28 March 2023 Morning Session Analysis

US dollar retreated as bank contagion fears eased.

The dollar index, which traded against a basket of six major currencies, failed to extend its rally yesterday as the market worries around the Deutsche Bank eased following a large sell-off in the later of last week. Yesterday, the share price of Deutsche Bank rebounded sharply alongside the slide in cost of insuring its debt against default as the majority of the analysts reassured that the financial health of the largest bank in Germany was strong. According to the CMAQ pricing, the spreads on five-year senior credit default swaps (CDS) fell from as high as 226.9 bps to 198.6 bps on Monday. With that, it reignited the market confidence toward the future prospect of the bank and slacked up the market speculation over the possibility of happening crisis. As a result, the investors moved back their capital from the US dollar market to Euro market. At the same time, the news released early Monday that First Citizens BancShares agreed to acquire Silicon Valley Bank’s deposits and loans has calmed down the market concerns surrounding the health of smaller US banks. According to the Federal Deposit Insurance Corporation (FDIC) statement, the takeover transaction covers US$119 billion in deposits and $72 billion in assets, and SVB’s 17 branches will open as First Citizens starting from now onward. The takeover deal boosted the market sentiment of dollar index yesterday. As of writing, the dollar index -dipped 0.27% to 102.85.

In the commodities market, crude oil prices was traded higher by 5.22% to $72.70 per barrel as the market fears over the banking crisis subsided following the significant drop in Deutsche Bank’s CDS spread. Besides, gold prices ticked up by 0.06% to $1957.75 per troy ounce after falling significantly yesterday amid banking fears eased.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

16:45 GBP BoE Gov Bailey Speaks

21:15 EUR ECB President Lagarde Speaks

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 22:00 | USD – CB Consumer Confidence (Mar) | 102.9 | 101.0 | – |

