26 May 2023 Morning Session Analysis

The Greenback soars amid a resilient economy.

The dollar index, which traded against a basket of six major currencies, extended its gains toward 104.00 level amid a resilient economy. The number of Americans filing new claims for unemployment benefits rose slightly after the prior week’s data revised to a low, suggesting persistent labor market strength. The initial jobless claims increased to 229K from 225k after the previous data was revised, but the recent figures were lower than the market consensus at 250k, giving the dollar a boost. Economists expect layoffs to increase as the high-interest rate spread through the economy and tightening financial conditions make it harder for small businesses to extend credit. However, the labor data came in better than forecast, in line with recent Service PMI data that suggests the economy is expanding in the second quarter. In a separate report, the Commerce’s Bureau of Economic Analysis unveil the US Gross Domestic Product (GDP) and confirmed the economy is cooling down. GDP rose 1.3% in the first quarter, compared with 2.6% in the previous quarter, but was higher than the consensus estimates of 1.1%, marking the third consecutive expansion of the economy. Apart from this, US President Biden and Republication McCarthy appear near to a deal on the US debt ceiling as default looms, according to a Reuters report. As of writing, the dollar index edged up by 0.36% to 104.17.

In commodity markets, crude oil fell -0.07% to $71.78 a barrel after Russia’s Deputy Prime Minister expected no new oil cuts from OPEC at its meeting on Jun 4th. Besides, gold prices tickled by 0.04% to $1941.53 per troy ounce as the dollar strengthened.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 09:30 | AUD – Retail Sales (MoM) (Apr) | – | 0.3% | 0.4% |

