24 December 2020 Afternoon Session Analysis

Dollar pressured as Donald Trump obstruct U.S stimulus.

During late Asian session, the dollar index which traded against a basket of six major currency pairs have fell after reports of Donald Trump threaten to not sign the COVID-19 bills. Following latest development on U.S stimulus, President Donald Trump have recently threatened to not sign an $892 billion coronavirus relief bill that includes desperately needed money for individual Americans and wants to request the Congress to increase the amount in the stimulus check to $2000 for individuals of $4,000 for couples instead of $600. Following the potential obstruction that could affect the help for U.S citizens and recovery for U.S economy, confidence towards the U.S dollar have fell and caused investors to shift their portfolio from greenback to other safer markets such as Yen, thus devaluing its price. Still, market will continue to monitor the development to determine further direction for the greenback. At the time of writing, dollar index slips 0.27% to $90.04.

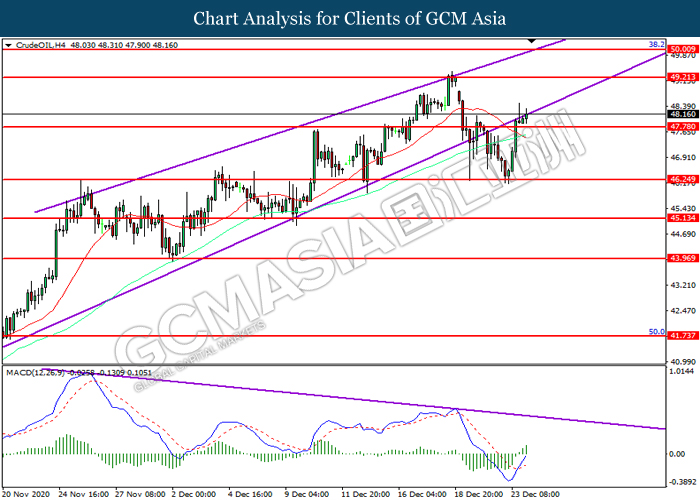

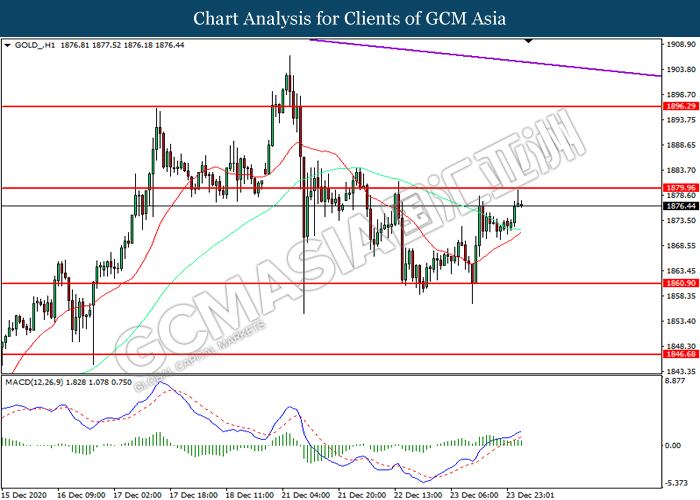

In the commodities market, crude oil price gains 0.48% to $48.26 per barrel as of writing following hopes of demand recovery. While oil market is expected to celebrate the holiday season, recent catalyst such as lower crude inventories and potential Brexit deal have help lifted the outlook for demand recovery and boosting the commodity price. On the other hand, gold price also rose 0.21% to $1876.75 a troy ounce at the time of writing amid increasing risk-aversion mood in the market due to Donald Trump’s stimulus drama.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

N/A

Technical Analysis

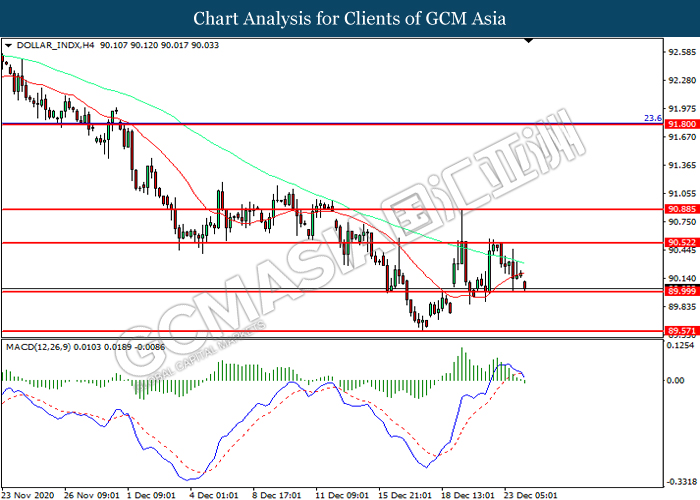

DOLLAR_INDX, H4: Dollar index was traded lower while currently testing the support level at 90.00. MACD which illustrated increasing bearish momentum suggest the index to extend its losses after it successfully breakout below the support level.

