27 October 2020 Morning Session Analysis

US Dollar surged on risk-off sentiment.

The Dollar Index which traded against a basket of six major currencies pairs surged on yesterday amid the risk-off sentiment in the FX market following the Covid-19 cases from the United States region hit a record-high. According to Bloomberg, the coronavirus infections from the U.S. was adding more than 85,000 people on yesterday. Meanwhile, some of the Europe countries had also imposed a new lockdown restriction in order to curb the spreading of the Covid-19 infections. According to Reuters, Spain announced a new state of emergency and Italy has ordered restaurants and bars to shut by 6 p.m. Such sentiment had diminished the risk appetite in the FX market, which prompting investors to shift their portfolio toward the safe-haven currency such as the US Dollar. Besides, the lack of progress with regards of the U.S. economic stimulus plans had also spurred further bullish momentum for the US Dollar. Nonetheless, the gain of the US Dollar was limited over the backdrop of the bearish housing data from the US region on yesterday. According to Census Bureau, the U.S. New Home Sales came in at only 959K, fared worse than expectation at 1,025K while dialling down the market optimism toward the economic progression from the United States. As of writing, the Dollar Index appreciated by 0.32% to 93.00.

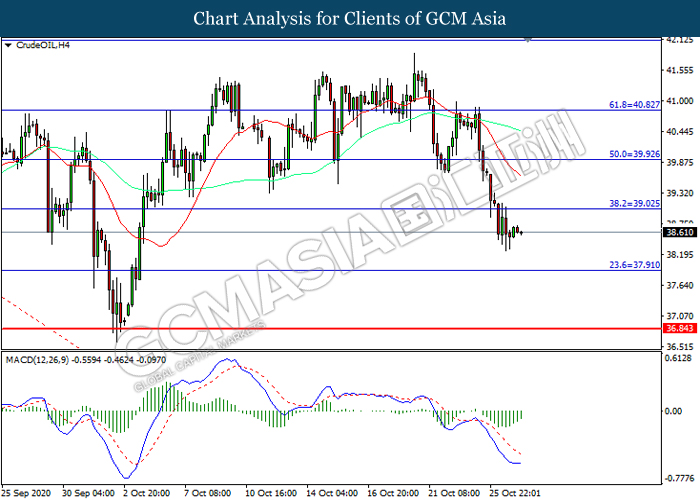

In the commodities market, the crude oil price slumped 0.10% to $38.65 per barrel as of writing. The oil market extends its losses amid the resurgence of the Covid-19 cases in the world, which spurring negative prospect for the crude oil demand. On the other hand, the gold price slumped 0.02% to $1902.20 per troy ounces as of writing due to the appreciation of the US Dollar.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 20:30 | USD – Core Durable Goods ORders (MoM) (Sep) | 0.6% | 0.4% | – |

| 20:30 | USD – CB Consumer Confidence (Oct) | 101.8 | 102.5 | – |

Technical Analysis

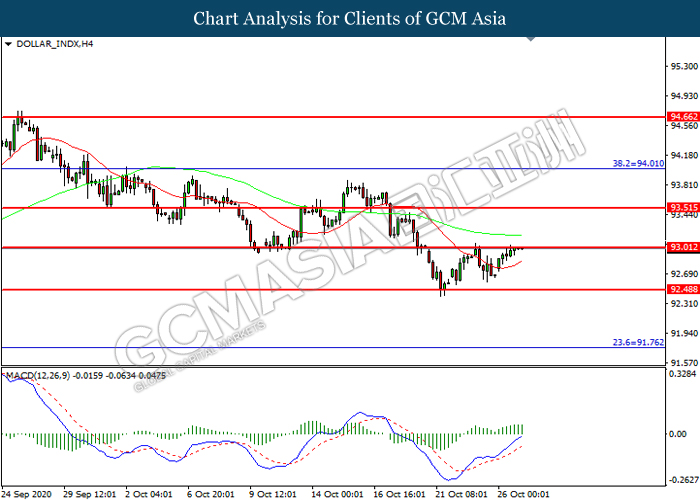

DOLLAR_INDX, H4: Dollar index was traded higher while currently testing the resistance level at 93.00. MACD which illustrated increasing bullish momentum suggest the index to extend its gains after it successfully breakout above the resistance level.

Resistance level: 93.00, 93.50

Support level: 92.50, 91.75

GBPUSD, H4: GBPUSD was traded lower while currently near the support level at 1.2995. However, MACD which illustrated diminishing bearish momentum suggest the pair to be traded higher in short-term as technical correction.

