27 June 2022 Afternoon Session Analysis

GBPUSD rose over the upbeat economic data.

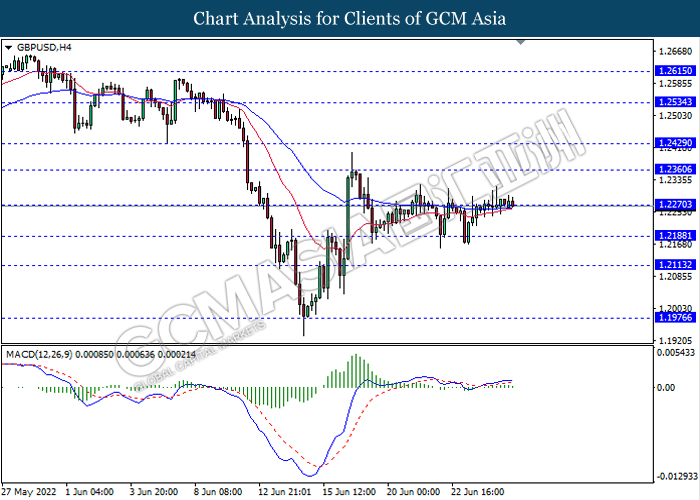

The GBPUSD edged up on Monday amid the backdrop of bullish economic data. According to Office for National Statistics, the UK Retail Sales MoM for May came in at the reading of -0.5%, exceeding the market forecast of -0.7%. The higher-than expected reading indicated that the recovery of UK retail sales market in UK, which brought positive prospects toward the economic progression in UK region. Nonetheless, the overall movement of GBPUSD is now relatively slower as the market participants overhe market participants ively slowerare still waiting the unleash of GDP data in upcoming Thursday. The GDP data would show the market value of all the finished goods and services produced within a country while it would figure out the economic health. Thus, investors would not rush to invest as they are eyeing on the GDP data in order to receive further trading signals. As of writing, GBPUSD appreciated by 0.09% to 1.2273.

In commodities market, crude oil price depreciated by 0.03% to $107.59 per barrel as of writing following the Leaders of the Group of Seven rich democracies are having “very constructive” discussions on a possible cap on Russian oil imports, according to the German government official speech on Saturday. Besides, gold price rallied by 0.38% to $1837.25 per troy ounce as of writing following the weakening of US Dollar.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 20:30 | USD – Durable Goods Orders (MoM) (May) | 0.4% | 0.3% | – |

| 22:00 | USD – Pending Home Sales (MoM) (May) | -3.9% | -4.0% | – |

Technical Analysis

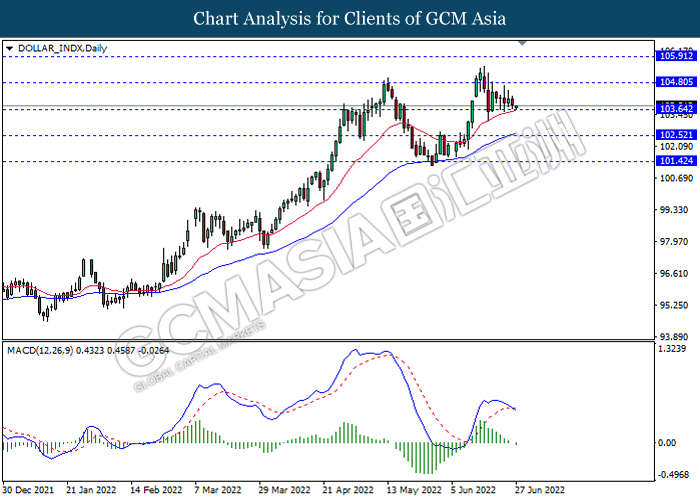

DOLLAR_INDX, Daily: Dollar index was traded lower while currently testing the support level. MACD which illustrated increasing bearish momentum suggest the index to extend its losses if successfully breakout the support level.

Resistance level: 104.80, 105.90

Support level: 103.65, 102.50

GBPUSD, H4: GBPUSD was traded lower while currently testing the support level. MACD which illustrated decreasing bullish momentum suggest the pair to extend its losses if successfully breakout the support level.

