25 November 2022 Afternoon Session Analysis

Euro stayed strong as data shown Europe economy recession was easing.

The EUR/USD, which widely traded by global investors edged up on yesterday after the upbeat economic data has been released. According to Ifo Institute for Economic Research, the Germany Ifo Business Climate Index in November notched up from the previous reading of 84.5 to 86.3, exceeding the market forecast of 85.0. With that, it might hinted that the economic recession that driven by energy crisis with Russia and supply chain headwinds could prove less severe than consensus expectation, which dialed up the market optimism toward economic progression in the Eurozone. Besides that, the overall trend of Euro currency remained bullish over the hawkish stance from European Central Bank (ECB) member. According to Reuters, the ECB board member Isabel Schnabel had denied the suggestion of smaller rate hike, as well as reiterating that the softer move would likely to hamper effort to bring down the spiking inflation risk. She argued that expectations for a shallower rate path are even working against the ECB, taking the actual policy stance further away from what is required to bring inflation back to its 2% target. As of writing, the EUR/USD raised by 0.02% to 1.0410.

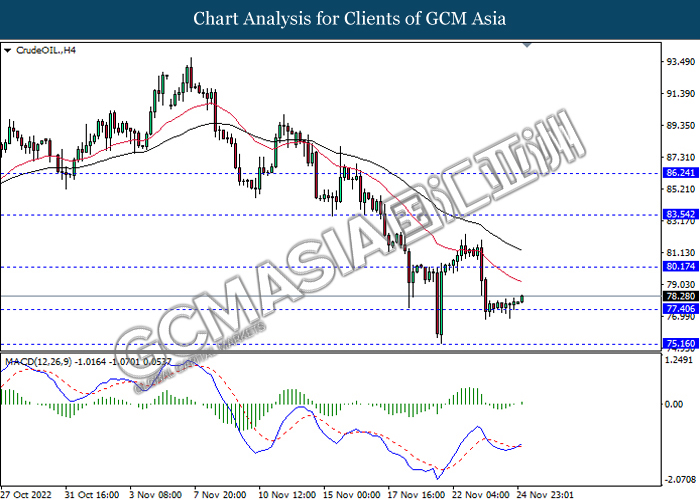

In the commodities market, the crude oil price appreciated by 0.32% to $78.19 per barrel as of writing following the G7 price cap and the EU ban on imports are aimed at cutting the revenue Russia receives from its exports of crude oil and products. In addition, the gold price appreciated by 0.15% to $1757.75 per troy ounce as of writing over the weakening of US Dollar.

Today’s Holiday Market Close

Time Market Event

All Day USD Thanksgiving Day

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 15:00 | EUR – German GDP (QoQ) (Q3) | 0.3% | 0.3% | – |

Technical Analysis

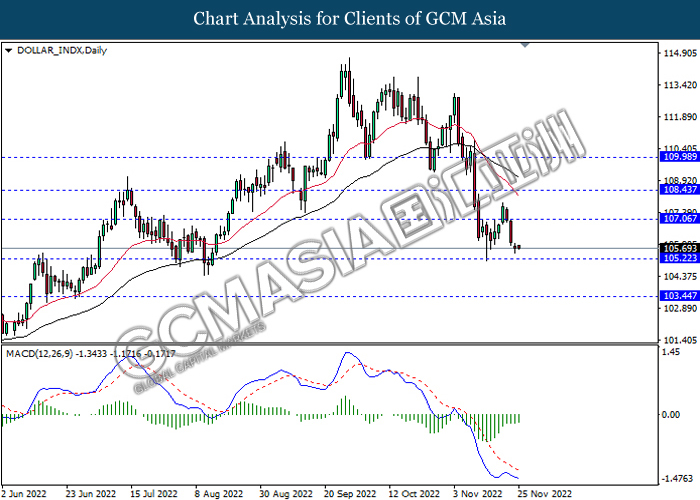

DOLLAR_INDX, Daily: Dollar index was traded lower while currently testing the support level. However, MACD which illustrated decreasing bearish momentum suggest the index to be traded higher as technical correction.