Resistance level: 1.3065, 1.3155

Support level: 1.2995, 1.2940

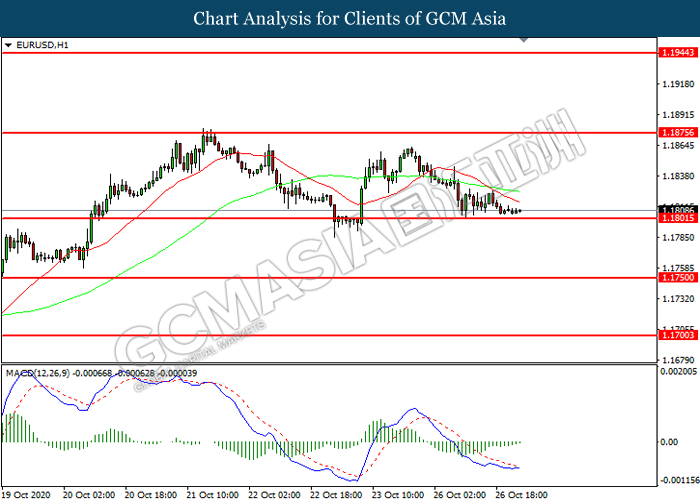

EURUSD, H1: EURUSD was traded lower while currently testing the support level at 1.1800. However, MACD which illustrated diminishing bearish momentum suggest the pair to be traded higher in short-term as technical correction.

Resistance level: 1.1875, 1.1945

Support level: 1.1800, 1.1750

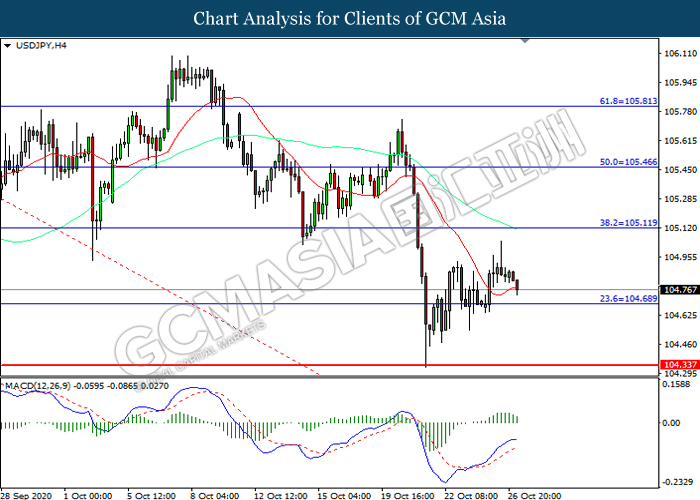

USDJPY, H4: USDJPY was traded lower while currently near the support level at 104.70. However, MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 105.10, 105.45

Support level: 104.70, 104.35

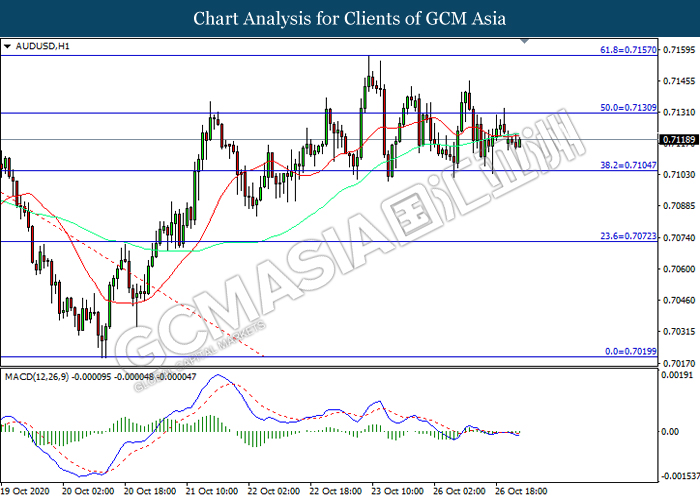

AUDUSD, H1: AUDUSD was traded lower following prior retracement from the resistance level at 0.7130. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses toward support level at 0.7105.

Resistance level: 0.7130, 0.7155

Support level: 0.7105, 0.7075

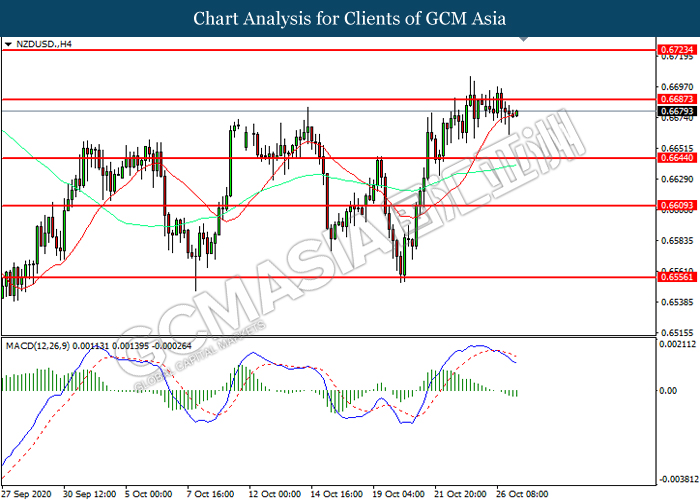

NZDUSD, H4: NZDUSD was traded lower following prior retracement from the resistance level at 0.6685. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses toward support level at 0.6645.

