26 November 2021 Afternoon Session Analysis

Pound sterling extend loss amid Brexit uncertainty.

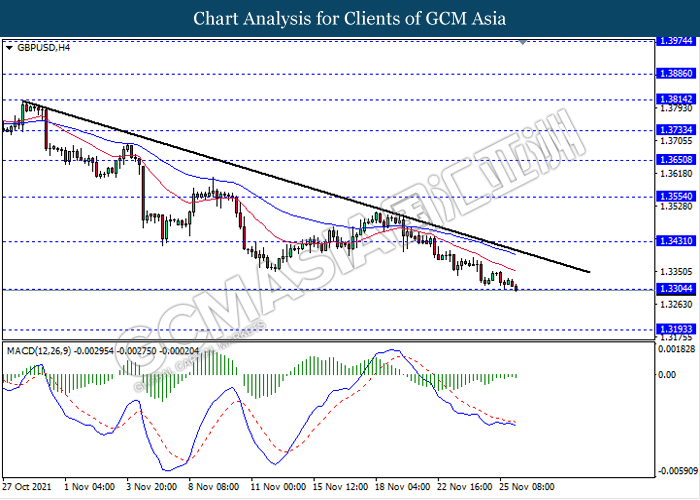

The pound sterling which traded against the dollar and other currency pairs remain pressured and fell amid lack of positive progress in Brexit. Following latest development, U.K government spokesperson stated that the UK PM had told the Irish PM that he was concerned about a substantial gap that remained between the UK and EU on the implementation of the Northern Ireland Protocol. On the other hand, the French Fishing Association Body stated that they still haven’t get the licensed they want, therefore the association said that French fishermen would be taking action on Friday to block French ports and the Channel tunnel. The blockades will disrupt UK/EU trade and are likely to exacerbate the supply chain disruptions already plaguing the UK economy. At the time of writing, GBP/USD fell 0.13% to $1.3301.

