26 July 2023 Morning Session Analysis

US dollar muted ahead of Fed’s interest rate decision.

The dollar index, which was traded against a basket of six major currencies, failed to extend its gains yesterday as the market participant remained cautious ahead of the Fed’s interest rate decision. Prior to now, the country’s currency managed to rebound from a 15-month low as there were some signs of remarkable resilience in the U.S. economy and ongoing weakness in Europe. But now, a majority of economists polled by Reuters now anticipate that Wednesday’s rate increase will be the last one in the current tightening cycle by the central bank. While the likelihood of a rate hike is largely factored into the markets, the uncertainty remains regarding the bank’s future signals, especially since U.S. inflation continues to trend above the annual target range set by the Fed. With that, there was no reason to rule out the possibility that the Fed will stick to its plan for at least one more rate hike this year following the Thursday move. On the other hand, the U.S. Consumer Confidence for the month of July reached a two-year high, supported by a tight labor market and easing inflationary pressures. However, it failed to spur the dollar index as the market participants continue to harbor fears of a potential recession following a series of rate hikes by Fed. As of writing, the dollar index dropped -0.07% to 101.30.

In the commodities market, crude oil prices spiked by 0.51% to $79.40 per barrel as a news reported that the China will step up its economic policy adjustments soon. Besides, gold prices edged up by 0.02% to $1964.50 per troy ounce amid the weakness of dollar index.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

02:00 USD FOMC Statement

(27th)

02:30 USD FOMC Press Conference

(27th)

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 20:00 | USD – Building Permits | 1.496M | 1.440M | – |