Resistance level: 1.2360, 1.2430

Support level: 1.2270, 1.2190

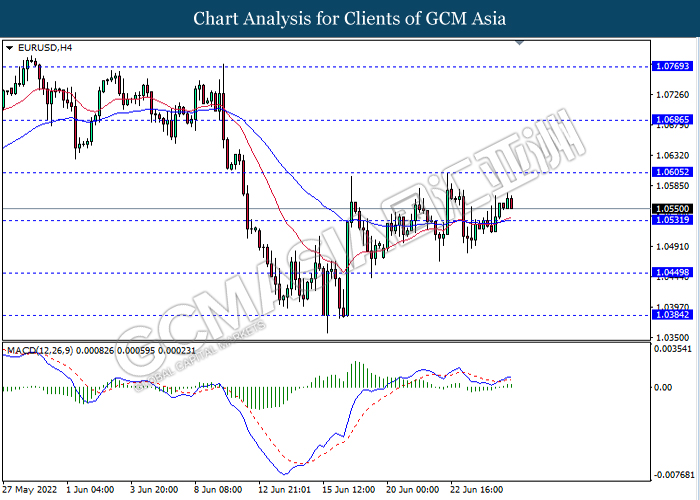

EURUSD, H4: EURUSD was traded higher following prior breakout above the previous resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains.

Resistance level: 1.0605, 1.0685

Support level: 1.0530, 1.0450

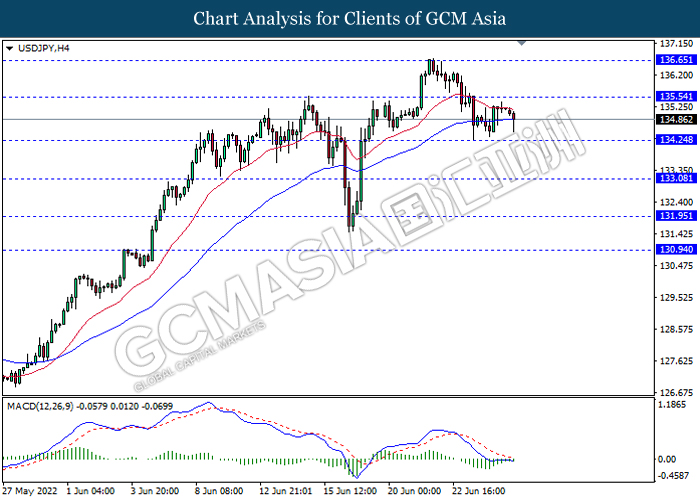

USDJPY, H4: USDJPY was traded lower following prior breakout below the previous support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses.

Resistance level: 135.55, 136.65

Support level: 134.25, 133.10

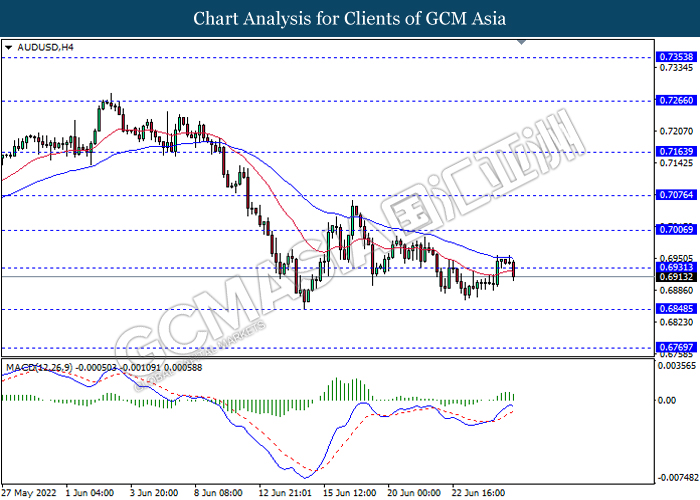

AUDUSD, H4: AUDUSD was traded lower following prior breakout below the previous support level. MACD which illustrated decreasing bullish momentum suggest the pair to extend its losses.

Resistance level: 0.6930, 0.7005

Support level: 0.6850, 0.6770

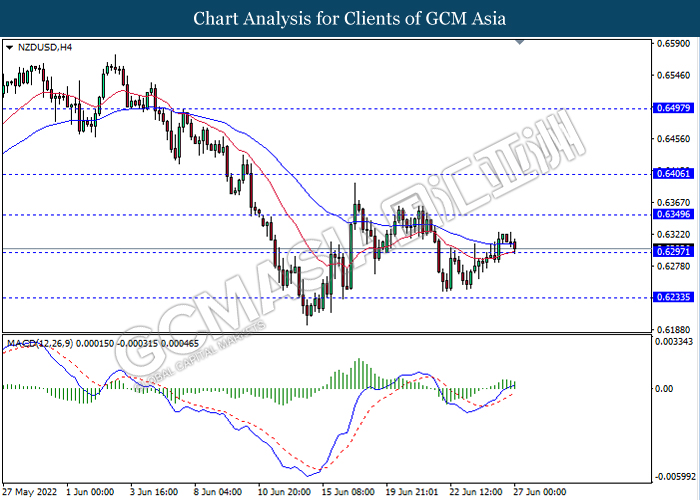

NZDUSD, H4: NZDUSD was traded lower while currently testing the support level. MACD which illustrated decreasing bullish momentum suggest the pair to extend its losses if successfully breakout the support level.

