26 June 2023 Morning Session Analysis

US dollar surged as market risk aversion heightened.

The dollar index, which was traded against a basket of six major currencies, managed to extend its gains as the further tightening moves from the central banks soured the risk sentiment in the market. Last week, a number of central banks which including Swiss National Bank (SNB) and Bank of England (BoE) have adjusted their official cash rate upward, whereby BoE even increased their interest rate more than market expectation. Theoretically, a higher interest rates are generally good for currencies, but the risk that higher rates could lead to a recession in the U.K. has hit the pound, prompting some investors to seek safe havens such as the U.S. dollar. Besides, Federal Reserve Chairman Jerome Powell, concluding two days of congressional testimony, reiterated his view that the United States is likely to raise interest rates at least two more times this year to curb high inflation. Also, the dollar index gained further following an upbeat services data was released. According to the Markit, the US Services PMI came in at 54.1, slightly higher than the consensus forecast at 54.0, reflecting the fifth consecutive month of improvement in services sector. As of writing, the dollar index dropped -0.12% to 102.80.

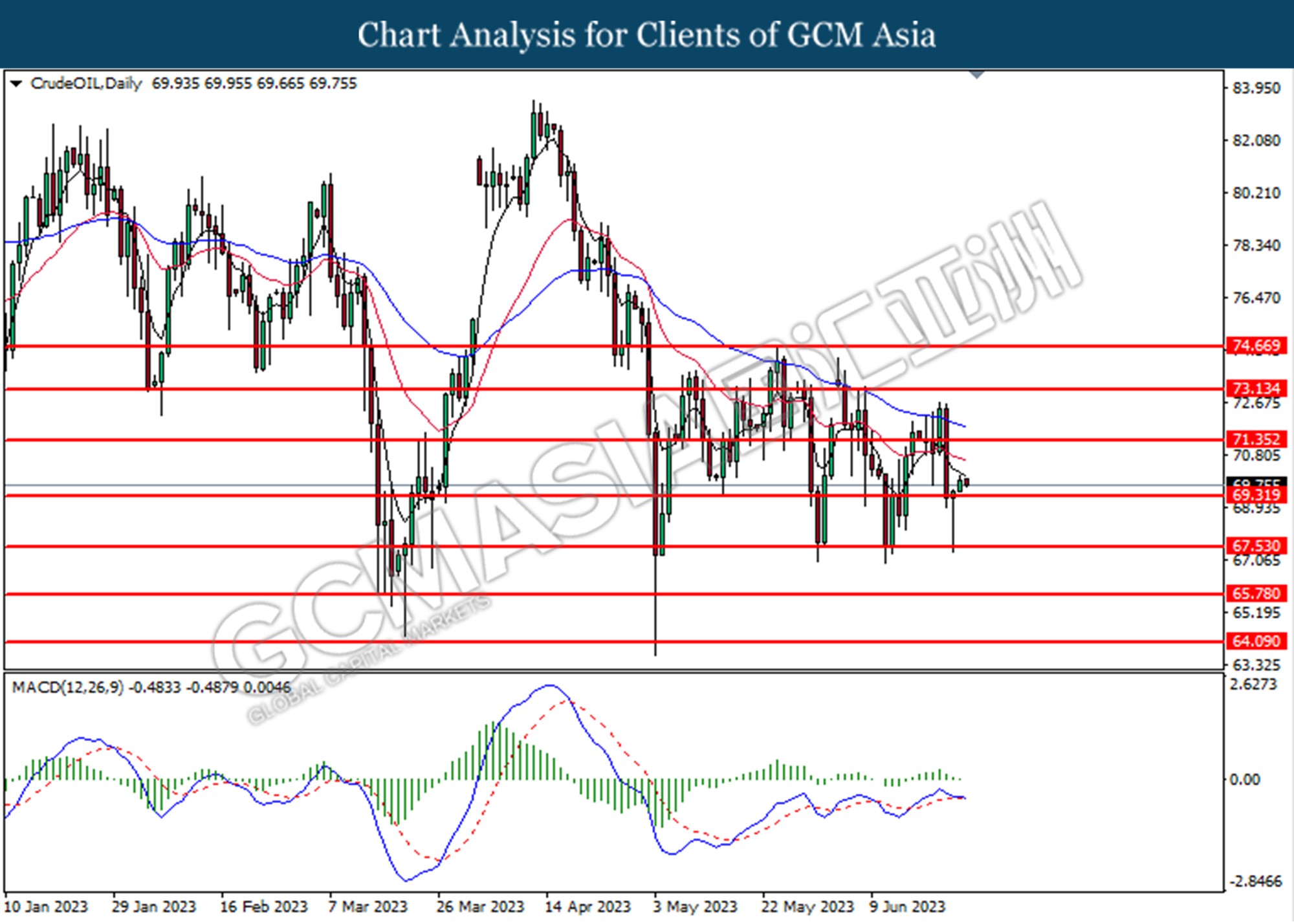

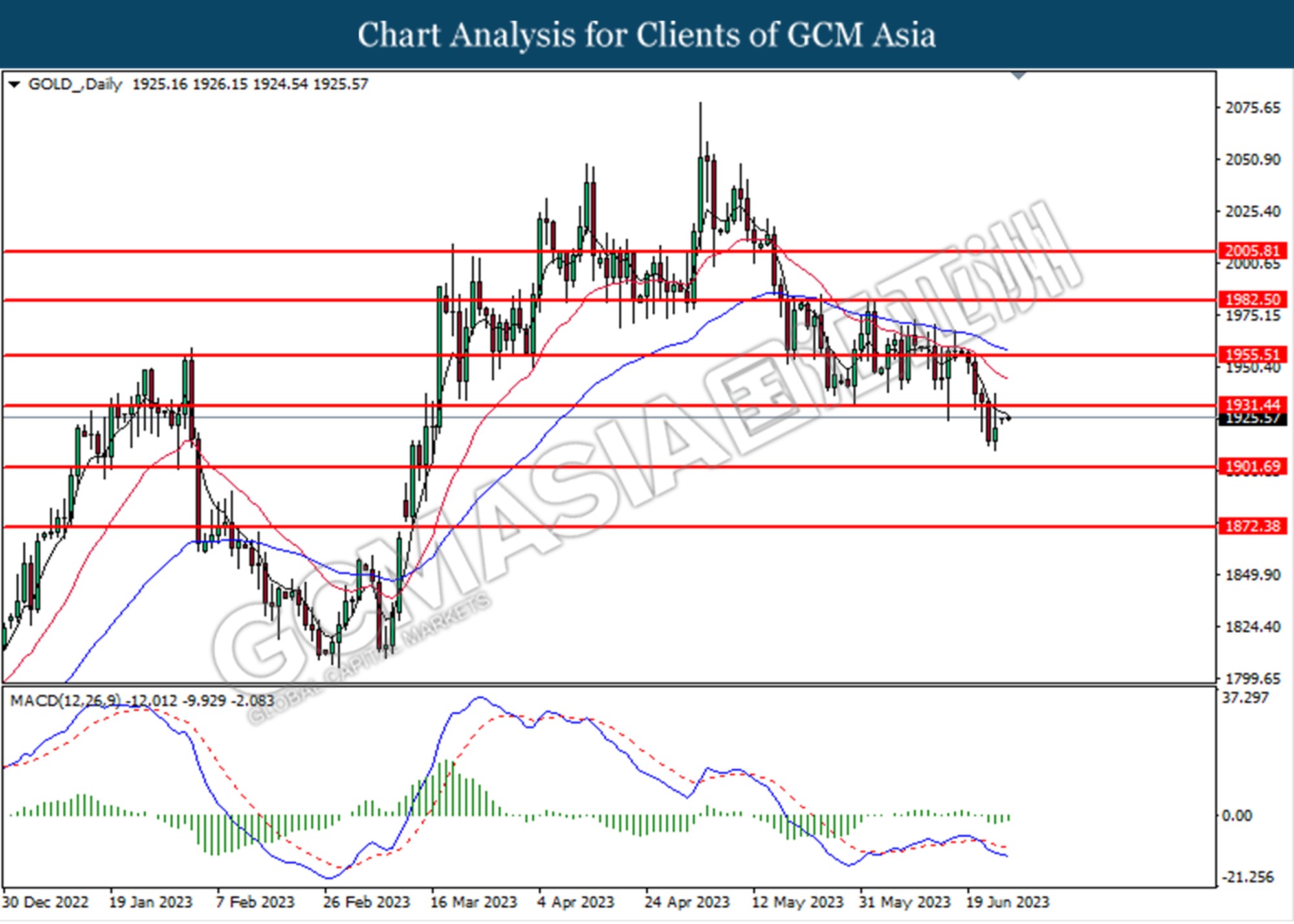

In the commodities market, crude oil prices rebounded by 0.68% to $69.88 per barrel after falling tremendously amid interest rate hikes around the world. Besides, the gold prices edged up by 0.16% to $1924.50 per troy ounce as the Wagner mutiny showed cracks in Putin authority, pointing high uncertainty ahead.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