Resistance level: 90.50, 90.90

Support level: 90.00, 89.55

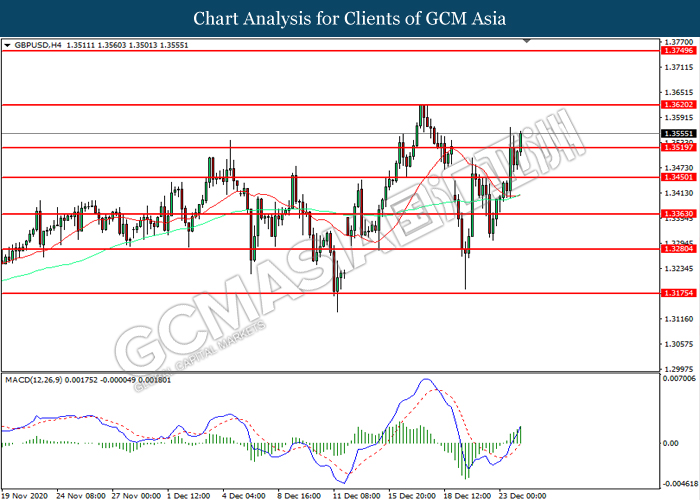

GBPUSD, H4: GBPUSD was traded higher following prior breakout above the previous resistance level at 1.3520. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains toward resistance level at 1.3620

Resistance level: 1.3620, 1.3750

Support level: 1.3365, 1.3280

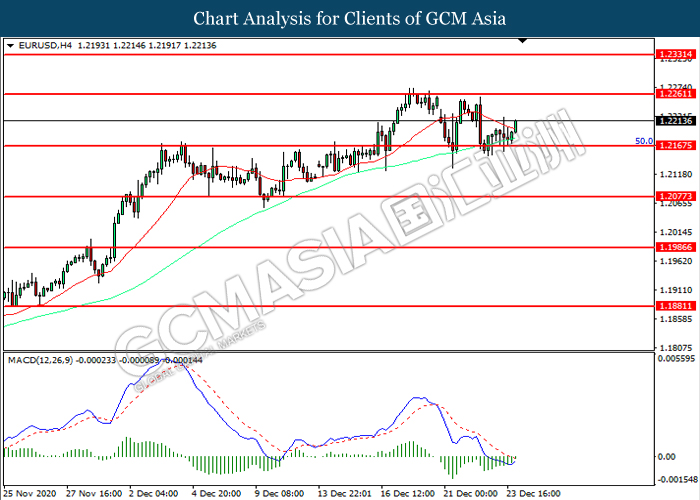

EURUSD, H4: EURUSD was traded higher following prior rebound from the support level at 1.2165. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains toward resistance level at 1.2260.

Resistance level: 1.2260, 1.2330

Support level: 1.2165, 1.2075

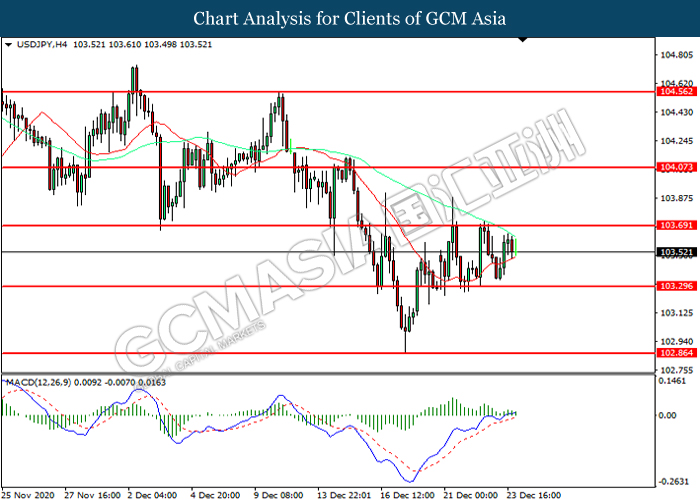

USDJPY, H4: USDJPY was traded lower following prior retracement from the resistance level at 103.70. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses toward support level at 103.30.

Resistance level: 103.70, 104.05

Support level: 103.30, 102.85

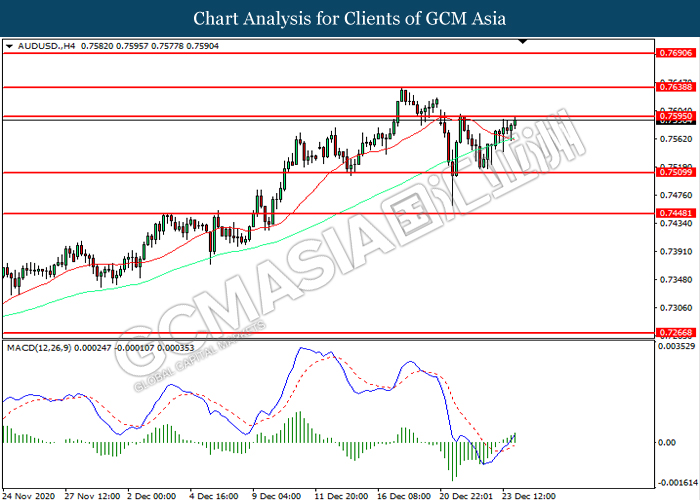

AUDUSD, H4: AUDUSD was traded higher while currently testing the resistance level at 0.7595. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 0.7595, 0.7640