Resistance level: 0.6350, 0.6405

Support level: 0.6295, 0.6235

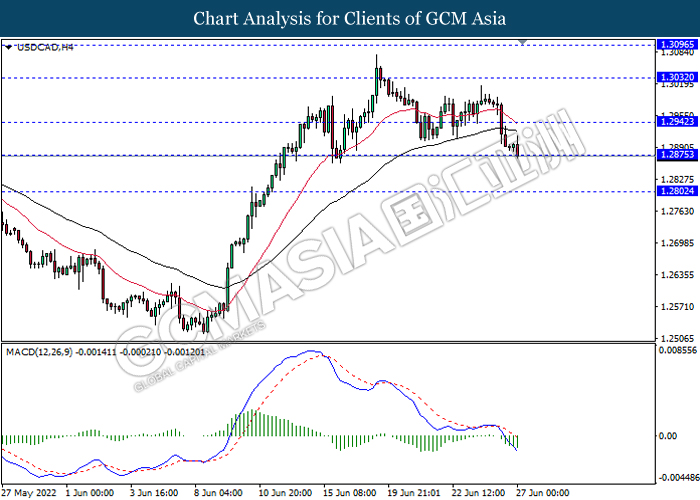

USDCAD, H4: USDCAD was traded lower while currently testing the support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses if successfully breakout the support level.

Resistance level: 1.2940, 1.3030

Support level: 1.2875, 1.2800

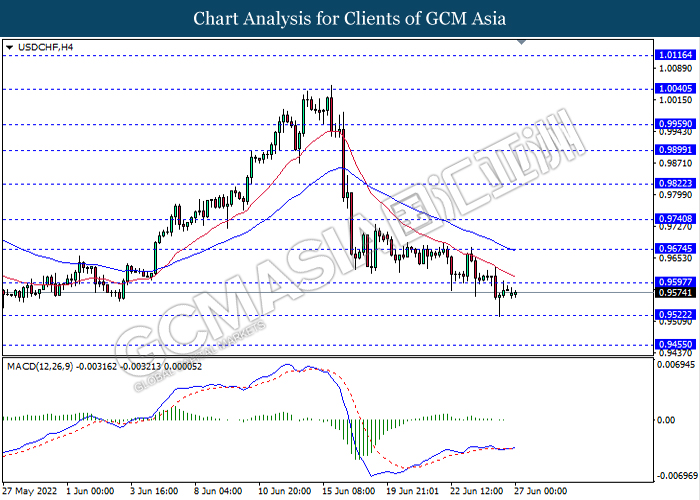

USDCHF, H4: USDCHF was traded lower following prior breakout below the previous support level. MACD which illustrated decreasing bullish momentum suggest the pair to extend its losses.

Resistance level: 0.9595, 0.9675

Support level: 0.9520, 0.9455

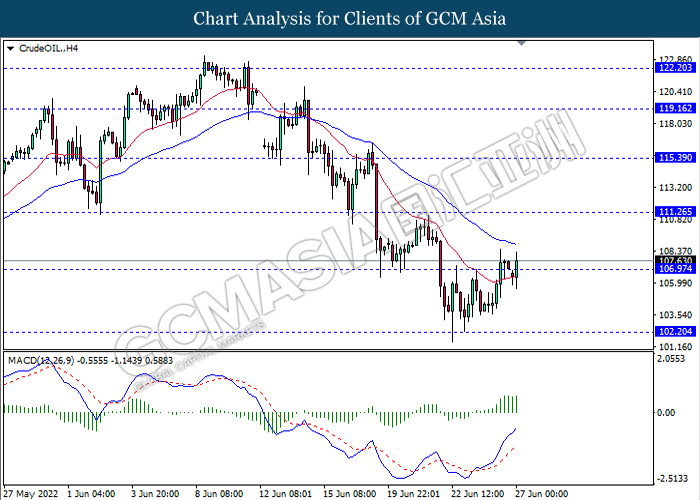

CrudeOIL, H4: Crude oil price was traded higher following prior breakout above the previous resistance level. MACD which illustrated increasing bullish momentum suggest the commodity to extend its gains.

Resistance level: 111.25, 115.40

Support level: 106.95, 102.20

GOLD_, H4: Gold price was traded higher following prior breakout above the previous resistance level. However, MACD which illustrated increasing bullish momentum suggest the commodity to extend its gains.

Resistance level: 1841.85, 1855.00

Support level: 1829.90, 1819.70