26 June 2020 Afternoon Session Analysis

Japanese Yen struggles after inflation data.

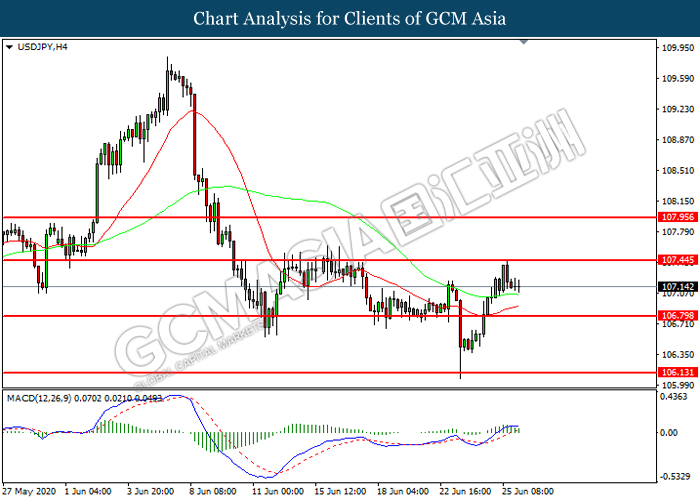

The Japanese Yen which measured its value against the dollar and other currency pairs have fell during late Asian session after the release of Japan CPI. According to Statistics Bureau of Japan, Tokyo Consumer Price Index have decline to 0.3%, missing market expectation of 0.6% while core CPI matched 0.2%. Besides that, downbeat statements from BoJ Governor Haruhiko Kuroda have also dragged down further the sentiment. Earlier during the day, Kuroda stated that the coronavirus (COVID-19) pandemic has had a severe impact on countries all over the world, and Japan is no exception. The policymaker also cited fears that Japan’s GDP for the second quarter (Q2) could see considerable contraction. Moreover, Bank of Japan board member Seiji Adachi also mention that the central bank will control interest rates and prevent them from spiking to ensure Japan’s safety in finance. At the time of writing, USD/JPY edge higher 0.05% to 107.15.

In the commodities market, crude oil price gains 0.19% to $39.07 per barrel as of writing following upbeat traffic data. According to reports, Satellite traffic data from China, Europe and the United States indicated a healthy increase in levels, boosting investor sentiment and confidence in demand recovery. Still, market remains cautious amid COVID-19 fears. On the other hand, gold price retreats 0.11% to $1761.80 a troy ounce amid rebound in dollar.

Today’s Holiday Market Close

Time Market Event

All Day CNY Dragon Boat Festival

Today’s Highlight Events

Time Market Event

15:00 EUR ECB President Lagarde Speaks

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 22:00 | USD – Michigan Consumer Sentiment (Apr) | 78.9 | 79.0 | – |

| 01:00

(27th) |

CrudeOIL – U.S. Baker Hughes Oil Rig Count | 189 | – | – |

Technical Analysis

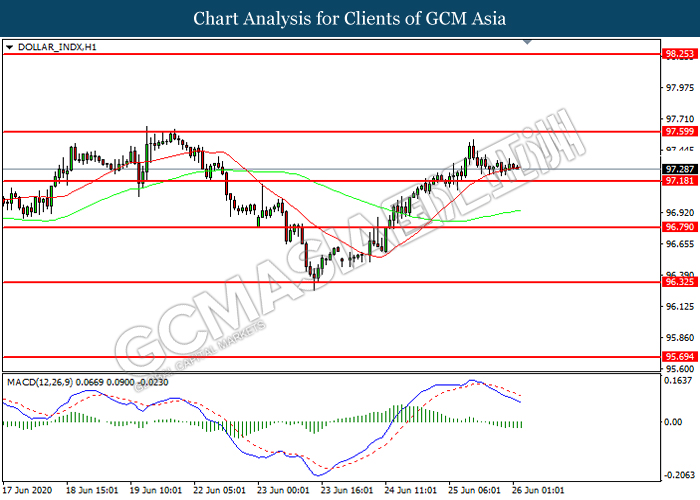

DOLLAR_INDX, H1: Dollar index was traded lower while currently testing the support level at 97.20. MACD which illustrated increasing bearish momentum suggest the index to extend its losses after it successfully breakout below the support level.

