28 March 2023 Afternoon Session Analysis

BoE Bailey’s hawkish speech supports Pound gains.

The British Pound extended its gains amid the Bank of England (BoE) Governor Andrew Bailey’s hawkish statement. In the speech, Bailey reiterated that the UK CPI inflation is persistent at a higher level of 10.4%, and must return the CPI back to the BoE 2% target. Recently, there has been evidence of more resilience in economic activity, as nominal wage growth and retail sales data showed upbeat results. The data signaled to BoE that inflation will not be entirely smooth, where the cost and price pressures will likely to remain elevated. Since inflation is at a higher level, the BoE will likely to further tighten its monetary policy if necessary. Simultaneously, the Pound was strengthened against the dollar after risk sentiment improved. The BoE’s Bailey also mentioned the UK banking system is resilient, with robust capital and sufficient liquidity to support the economy while giving confidence to the investors. Hence, the overall UK economic prospect remains bright, giving the BoE more room to tighten its monetary policy further. The pair of GBP/USD appreciated 0.27% to $1.2317 as of writing.

In the commodities market, the crude oil prices were soaring by 0.21% to $72.96 per barrel as of writing amid the supply interruption from Kurdistan continued to weigh on the market. Besides, gold prices edged up by 0.11% to $1973.40 per troy ounce as the dollar weakened.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

16:45 GBP BoE Gov Bailey Speaks

21:15 EUR ECB President Lagarde Speaks

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 22:00 | USD – CB Consumer Confidence (Mar) | 102.9 | 101.0 | – |

Technical Analysis

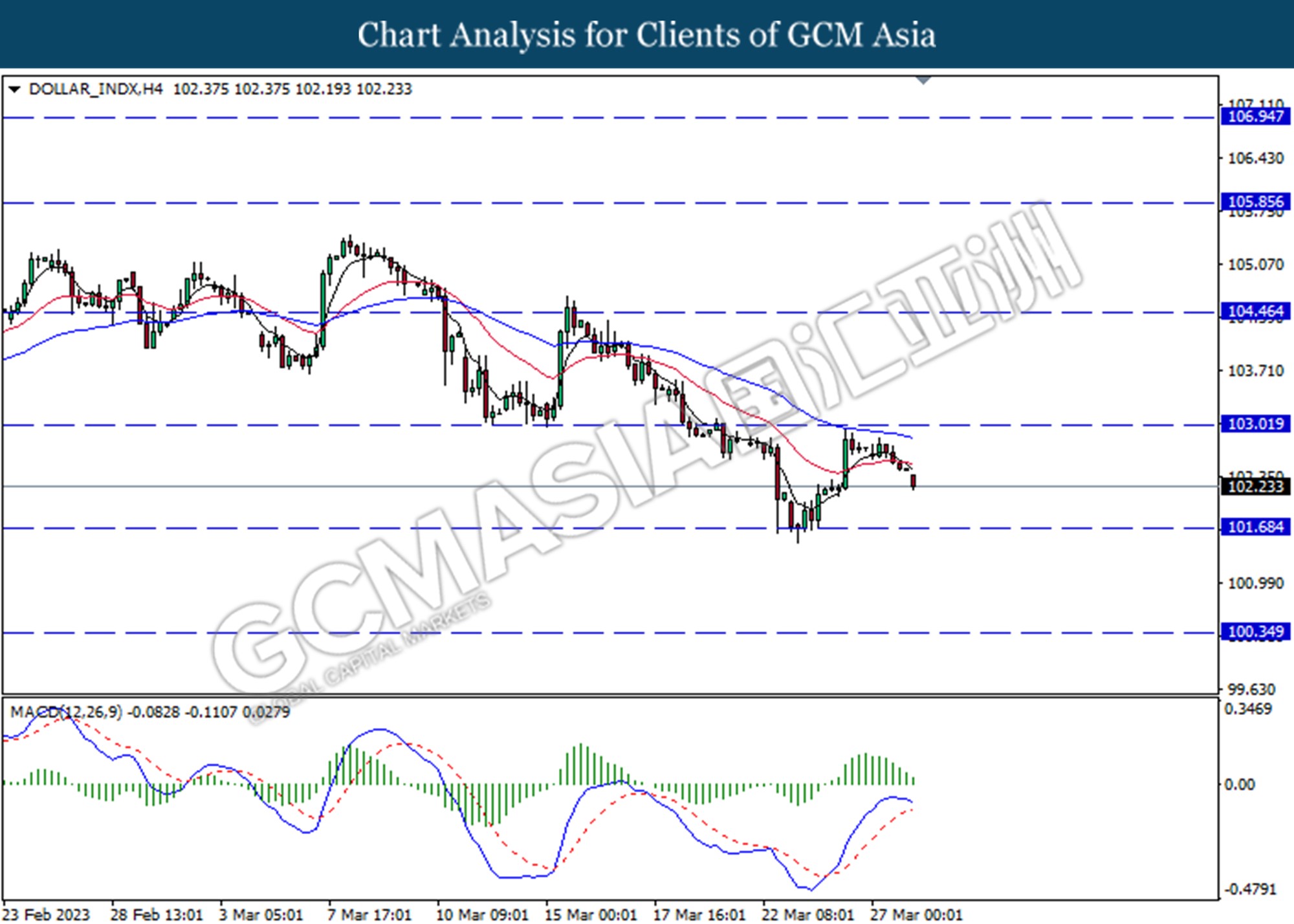

DOLLAR_INDX, H4: Dollar index was traded lower following the prior retracement from the higher level. MACD which illustrated diminishing bullish momentum suggests the index to extend its losses toward the support level at 101.70.

