25 July 2023 Morning Session Analysis

Greenback’s rally extended as Europe’s economy showed risks of recession.

The dollar index, which was traded against a basket of six major currencies, maintained its gains on Monday as it supported by recent economic data, which highlighted a stronger US economy compared to a sluggish euro zone. A significant purchasing managers’ survey revealed that US business activity had slowed to a five-month low in July, primarily due to a deceleration in the service sector’s growth. Yesterday, both the US Composite PMI and Services PMI posted weaker-than-expected readings at 52.0 and 52.4, while the economist forecast were at 53.1 and 54.0 respectively. Nevertheless, the data fared better than similar surveys conducted in Europe. In July, the German economy experienced a contraction as manufacturing output faced a significant downturn, coinciding with a sustained deceleration in services activity growth. Looking at the global picture, the US economy seems to offer more reasons for optimism compared to many other regions, which in turn is bolstering the strength of the US dollar. Traders are now focusing on clues about the future monetary policy outlook of the Federal Reserve. As of writing, the dollar index rose by 0.31% to 101.38.

In the commodities market, crude oil prices were down by -0.11% to $78.90 per barrel amid growing expectation of more China stimulus plan and tighter supplies. Besides, gold prices dropped by -0.02% to $1954.90 per troy ounce amid the strengthening of dollar index.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 22:00 | USD – CB Consumer Confidence (Jul) | 109.7 | 111.5 | – |

Technical Analysis

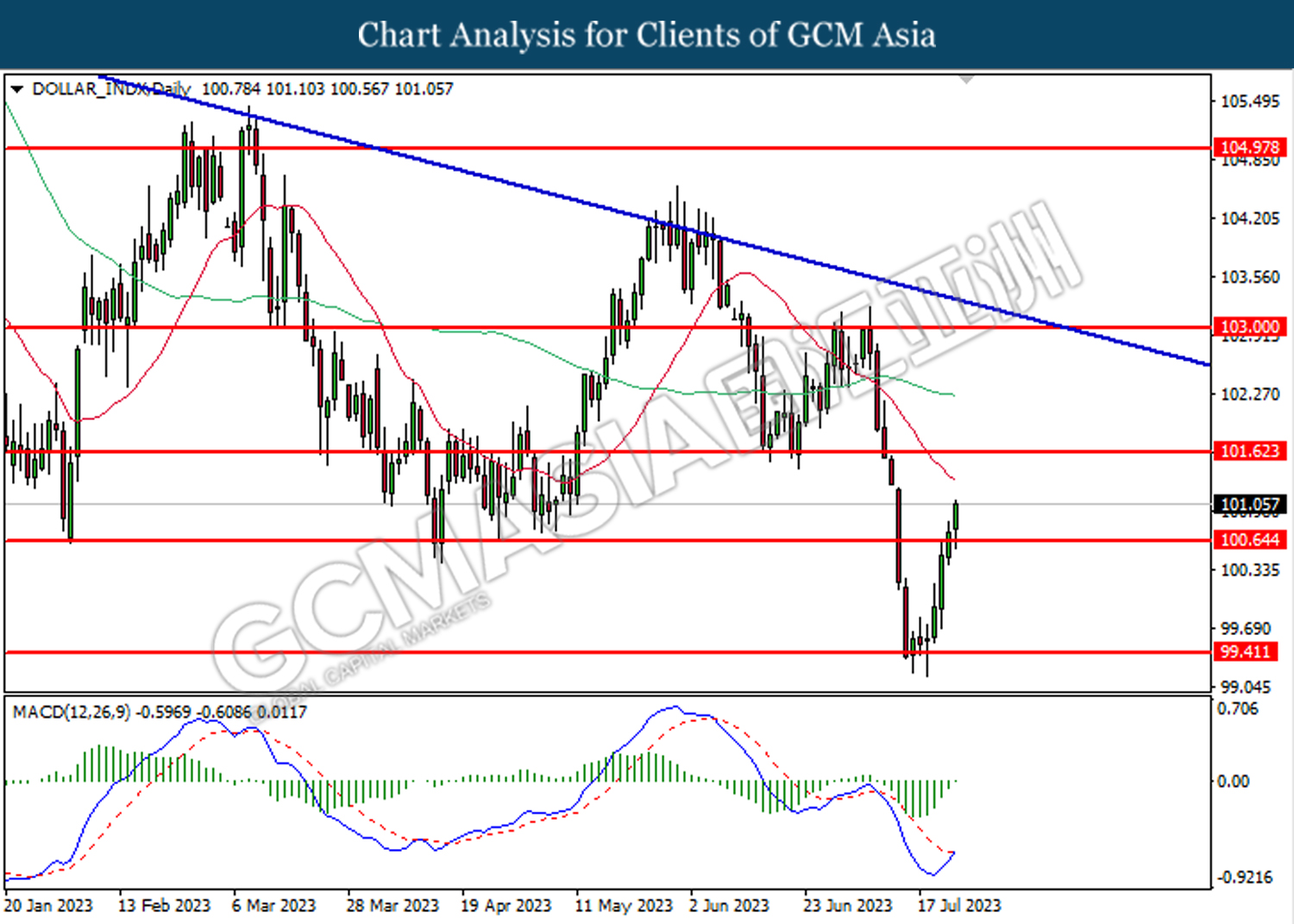

DOLLAR_INDX, Daily: Dollar index was traded higher following the prior breakout above the previous resistance level at 100.65. MACD which illustrated diminishing bearish momentum suggests the index to extend its gains toward the resistance level at 101.60.

