27 July 2023 Afternoon Session Analysis

Aussie dollar slipped after inflation cooling down.

Aussie (AUD), which was widely traded by global investors, slipped as CPI data fell more than the market forecast. According to the Australian Statistician, the second quarter CPI decreased from 7.0% to 6.0%, below the market forecast of 6.2%. The Australian economy was softening dramatically, the pace of inflation has peaked and is moderating quickly, and the Reserve Bank of Australia (RBA) targets 2-3% of inflation by mid-2025. The economic condition for Australia is complicated due to consumers and businesses are losing confidences, but the labor market still remains tight. In the next RBA meeting, investors expect the central bank might raise another 25 basis points (bps) before rate pause in the future. With that being said, the pair of AUD/USD rebounded significantly following the US FOMC Press Conference. Yesterday, the Fed raised interest rate by 25 bps as market forecasted. Also, Jerome Powell said the coming interest rate decision would be data-dependent, while the Fed will still bias toward prolonged ‘hawkish hold’. The FOMC statement showed the assessment of the economic activity is at “moderate pace”, compared to June’s “modest” pace. As of writing, AUD/USD rose 0.70% to 0.6800.

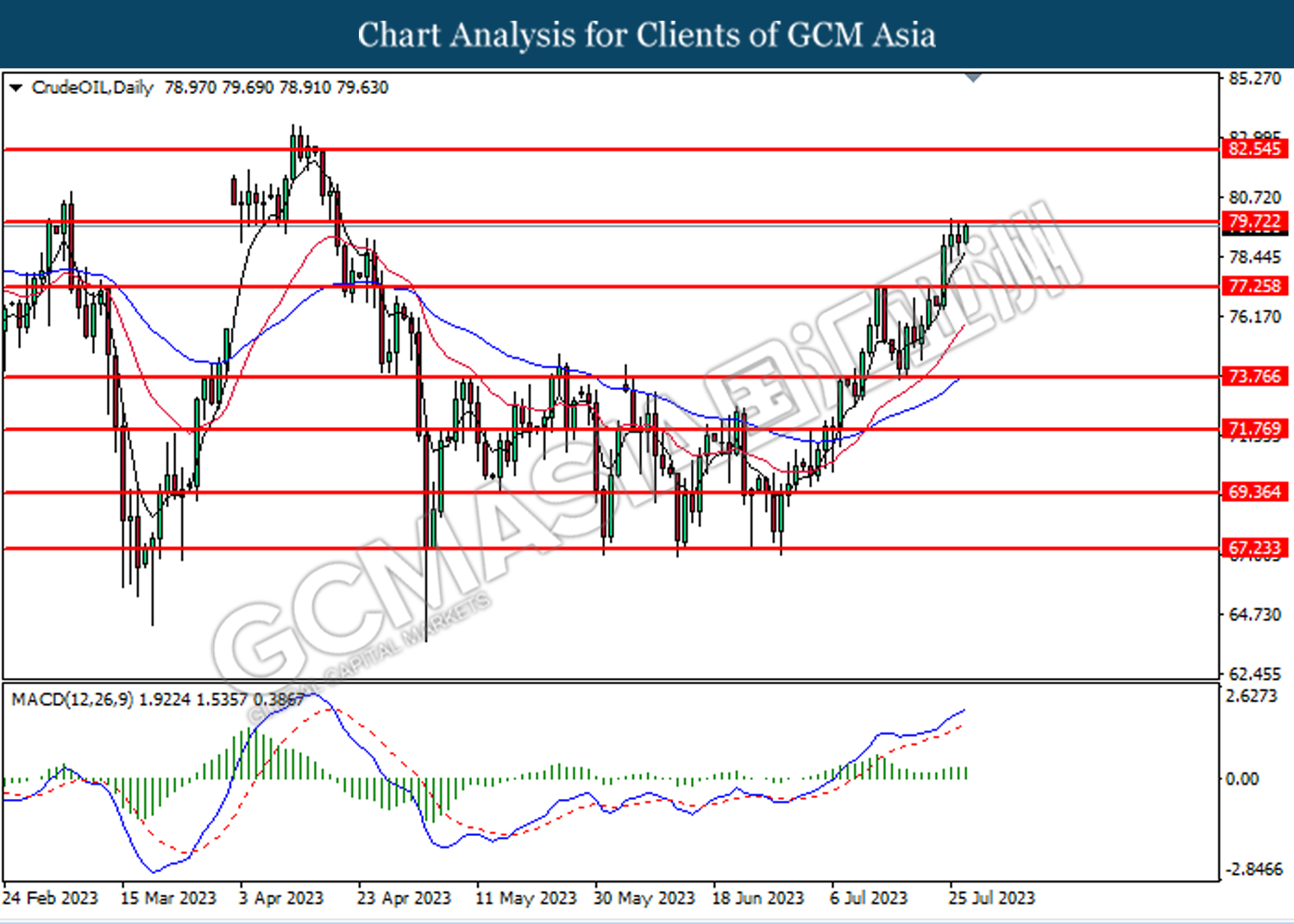

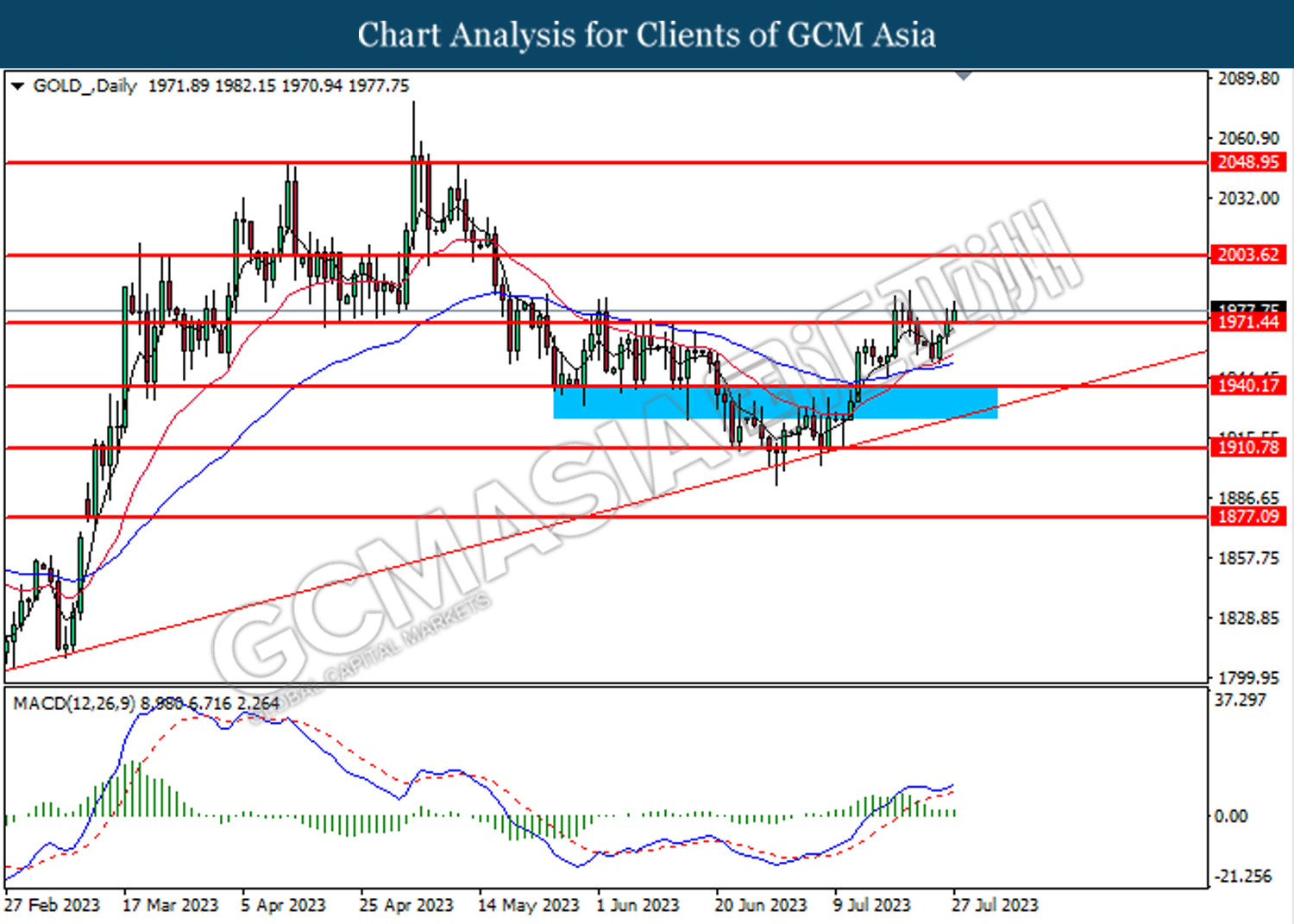

In the commodities market, crude oil prices rose 1.19% to $79.65 per barrel due to crude inventories drew by 600,000 barrels last week and the weakening of the US Dollar. Besides, gold prices rose 0.34% to $1978.60 per troy amid the weakening of the US Dollar.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