Resistance level: 103.00, 104.45

Support level: 101.70, 100.35

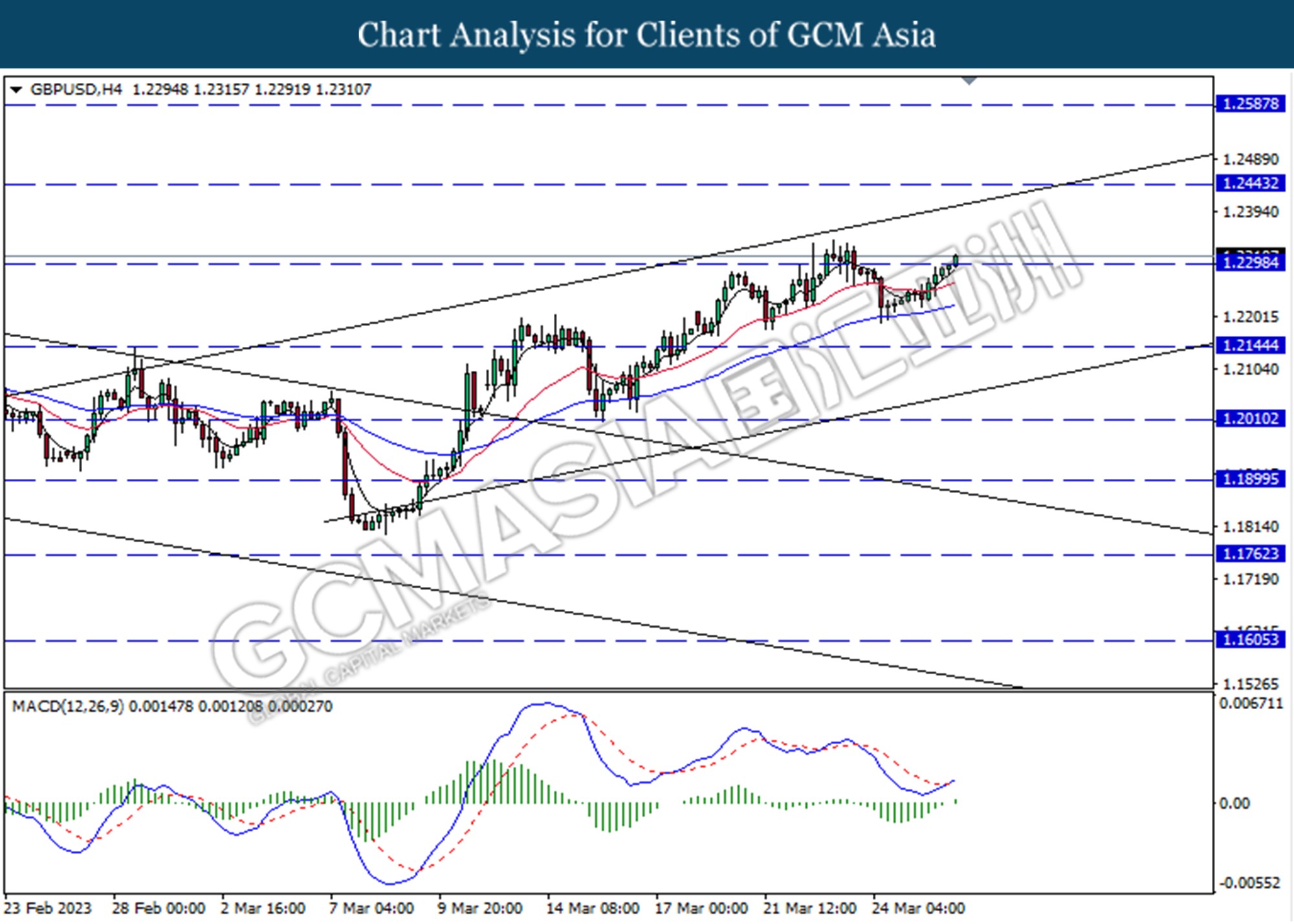

GBPUSD, H4: GBPUSD was traded higher following the prior breakout above the previous resistance level at 1.2300. MACD which illustrated bullish momentum suggests the pair to extend its gains toward the resistance level at 1.2445.

