27 June 2022 Morning Session Analysis

US Dollar retreated amid easing inflation fears.

The Dollar Index was traded lower last week as market participants assessed the prospect of major central bank rate hikes to curb spiking inflation rate. The diminishing in oil and commodity prices last week had eased inflation fears while sparkling further risk appetite in the global financial market, prompting investors to shift their portfolio toward the riskier equity markets. In addition, easing inflation risk had diminished the odds for the Federal Reserve to implement tightening monetary policy in future. As for now, US Fed Fund Futures on Friday speculated a 73% probability of 75 basis point rate hike at July meeting. Though, the overall statement from the Fed’s Monetary Policy Committee (MPC) skewed to hawkish tone despite the recession risk continue to linger in the global financial market. As for now, investors would still eye on the latest monetary policy decision from Fed as well as the crucial economic data to receive further trading signal. As of writing, the Dollar Index depreciated by 0.17% to 104.00.

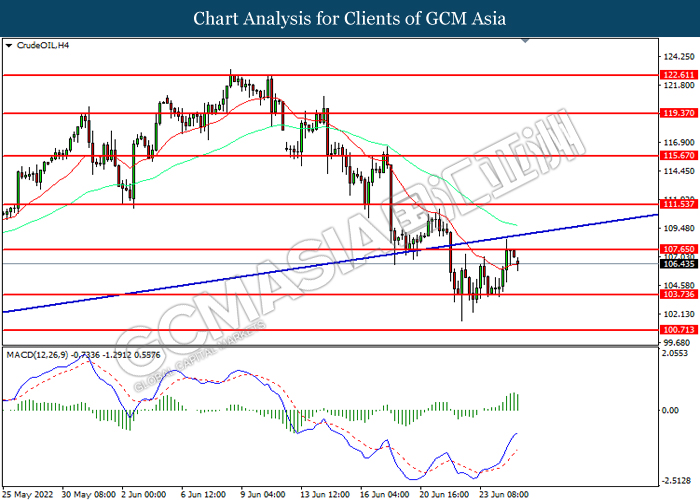

In the commodities market, the crude oil price slumped 0.96% to $106.20 per barrel amid technical correction in the early Asian trading session. Nonetheless, the oil price rebounded on last week amid the rising tensions between the Russia-Ukraine issues continue to spur bullish momentum on this black-commodity. On the other hand, the gold price surged 0.20% to $1832.00 per troy ounces as of writing following the Group of Seven claimed that they will announce a ban on gold imports from Russia on Tuesday.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 20:30 | USD – Durable Goods Orders (MoM) (May) | 0.4% | 0.3% | – |

| 22:00 | USD – Pending Home Sales (MoM) (May) | -3.9% | -4.0% | – |

Technical Analysis

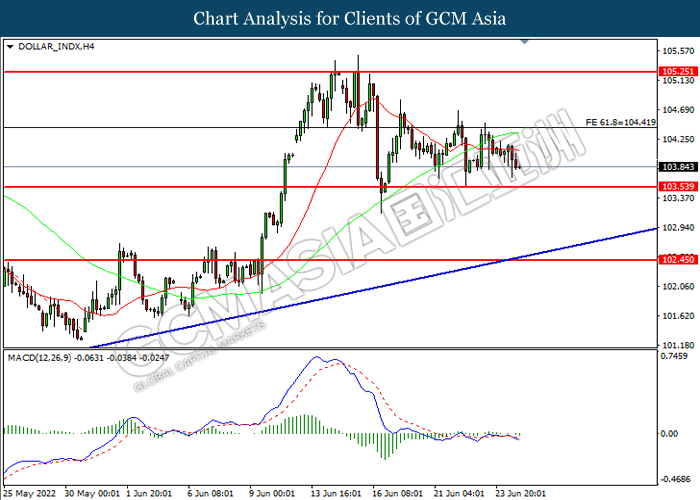

DOLLAR_INDX, H4: Dollar index was traded lower following prior retracement from the resistance level. MACD which illustrated increasing bearish momentum suggest the index to extend its losses toward support level.

