27 March 2023 Afternoon Session Analysis

Pound steadied as UK’s optimistic economic outlook.

Sterling held steady as Bank of England (BoE) Governor Andrew Bailey expressed optimism about the UK’s economic outlook. Bailey said in an interview broadcast on Friday that he expects Britain would now able to avoid recession this year although economic growth prospects remained subdued. Prior to this, the BoE expected the UK economy to shrink in the first quarter, but a series of official data published earlier in March showed the economy has returned to growth in Jan unexpectedly. Retail sales data released on Friday hit 1.2%, stronger than market expectation of 0.2%, higher than prior reading, based on the Britain’s Office for National Statistics. At the same time, the UK released its Composite PMI data last Friday, where the services PMI were positive at 52.8, above the 50-level threshold, while the manufacturing PMI slipped to 48.0, representing 8 months of contraction. Despite, the S&P Global said the improvement of confidence was reflected by an easing of post-Covid supply chain difficulties and raising in retail sales. The economists also revised their expectation of the UK economic outlook after the PMI survey showed a second month of rising output in March. As of writing the GBP/USD gained slightly by 0.02% to $1.2234.

In the commodity market, the crude oil prices were traded up by 0.95% to $69.91 per barrel after hitting the 15 month low as the market concerns over an economic slowdown. On the other side, the gold price dipped by -0.62% to $1988.90 per troy ounce as of writing amid investors locked in profits after substantial gains in bullion prices.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 16:00 | EUR – German Ifo Business Climate Index (Mar) | 91.1 | 91 | – |

Technical Analysis

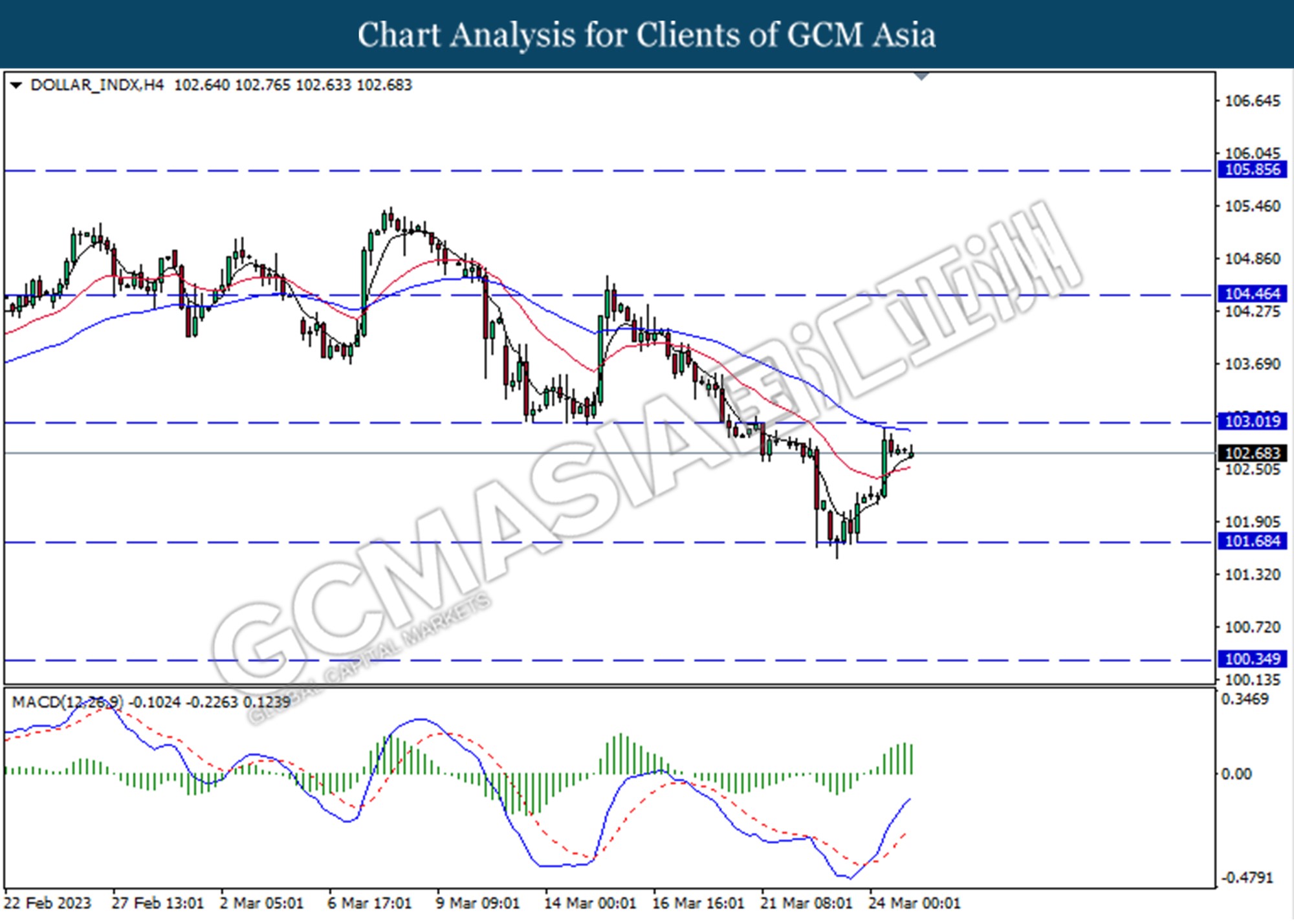

DOLLAR_INDX, H4: Dollar index was traded lower following a prior retracement from the higher level. MACD which illustrated decreasing bullish momentum suggests the index to extend its losses toward the support level at 101.70.