20:15 EUR ECB Monetary Policy Statement

20:45 EUR ECB Press Conference

22:15 EUR ECB President Lagarde Speaks

Today’s Highlight Economic Data

|

Time |

Event | Previous | Forecast | Actual |

| 20:15 | EUR – ECB Interest Rate Decision (Jul) | 4.00% | 4.25% | – |

| 20:30 | USD – Core Durable Goods Orders (MoM) (Jun) | 0.6% | 0.1% | – |

| 20:30 | USD – GDP (QoQ) (Q2) | 2.0% | 1.7% | – |

| 20:30 | USD – Initial Jobless Claims | 228K | 235K | – |

| 22:00 | USD – Pending Home Sales (MoM) (Jun) | -2.7% | -0.6% |

– |

Technical Analysis

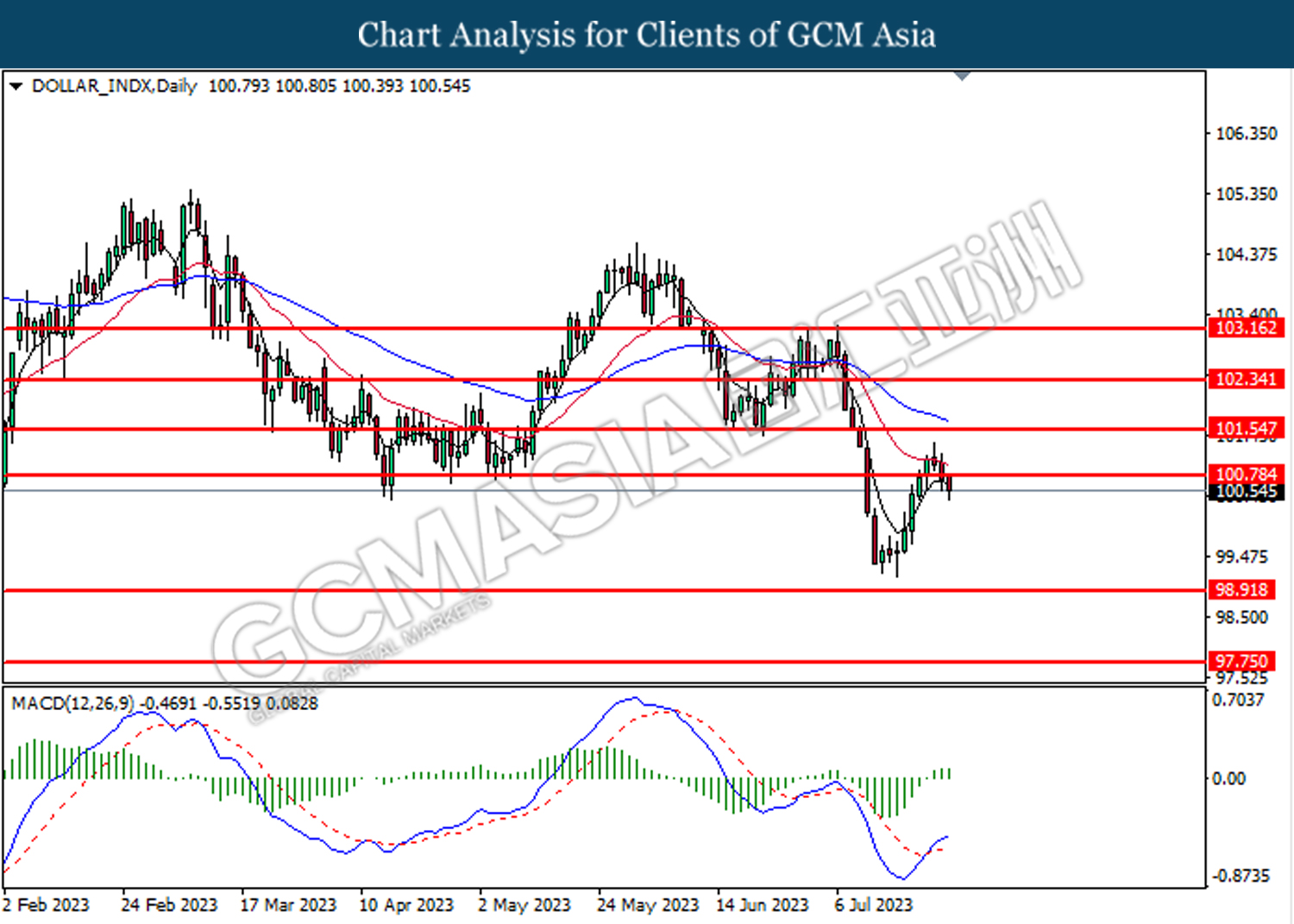

DOLLAR_INDX, Daily: Dollar index was traded lower following the prior breakout the previous support level at 100.80. However, MACD which illustrated increasing bullish momentum suggests the index to undergo technical correction in short term.

