28 March 2017 Daily Analysis

Greenback limps as Trumpflation deflates.

Euro retreats from previous four and a half months’ peak of $1.0906 following a slight rebound of the greenback during early Asian session. Previously, the common currency was boosted when German Chancellor Angela Markel’s conservative won a regional election, dealing a setback to the Social Democrat rivals while boosting her prospect to win the fourth-term in September’s national election. Additionally, yesterday’s German Ifo Index shows a better-than-expected reading, placing some limit to the overall downside of the currency. Pairing of EUR/USD was down 0.03% and last quoted at $1.0861. On the other hand, the greenback hobbles away from multi-months low after opening the week with a wide gap as market participants react towards last Friday’s healthcare bill debacle. Trump administrations are now under investor’s skepticism over its ability to pass on other bills such as tax reform and infrastructure spending through the government. Likewise, the dollar index ticked up 0.05% to 98.96 this morning.

In the commodities market, crude oil price rebounded in Asia while industry data on US inventories is expected to set the near-term market tone. Otherwise, gold price was traded flat at $1,254.80 as investors ponder upon US politics that surrounds Trump administration.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

22:10 CAD BoC Gov Poloz Speaks

00:50 USD Fed Chair Yellen Speaks

Today’s Highlight Economy Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 22:00 | USD – CB Consumer Confidence (Mar) | 114.8 | 114.0 | – |

| 04:30 | Crude Oil – API Weekly Crude Oil Stock | 4.500M | – | – |

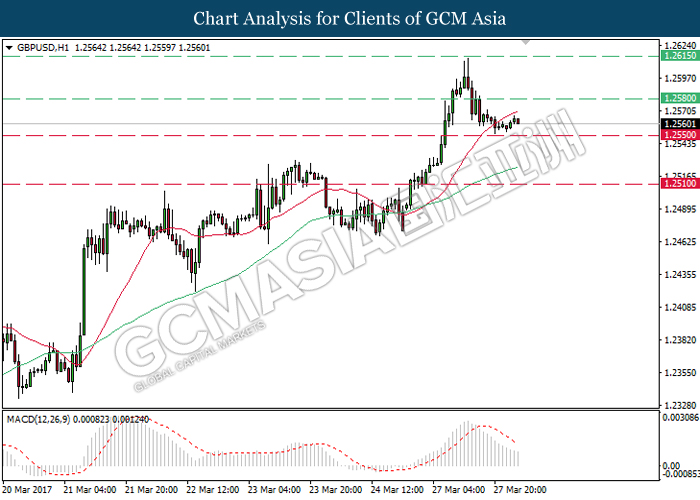

GBPUSD

GBPUSD, H1: GBPUSD was traded lower following prior retrace from previous high of 1.2615 while currently testing below the 20-moving average line (red). As the MACD indicator remains hovered outside of upward momentum, GBPUSD is expected to be traded lower in the short-term as technical correction. Otherwise, long-term trend direction suggests GBPUSD to extend its upward momentum.

Resistance level: 1.2580, 1.2615

Support level: 1.2550, 1.2510

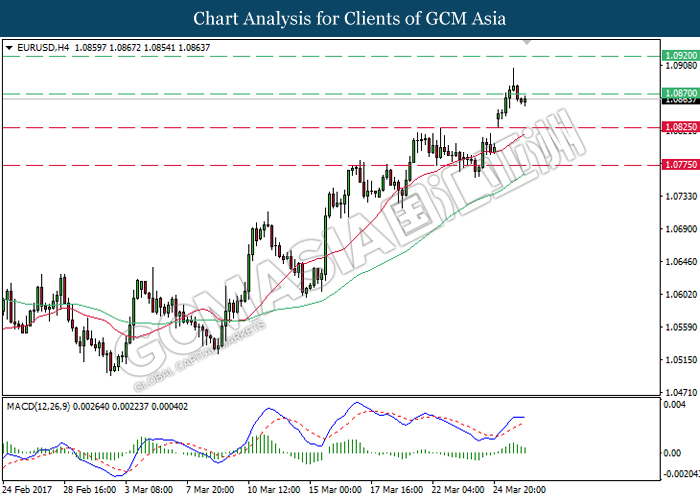

EURUSD

EURUSD, H4: EURUSD was traded lower following previous retracement while currently testing near the resistance level of 1.0870. As the upward signal line from MACD histogram begins to narrow sideways, EURUSD may be traded lower in the short-term as technical correction. Otherwise, long-term trend direction suggests EURUSD to extend its prior uptrend.