Resistance level: 101.60, 103.00

Support level: 100.65, 99.40

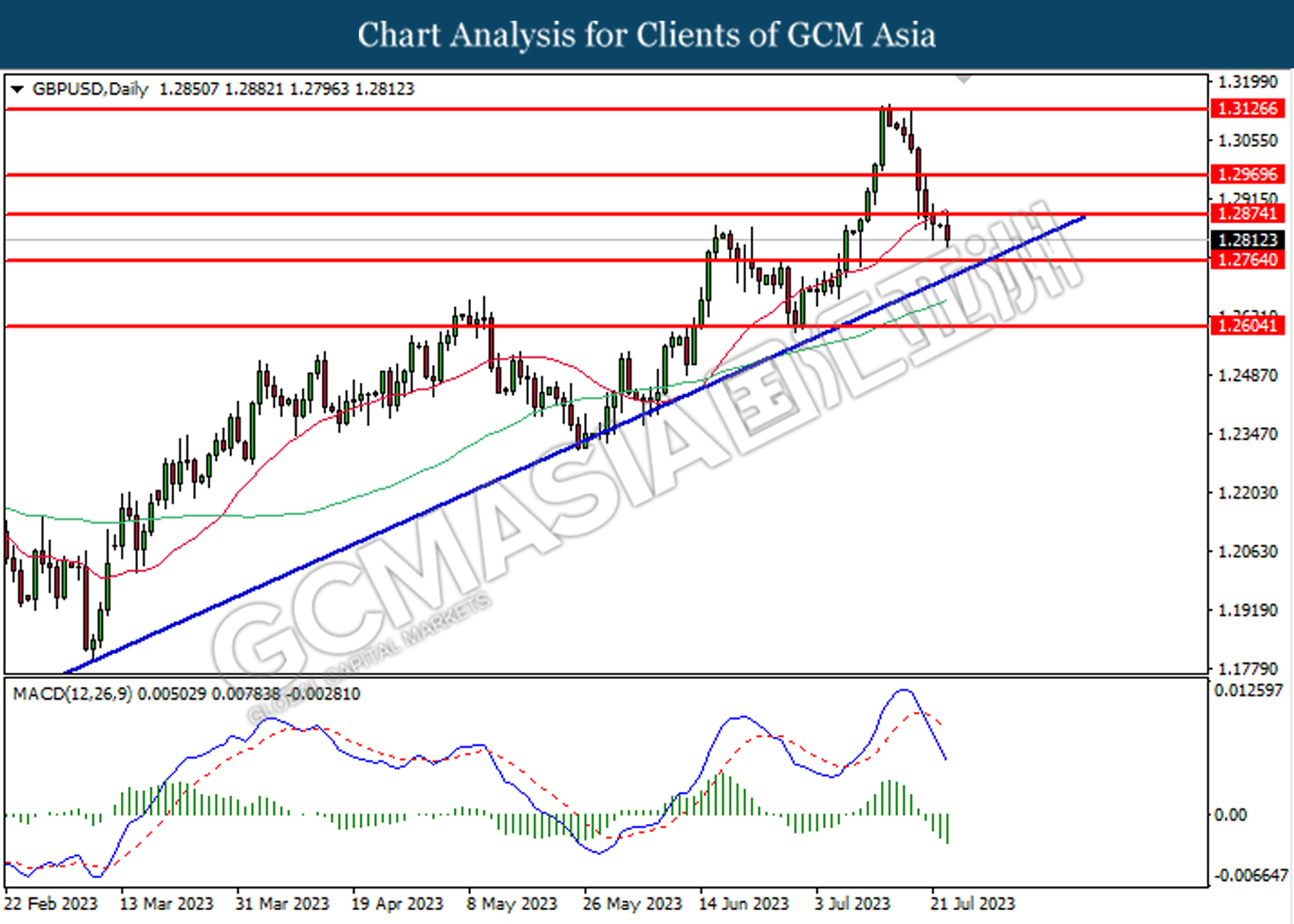

GBPUSD, Daily: GBPUSD was traded lower following the prior breakout below the previous support level at 1.2875. MACD which illustrated bearish bias momentum suggest the pair to extend its losses toward the support level at 1.2765.

