26 October 2020 Morning Session Analysis

Pound slumped amid bearish economic data.

Pound Sterling slumped on last Friday over the backdrop of a string of downbeat economic data from the UK region. According to Markit Economics, the U.K. Composite Purchasing Managers’ Index (PMI) had notched down significantly from the previous reading of 55.7 to 52.9, worse than the market forecast at 55.6. Similarly, the U.K. Manufacturing Purchasing Managers Index (PMI) and U.K. Services Purchasing Managers Index (PMI) came in at only 53.3 and 52.3, which fared worse than the market forecast at 54.3 and 55.0 respectively. As these crucial economic data had fared bearish reading, which dialled down the market optimism toward the economic progression in United Kingdom while spurring significant selloff for the Pound Sterling. Besides that, the resurgent number of the coronavirus contagions from the UK and uncertainty with regards of the Brexit issues had also dragged down the appeal of the Pound Sterling. Nonetheless, the losses experienced by the Pound Sterling was limited amid positive retail sales data on last Friday. According to Office for National Statistics, the U.K. Retail Sales for last month had improved significantly from 0.9% to 1.5%, which better than expectation at 0.4%. As of writing, the GBP/USD depreciated by 0.04% to 1.3042.

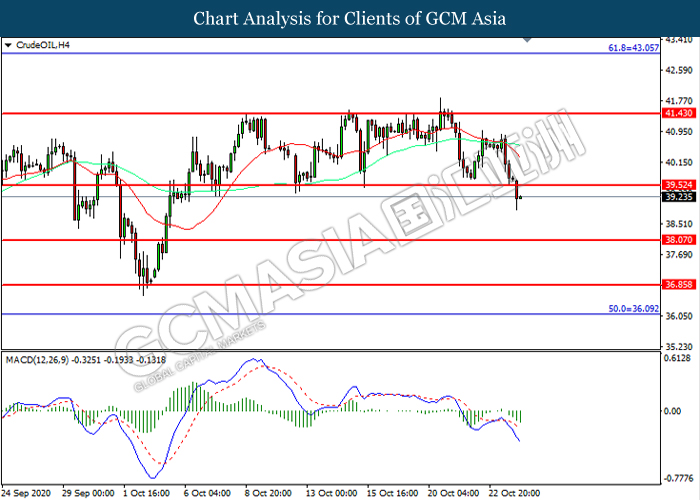

In the commodities market, the crude oil price slumped 1.46% to $39.12 per barrels as of writing. The oil market edged lower amid the fears of the spiking numbers of the coronavirus infections had provided negative prospect for the oil demand. On the other hand, the gold price slumped 0.25% to $1896.45 per troy ounces amid market participants expected the U.S. coronavirus stimulus plan will be passed only after the 3rd November 2020 U.S. election.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 17:00 | EUR – German Ifo Business Climate Index (Oct) | 93.4 | 93.0 | – |

| 22:00 | USD – New Home Sales (Sep) | 1,011K | 1,025K | – |

Technical Analysis

DOLLAR_INDX, H4: Dollar index was traded lower while currently near the support level at 92.55. MACD which illustrated diminishing bullish momentum suggest the index to extend its losses after it successfully breakout below the support level.

Resistance level: 93.00, 93.50

Support level: 92.55, 91.75

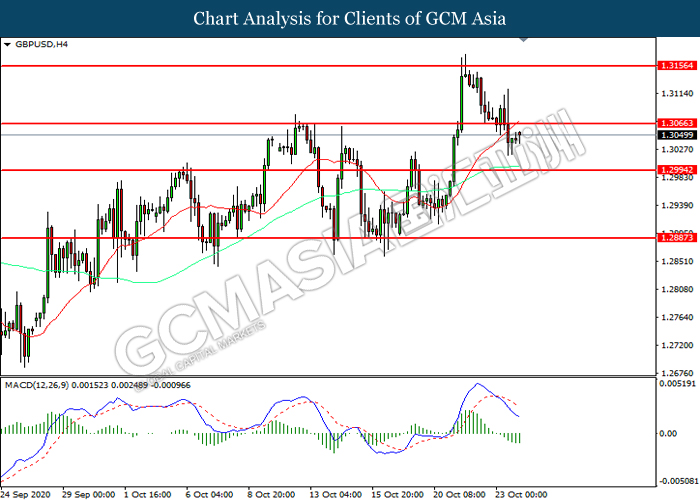

GBPUSD, H4: GBPUSD was traded lower following prior breakout below the previous support level at 1.3065. MACD which illustrated increasing bearish momentum suggest the pair toe tend its losses toward support level at 1.2995.