Resistance level: 97.60, 98.25

Support level: 97.20, 96.80

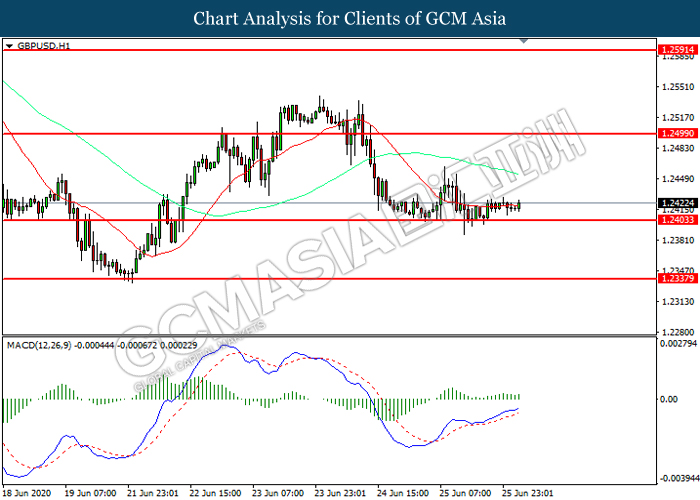

GBPUSD, H1: GBPUSD was traded within a range while currently testing the support level at 1.2405. MACD which illustrated increasing bullish momentum suggest the pair to be traded higher in short-term as technical correction.

Resistance level: 1.2500, 1.2590

Support level: 1.2405, 1.2335

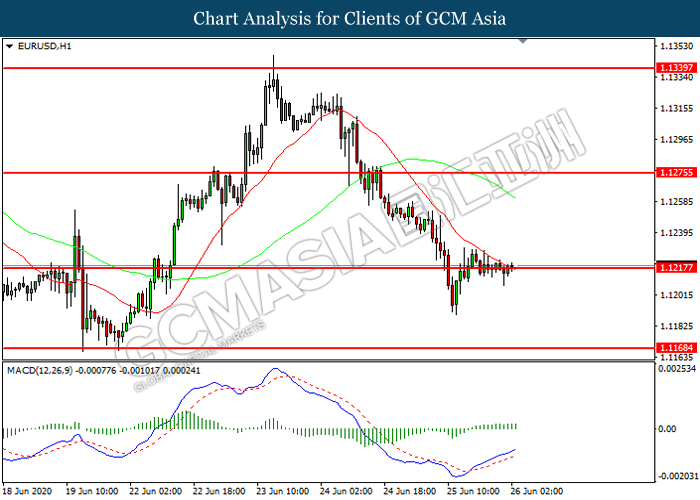

EURUSD, H1: EURUSD was traded within a range while currently testing the support level at 1.1215. MACD which illustrated increasing bullish momentum suggest the pair to be traded higher in short-term as technical correction.

Resistance level: 1.1275, 1.1340

Support level: 1.1215, 1.1170

USDJPY, H4: USDJPY was traded lower following prior retracement from the resistance level at 107.45. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses toward support level at 106.80.