| 14:00 | GBP – Retail Sales (MoM) (Apr) | – | 0.4% | -0.9% |

| 20:30 | USD – Core Durable Goods Orders (MoM) (Apr) | – | 0.0% | 0.3% |

| 20:30 | USD – Core PCE Price Index (MoM) (Apr) | – | 0.3% | 0.3% |

Technical Analysis

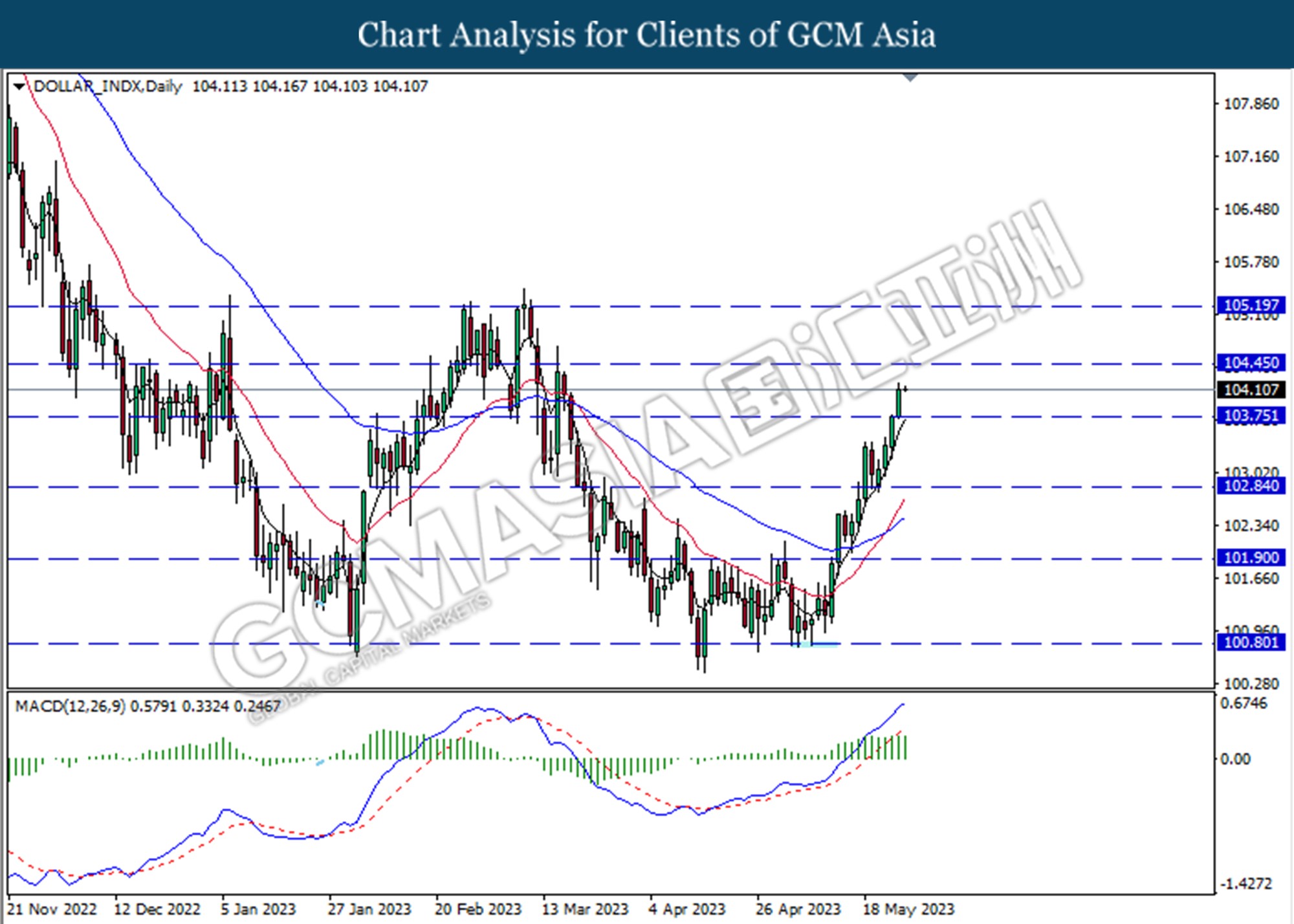

DOLLAR_INDX, Daily: Dollar index was traded higher following the prior breakout above the previous resistance level at 103.75. MACD which illustrated bullish momentum suggests the index extended its gains toward the resistance level at 104.45.

Resistance level: 104.45, 105.20

Support level: 103.75, 102.85

GBPUSD, Daily: GBPUSD was traded lower following the prior retracement from the higher level. MACD which illustrated increasing bearish momentum suggests the pair extended its losses toward the support level at 1.2300.

Resistance level: 1.2445, 1.2590

Support level: 1.2300, 1.2145

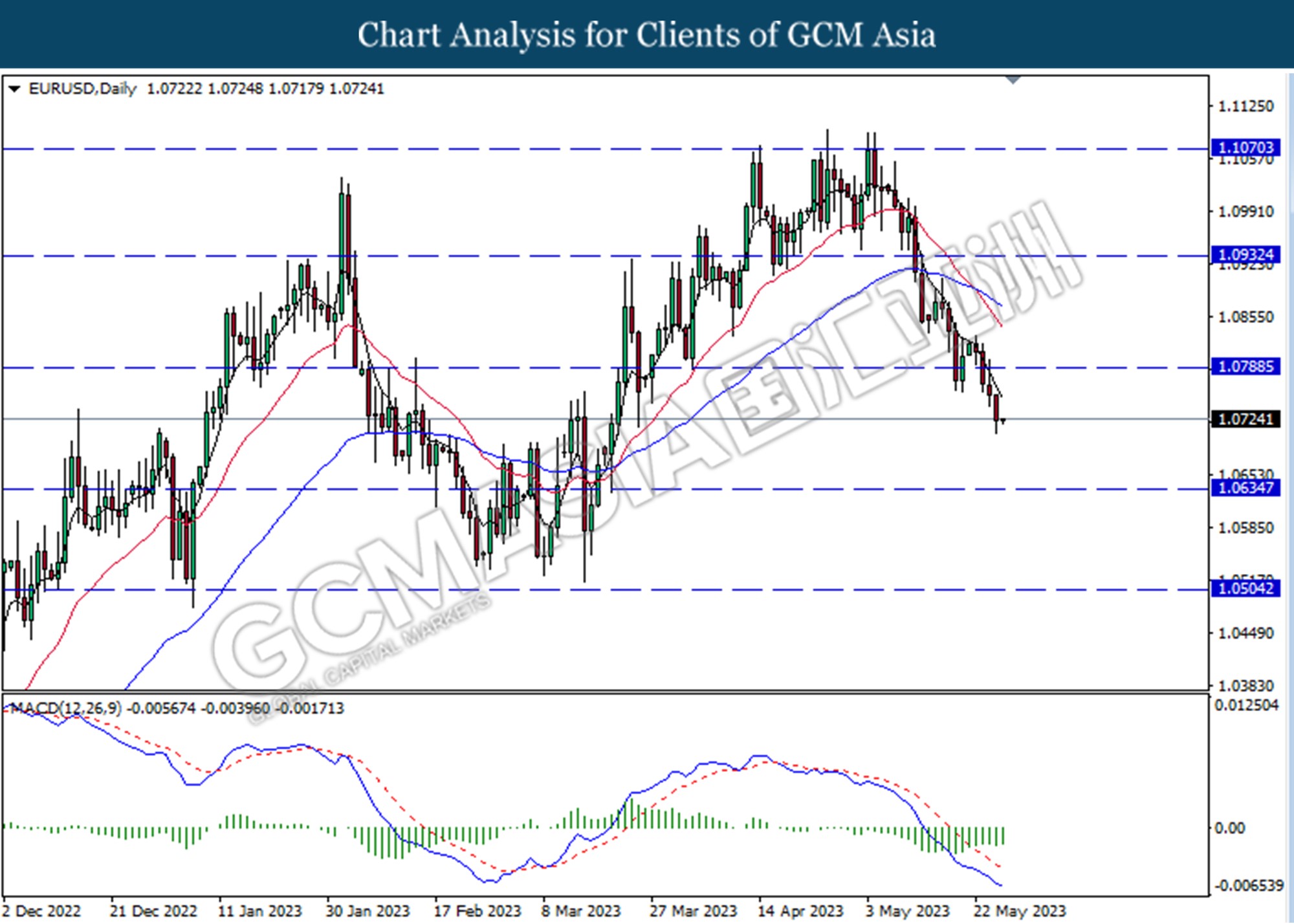

EURUSD, Daily: EURUSD was traded lower following the prior breaks below the previous support level at 1.0790. However, MACD which illustrated diminishing bearish momentum suggests the pair undergoes a technical correction in a short term.

