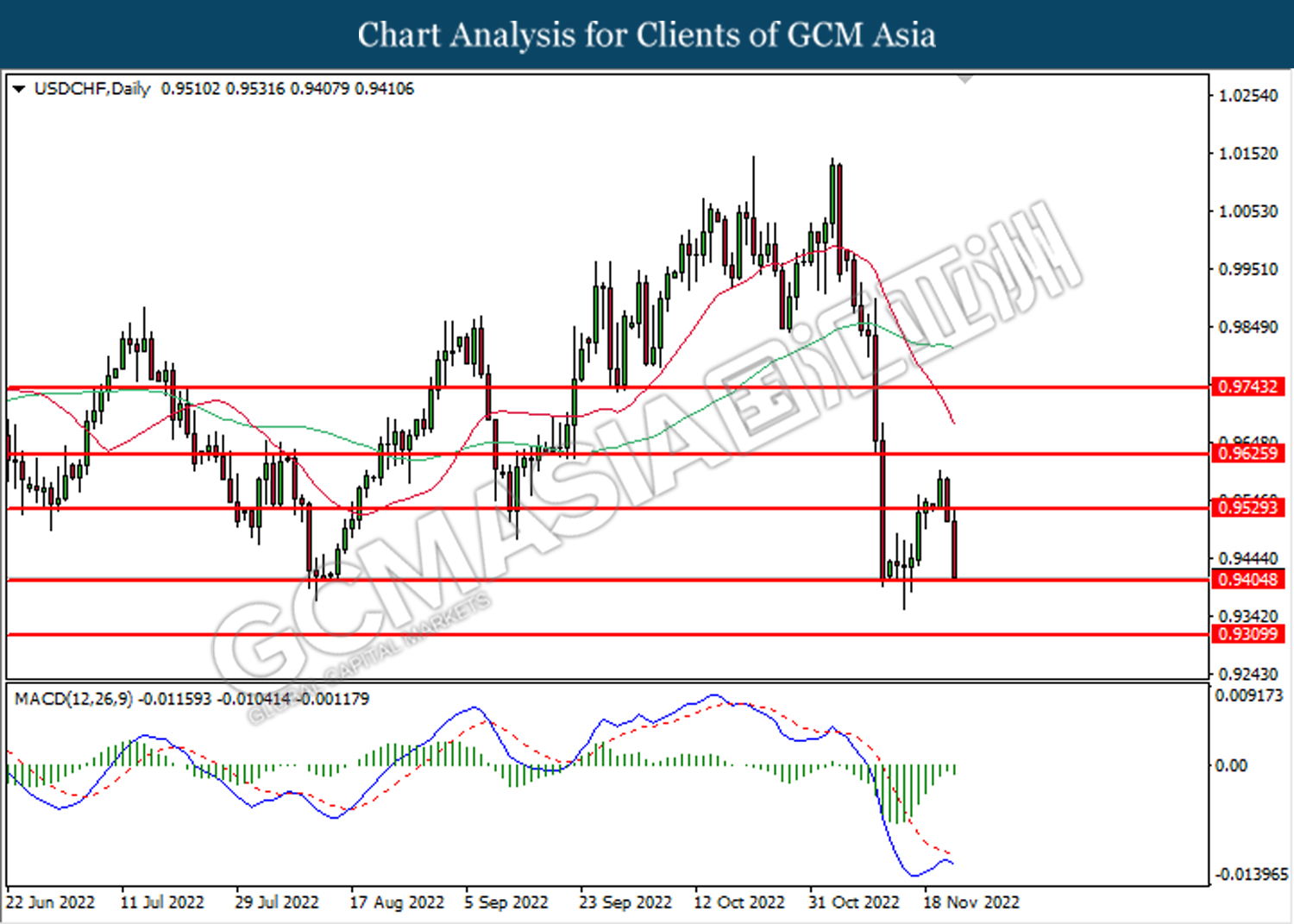

USDCHF, Daily: USDCHF was traded lower while currently testing the support level at 0.9405. MACD which illustrated bearish bias momentum suggest the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 0.9530, 0.9625

