25 November 2022 Morning Session Analysis

Greenback slipped during the Thanksgiving Holidays.

The dollar index, which gauges its value against a basket of six major currencies, is teetering on the brink as market risk sentiment improved after Fed meeting minutes were released. Early yesterday, the Fed minutes reported that the officials agreed with a smaller rate hike in the upcoming December meeting. It means that a 50-basis point rate rise is likely to happen in the next month after 4 consecutive 75-basis points of a rate hike. At this juncture, the CME FedWatch tool shows that the possibility of 50 basis points of a rate hike is about 76%, while the possibility of 75 basis points of a rate hike is 24%. With that, it dampened the appeal of the dollar market and urged the market participants to seek other shinier markets. Besides, with the Thanksgiving Holiday, the forex market had relatively low liquidity as it was thinly traded throughout the day. As such, the market is expected to have slow movement or low fluctuation for the rest of the trading session in this week. As of writing, the dollar index edged down -0.20% to 105.85.

In the commodities market, the crude oil price rose by 0.68% to $77.95 per barrel amid a technical rebound after plunging for more than 5% in the previous trading session. Besides, the gold prices edged up by 0.33% to $1755.40 per troy ounce amid the dollar weakened.

Today’s Holiday Market Close

Time Market Event

All Day USD Thanksgiving Day

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 15:00 | EUR – German GDP (QoQ) (Q3) | 0.3% | 0.3% | – |

