25 July 2023 Afternoon Session Analysis

British Pound extended losses on disappointing PMI data.

Pound Sterling (GBP), which was widely traded by global investors, dropped after the announcement of a disappointing PMI in the UK. According to the Markit/CIPS, the UK manufacturing PMI dropped from 46.5 to 45.0, lower than market forecast at 46.1 while refreshing the record of lowest level in 6 months. Besides, the UK services PMI also dropped from 53.7 to 51.5, lower than market forecast at 53.0. Both of the weaker-than-expected PMI data represented that the UK economy was suppressed by the higher prices and poor demand, where investors were afraid that the recession scenario may come true. Not only UK economic condition is slowing down, the global economic condition is slowing down also, like Europe, France and Germany, which has proven by the downbeat PMI. Besides that, the investors have reduced their expectation of rate hike from Bank of England (BoE), from 50 basis points to 25 basis points as the risk of recession loomed. On the other hands, the US Dollar Index turned bullish as the US economy remained strong despite a series of rate hikes had been conducted by the Federal Reserve. Moreover, according to the CME FedWatch Tool, there are almost 99% of the investors expect the interest rate will be hiked by Fed again with another 25 basis point on coming Thursday. As of writing, the GBP/USD rose 0.05% to 1.2835.

In the commodities market, crude oil prices rose 0.28% to $78.90 per barrel due to production cuts announced earlier by Saudi Arabia and Russia. Also, China as a biggest oil importer, is expected to implement more stimulus package to spur its economy, which in turn will boost up the oil demand. Besides, gold prices rose 0.40% to $1962.40 per troy amid the weakening of US Dollar.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Event | Previous | Forecast | Actual |

| 22:00 | USD – CB Consumer Confidence (Jul) | 109.7 | 111.5 | – |

Technical Analysis

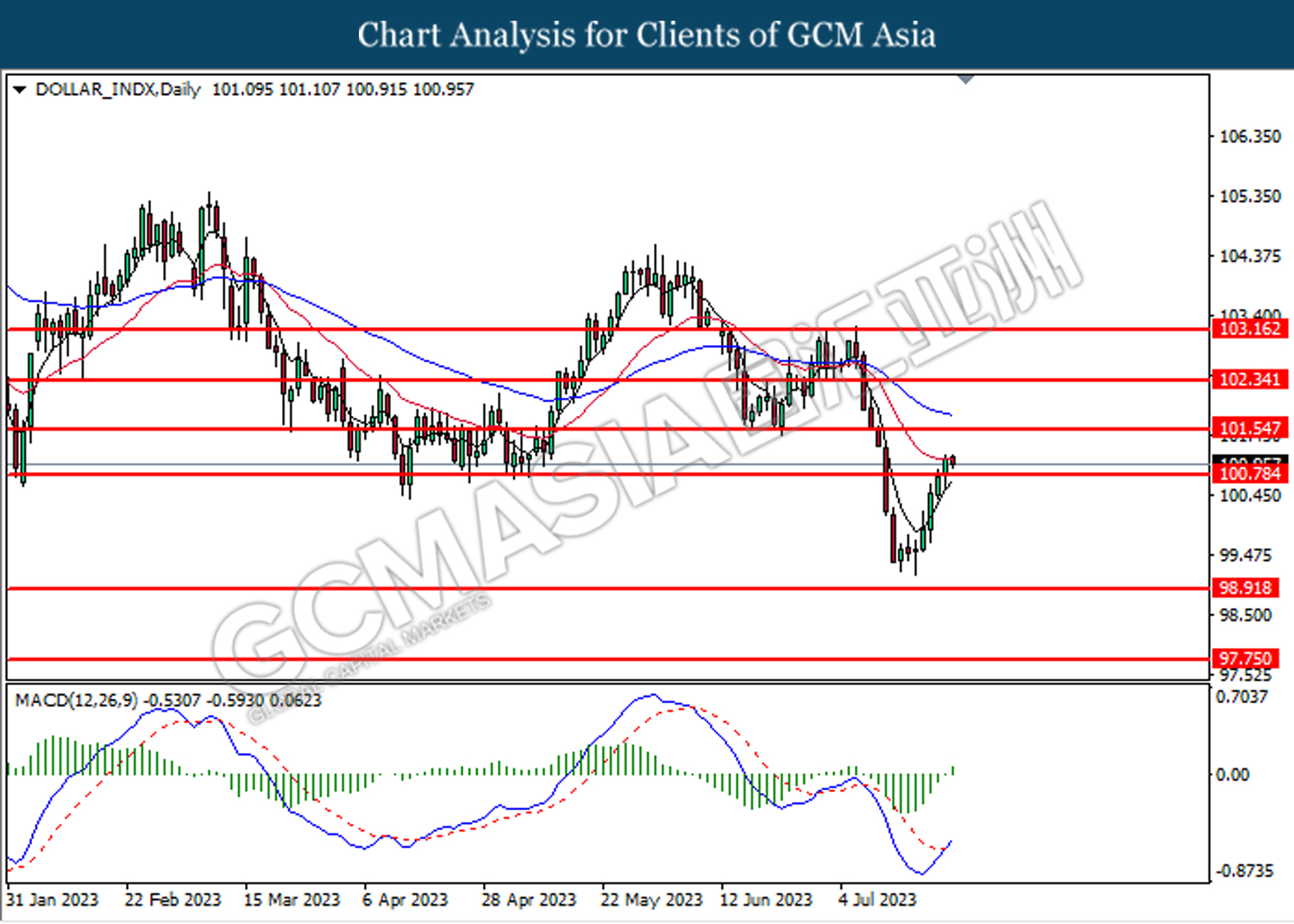

DOLLAR_INDX, Daily: Dollar index was traded higher after it breakout the previous resistance level at 100.80. MACD which illustrated a turn from bearish momentum to bullish momentum suggests the index to extend its gains toward the resistance level at 101.55.