Resistance level: 1.2445, 1.2590

Support level: 1.2300, 1.2145

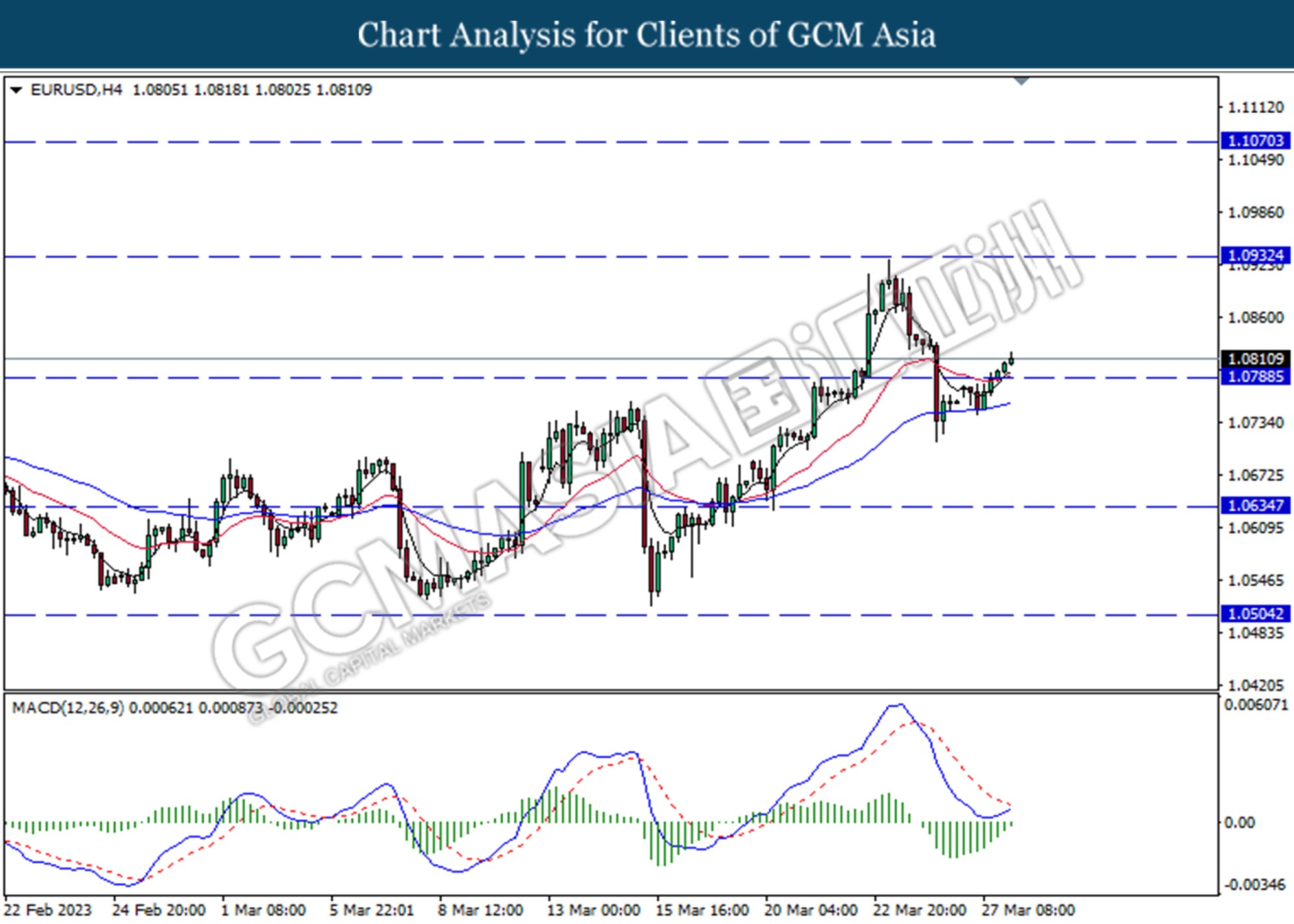

EURUSD, H4: EURUSD was traded higher following the prior break above the previous resistance level at 1.0790. MACD which illustrated diminishing bearish bias momentum suggests the pair to extend its gains toward the resistance level at 1.0930.