Resistance level: 1.0790, 1.0940

Support level: 1.0635, 1.0505

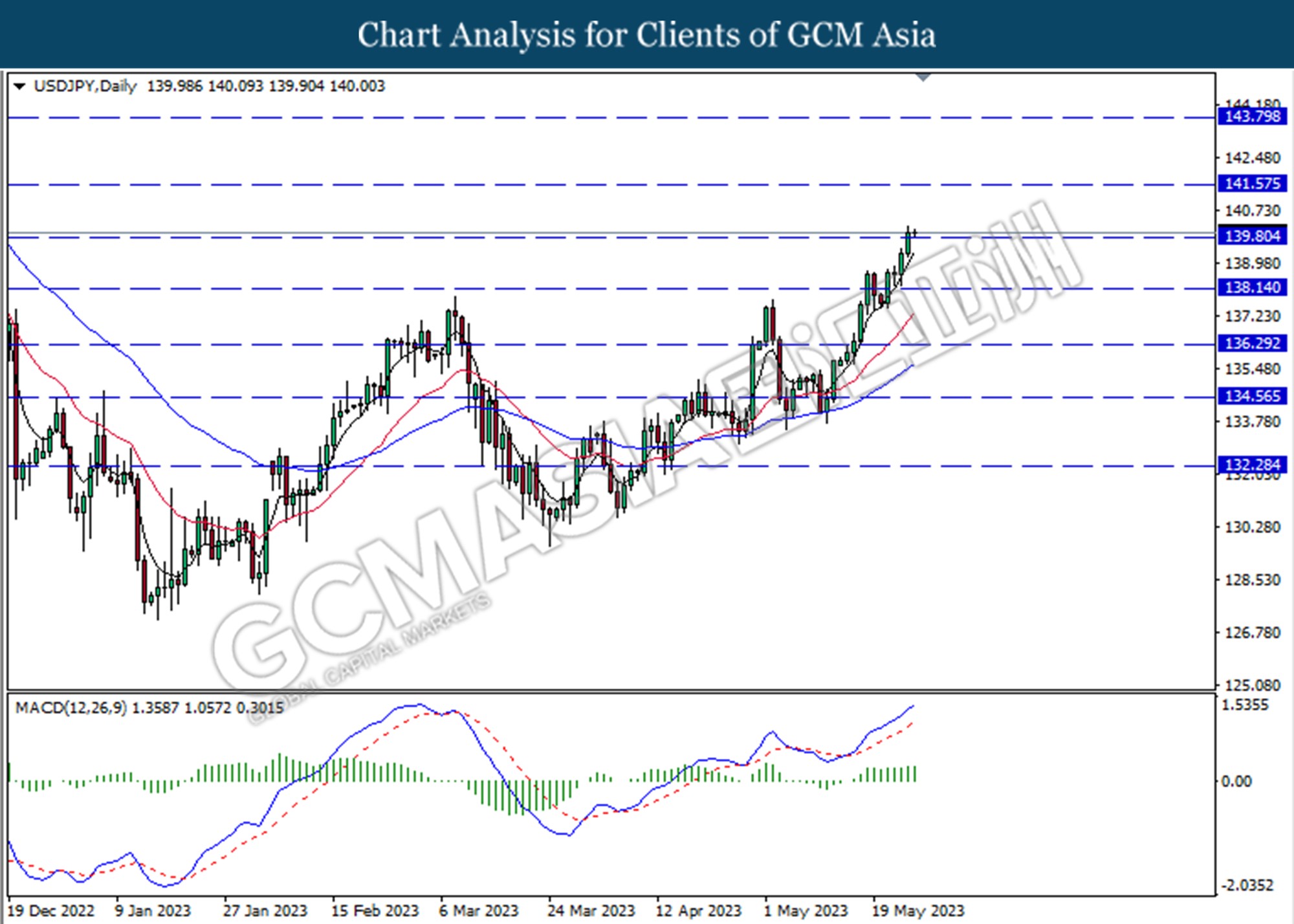

USDJPY, Daily: USDJPY was traded higher following the prior breaks above the previous resistance level at 139.80. MACD which illustrated increasing bullish momentum suggests the pair extended its gains toward the resistance level at 139.80.

