27 March 2023 Morning Session Analysis

US Dollar boosted as market’s risk-aversion raised.

The Dollar Index which traded against a basket of six major currencies found its ground on Friday following the fresh fears among the European banking sector. According to Reuters, the cost of insuring the Deutsche Bank’s debt against the risk of default rose higher than a four-year high, leading the share of the bank slumped on the day. Deutsche Bank’s credit default swaps (CDS) – a form of insurance for bondholders, had shot up above 220 basis points from 142 bps just two days ago, which is the most since late 2018, based on data from S&P Market Intelligence. With that, it indicated that the European banks would likely to face a financial crisis that could lead to bankruptcy, just as Silicon Valley Bank and Signature Bank did two weeks ago. Consequences, Euro has lost the eye of investors, as well as the market participants are preferring to purchase safe-haven dollar. On the other hand, the hawkish statement presented by Fed officials had also extended the gains of US Dollar. Federal Reserve Bank of St. Louis President James Bullard claimed on Friday that the current inflation in the US has declined, but it still higher than the headline measure. As of writing, the Dollar Index dropped by 0.09% to 102.70.

In the commodity market, the crude oil price appreciates by 0.48% to $69.59 per barrel as of writing following the Iraq has stopped its oil exports after it won a longstanding arbitration case against Turkey. In addition, the gold price depreciated by 0.33% to $1974.19 per troy ounce as of writing over the strengthening of US Dollar.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 16:00 | EUR – German Ifo Business Climate Index (Mar) | 91.1 | 91 | – |

Technical Analysis

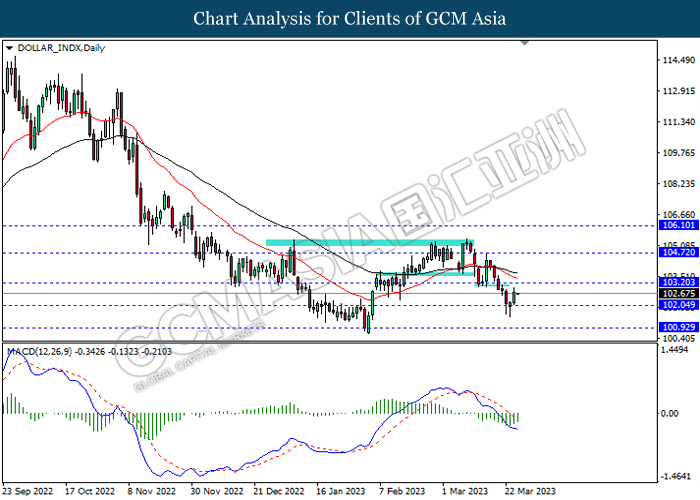

DOLLAR_INDX, Daily: Dollar index was traded higher following prior rebound from the support level. MACD which illustrated decreasing bearish momentum suggest the index to extend its gains.

Resistance level: 103.20, 104.70

Support level: 102.05, 100.90

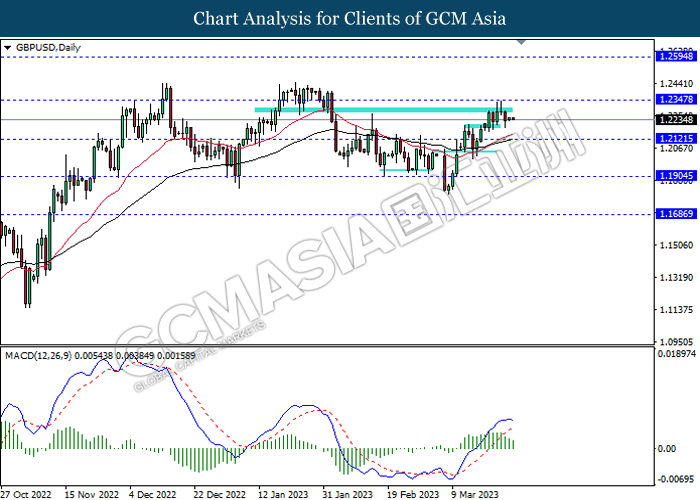

GBPUSD, Daily: GBPUSD was traded higher following prior breakout the previous resistance level. However, MACD which illustrated decreasing bullish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 1.2345, 1.2595

Support level: 1.2120, 1.1905

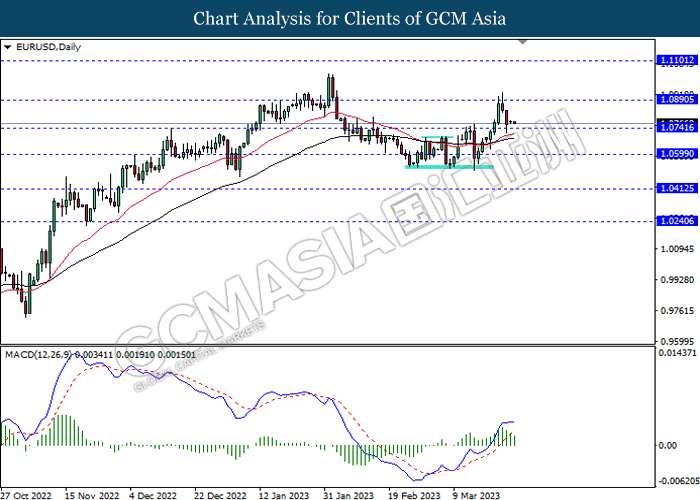

EURUSD, Daily: EURUSD was traded lower while currently testing the support level. MACD which illustrated decreasing bullish momentum suggest the pair to extend its losses if successfully breakout the support level.