Resistance level: 1.0930, 1.1070

Support level: 1.0790, 1.0635

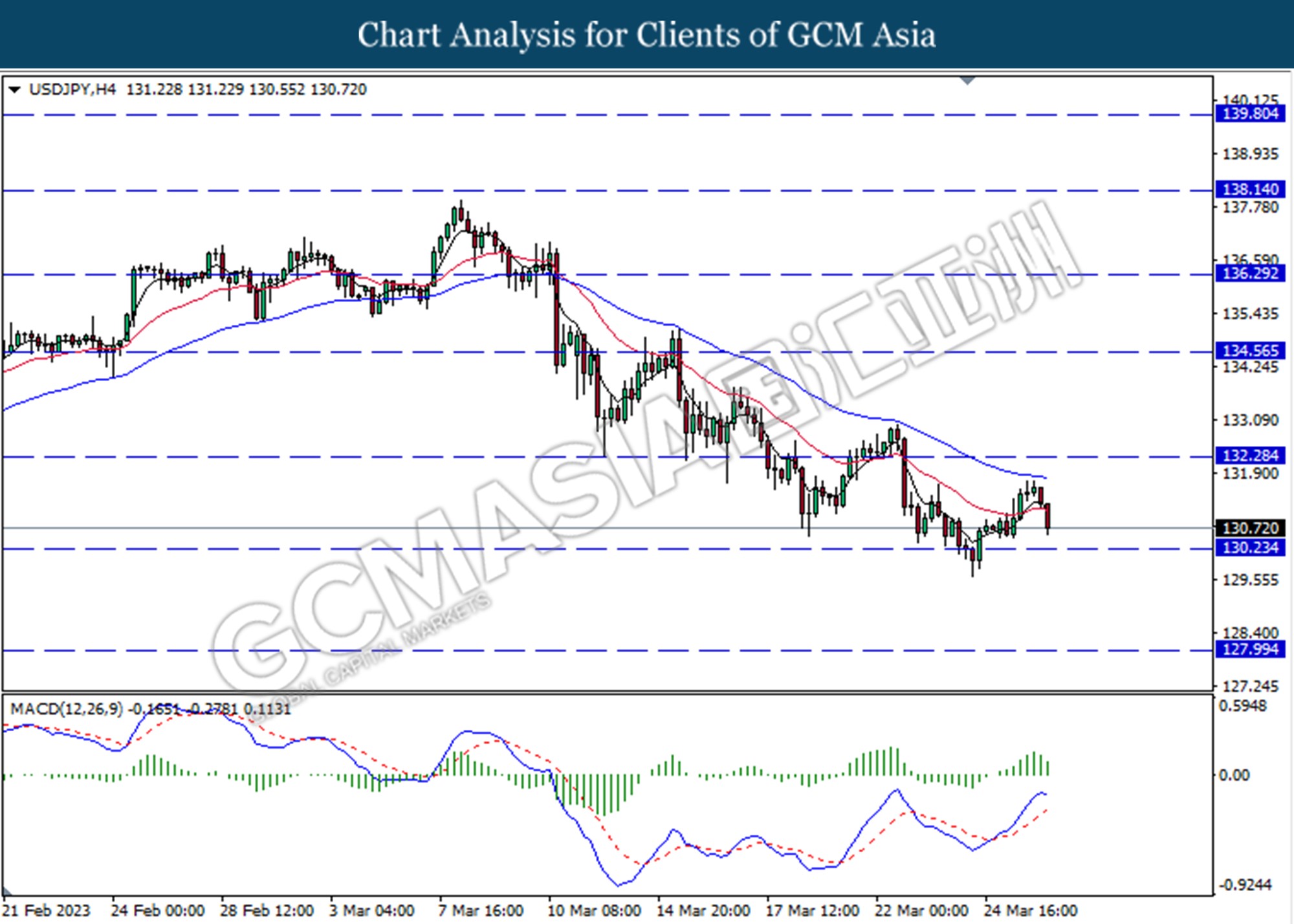

USDJPY, H4: USDJPY was traded lower following the prior retracement from the higher level. MACD which illustrated diminishing bullish momentum suggests the pair to extend its losses toward the support level at 130.25.

Resistance level: 132.30, 134.60

Support level: 130.25, 128.00

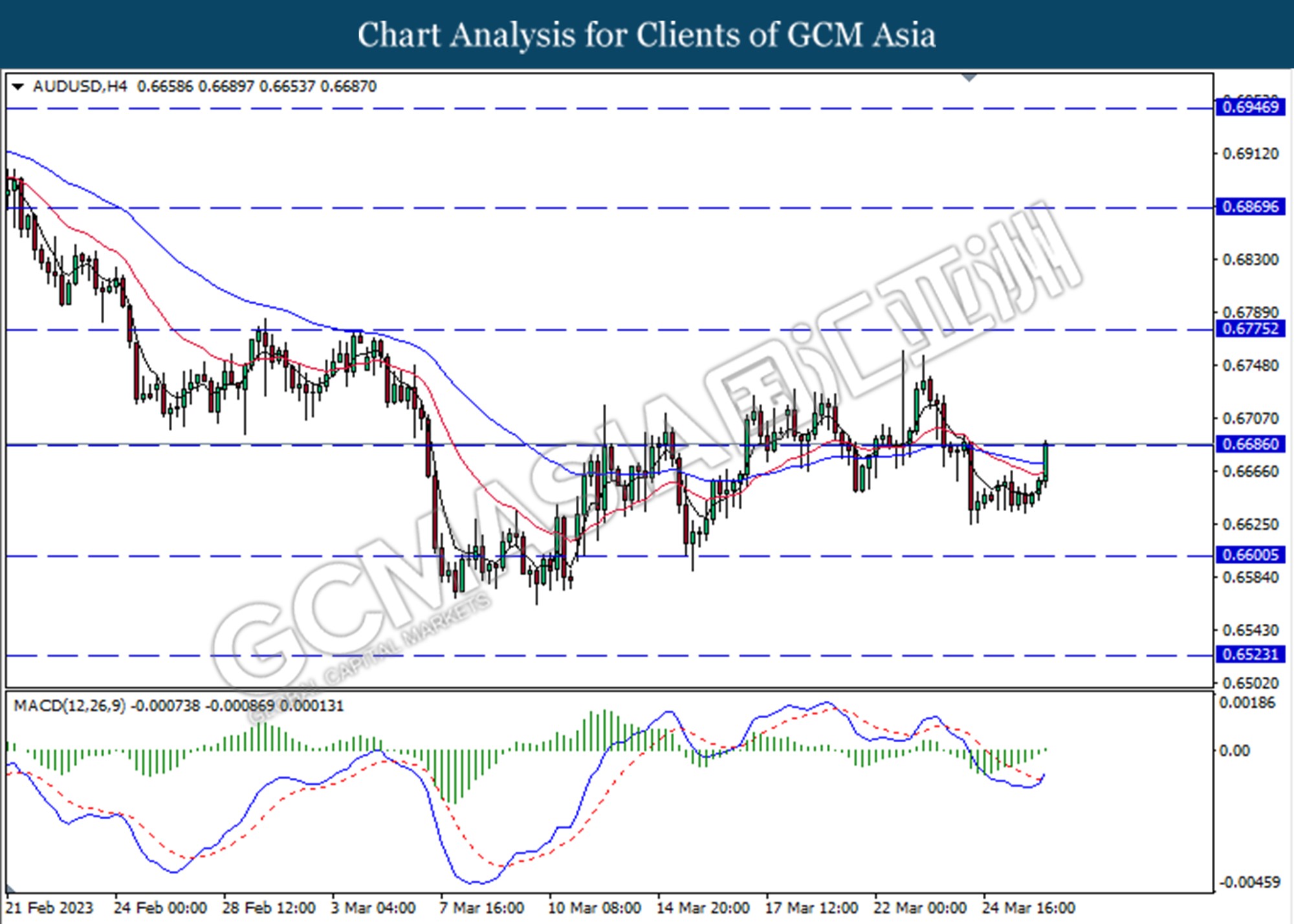

AUDUSD, H4: AUDUSD was traded higher while currently testing for the resistance level at 0.6685. MACD which illustrated diminishing bearish momentum suggests the pair to extend its gains if successfully breaks above the resistance level.