N/A

Technical Analysis

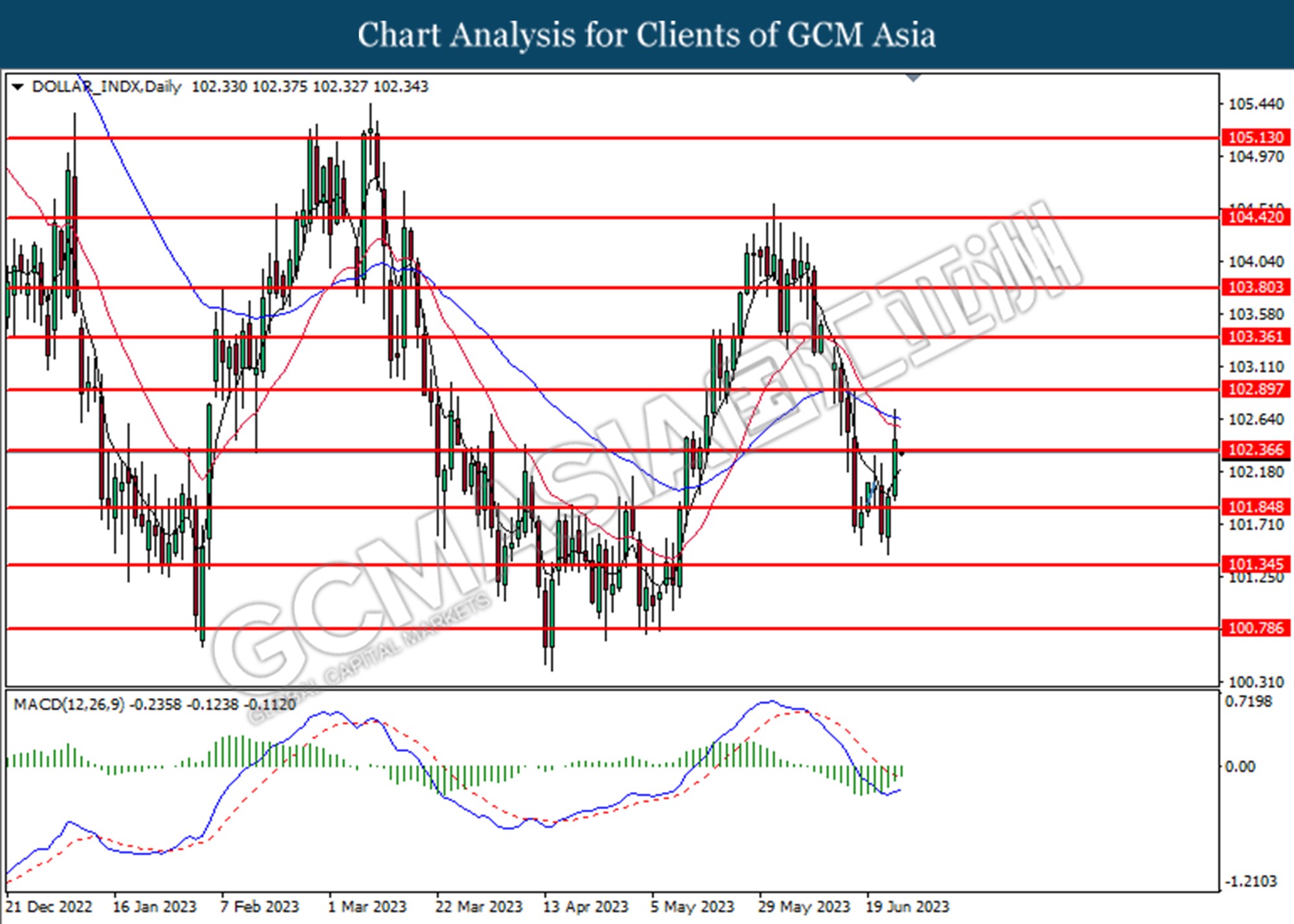

DOLLAR_INDX, Daily: Dollar index was traded higher while currently testing the resistance level at 102.35. MACD which illustrated diminishing bearish momentum suggests the index to extend its gains after it successfully breakout above the resistance level.