Technical Analysis

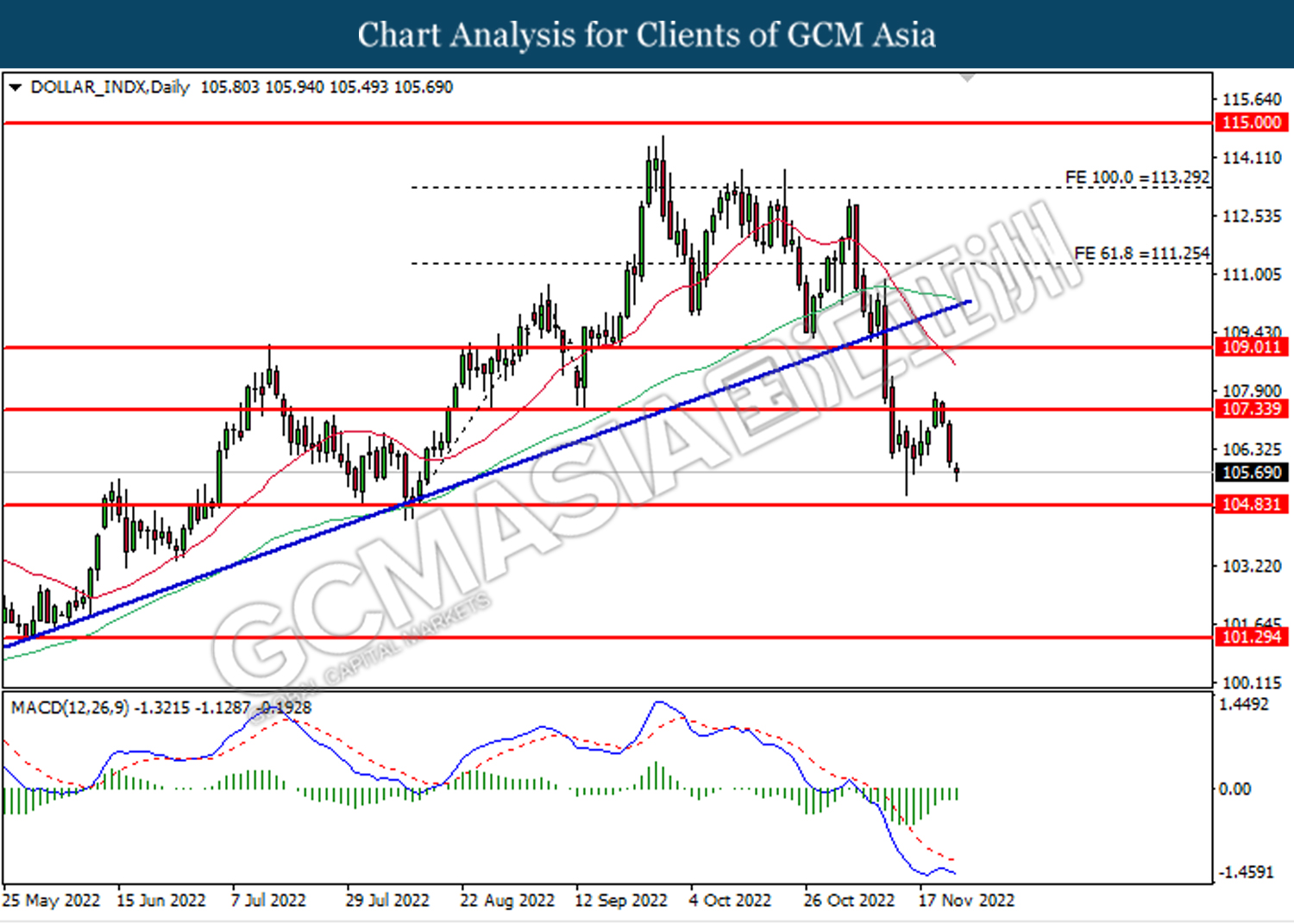

DOLLAR_INDX, Daily: Dollar index was traded lower following prior breakout below the previous support level at 107.35. MACD which illustrated bearish bias momentum suggests the index to extend its losses toward the support level at 104.85.