Technical Analysis

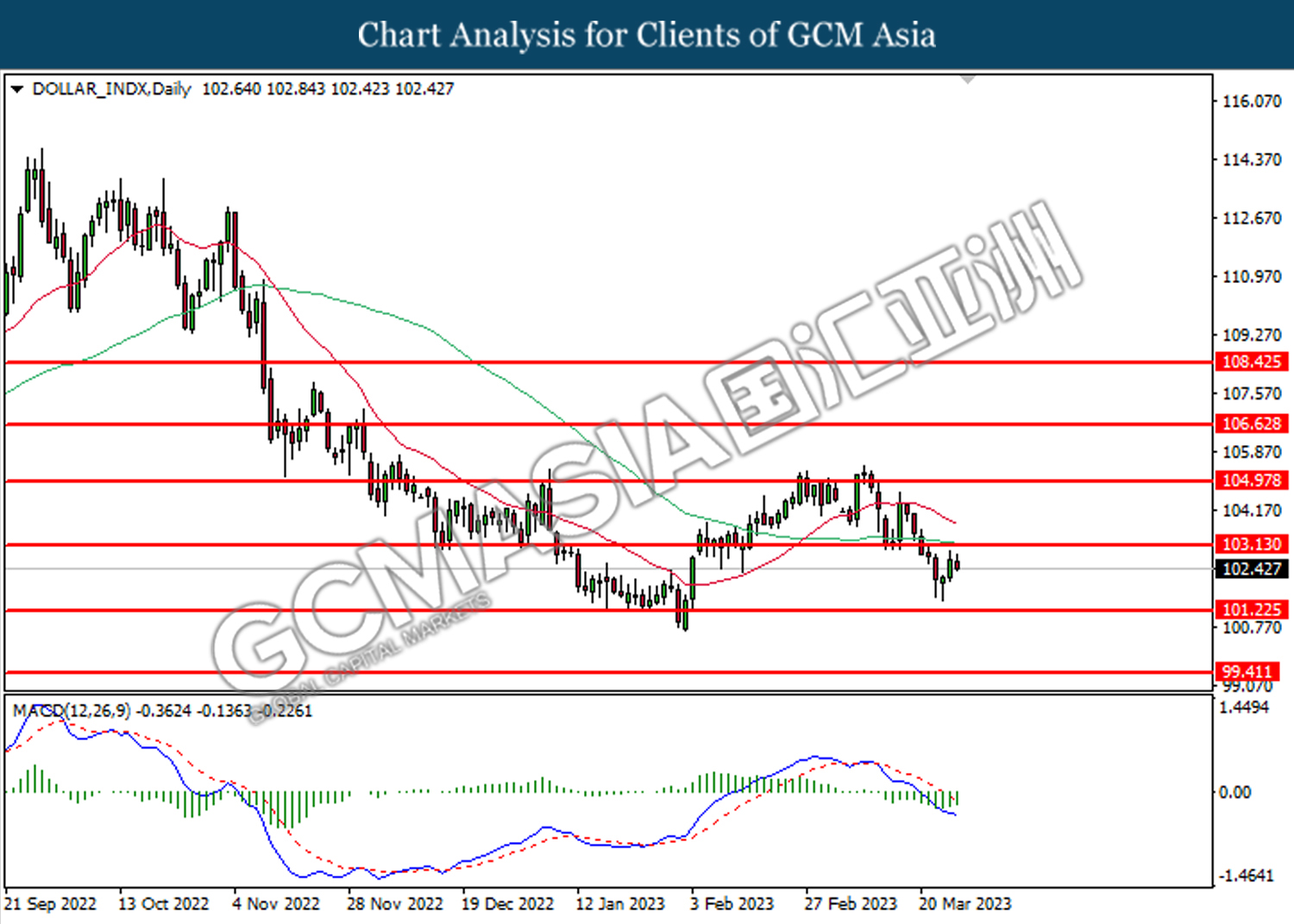

DOLLAR_INDX, Daily: Dollar index was traded lower following the prior retracement from the resistance level at 103.15. MACD which illustrated bearish bias momentum suggests the index to extend its losses toward the support level at 101.25.