Resistance level: 102.35, 102.90

Support level: 101.85, 101.35

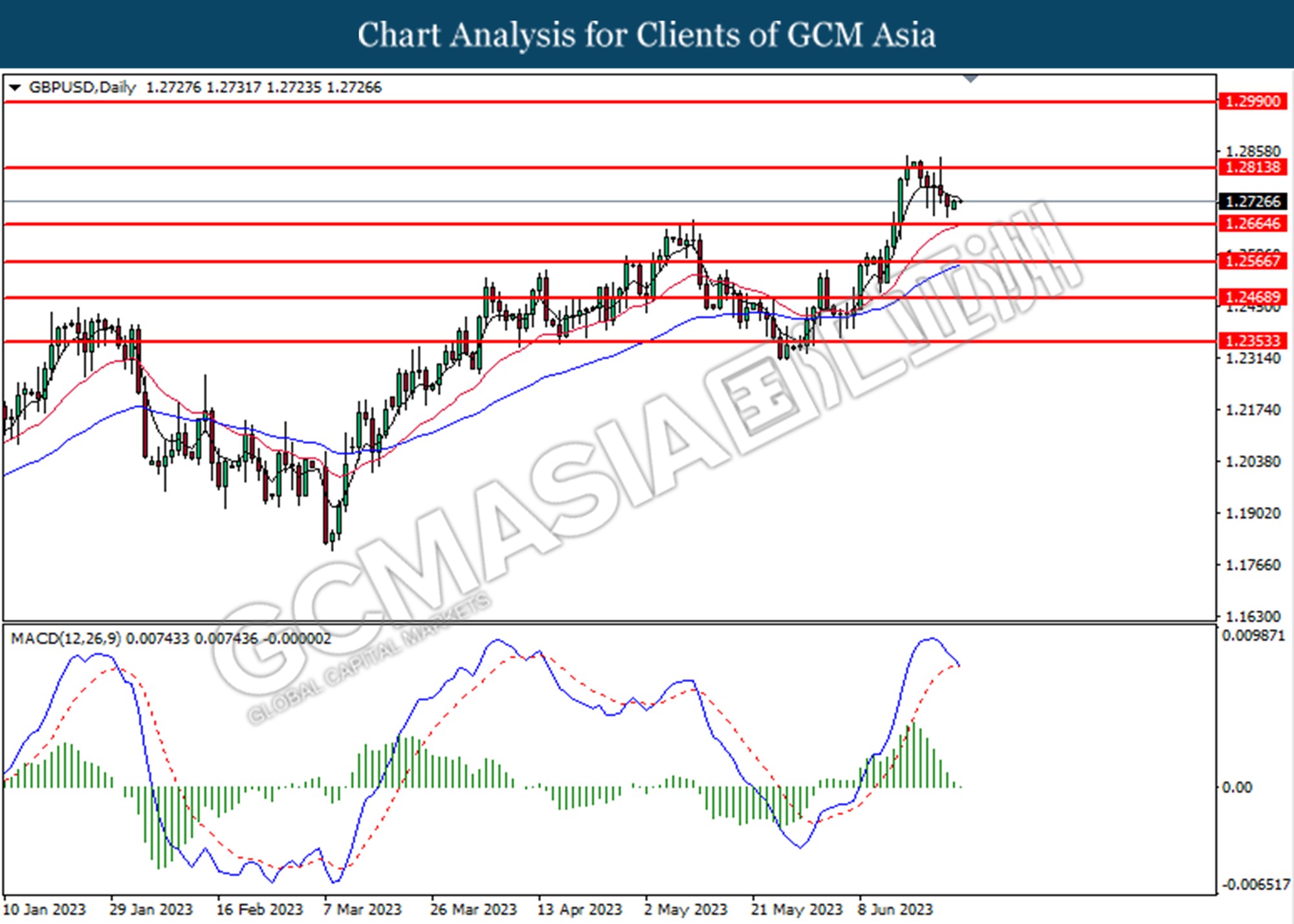

GBPUSD, Daily: GBPUSD was traded lower following the prior retracement from the resistance level at 1.2815. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses toward the support level.

Resistance level: 1.2815, 1.2990

Support level: 1.2665, 1.2565

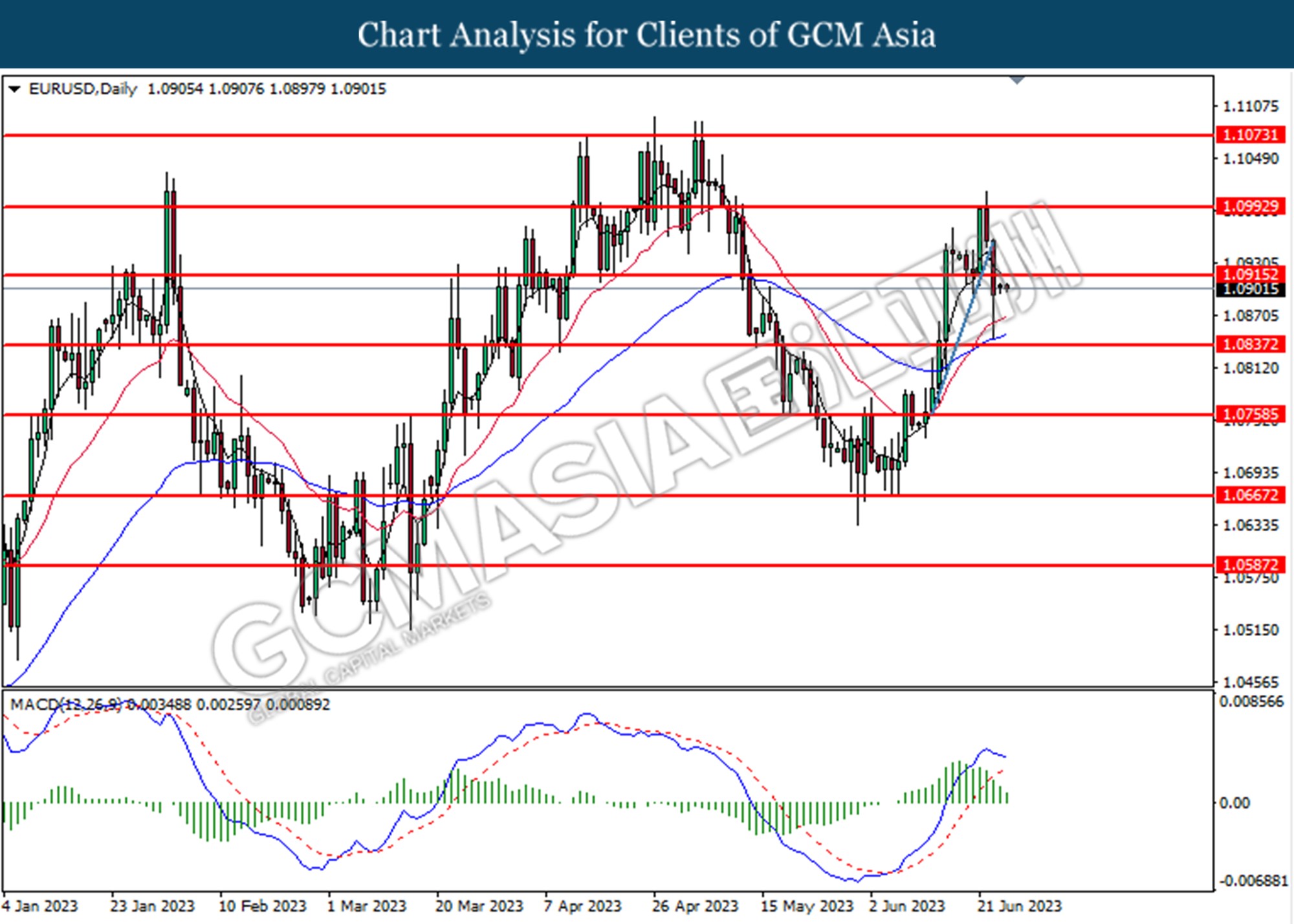

EURUSD, Daily: EURUSD was traded lower following the prior breakout below the previous support level at 1.0915. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses toward the support level at 1.0835.