Resistance level: 141.60, 143.80

Support level: 139.80, 138.15

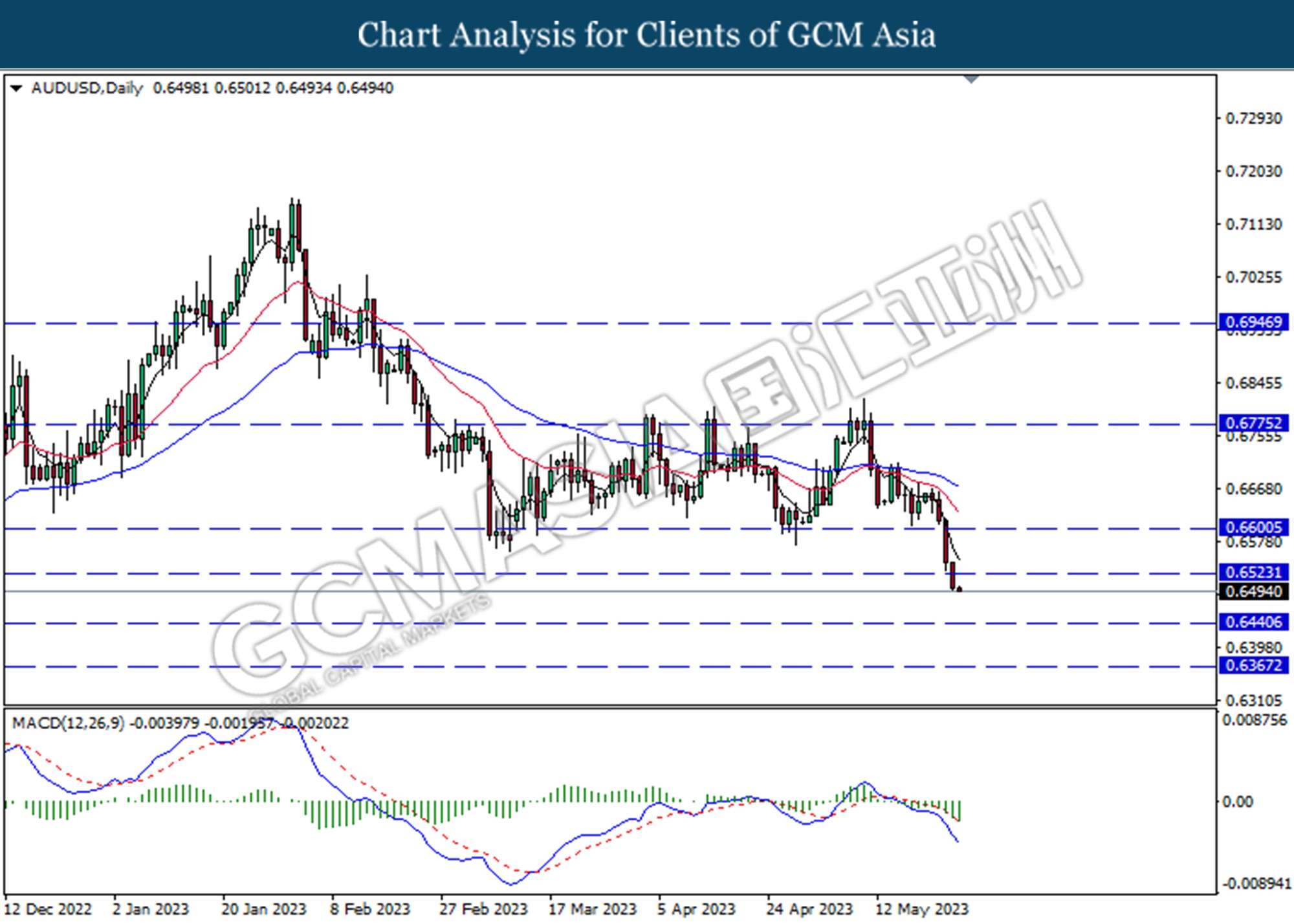

AUDUSD, Daily: AUDUSD was traded lower following the prior breaks below the previous support level at 0.6525. MACD which illustrated increasing bearish momentum suggests the pair extended its losses toward the support level.

