26 July 2023 Afternoon Session Analysis

EUR extended its losses due to recession fear on worse economic data.

European dollar (EUR), which was widely traded by global investors, slumped after the recent economic data disappointed the investors and raised the market recession fear. According to the Ifo Institute for Economic Research, the Germany Ifo Business Climate Index decreased to 87.3 from 88.6, below the market forecast of 88.0. Besides that, the recent PMI data released by all European country included French, Germany, and European has disappointed investors. These PMI data from each sector and each country were below the previous market forecast, which represented the sign of slowing down in the entire Europe’s manufacturing sector. Also, it is noteworthy to highlight that the Germany and French are both the largest countries in Europe but both country’s economic conditions were underperformed, which made investors lost their confidence toward the prospect of Europe’s economy. These data would probably cause shifting stances amongst ECB’s hawkish members, but market participants still expect European Central Bank (ECB) will raise interest rates in the coming Thursday. Although inflation has decreased, but it is still remains above the target of 2%. As of writing, EUR/USD dropped -0.05% to 1.1045.

In the commodities market, crude oil prices dropped -0.34% to $79.30 per barrel due to the API weekly crude oil stocks has increased and above the market forecast. Besides, gold prices dropped -0.05% to $1963.80 per troy amid the strengthening of US Dollar.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

02:00 USD FOMC Statement

(27th)

02:30 USD FOMC Press Conference

(27th)