Resistance level: 100.80, 101.55

Support level: 98.90, 97.75

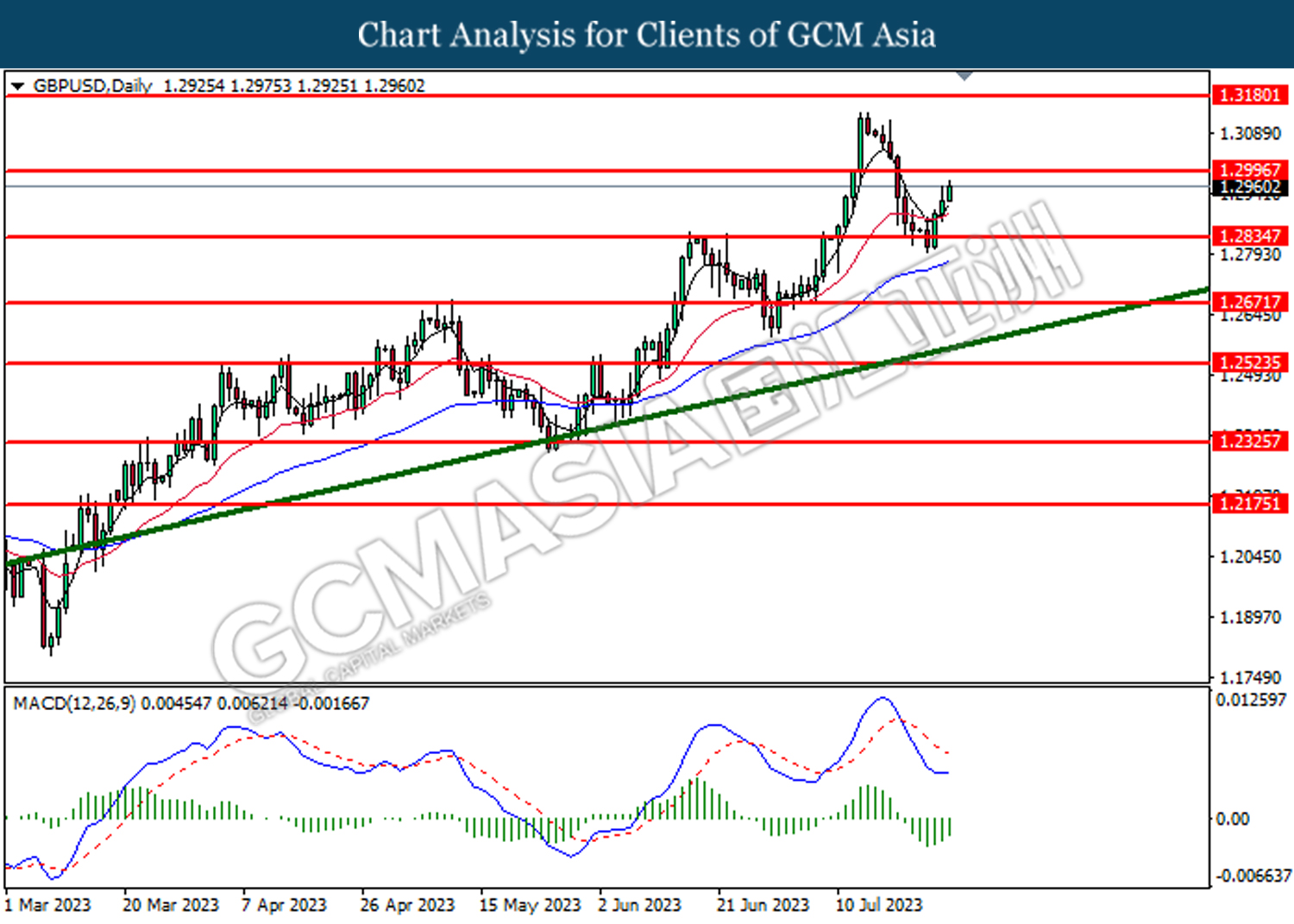

GBPUSD, Daily: GBPUSD was traded higher following the prior breakout above the previous resistance level at 1.2835. MACD which illustrated decreasing bearish momentum suggest the pair to extend its gains toward the resistance level at 1.3000.

Resistance level: 1.3000, 1.3180

Support level: 1.2835, 1.2670

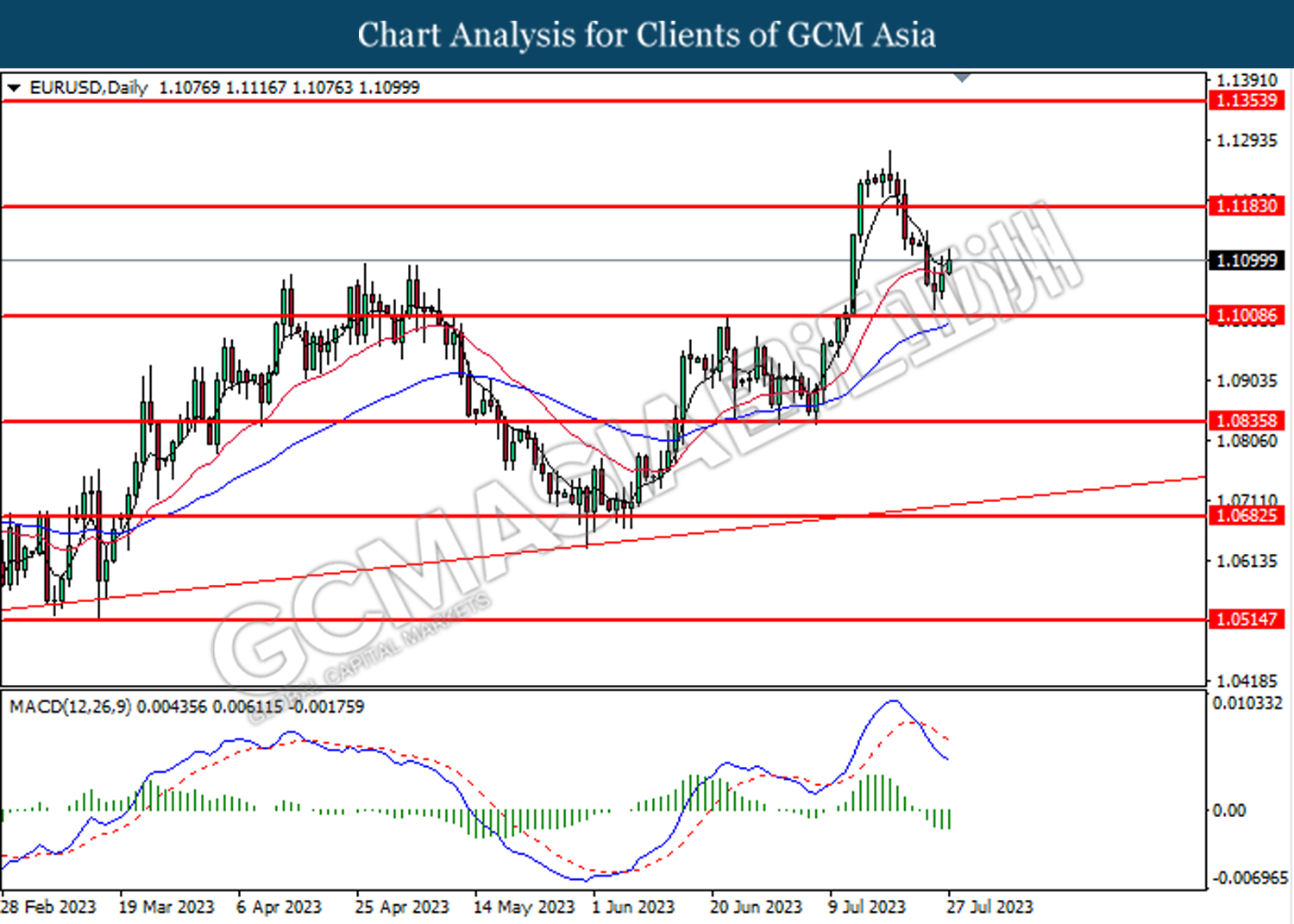

EURUSD, Daily: EURUSD was traded higher following the prior rebounded from the support level at 1.1010. MACD which illustrated decreasing bearish momentum suggest the pair to extend its gains toward the resistance level at 1.1185.

