28 October 2020 Morning Session Analysis

Dollar surged amid hopes upon the coronavirus economic relief faded.

The Dollar Index which traded against a basket of six major currencies pairs extend its gains on yesterday amid diminishing hopes upon the coronavirus economic relief from the United States. According to Reuters, U.S. President Donald Trump acknowledged on Tuesday that a coronavirus economic relief deal would likely come after the 3rd November 2020 U.S. election as Republicans in the U.S. Senate and Congressional Democrats still unable to achieve any consensus. On the economic data front, the US Dollar received further bullish momentum over the backdrop of the positive economic data from the U.S. region. According to Census Bureau, the U.S. Core Durable Goods Orders for last month came in at 0.8%, much better than the market forecast at 0.4%. Though, the gains experienced by the US Dollar was limited following the worse-than-expected U.S. CB Consumer Confidence data was released. The Conference Board reported that the U.S. CB Consumer Confidence had notched down from the previous reading of 101.3 to 100.9, which worse than the market expectation at 102.0. Nonetheless, the overall trend for the Dollar Index still remained subdued on yesterday as market participants are still scrutinizing the latest updates with regards of the U.S. Election and the U.S. economic stimulus plan in order to receive further trading signal. As of writing, the Dollar Index surged 0.05% to 92.97.

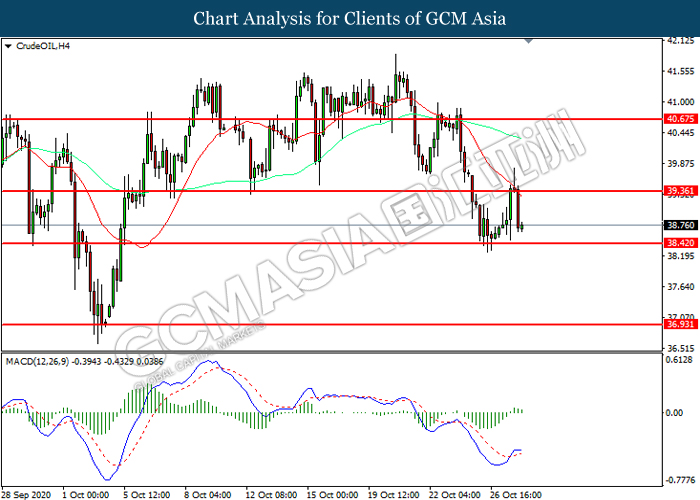

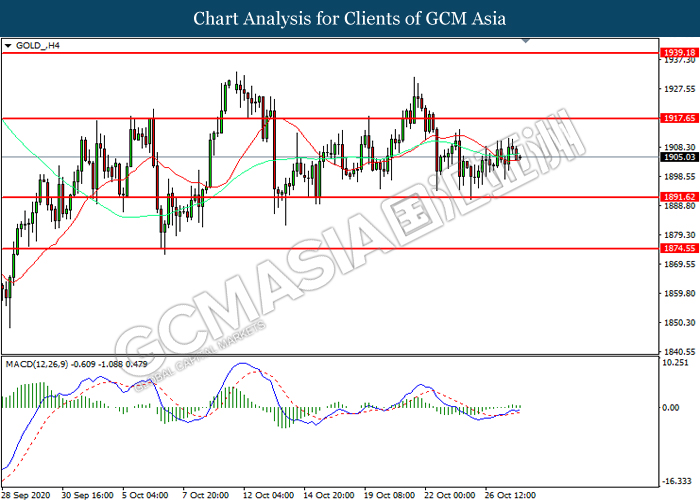

In the commodities market, the crude oil price slumped 0.38% to $38.75 per barrel as of writing. The oil market extends its losses following the U.S. oil stockpiles rose sharply last week, which spurring concerns about the strength of oil demand at the midst of the coronavirus crisis. According to American Petroleum Institute (API), the U.S. API Weekly Crude Oil stock had rose significantly from the previous reading of 0.584M to 4.577M. On the other hand, the gold market slumped 0.18% to $1904.50 per troy ounces as of writing amid strengthening US Dollar.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

