27 July 2023 Morning Session Analysis

Greenback dipped amid Powell’s less-hawkish statement.

The dollar index, which was traded against a basket of six major currencies, took a breath from its prior rallies after the long-waited Fed’s meeting in the early morning. In line with market expectations, the Federal Reserve increased the benchmark borrowing rate by 25 basis point. This move marks the 11th rate increase in the current rate-hiking cycle and brings the benchmark rate to a range of 5.25% to 5.5%, reaching its highest level since 2001. Regarding future rate increases, Chair Powell stated that the Federal Open Market Committee (FOMC) did not provide explicit guidance. Depending on upcoming economic data, the central bank may choose to raise rates again or keep them steady in their next meeting. However, Powell emphasized that the Federal Reserve intends to maintain a restrictive policy stance until they are confident that inflation is sustainably moving towards their target of 2%. They are also prepared to further tighten monetary policy if necessary. Despite some recent indications of a cooling in price increases, Powell expressed that the Fed is not yet fully convinced that inflation is under control, particularly considering that core inflation remains above 3%. The central bank will be taking a cautious approach and closely monitors the latest economic data before making any decisions. As of writing, the dollar index dropped -0.32% to 101.05.

In the commodities market, crude oil prices edged down by -0.67% to $78.85 per barrel followed by data showing a smaller-than-expected drop in U.S. crude inventories and the Federal Reserve raised its interest rates by 25 basis points. Besides, gold prices edged up by 0.10% to $1974.05 per troy ounce amid the weakness of dollar index.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

20:15 EUR ECB Monetary Policy Statement

20:45 EUR ECB Press Conference

22:15 EUR ECB President Lagarde Speaks

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 20:15 | EUR – ECB Interest Rate Decision (Jul) | 4.00% | 4.25% | – |