Resistance level: 1.1185, 1.1355

Support level: 1.1010, 1.0835

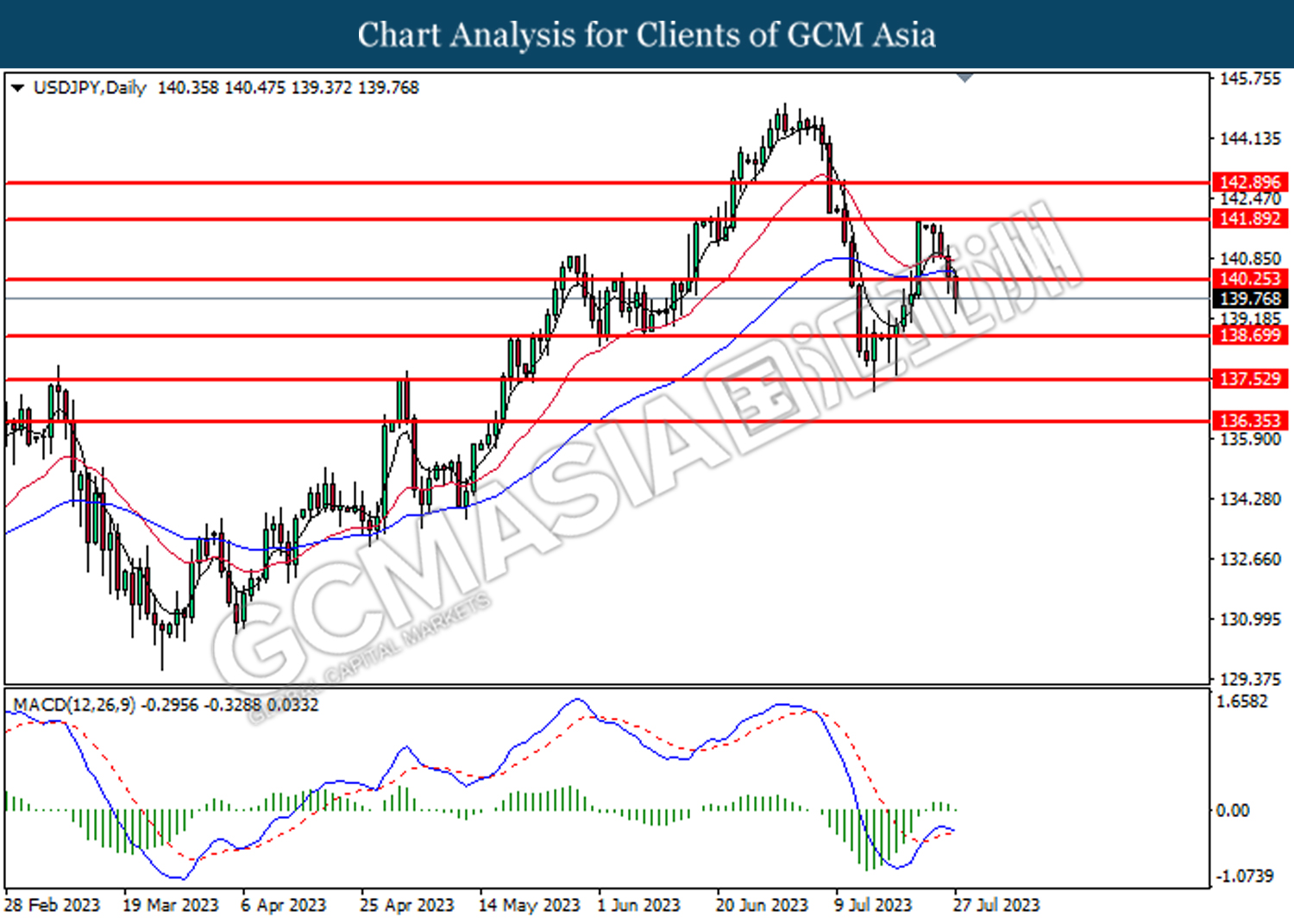

USDJPY, Daily: USDJPY was traded lower following the prior breakout below the previous support level at 140.25. MACD which illustrated decreasing bullish momentum suggest the pair to extend its losses toward the support level at 138.70