Resistance level: 1.0870, 1.0920

Support level: 1.0825, 1.0775

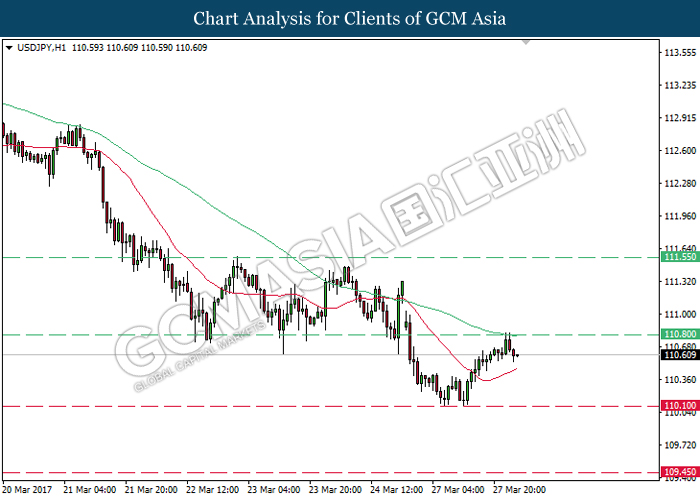

USDJPY

USDJPY, H1: USDJPY was traded lower following prior retrace form the resistance level of 110.80 while currently testing in between both moving average line. A successful closure below the 20-moving average line (red) would suggest USDJPY to advance further down, towards the target of support level at 110.10.

Resistance level: 110.80, 111.55

Support level: 110.10, 109.45

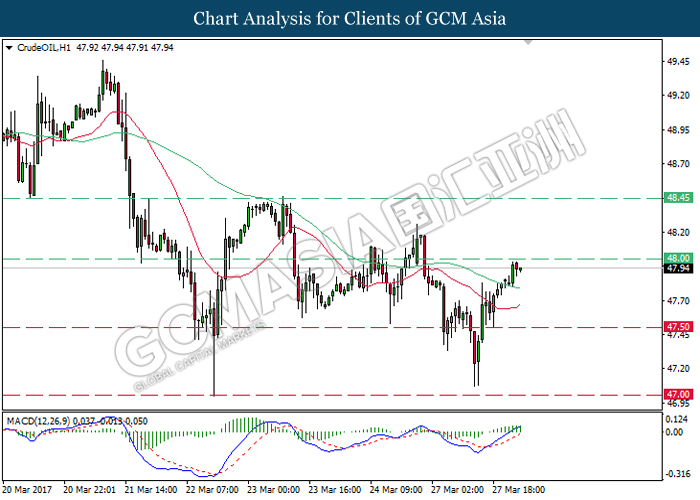

CrudeOIL

CrudeOIL, H1: Crude oil price was traded higher following prior rebound form the support level of 47.50 while currently testing near the resistance level of 48.00. With regards to the MACD histogram which illustrate upward signal and momentum, a closure above the level of 48.00 would suggest crude oil price to extend its upward momentum.

Resistance level: 48.00, 48.45

Support level: 47.50, 47.00

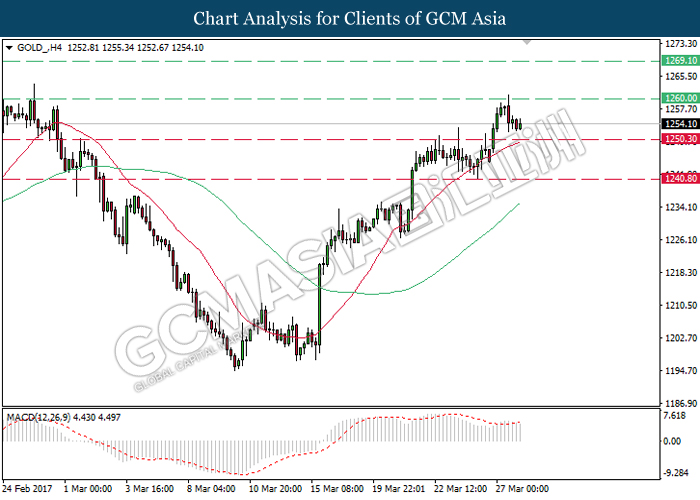

GOLD

GOLD_, H4: Gold price was traded lower following a retrace from previous high of 1260.00. Referring to the MACD indicator which begins to hover outside of upward momentum, gold price is expected to experience brief retracement period and to be traded lower in the short-term. Long-term trend direction suggests the extension of prior uptrend.

Resistance level: 1260.00, 1269.10

Support level: 1250.30, 1240.80