Resistance level: 1.2875, 1.2970

Support level: 1.2765, 1.2605

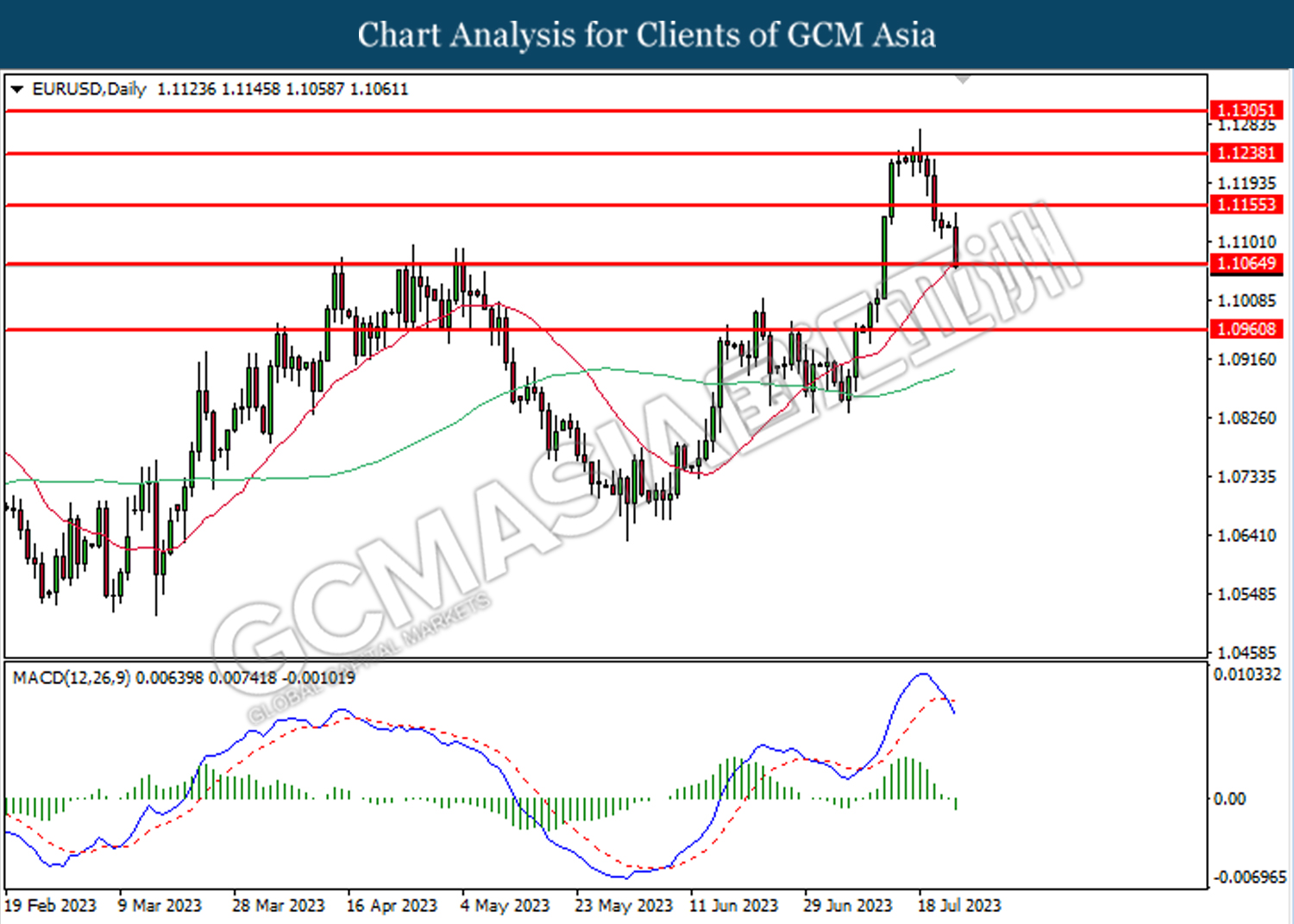

EURUSD, Daily: was traded lower following the prior breakout below the previous support level at 1.1155. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses toward the support level at 1.1065.