Resistance level: 107.35, 109.00

Support level: 104.85, 101.30

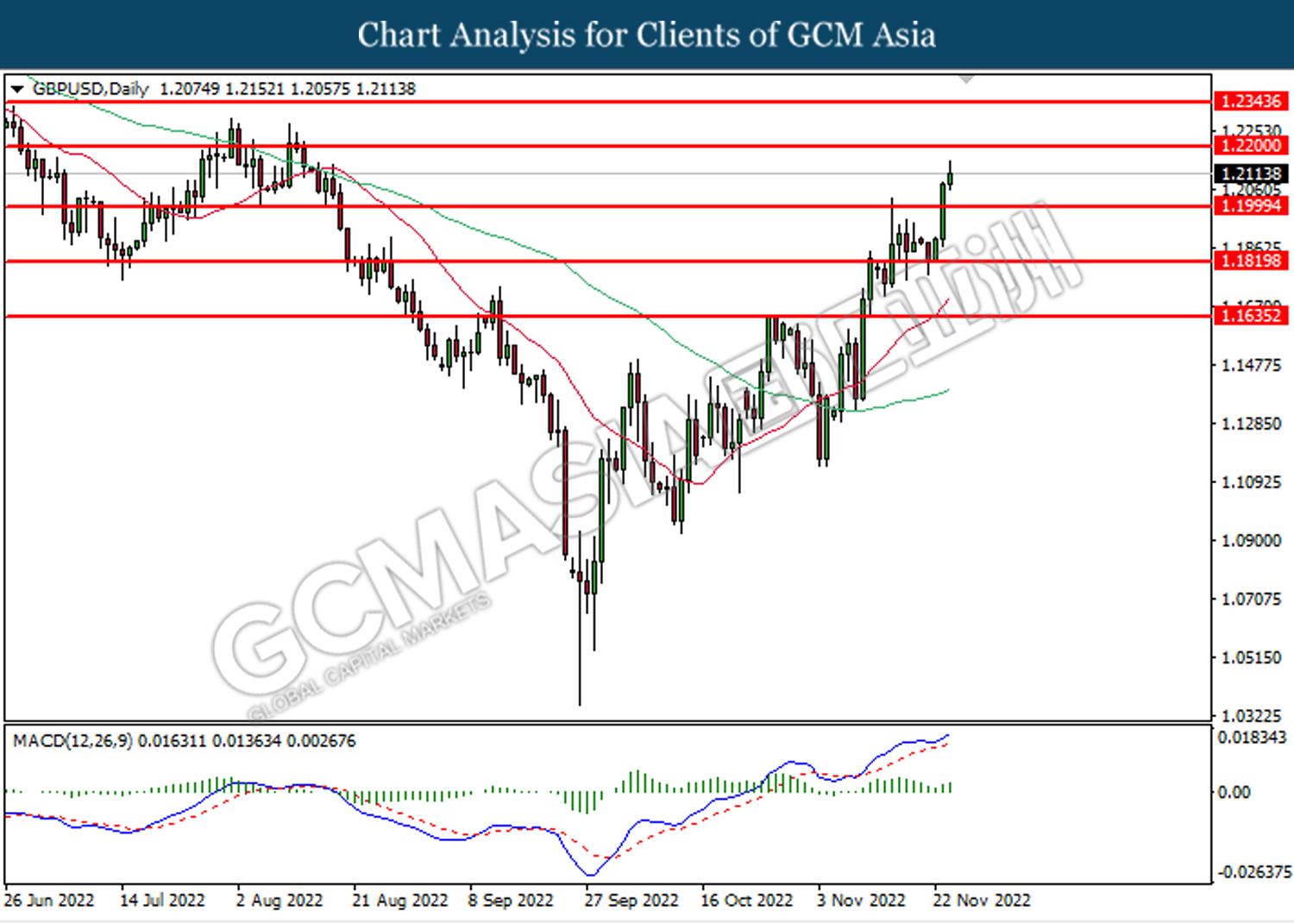

GBPUSD, Daily: GBPUSD was traded higher following prior breakout above the previous resistance level at 1.2000. MACD which illustrated bullish bias momentum suggest the pair to extend its gains toward the resistance level at 1.2200.

Resistance level: 1.2200, 1.2345

Support level: 1.2000, 1.1820

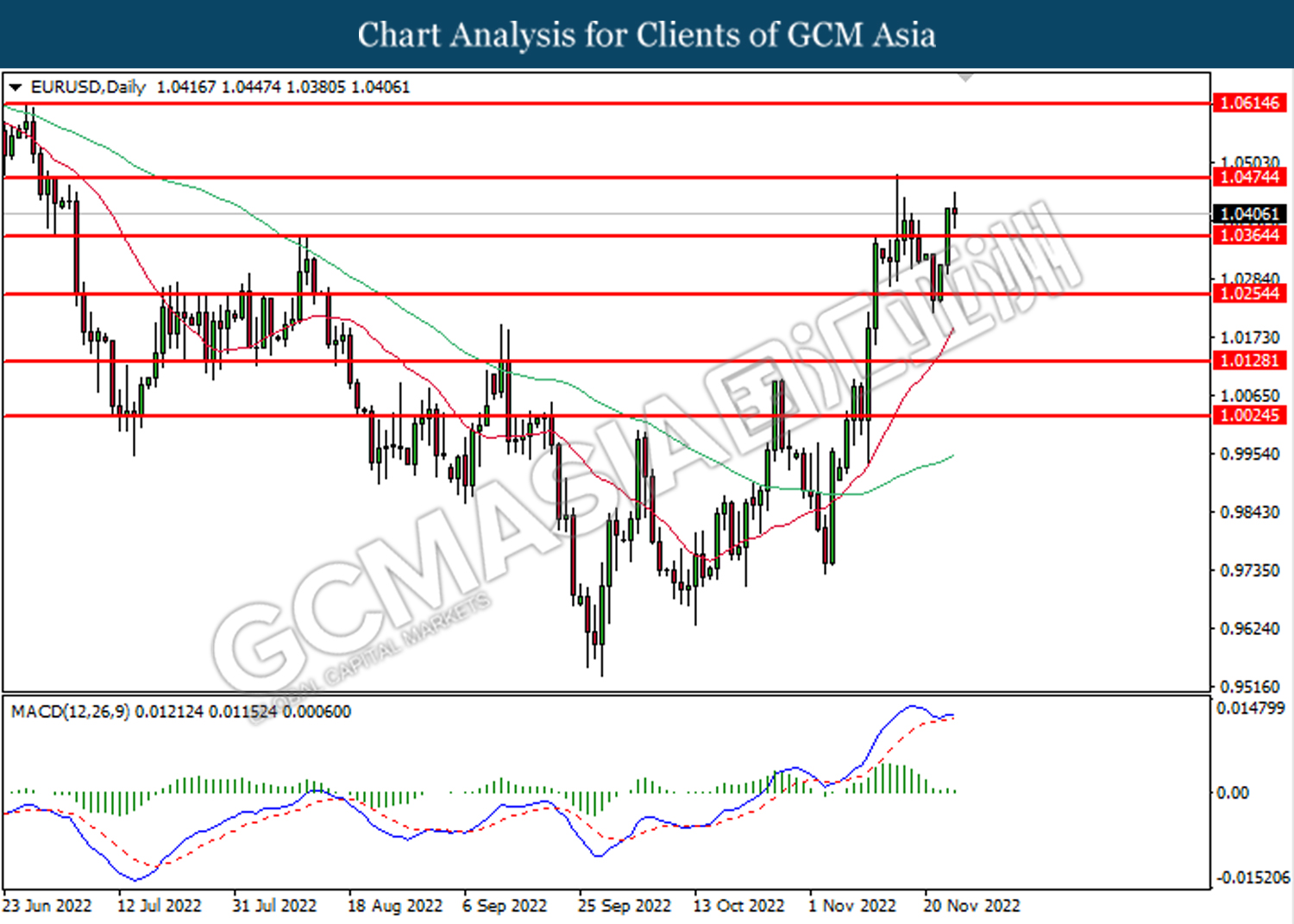

EURUSD, Daily: EURUSD was traded higher following prior breakout above the previous resistance level at 1.0365. MACD which illustrated bullish bias momentum suggest the pair to extend its gains toward the resistance level at 1.0475.