Resistance level: 1.0915, 1.0995

Support level: 1.0835, 1.0760

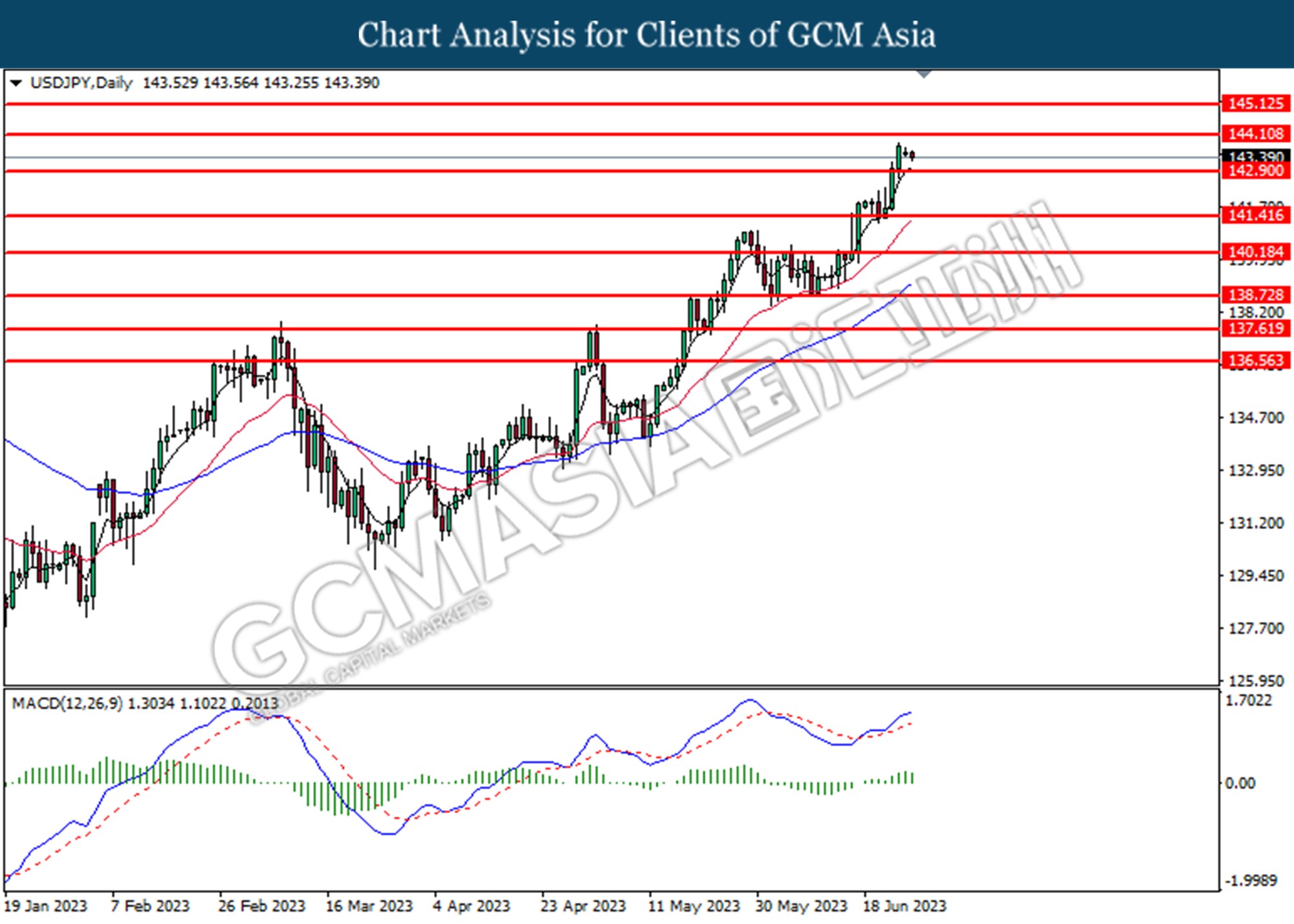

USDJPY, Daily: USDJPY was traded higher following the prior breakout above the previous resistance level at 142.90. MACD which illustrated bullish bias momentum suggest the pair to extend its gains toward the resistance level at 144.10.