Resistance level: 1.1155, 1.1240

Support level: 1.1065, 1.0960

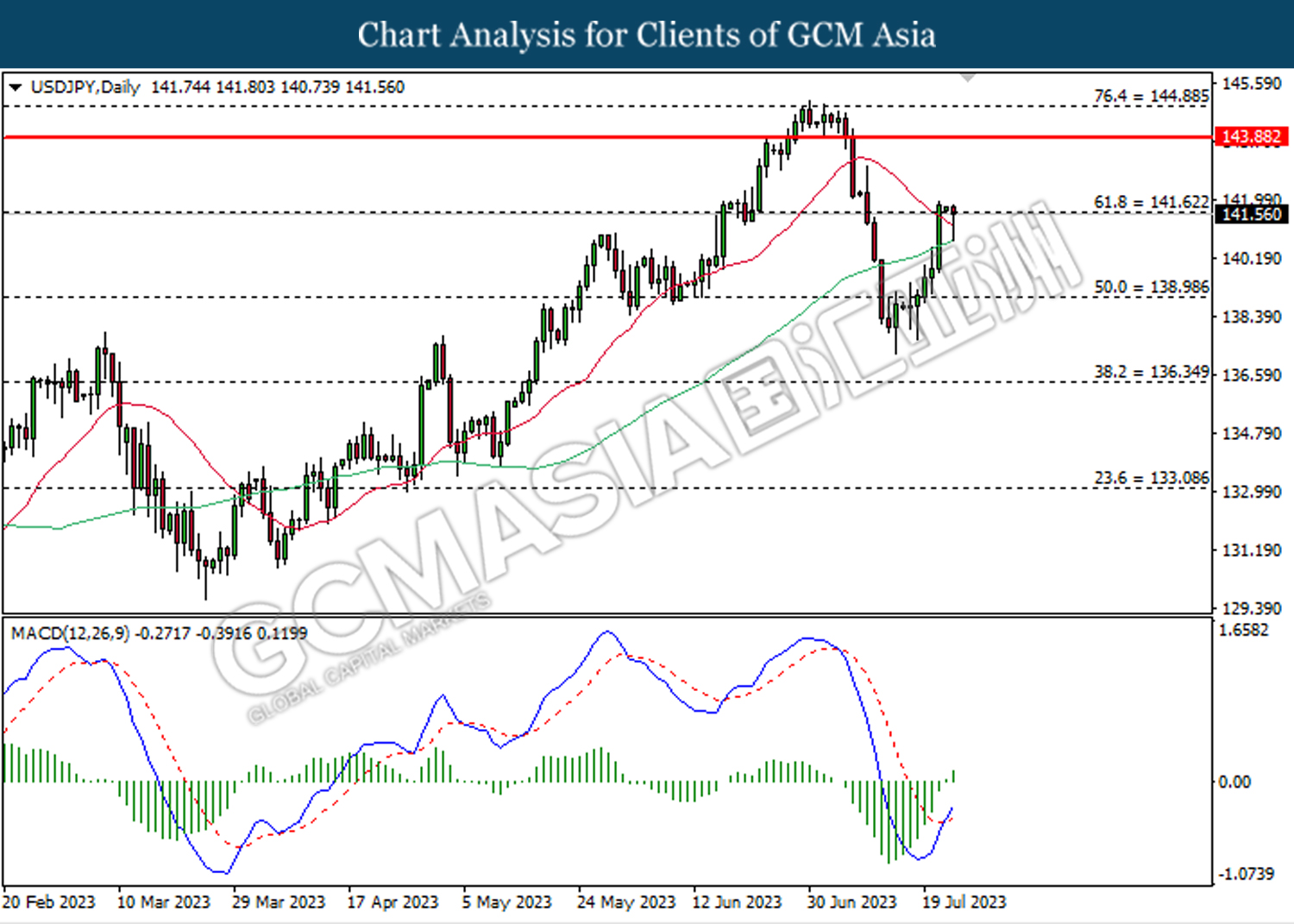

USDJPY, Daily: USDJPY was traded lower while currently testing the support level at 141.60. However, MACD which illustrated bullish bias momentum suggest the pair to undergo technical correction in short term.

Resistance level: 143.90, 144.90

Support level: 141.60, 139.00

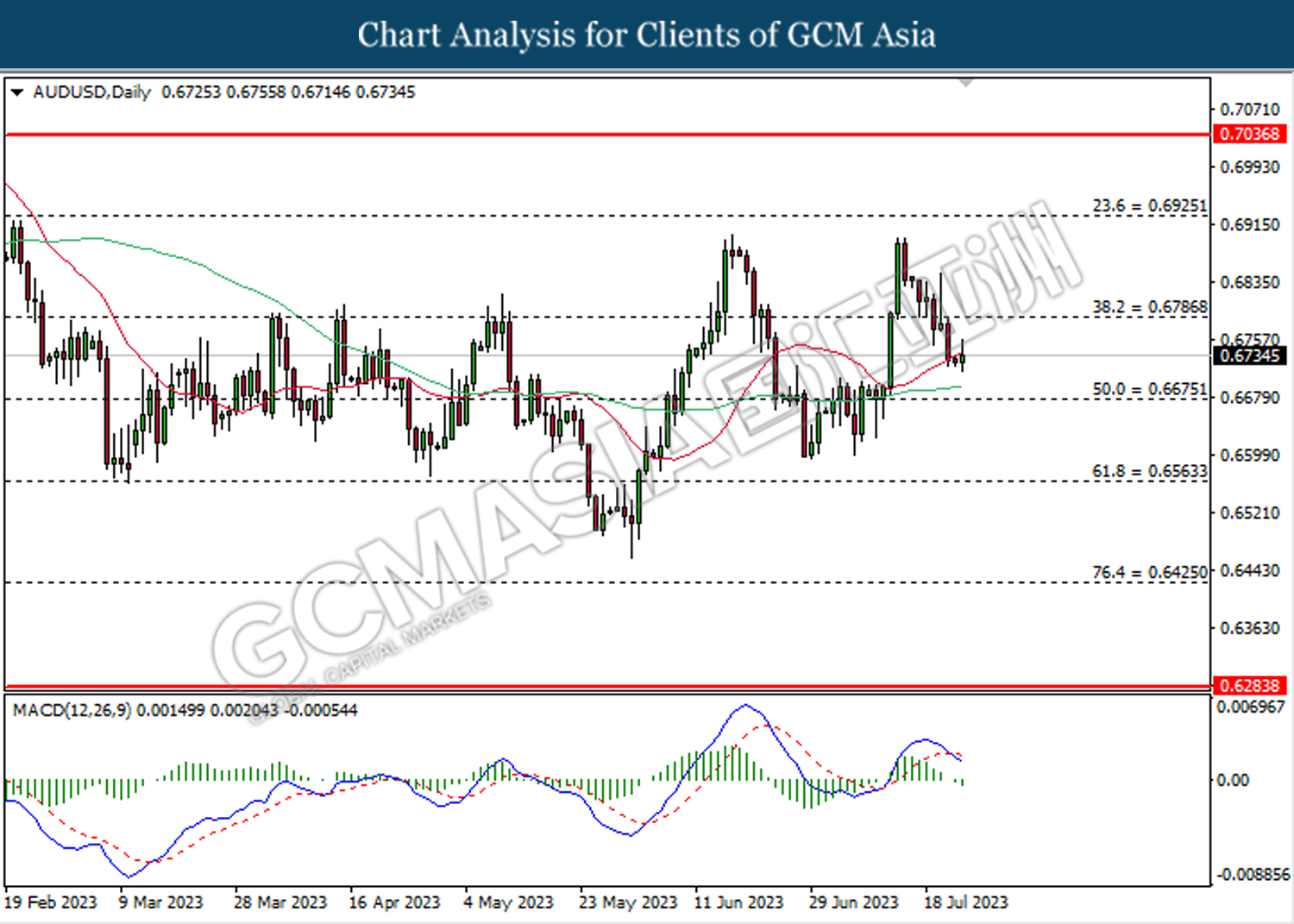

AUDUSD, Daily: AUDUSD was traded lower following the prior breakout below the previous support level at 0.6785. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses toward the support level at 0.6675.