Resistance level: 0.6685, 0.6775

Support level: 0.6605, 0.6525

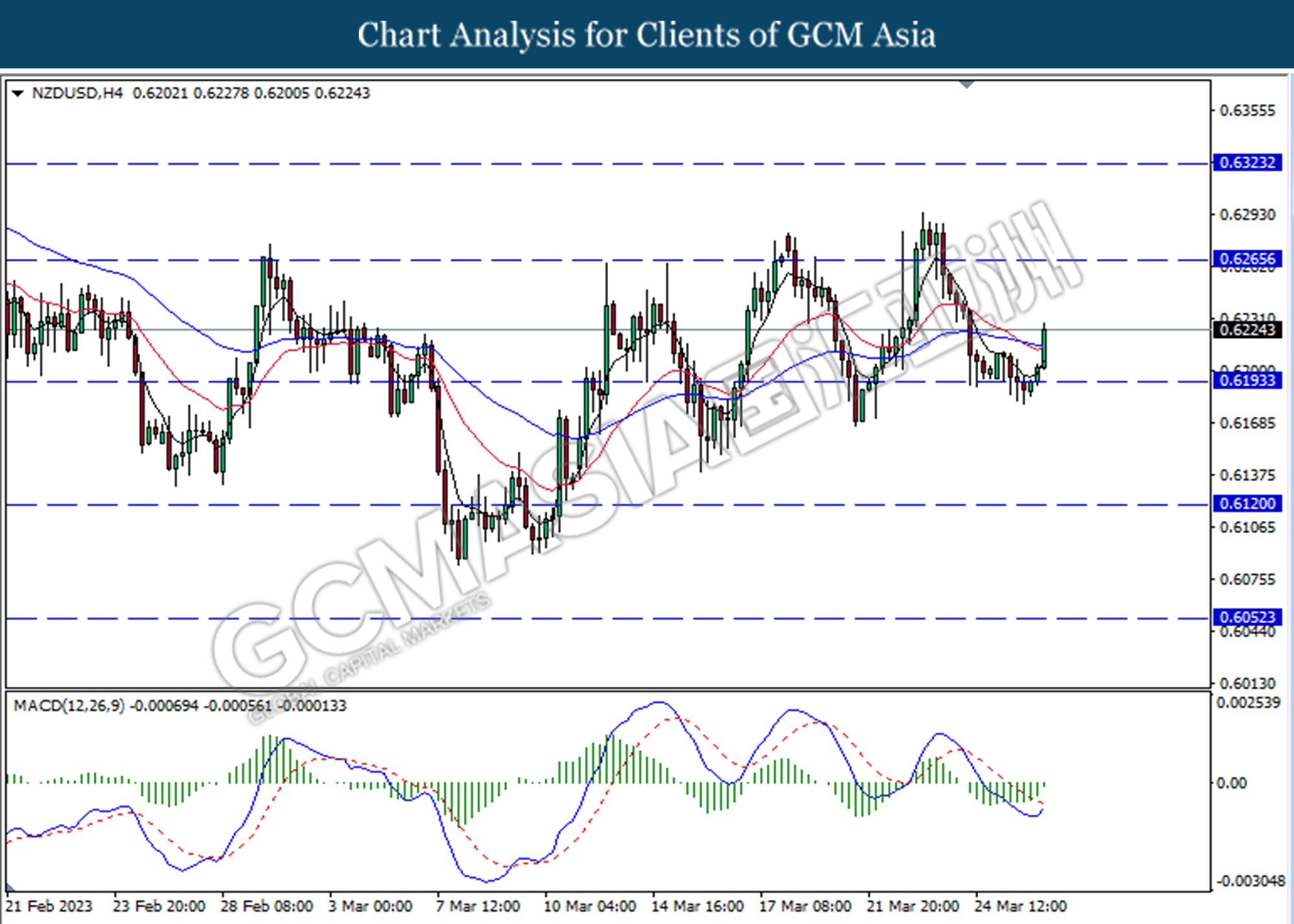

NZDUSD, H4: NZDUSD was traded higher following the prior break above the previous resistance level at 0.6195. MACD which illustrated diminishing bearish momentum suggests the pair to extend its gains toward the resistance level at 0.6265.