Resistance level: 0.6685, 0.6725

Support level: 0.6645, 0.6610

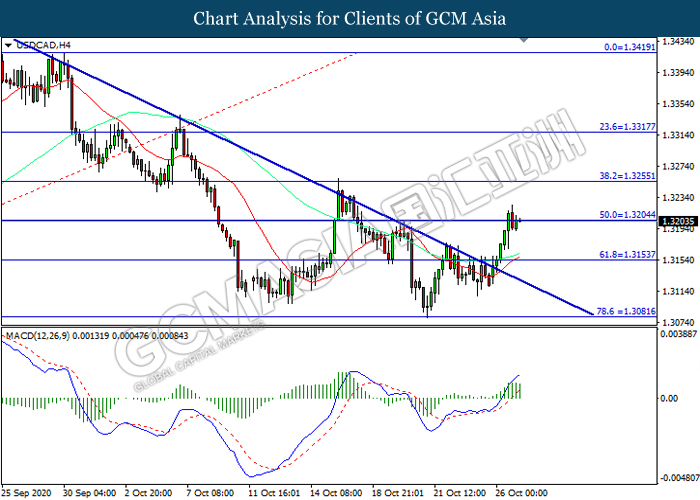

USDCAD, H4: USDCAD was traded higher while currently testing the resistance level at 1.3205. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 1.3205, 1.3255

Support level: 1.3155, 1.3080

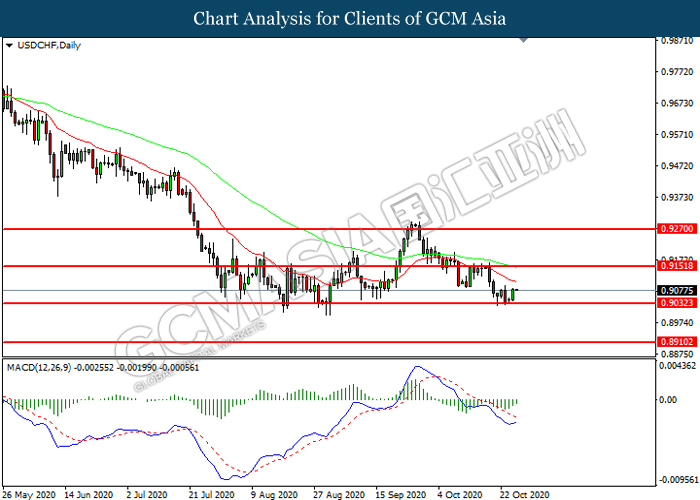

USDCHF, Daily: USDCHF was traded higher following prior rebound from the support level at 0.9030. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains toward resistance level at 0.9150.

Resistance level: 0.9150, 0.9270

Support level: 0.9030, 0.8910

CrudeOIL, H4: Crude oil price was traded lower following prior breakout below the previous support level at 39.05. However, MACD which illustrated diminishing bearish momentum suggest the commodity to be traded higher in short-term as technical correction.

Resistance level: 39.50, 41.45

Support level: 38.05, 38.85

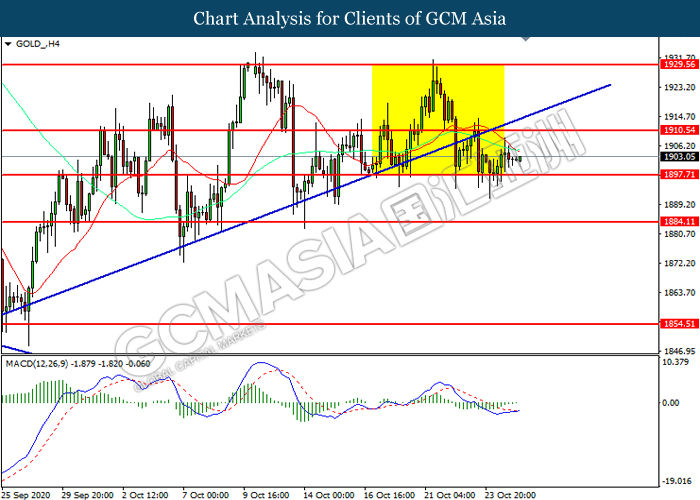

GOLD_, H4: Gold price was traded higher following prior rebound from the support level at 1897.70. MACD which illustrated diminishing bearish momentum suggest the commodity to extend its gains toward resistance level at 1910.55.

Resistance level: 1910.55, 1929.55

Support level: 1897.70, 1884.10