Today’s Highlight Economic Data

| Time | Event | Previous | Forecast | Actual |

| 20:00 | USD – Building Permits | 1.496M | 1.440M | – |

| 22:00 | USD – New Home Sales (Jun) | 763K | 727K | – |

| 22:30 | USD – Crude Oil Inventories | -0.708M | -2.400M | – |

| 02:00

(27th) |

USD – Fed Interest Rate Decision | 5.25% | 5.50% | – |

Technical Analysis

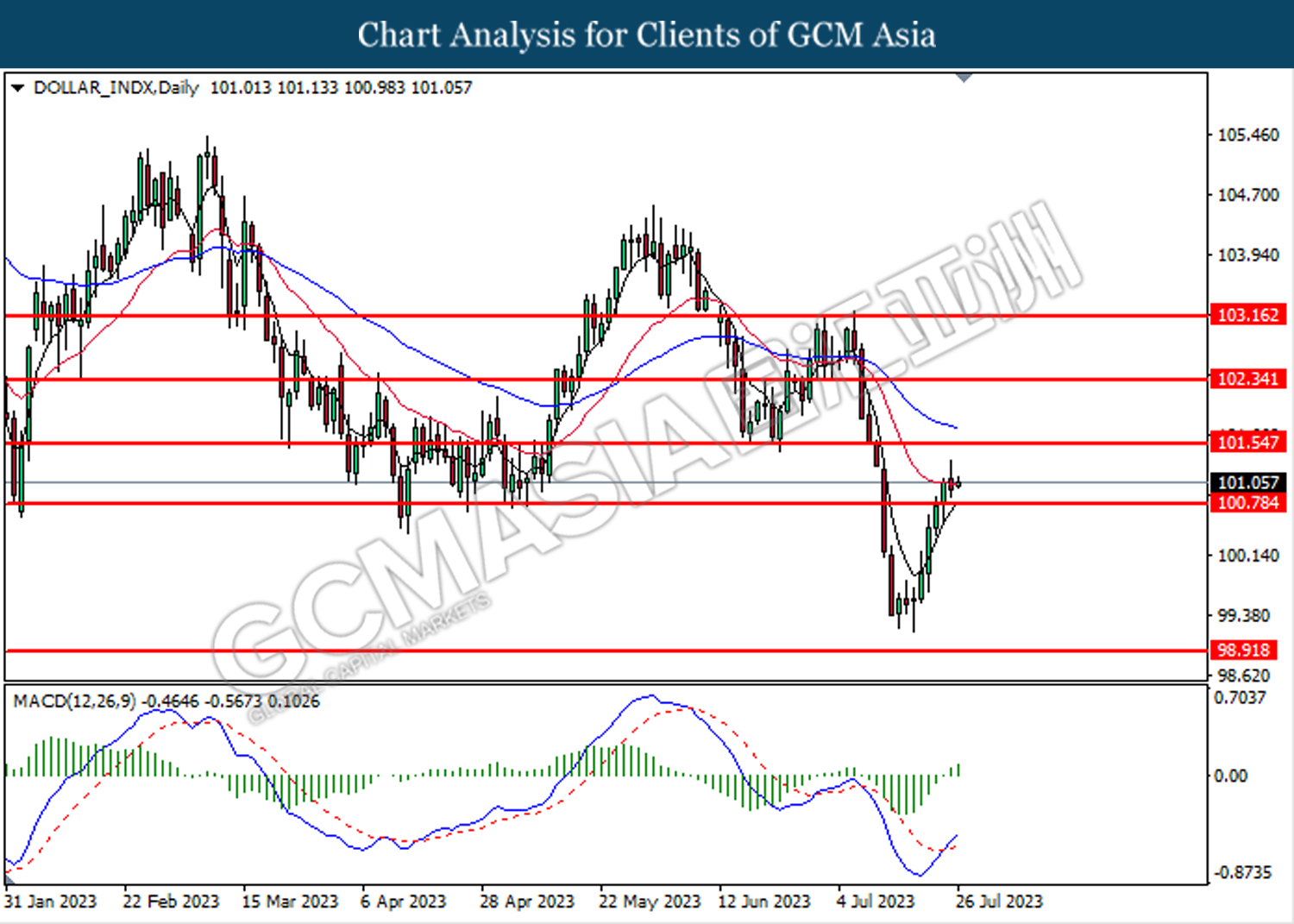

DOLLAR_INDX, Daily: Dollar index was traded higher after it breakout the previous resistance level at 100.80. MACD which illustrated increasing bullish momentum suggests the index to extend its gains toward the resistance level at 101.55.

Resistance level: 101.55, 102.35

Support level: 100.80, 99.80

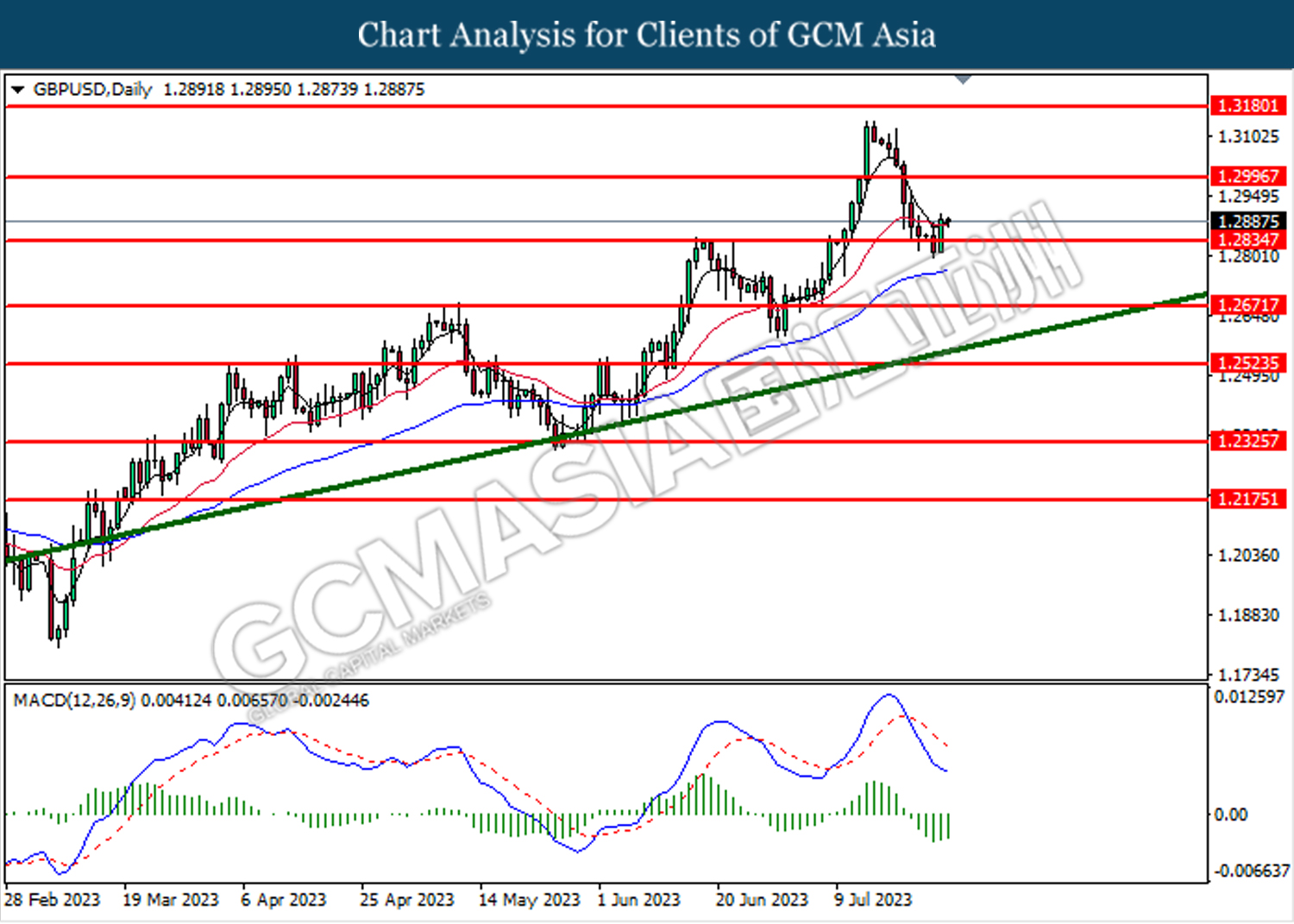

GBPUSD, Daily: GBPUSD was traded higher following the prior breakout above the previous resistance level at 1.2835. MACD which illustrated decreasing bearish momentum suggest the pair to extend its gains toward the resistance level at 1.3000.