| 20:30 | USD – Core Durable Goods Orders (MoM) (Jun) | 0.6% | 0.1% | – |

| 20:30 | USD – GDP (QoQ) (Q2) | 2.0% | 1.7% | – |

| 20:30 | USD – Initial Jobless Claims | 228K | 235K | – |

| 22:00 | USD – Pending Home Sales (MoM) (Jun) | -2.7% | -0.6% | – |

Technical Analysis

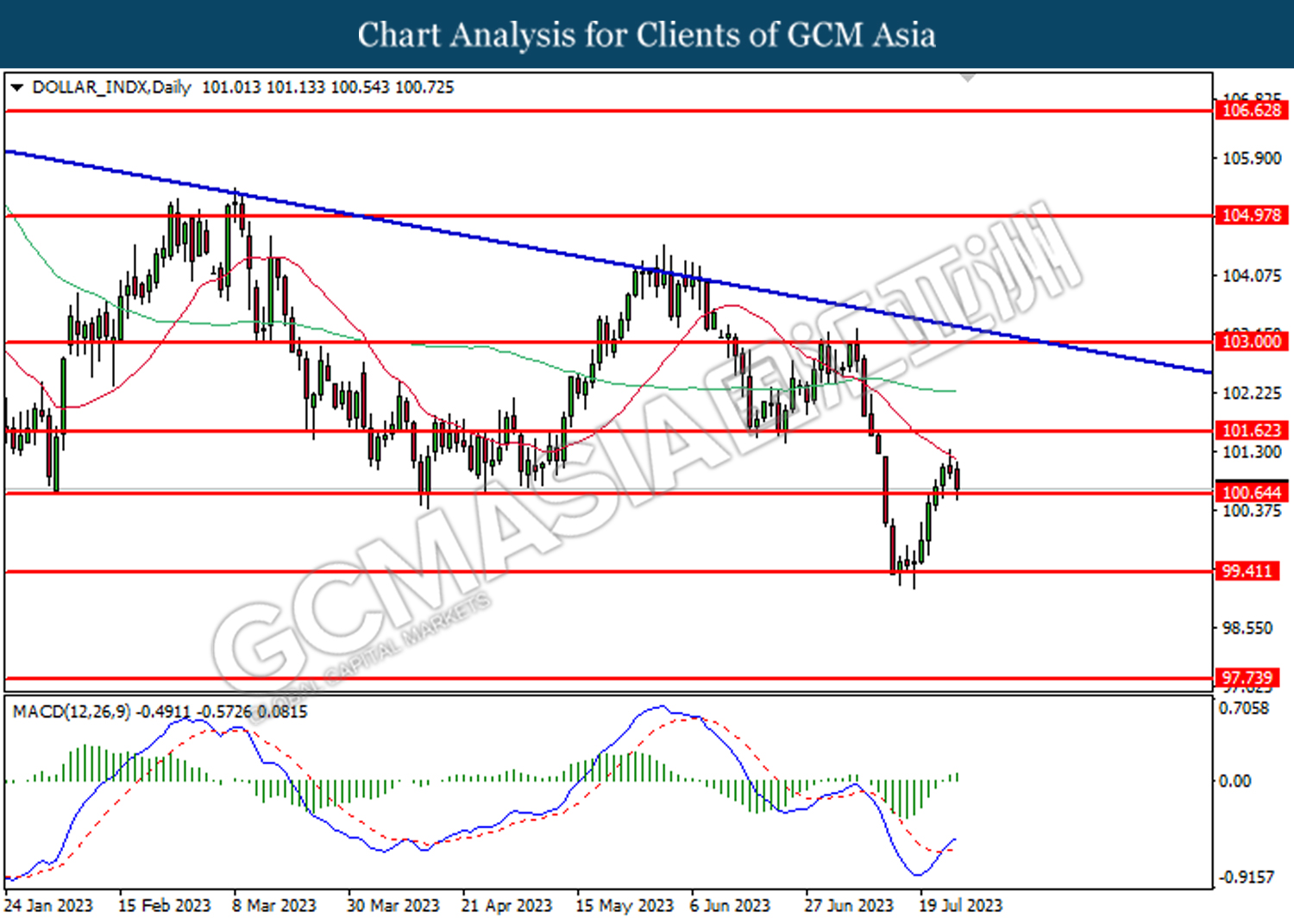

DOLLAR_INDX, Daily: Dollar index was traded lower while currently testing the support level at 100.65. However, MACD which illustrated bullish bias momentum suggests the index to undergo technical correction in short term.

Resistance level: 101.60, 103.00

Support level: 100.65, 99.40

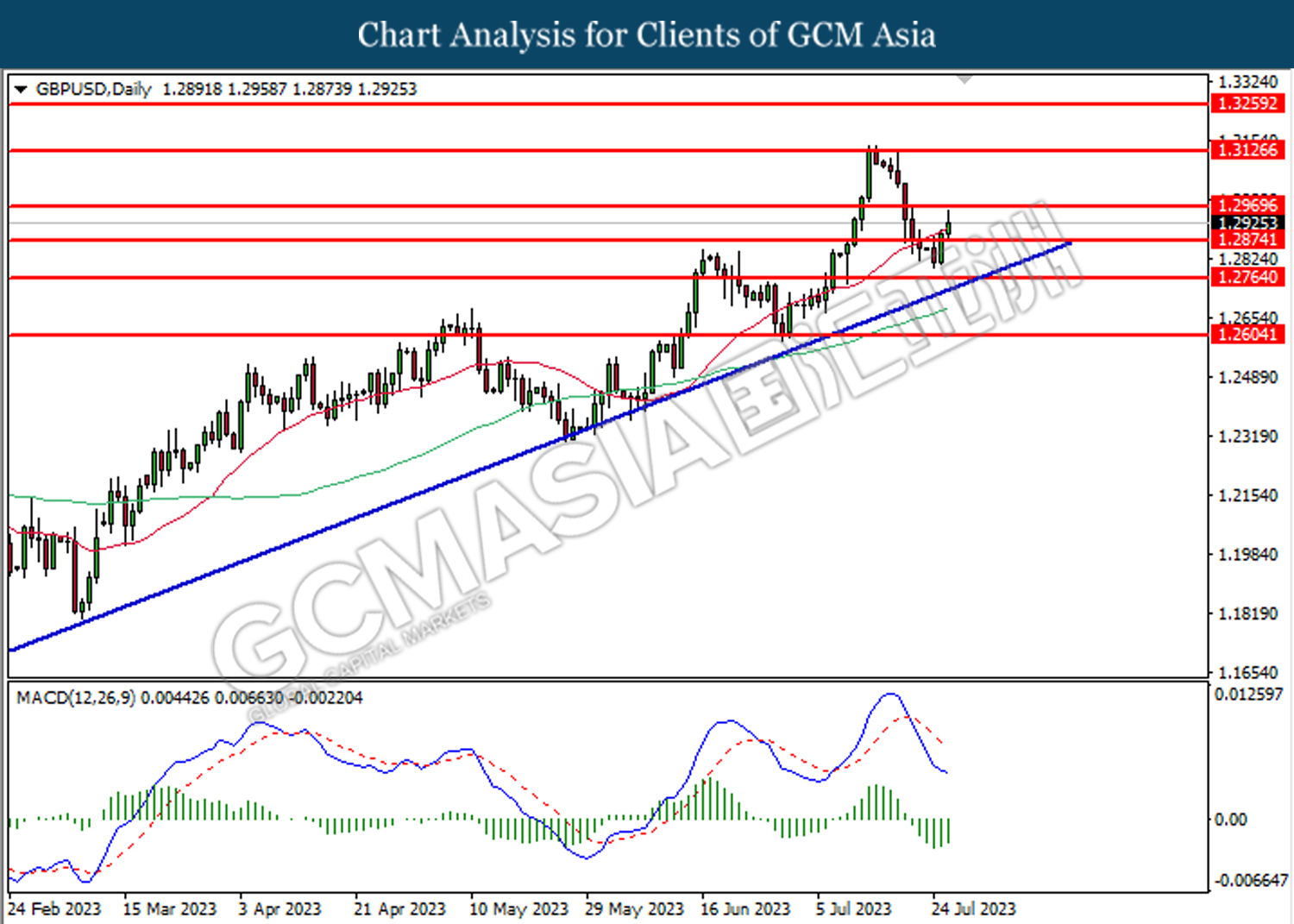

GBPUSD, Daily: GBPUSD was traded higher while currently testing the resistance level at 1.2970. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 1.2970, 1.3125

Support level: 1.2875, 1.2765

EURUSD, Daily: was traded higher while currently retesting the resistance level at 1.1065. However, MACD which illustrated bearish bias momentum suggest the pair to undergo technical correction in short term.

