25 June 2020 Afternoon Session Analysis

Loonie slips amid Fitch rating downgrade.

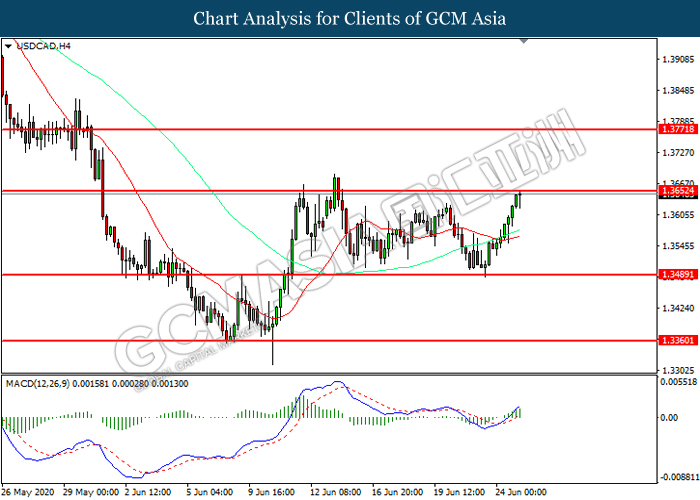

During late Asian session, the Canadian Lonnie which traded against the greenback and other currency pairs have plummeted after Fitch Ratings downgrades Canada’s credit rating. According to reports, one of U.S big 3 credit agencies, Fitch Ratings have stripped Canada of its AAA status due to a spike in emergency spending for coronavirus, making it the first top-rated country to be downgraded by ratings agency during the pandemic. Fitch also forecasted that the Canada’s pandemic response will increase its government debt to 115.1% of GDP in 2020, up from 88.3% in 2019. The Loonie was briefly weakened by the news which exert selling pressure towards the currency. On top of that, exhausted oil price also further adding pressure towards the commodity-backed currency. At the time of writing, USD/CAD rose 0.09$ to $1.3643.