Resistance level: 0.6785, 0.6925

Support level: 0.6675, 0.6565

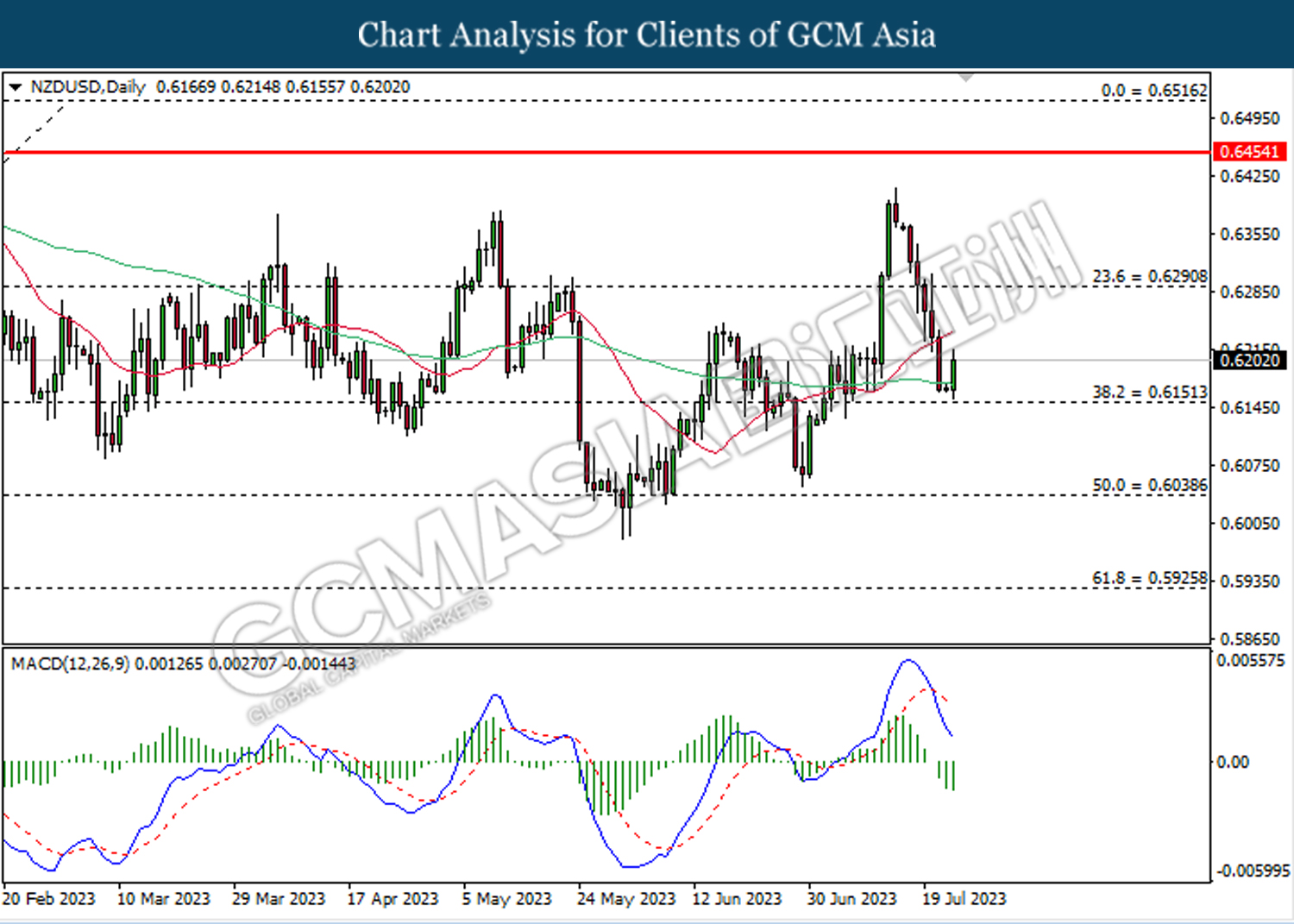

NZDUSD, Daily: NZDUSD was traded higher following the prior rebound from the support level at 0.6150. However, MACD which illustrated bearish bias momentum suggest the pair to undergo technical correction in short term.