Resistance level: 103.00, 104.45

Support level: 101.70, 100.35

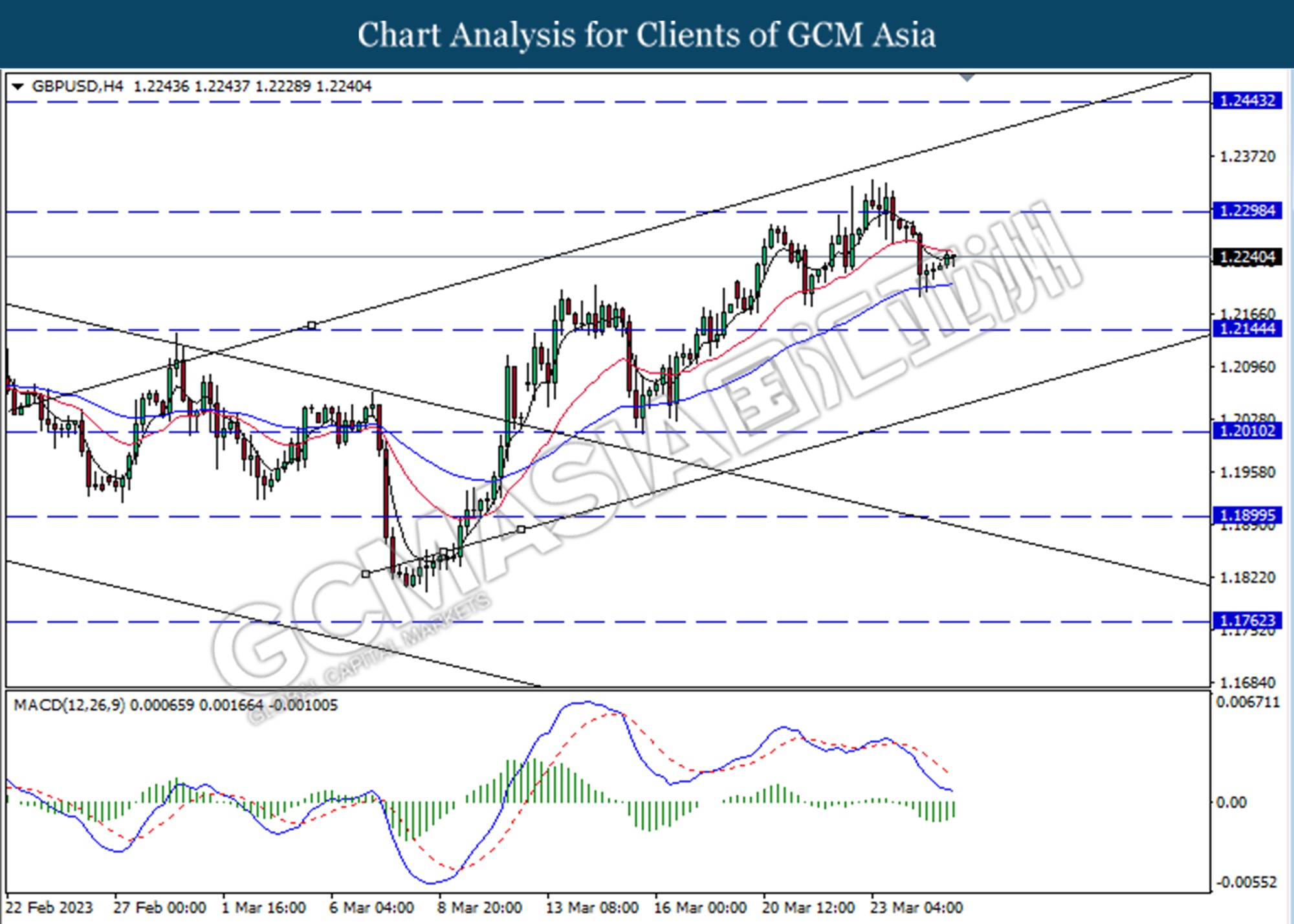

GBPUSD, H4: GBPUSD was traded lower following a prior rebound from the lower level. However, MACD which illustrated decreasing bearish momentum suggests the pair to be traded higher as technical correction.