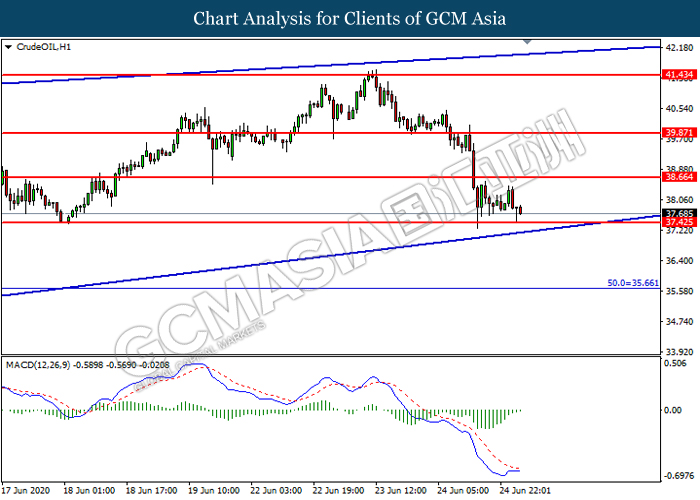

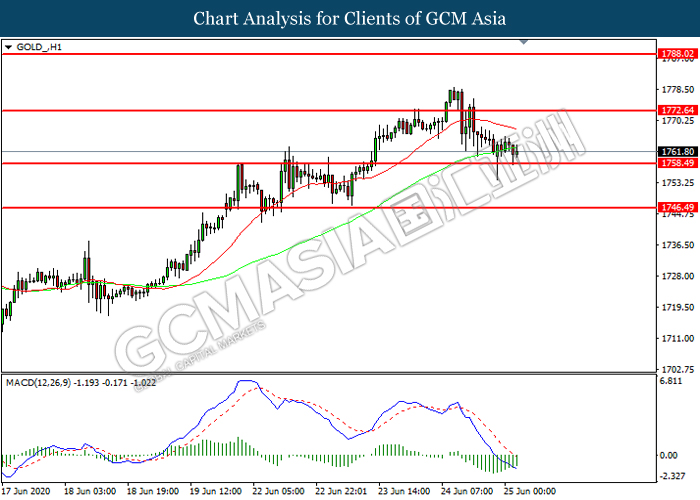

In the commodities market, crude oil price fell 1.09% to $37.50 per barrel as of writing as U.S production making a comeback. According to official weekly data from the U.S government, drillers in U.S shale fields have added to production for the first time since March. It was also the first rise in U.S production in 13 weeks. Moreover, the ongoing concern of coronavirus also continue to weigh heavily on the market where at least 22 of 50 US states have reported a rise in Covid-19 cases. On the other hand, gold price retreats 0.05% to $1761.28 a troy ounce at the time of writing following dollar comeback.

Today’s Holiday Market Close

Time Market Event

All Day CNY Dragon Boat Festival

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 20:30 | USD – Core Durable Goods Orders (MoM)(May) | -7.7% | 2.5% | – |

| 20:30 | USD – GDP (QoQ)(Q1) | -5.0% | -5.0% | – |

| 20:30 | USD – Initial Jobless Claims | 1,508K | 1,300K | – |

Technical Analysis

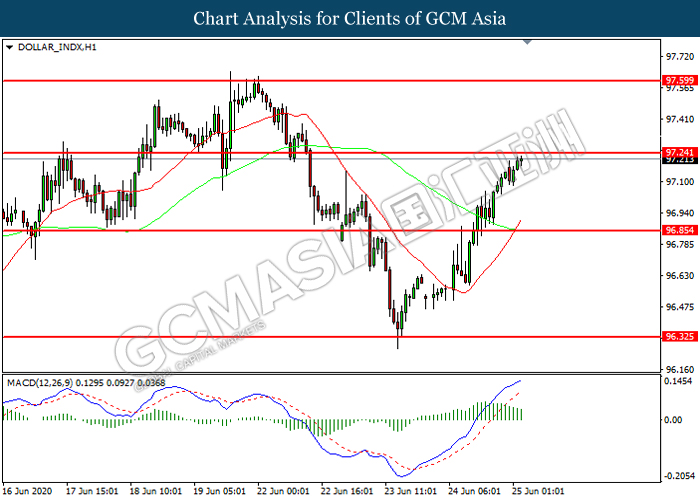

DOLLAR_INDX, H1: Dollar index was traded higher while currently testing the resistance level at 97.25. However, MACD which illustrated diminishing bullish momentum suggest the index to be traded lower in short-term as technical correction.

Resistance level: 97.25, 97.60

Support level: 96.85, 96.35

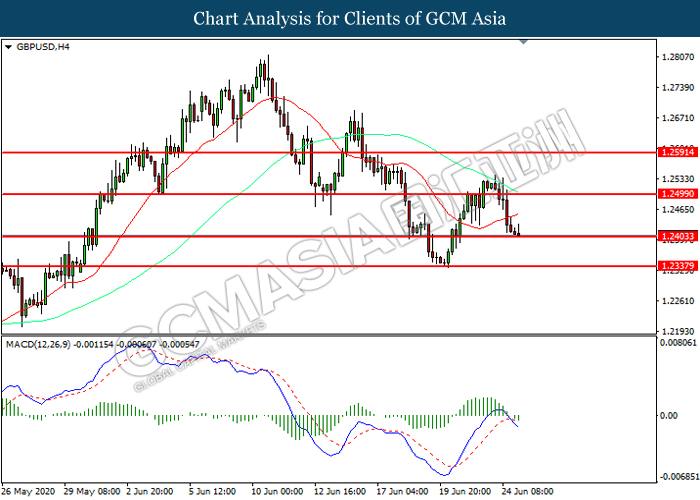

GBPUSD, H4: GBPUSD was traded lower while currently testing the support level at 1.2405. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 1.2500, 1.2590