Resistance level: 0.6290, 0.6455

Support level: 0.6150, 0.6040

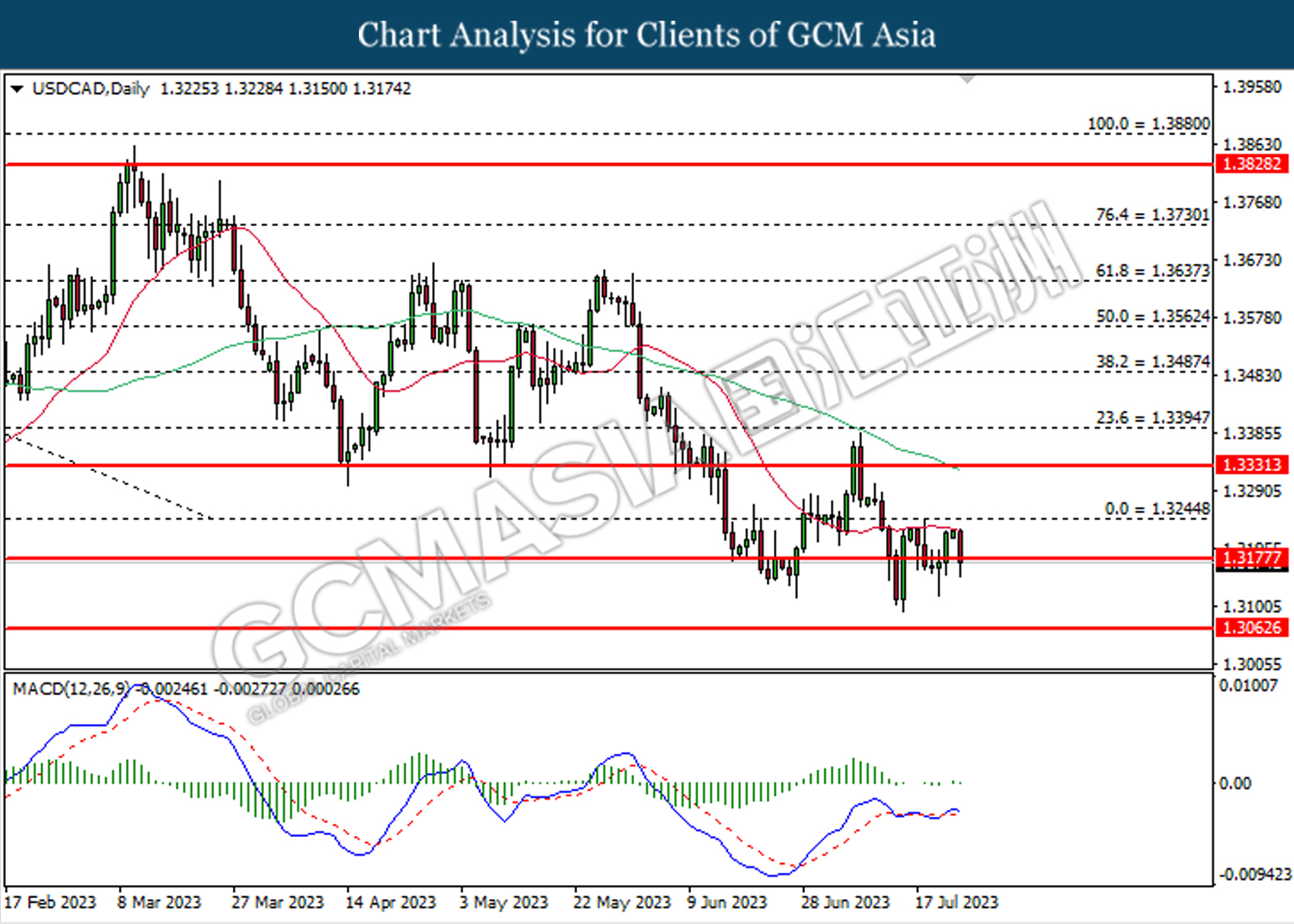

USDCAD, Daily: USDCAD was traded lower while currently testing the support level at 1.3175. MACD which illustrated diminishing bullish momentum suggests the pair to undergo technical correction in short term.