Resistance level: 1.1065, 1.1155

Support level: 1.0960, 1.0850

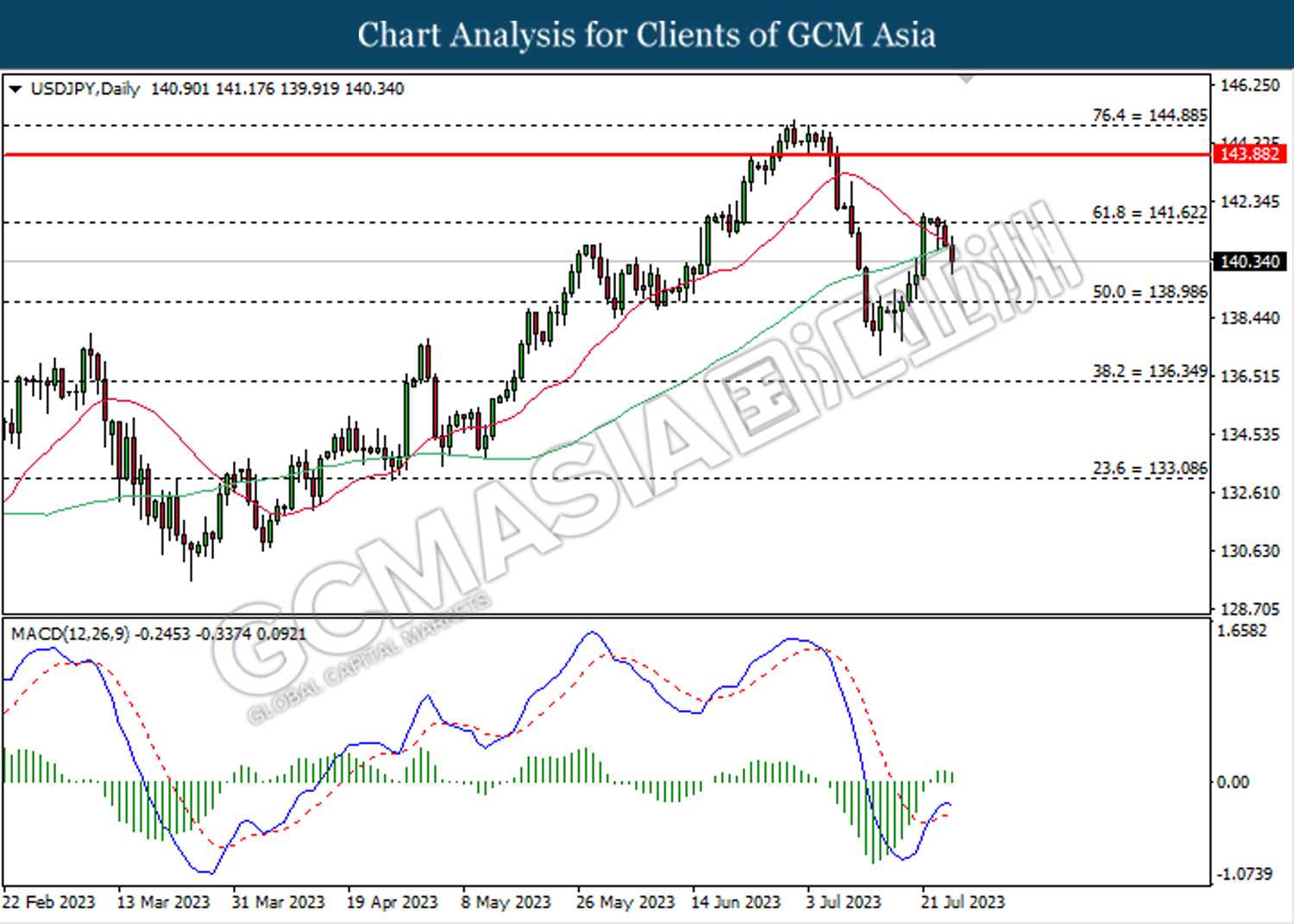

USDJPY, Daily: USDJPY was traded lower following the prior retracement from the resistance level at 141.60. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses toward the support level.

