27 July 2020 Morning Session Analysis

Dollar plunged amid the weakness of its economy.

Dollar index which gauge its value against a basket of six major currencies loss its grip while further extend its losses to the lowest level in nearly 2 years as US economy stalling and high geopolitical risk urged investor to run away from dollar market. Since the outbreak of Covid-19, US economy has been tampered by the virus’s fallout significantly as strictly imposition of country lockdown from local government has sent the entire economy into freezing stage. Besides, recent economic data from US has also showed no sign of strong recovery to be happened in near term as the pandemic in US remains while total reported cases surpassed 4 million as of last week. Moreover, it is also noteworthy that the prospect of greenback market remains faded as investors are expecting Washington will fork out trillions of money to limit the viral damage which caused by the pandemic. Last but not least, investor are also eyeing on the development of tension between US and China in order to determine the direction of greenback. As of now, dollar index dropped 0.10% to 94.35.

In the commodities market, crude oil price depreciated by 0.70% to $41.00 per barrel as market worries over the pandemic overshadowed the previous gains of this black commodity product. However, the development of vaccine is still the main catalyst to determine the oil market future. Besides, gold price rose 0.35% to 1906.65 a troy ounce amid uncertainty risk of pandemic and US-Sino issue remain unsolved.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 16:00 | EUR – German Ifo Business Climate Index (Jul) | 86.2 | 89.3 | – |

| 20:30 | USD – Core Durable Goods Orders (MoM)(Jun) | 3.7% | 3.5% | – |

Technical Analysis

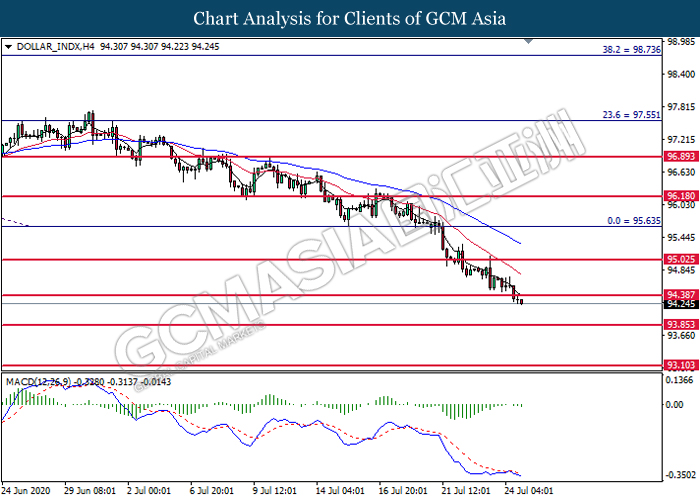

DOLLAR_INDX, H4: Dollar index was traded lower following recent breakout below the previous support level 94.40. MACD which illustrate bearish bias momentum signal suggest the dollar to extend its losses toward the support level at 93.85.

Resistance level: 94.40, 95.00

Support level: 93.85, 93.10

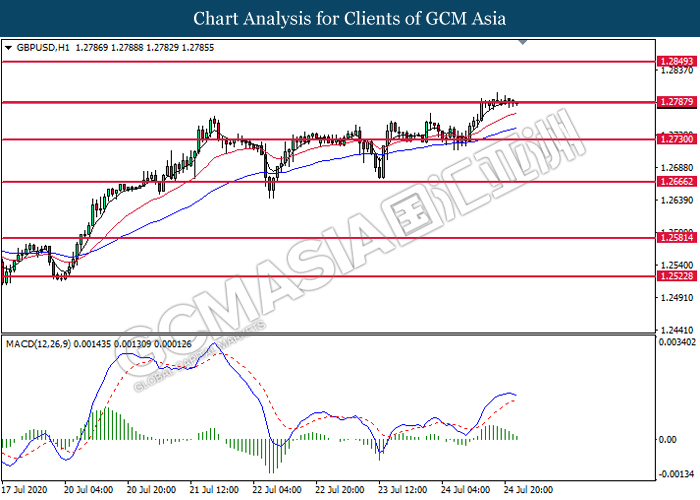

GBPUSD, H1: GBPUSD was traded higher while currently testing the resistance level at 1.2790. However, MACD which illustrate diminishing bullish momentum signal suggest the pair to be traded lower in short term toward the support level at 1.2730.