Resistance level: 103.15, 105.00

Support level: 101.25, 99.40

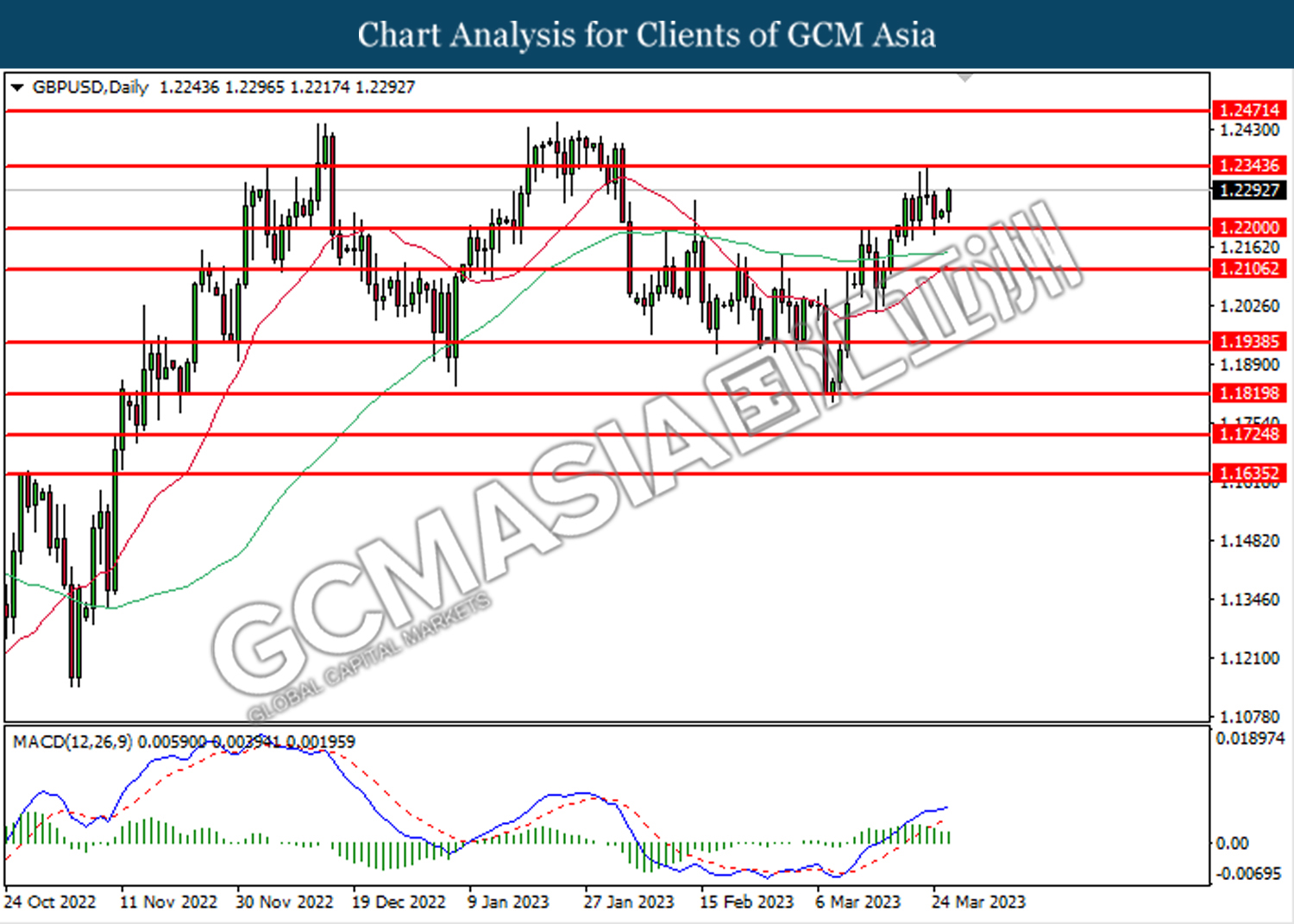

GBPUSD, Daily: GBPUSD was traded higher following the prior breakout above the previous resistance level at 1.2200. MACD which illustrated bullish bias momentum suggest the pair to extend its gains toward the resistance level at 1.2345.