Resistance level: 1.0475, 1.0615

Support level: 1.0365, 1.0255

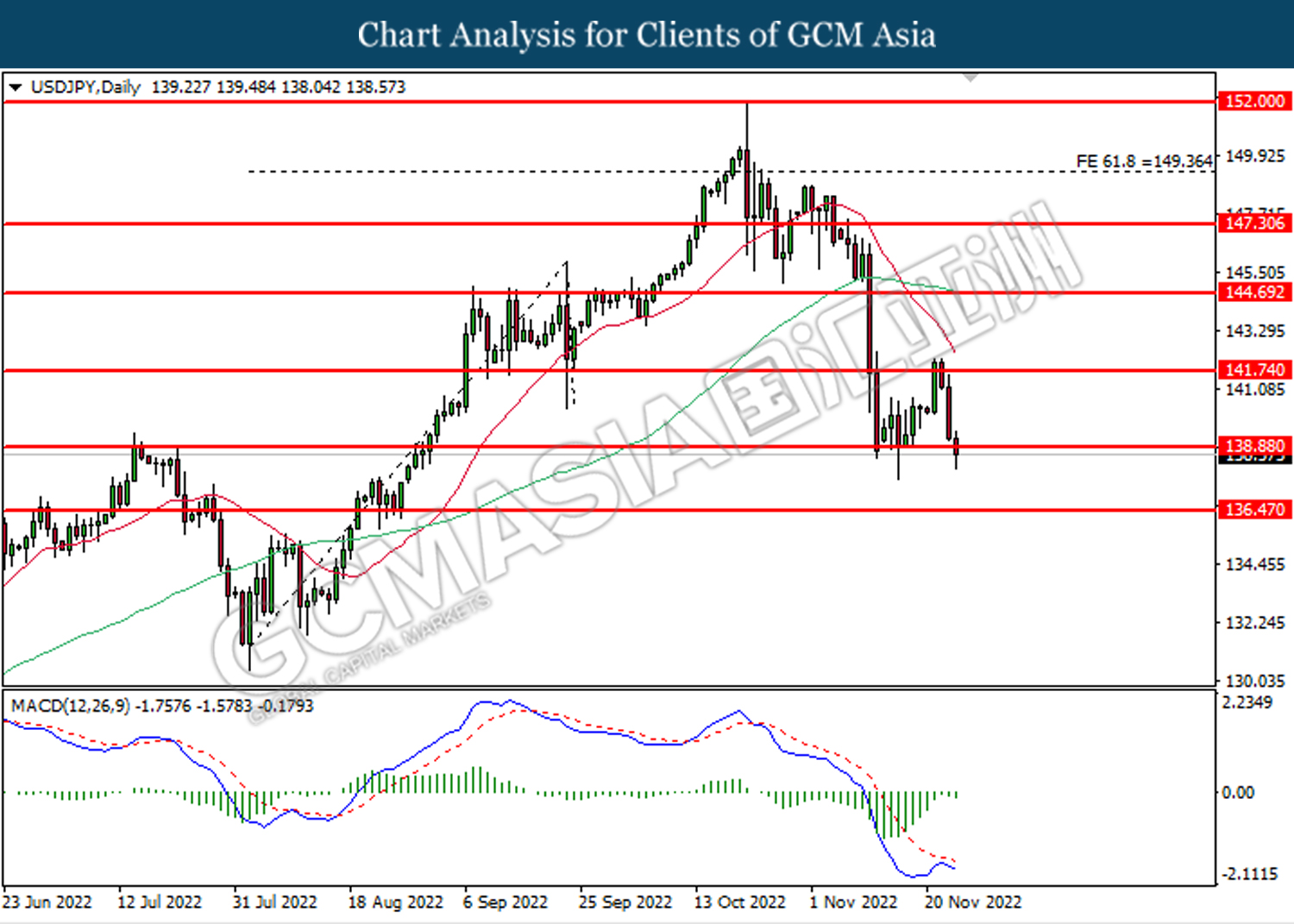

USDJPY, Daily: USDJPY was traded lower while currently testing the support level at 138.90. MACD which illustrated bearish bias momentum suggest the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 141.75, 144.70