Resistance level: 107.45, 107.95

Support level: 106.80, 106.15

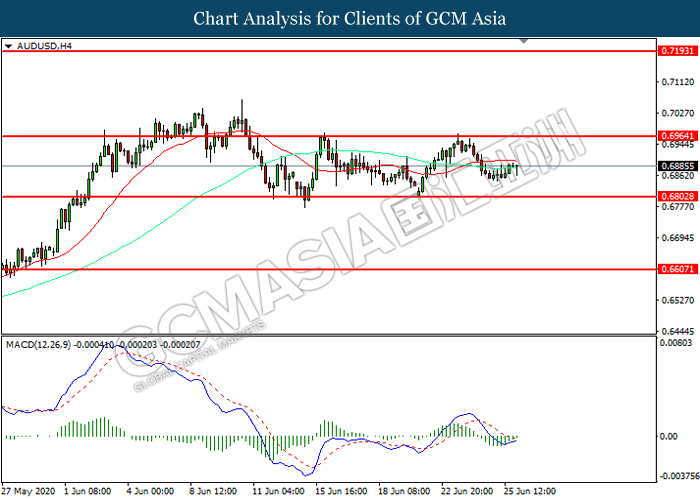

AUDUSD, H4: AUDUSD was traded lower following prior retracement from the resistance level alt 0.6965. However, MACD which illustrated diminishing bearish momentum suggest the pair to be traded higher in short-term as technical correction.

Resistance level: 0.6965, 0.7195

Support level: 0.6805, 0.6605

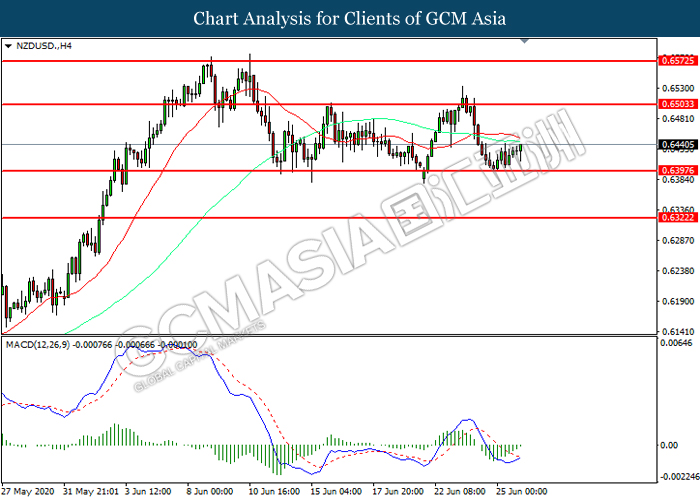

NZDUSD, H4: NZDUSD was traded higher following prior rebound from the support level at 0.6395. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains toward the resistance level 0.6505.

Resistance level: 0.6505, 0.6575

Support level: 0.6395, 0.6320

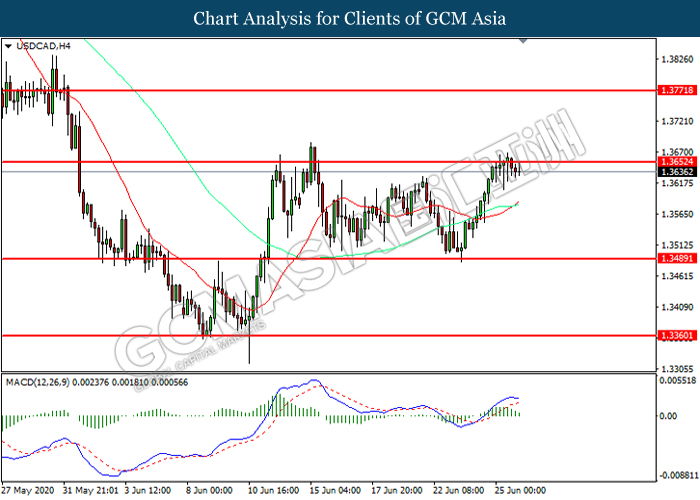

USDCAD, H4: USDCAD was traded higher while currently testing the resistance level at 1.3650. However, MACD which illustrated diminishing bullish momentum suggest the pair to be traded lower in short-term as technical correction.