Resistance level: 1.2345, 1.2470

Support level: 1.2200, 1.2105

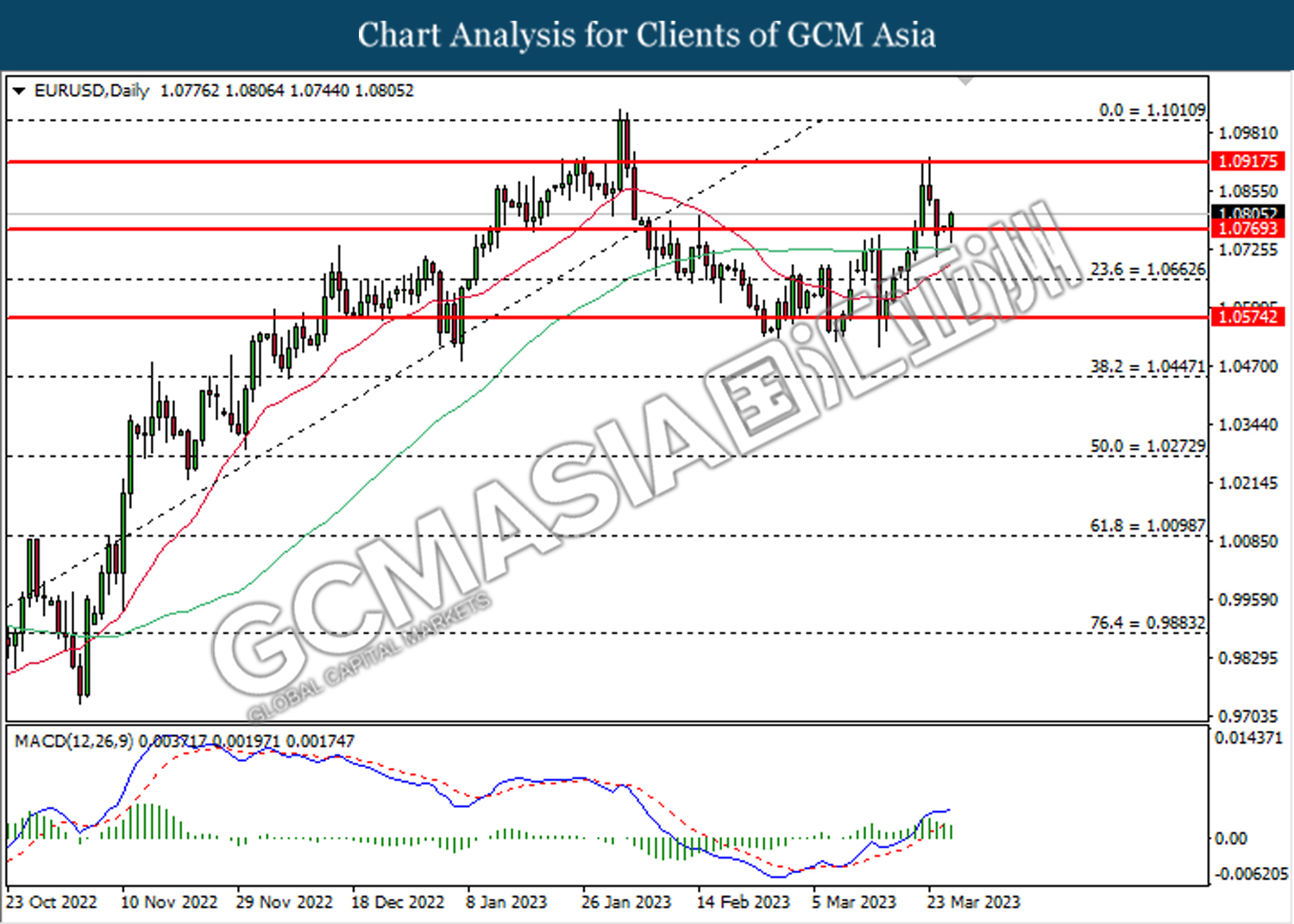

EURUSD, Daily: EURUSD was traded higher following the prior rebound from the support level at 1.0770. MACD which illustrated bullish bias momentum suggest the pair to extend its gains toward the resistance level at 1.0915.