Resistance level: 1.3065, 1.3155

Support level: 1.2995, 1.2885

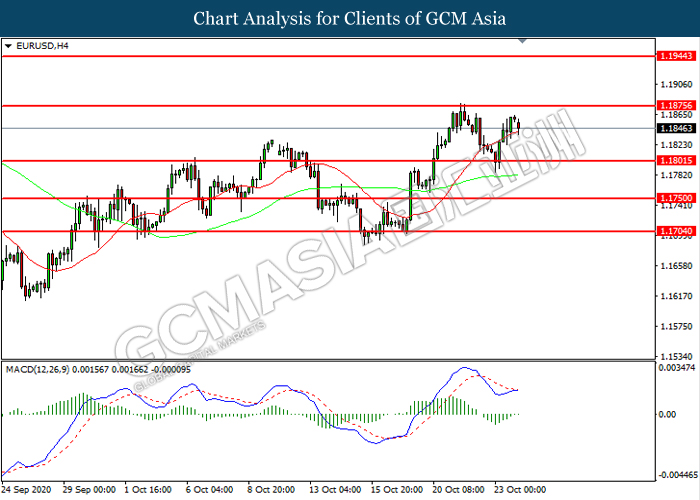

EURUSD, H4: EURUSD was traded higher while currently testing the resistance level at 1.1875. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 1.1875, 1.1945

Support level: 1.1800, 1.1750

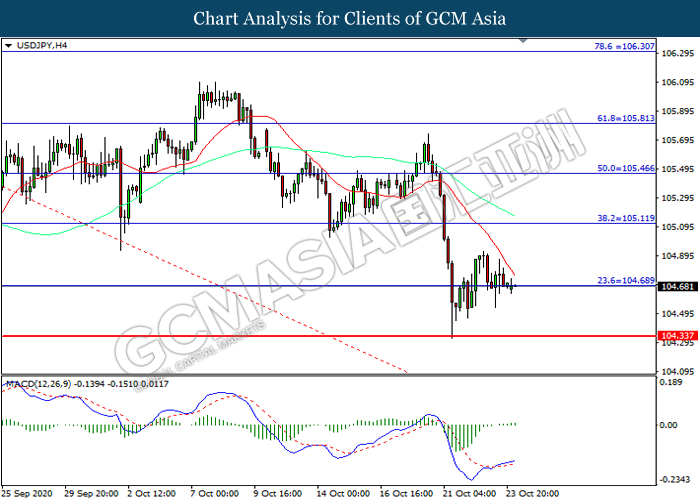

USDJPY, H4: USDJPY was traded lower while currently testing the support level at 104.70. However, MACD which illustrated increasing bullish momentum suggest the pair to be traded higher in short-term as technical correction.

Resistance level: 105.10, 105.45

Support level: 104.35, 104.70

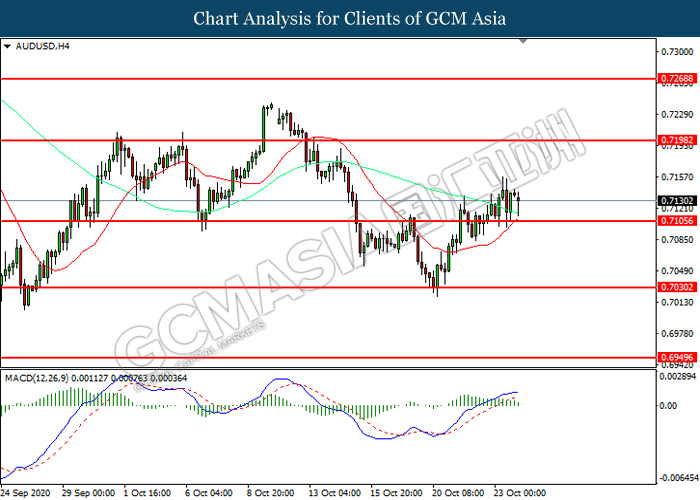

AUDUSD, H4: AUDUSD was traded higher following prior breakout above the previous resistance level at 0.7105. However, MACD which illustrated diminishing bullish momentum suggest the pair to be traded lower in short-term as technical correction.

Resistance level: 0.7200, 0.7270

Support level: 0.7105, 0.7030

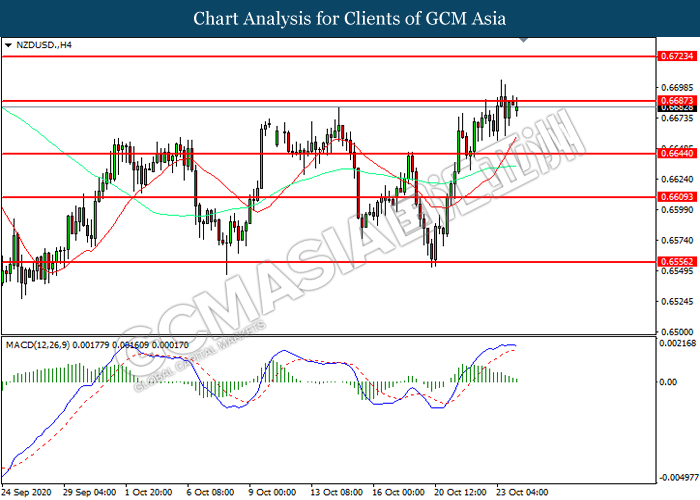

NZDUSD, H4: NZDUSD was traded higher while currently testing the resistance level at 0.6685. However, MACD which illustrated diminishing bullish momentum suggest the pair to be traded lower in short-term as technical correction.