Resistance level: 101.55, 102.35

Support level: 100.80, 99.80

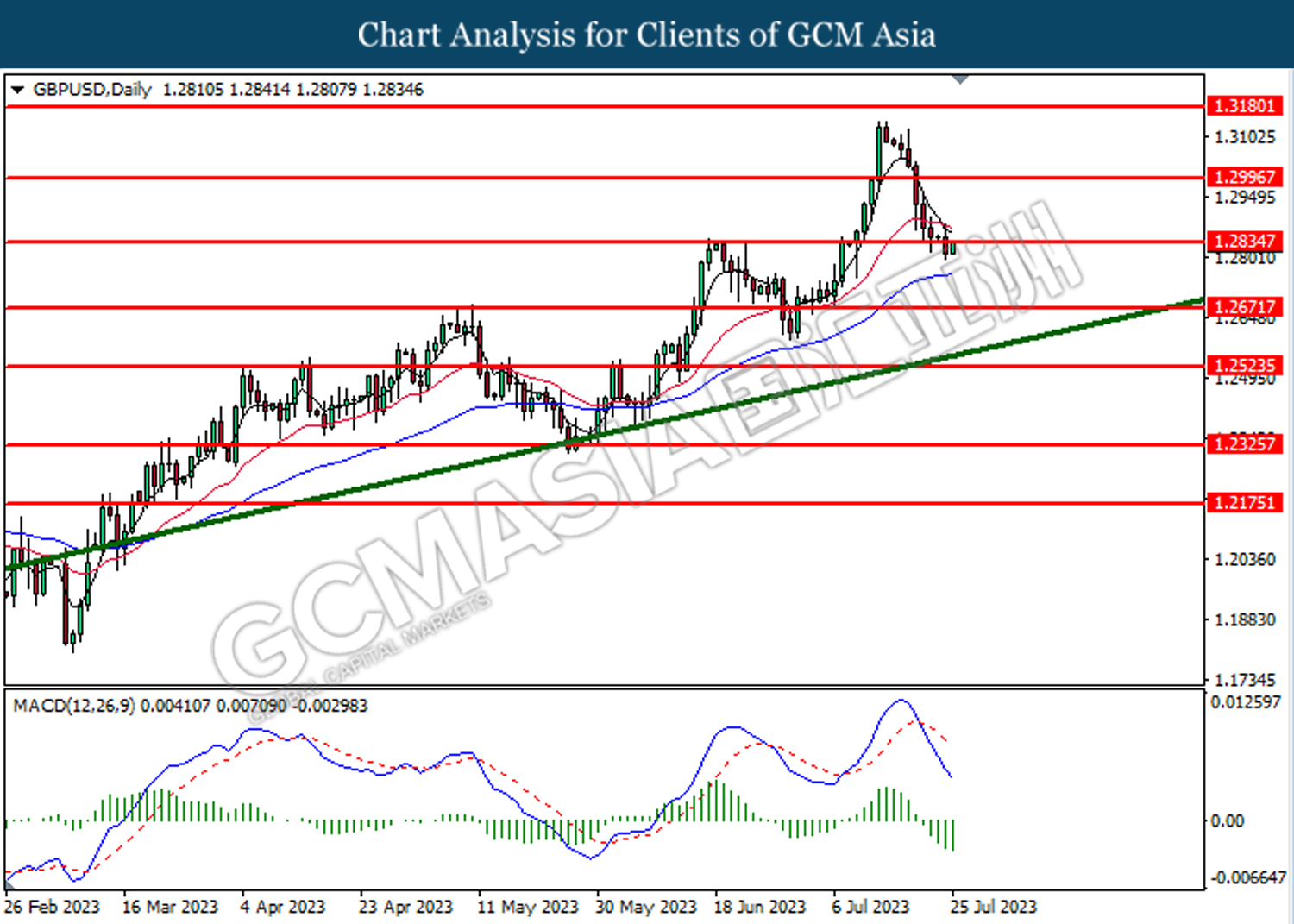

GBPUSD, Daily: GBPUSD was traded higher while testing the resistance level at 1.2835. However, MACD which illustrated increasing bearish momentum suggest the pair to undergo technical correction in short term.