Resistance level: 107.05, 108.45

Support level: 105.20, 103.45

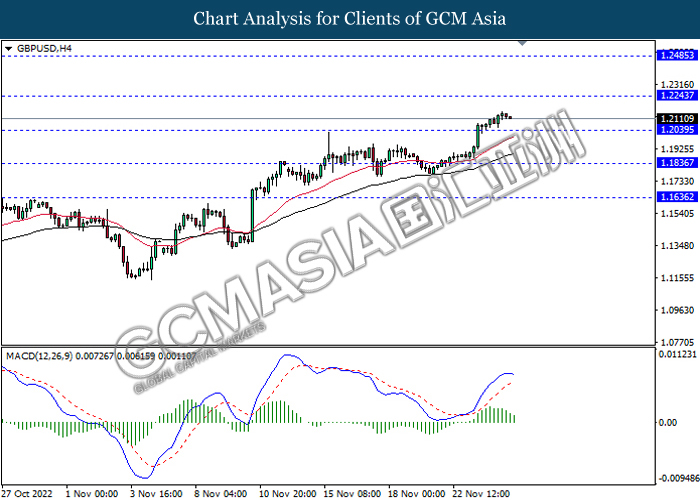

GBPUSD, H4: GBPUSD was traded higher following prior breakout above the previous resistance level. However, MACD which illustrated decreasing bullish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 1.2245, 1.2485

Support level: 1.2040, 1.1835

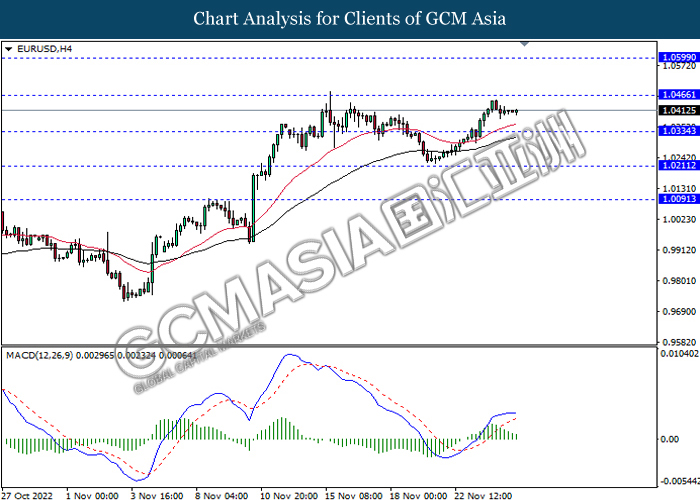

EURUSD, H4: EURUSD was traded higher following prior breakout above the previous resistance level. However, MACD which illustrated decreasing bullish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 1.0465, 1.0600

Support level: 1.0335, 1.0210

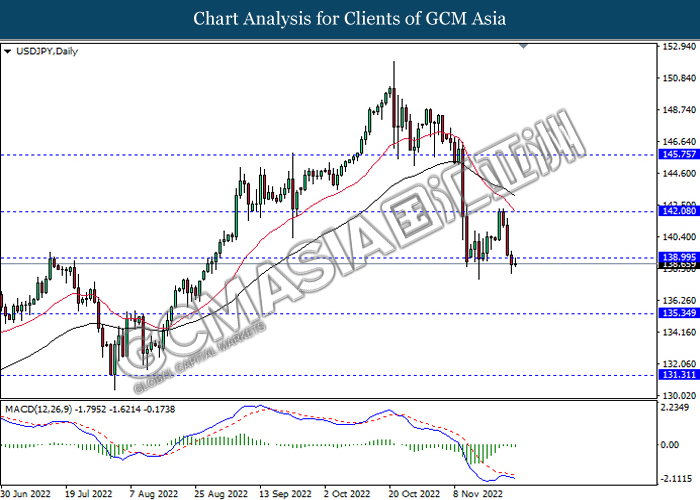

USDJPY, Daily: USDJPY was traded lower following prior breakout below the previous support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses.

Resistance level: 139.00, 142.10

Support level: 135.35, 131.30

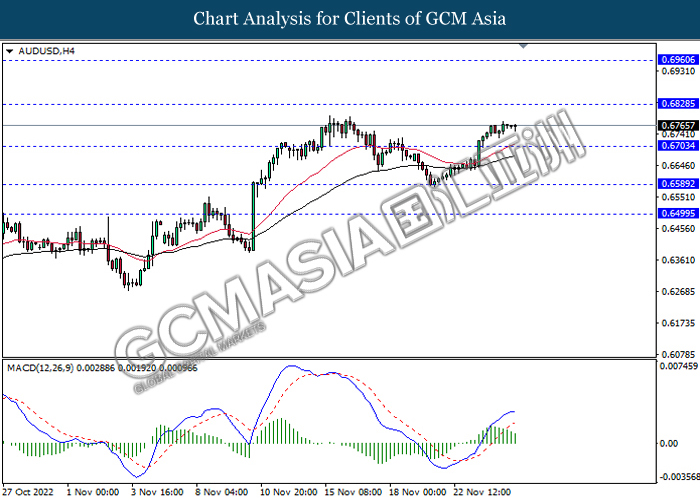

AUDUSD, H4: AUDUSD was traded higher following prior breakout above the previous resistance level. However, MACD which illustrated decreasing bullish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 0.6830, 0.6960