| 22:00 | USD – New Home Sales (Jun) | 763K | 727K | – |

| 22:30 | USD – Crude Oil Inventories | -0.708M | -2.400M | – |

| 02:00

(27th) |

USD – Fed Interest Rate Decision | 5.25% | 5.50% | – |

Technical Analysis

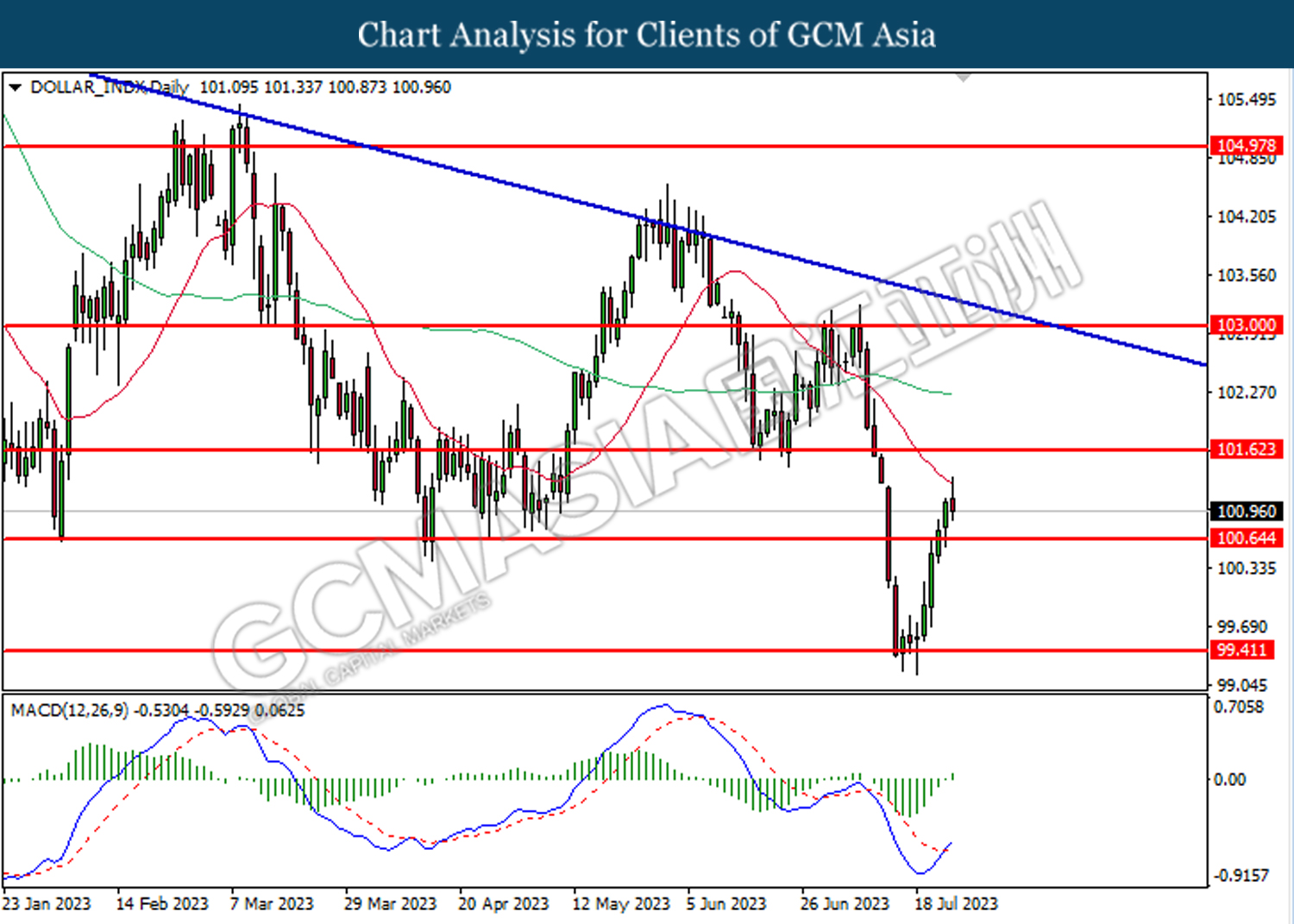

DOLLAR_INDX, Daily: Dollar index was traded higher following the prior breakout above the previous resistance level at 100.65. MACD which illustrated diminishing bearish momentum suggests the index to extend its gains toward the resistance level at 101.60.

Resistance level: 101.60, 103.00

Support level: 100.65, 99.40

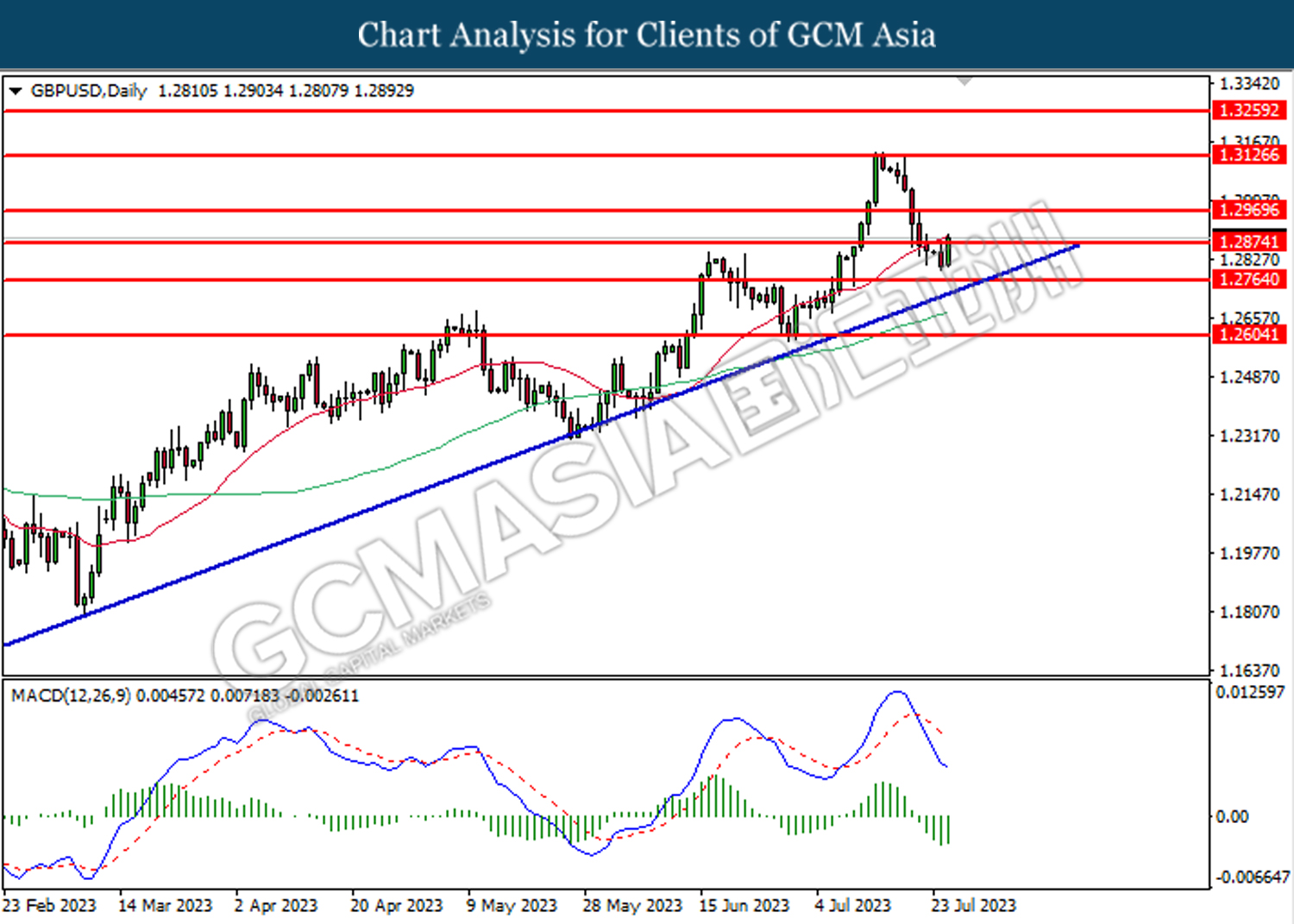

GBPUSD, Daily: GBPUSD was traded higher while currently testing the resistance level at 1.2875. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 1.2875, 1.2970