Resistance level: 1.2835, 1.3000

Support level: 1.2670, 1.2525

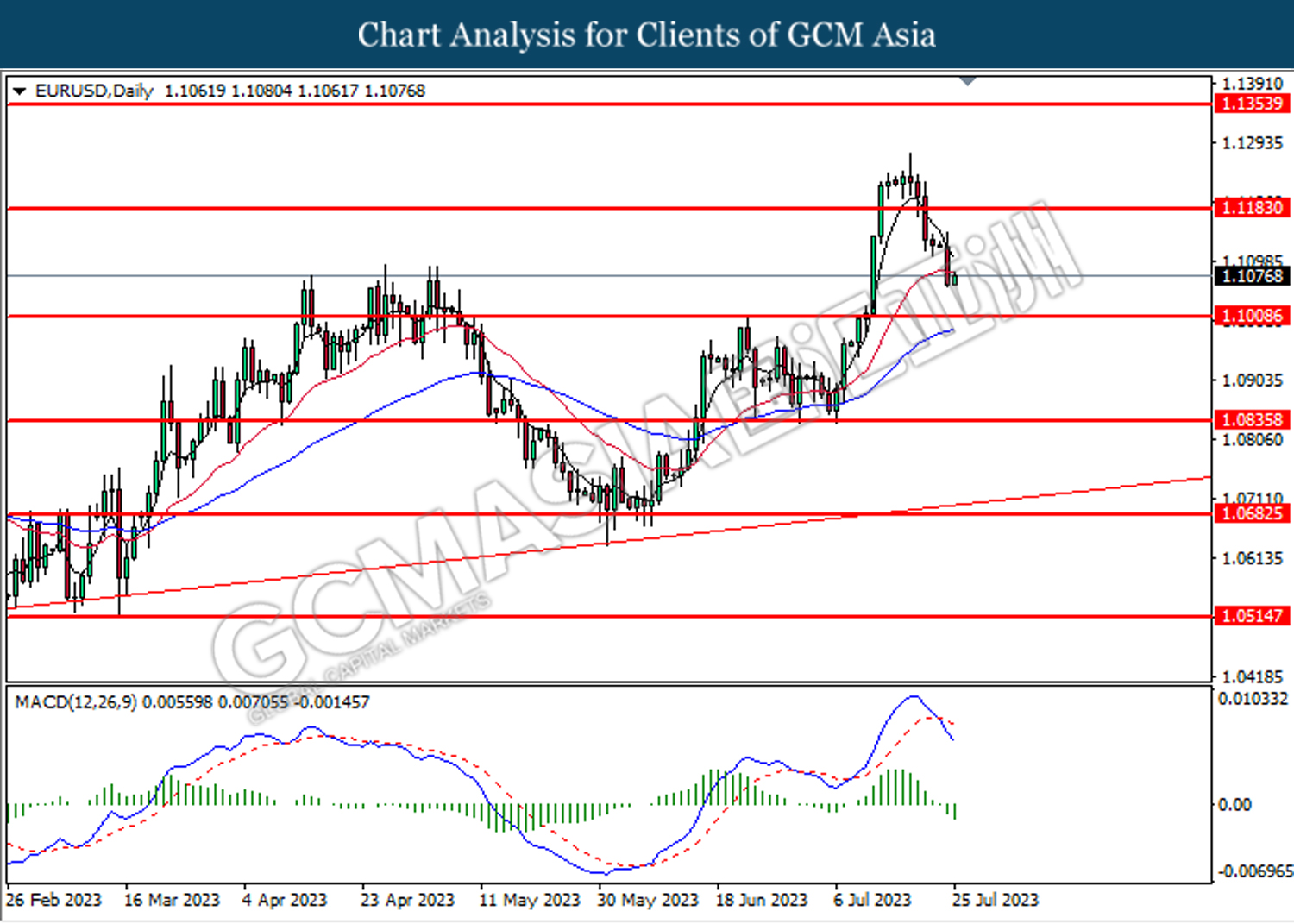

EURUSD, Daily: EURUSD was traded lower following the prior breakout below the previous support level at 1.1185. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses toward the support level at 1.1010.