Resistance level: 140.25, 141.90

Support level: 138.70, 137.55

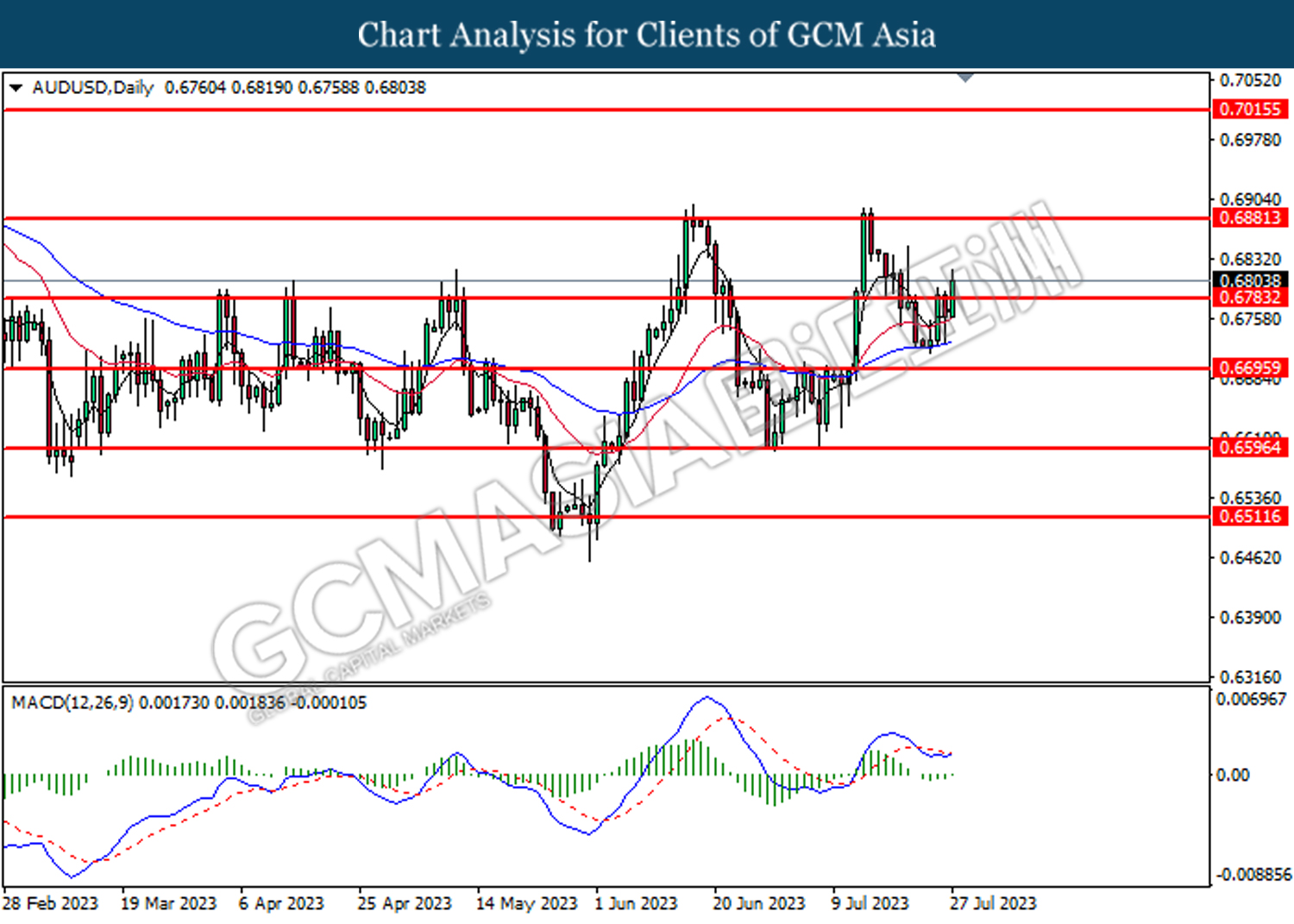

AUDUSD, Daily: AUDUSD was traded higher following the prior breakout above the previous resistance level at 0.6785. MACD which illustrated decreasing bearish momentum suggests the pair to extend its gains toward the resistance level at 0.6880