Resistance level: 1.2300, 1.2445

Support level: 1.2145, 1.2010

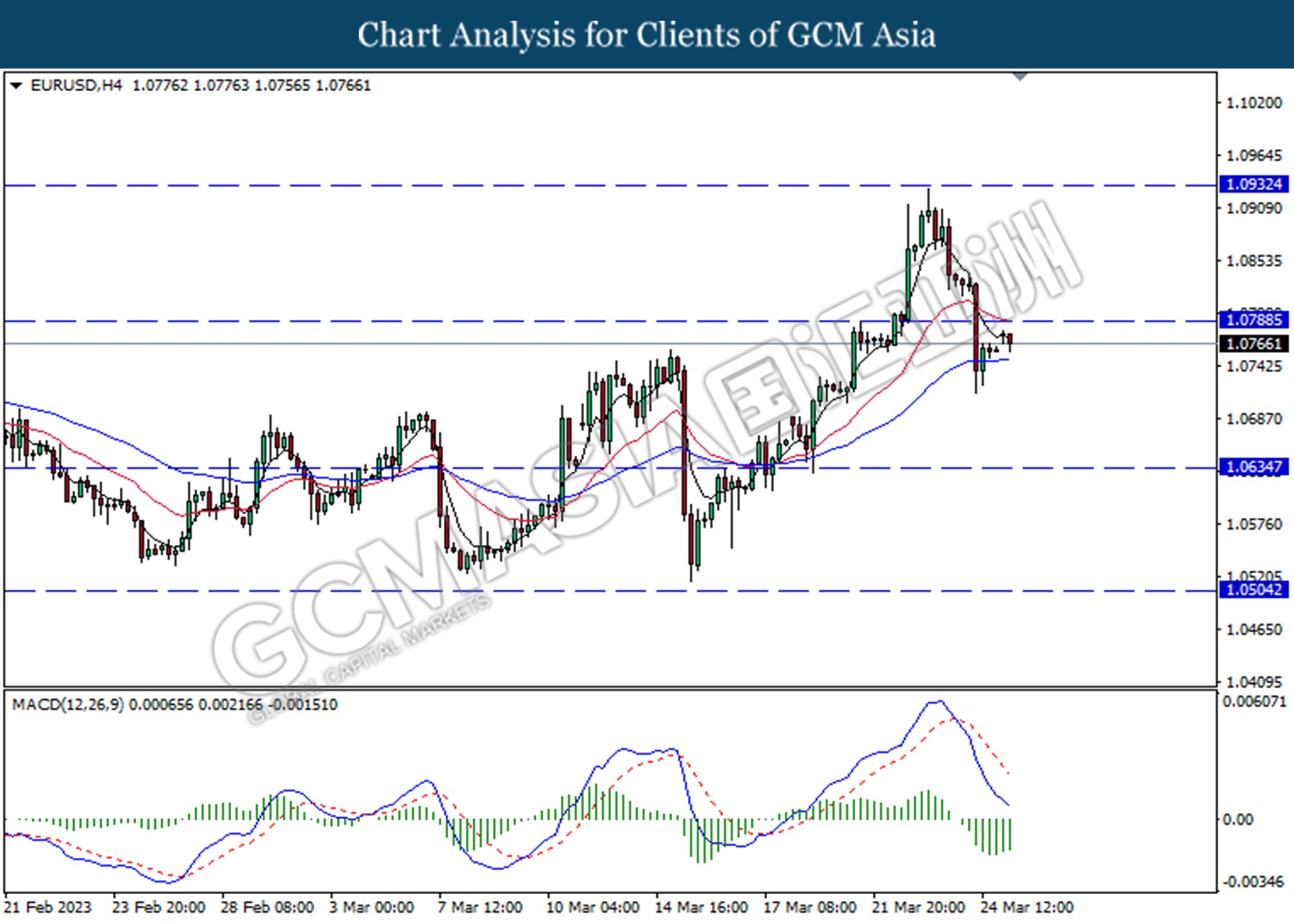

EURUSD, H4: EURUSD was traded lower following a prior retracement from the higher level. However, MACD which illustrated decreasing bearish momentum suggests the pair traded higher as technical correction.