Resistance level: 1.3000, 1.3180

Support level: 1.2835, 1.2670

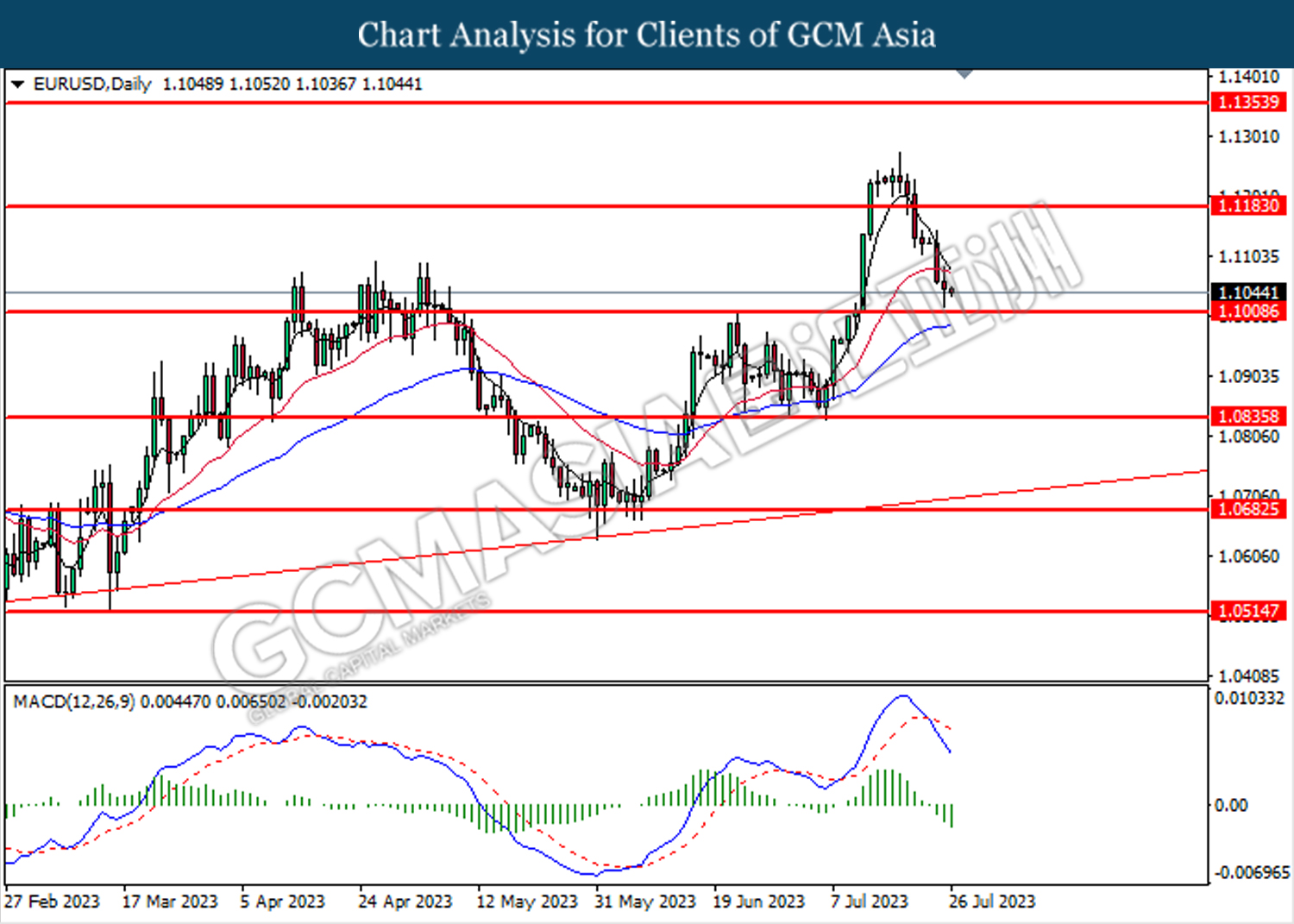

EURUSD, Daily: EURUSD was traded lower following the prior breakout below the previous support level at 1.1185. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses toward the support level at 1.1010.