Resistance level: 0.6265, 0.6320

Support level: 0.6195, 0.6120

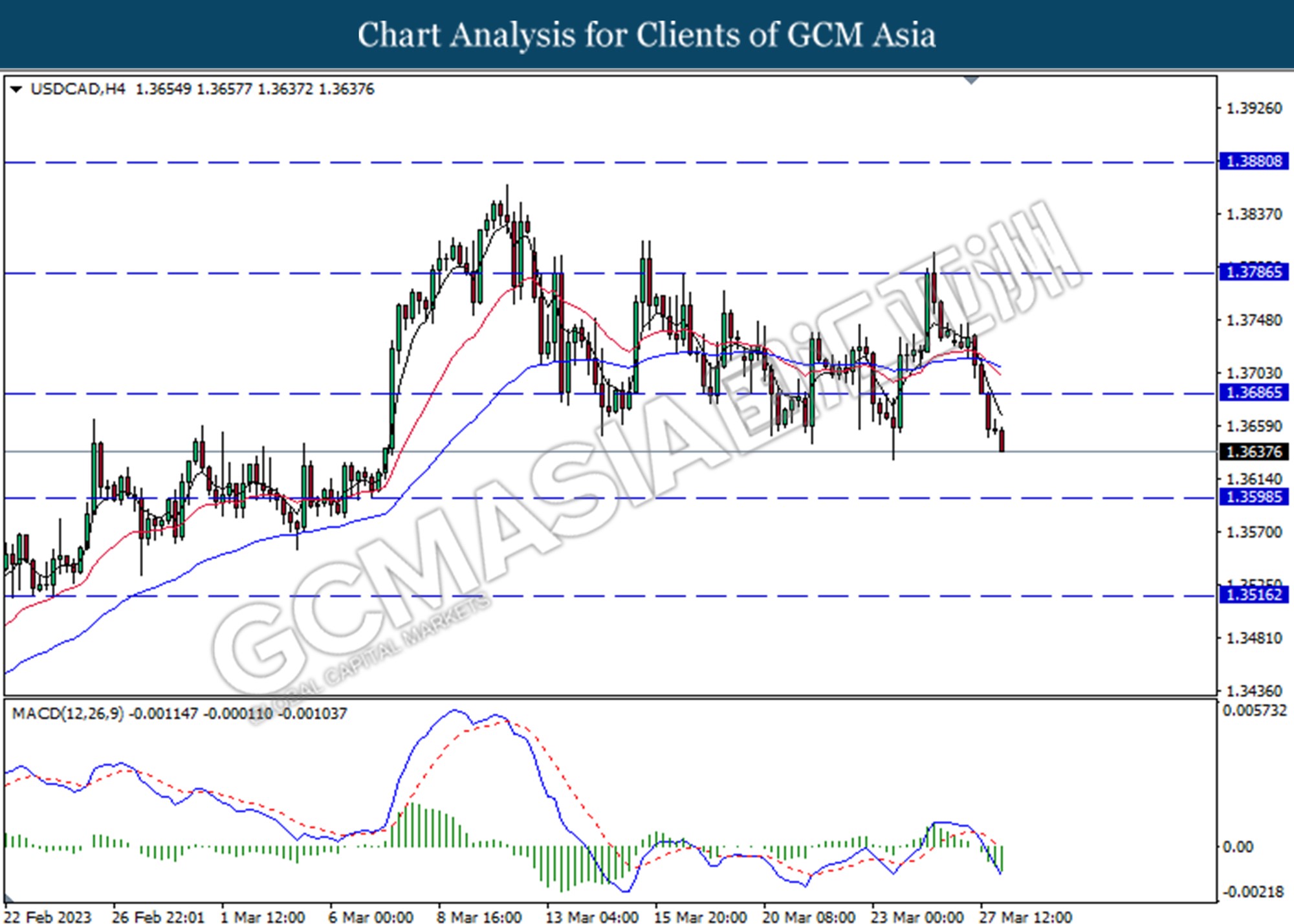

USDCAD, H4: USDCAD was traded lower following the prior break below from the previous support level at 1.3685. MACD which illustrated increasing bearish momentum suggests the pair to extend its losses toward the support level at 1.3600.

