27 October 2020 Afternoon Session Analysis

Yen rose following rising U.S – China tension.

The Japanese Yen which traded against the dollar and other currency pair have rose during late Asian session amid rising tension between the U.S and China as well as concerns over COVID-19 supporting the demand for safe-haven market. On the coronavirus front, several countries such as Russia, France, Italy and U.S continue to set new records for the number of daily COVID-19 cases. As of today, COVID-19 cases have passed through 43.4 million globally according to data from John Hopkins University. At the same time, tensions between U.S and China begin to mount as U.S approve a $2.4 billion sales of anti-ship missiles to Taiwan. In retaliation, China announced that it will impose sanctions on U.S companies and individual. The worsening relationship between the U.S and China also caused investors to turn their backs on riskier assets, thus shifting their portfolio into safe-haven market such as Japanese Yen. At the time of writing, USD/JPY slips 0.10% to 104.69.

In the commodities market, crude oil price remains weak and fell 0.28% to $38.64 per barrel as of writing following rising output by Libya. According to reports, Libya is set to open its last oil field to push daily oil output by 1 million barrel. On top of that, the commodity price also continue to be pressured by fragile demand outlook which continue to be crippled by the rising cases of coronavirus. On the other hand, gold price gains 0.35% to $1908.85 a troy ounce at the time of writing following market uncertainty and dollar weakness.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 20:30 | USD – Core Durable Goods ORders (MoM) (Sep) | 0.6% | 0.4% | – |

| 20:30 | USD – CB Consumer Confidence (Oct) | 101.8 | 102.5 | – |

Technical Analysis

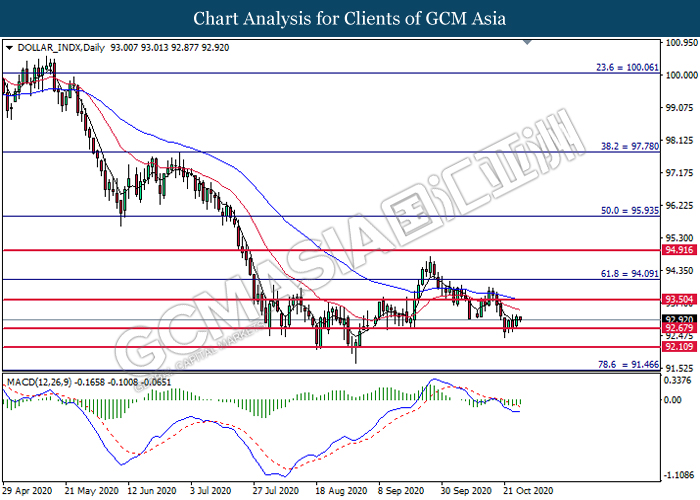

DOLLAR_INDX, Daily: Dollar index was traded higher following prior rebound from the support level at 92.70. MACD which illustrate diminishing bearish momentum signal suggest the dollar to extend its gains toward the resistance level at 93.50.

Resistance level: 93.50, 94.10

Support level: 92.70, 92.10

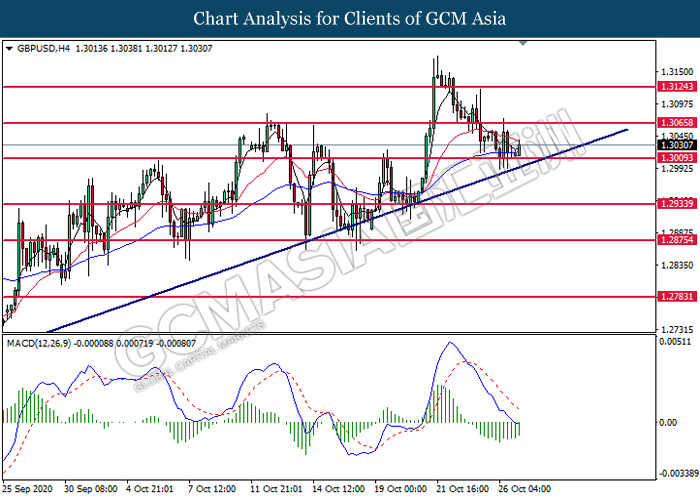

GBPUSD, H4: GBPUSD was traded higher following prior rebound from the support level at 1.3010. MACD which illustrates diminishing bearish momentum suggest the pair to extend its gains toward the resistance level at 1.3065.

