24 December 2020 Morning Session Analysis

Pound skyrocketed as the Brexit deal is imminent.

Pound sterling which act as one of the major currencies that being traded by the investors in FX market surged significantly as the likelihood of achieving a deal increased as Christmas deadline looms. According to the senior diplomat from EU, he stated that a Brexit trade deal is imminent, and the deal could be approved by both sides negotiators as early as tonight. Besides, European Commission have also revealed that EU member states may be summoned to a meeting soon to approve any accord as the deal has enters the end phrase. Prior to now, Von der Leyen and Johnson had been poised to hold a press conference early on Wednesday to announce the deal, but they decide to extend the announcement as the long legal text of Brexit deal required them to have extra time to go through. As of now, the negotiators from both sides are still battling deep into the night to gain a last minute advantage, seeking to achieve a consensus and seal a deal in order to avoid Hard-Brexit situation which could damage the future trades between UK and EU. During Asian early trading session, the pair of GBP/USD rose 0.14% to 1.3511.

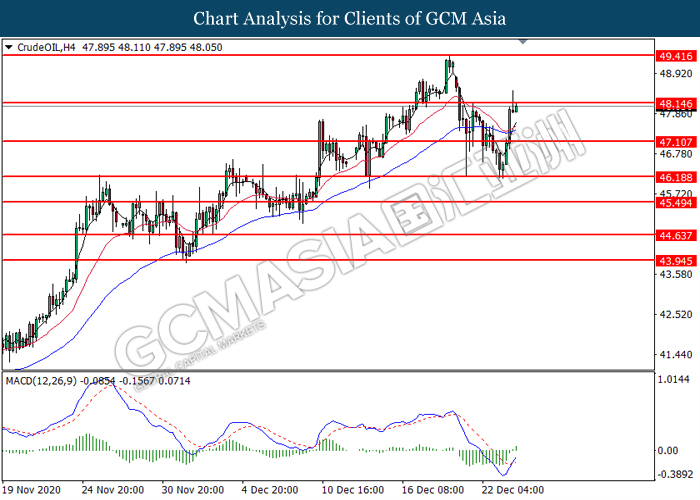

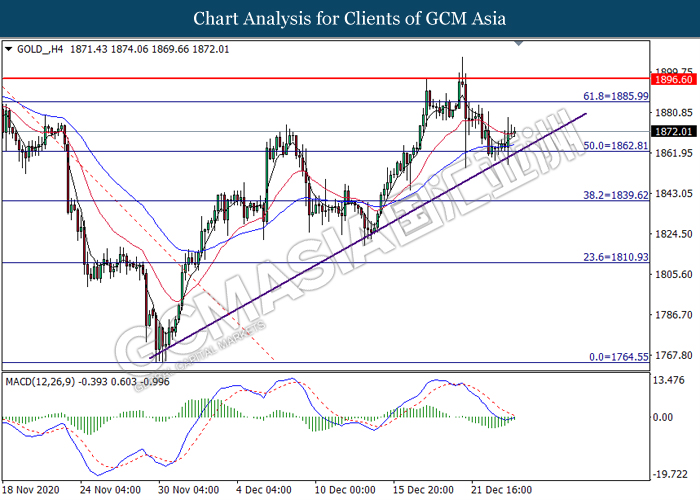

In the commodities market, the crude oil price up by 0.12% to $48.16 per barrel as of writing amid an oil draw in last week inventories level. According to the EIA, US Crude Oil Inventories dropped 0.562M, slightly lower than the economist forecast at -3.186M. Besides, the positive news from Brexit development has also turns the black commodity market scented as Hard-Brexit may tamper the future trade between UK and EU, and eventually affect the oil market. Besides, gold price appreciated by 0.05% to $1871.90 a troy ounce as fears over mutated virus remains.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 21:30 | USD – Core Durable Goods Orders (MoM)(Nov) | 1.3% | 0.6% | – |