Resistance level: 1.1185, 1.1355

Support level: 1.1010, 1.0835

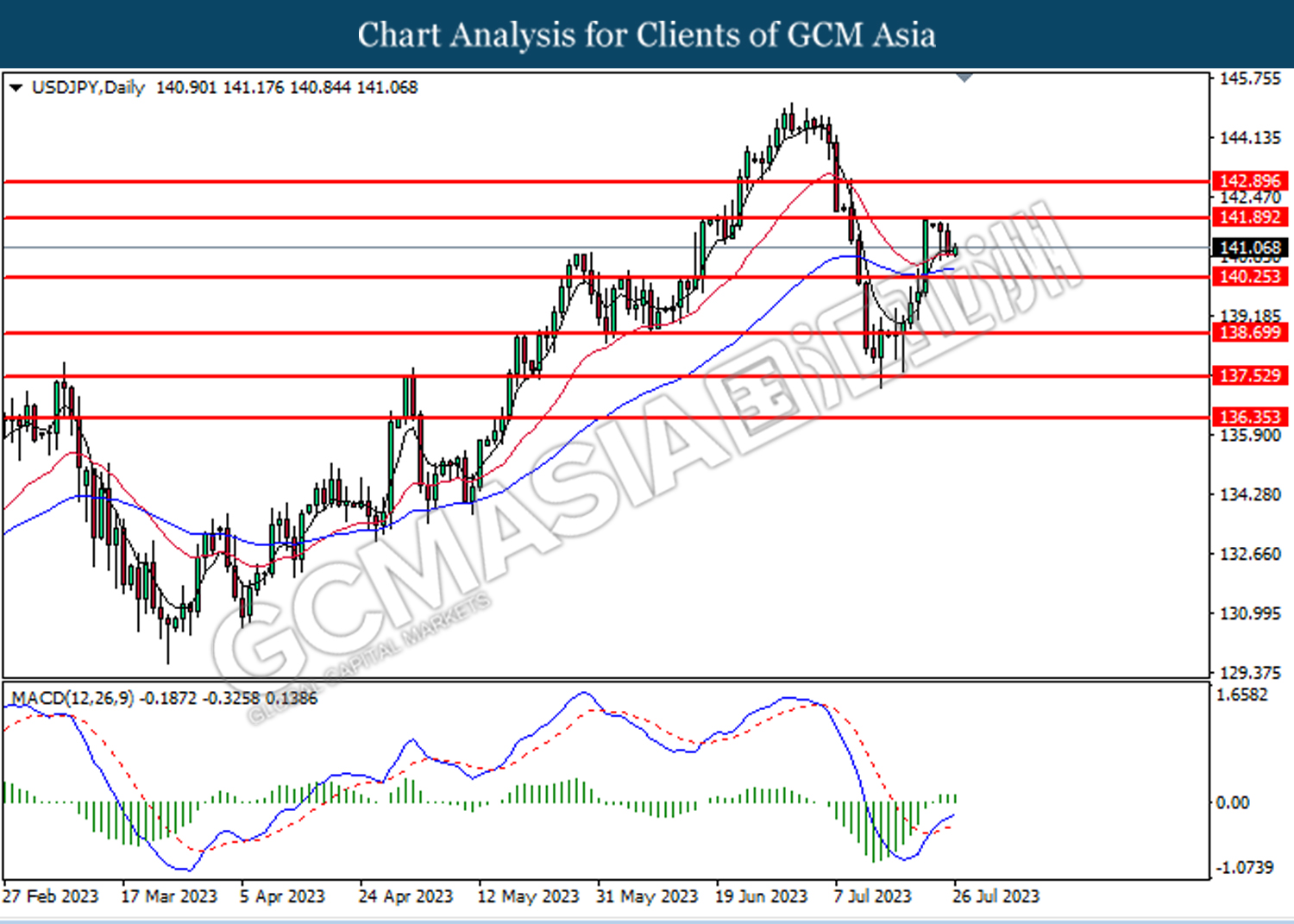

USDJPY, Daily: USDJPY was traded lower following the prior retracement from the resistance level at 141.90. However, MACD which illustrated increasing bullish momentum suggest the pair to undergo a technical correction in short term.

