26 October 2020 Afternoon Session Analysis

Dollar rebound amid virus spurred safe-haven demand.

During late Asian session, the dollar which traded against a basket of six major currency pairs have regained support and rebound as worsening coronavirus in U.S and Europe and lack of progress in U.S stimulus leading traders in a cautious mood. In coronavirus front, the U.S reported more than 83,000 coronavirus cases two days in a row, surpassed previous deadly record of roughly 77,300 cases on July 16. At the same time, the surging cases in Europe have also cause some countries such as Italy to ordered restaurants and bar to shut down by 6 p.m. On the other hand, U.S. House Speaker Nancy Pelosi said on Sunday that she expected a White House response on Monday regarding the latest stimulus spending plan. Recently, a senior administration official said the stimulus deal wasn’t dead, but could have been made at times over the past 10 days. The statement accused that Pelosi’s suggestion of compromise had been mostly done for show. At the time of writing, dollar index rose 0.14% to 92.84.

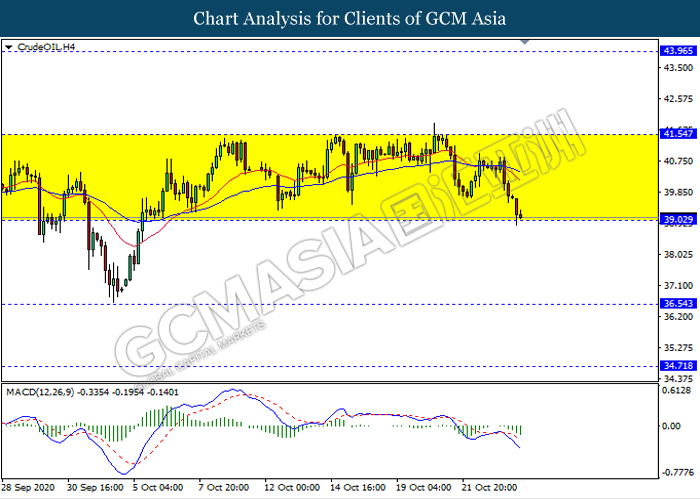

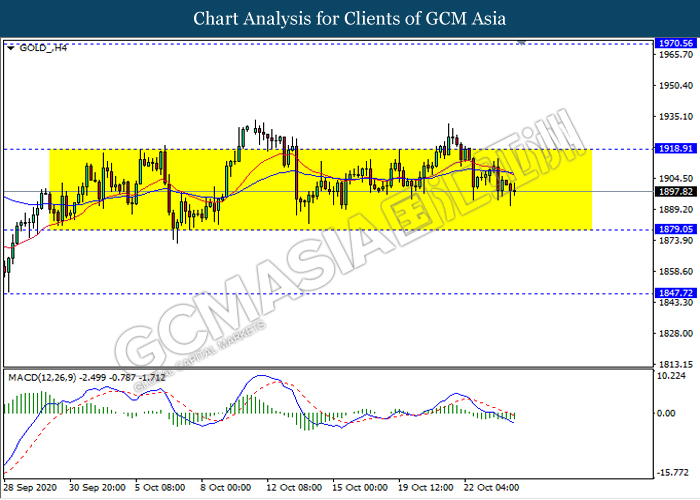

In the commodities market, crude oil price fell 1.23% to $39.18 per barrel as of writing amid worsening demand outlook continue to weigh on the sentiment. Market confidence towards the black commodity remains weak due to drastic increase in coronavirus cases despite with the recent news of an FDA approval for remdesivir. Next, gold price slips 0.17% to $1898.29 a troy ounce at the time of writing following dollar regain support.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 17:00 | EUR – German Ifo Business Climate Index (Oct) | 93.4 | 93.0 | – |