Resistance level: 141.60, 143.90

Support level: 139.00, 136.35

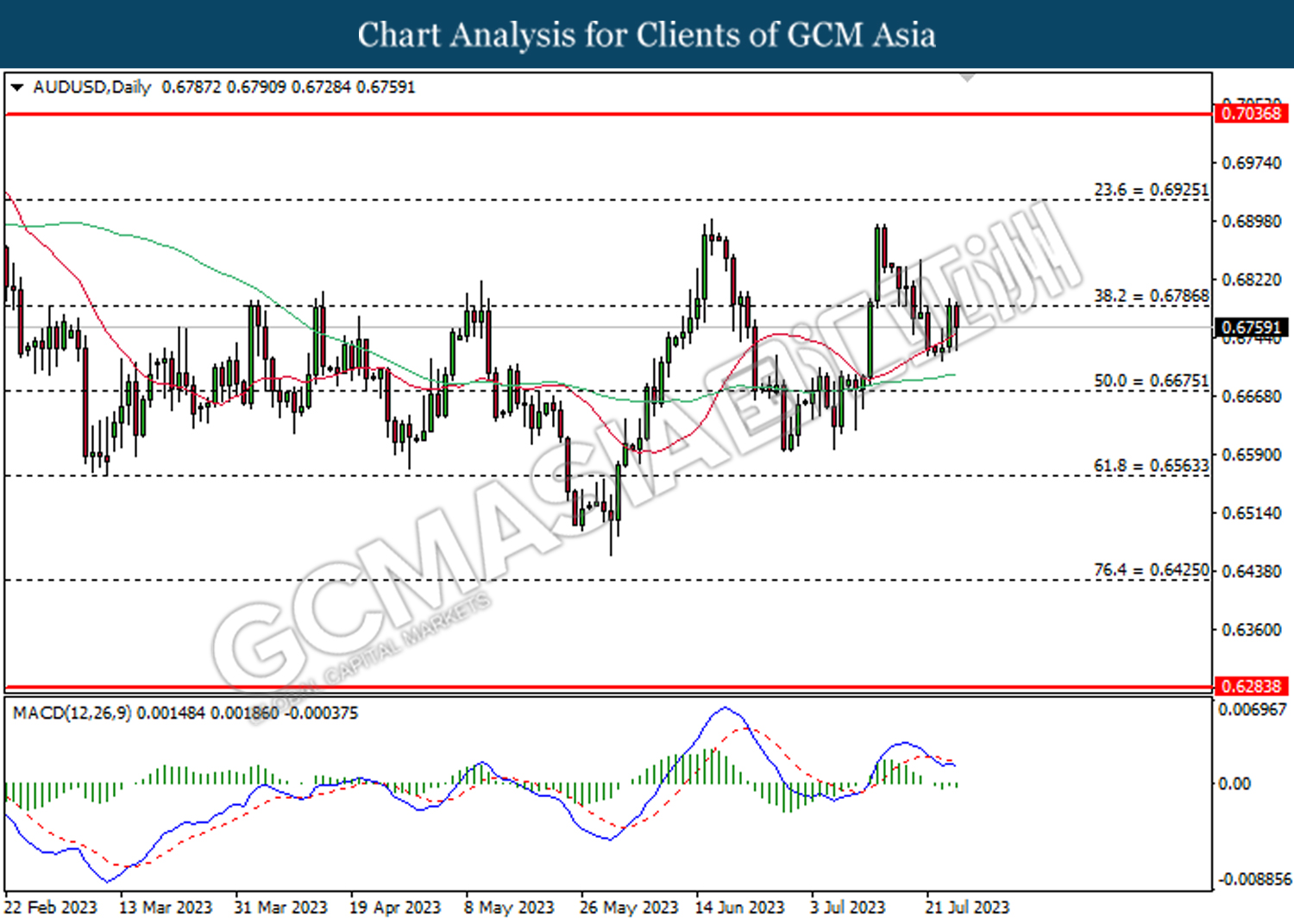

AUDUSD, Daily: AUDUSD was traded higher while currently testing the resistance level at 0.6785. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 0.6785, 0.6925