23:15 CAD BoC Press Conference

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 22:00 | CAD – BoC Interest Rate Decision | 0.25% | 0.25% | – |

| 22:30 | USD – Crude Oil Inventories | -1.001M | – | – |

Technical Analysis

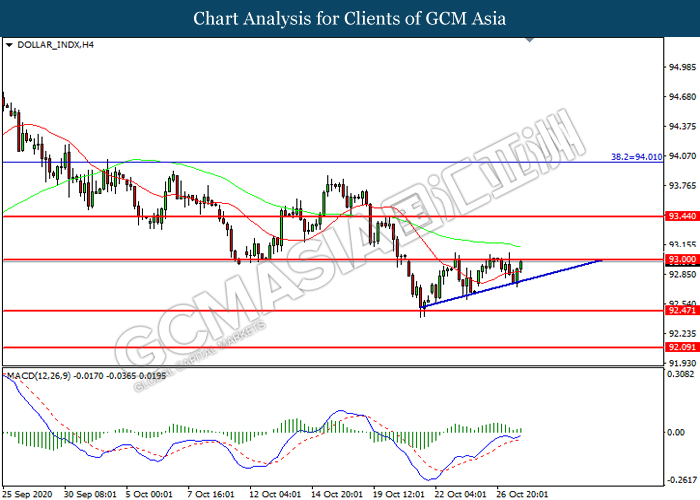

DOLLAR_INDX, H4: Dollar index was traded higher while currently testing the resistance level at 93.00. MACD which illustrated increasing bullish momentum suggest the index to extend its gains after it successfully breakout above the resistance level.

Resistance level: 93.00, 93.45

Support level: 92.50, 92.10

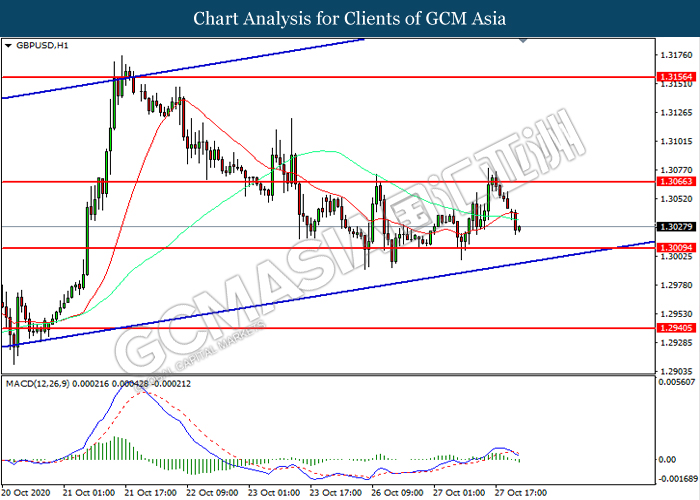

GBPUSD, H1: GBPUSD was traded lower while currently near the support level at 1.3010. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 1.3065, 1.3155

Support level: 1.3010, 1.2940

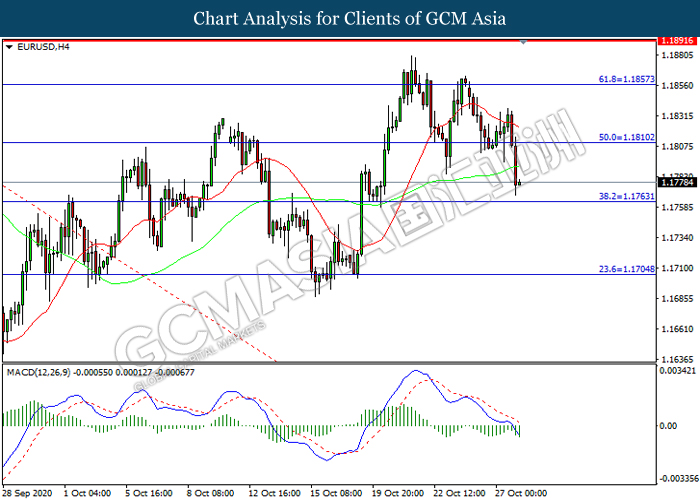

EURUSD, H4: EURUSD was traded lower while currently testing the support level at 1.1765. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 1.1810, 1.1855