| 22:00 | USD – New Home Sales (Sep) | 1,011K | 1,025K | – |

Technical Analysis

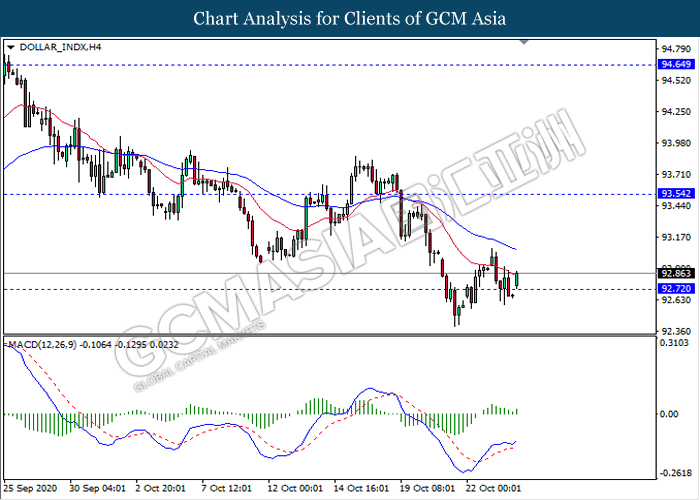

DOLLAR_INDX, H4: Dollar index was traded higher following prior rebound from the support level 92.70. MACD which illustrate bullish momentum signal suggest the dollar to extend its rebound towards the resistance level 93.55.

Resistance level: 93.55, 94.65

Support level: 92.70, 91.75

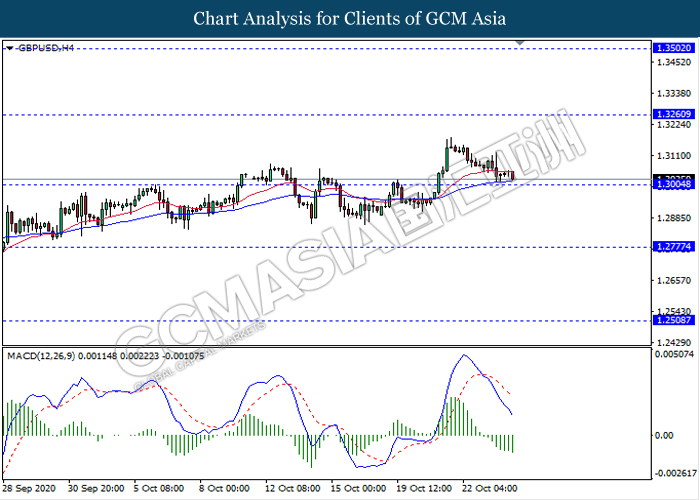

GBPUSD, H4: GBPUSD was traded lower while currently testing the support level 1.3005. MACD which illustrate ongoing bearish momentum signal suggest the pair to extend its losses after it breaks below the support level.

Resistance level: 1.3260, 1.3500

Support level: 1.3005, 1.2775

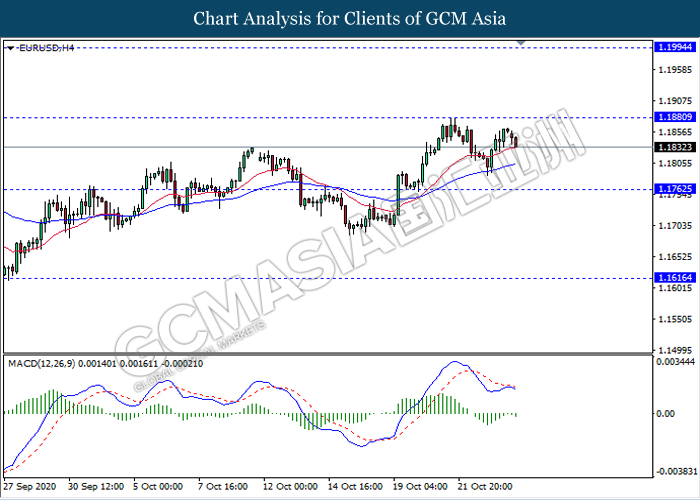

EURUSD, H4: EURUSD was traded lower following prior retracement from the resistance level 1.1880. MACD which illustrate persistent bearish momentum signal suggest the pair to extend its retracement towards the support level 1.1760.