Technical Analysis

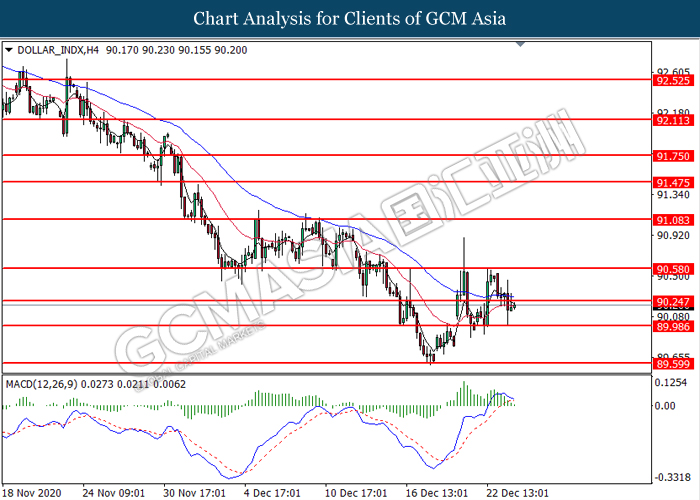

DOLLAR_INDX, H4: Dollar index was traded lower following prior breakout below the previous support level at 90.25. MACD which illustrated diminishing bullish momentum suggest the index to extend its losses toward the support level at 90.00.

Resistance level: 90.25, 90.60

Support level: 90.00, 89.60

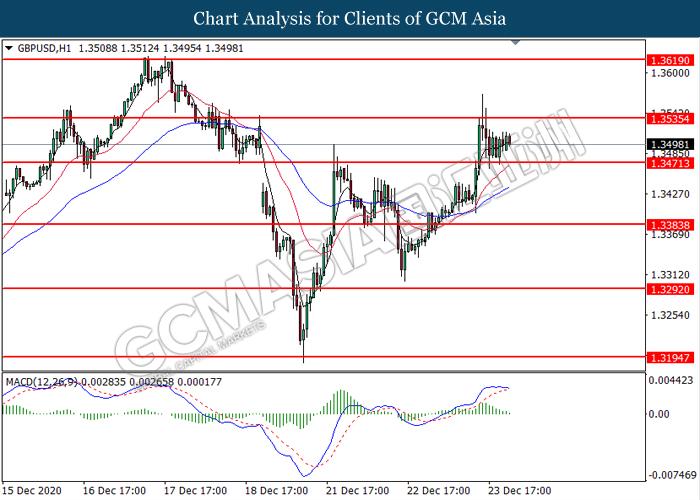

GBPUSD, H1: GBPUSD was traded lower following prior retracement from the resistance level at 1.3535. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses toward the support level at 1.3470.

Resistance level: 1.3535, 1.3620

Support level: 1.3470, 1.3385

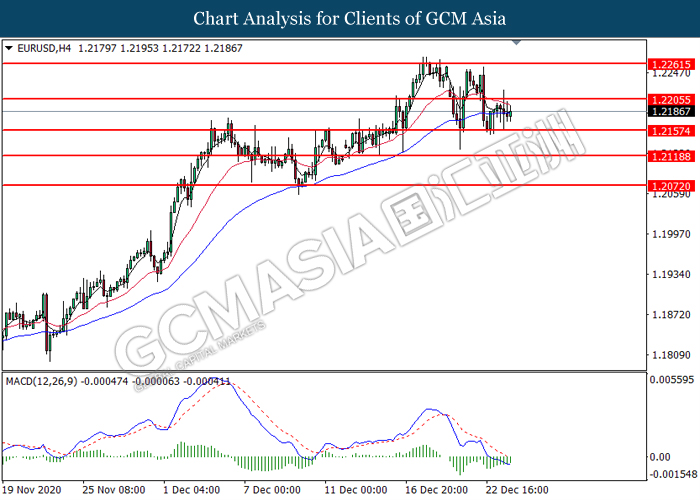

EURUSD, H4: EURUSD was traded lower following prior retracement from the resistance level at 1.2205. MACD which illustrated bearish bias momentum suggest the pair to extend its losses toward the support level at 1.2155.