Support level: 138.90, 136.45

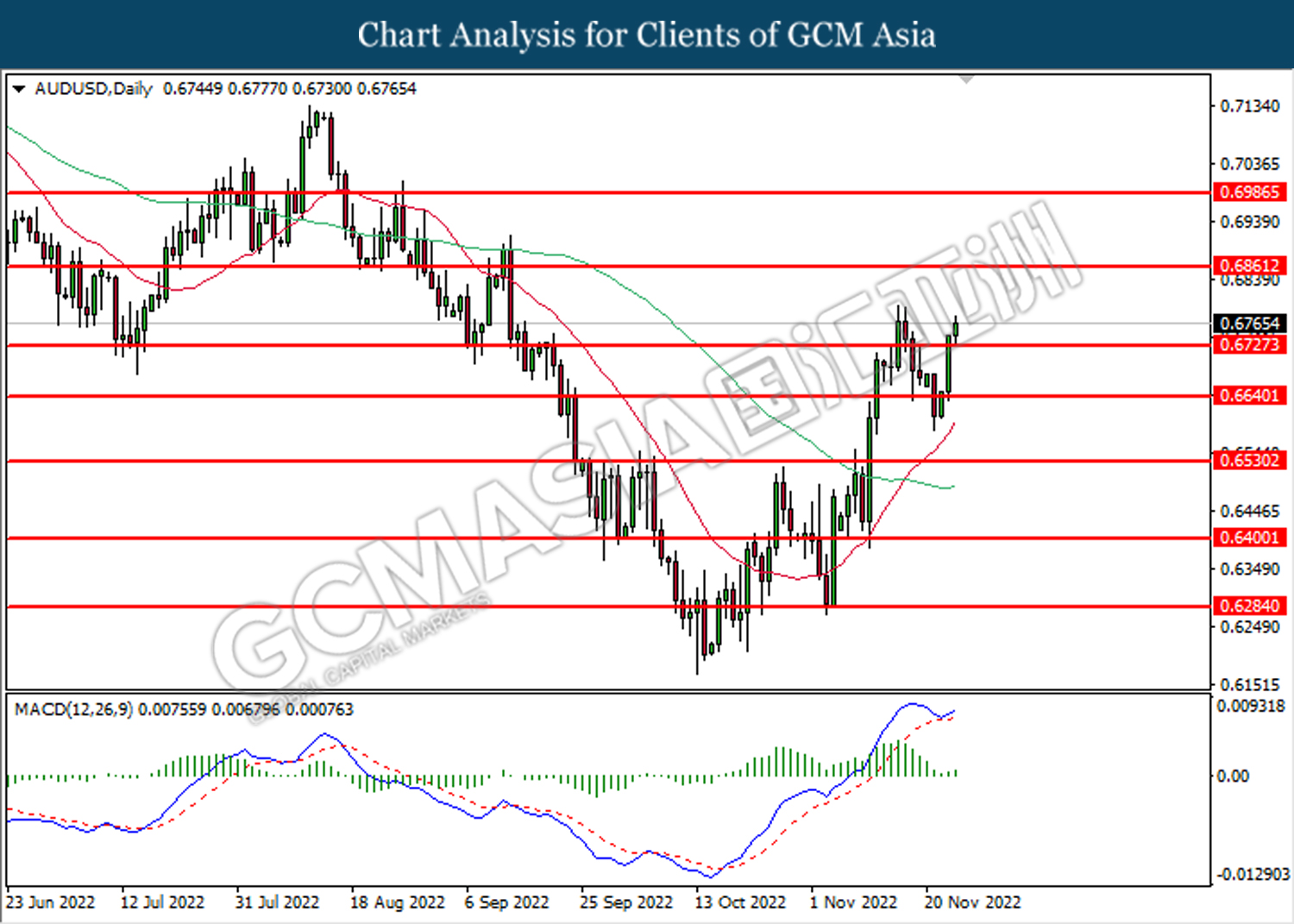

AUDUSD, Daily: AUDUSD was traded higher following prior breakout above the previous resistance level at 0.6725. MACD which illustrated bullish bias momentum suggest the pair to extend its gains toward the resistance level at 0.6860.