Resistance level: 141.90, 142.90

Support level: 140.25, 138.70

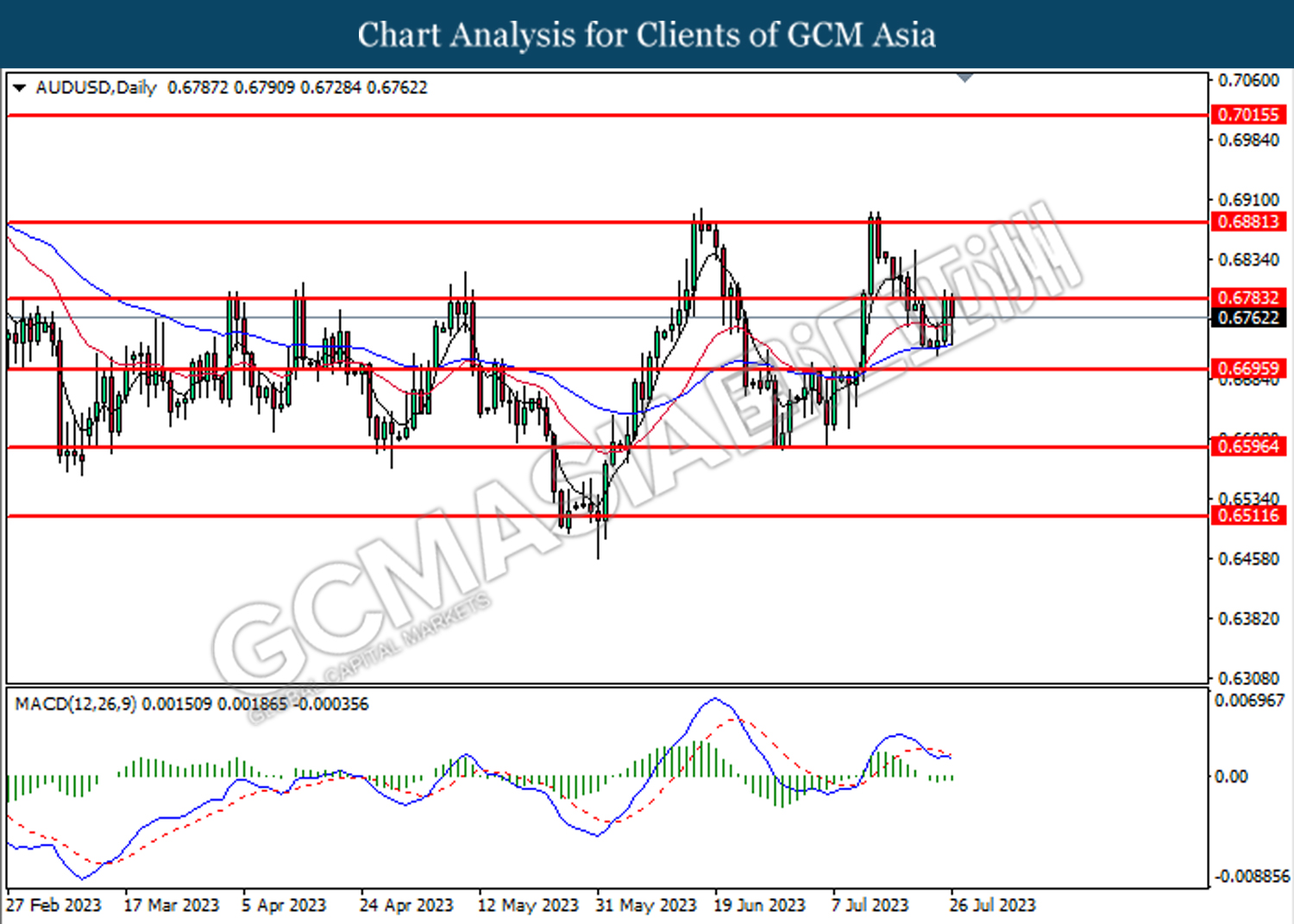

AUDUSD, Daily: AUDUSD was traded higher while testing the resistance level at 0.6785 MACD which illustrated increasing bearish momentum suggests the pair to undergo technical correction in short term.