Resistance level: 1.3065, 1.3125

Support level: 1.3010, 1.2935

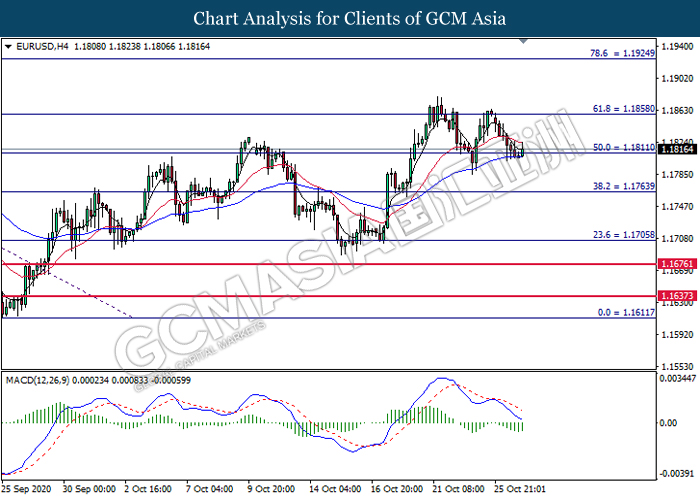

EURUSD, H4: EURUSD was traded higher following prior rebound from the support level at 1.1810. MACD which illustrate diminishing bearish momentum signal suggest the pair to be traded higher in short term toward the resistance level at 1.1860.

Resistance level: 1.1860, 1.1925

Support level: 1.1810, 1.1765

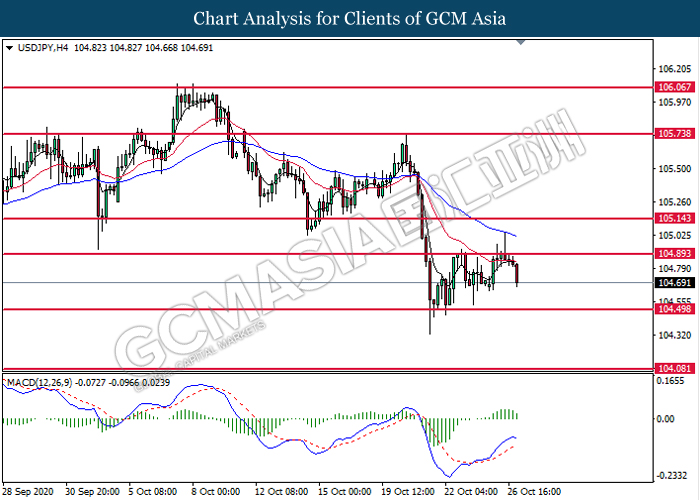

USDJPY, H4: USDJPY was traded lower following prior retracement from the resistance level at 104.90. MACD which illustrate diminishing bullish momentum suggest the pair to extend its losses toward the support level at 104.50.