Support level: 1.2405, 1.2335

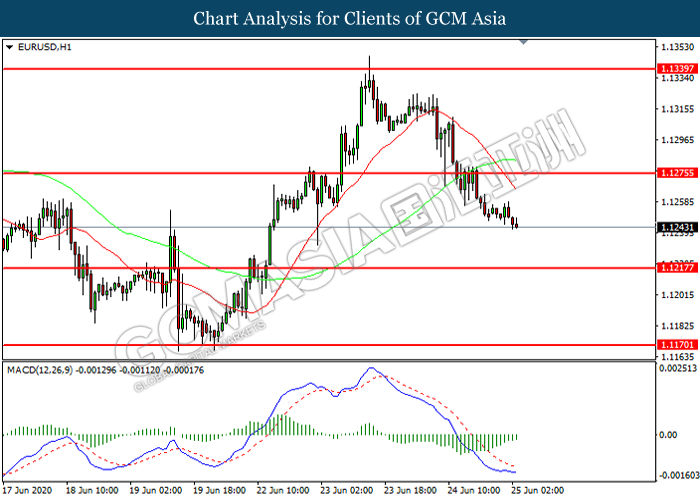

EURUSD, H1: EURUSD was traded lower following prior breakout below the previous support level at 1.1275. However, MACD which illustrated diminishing bearish momentum suggest the pair to be traded higher in short-term as technical correction.

Resistance level: 1.1275, 1.1340

Support level: 1.1215, 1.1170

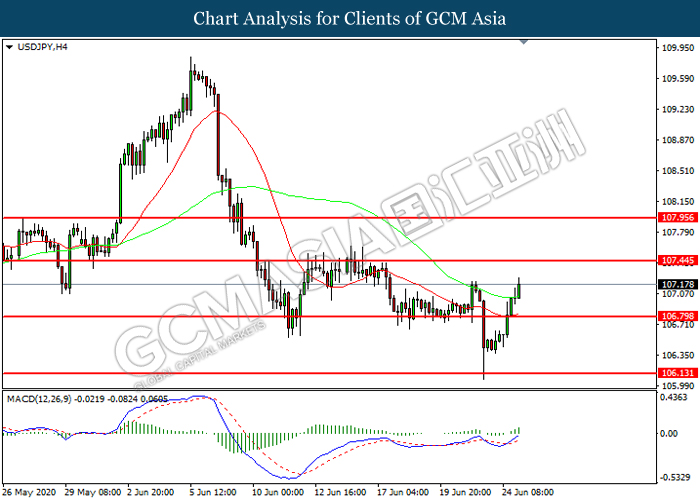

USDJPY, H4: USDJPY was traded higher following prior breakout above the previous resistance level at 106.80. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains toward resistance level at 107.45.

Resistance level: 107.45, 107.95

Support level: 106.80, 106.15

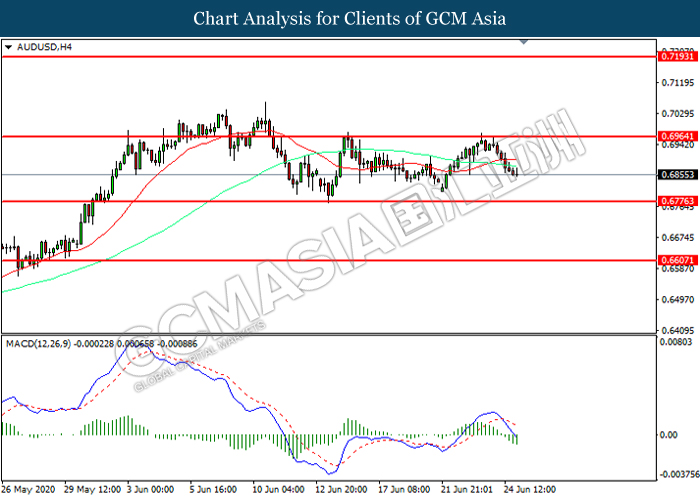

AUDUSD, H4: AUDUSD was traded lower following prior retracement from the resistance level at 0.6965. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses toward support level at 0.6775.

