26 June 2020 Morning Session Analysis

Dollar hovered following the release of mixed economic data.

Dollar index which gauges its value against a basket of six major currencies was having a mixed pattern and hovered near the recent high level during early Asian trading session amid unclear sentiment in dollar market. According to the Census Bureau, US Core Durable Goods Orders came in at 4.0%, higher than the economist forecast of 2.5%, showing that US manufacturing sector is in the midst of recovery stage. However, market participants are now forecasting weak underlying inflation pressure in the future after the recent GDP data showed that US economy shrank at a pace of 5.0% in the first quarter. Amidst the outbreak of coronavirus, US doesn’t seem to have a downward curved in the figure of infection, where the market sees little hopes over a strong rebound may happen in US economy as of now. Moreover, Initial Jobless Claims data which acts as a strong indicator to reflect the current US labour market condition showed that there is a high number of Americans were still filing for unemployment insurance claims last week. According to the Department of Labour, US Initial Jobless Claims data reported an increase of 1,480K, blowing the estimates of 1,300K, indicating the labour market still remains weak and vulnerable under the shadow of pandemic. As of now, dollar index rose by 0.05% to 97.40.

In the commodities market, crude oil price appreciated 1.21% to $39.20 per barrel despite demand worries persist on recent spike in coronavirus. As of now, oil market participants are still remain cautious amid recent signs of second wave of coronavirus in few of the major countries. Besides, gold price rose 0.10% to $1765.40 per troy ounce amid market worries over the virus heightened.

Today’s Holiday Market Close

Time Market Event

All Day CNY Dragon Boat Festival

Today’s Highlight Events

Time Market Event

15:00 EUR ECB President Lagarde Speaks

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 22:00 | USD – Michigan Consumer Sentiment (Apr) | 78.9 | 79.0 | – |

| 01:00

(27th) |

CrudeOIL – U.S. Baker Hughes Oil Rig Count | 189 | – | – |

Technical Analysis

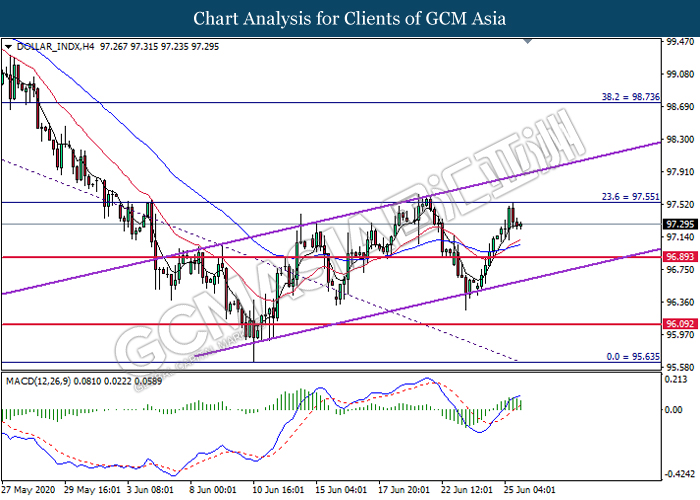

DOLLAR_INDX, Daily: Dollar index was traded lower following prior retracement from the resistance level at 97.55. MACD which illustrate diminishing bullish momentum signal suggest the pair to extend its retracement toward the support level at 96.90.