Resistance level: 144.10, 145.15

Support level: 142.90, 141.40

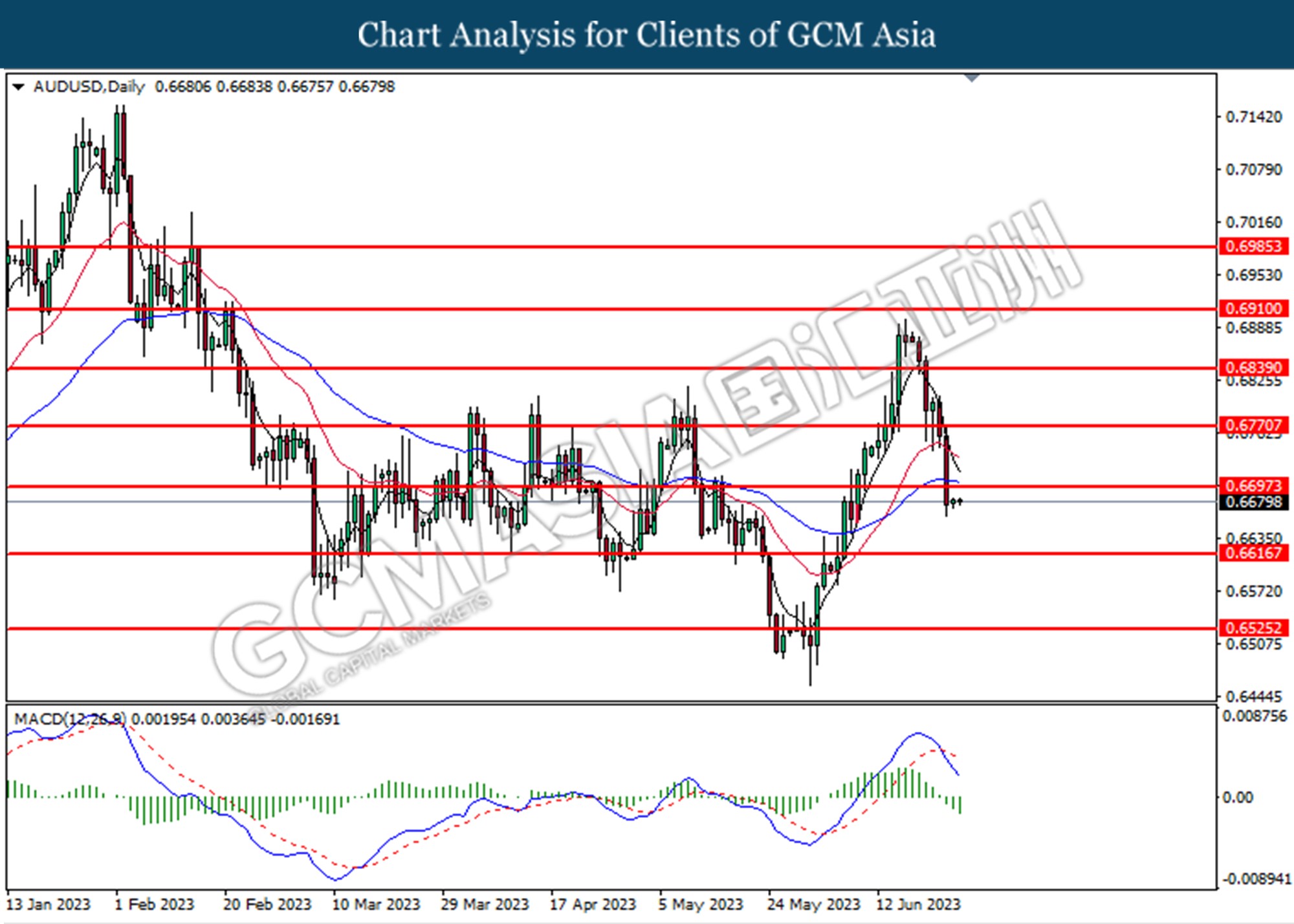

AUDUSD, Daily: AUDUSD was traded lower following the prior breakout below the previous support level at 0.6695. MACD which illustrated bearish bias momentum suggest the pair to extend its losses toward the support level at 0.6615.