Resistance level: 0.6525, 0.6600,

Support level: 0.6440, 0.6365

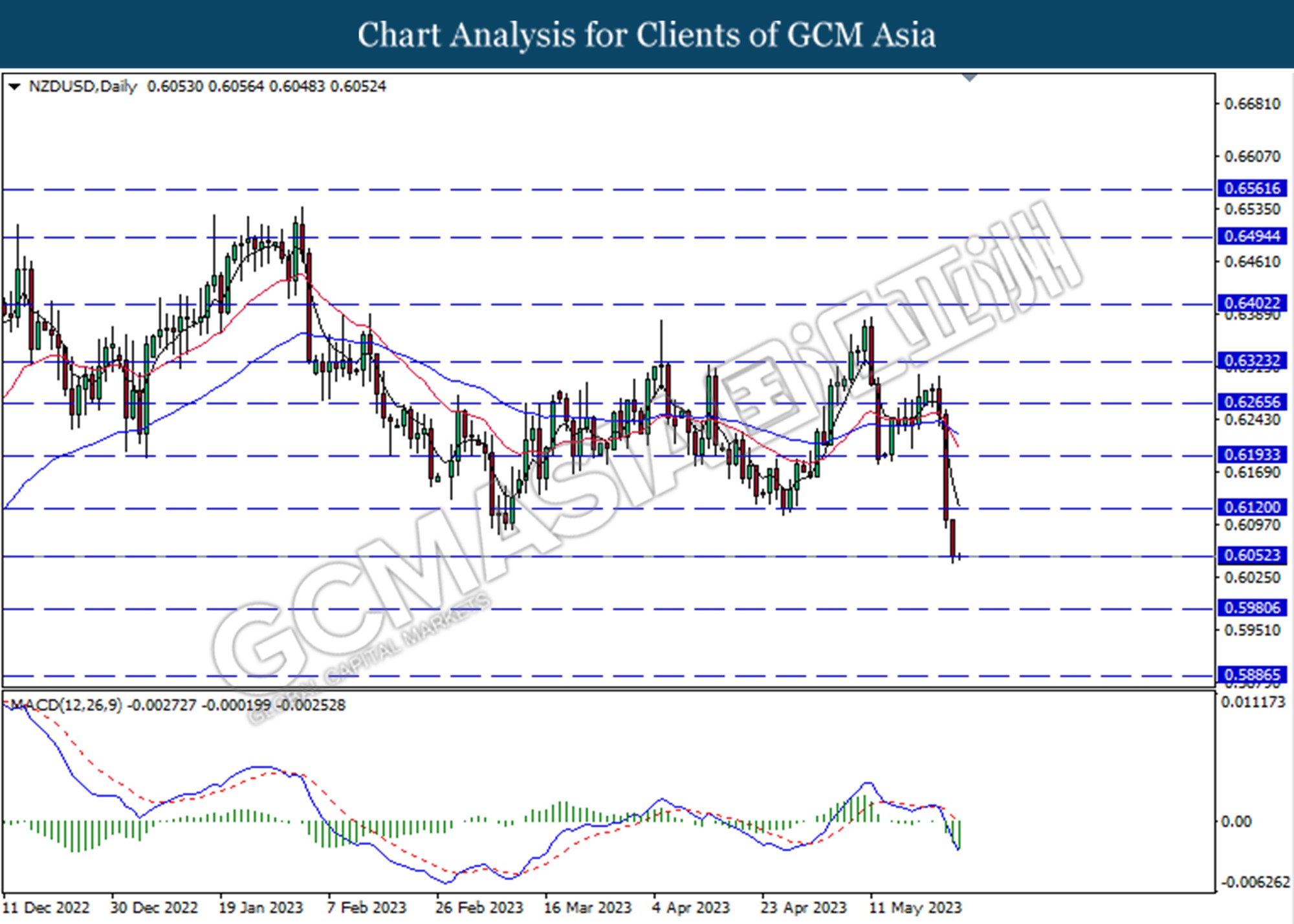

NZDUSD, Daily: NZDUSD was traded lower while currently testing for the support level at 0.6050. MACD which illustrated increasing bearish momentum suggests the pair extended its losses if successfully breaks below the support level.