Support level: 0.6705, 0.6590

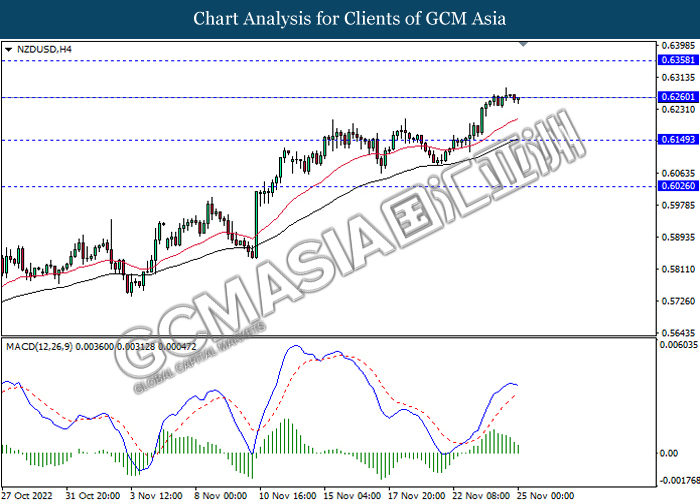

NZDUSD, H4: NZDUSD was traded higher while currently testing the resistance level. However, MACD which illustrated decreasing bullish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 0.6260, 0.6360

Support level: 0.6150, 0.6025

USDCAD, H4: USDCAD was traded lower while currently testing the support level. Hoiwever, MACD which illustrated decreasing bearish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 1.3455, 1.3635

Support level: 1.3320, 1.3155

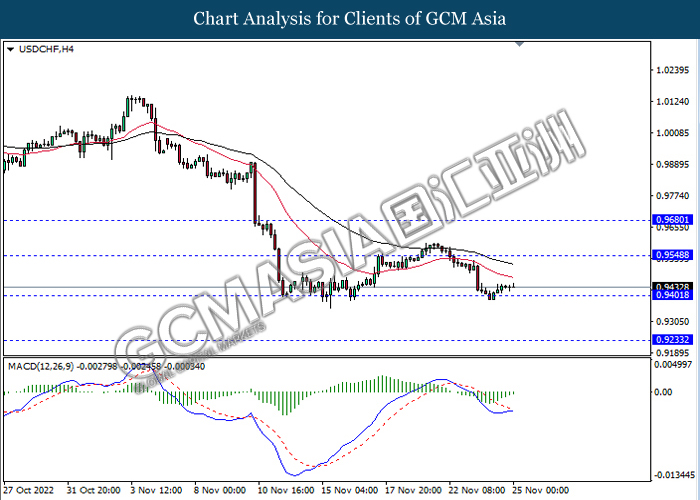

USDCHF, H4: USDCHF was traded higher following prior rebound from the support level. MACD which illustrated decreasing bearish momentum suggest the pair to extend its gains.

Resistance level: 0.9550, 0.9680

Support level: 0.9400, 0.9235

CrudeOIL, H4: Crude oil price was traded higher following prior rebound from the support level. MACD which illustrated increasing bullish momentum suggest the commodity to extend its gains.

Resistance level: 80.15, 83.55

Support level: 77.40, 75.15

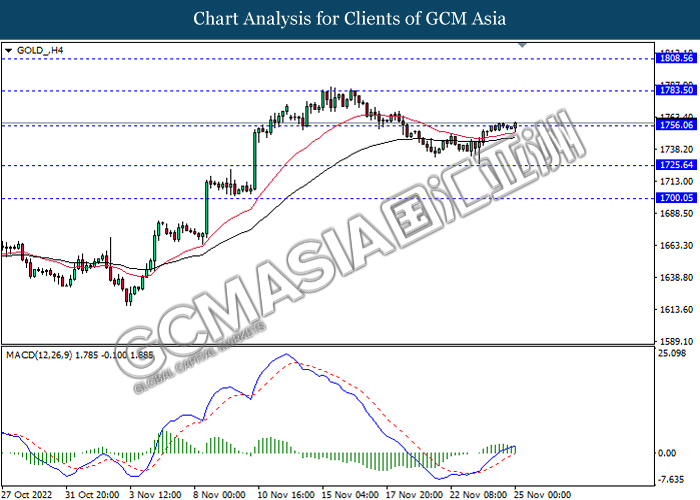

GOLD_, H4: Gold price was traded higher following prior breakout above the previous resistance level. However, MACD which illustrated decreasing bullish momentum suggest the commodity to be traded lower as technical correction.

Resistance level: 1783.50, 1808.55

Support level: 1756.05, 1725.65