Resistance level: 0.6785, 0.6880

Support level: 0.6695, 0.6595

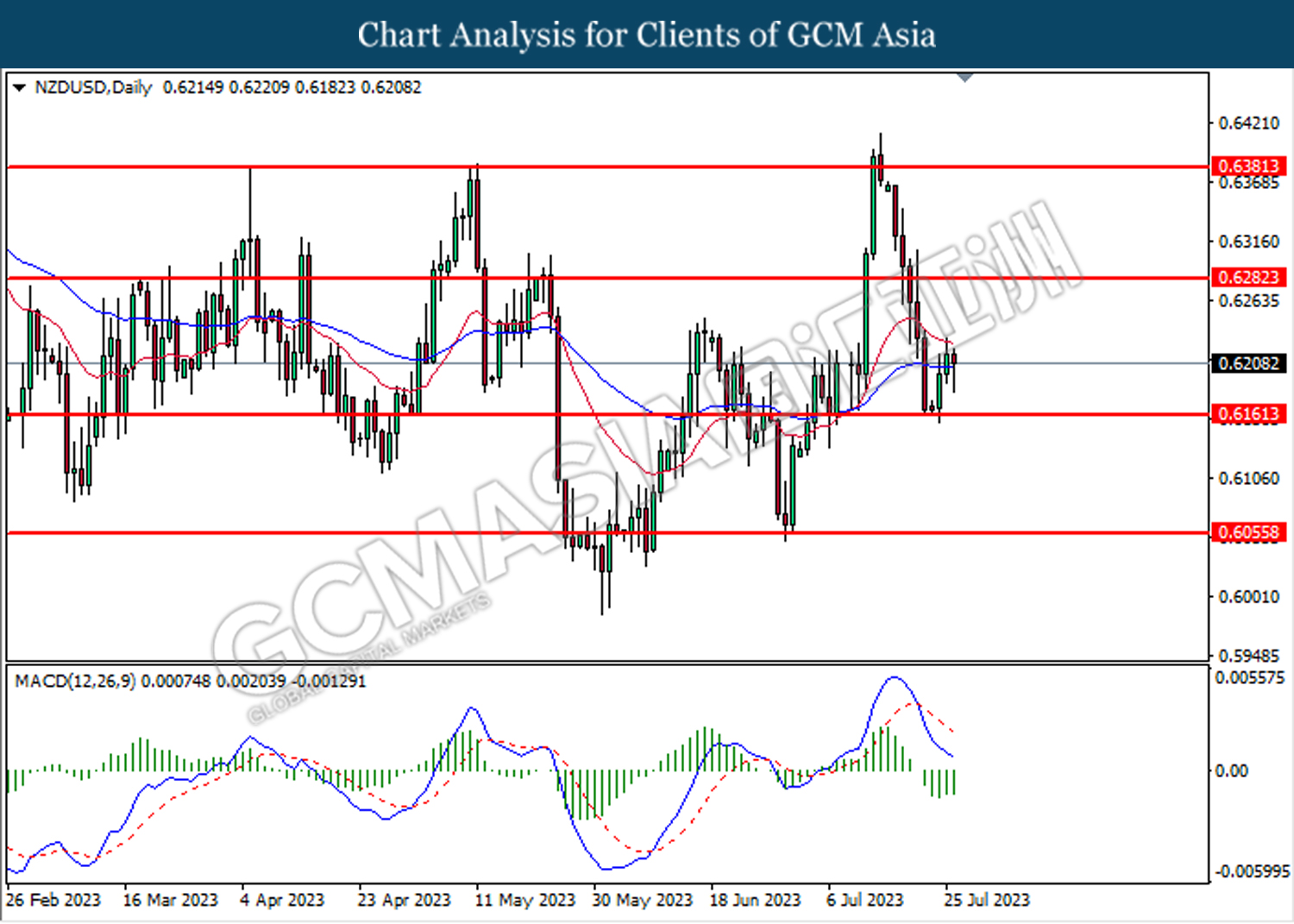

NZDUSD, Daily: NZDUSD was traded higher following the prior rebound from the support level at 0.6160. MACD which illustrated decreasing bearish momentum suggests the pair to extend its gains toward the resistance level at 0.6280.