Resistance level: 1.1185, 1.1355

Support level: 1.1010, 1.0835

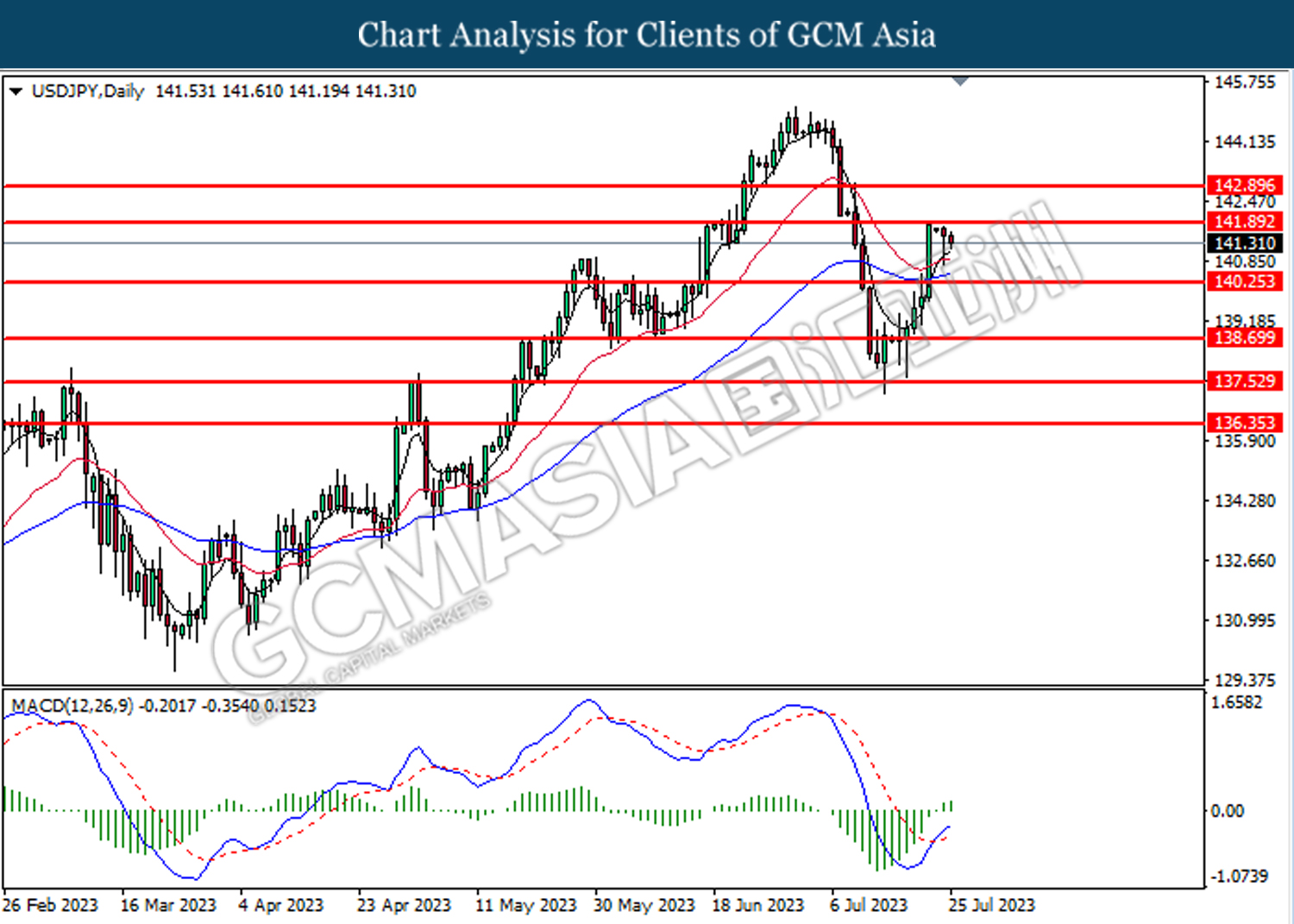

USDJPY, Daily: USDJPY was traded lower following the prior retracement from the resistance level at 141.90. However, MACD which illustrated increasing bullish momentum suggest the pair to undergo a technical correction in short term.

Resistance level: 141.90, 142.90

Support level: 140.25, 138.70

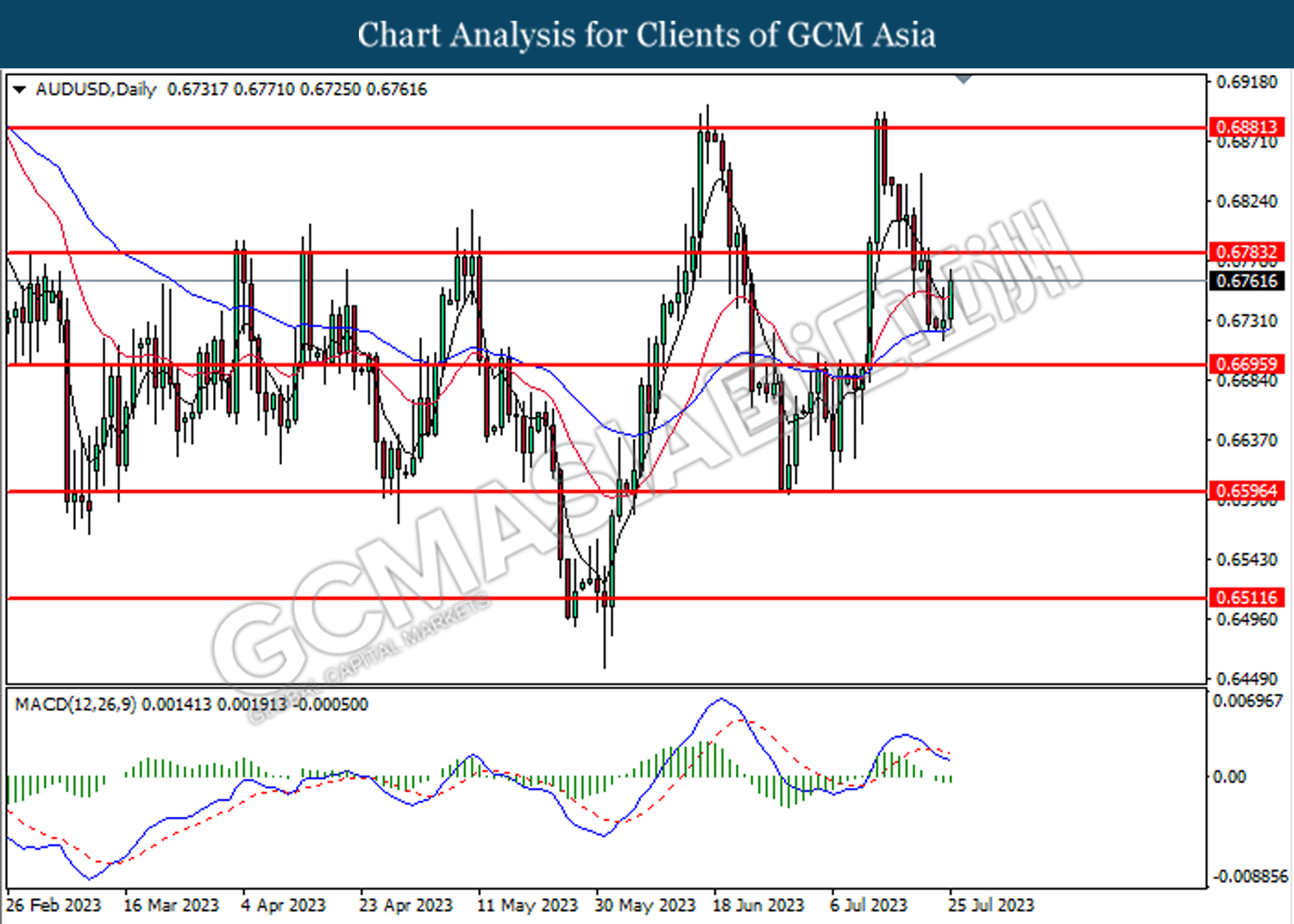

AUDUSD, Daily: AUDUSD was traded higher following the prior rebound from the lower level. MACD which illustrated increasing bearish momentum suggests the pair to undergo technical correction in short term.