Resistance level: 0.6880, 0.7015

Support level: 0.6785, 0.6695

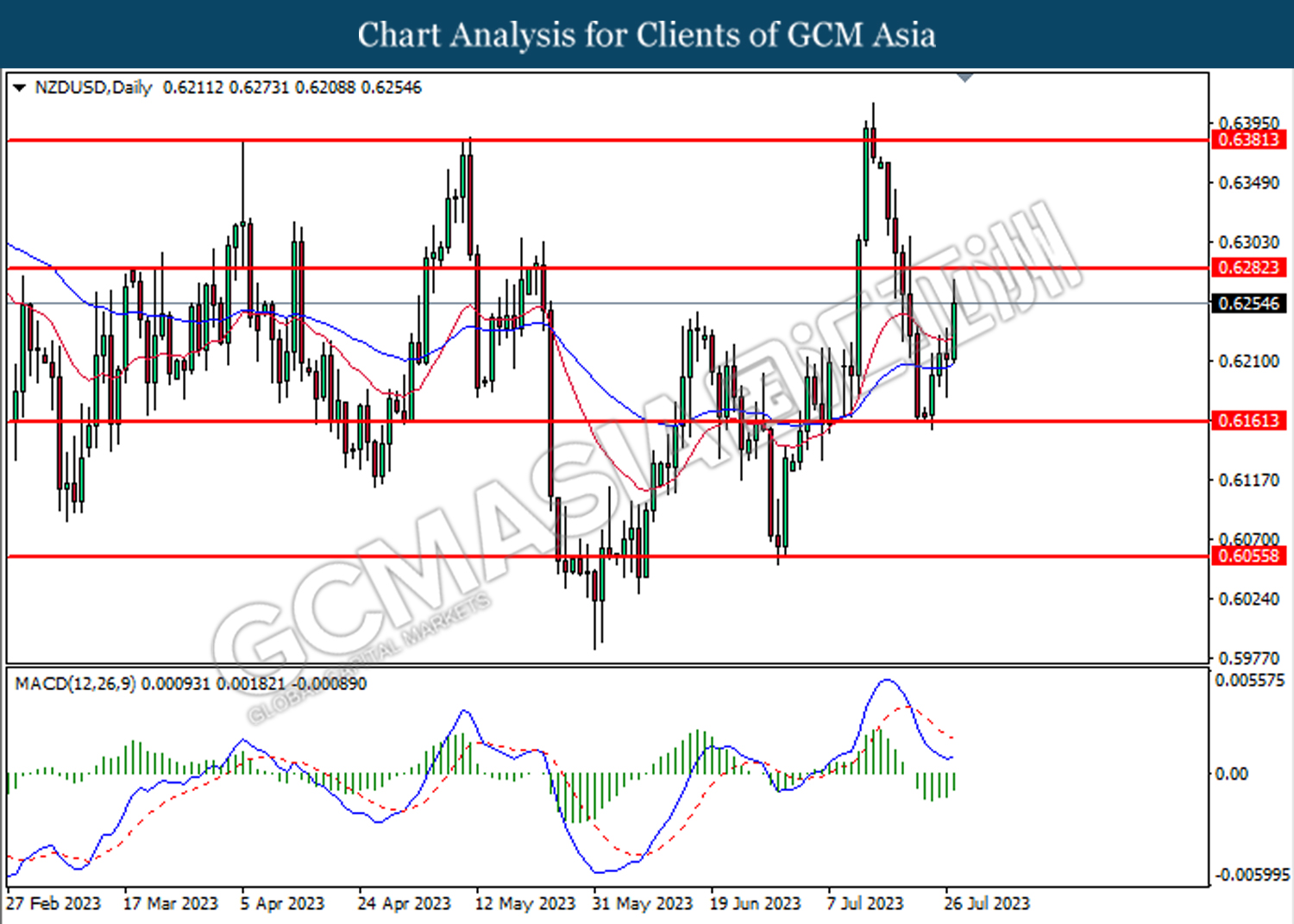

NZDUSD, Daily: NZDUSD was traded higher following the prior rebound from the support level at 0.6160. MACD which illustrated decreasing bearish momentum suggests the pair to extend its gains toward the resistance level at 0.6280.

Resistance level: 0.6280, 0.6380

Support level: 0.6160, 0.6055

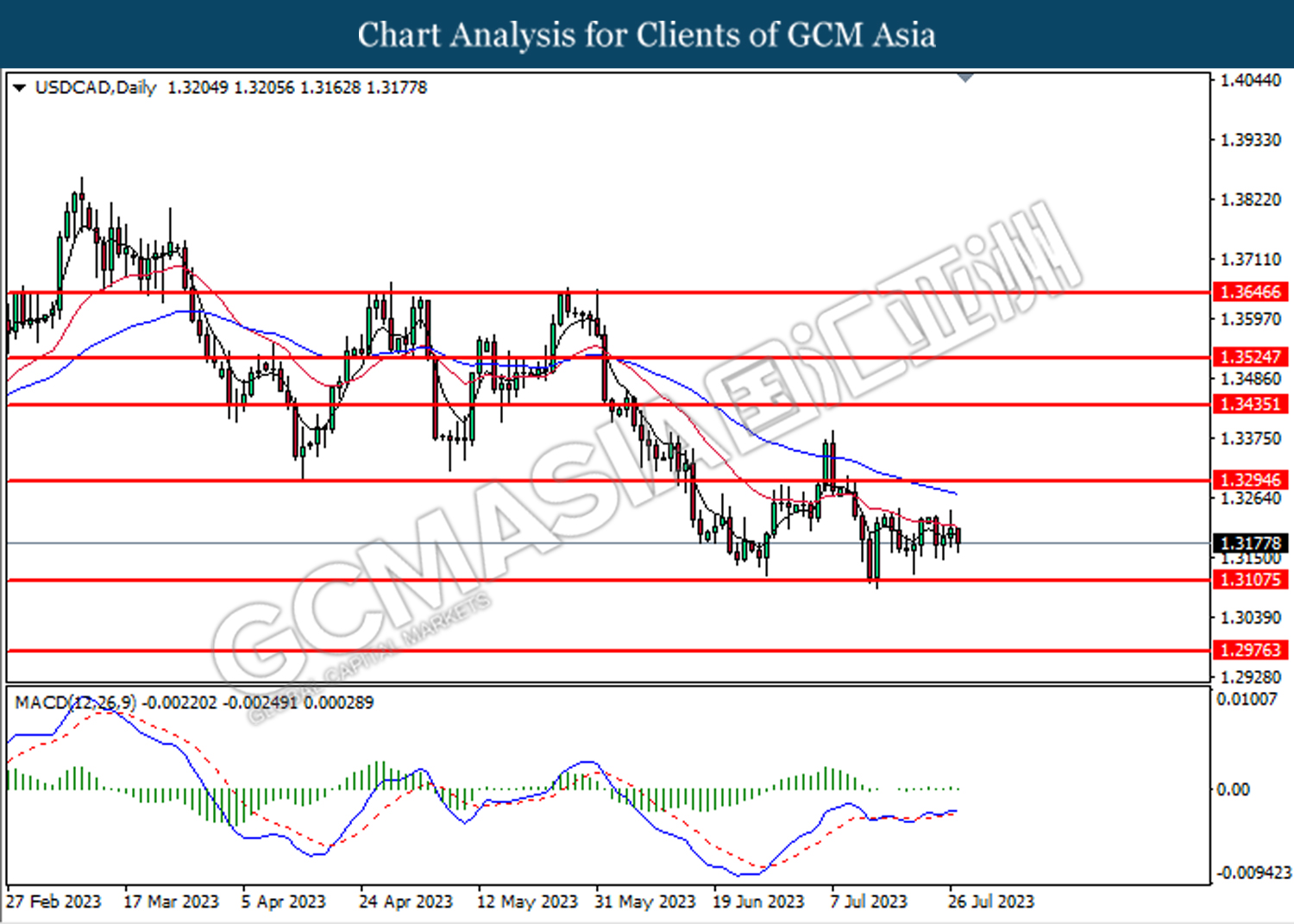

USDCAD, Daily: USDCAD was traded flat above the support level at 1.3110. Due to lack of signal for MACD it is recommended to wait for the signal only entry the market order.