Resistance level: 104.40, 105.25

Support level: 103.55, 102.45

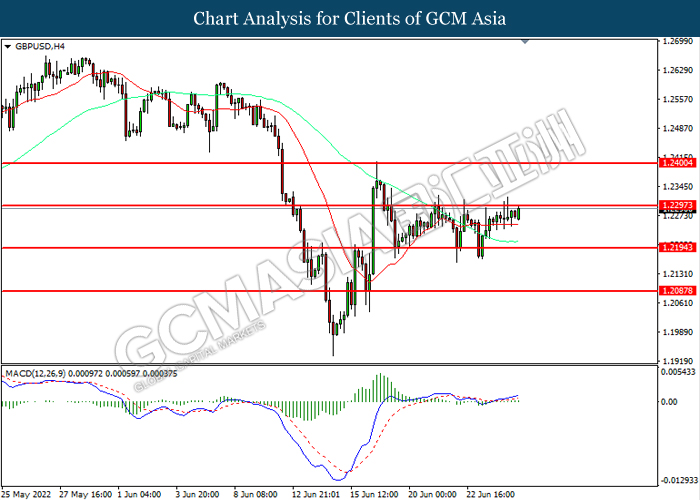

GBPUSD, H4: GBPUSD was traded higher while currently testing the resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains after breakout.

Resistance level: 1.2295, 1.2400

Support level: 1.2195, 1.2085

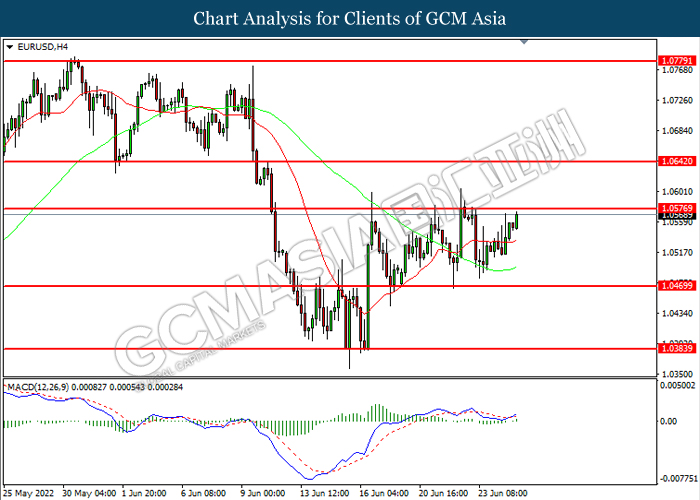

EURUSD, H4: EURUSD was traded higher while currently testing the resistance level. MACD which illustrated increasing bearish momentum suggest the pair to extend its gains after breakout.

Resistance level: 1.05675, 1.0640

Support level: 1.0470, 1.0385

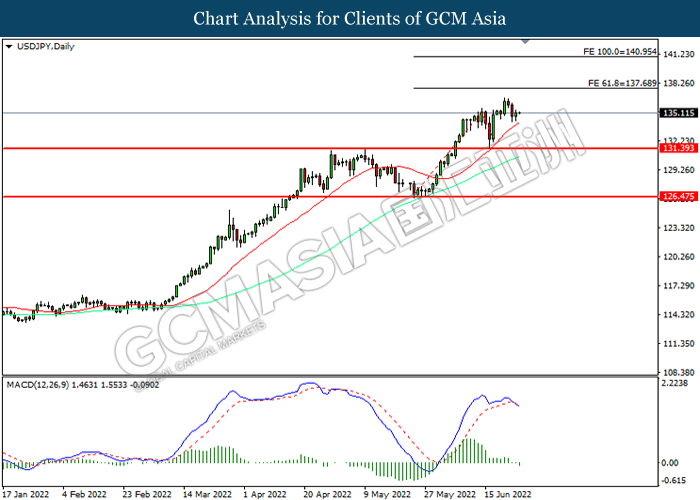

USDJPY, Daily: USDJPY was traded higher while currently testing the resistance level. However, MACD which illustrated increasing bearish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 137.70, 140.95

Support level: 131.40, 126.45

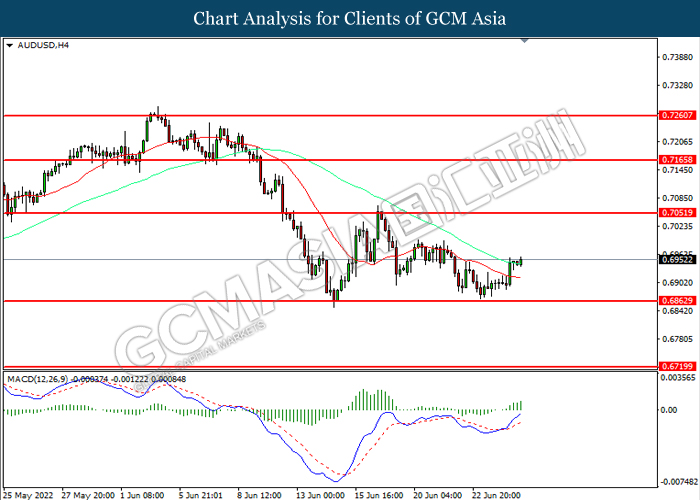

AUDUSD, H4: AUDUSD was traded higher following prior rebounded from the support level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains.