Resistance level: 0.6785, 0.6880

Support level: 0.6695, 0.6595

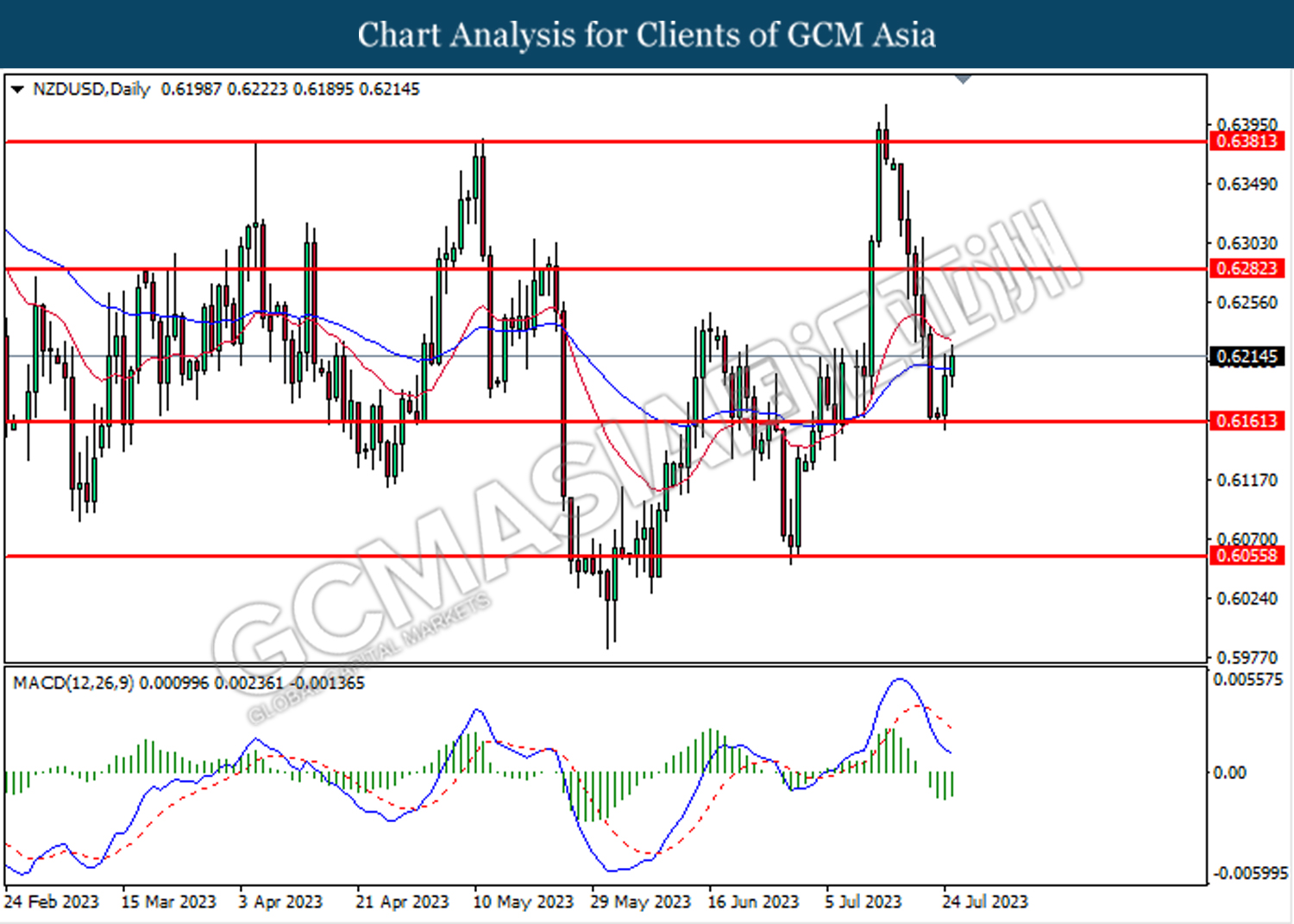

NZDUSD, Daily: NZDUSD was traded following the prior rebound from the support level at 0.6160. MACD which illustrated decreasing bearish momentum suggests the pair to extend its gains toward the resistance level at 0.6280.