Resistance level: 0.6860, 0.6985

Support level: 0.6725, 0.6640

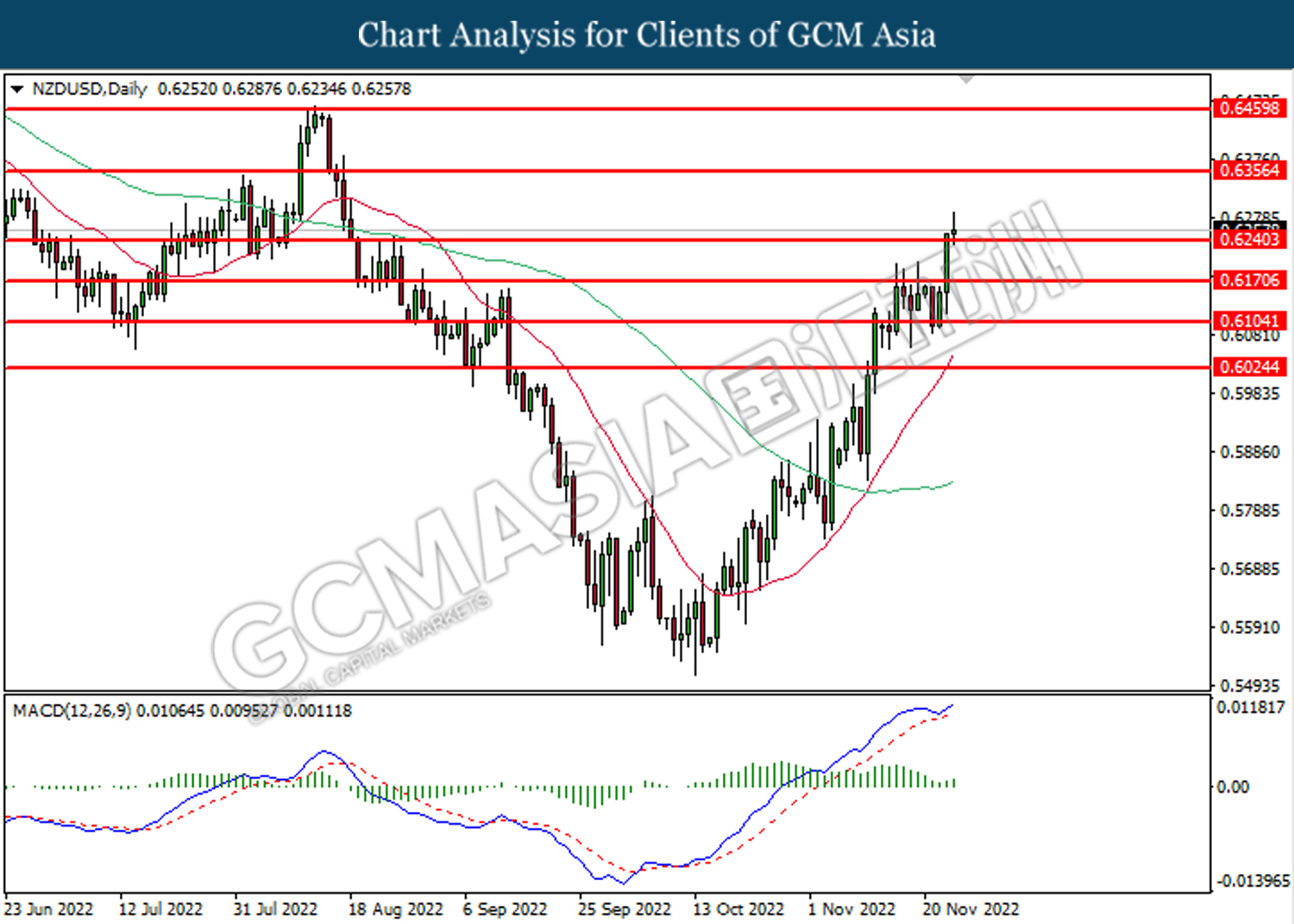

NZDUSD, Daily: NZDUSD was traded higher following prior breakout above the previous resistance level at 0.6240. MACD which illustrated bullish bias momentum suggest the pair to extend its gains toward the resistance level at 0.6355.