Resistance level: 1.3685, 1.3785

Support level: 1.3600, 1.3515

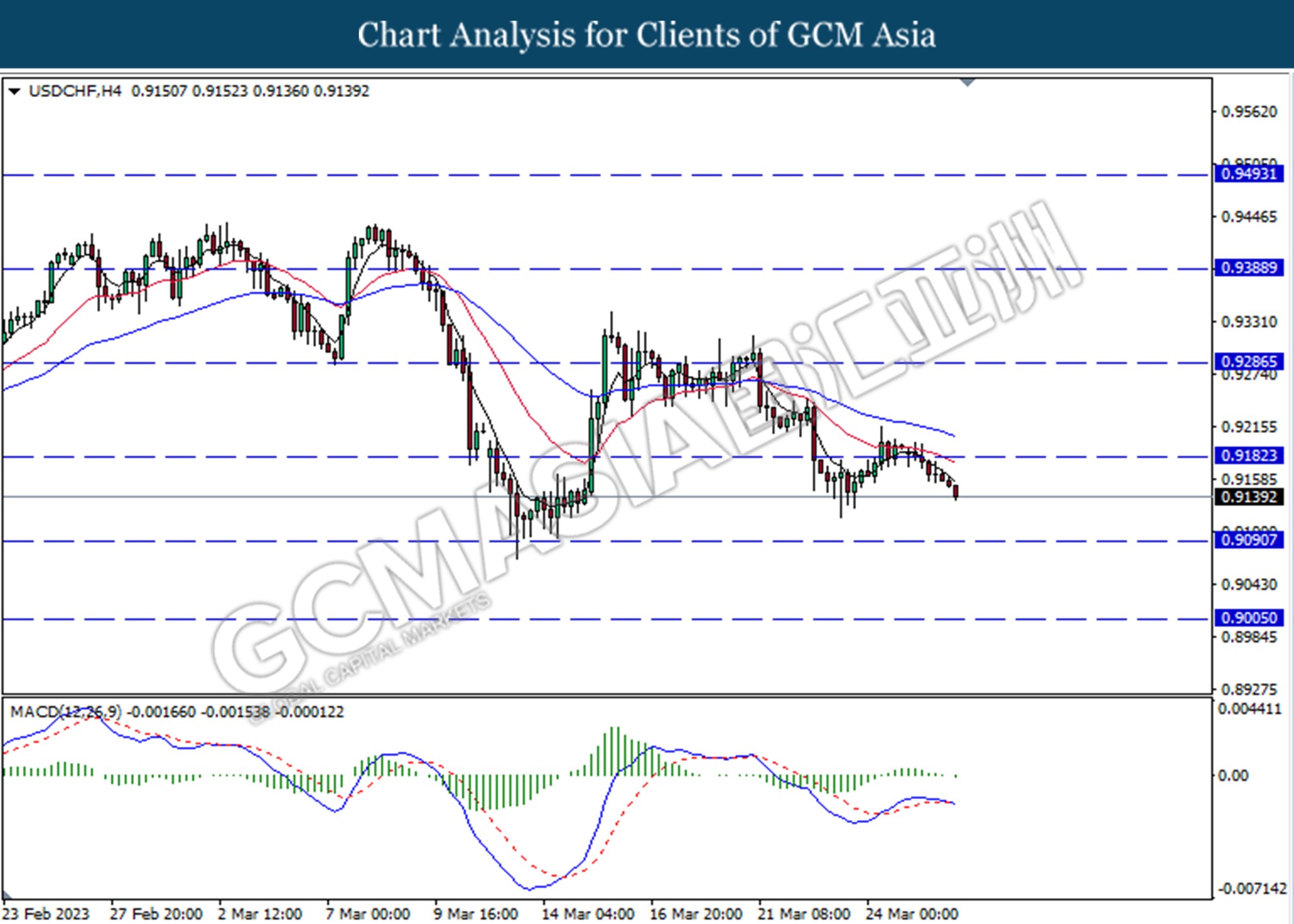

USDCHF, H4: USDCHF was traded lower following the prior break below from the previous support level at 0.9180. MACD which illustrated bearish momentum suggests the pair to extend its losses toward the support level at 0.9090.