Resistance level: 0.6280, 0.6380

Support level: 0.6160, 0.6055

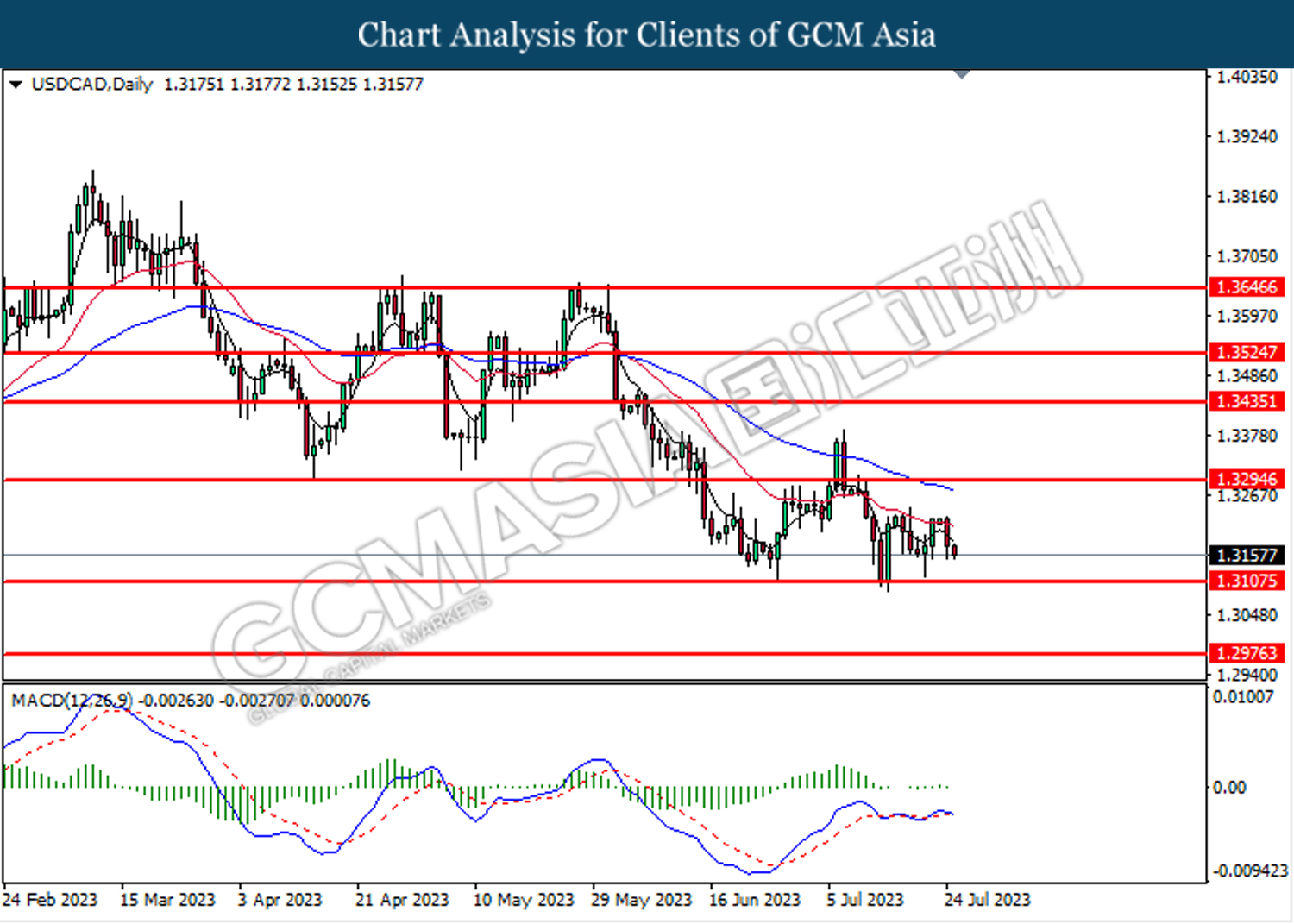

USDCAD, Daily: USDCAD was traded flat above the support level at 1.3110. MACD which illustrated increasing bullish momentum suggests the pair to extend its gains toward the resistance level at 1.3295