Resistance level: 0.6965, 0.7195

Support level: 0.6775, 0.6605

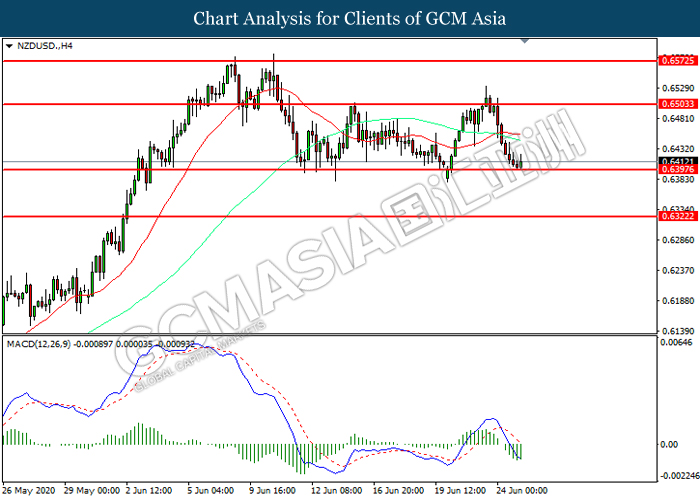

NZDUSD, H4: NZDUSD was traded lower while currently testing the support level at 0.6395. However, MACD which illustrated diminishing bearish momentum suggest the pair to be traded higher in short-term as technical correction.

Resistance level: 0.6505, 0.6575

Support level: 0.6395, 0.6320

USDCAD, H4: USDCAD was traded higher while currently testing the resistance level at 1.3650. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 1.3650, 1.3770

Support level: 1.3490, 1.3360

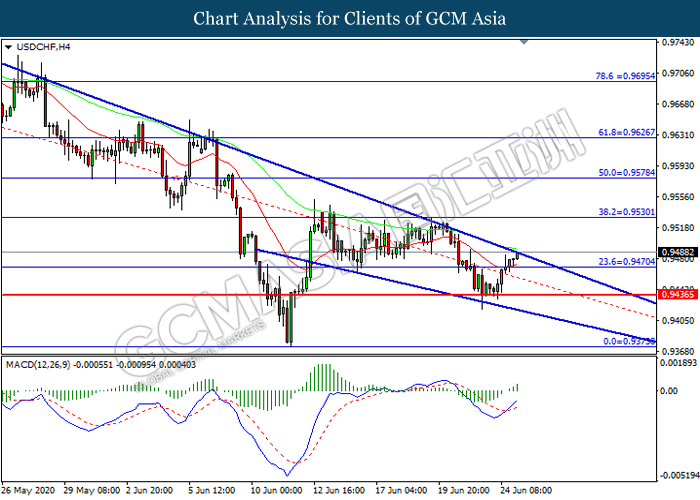

USDCHF, H4: USDCHF was traded higher following prior breakout above the previous resistance level at 0.9470. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains toward resistance level at 0.9530.

Resistance level: 0.9530, 0.9580

Support level: 0.9470, 0.9435

CrudeOIL, H1: Crude oil price was traded lower while currently testing the support level at 37.45. However, MACD which illustrated diminishing bearish momentum suggest the commodity to be traded higher in short-term as technical correction.

Resistance level: 38.65, 39.85

Support level: 37.45, 35.65

GOLD_, H1: Gold price was traded lower while currently testing the support level at 1758.50. However, MACD which illustrated diminishing bearish momentum suggest the commodity to be traded higher in short-term as technical correction.

Resistance level: 1772.65, 1788.00

Support level: 1758.50, 1746.50