Support level: 1.2765, 1.2605

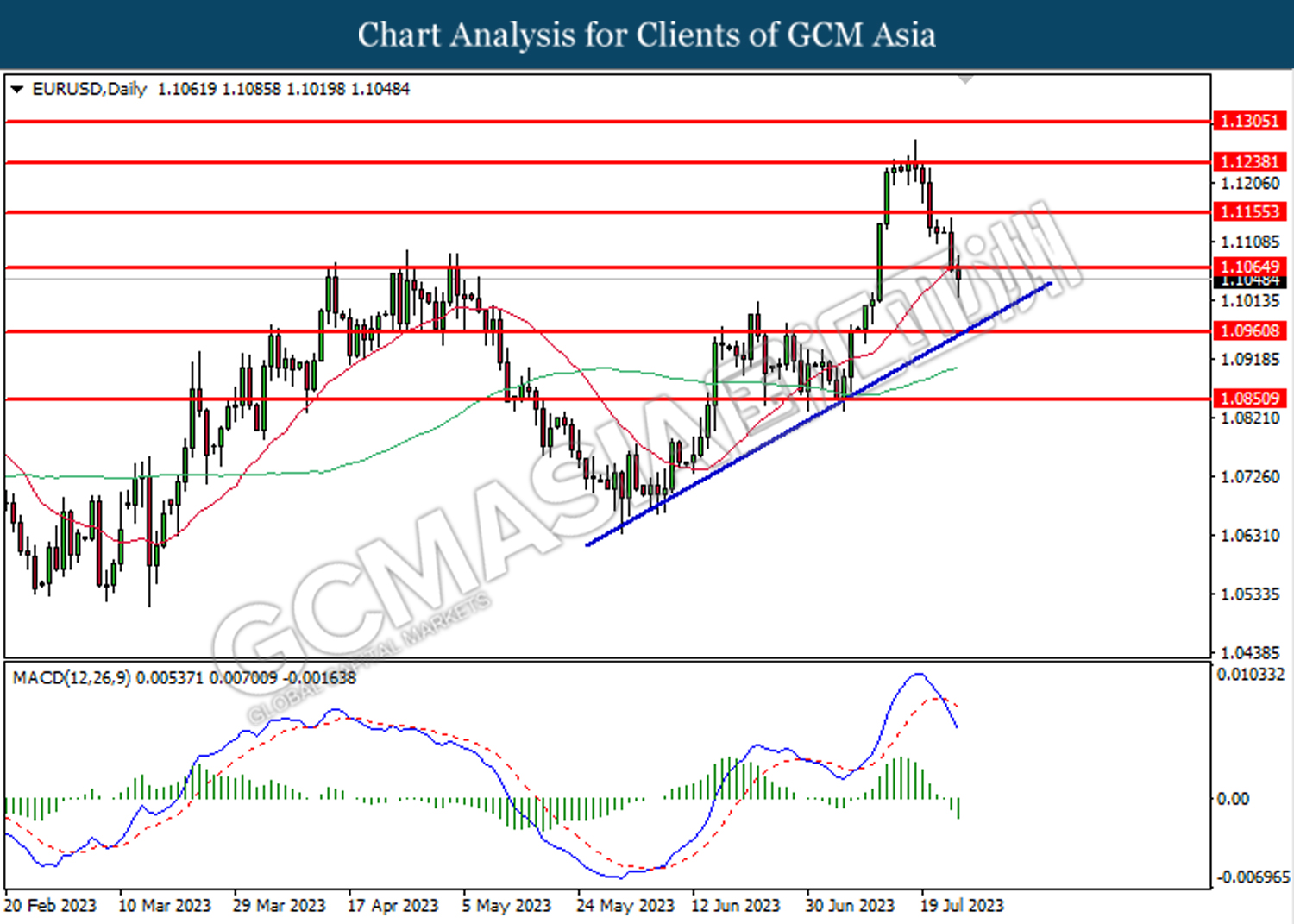

EURUSD, Daily: was traded lower following the prior breakout below the previous support level at 1.1065. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses toward the support level at 1.0960.