Resistance level: 1.0790, 1.0930

Support level: 1.0635, 1.0505

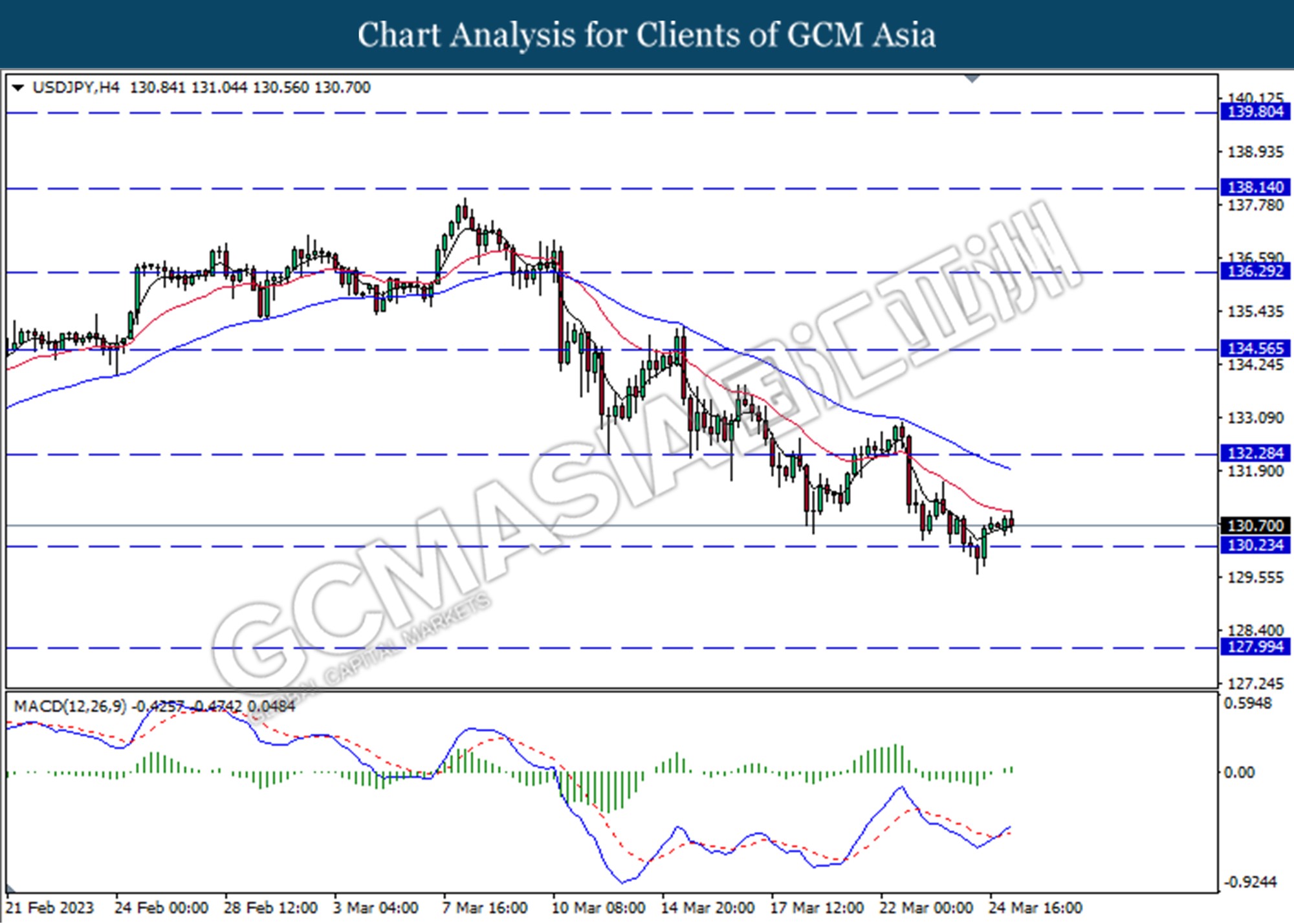

USDJPY, H4: USDJPY was traded lower following a prior retracement from the higher level. However, MACD which illustrated increasing bullish momentum suggests the pair to be traded higher as technical correction.

Resistance level: 132.30, 134.60

Support level: 130.25, 128.00

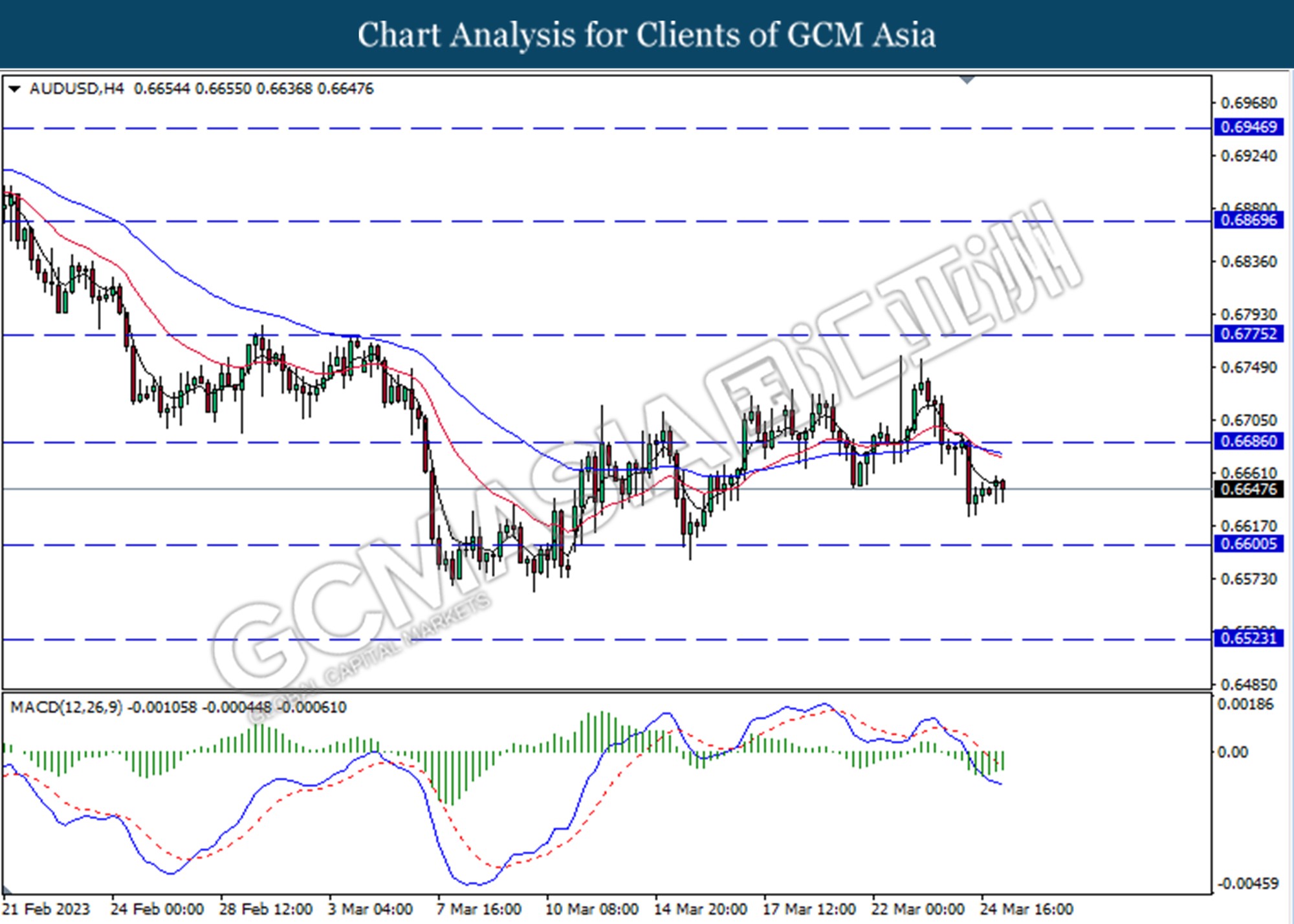

AUDUSD, H4: AUDUSD was traded lower following a prior retracement from the higher level. However, MACD which illustrated decreasing bearish momentum suggests the pair to undergo technical correction in the short term.