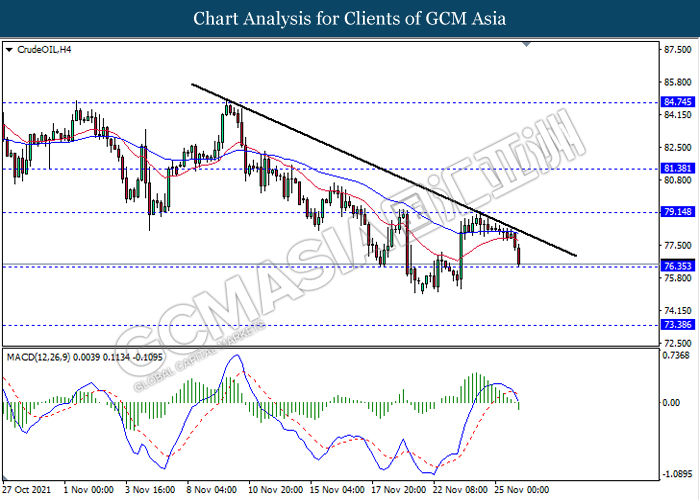

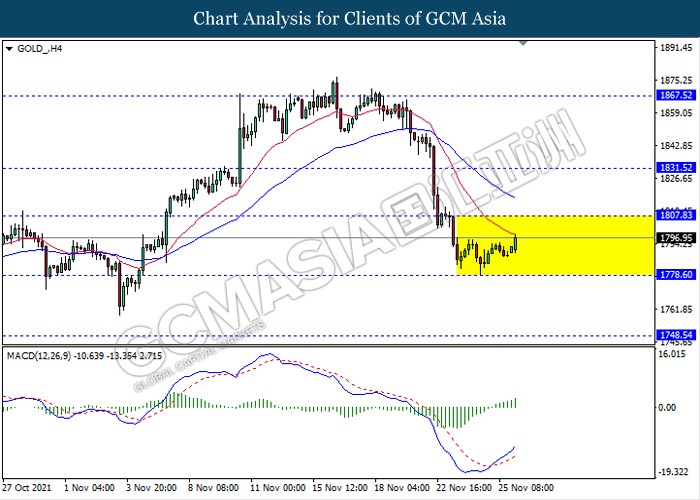

In the commodities market, crude oil price plunged 1.98% to $76.50 per barrel as of writing following concerns of oversupply in Q1 next year. U.S. President Joe Biden’s administration recently announced plan to release millions of barrels of oil from strategic reserves in coordination with other large consuming nations, including China, India and Japan in effort to cooling down price. Several OPEC sources stated that the release is likely to inflate supply in the coming months. On the other hand, gold price 0.48% to $1797.08 a troy ounce at the time of writing following dollar retracement.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

16:00 EUR ECB President Lagarde Speaks

Today’s Highlight Economic Data

N/A

Technical Analysis

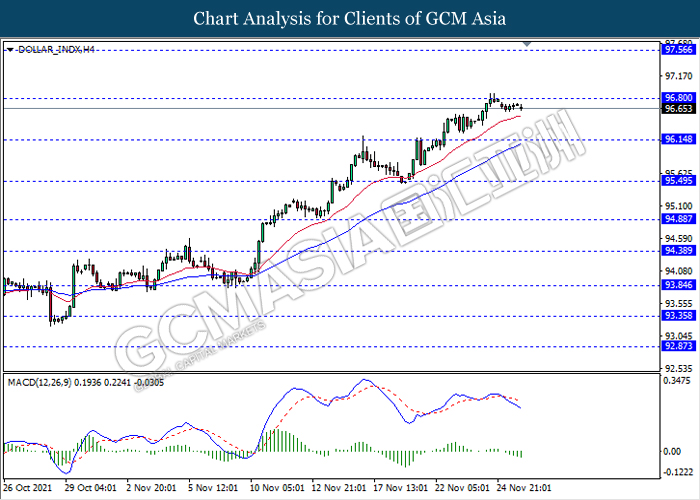

DOLLAR_INDX, H4: Dollar index was traded flat while currently testing near the resistance level 96.80. However, MACD which illustrate bearish momentum signal with the formation of death cross suggest the dollar to be traded lower towards the support level 96.15.

Resistance level: 96.80, 97.55

Support level: 96.15, 95.50

GBPUSD, H4: GBPUSD was traded lower while currently testing the support level 1.3305. MACD which illustrate persistent bearish momentum signal suggest the pair to extend its losses after it breaks below the support level.

Resistance level: 1.3430, 1.3555

Support level: 1.3305, 1.3195

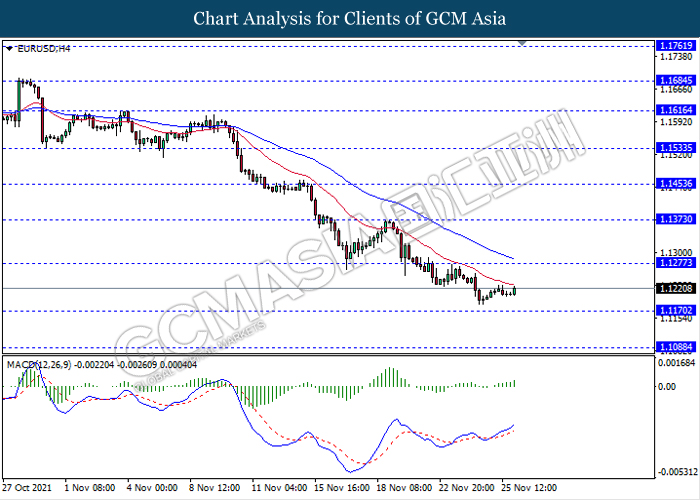

EURUSD, H4: EURUSD was traded higher following recent rebound from its low level. MACD which illustrate bullish momentum signal suggest the pair to extend its rebound towards the resistance level 1.1275.