Resistance level: 1.1065, 1.1155

Support level: 1.0960, 1.0850

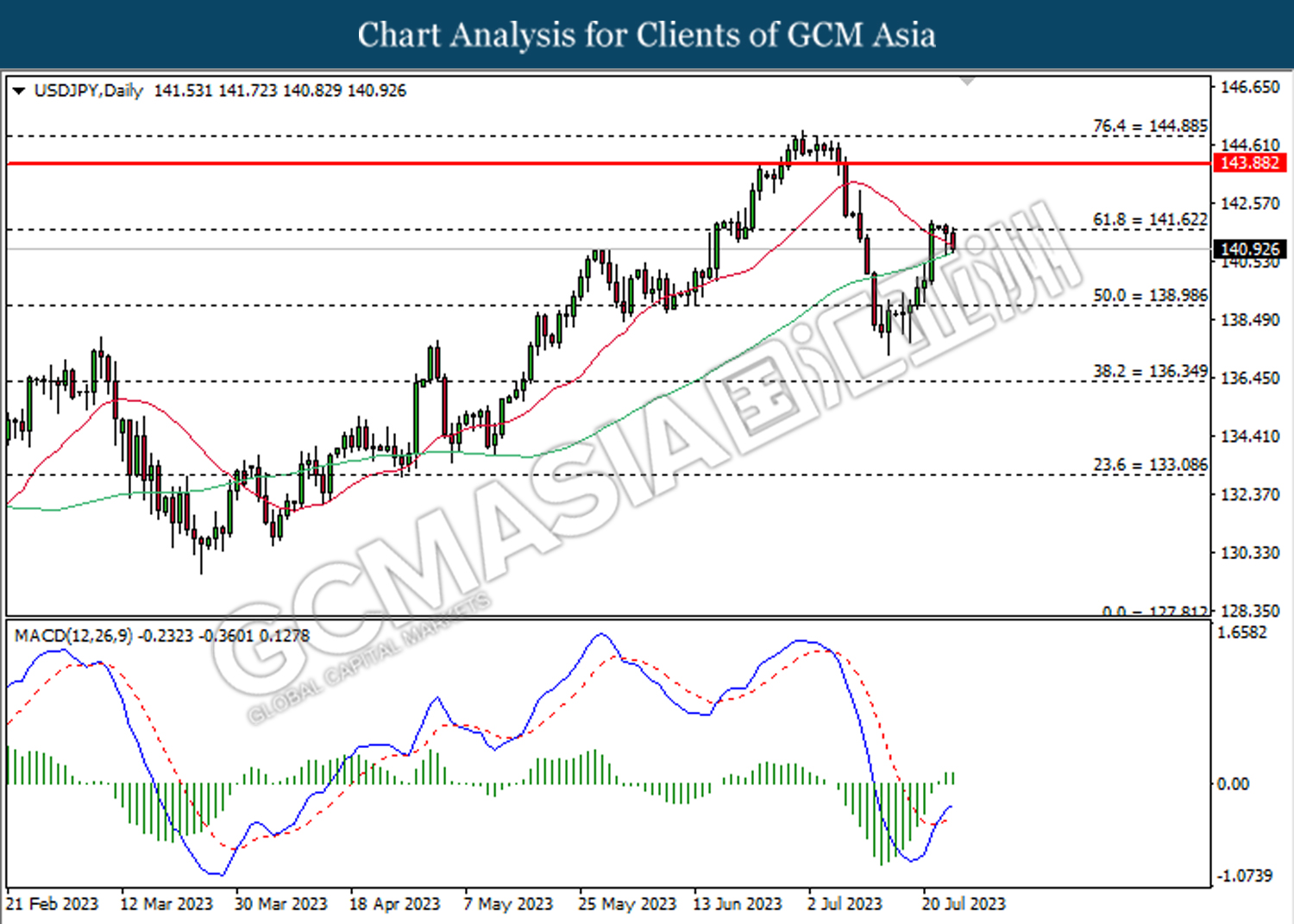

USDJPY, Daily: USDJPY was traded lower following the prior retracement from the resistance level at 141.60. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses toward the support level.