Resistance level: 0.6685, 0.6725

Support level: 0.6645, 0.6610

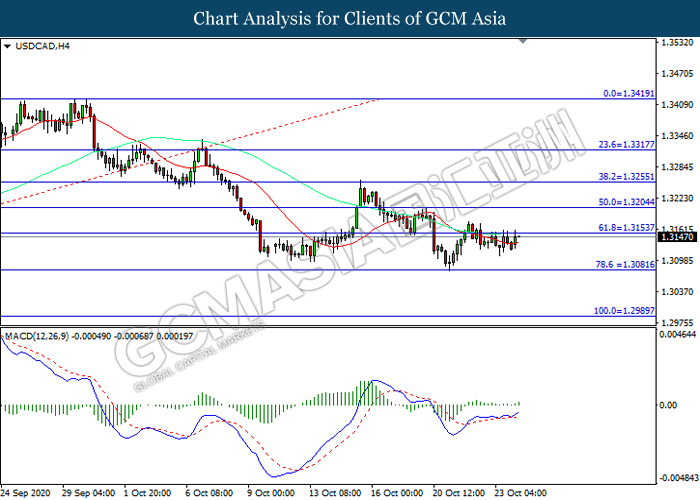

USDCAD, H4: USDCAD was traded higher while currently testing the resistance level at 1.3155. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 1.3155, 1.3205

Support level: 1.3080, 1.2990

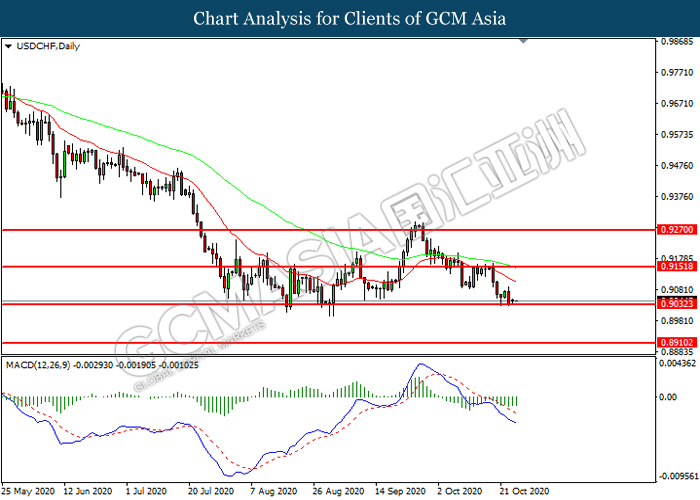

USDCHF, Daily: USDCHF was traded lower while currently testing the support level at 0.9030. However, MACD which illustrated diminishing bearish momentum suggest the pair to be traded higher in short-term as technical correction.

Resistance level: 0.9150, 0.9270

Support level: 0.9030, 0.8910

CrudeOIL, H4: Crude oil price was traded lower following prior breakout above the previous support level at 39.50. MACD which illustrated increasing bearish momentum suggest the commodity to extend its losses toward support level at 38.05.

Resistance level: 39.50, 41.45

Support level: 38.05, 38.85

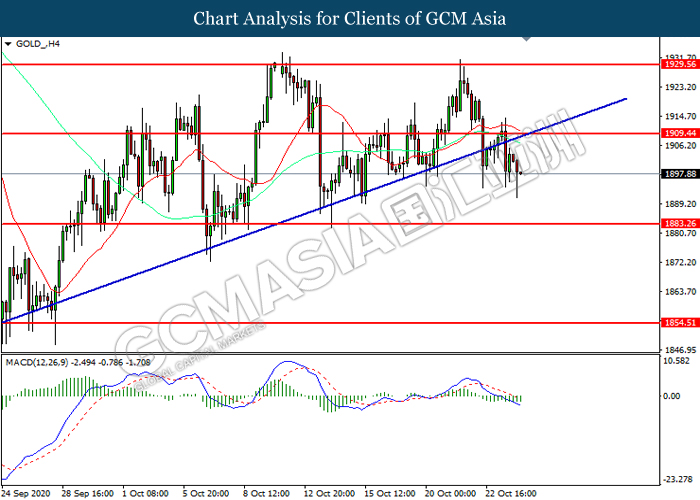

GOLD_, H4: Gold price was traded lower following prior retracement from the resistance level at 1909.45. MACD which illustrated increasing bearish momentum suggest the commodity to extend its losses toward support level at 1883.25.

Resistance level: 1909.45, 1929.55

Support level: 1883.25, 1854.50