Resistance level: 97.55, 98.75

Support level: 96.90, 96.10

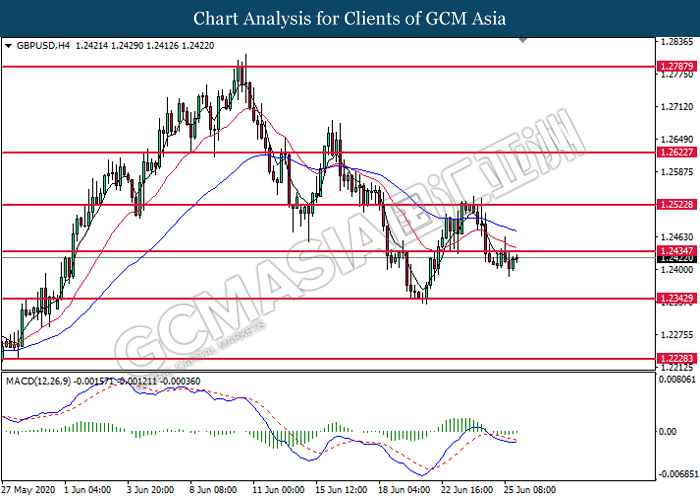

GBPUSD, H4: GBPUSD was traded higher following prior rebound from the lower level. MACD which illustrate diminishing bearish momentum suggest the pair to extend its gains toward the resistance level at 1.2435.

Resistance level: 1.2435, 1.2525

Support level: 1.2345, 1.2230

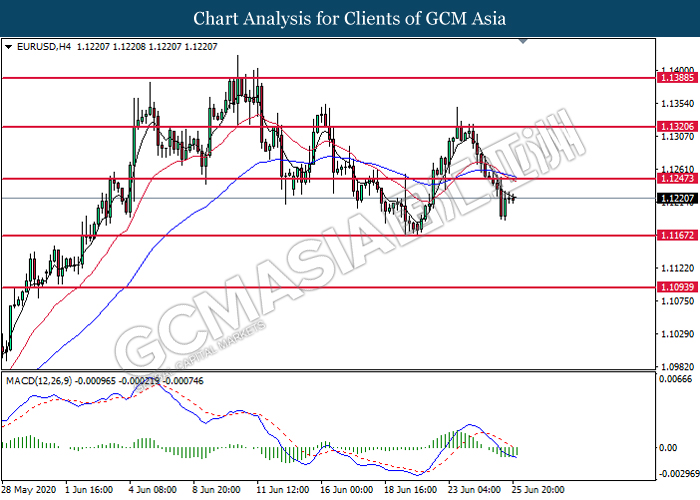

EURUSD, H4: EURUSD was traded higher following prior rebound from the lower level. MACD which illustrate diminishing bearish momentum signal suggest the pair to extend its rebound toward the resistance level at 1.1245.

Resistance level: 1.1245, 1.1320

Support level: 1.1165, 1.1095

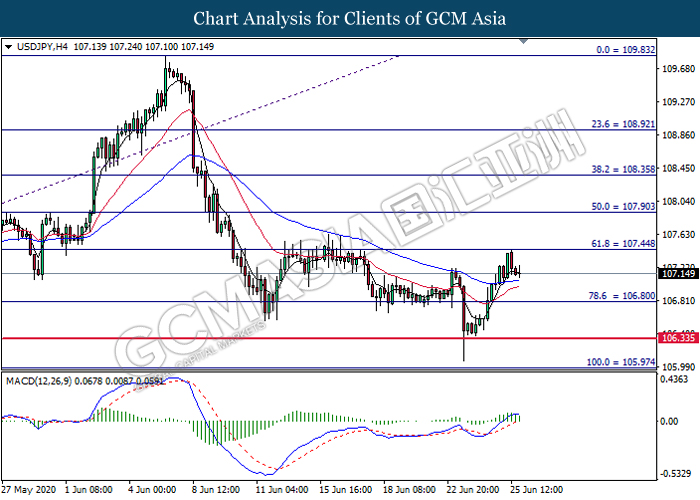

USDJPY, H4: USDJPY was traded lower following prior retracement from the resistance level at 107.45. MACD which illustrate diminishing bullish momentum signal suggest the pair to extend its losses toward the support level at 106.80.