Resistance level: 1.3650, 1.3770

Support level: 1.3490, 1.3360

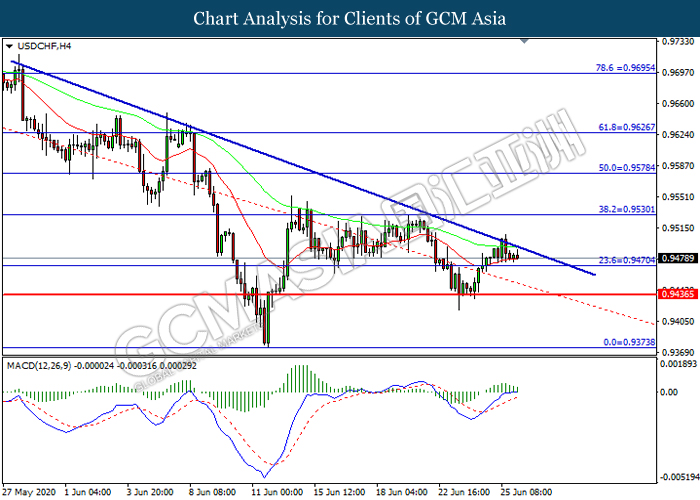

USDCHF, H4: USDCHF was traded lower while currently testing the support level at 0.9470. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 0.9530, 0.9580

Support level: 0.9470, 0.9435

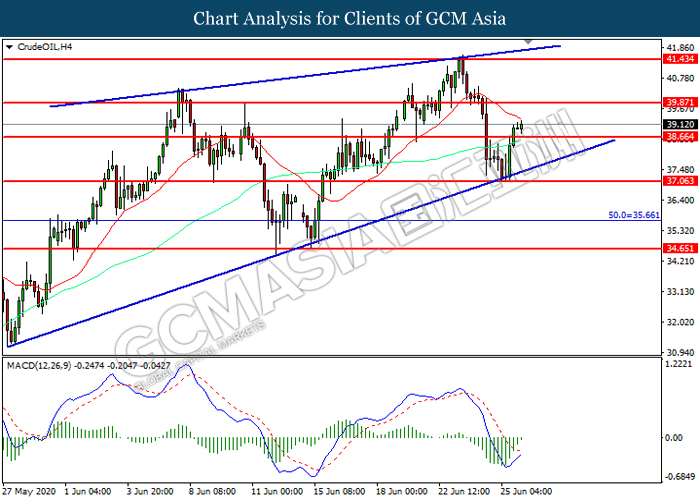

CrudeOIL, H4: Crude oil price was traded higher following prior breakout above the previous resistance level at 38.65. MACD which illustrated diminishing bearish momentum suggest the commodity to extend its gains toward resistance level at 39.85.

Resistance level: 39.85, 41.45

Support level: 38.65, 37.05

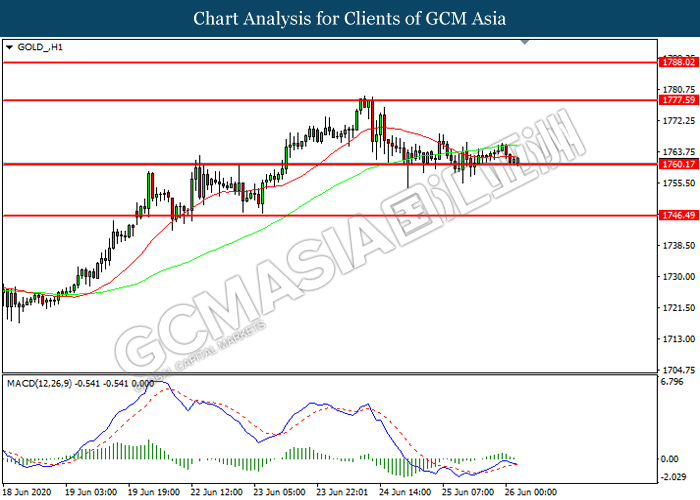

GOLD_, H1: Gold price was traded within a range while currently testing the support level at 1760.15. MACD which illustrated diminishing bullish momentum suggest the commodity to be traded lower after it successfully breakout below the support level.

Resistance level: 1777.60, 1788.00

Support level: 1760.15, 1746.50