Resistance level: 1.0915, 1.1010

Support level: 1.0770, 1.0665

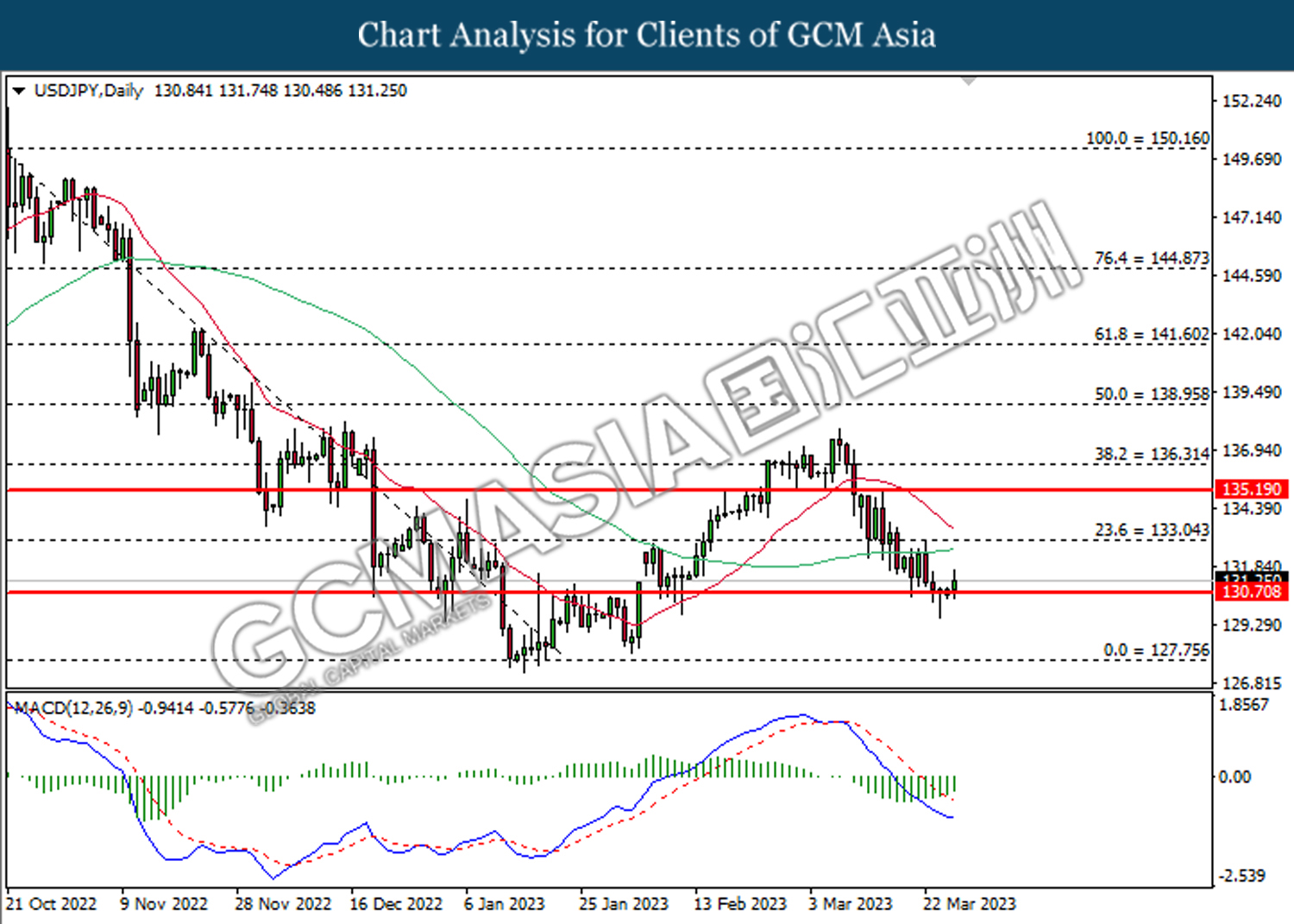

USDJPY, Daily: USDJPY was traded higher following the prior rebound from the support level at 130.70. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains toward the resistance level at 133.05.

Resistance level: 133.05, 135.20

Support level: 130.70, 127.75

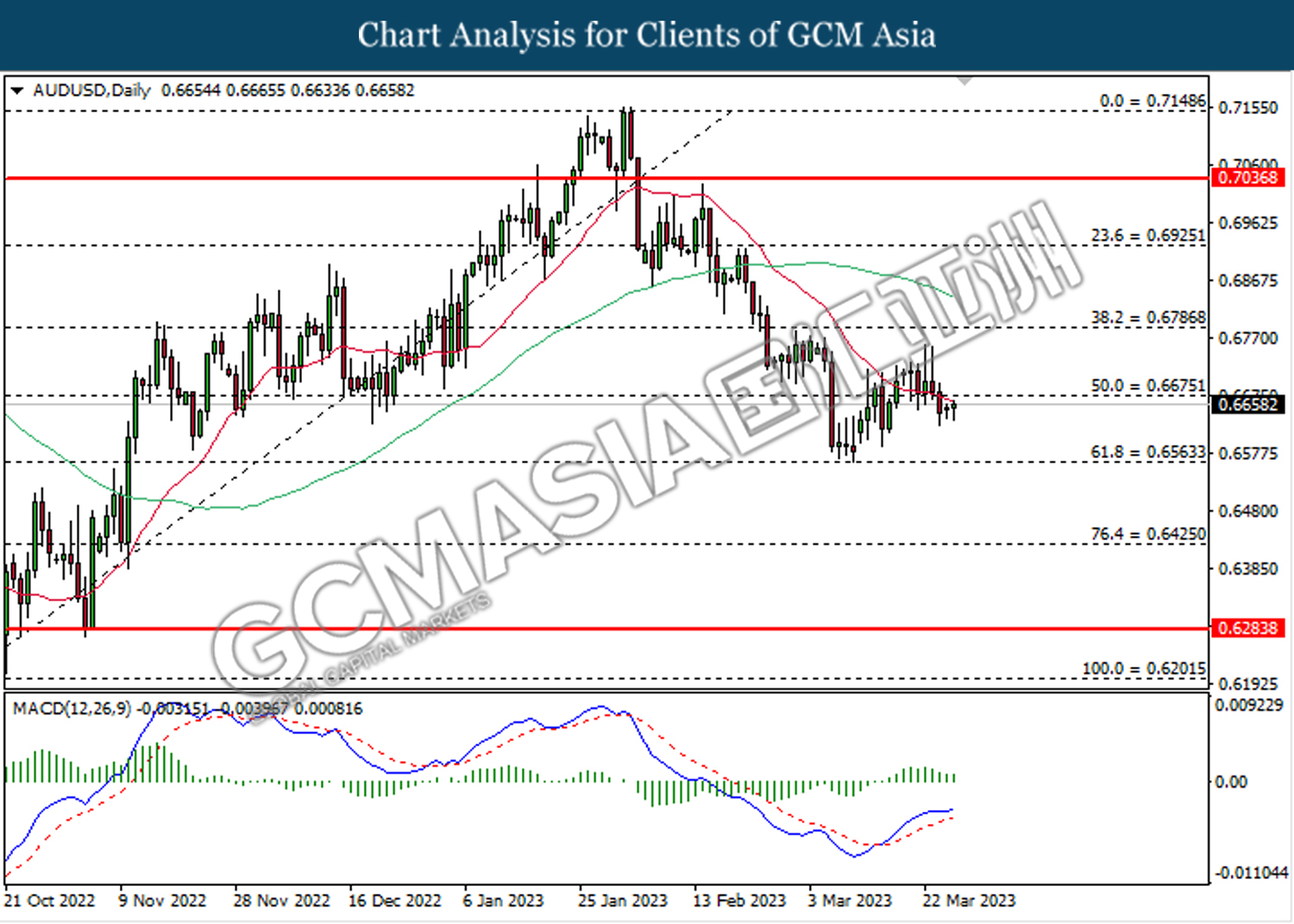

AUDUSD, Daily: AUDUSD was traded lower following the prior breakout below the previous support level at 0.6675. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses toward the support level at 0.6565.