Resistance level: 0.9180, 0.9285

Support level: 0.9090, 0.9005

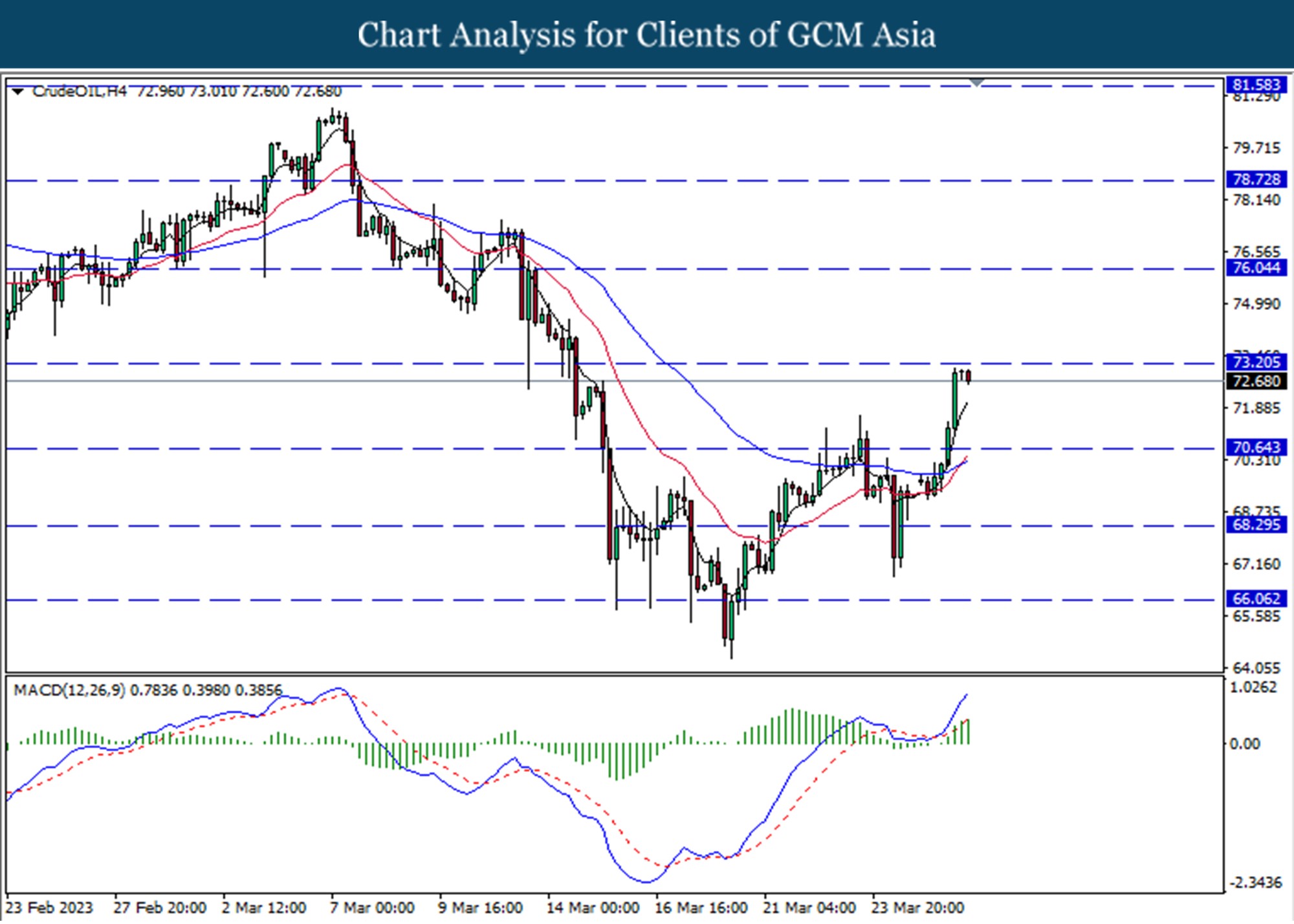

CrudeOIL, H4: Crude oil price was traded lower following a prior retracement from the higher level. However, MACD which illustrated increasing bullish momentum suggests the commodity to undergo technical correction in the short term.

Resistance level: 70.65, 73.20

Support level: 68.20, 66.05

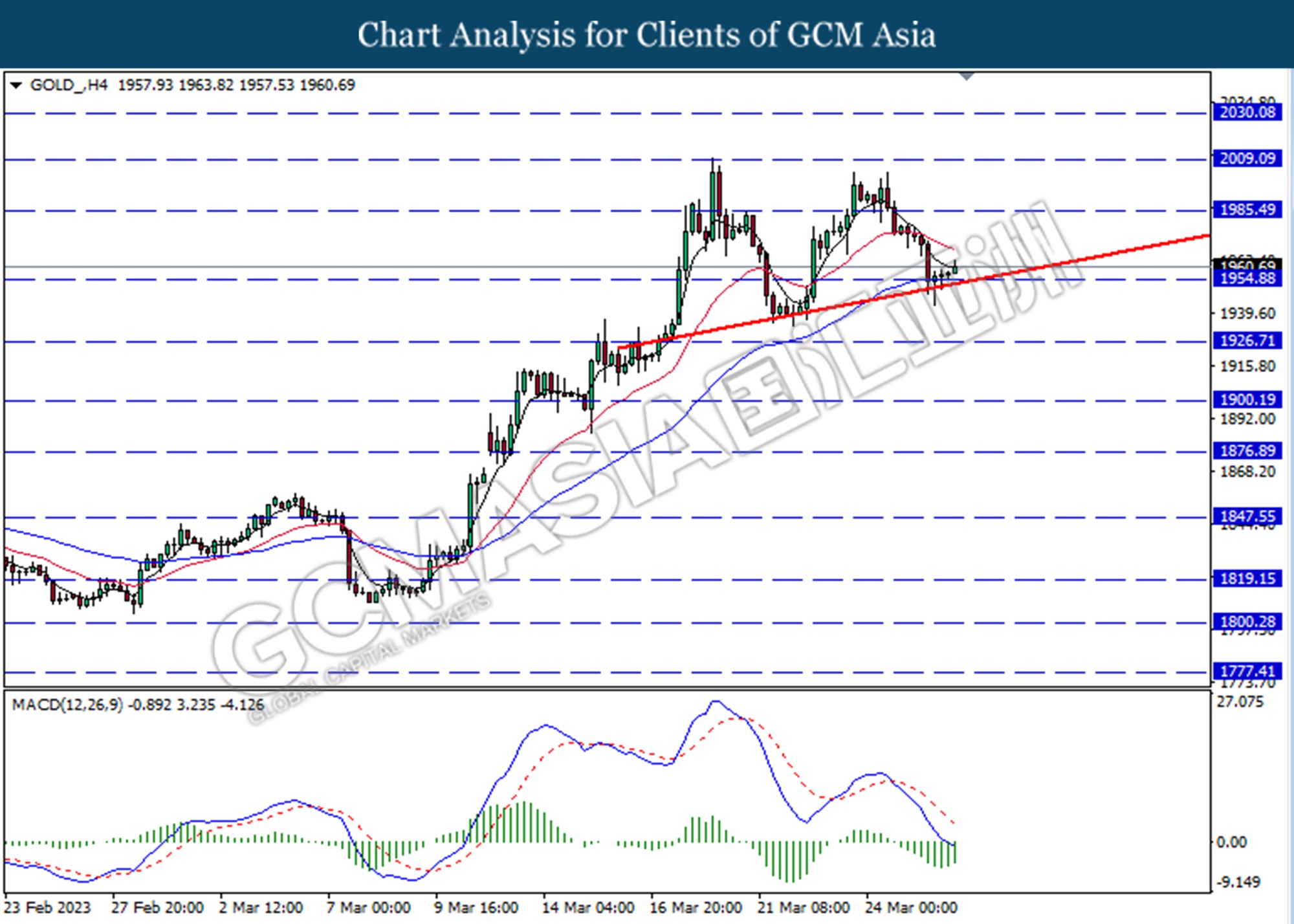

GOLD_, H4: Gold price was traded higher following a prior rebound from the support level at 1954.90. MACD which illustrated diminishing bearish momentum suggests the commodity to extend its gains toward the resistance level at 1985.50.

Resistance level: 1985.50, 2009.10

Support level: 1954.90, 1926.70