Resistance level: 1.1275, 1.1375

Support level: 1.1170, 1.1090

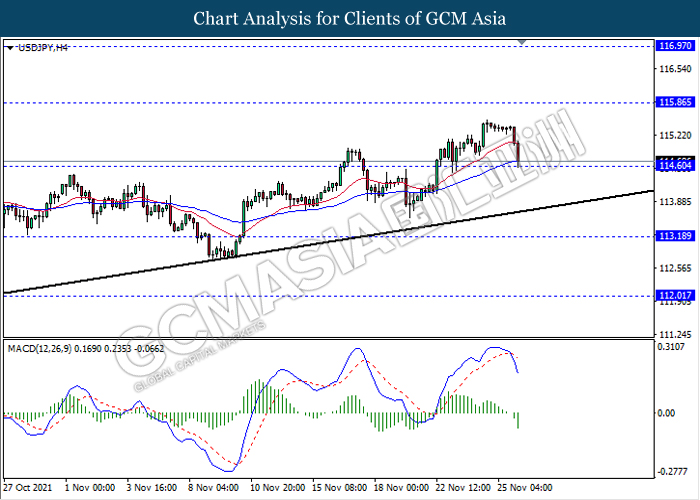

USDJPY, H4: USDJPY was traded lower while currently testing the support level 114.60. MACD which illustrate bearish momentum signal with the formation of death cross suggest the pair to extend its losses after it breaks below the support level 114.60.

Resistance level: 115.85, 116.95

Support level: 114.60, 113.20

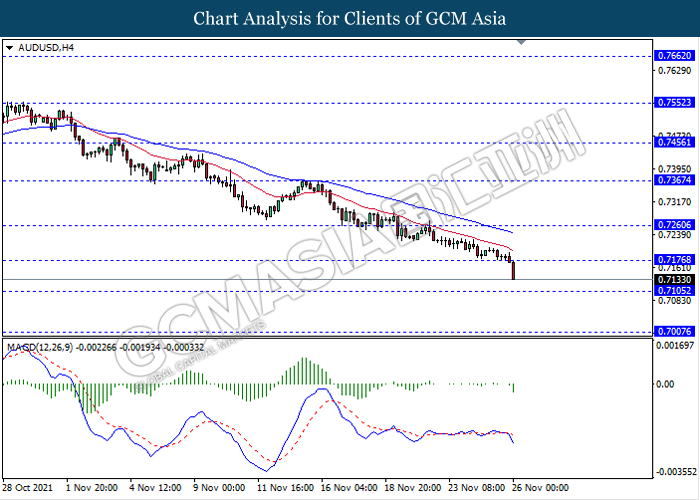

AUDUSD, H4: AUDUSD was traded lower while currently testing near the support level 0.7105. MACD which illustrate bearish bias signal suggest the pair to extend its losses after it breaks below the support level 0.7105.

Resistance level: 0.7175, 0.7260

Support level: 0.7105, 0.7005

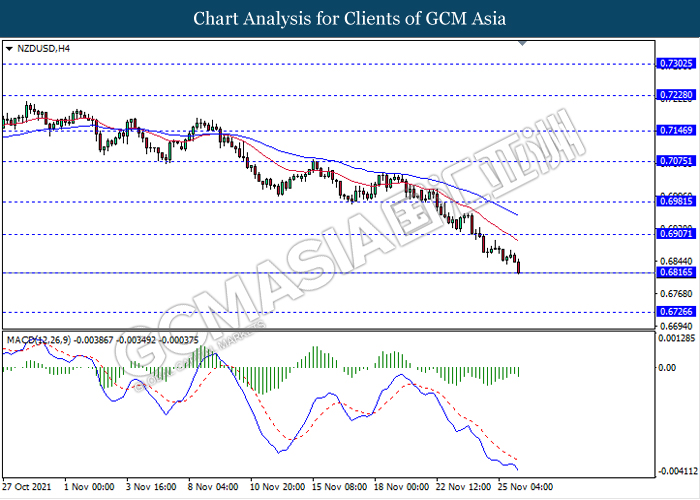

NZDUSD, H4: NZDUSD was traded lower while currently testing the support level 0.6815. MACD which illustrate persistent bearish momentum signal suggest the pair to extend its losses after it break below the support level 0.6815.