Resistance level: 0.6675, 0.6785

Support level: 0.6565, 0.6425

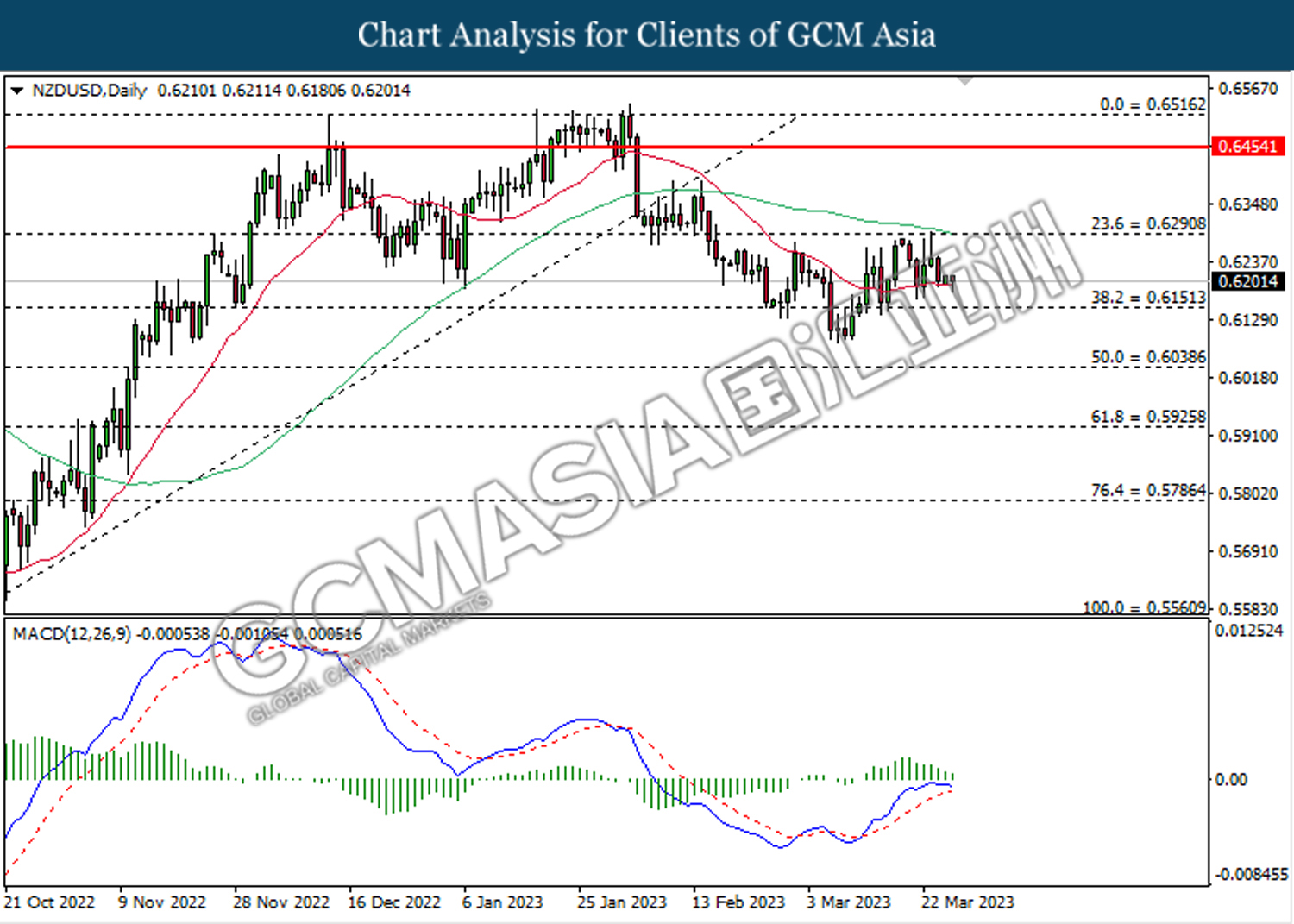

NZDUSD, Daily: NZDUSD was traded lower following the prior retracement from the resistance level at 0.6290. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses toward the support level at 0.6150.