Support level: 0.7510, 0.7450

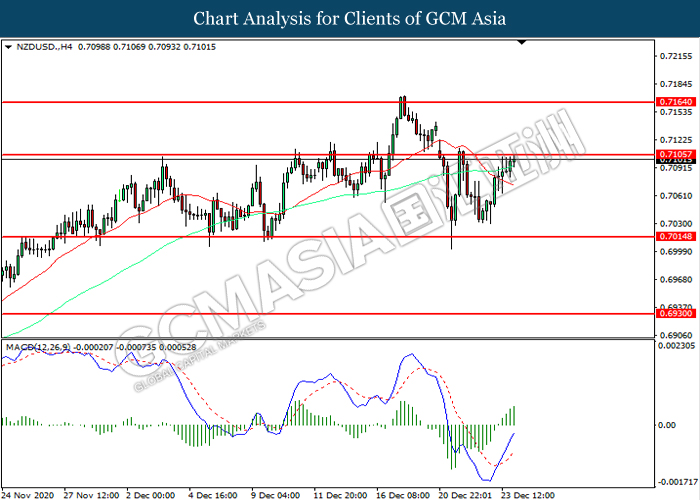

NZDUSD, H4: NZDUSD was traded higher while currently testing the resistance level at 0.7105. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 0.7105, 0.7165

Support level: 0.7015, 0.6930

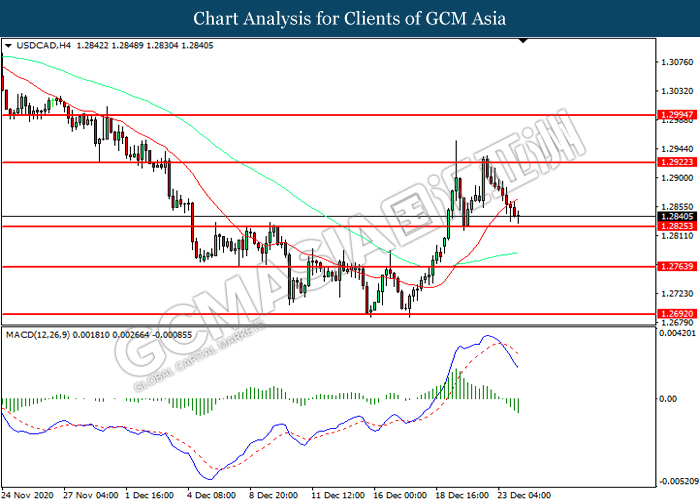

USDCAD, H4: USDCAD was traded lower while currently testing the support level at 1.2825. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 1.2920, 1.2995

Support level: 1.2825, 1.2765

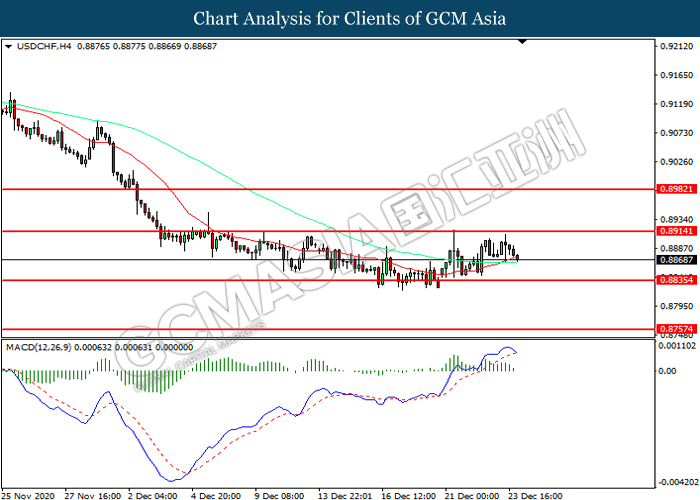

USDCHF, H4: USDCHF was traded lower following prior retracement from the resistance level at 0.8915. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses toward support level at 0.8835.

Resistance level: 0.8915, 0.8980

Support level: 0.8835, 0.8755

CrudeOIL, H4: Crude oil price was traded higher following prior breakout above the previous resistance level at 47.80. MACD which illustrated increasing bullish momentum suggest the commodity to extend its gains toward resistance level at 49.20.

Resistance level: 49.20, 50.00

Support level: 47.80, 46.25

GOLD_, H1: Gold price was traded higher while currently testing the resistance level at 1879.95. However, MACD which illustrated diminishing bullish momentum suggest the commodity to be traded lower in short-term as technical correction.

Resistance level: 1879.95, 1896.30

Support level: 1860.90, 1846.70