Support level: 1.1765, 1.1705

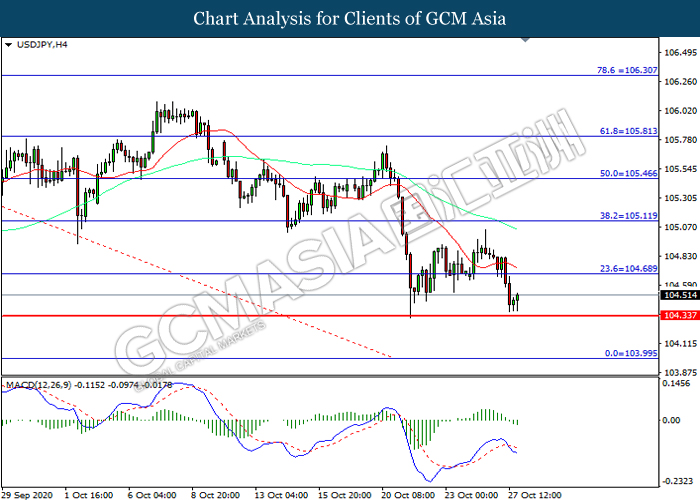

USDJPY, H4: USDJPY was traded lower while currently testing the support level 104.35. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 104.70, 105.10

Support level: 104.35, 104.00

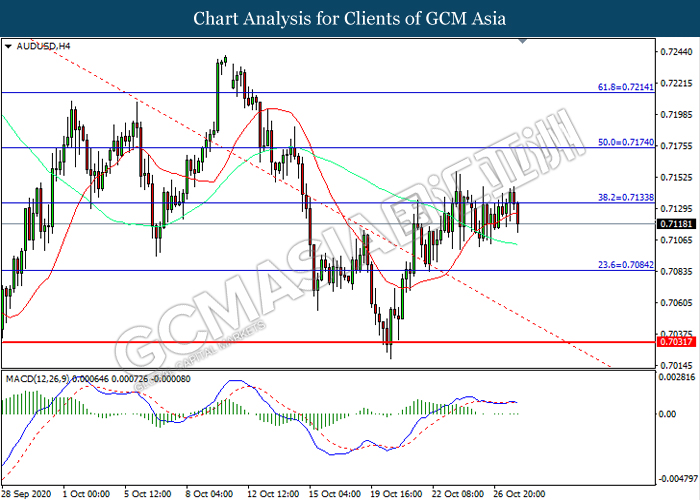

AUDUSD, H4: AUDUSD was traded lower following prior retracement from the resistance level at 0.7135. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses toward support level at 0.7085.

Resistance level: 0.7135, 0.7175

Support level: 0.7085, 0.7030

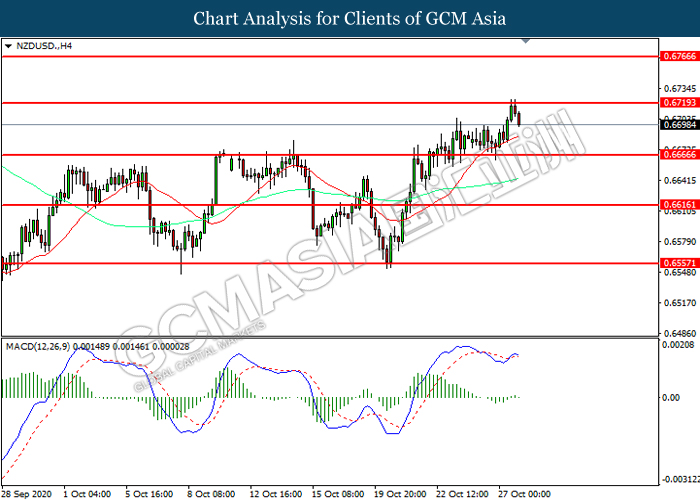

NZDUSD, H4: NZDUSD was traded lower following prior retracement from the resistance level at 0.6720. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses toward support level ta 0.6665.