Resistance level: 0.6905, 0.6980

Support level: 0.6815, 0.6725

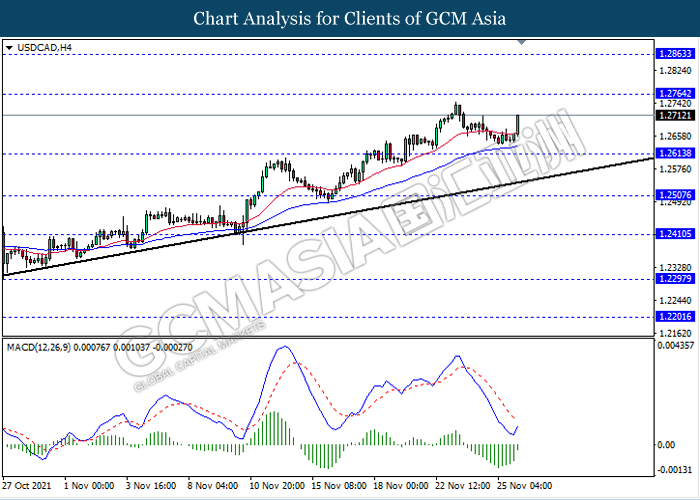

USDCAD, H4: USDCAD was traded higher following prior rebound form the support level 1.2615. MACD which illustrate diminishing bearish momentum signal suggest the pair to extend its gains towards the resistance level 1.2765.

Resistance level: 1.2765, 1.2865

Support level: 1.2615, 1.2505

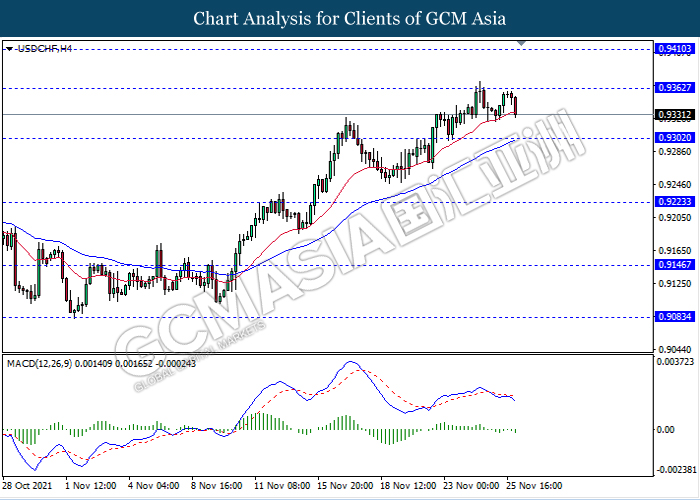

USDCHF, H4: USDCHF was traded lower following prior retracement from the resistance level 0.9360. MACD which illustrate bearish momentum signal with the formation of death cross suggest the pair to extend its losses towards the support level 0.9300.

Resistance level: 0.9360, 0.9410

Support level: 0.9300, 0.9225

CrudeOIL, H4: Crude oil price was traded lower while currently testing the support level 76.35. MACD which illustrate bearish bias signal with the formation of death cross suggest the pair to extend its losses after it breaks below the support level.

Resistance level: 79.15, 81.40

Support level: 76.30, 73.40

GOLD_, H4: Gold price remain traded in a sideway channel. However, MACD which illustrate bullish momentum signal with the formation of golden cross suggest the commodity to be traded higher in short term towards the resistance level 1807.85.

Resistance level: 1807.85, 1831.50

Support level: 1778.60, 1748.55