Resistance level: 0.6685, 0.6775

Support level: 0.6605, 0.6525

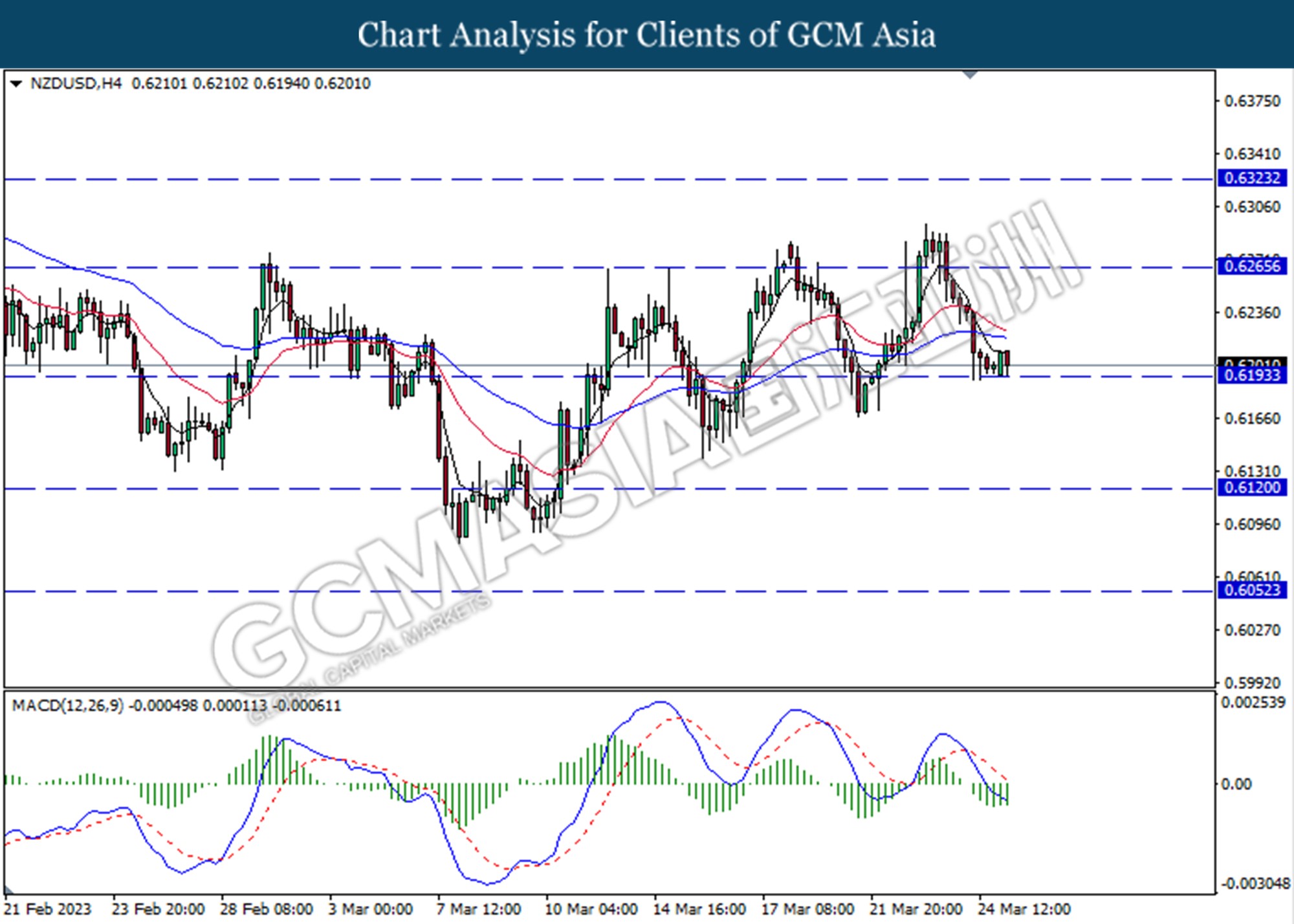

NZDUSD, H4: NZDUSD was traded lower while currently testing for the support level at 0.6195. However, MACD which illustrated decreasing bearish momentum suggests the pair to undergo technical correction in the short term.