Resistance level: 0.6290, 0.6455

Support level: 0.6150, 0.6040

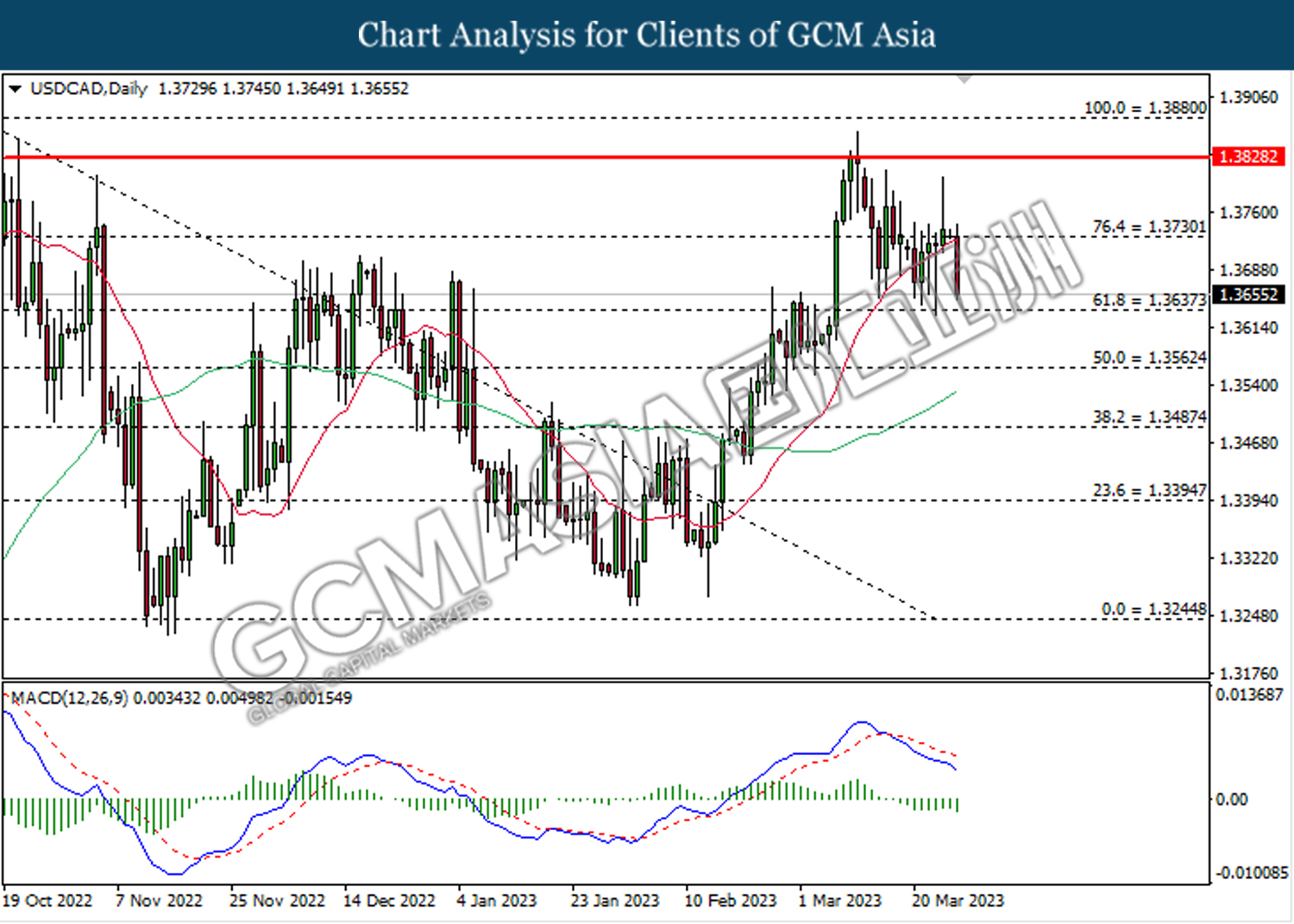

USDCAD, Daily: USDCAD was traded lower following the prior retracement from the resistance level at 1.3730. MACD which illustrated bearish bias momentum suggests the pair to extend its losses toward the support level at 1.3635.