Resistance level: 0.6355, 0.6460

Support level: 0.6240, 0.6170

USDCAD, Daily: USDCAD was traded lower following prior breakout below the previous support level at 1.3400. MACD which illustrated bearish bias momentum suggests the pair to extend its losses toward the support level at 1.3265.

Resistance level: 1.3400, 1.3505

Support level: 1.3265, 1.3155

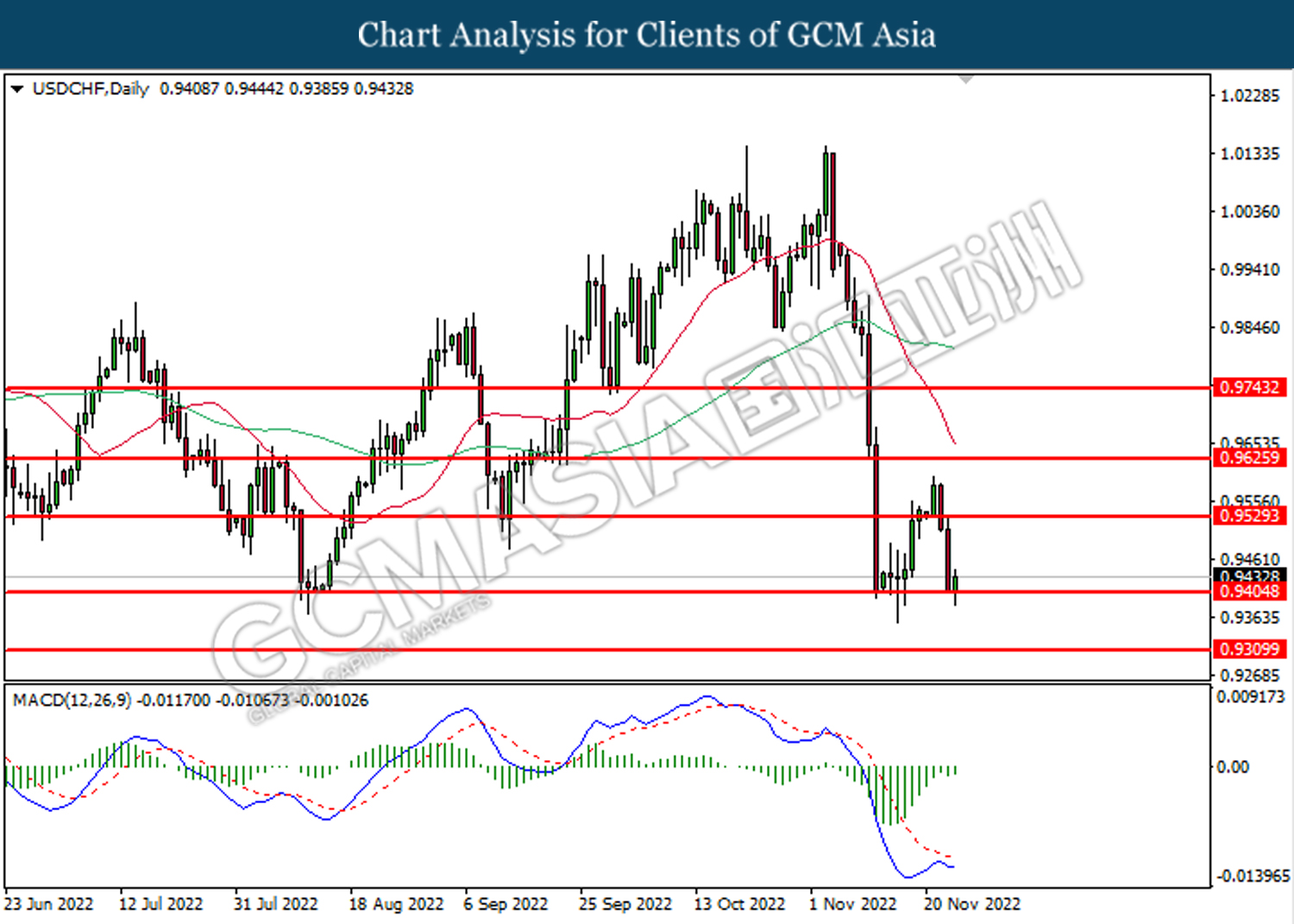

USDCHF, Daily: USDCHF was traded lower while currently testing the support level at 0.9405. MACD which illustrated bearish bias momentum suggest the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 0.9530, 0.9625