Resistance level: 1.3295, 1.3435

Support level: 1.3110, 1.2975

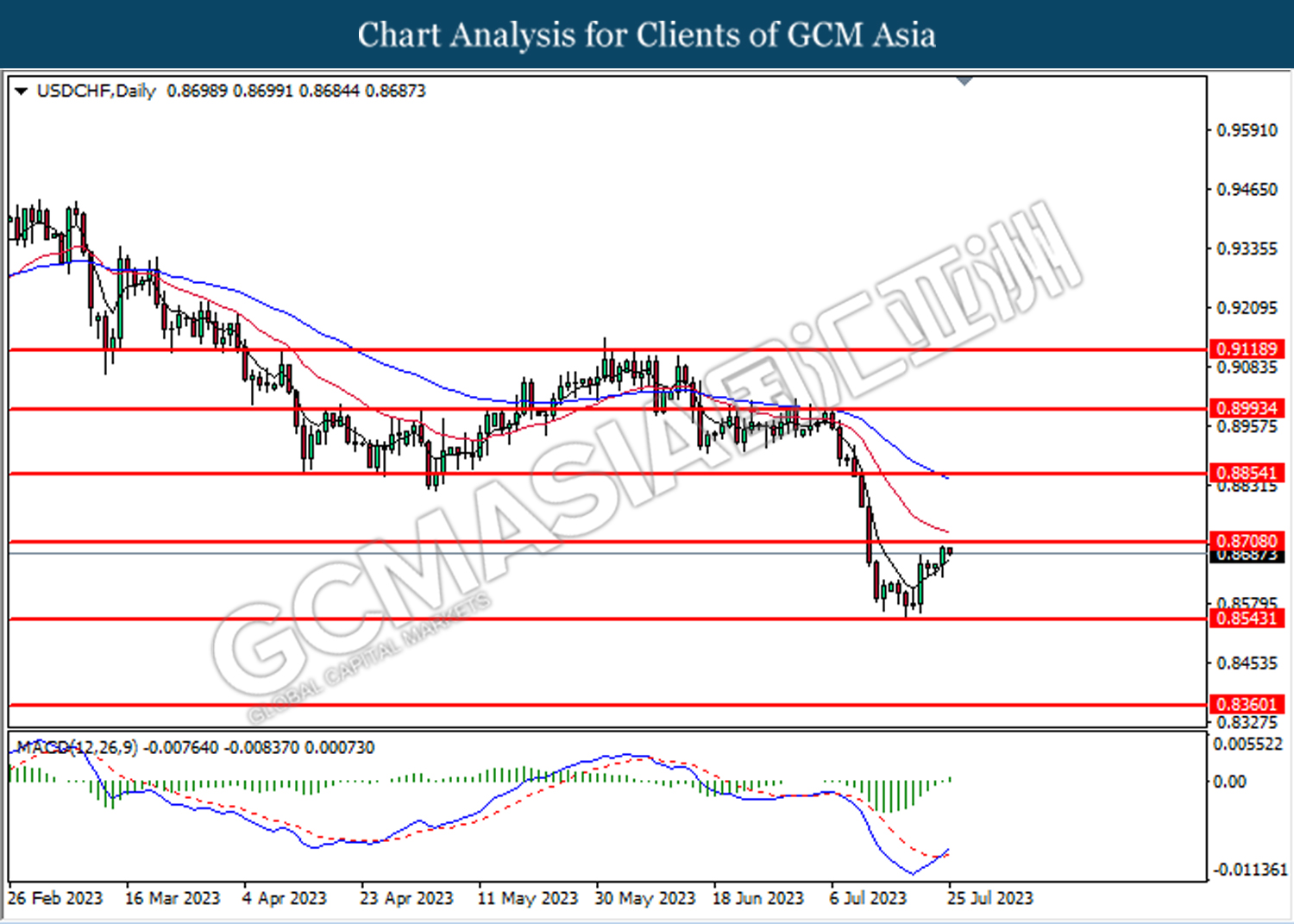

USDCHF, Daily: USDCHF was traded higher while testing the resistance level at 0.8710. MACD which illustrated a turn from bearish momentum to bullish momentum suggests the pair to extend its gains after it breakout the resistance level.