Resistance level: 141.60, 143.90

Support level: 139.00, 136.35

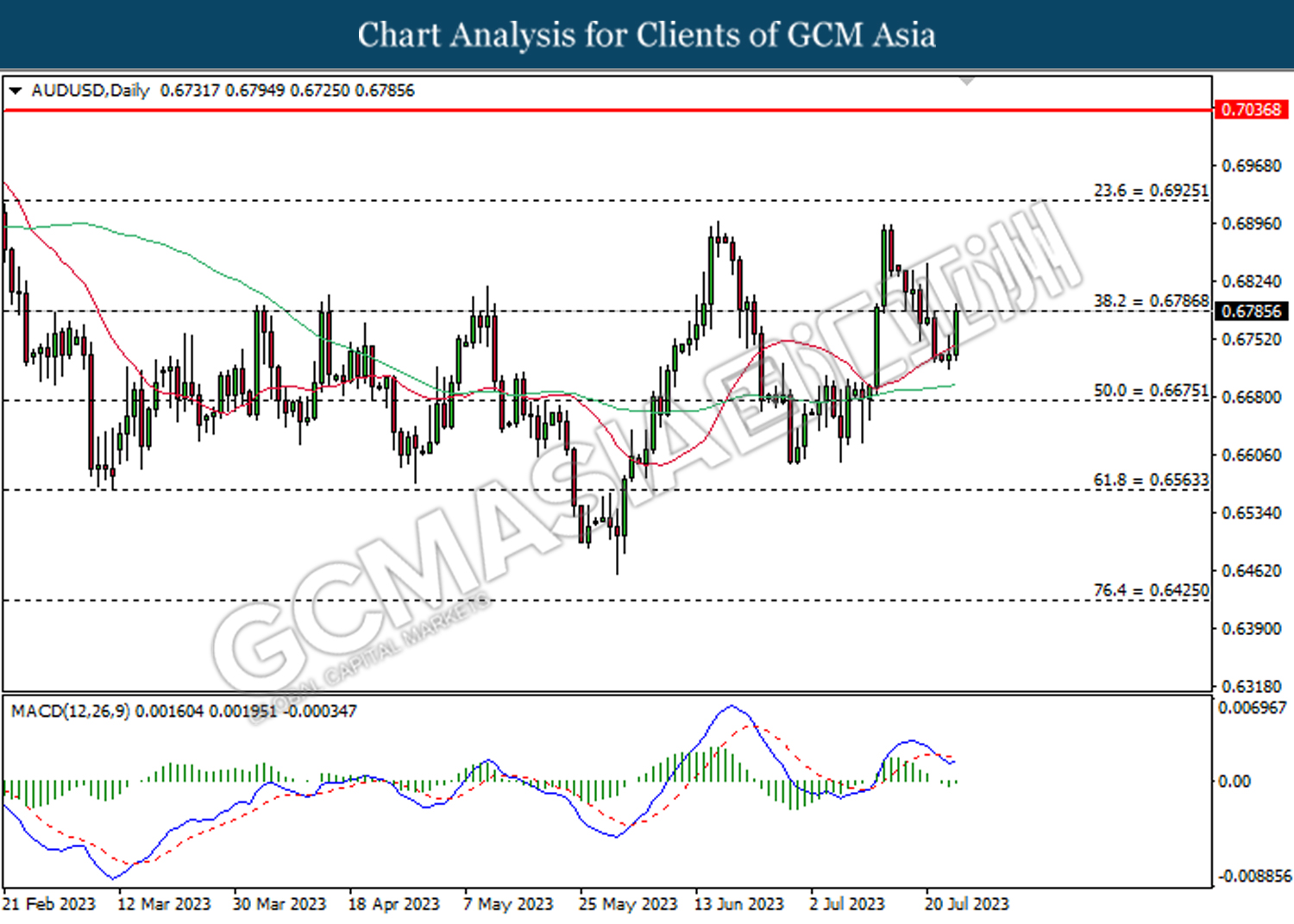

AUDUSD, Daily: AUDUSD was traded higher while currently testing the resistance level at 0.6785. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 0.6785, 0.6925