Resistance level: 1.0890, 1.1100

Support level: 1.0740, 1.0600

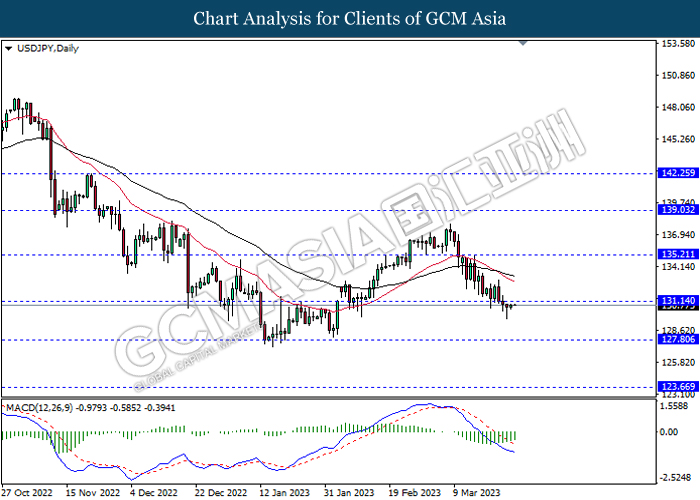

USDJPY, Daily: USDJPY was traded lower following prior breakout below the previous support level. However, MACD which illustrated decreasing bearish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 131.15, 135.20

Support level: 127.80, 123.65

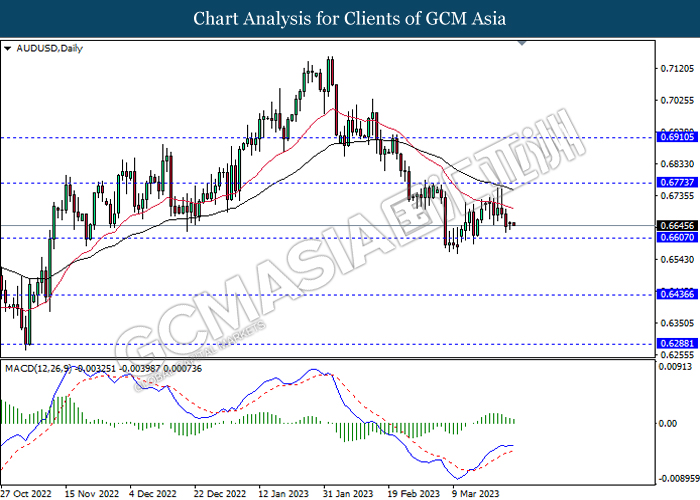

AUDUSD, Daily: AUDUSD was traded lower while currently testing the support level. MACD which illustrated decreasing bullish momentum suggest the pair to extend its losses if successfully breakout the support level.

Resistance level: 0.6775, 0.6910

Support level: 0.6605, 0.6435

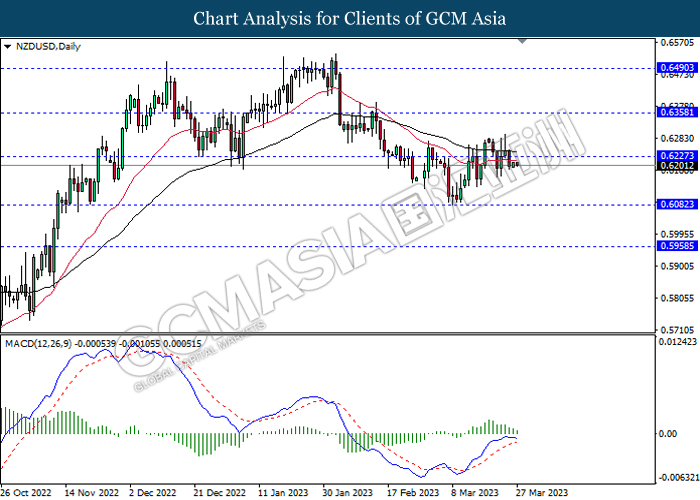

NZDUSD, Daily: NZDUSD was traded lower following prior breakout below the previous support level. MACD which illustrated decreasing bullish momentum suggest the pair to extend its losses.