Resistance level: 1.1880, 1.1995

Support level: 1.1760, 1.1615

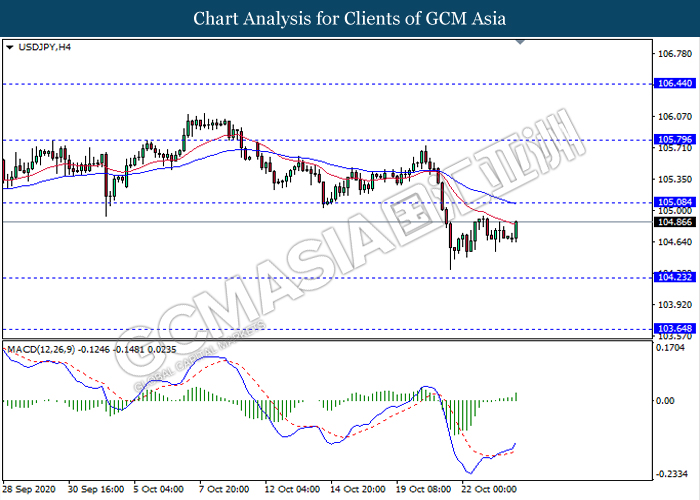

USDJPY, H4: USDJPY remain traded flat while currently testing near the resistance level 105.10. However, MACD which illustrate bullish bias signal with the recent formation of golden cross suggest the pair to be traded higher after it breaks above the resistance level.

Resistance level: 105.10, 105.80

Support level: 104.25, 103.65

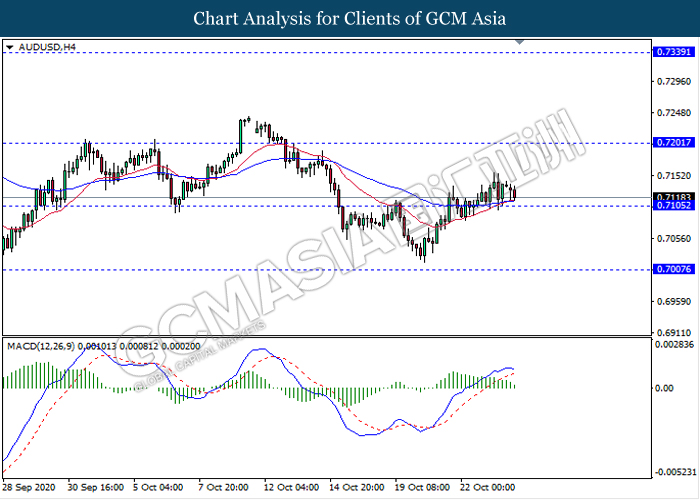

AUDUSD, H4: AUDUSD was traded flat while currently testing the support level 0.7105. However, MACD which display diminishing bullish momentum signal suggest the pair to be traded lower after it breaks below the support level.

Resistance level: 0.7200, 0.7340

Support level: 0.7105, 0.7005

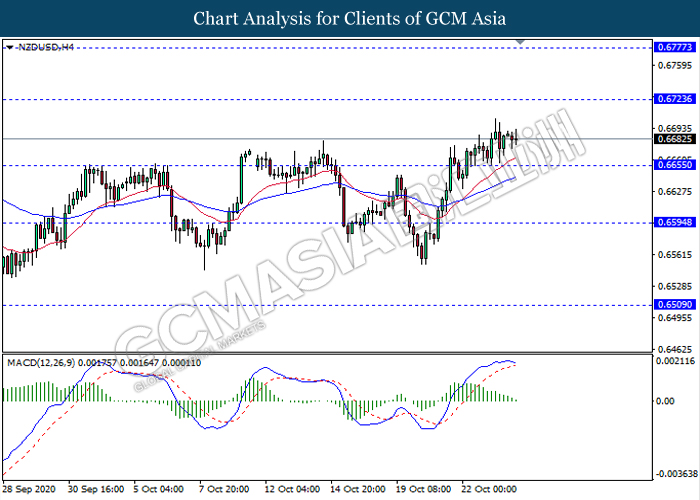

NZDUSD, H4: NZDUSD was traded higher following prior breakout above the previous resistance level 0.6655. However, MACD which illustrate diminishing bullish momentum signal suggest the pair to experience a technical correction in short term towards the support level 0.6655.