Support level: 0.6675, 0.6565

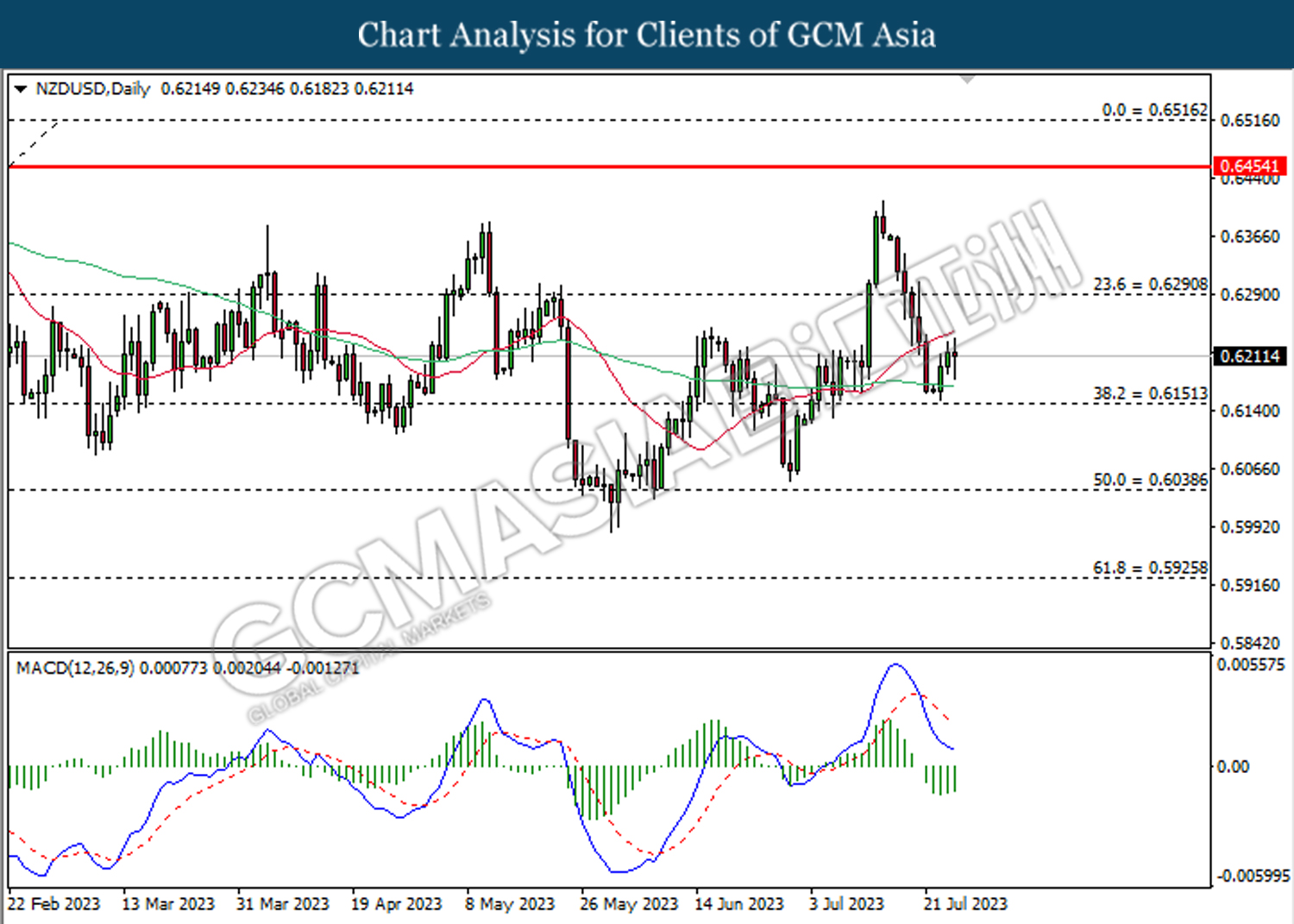

NZDUSD, Daily: NZDUSD was traded higher following the prior rebound from the support level at 0.6150. However, MACD which illustrated bearish bias momentum suggest the pair to undergo technical correction in short term.