Resistance level: 0.6225, 0.6360

Support level: 0.6080, 0.5960

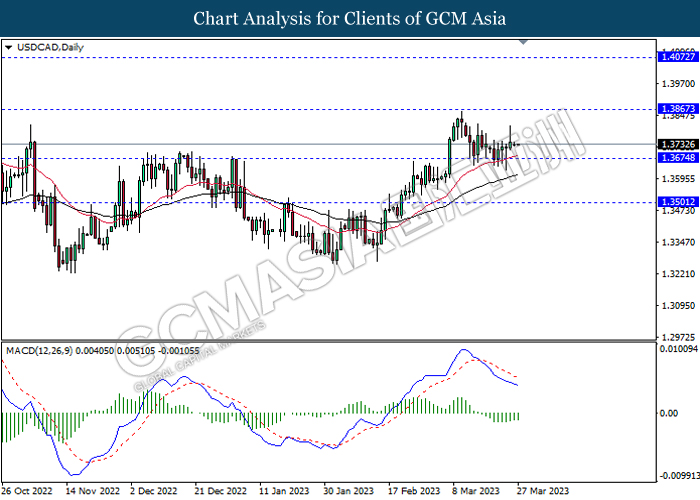

USDCAD, Daily: USDCAD was traded higher following prior rebound from the support level. MACD which illustrated decreasing bearish momentum suggest the pair to extend its gains.

Resistance level: 1.3865, 1.4070

Support level: 1.3675, 1.3500

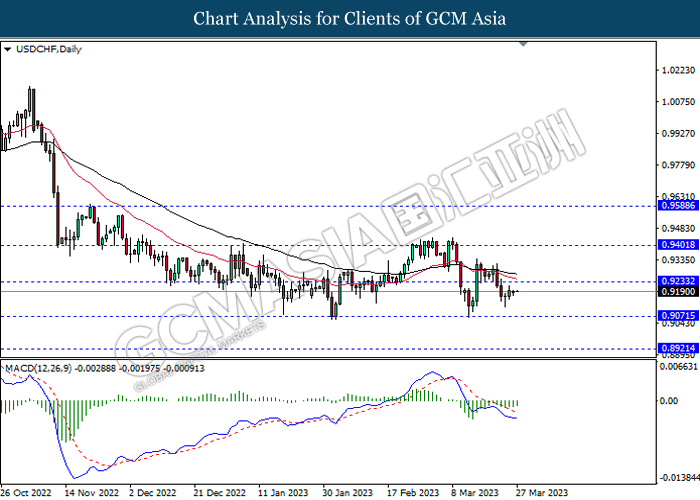

USDCHF, Daily: USDCHF was traded lower following prior breakout below the previous support level. However, MACD which illustrated decreasing bearish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 0.9235, 0.9400

Support level: 0.9070, 0.8920

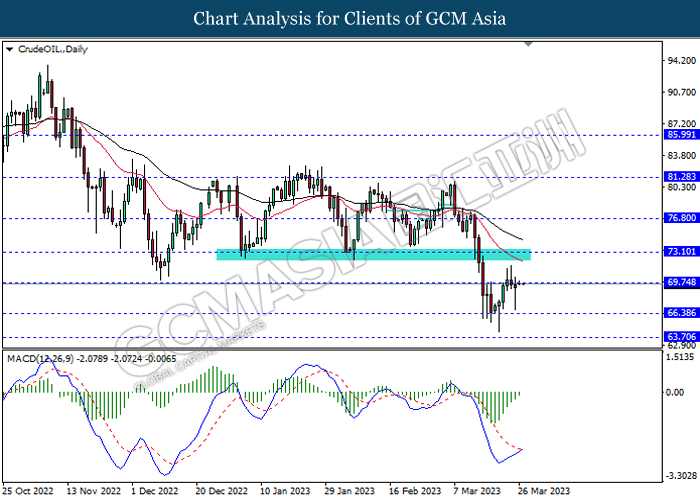

CrudeOIL, Daily: Crude oil price was traded higher while currently testing the resistance level. MACD which illustrated decreasing bearish momentum suggest the commodity to extend its gains if successfully breakout the resistance level.

Resistance level: 69.75, 73.10

Support level: 66.40, 63.70

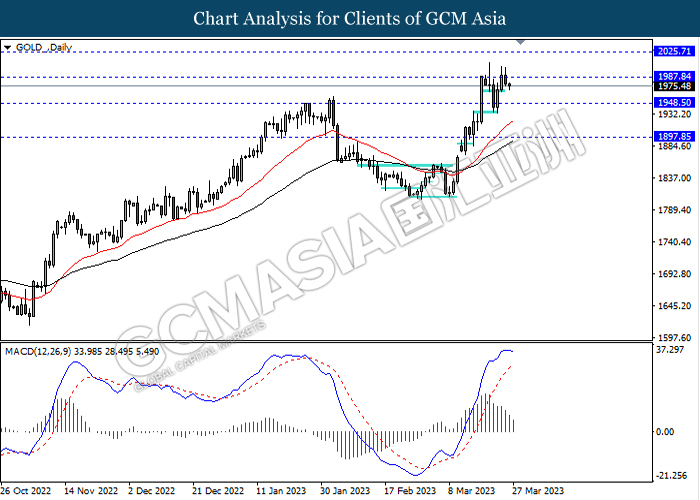

GOLD_, Daily: Gold price was traded lower following prior retracement from the resistance level. MACD which illustrated decreasing bullish momentum suggest the commodity to extend its losses.

Resistance level: 1987.85, 2025.70

Support level: 1948.50, 1897.85