Resistance level: 0.6265, 0.6320

Support level: 0.6195, 0.6120

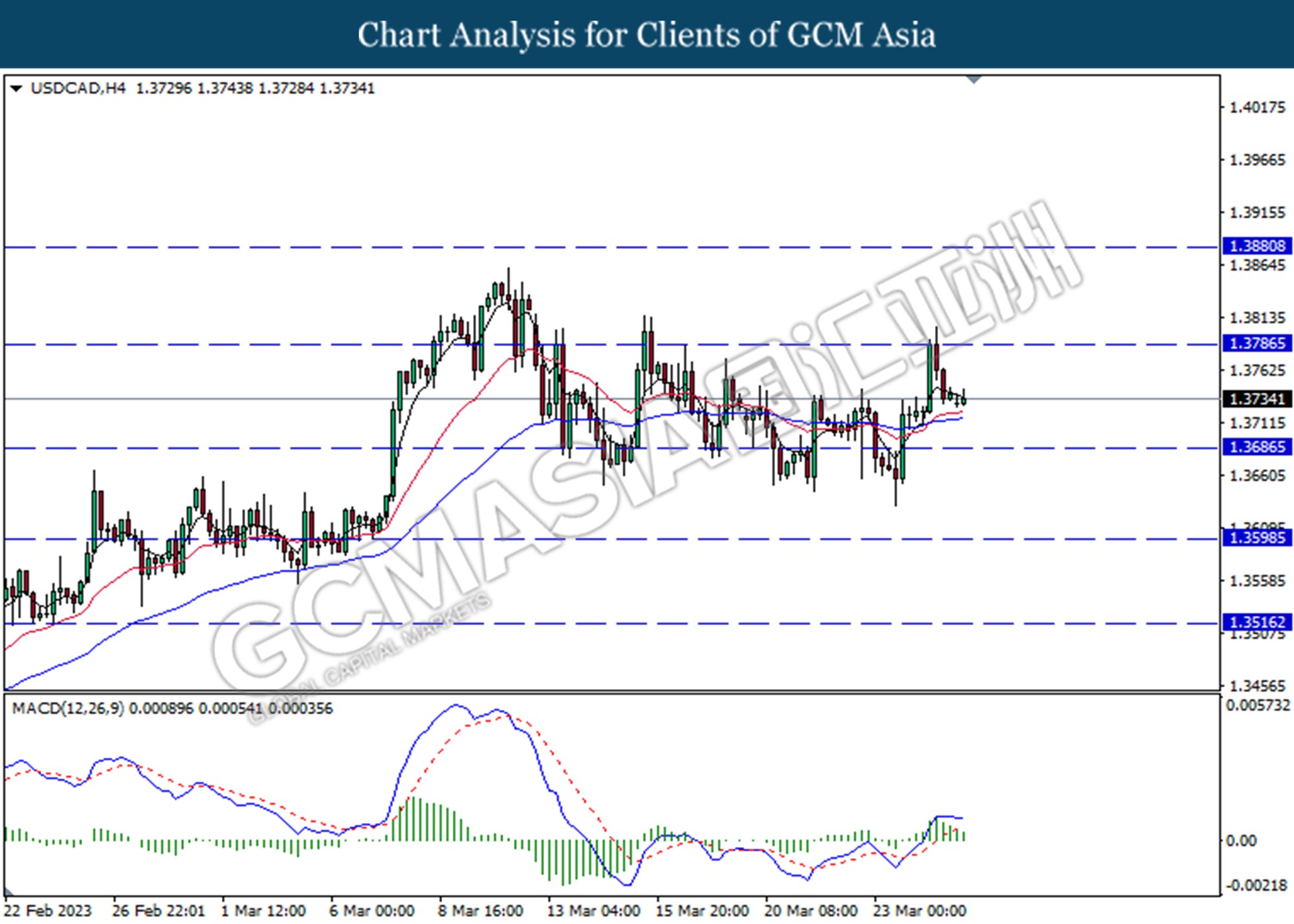

USDCAD, H4: USDCAD was traded higher following a prior rebound from the lower level. However, MACD which illustrated decreasing bullish momentum suggests the pair to traded lower as technical correction.