Resistance level: 1.2790, 1.2850

Support level: 1.2730, 1.2665

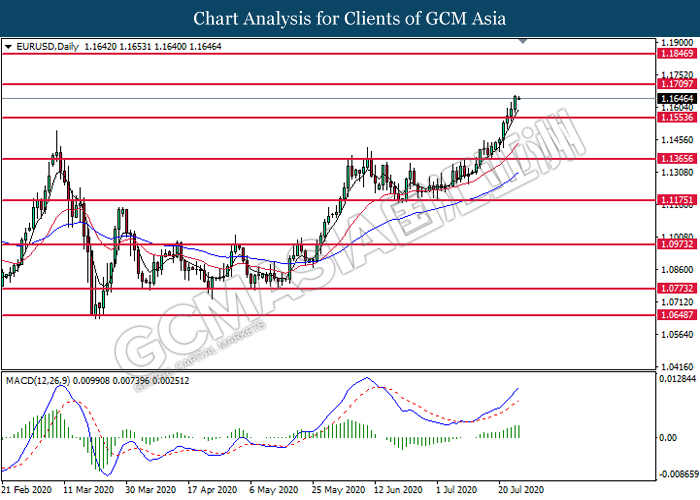

EURUSD, Daily: EURUSD was traded higher following prior breakout above the previous resistance level at 1.1555. MACD which illustrate bullish momentum suggest the pair to extend its gains toward the resistance level at 1.1710.

Resistance level: 1.1710, 1.1845

Support level: 1.1555, 1.1365

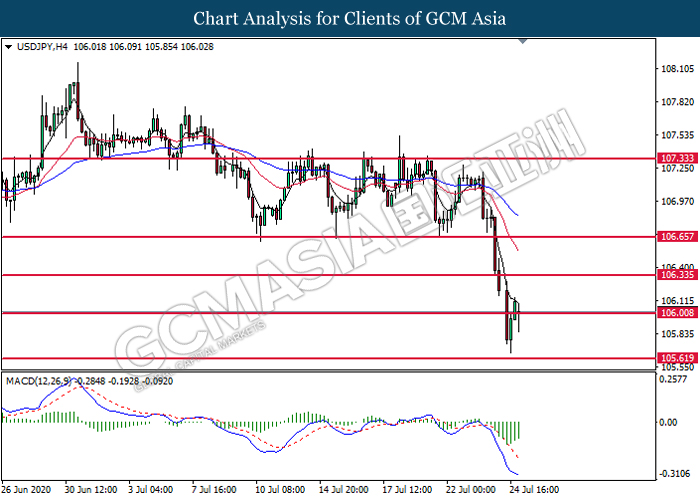

USDJPY, H4: USDJPY was traded lower while currently testing near the support level at 106.00. MACD which illustrate diminishing bearish momentum signal suggest the pair to be traded higher in short term.