Resistance level: 1.3245, 1.3330

Support level: 1.3175, 1.3065

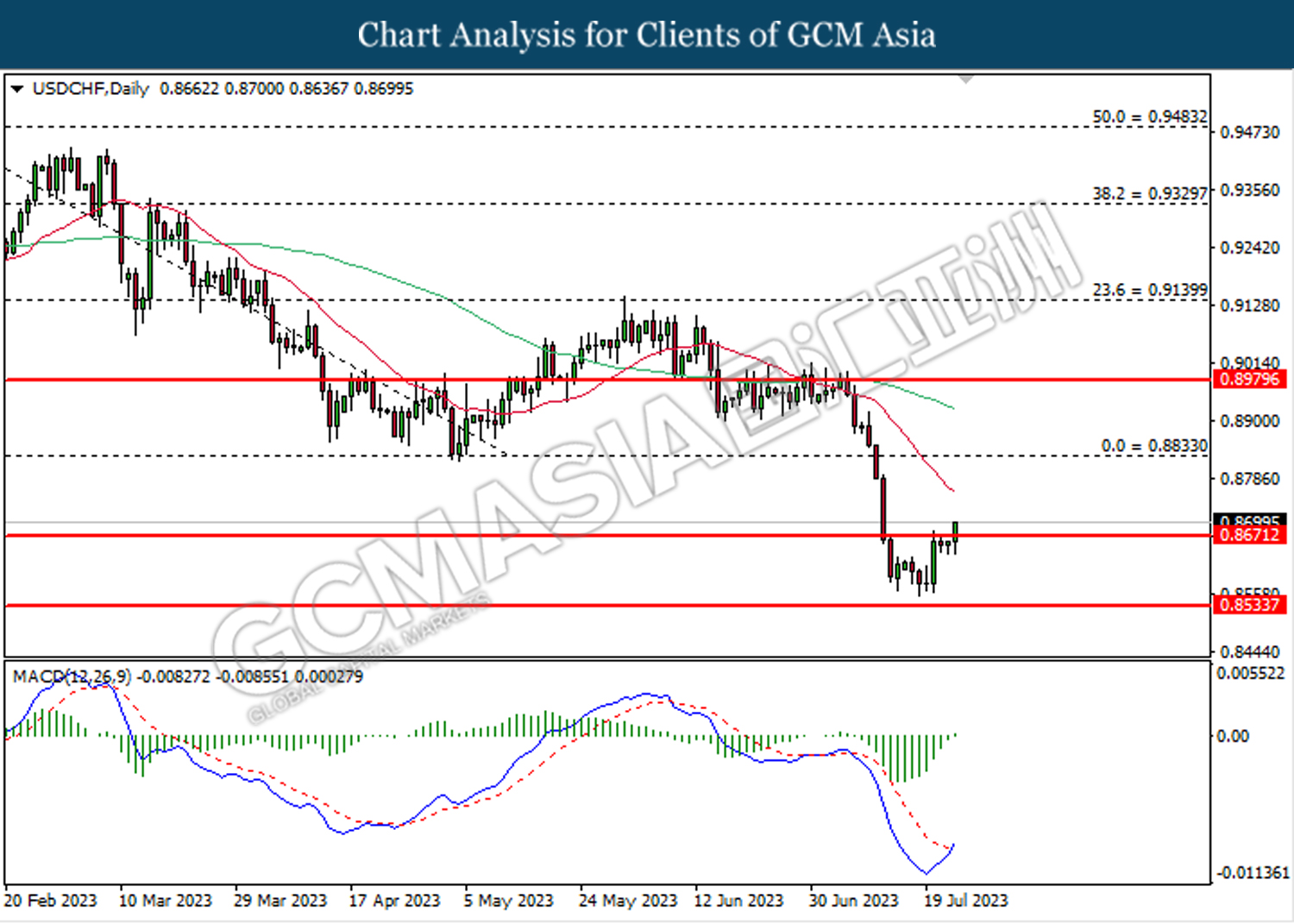

USDCHF, Daily: USDCHF was traded higher while currently testing the resistance level at 0.8670. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 0.8670, 0.8775