Resistance level: 0.6290, 0.6455

Support level: 0.6150, 0.6040

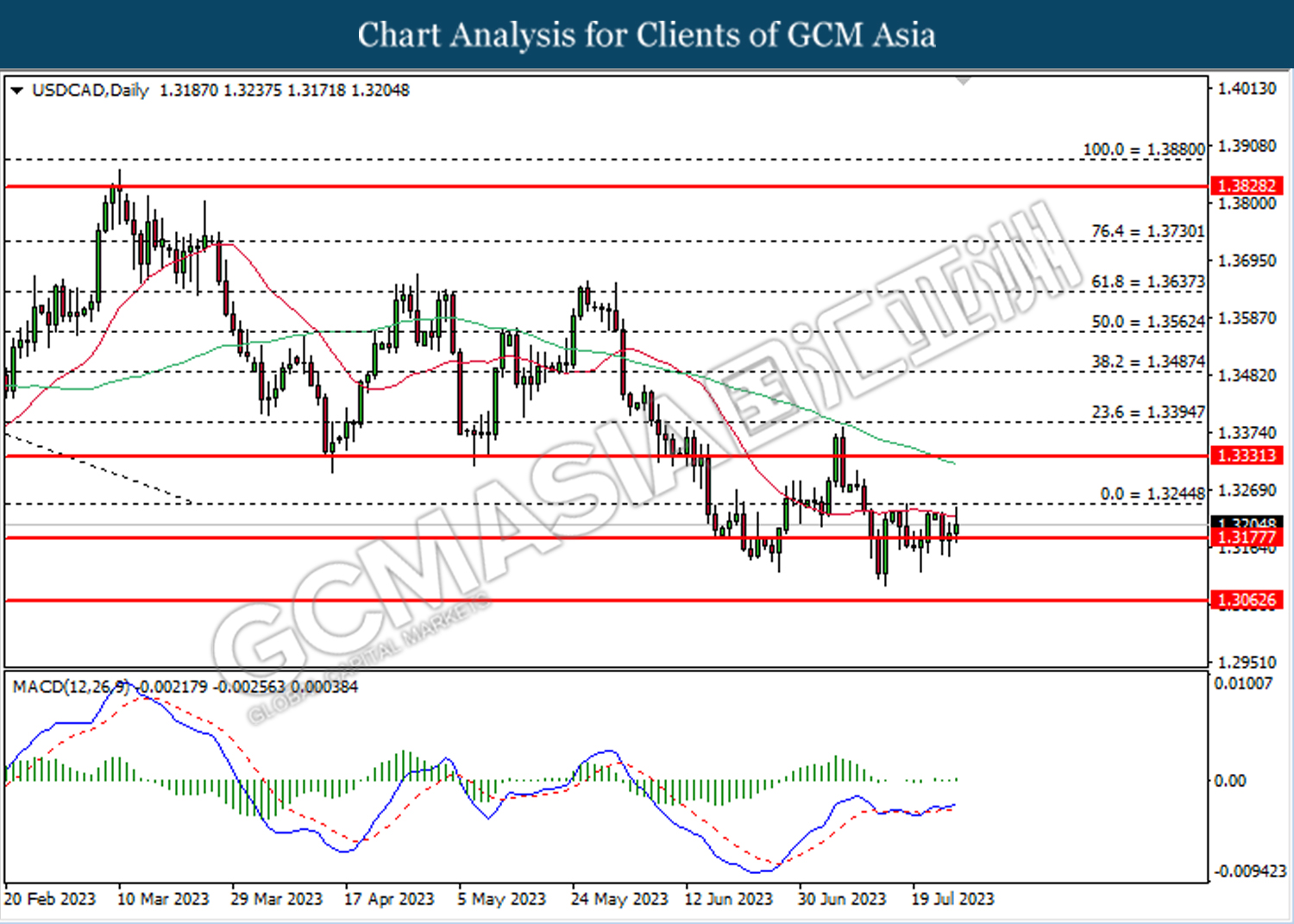

USDCAD, Daily: USDCAD was traded lower while currently testing the support level at 1.3175. However, MACD which illustrated bullish bias momentum suggests the pair to undergo technical correction in short term.