Resistance level: 0.7050, 0.7165

Support level: 0.6865, 0.6720

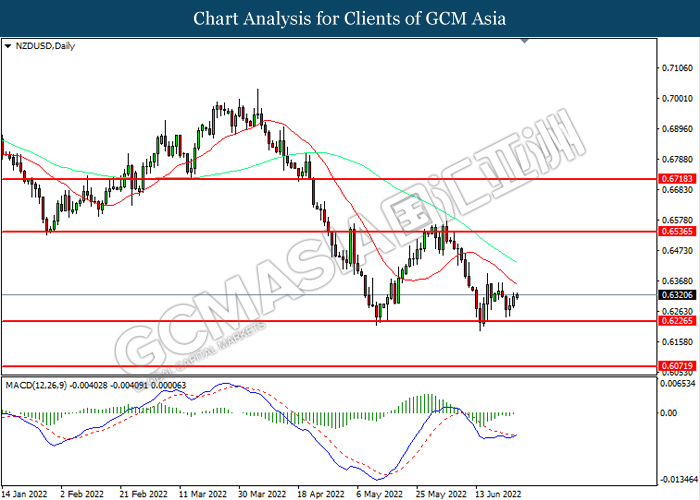

NZDUSD, Daily: NZDUSD was traded lower while currently testing the support level. However, MACD which illustrated diminishing bearish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 0.6535, 0.6720

Support level: 0.6225, 0.6070

USDCAD, H4: USDCAD was traded lower following prior retracement from the resistance level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses toward support level.

Resistance level: 1.2975, 1.3050

Support level: 1.2860, 1.2765

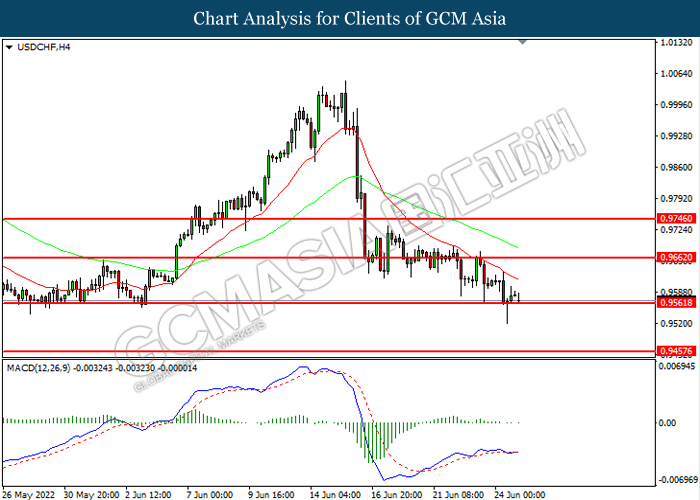

USDCHF, H4: USDCHF was traded lower while currently testing the support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses after breakout.

Resistance level: 0.9660, 0.9745

Support level: 0.9560, 0.9460

CrudeOIL, H4: Crude oil price was traded higher while currently testing the resistance level. However, MACD which illustrated diminishing bullish momentum suggest the commodity to be traded lower as technical correction.

Resistance level: 107.65, 111.55

Support level: 103.75, 100.70

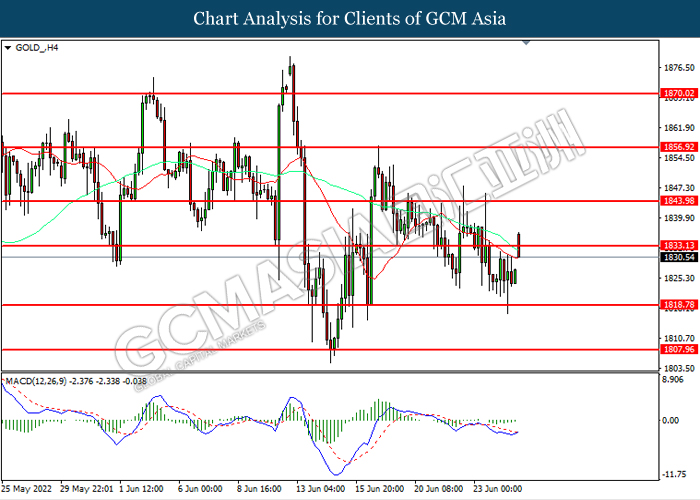

GOLD_, H4: Gold price was traded higher while currently testing the resistance level. MACD which illustrated diminishing bearish momentum suggest the commodity to extend its gains after breakout.

Resistance level: 1835.15, 1844.00

Support level: 1818.80, 1807.95