Resistance level: 106.35, 106.65

Support level: 106.00, 105.60

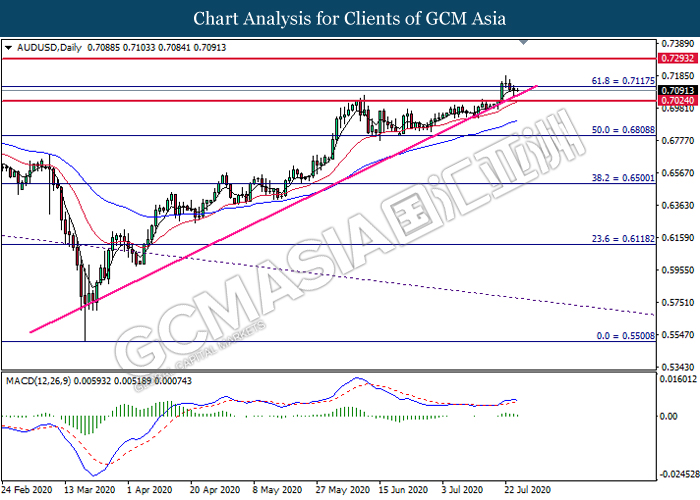

AUDUSD, Daily: AUDUSD was traded lower following prior retracement from the resistance level at 0.7115. MACD which illustrate diminishing bullish momentum signal suggest the pair to extend its losses toward the support level at 0.7025.

Resistance level: 0.7115, 0.7295

Support level: 0.7025, 0.6810

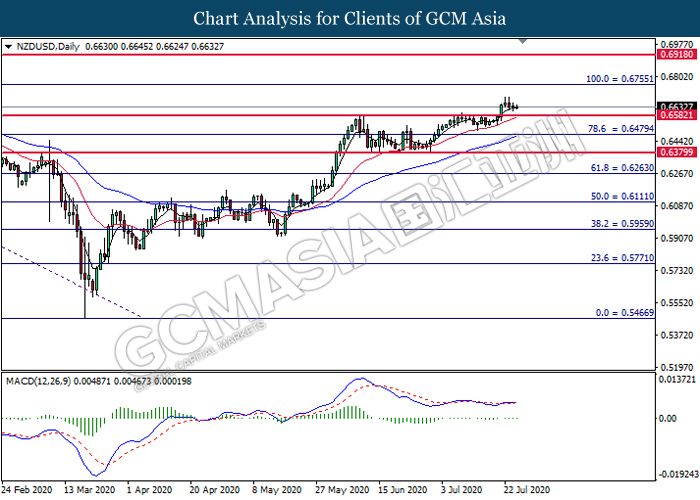

NZDUSD, Daily: NZDUSD was traded higher following prior breakout above the previous resistance level at 0.6580. Due to lack of signal from MACD, it is suggested to wait for further confirmation before entering into the market.

Resistance level: 0.6755, 0.6920

Support level: 0.6580, 0.6480

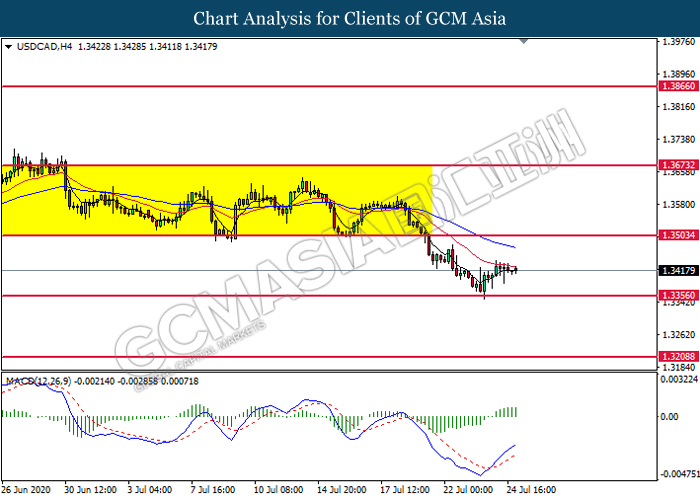

USDCAD, H4: USDCAD was traded higher following prior rebound from the support level at 1.3355. MACD which illustrate bullish bias momentum suggest the pair to extend its rebound toward the resistance level at 1.3505.