Resistance level: 107.45, 107.90

Support level: 106.80, 106.35

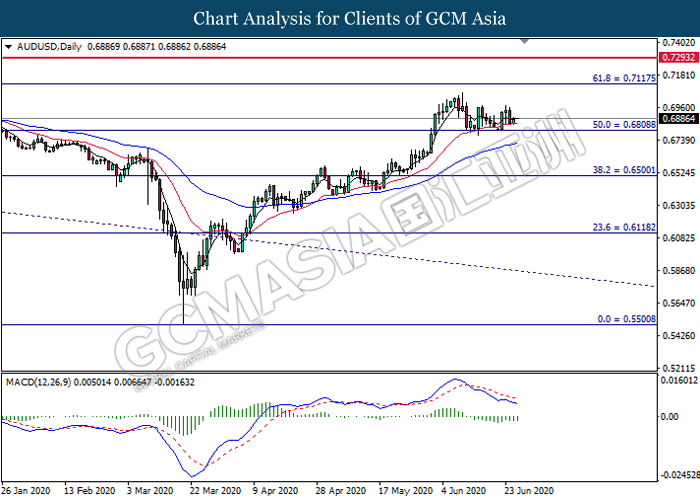

AUDUSD, Daily: AUDUSD was traded higher following prior rebound from the support level at 0.6810. MACD which display diminishing bearish momentum signal suggest the pair to extend its gains toward the resistance level at 0.7115.

Resistance level: 0.7115, 0.7295

Support level: 0.6810, 0.6500

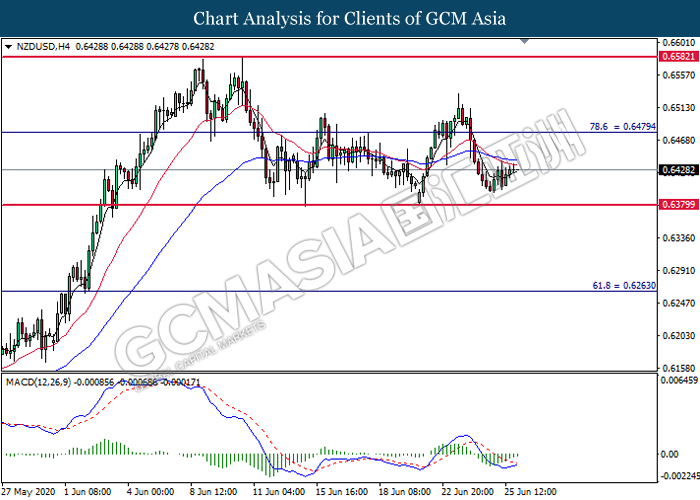

NZDUSD, H4: NZDUSD was traded higher following prior rebound near the support level at 0.6380. MACD which illustrate diminishing bearish momentum signal suggest the pair to extend its gains toward the resistance level at 0.6480.

Resistance level: 0.6480, 0.6580

Support level: 0.6380, 0.6265

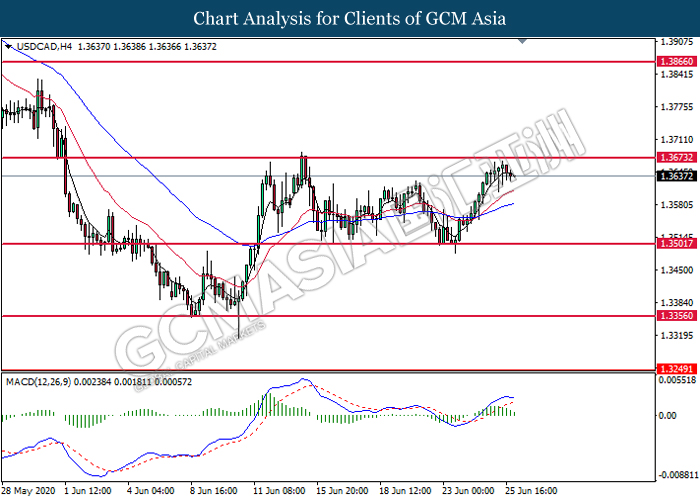

USDCAD, H4: USDCAD was traded lower following prior retracement from the resistance level at 1.3675. MACD which illustrate diminishing bullish momentum signal suggest the pair to extend its losses toward the support level at 1.3500.