Resistance level: 0.6695, 0.6770

Support level: 0.6615, 0.6525

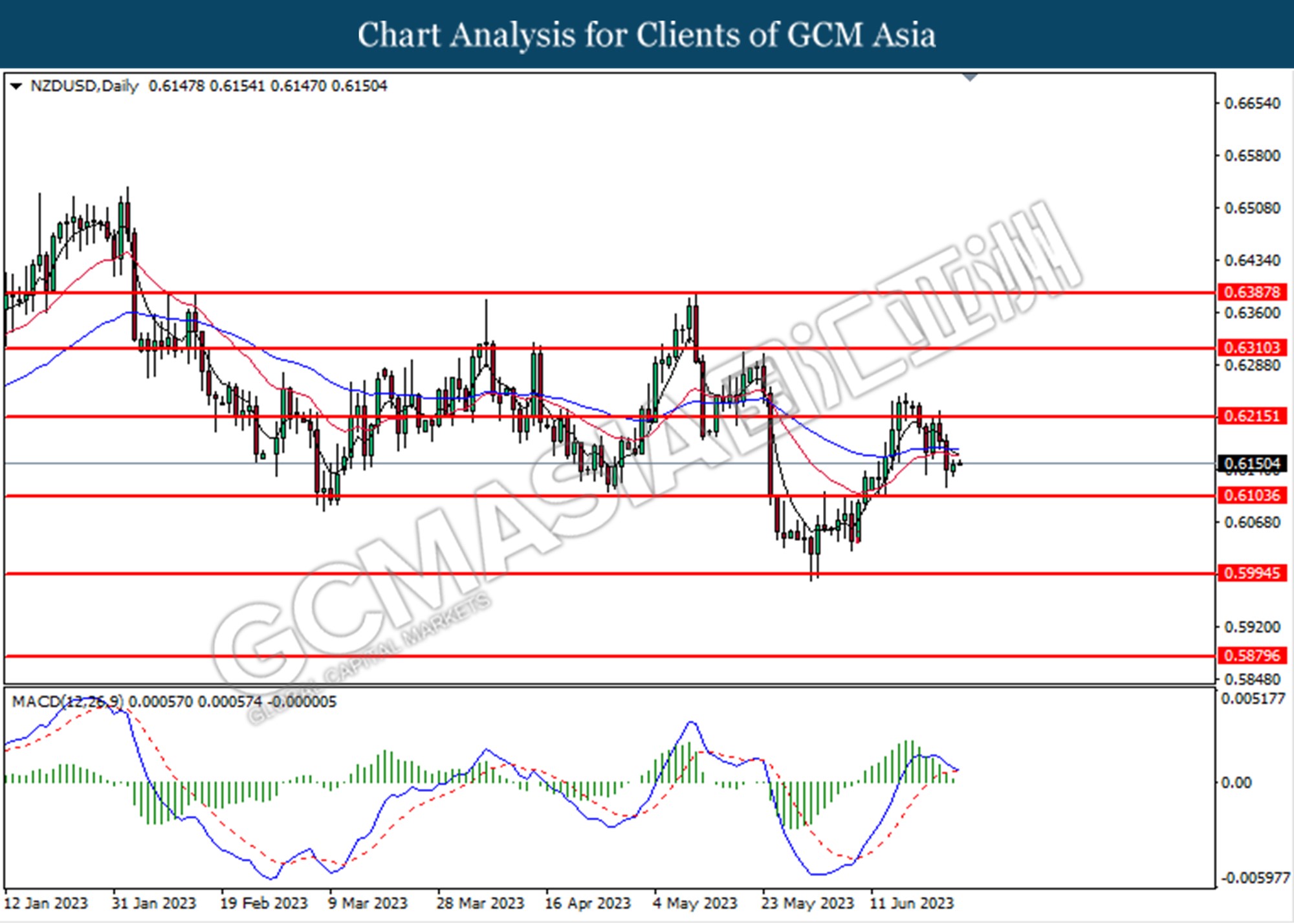

NZDUSD, Daily: NZDUSD was traded lower following the prior retracement from the resistance level at 0.6215. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses toward the support level at 0.6105.

Resistance level: 0.6215, 0.6310

Support level: 0.6105, 0.5995

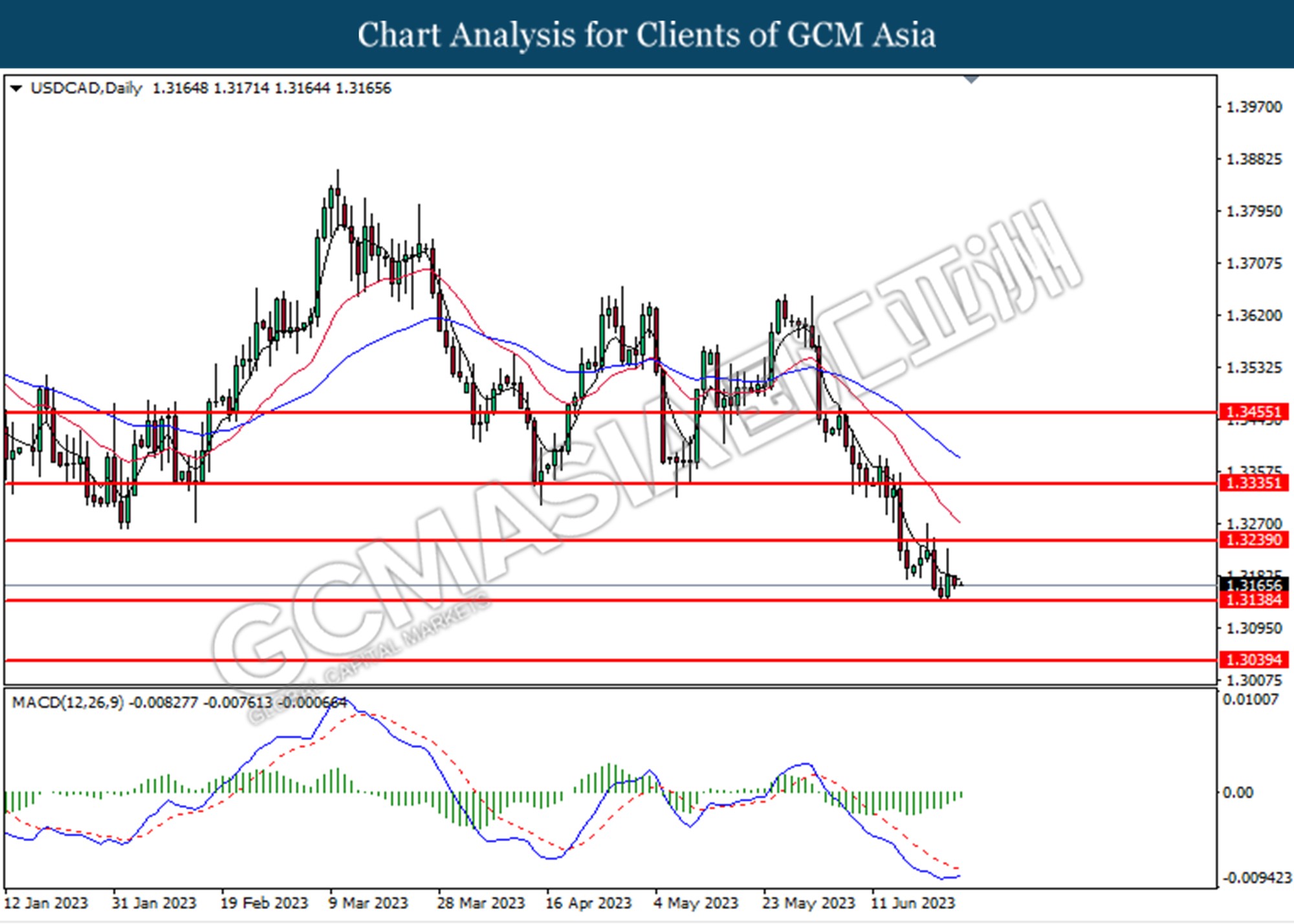

USDCAD, Daily: USDCAD was traded lower while currently testing the support level at 1.3140. However, MACD which illustrated diminishing bearish bias momentum suggests the pair to undergo technical correction in short term.