Resistance level: 0.6725, 0.6775

Support level: 0.6655, 0.6595

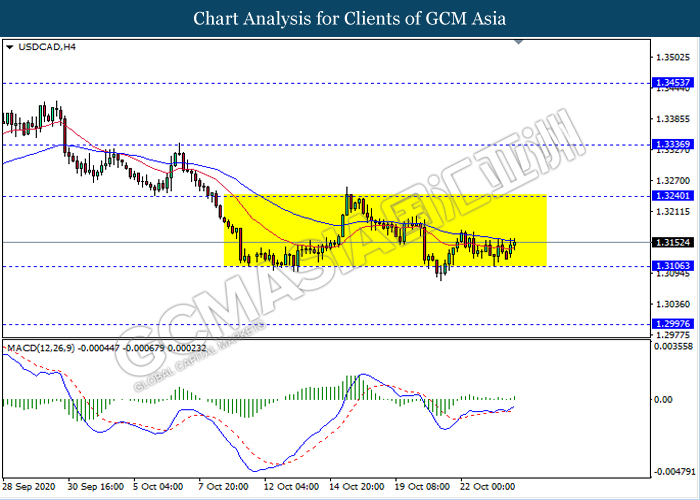

USDCAD, H4: USDCAD remain traded in a sideway channel while traded flat near the support level 1.3105. However, MACD which illustrate bullish bias signal suggest the pair to be traded higher in short term towards the resistance level 1.3240.

Resistance level: 1.3240, 1.3335

Support level: 1.3105, 1.2995

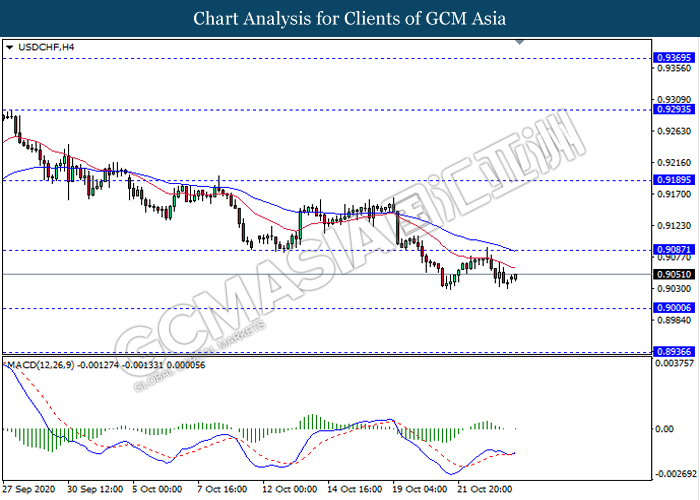

USDCHF, H4: USDCHF was traded lower following recent retracement from resistance level 0.9085. However, MACD which display bullish momentum signal suggest the pair to be traded higher in short term towards back the level 0.9085.

Resistance level: 0.9085, 0.9190

Support level: 0.9000, 0.8935

CrudeOIL, H4: Crude oil price remain traded in a sideway channel while currently testing the support level 39.00. However, MACD which illustrate bearish momentum signal suggest the commodity to be traded lower after it breaks below the support level 39.00.

Resistance level: 41.55, 43.95

Support level: 39.00, 36.55

GOLD_, H4: Gold price remain traded in a sideway channel following recent retracement from MA lines. However, MACD which illustrate bearish momentum signal suggest the commodity to be traded lower towards the support level 1879.05.

Resistance level: 1918.90, 1970.55

Support level: 1879.05, 1847.70