Resistance level: 0.6280, 0.6380

Support level: 0.6160, 0.6055

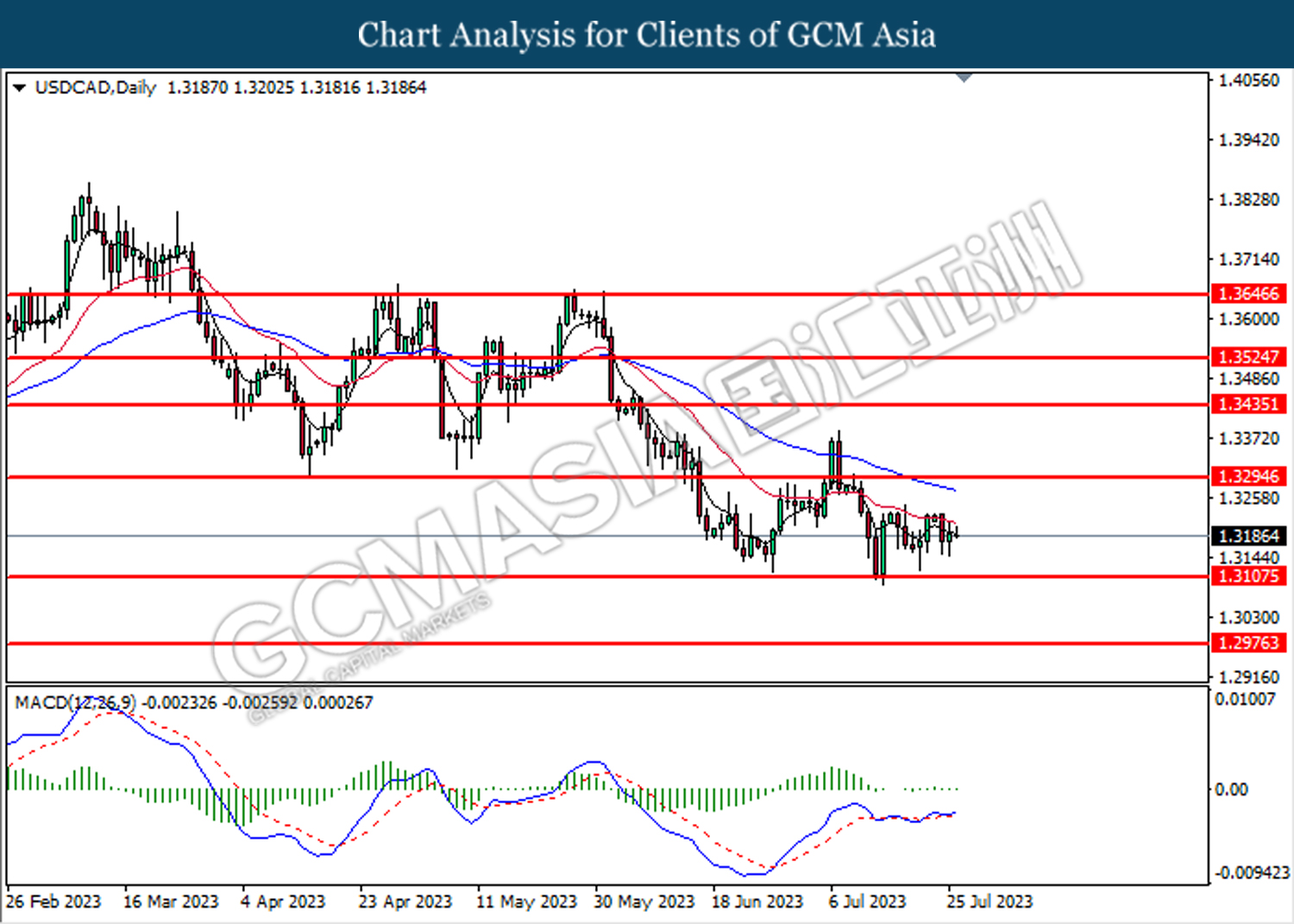

USDCAD, Daily: USDCAD was traded flat above the support level at 1.3110. MACD which illustrated increasing bullish momentum suggests the pair to extend its gains toward the resistance level at 1.3295

Resistance level: 1.3295, 1.3435

Support level: 1.3110, 1.2975

USDCHF, Daily: USDCHF was traded lower following the prior retracement from the resistance level at 0.8710. However, MACD which illustrated increasing bullish momentum suggests the pair to undergo technical correction in short term.

Resistance level: 0.8710, 0.8855

Support level: 0.8545, 0.8360

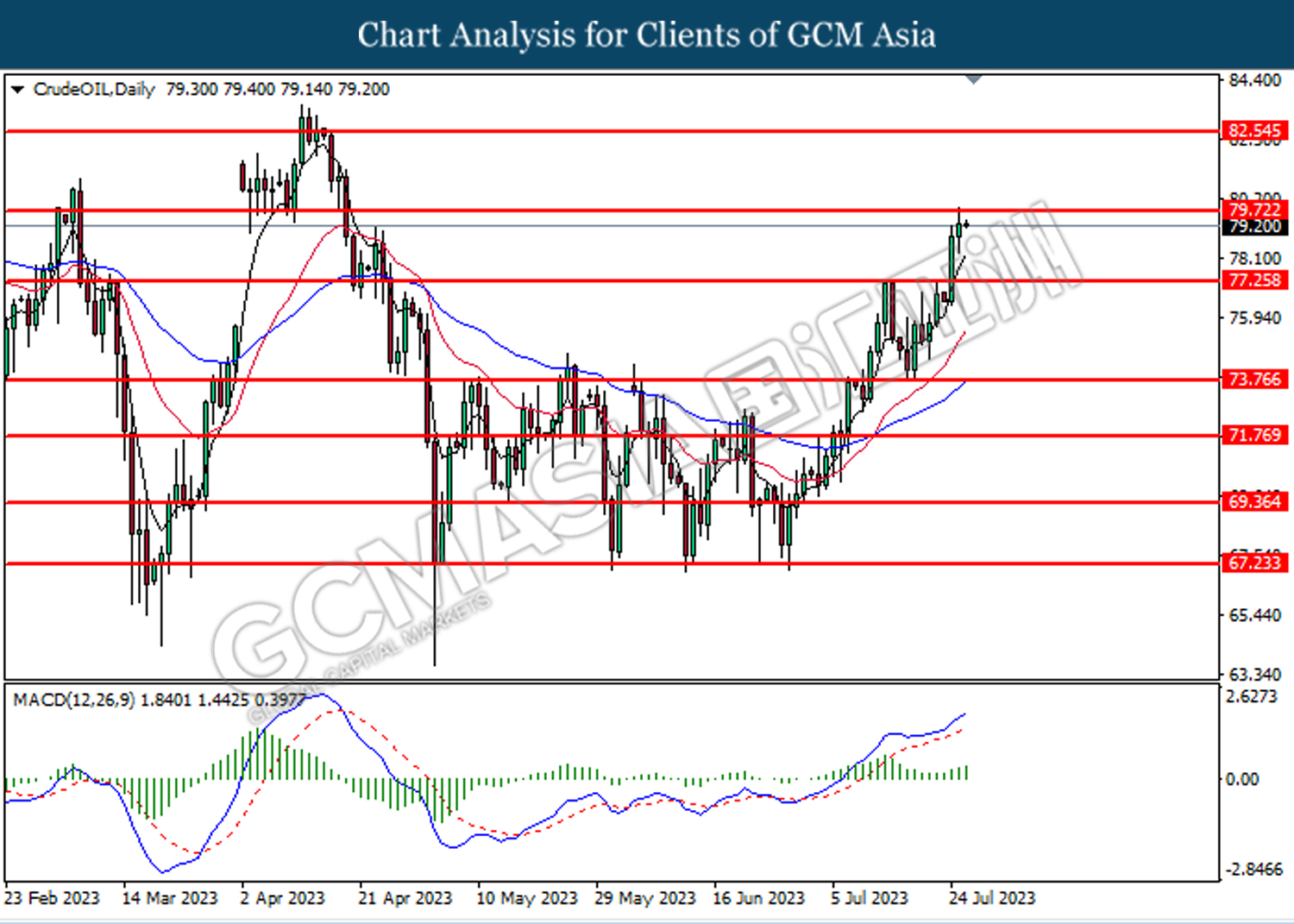

CrudeOIL, Daily: Crude oil price was traded higher following the prior breakout above the previous resistance level at 77.25. MACD which illustrated increasing bullish momentum suggests the commodity to extend its gains toward the resistance level at 79.70.