Resistance level: 1.2205, 1.2260

Support level: 1.2155, 1.2120

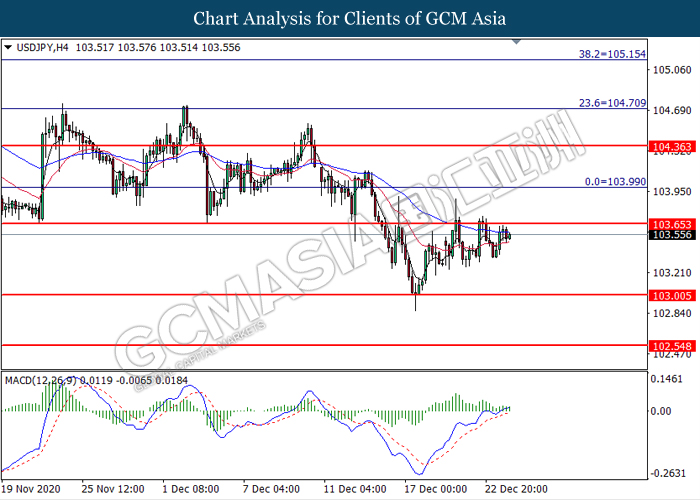

USDJPY, H4: USDJPY was traded lower following prior retracement from the resistance level at 103.65. MACD which illustrated diminishing bullish momentum suggest the pair to be traded lower toward the support level at 103.00.

Resistance level: 103.65, 104.00

Support level: 103.00, 102.55

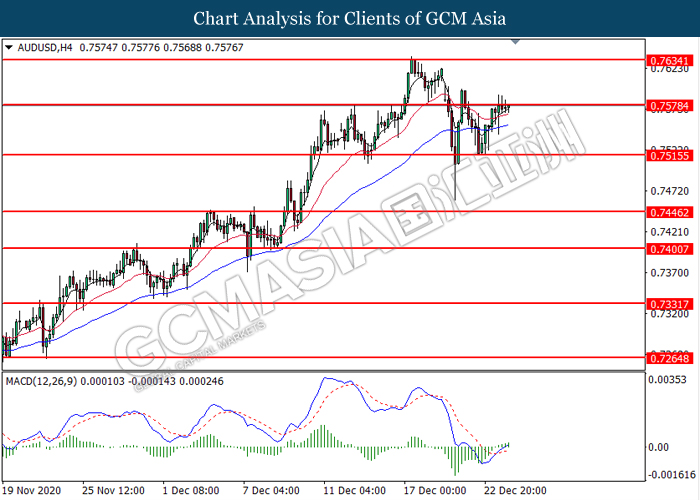

AUDUSD, H4: AUDUSD was traded higher while currently testing the resistance level at 0.7580. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains after it successfully breakout above the resistance level at 0.7580.

Resistance level: 0.7580, 0.7635

Support level: 0.7515, 0.7445

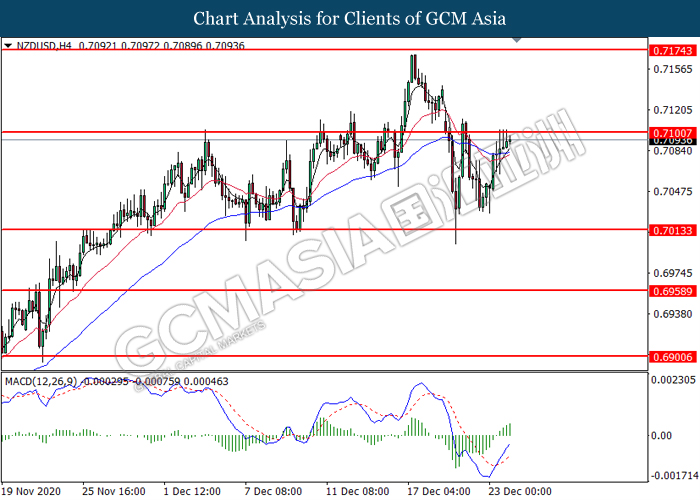

NZDUSD, H4: NZDUSD was traded higher while currently testing the resistance level at 0.7100. MACD which illustrated bullish bias momentum suggest the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 0.7100, 0.7175