Resistance level: 0.6720, 0.6765

Support level: 0.6665, 0.6615

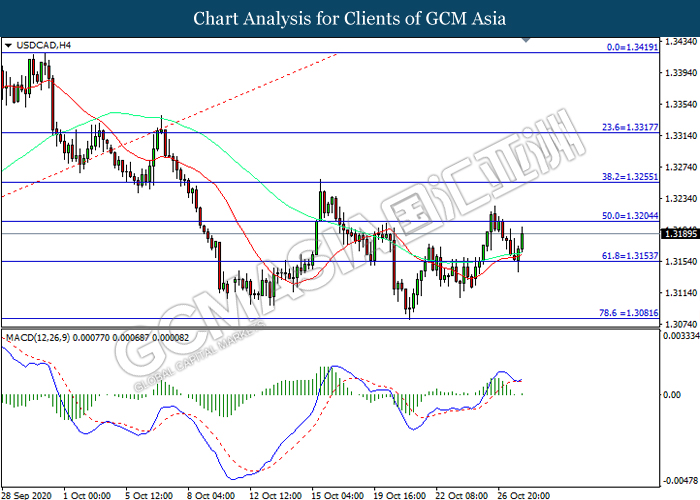

USDCAD, H4: USDCAD was traded higher following prior rebound from the support level at 1.3155. However, MACD which illustrated diminishing bullish momentum suggest the pair to be traded lower in short-term as technical correction.

Resistance level: 1.3205, 1.3255

Support level: 1.3155, 1.3080

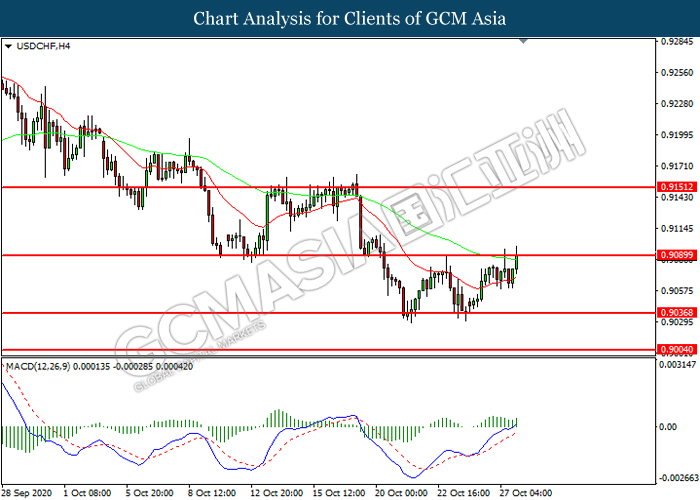

USDCHF, H4: USDCHF was traded higher while currently testing the resistance level at 0.9090. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 0.9090, 0.9150

Support level: 0.9035, 0.9005

CrudeOIL, H4: Crude oil price was traded lower while currently testing the support level at 38.40. MACD which illustrated diminishing bullish momentum suggest the commodity to extend its losses after it successfully breakout below the support level.

Resistance level: 39.35, 40.65

Support level: 38.40, 36.95

GOLD_, H4: Gold price was traded higher following prior rebound from the support level at 1891.60. However, MACD which illustrated diminishing bullish momentum suggest the commodity to be traded lower in short-term as technical correction.

Resistance level: 1917.65, 1939.20

Support level: 1891.60, 1874.55