Resistance level: 1.3245, 1.3330

Support level: 1.3175, 1.3065

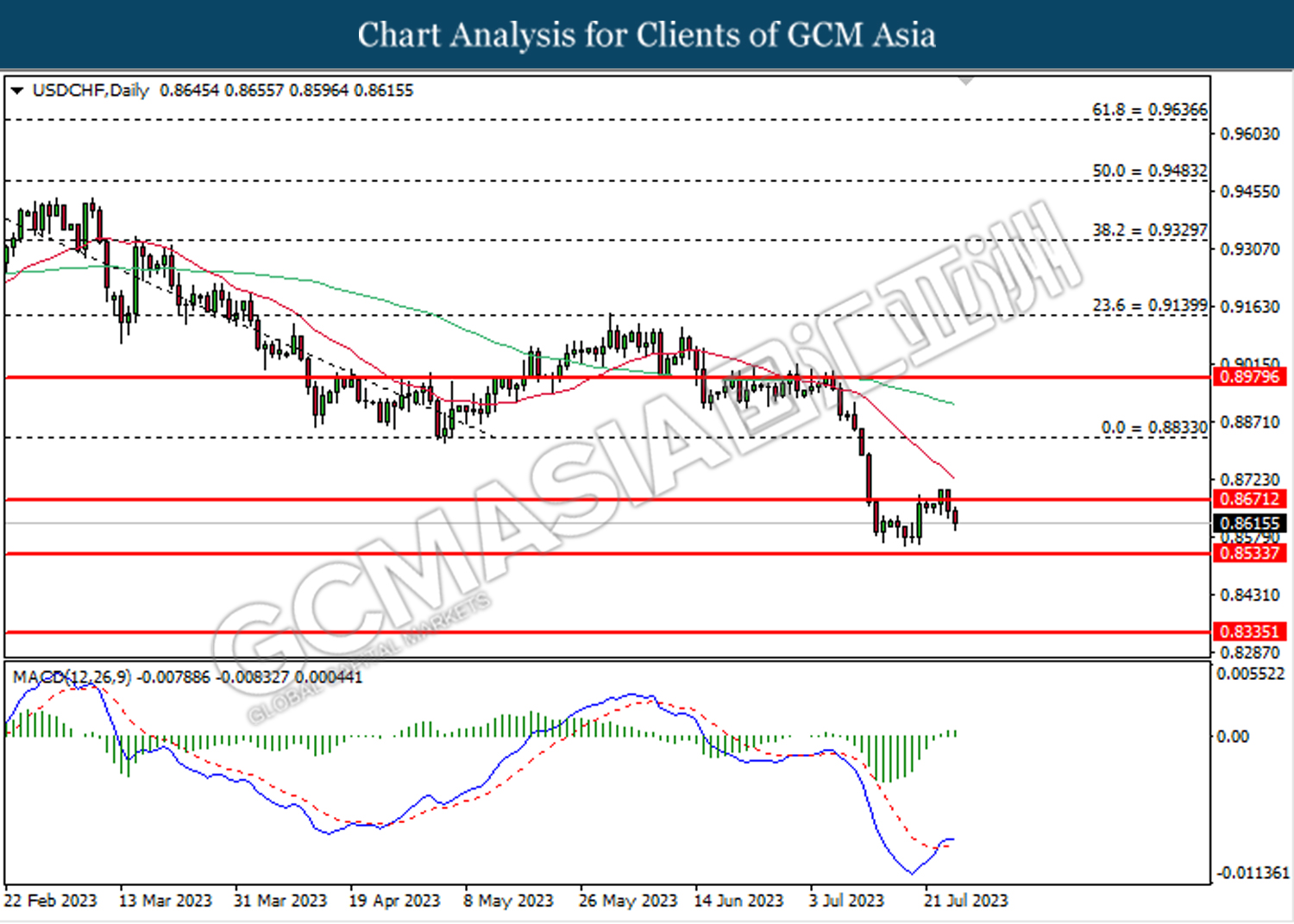

USDCHF, Daily: USDCHF was traded lower following the prior retracement from the resistance level at 0.8670. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses toward the support level at 0.8535.

Resistance level: 0.8670, 0.8775

Support level: 0.8535, 0.8355

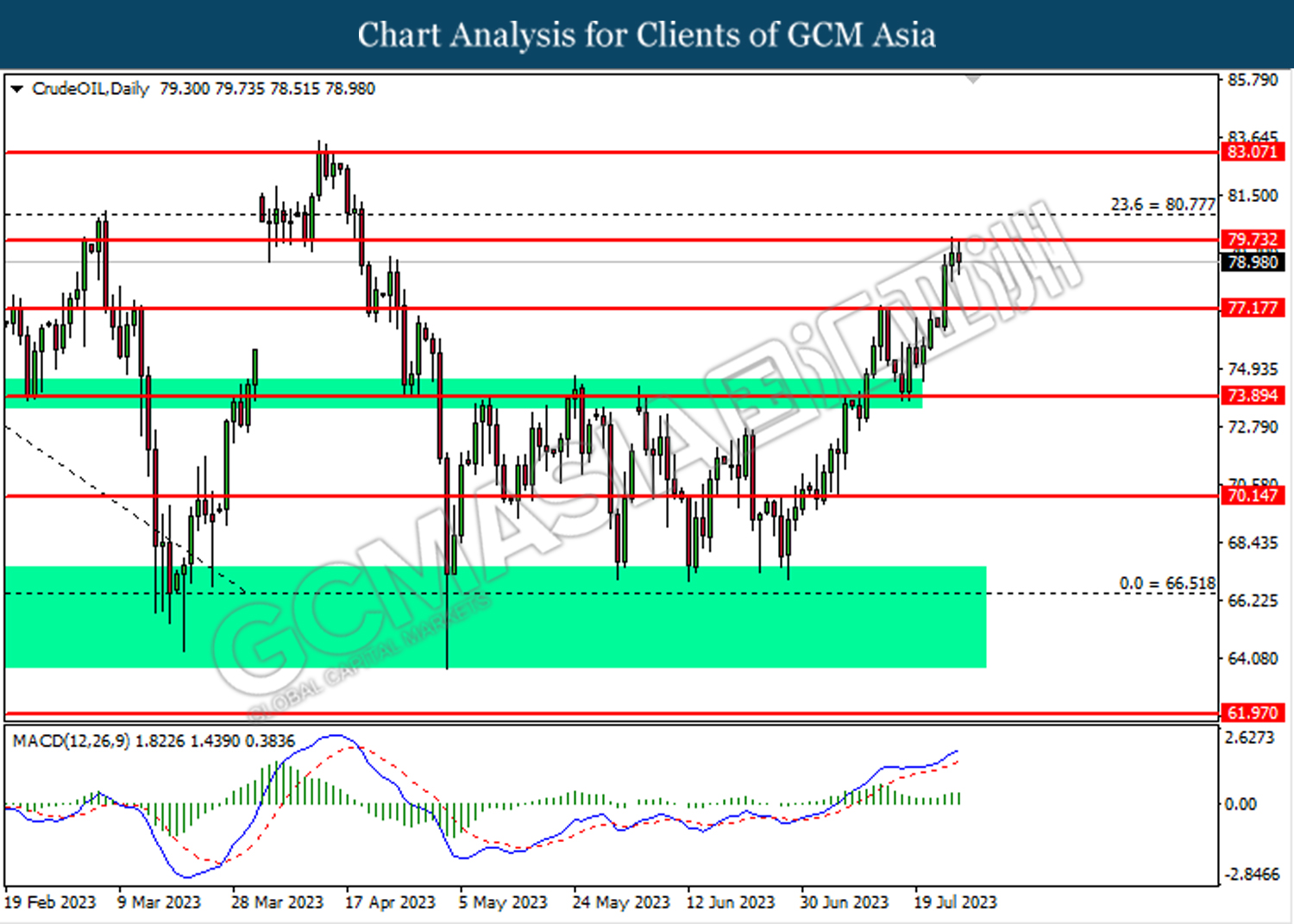

CrudeOIL, Daily: Crude oil price was traded higher while currently testing the resistance level at 79.75. MACD which illustrated bullish bias momentum suggest the commodity to extend its gains after it successfully breakout above the resistance level.