Support level: 0.6675, 0.6565

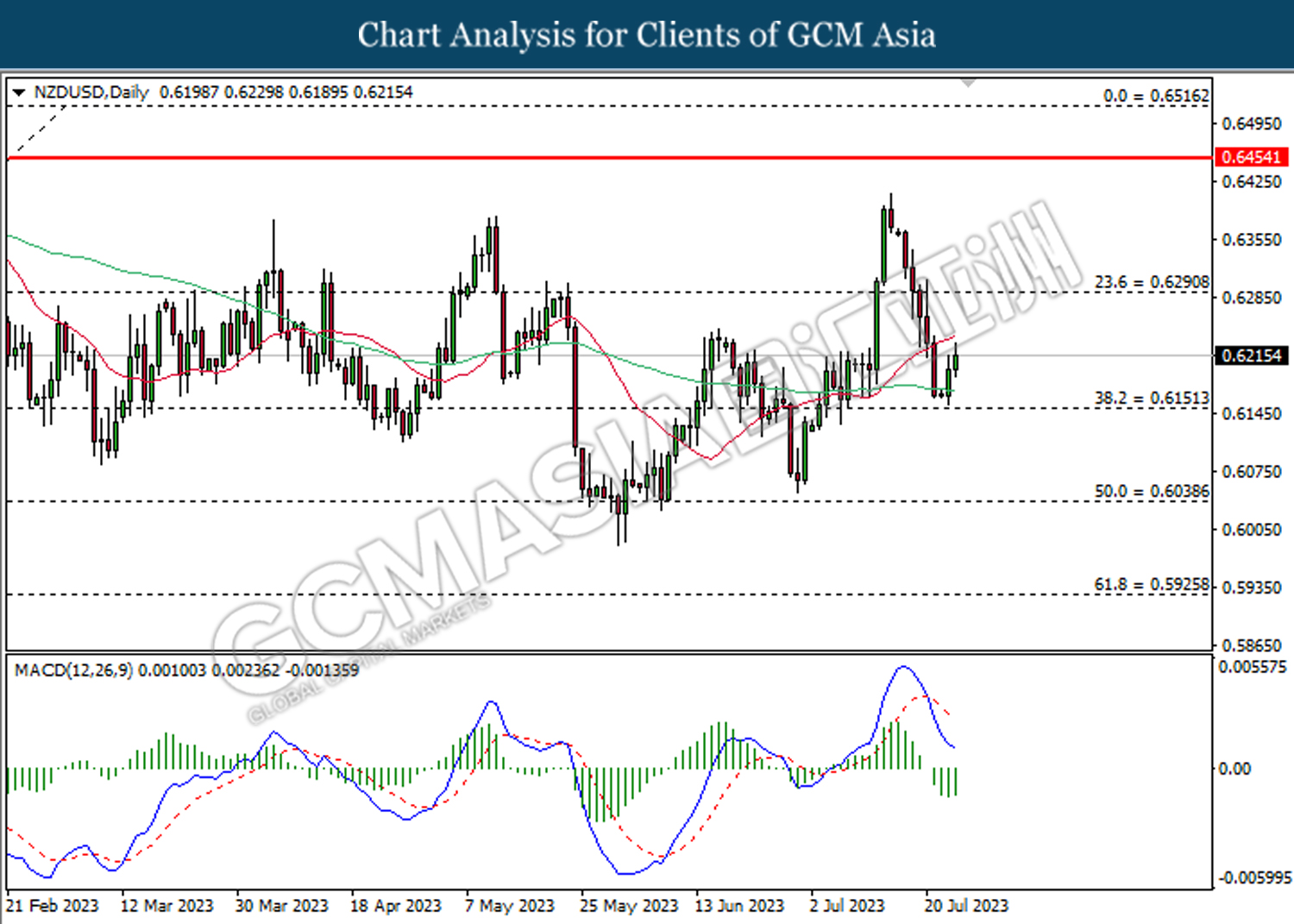

NZDUSD, Daily: NZDUSD was traded higher following the prior rebound from the support level at 0.6150. However, MACD which illustrated bearish bias momentum suggest the pair to undergo technical correction in short term.