Support level: 0.7015, 0.6960

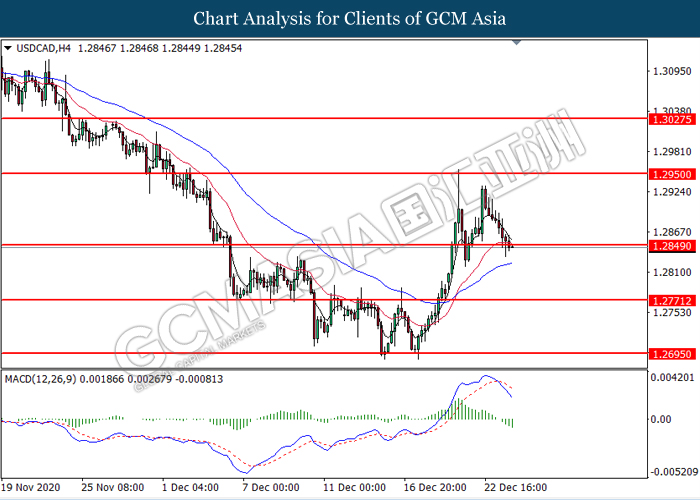

USDCAD, H4: USDCAD was traded lower following prior breakout below the previous support level at 1.2850. MACD which illustrated bearish bias momentum suggest the pair to extend its losses toward the support level at 1.2770.

Resistance level: 1.2850, 1.2950

Support level: 1.2770, 1.2695

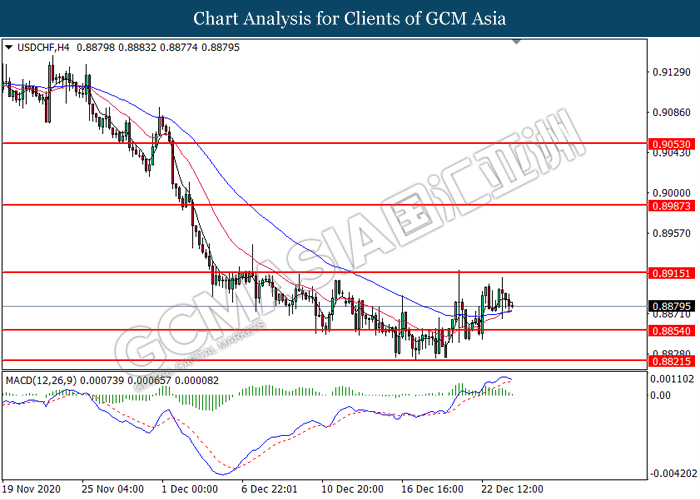

USDCHF, H4: USDCHF was traded lower following prior retracement from the higher level. MACD which illustrated diminishing bullish momentum suggest the pair to losses toward the support level at 0.8855.

Resistance level: 0.8915, 0.8985

Support level: 0.8855, 0.8820

CrudeOIL, H4: Crude oil price was traded higher while currently testing the resistance level at 48.15. MACD which illustrated bullish bias momentum suggest the commodity to extend its gains after it successfully breakout above the resistance level.

Resistance level: 48.15, 49.40

Support level: 47.10, 46.20

GOLD_, H4: Gold price was traded higher following prior rebound from the support level at 1862.80. MACD which illustrated diminishing bearish momentum suggest the commodity to extend its gains toward the resistance level at 1886.00

Resistance level: 1886.00, 1896.60

Support level: 1862.80, 1839.60