Resistance level: 79.75, 80.75

Support level: 77.15, 73.90

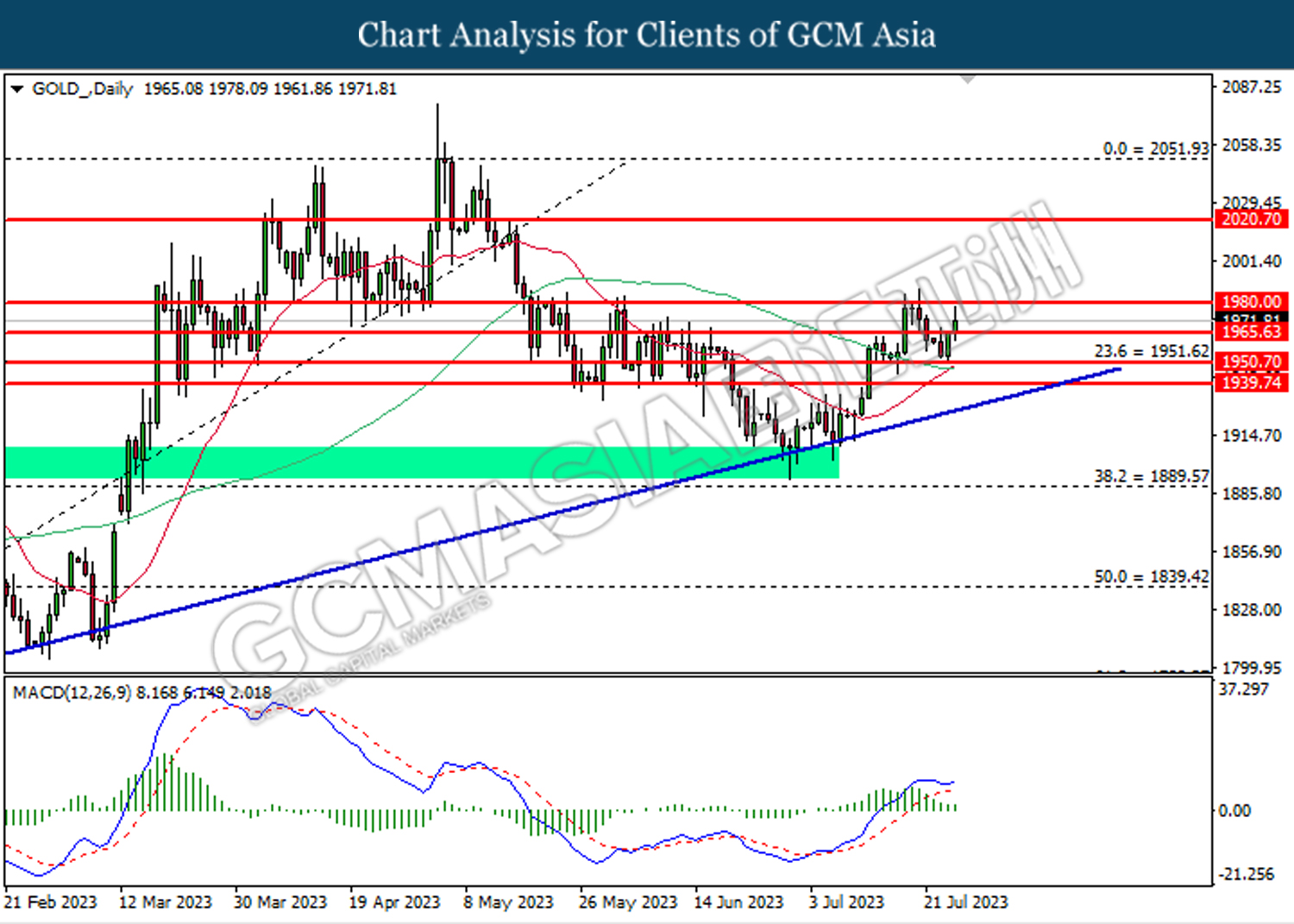

GOLD_, Daily: Gold price was traded higher while currently testing the resistance level at 1965.65. MACD which illustrated bullish bias momentum suggests the commodity to extend its gains after it successfully breakout above the resistance level.

Resistance level: 1965.65, 1980.00

Support level: 1950.70, 1939.75