Resistance level: 0.8710, 0.8855

Support level: 0.8545, 0.8360

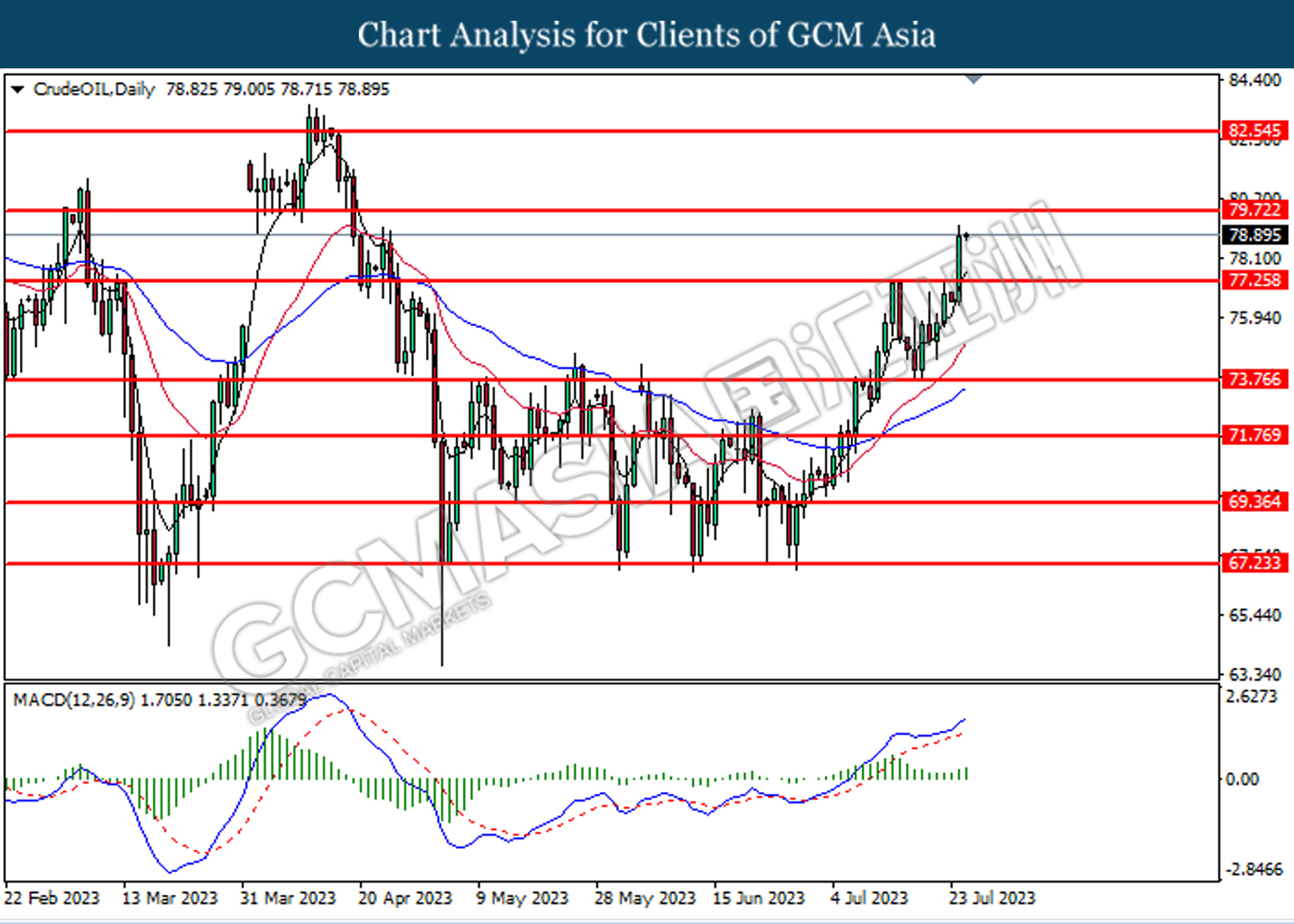

CrudeOIL, Daily: Crude oil price was traded higher following the prior breakout above the previous resistance level at 77.25. MACD which illustrated increasing bullish momentum suggests the commodity to extend its gains toward the resistance level at 79.70.

Resistance level: 79.70, 82.55

Support level: 77.25, 73.75

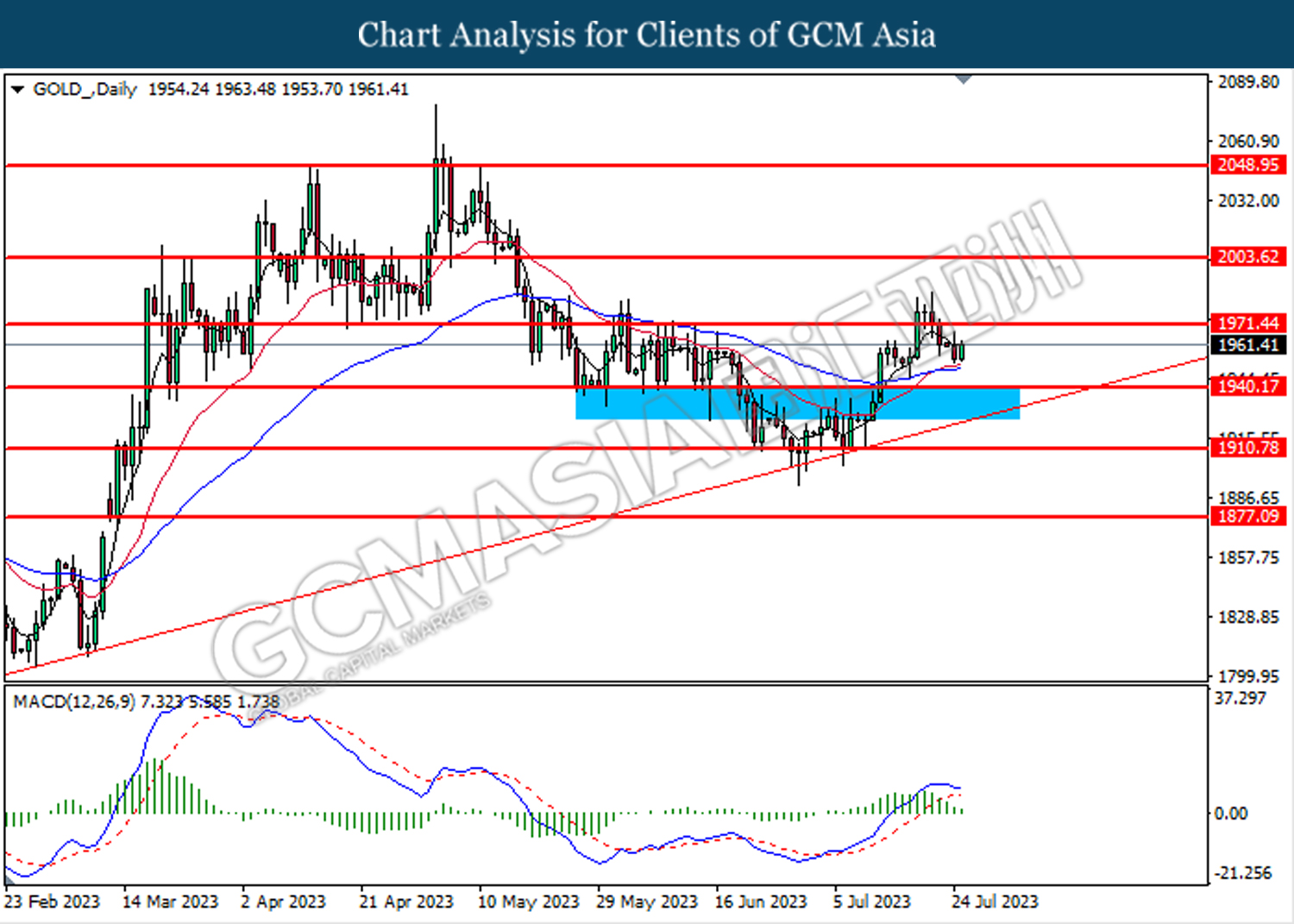

GOLD_, Daily: Gold price was traded lower following the prior breakout below the previous support level at 1971.40. MACD which illustrated diminishing bullish momentum suggests the commodity to extend its losses toward the support level at 1940.20.

Resistance level: 1971.40, 2003.60

Support level: 1940.20, 1910.80