Resistance level: 1.3295, 1.3435

Support level: 1.3110, 1.2975

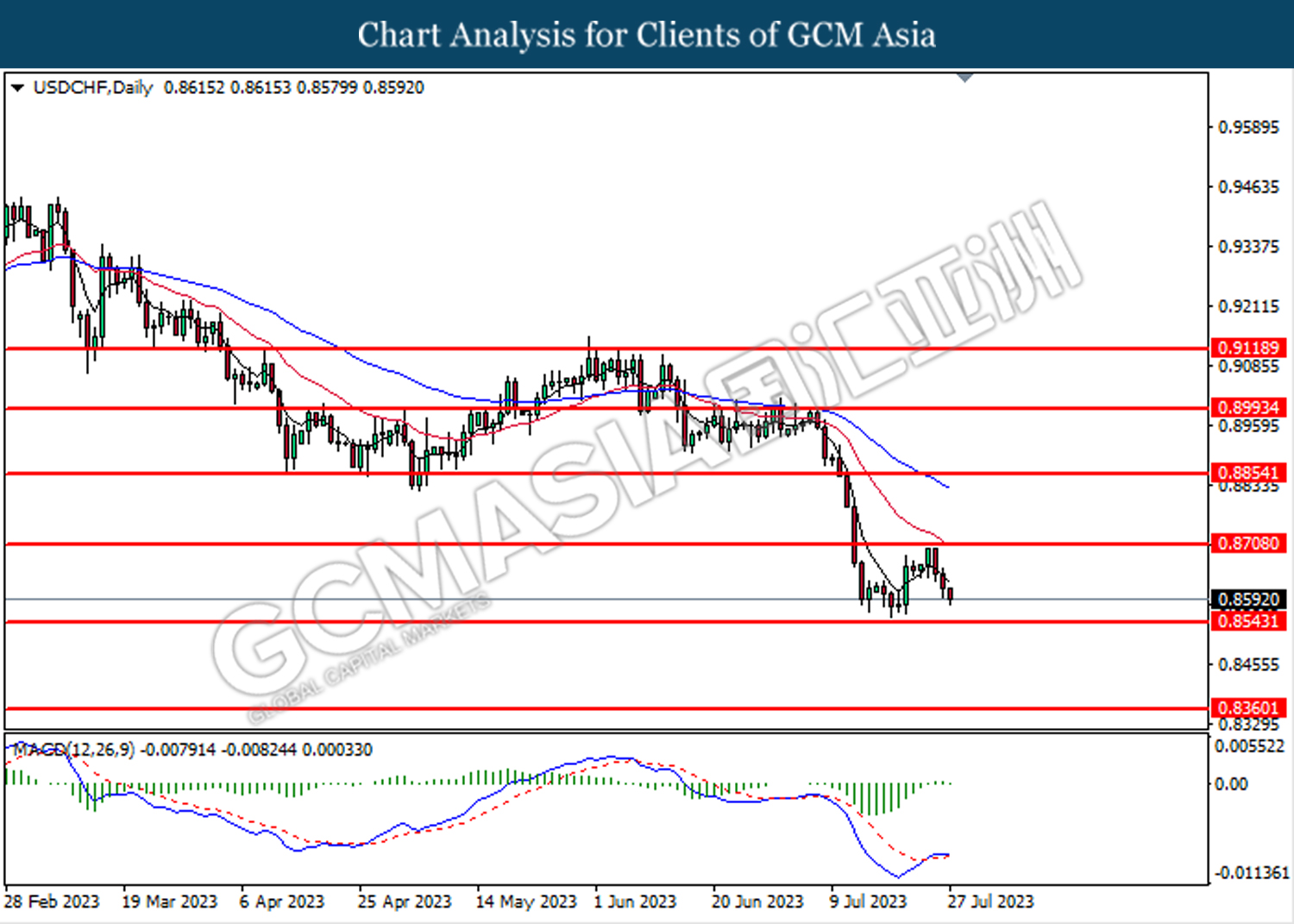

USDCHF, Daily: USDCHF was traded lower following the prior retracement from the resistance level at 0.8710. However, MACD which illustrated increasing bullish momentum suggests the pair to undergo technical correction in short term.

Resistance level: 0.8710, 0.8855

Support level: 0.8545, 0.8360

CrudeOIL, Daily: Crude oil price was traded higher while testing the resistance level at 79.70. MACD which illustrated increasing bullish momentum suggests the commodity to extend its gains after it breakout the resistance level.

Resistance level: 79.70, 82.55

Support level: 77.25, 73.75

GOLD_, Daily: Gold price was traded higher following the prior breakout above the previous resistance level at 1971.45. MACD which illustrated increasing bullish momentum suggests the commodity to extend its gains toward the resistance level at 2003.60.

Resistance level: 2003.60, 2048.95

Support level: 1971.45, 1940.20