Resistance level: 104.90, 105.15

Support level: 104.50, 104.10

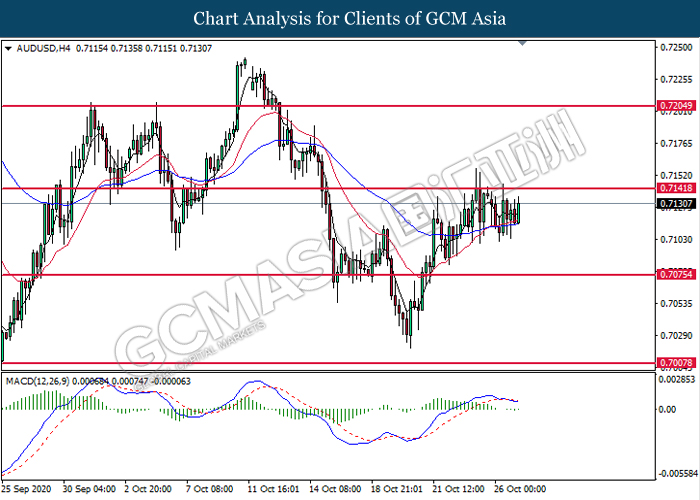

AUDUSD, H4: AUDUSD was traded flat near the resistance level at 0.7140. Due to lack of signal from MACD, it is suggested to wait for further confirmation before entering into the market.

Resistance level: 0.7140, 0.7205

Support level: 0.7075, 0.7010

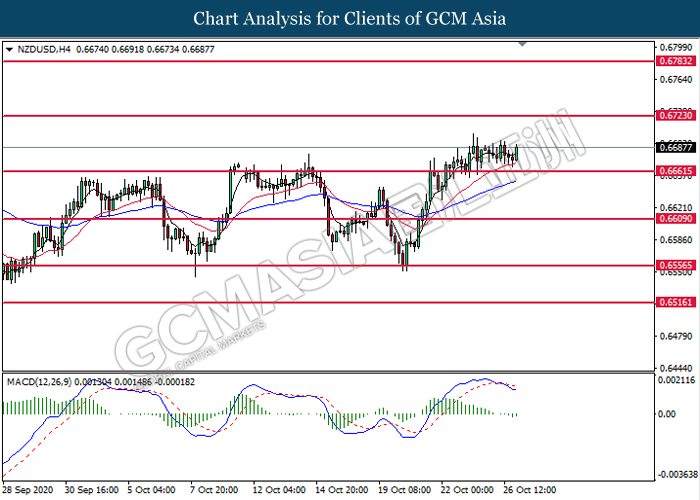

NZDUSD, H4: NZDUSD was traded higher following prior rebound from the support level at 0.6660. MACD which illustrate diminishing bearish momentum signal suggest the pair to extend its gains toward the resistance level at 0.6725.

Resistance level: 0.6725, 0.6785

Support level: 0.6660, 0.6610

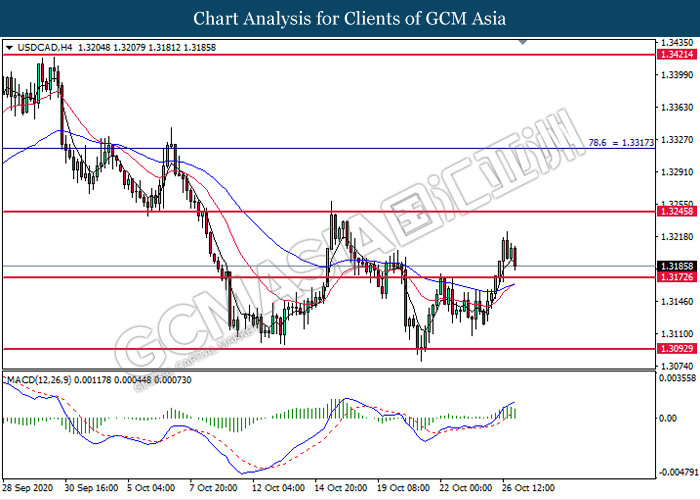

USDCAD, H4: USDCAD was traded lower following prior retracement from the higher level. MACD which illustrate diminishing bullish momentum signal suggest the pair to extend its losses toward the support level at 1.3175.