Resistance level: 0.6120, 0.6195

Support level: 0.6050, 0.5980

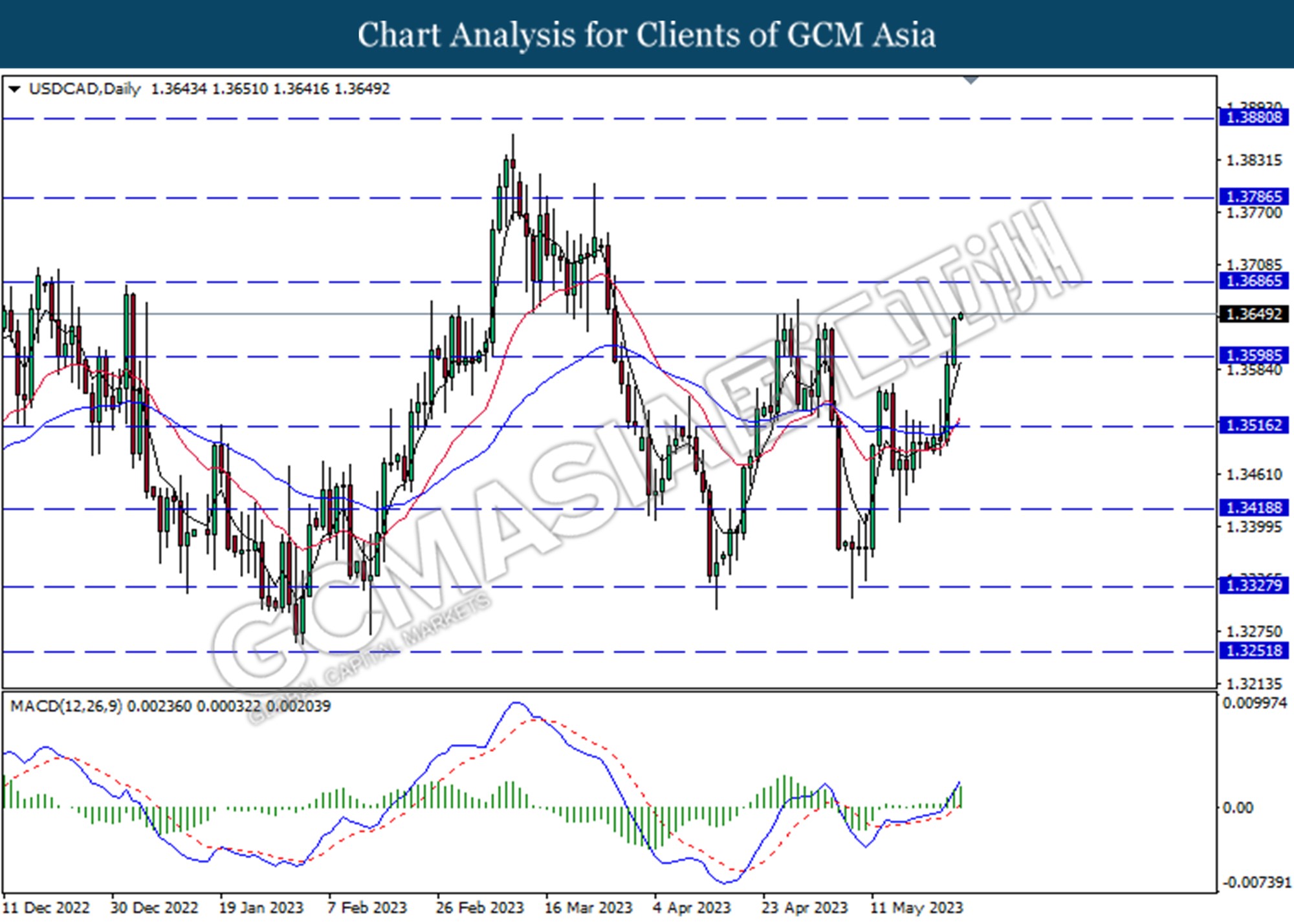

USDCAD, Daily: USDCAD was traded higher following the prior breaks above the previous resistance level at 1.3600. MACD which illustrated increasing bullish momentum suggests the pair extended its gains toward the resistance level.