Resistance level: 79.70, 82.55

Support level: 77.25, 73.75

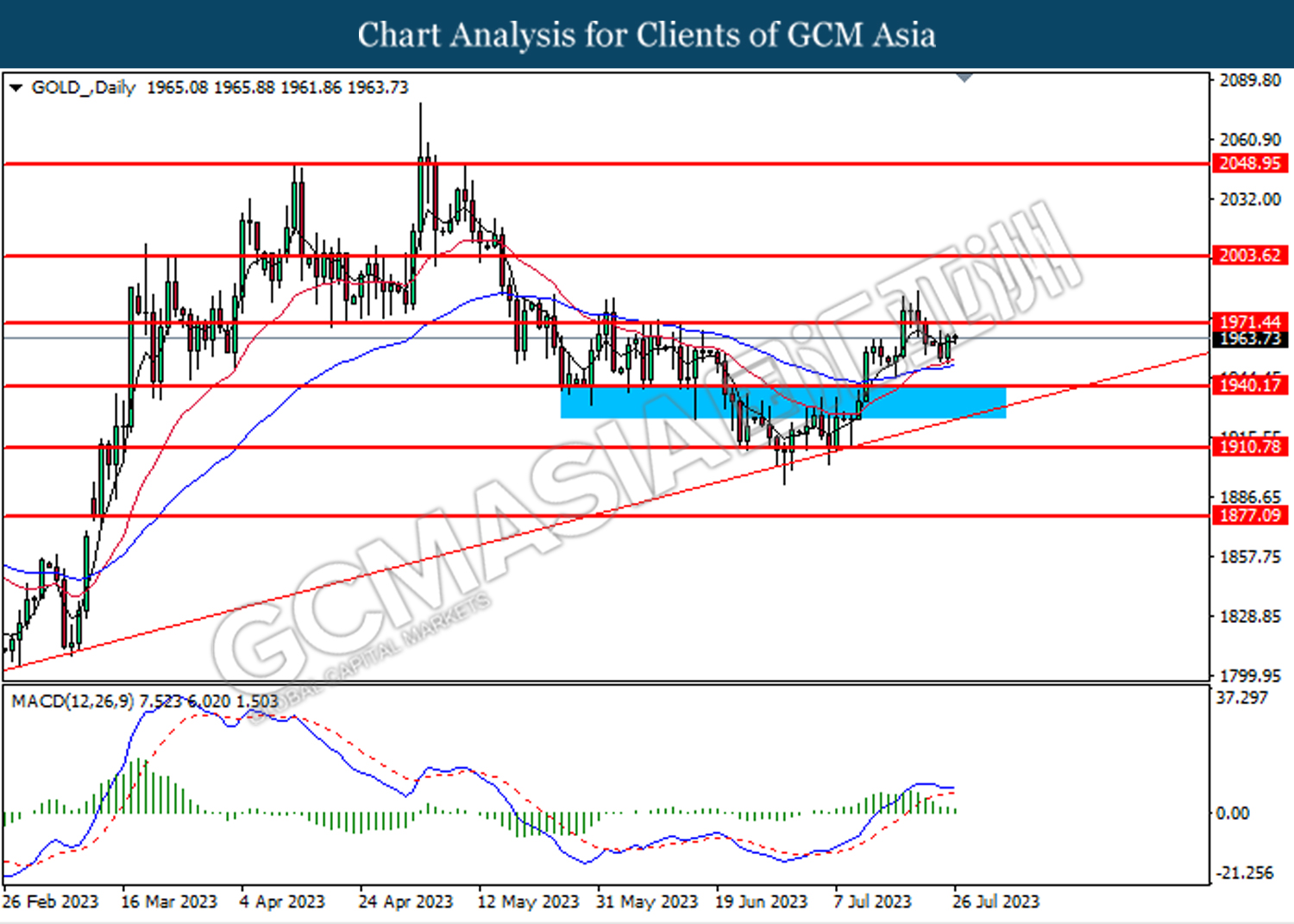

GOLD_, Daily: Gold price was traded lower following the prior breakout below the previous support level at 1971.40. MACD which illustrated diminishing bullish momentum suggests the commodity to extend its losses toward the support level at 1940.20.

Resistance level: 1971.40, 2003.60

Support level: 1940.20, 1910.80