Resistance level: 1.3785, 1.3880

Support level: 1.3685, 1.3600

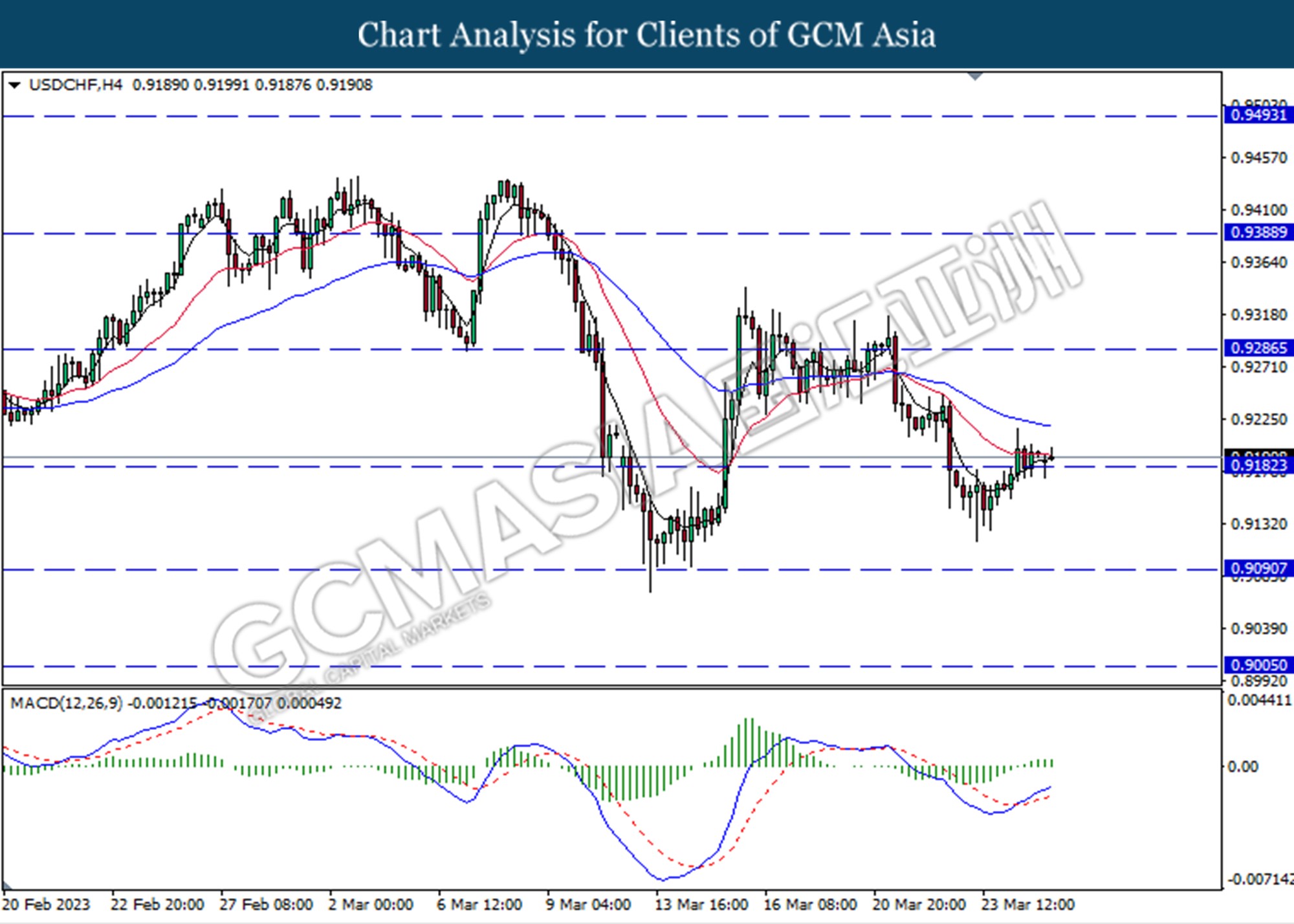

USDCHF, H4: USDCHF was traded lower following a prior retracement from the higher level. However, MACD which illustrated bullish momentum suggests the pair to undergo technical correction in the short term.