Support level: 0.9405, 0.9310

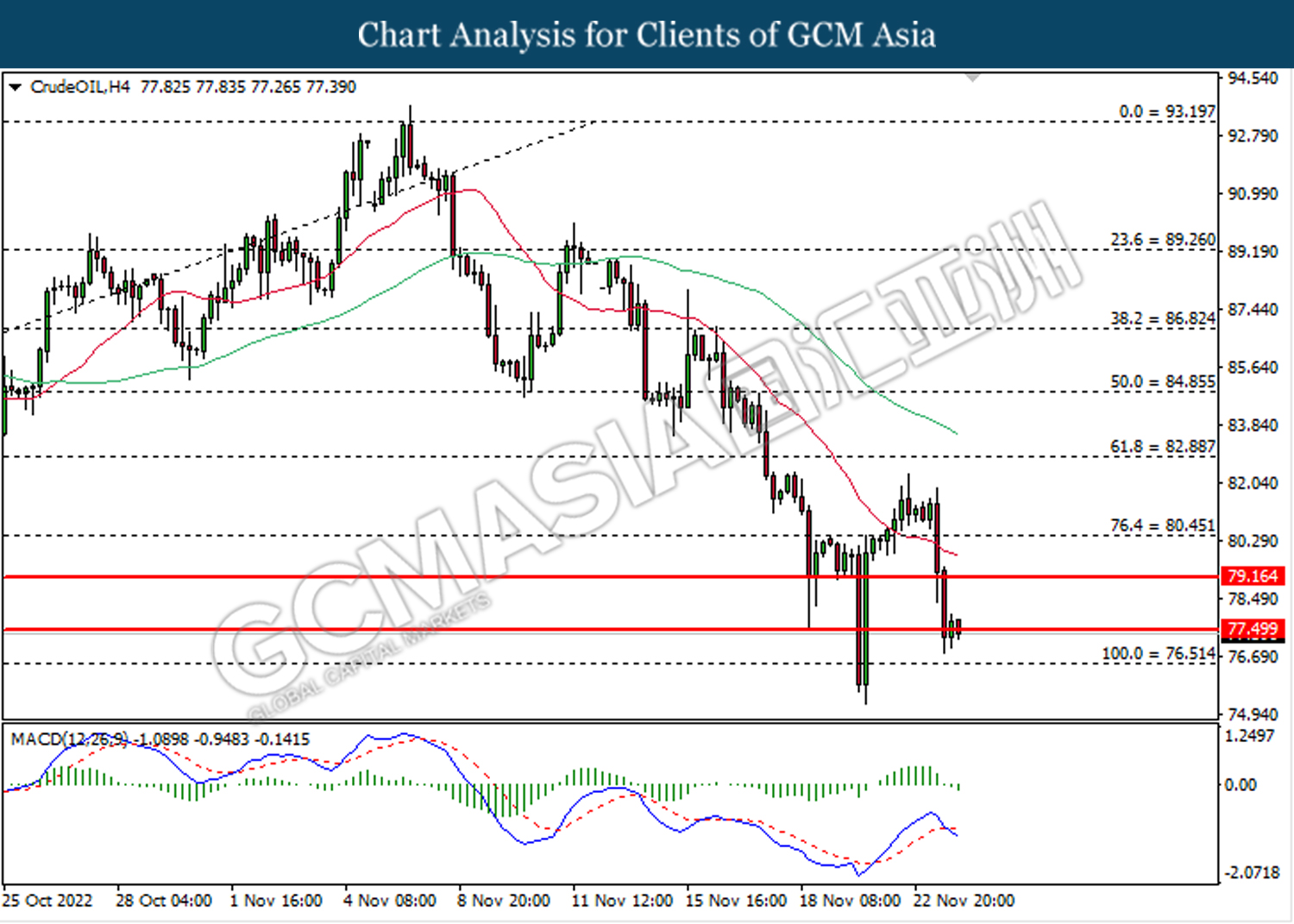

CrudeOIL, H4: Crude oil price was traded lower while currently testing the support level at 77.50. MACD which illustrated bearish bias momentum suggest the commodity to extend its losses after it successfully breakout below the support level.

Resistance level: 79.15, 80.45

Support level: 77.50, 76.50

GOLD_, Daily: Gold price was traded higher following prior rebound from the support level at 1726.15. MACD which illustrated bullish bias momentum suggests the commodity to extend its gains toward the resistance level at 1766.50.

Resistance level: 1766.50, 1805.90

Support level: 1726.15, 1693.35