Resistance level: 1.3505, 1.3675

Support level: 1.3355, 1.3210

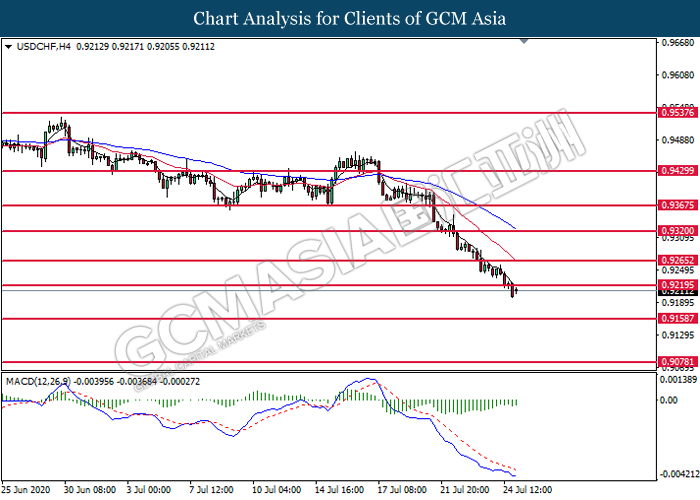

USDCHF, H4: USDCHF was traded lower following prior breakout below the previous support level 0.9220. MACD which illustrate bearish bias momentum signal suggest the pair to extend its losses toward the support level at 0.9160.

Resistance level: 0.9220, 0.9265

Support level: 0.9160, 0.9080

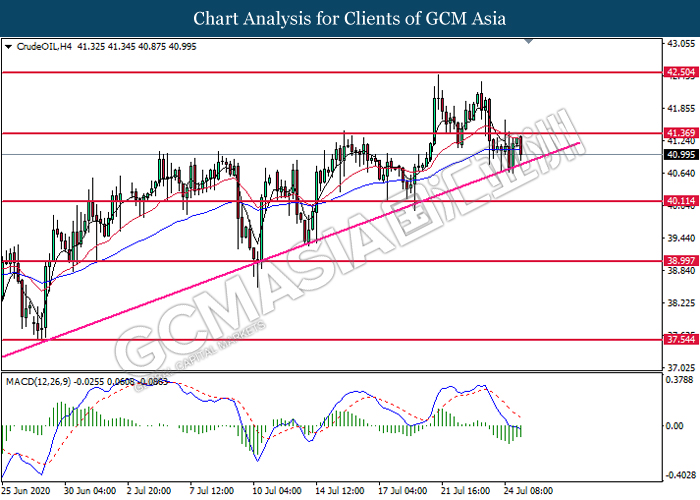

CrudeOIL, H4: Crude oil price was traded lower following prior retracement from the resistance level at 41.35. MACD which illustrate bearish bias signal suggest the commodity to extend its losses toward the support level at 40.10.

Resistance level: 41.35, 42.50

Support level: 40.10, 39.00

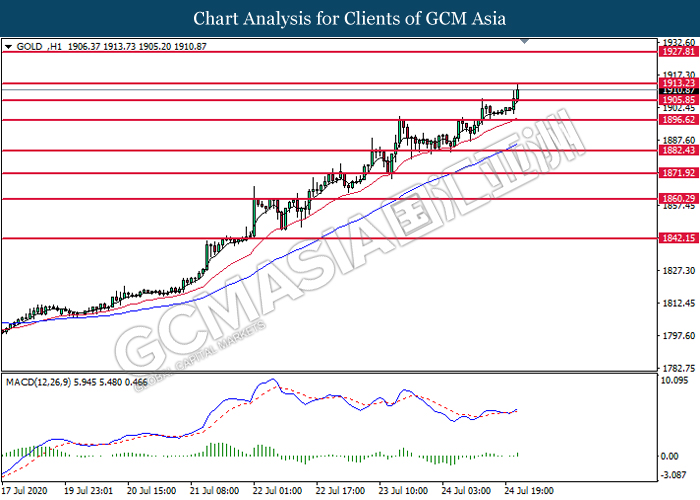

GOLD_, H1: Gold price was traded higher while currently testing the resistance level at 1913.25 MACD which illustrate bullish bias momentum signal suggest the commodity to extend its gains after it successfully breakout above the resistance level.

Resistance level: 1913.25, 1927.80

Support level: 1905.85, 1896.60