Resistance level: 1.3240, 1.3335

Support level: 1.3140, 1.3040

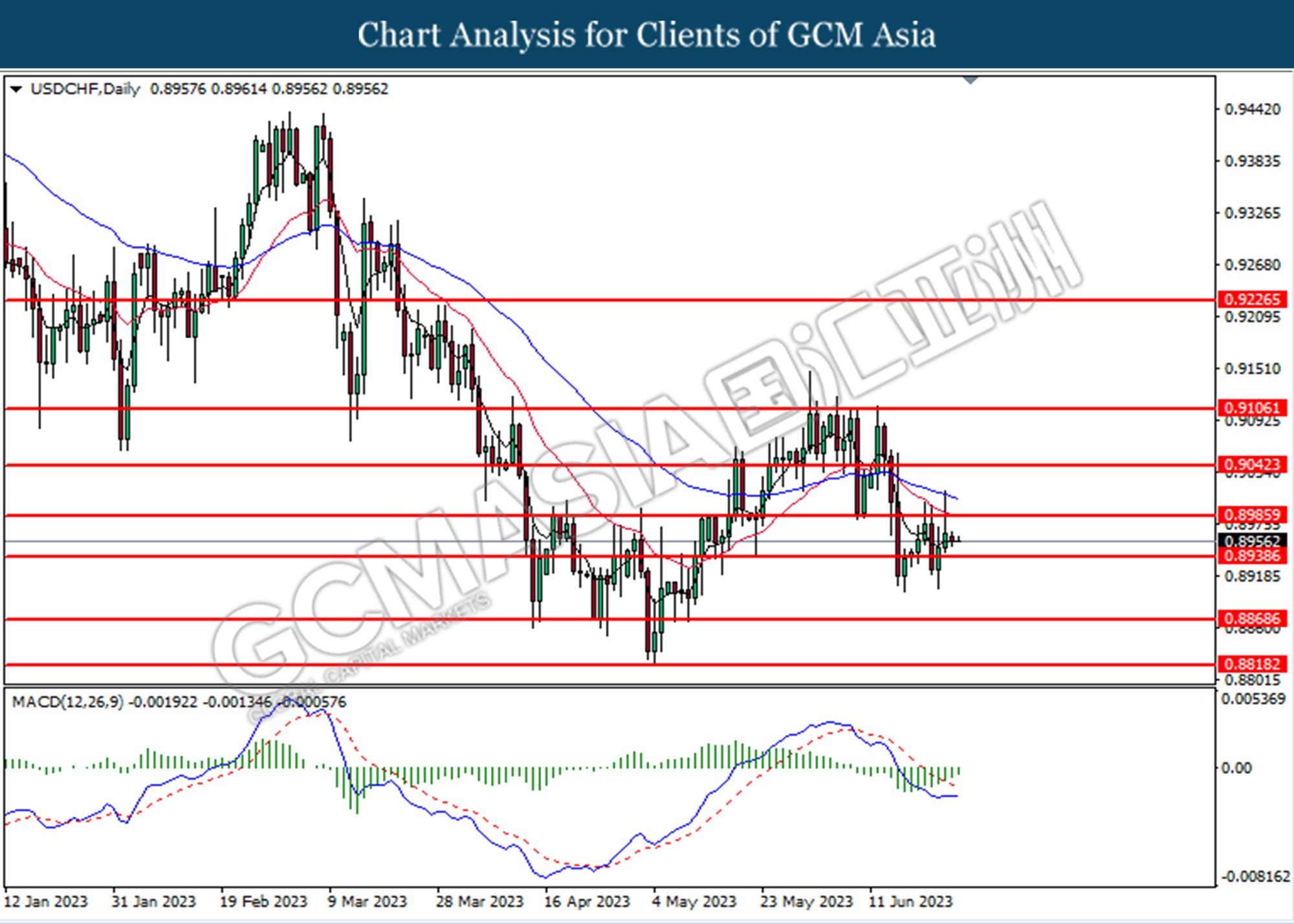

USDCHF, Daily: USDCHF was traded lower following the prior retracement from the resistance level at 0.8985. However, MACD which illustrated diminishing bearish bias momentum suggest the pair to undergo technical correction in short term.

Resistance level: 0.8985, 0.9040

Support level: 0.8870, 0.8820

CrudeOIL, Daily: Crude oil price was traded higher following the prior rebound from the support level at 69.30. However, MACD which illustrated diminishing bullish momentum suggest the commodity to undergo technical correction in short term.

Resistance level: 71.35, 73.15

Support level: 69.30, 67.55

GOLD_, Daily: Gold price was traded higher while currently testing the resistance level at 1931.45. MACD which illustrated diminishing bearish momentum suggests the commodity to extend its gains after it successfully breakout above the resistance level.

Resistance level: 1931.45, 1955.50

Support level: 1901.70, 1872.40