Resistance level: 1.3675, 1.3865

Support level: 1.3500, 1.3355

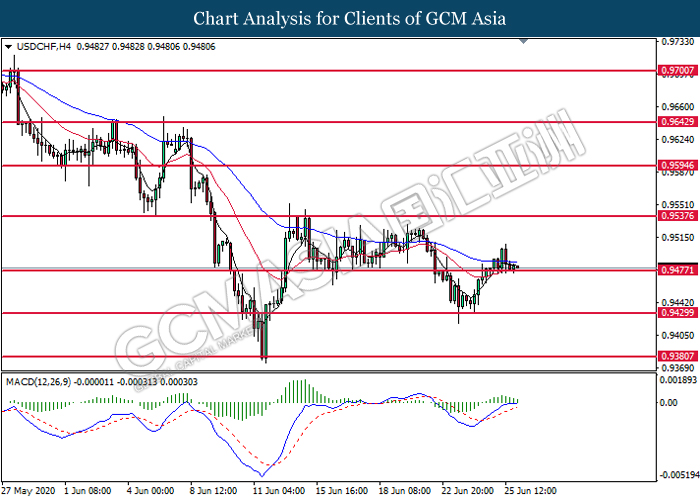

USDCHF, H4: USDCHF was traded lower while currently testing the support level at 0.9475. MACD which illustrate diminishing bullish momentum signal suggest the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 0.9535, 0.9595

Support level: 0.9475, 0.9430

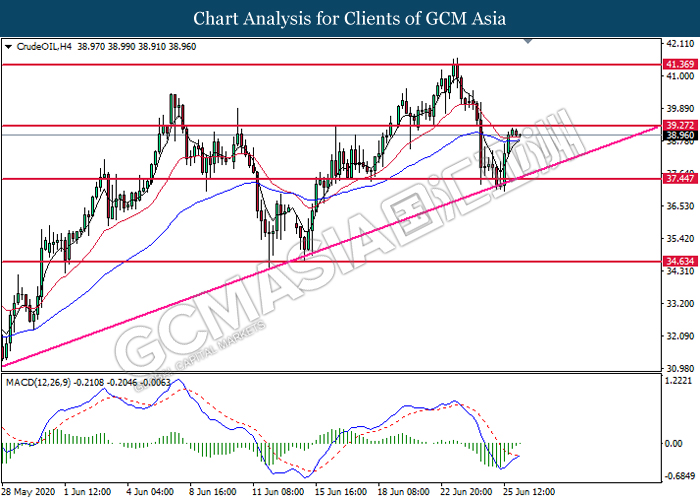

CrudeOIL, H4: Crude oil price was traded lower following prior retracement from the resistance level at 39.25. However, MACD which illustrate diminishing bearish momentum signal suggest the commodity to undergo technical correction toward the higher level.

Resistance level: 39.25, 41.35

Support level: 37.45, 34.65

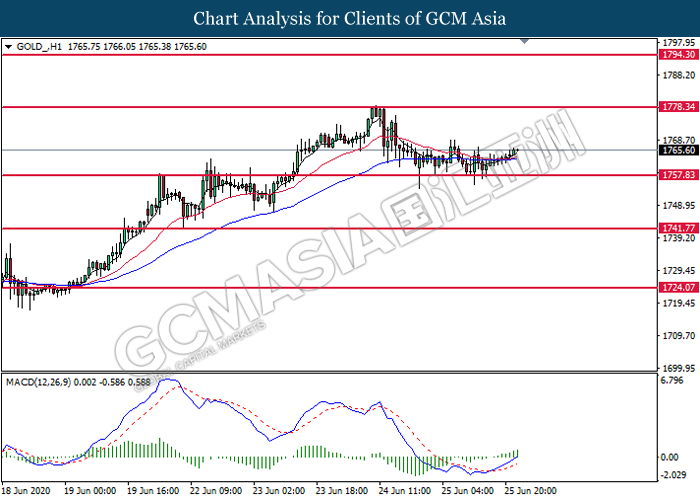

GOLD_, H1: Gold price was traded higher following prior rebound from the support level at 1757.85. MACD which illustrate bullish bias momentum suggest the pair to extend its gains toward the resistance level at 1778.35.

Resistance level: 1778.35, 1794.30

Support level: 1757.85, 1741.75