Support level: 0.8535, 0.8355

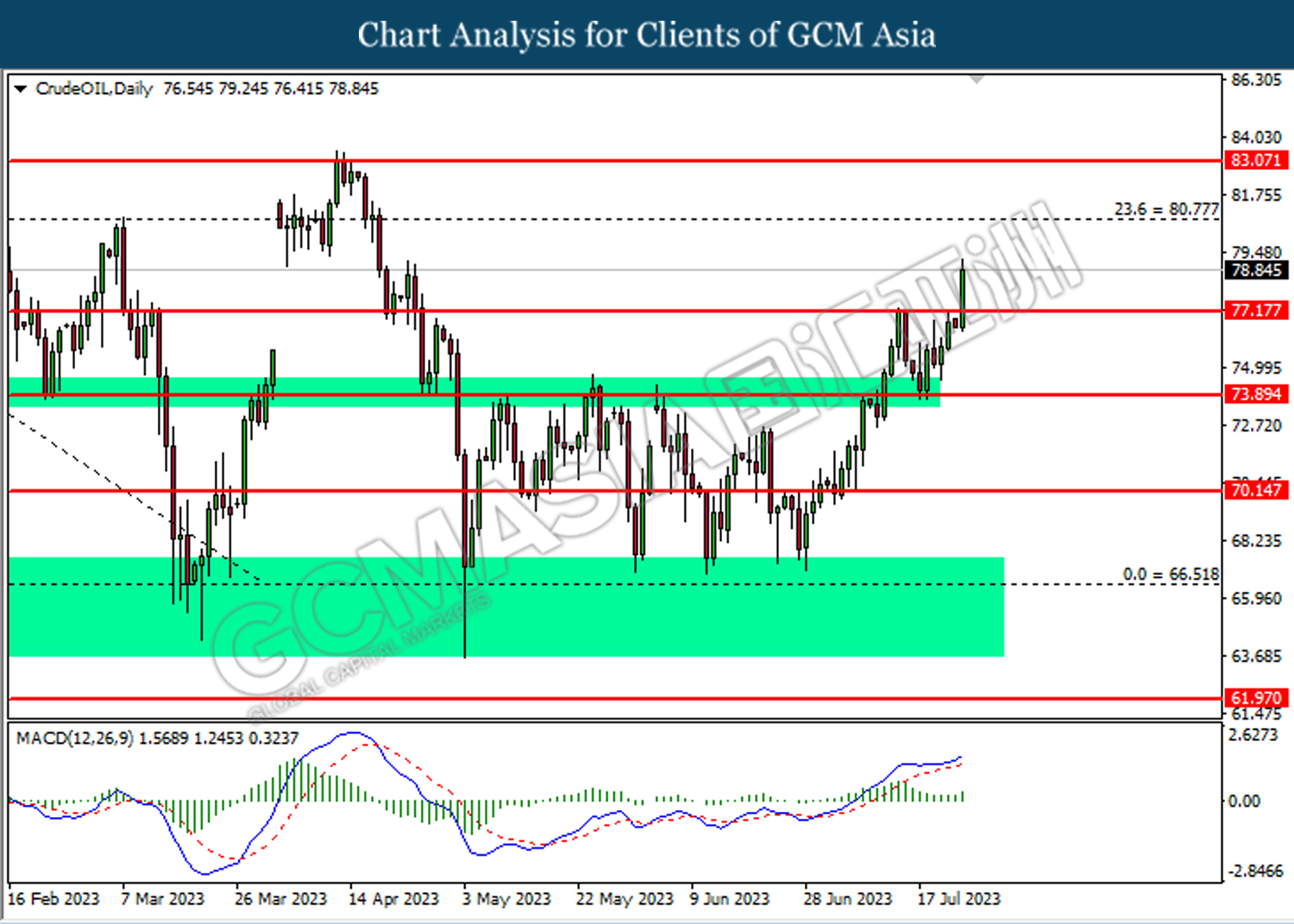

CrudeOIL, Daily: Crude oil price was traded higher while currently testing the resistance level at 77.15. MACD which illustrated bullish bias momentum suggest the commodity to extend its gains after it successfully breakout above the resistance level.

Resistance level: 77.15, 80.75

Support level: 73.90, 70.15

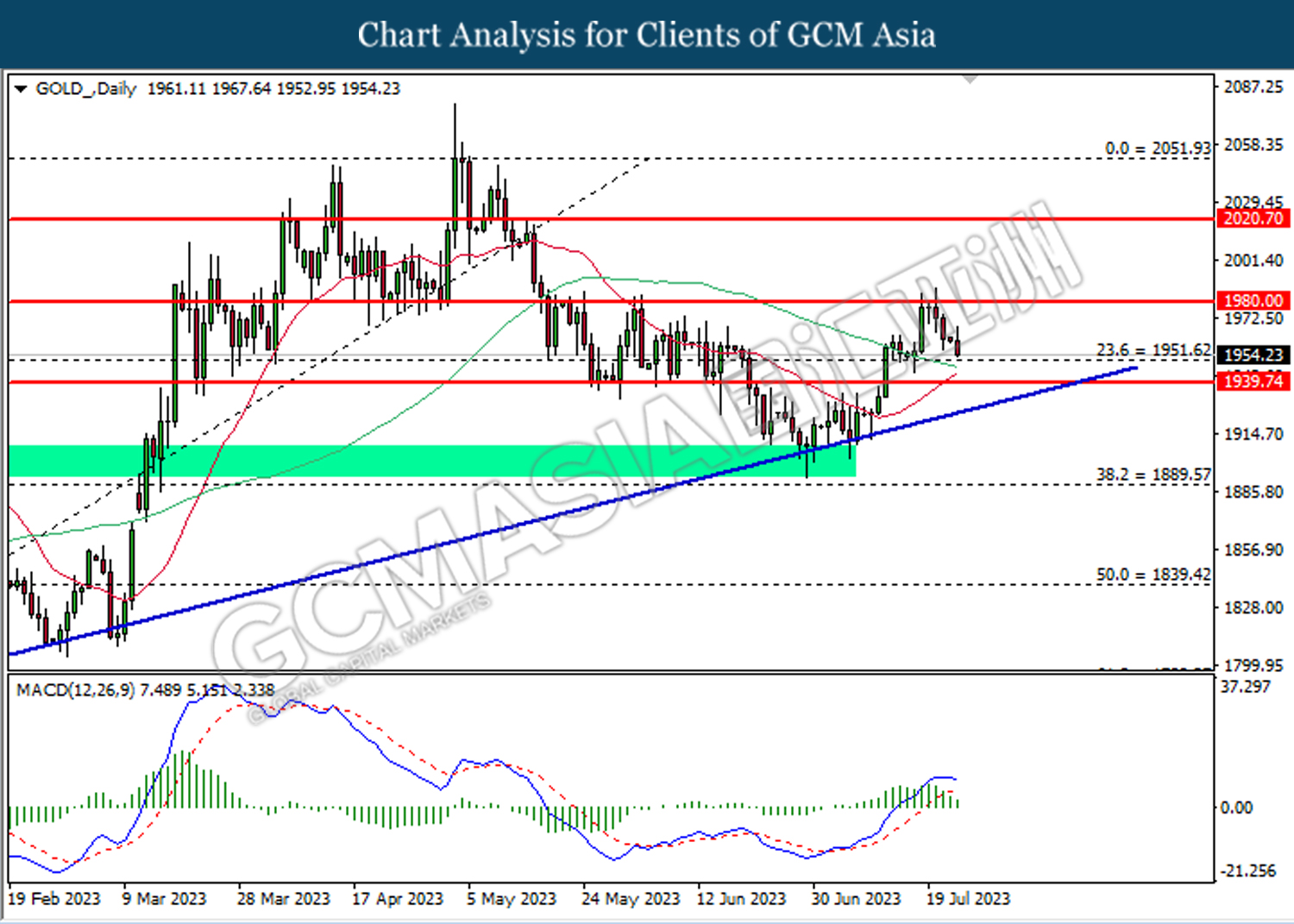

GOLD_, Daily: Gold price was traded lower following the prior retracement from the resistance level at 1980.00. MACD which illustrated diminishing bullish momentum suggests the commodity to extend its losses toward the support level at 1951.60.

Resistance level: 1980.00, 2020.70

Support level: 1951.60, 1939.75