Resistance level: 1.3245, 1.3315

Support level: 1.3175, 1.3095

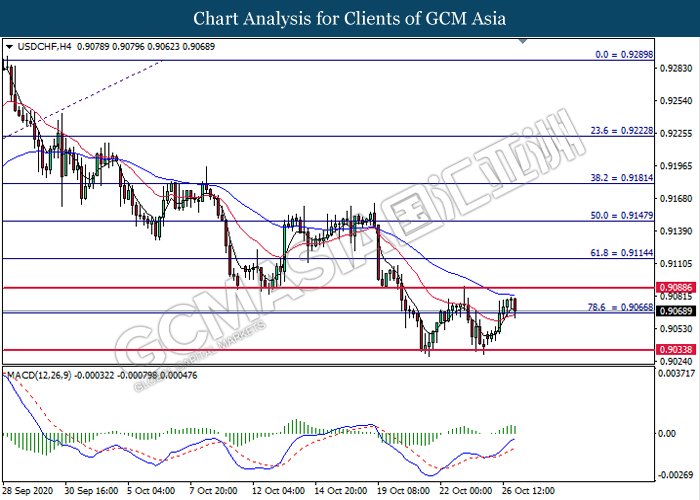

USDCHF, H4: USDCHF was traded lower while currently testing the support level at 0.9065. MACD which display diminishing bullish momentum suggest the pair to extend its losses after it successfully breakout below the support level at 0.9065.

Resistance level: 0.9090, 0.9115

Support level: 0.9065, 0.9035

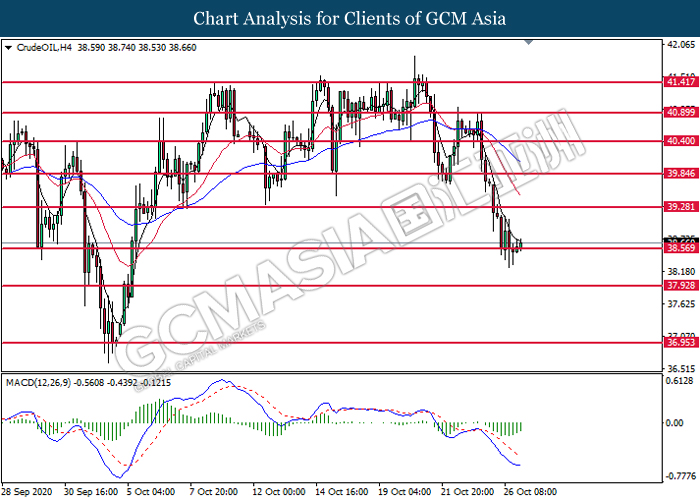

CrudeOIL, H4: Crude oil price was traded higher following prior rebound from the support level at 38.55. MACD which illustrate diminishing bearish momentum suggest the commodity to extend its gains toward the resistance level at 39.30.

Resistance level: 39.30, 39.85

Support level: 38.55, 37.95

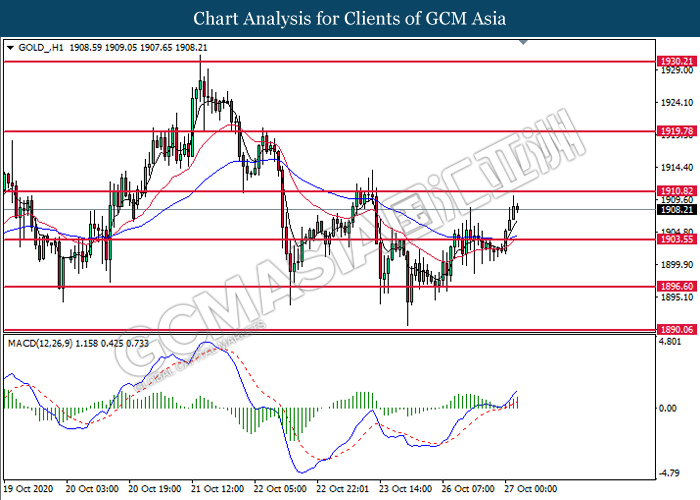

GOLD_, H1: Gold price was traded higher following prior breakout above the previous resistance level at 1903.55. MACD which illustrate bullish bias momentum suggest the commodity to extend its gains toward the resistance level at 1910.80.

Resistance level: 1910.80, 1919.80

Support level: 1903.55, 1896.60