Resistance level: 0.6290, 0.6455

Support level: 0.6150, 0.6040

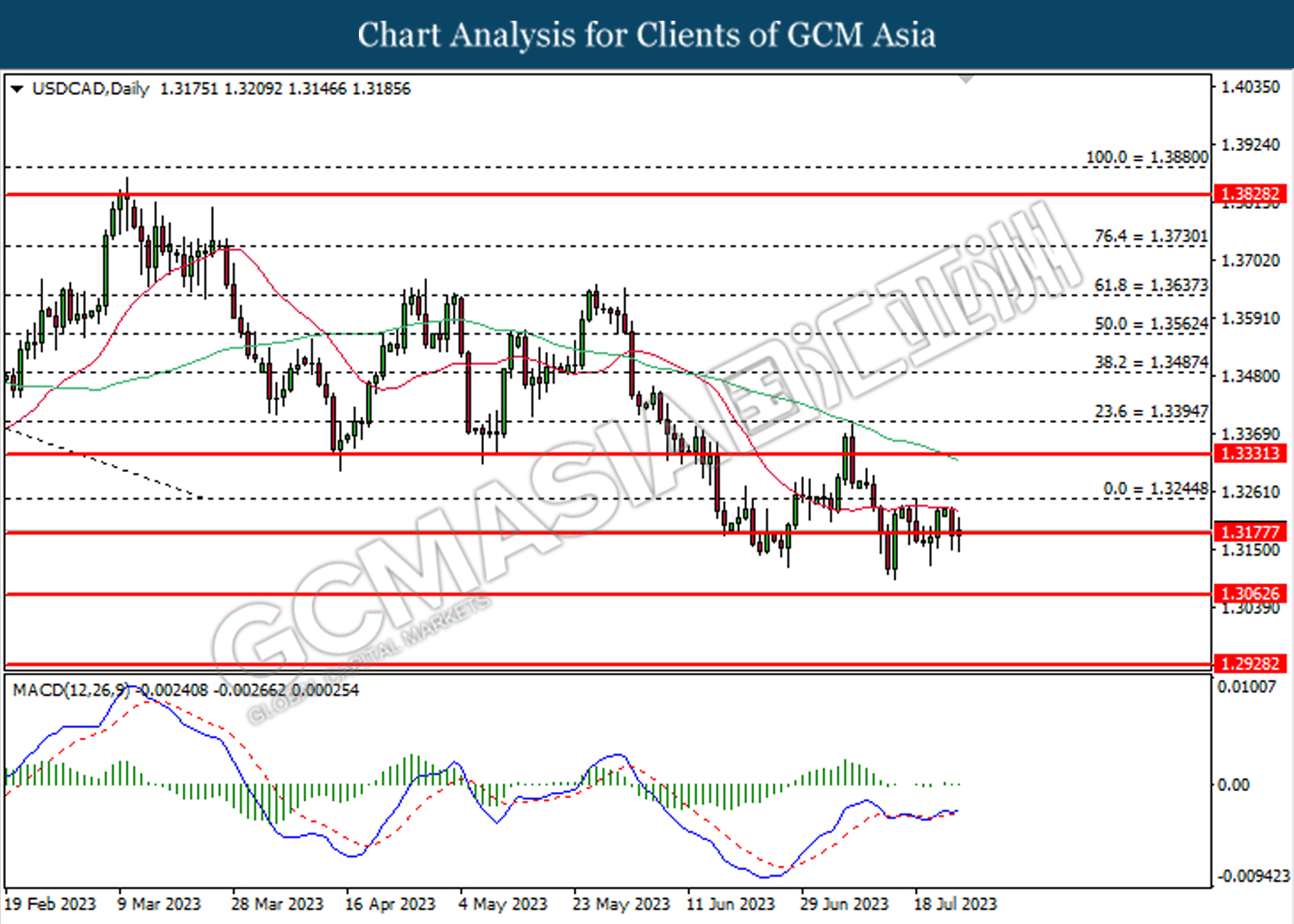

USDCAD, Daily: USDCAD was traded lower while currently testing the support level at 1.3175. MACD which illustrated diminishing bullish momentum suggests the pair to undergo technical correction in short term.

Resistance level: 1.3245, 1.3330

Support level: 1.3175, 1.3065

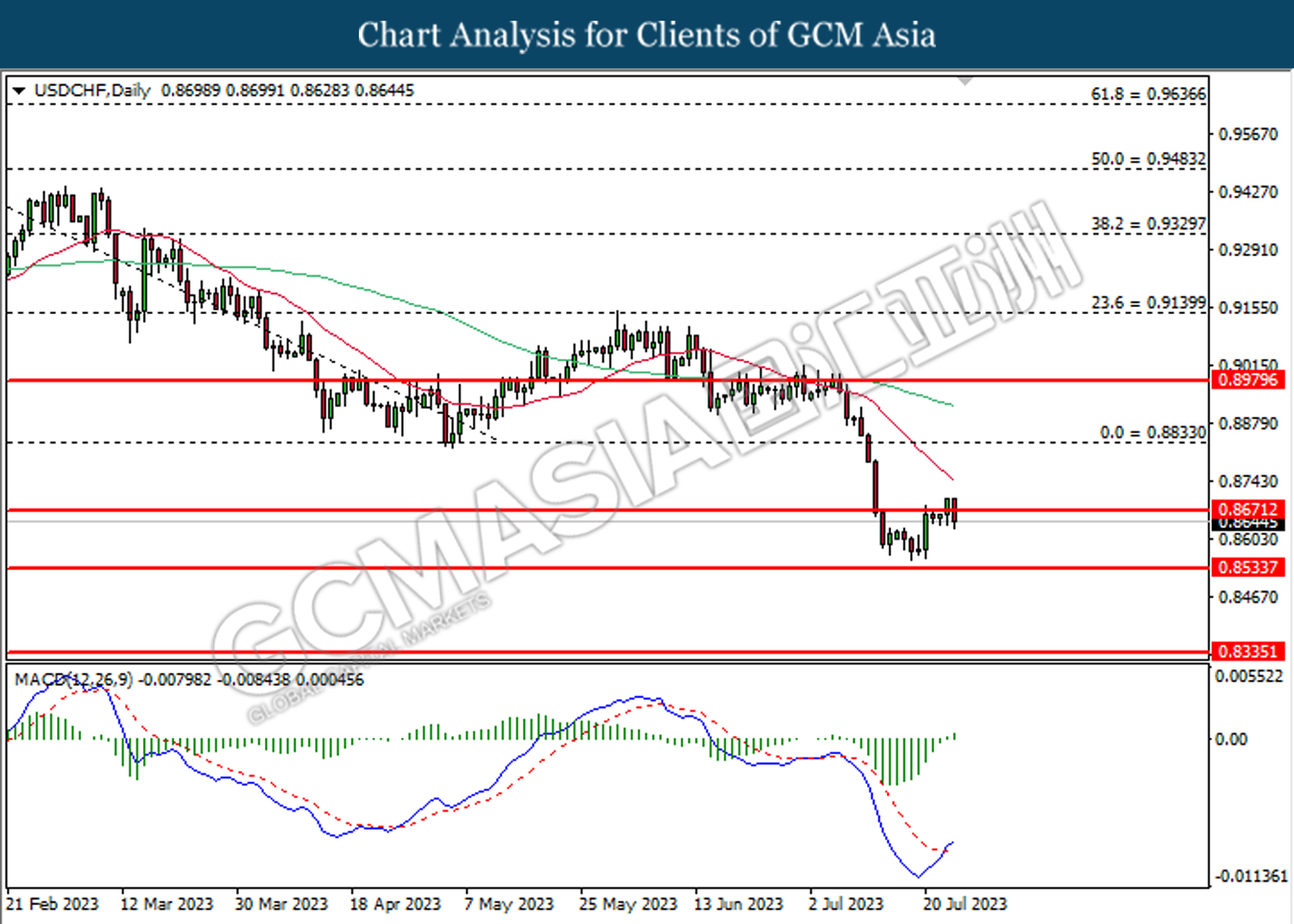

USDCHF, Daily: USDCHF was traded higher while currently testing the resistance level at 0.8670. MACD which illustrated bullish bias momentum suggest the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 0.8670, 0.8775

Support level: 0.8535, 0.8355

CrudeOIL, Daily: Crude oil price was traded higher following the prior breakout above the previous resistance level at 77.15. MACD which illustrated bullish bias momentum suggest the commodity to extend its gains toward the resistance level at 80.75.