Support level: 0.9405, 0.9310

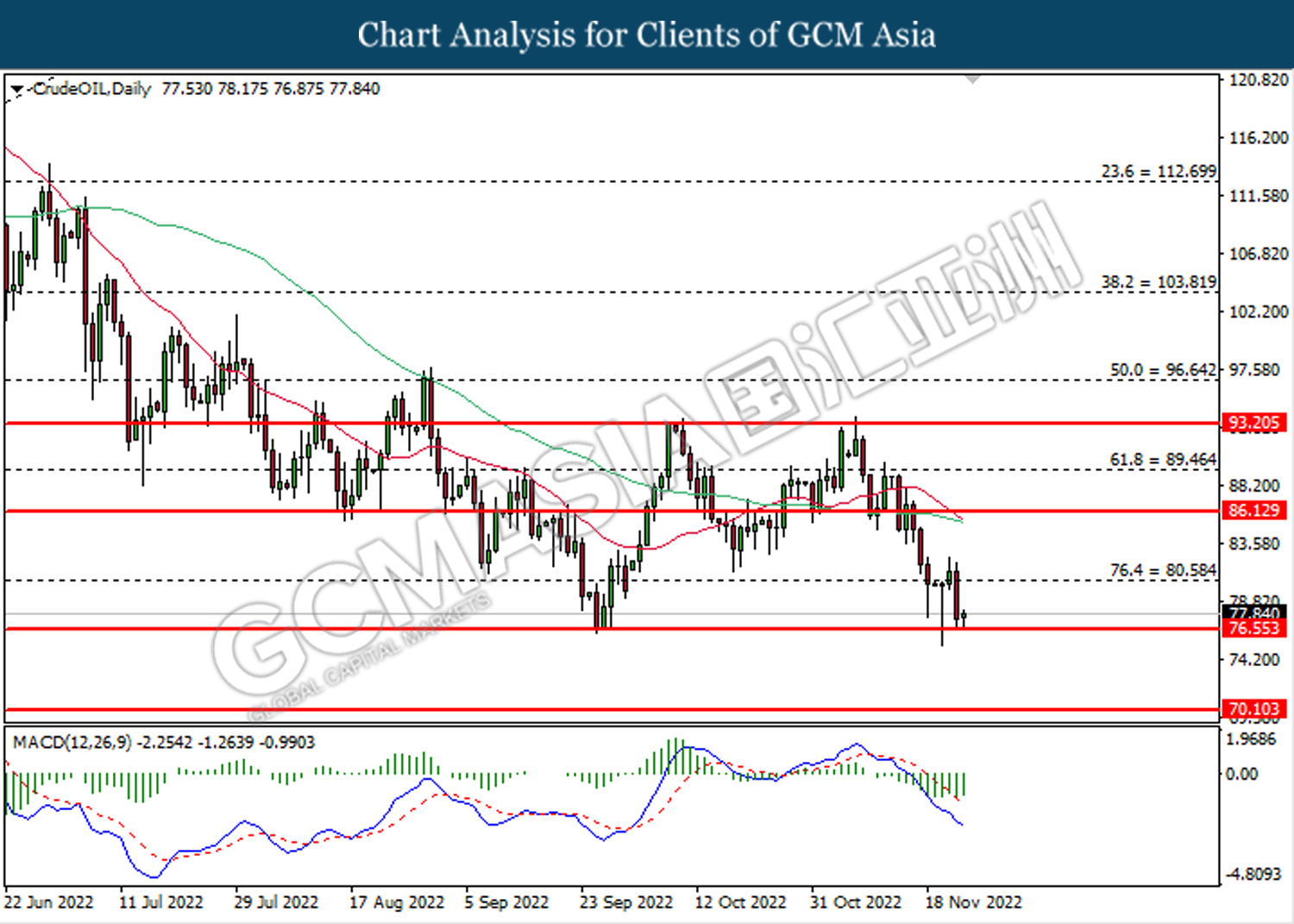

CrudeOIL, H4: Crude oil price was traded lower while currently testing the support level at 76.55. MACD which illustrated bearish bias momentum suggest the commodity to extend its losses after it successfully breakout below the support level.

Resistance level: 80.60, 86.15

Support level: 76.55, 70.10

GOLD_, Daily: Gold price was traded higher following prior rebound from the support level at 1726.15. MACD which illustrated bullish bias momentum suggests the commodity to extend its gains toward the resistance level at 1766.50.

Resistance level: 1766.50, 1805.90

Support level: 1726.15, 1693.35