Resistance level: 1.3685, 1.3785

Support level: 1.3600, 1.3515

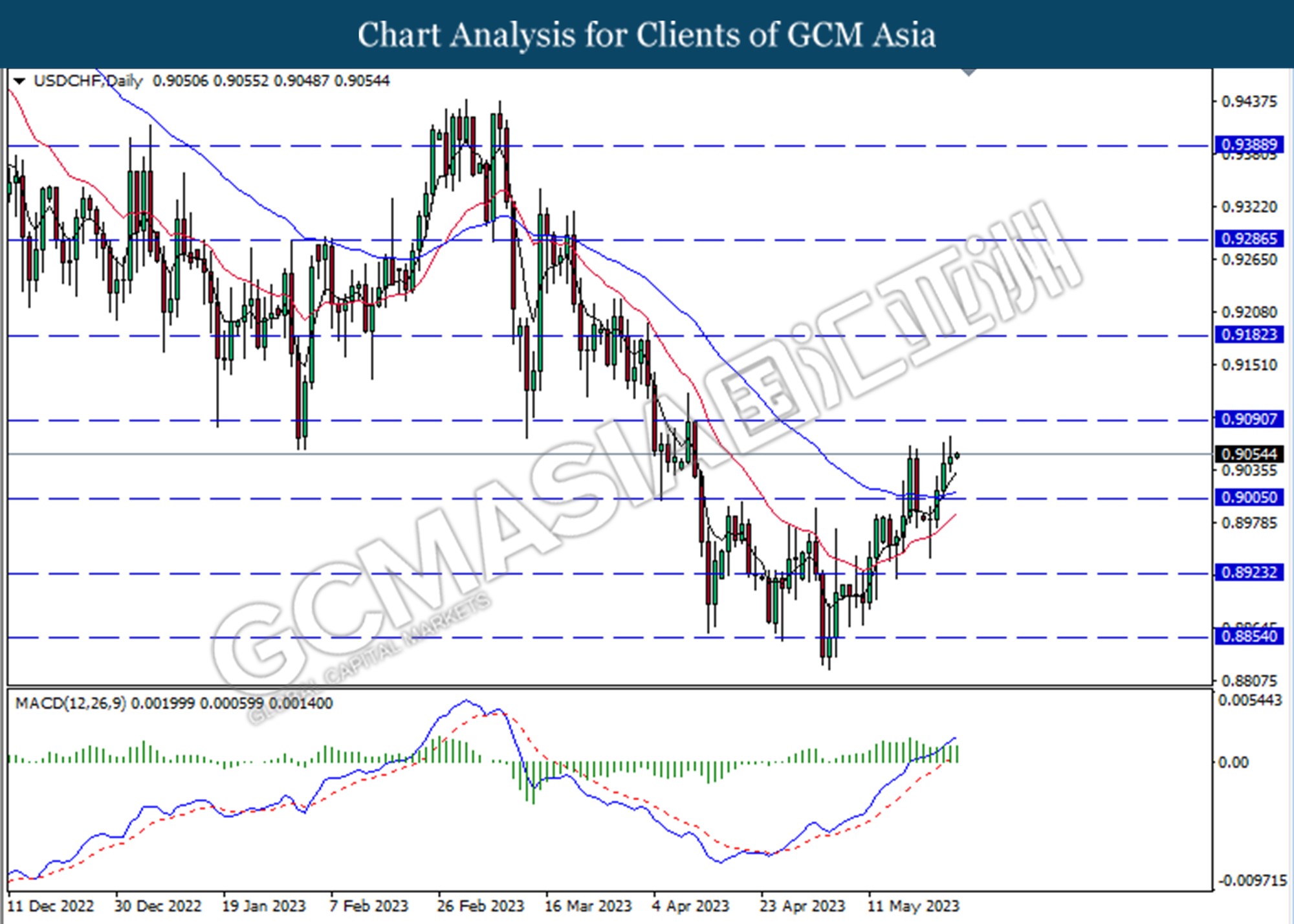

USDCHF, Daily: USDCHF was traded higher following the prior breaks above the previous resistance level at 0.9005. MACD which illustrated bullish momentum suggests the pair extended its gains toward the resistance level at 0.9090.

Resistance level: 0.9090, 0.9180

Support level: 0.9005, 0.8925

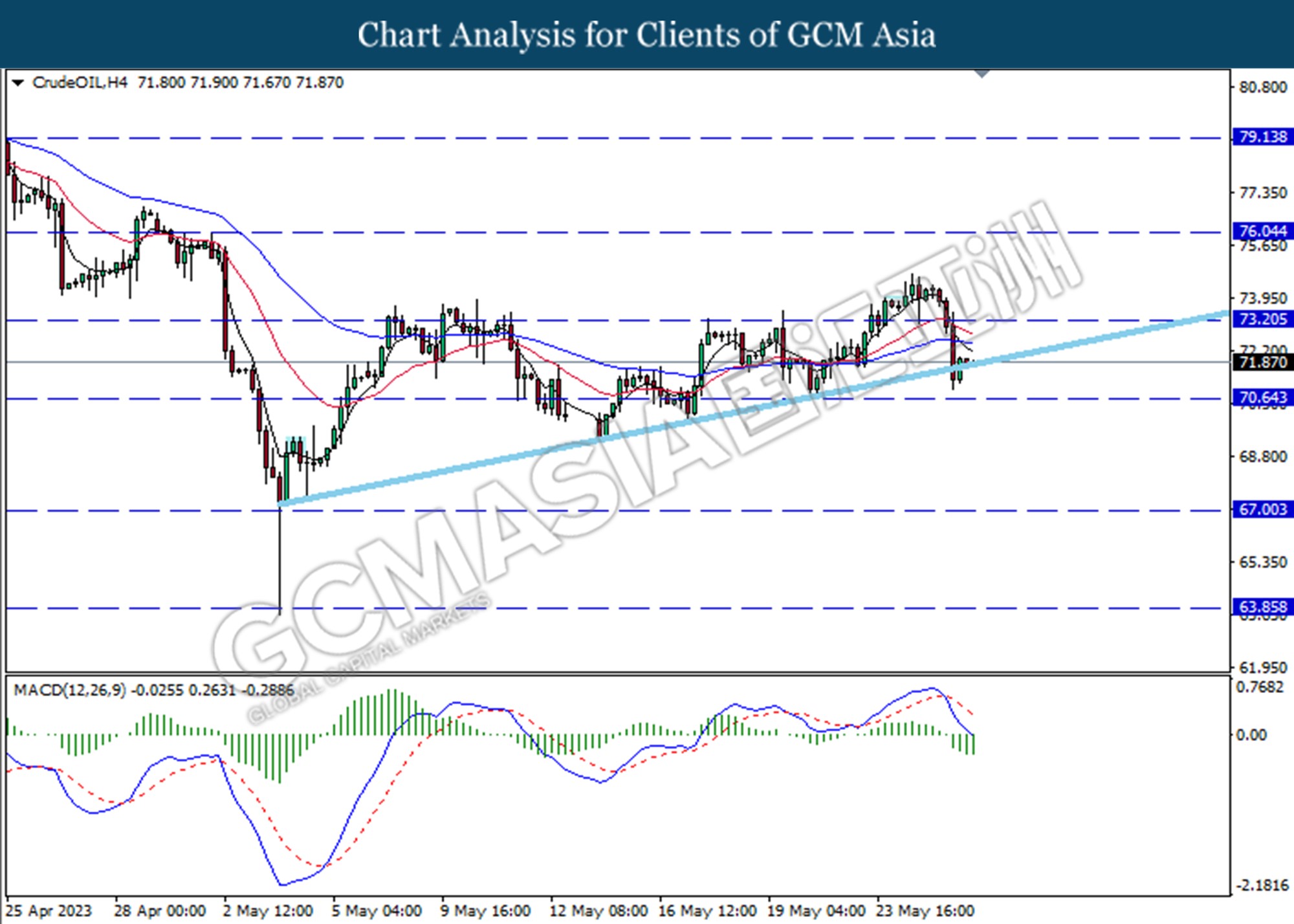

CrudeOIL, Daily: Crude oil price was traded higher following the prior rebound from the lower level. However, MACD which illustrated increasing bearish momentum suggests the commodity undergoes a technical correction in the short term.