Resistance level: 0.9285, 0.9390

Support level: 0.9180, 0.9090

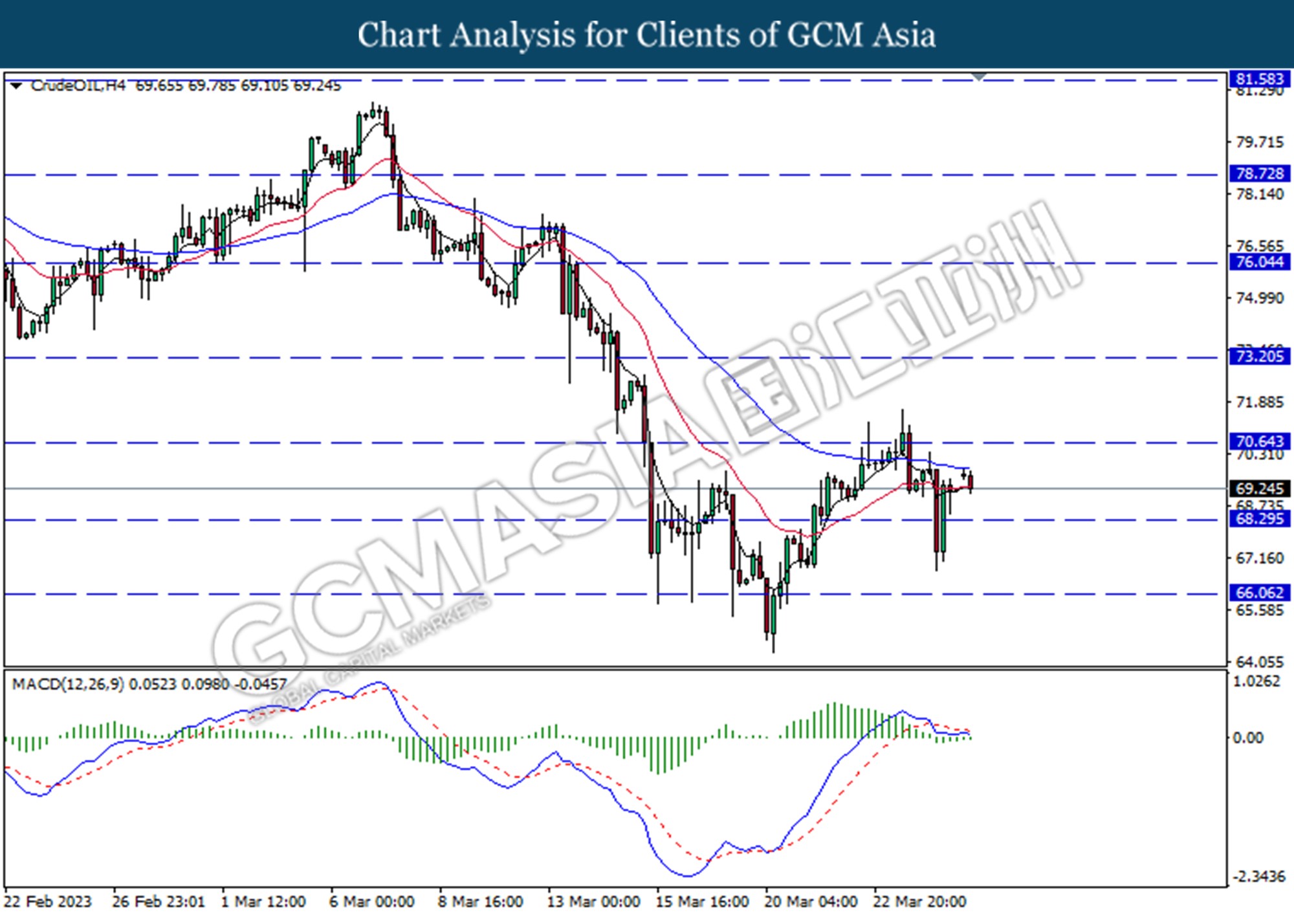

CrudeOIL, H4: Crude oil price was traded lower following retracement from the higher level. MACD which illustrated decreasing bullish momentum suggests the commodity to extend its losses toward the support level at 68.30

Resistance level: 70.65, 73.20

Support level: 68.20, 66.05

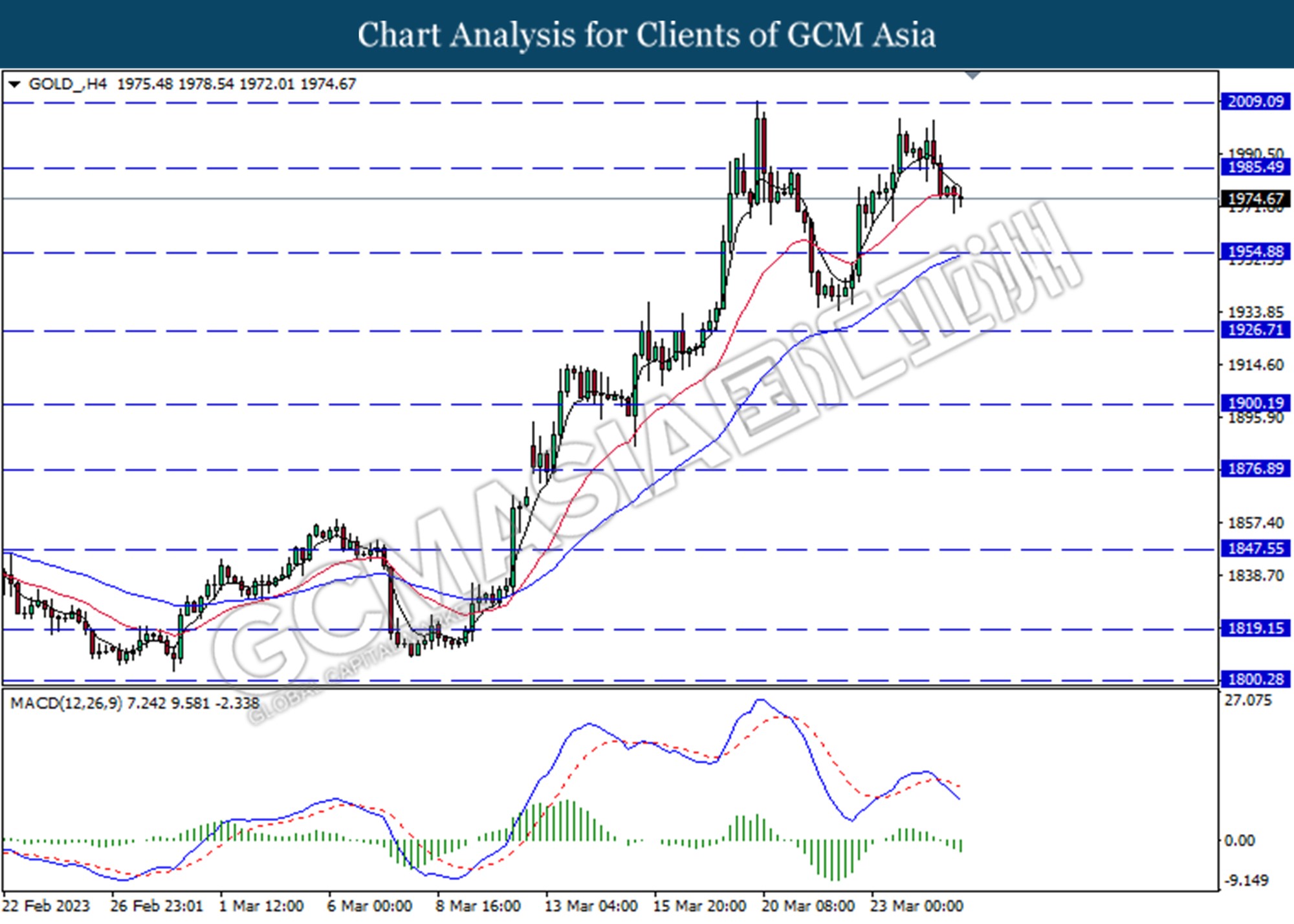

GOLD_, H4: Gold price was traded lower following a prior break below from the previous support level at 1985.50. MACD which illustrated increasing bearish momentum suggests the commodity to extend its losses toward the support level at 1954.90.

Resistance level: 1985.50, 2009.10

Support level: 1954.90, 1926.70