Resistance level: 80.75, 83.05

Support level: 77.15, 74.00

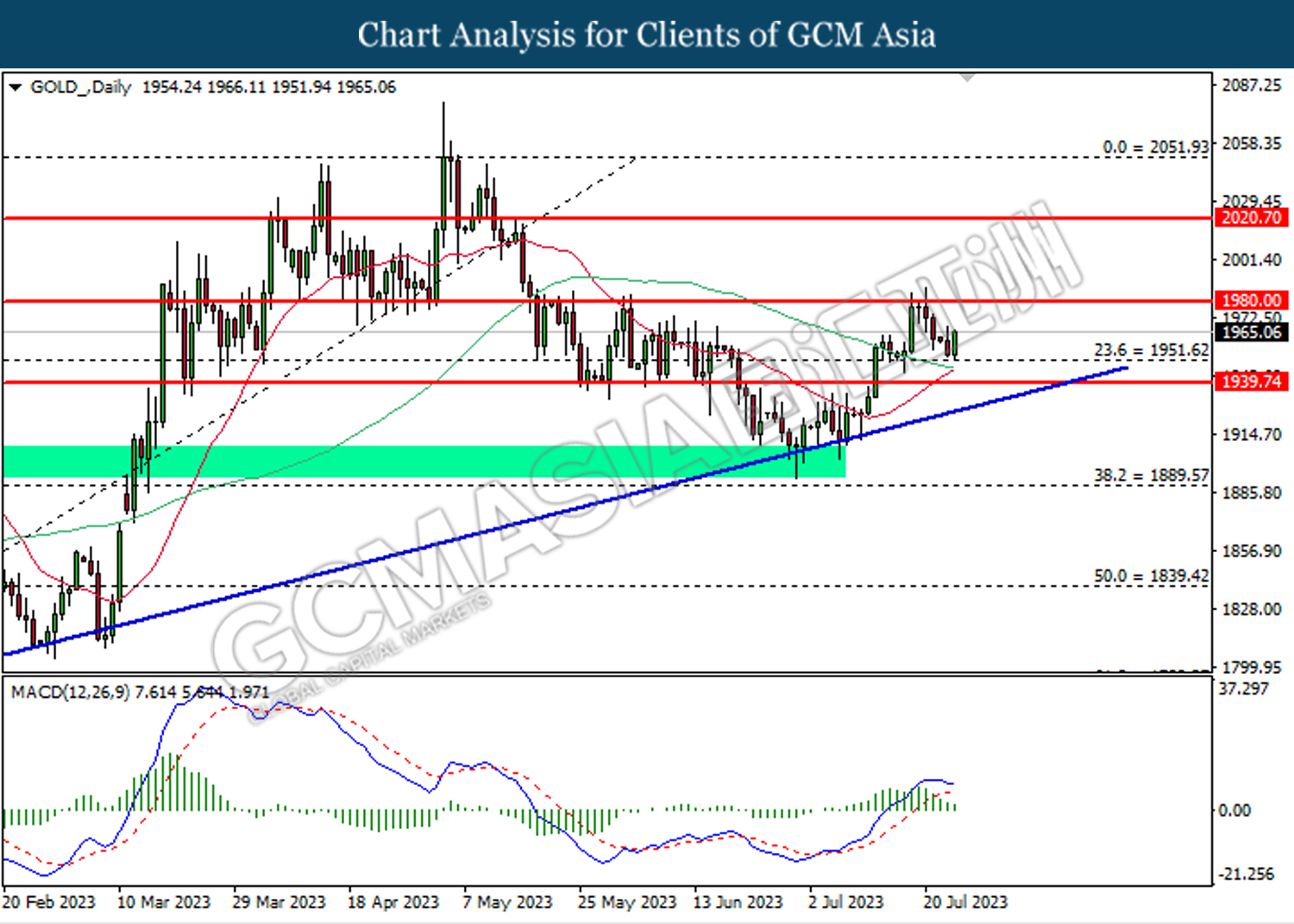

GOLD_, Daily: Gold price was traded higher following the prior rebound from the support level at 1951.60. However, MACD which illustrated diminishing bullish momentum suggests the commodity to undergo technical correction in short term.

Resistance level: 1980.00, 2020.70

Support level: 1951.60, 1939.75