Resistance level: 73.20, 76.05

Support level: 70.65, 67.00

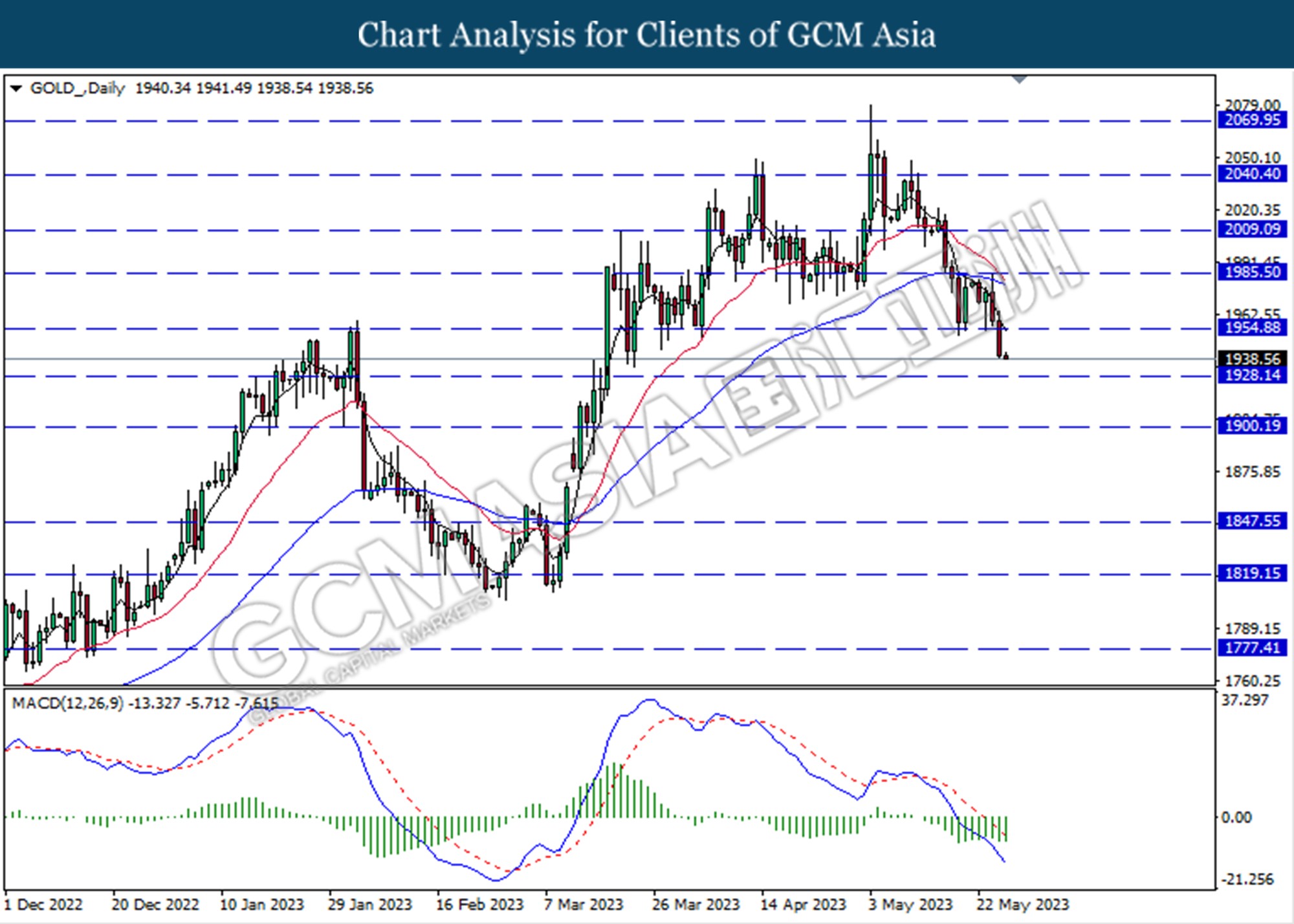

GOLD_, Daily: Gold price was traded lower following the prior breaks below from the previous support level at 1954.90. MACD which illustrated bearish momentum suggests the commodity extended its losses toward the support level at 1928.15.

Resistance level: 1954.90, 1985.50

Support level: 1928.15, 1900.20