Resistance level: 1.3730, 1.3830

Support level: 1.3635, 1.3565

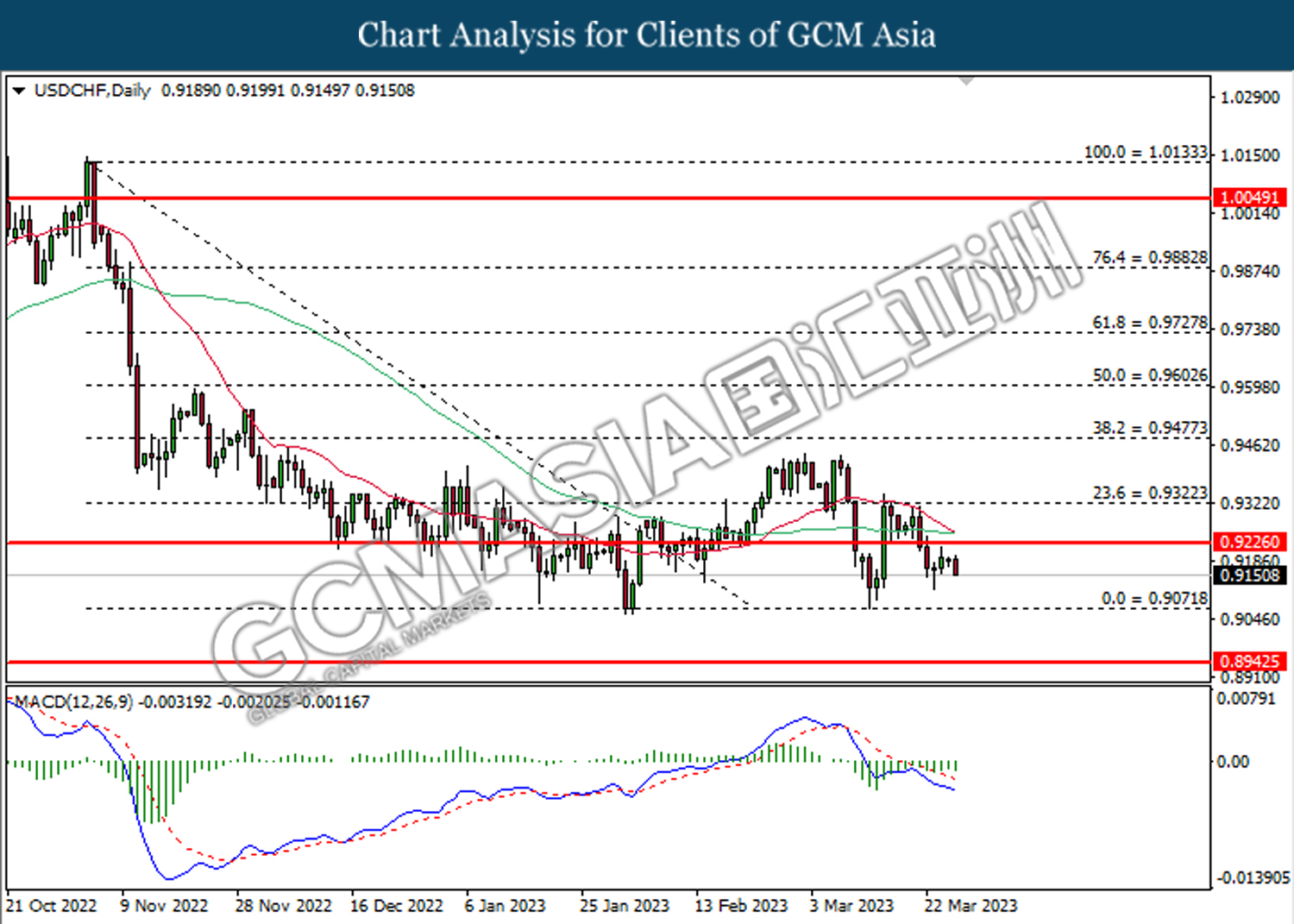

USDCHF, Daily: USDCHF was traded lower following the prior retracement from the resistance level at 0.9225. MACD which illustrated bearish bias momentum suggest the pair to extend its losses toward the support level at 0.9070.

Resistance level: 0.9225, 0.9325

Support level: 0.9070, 0.8945

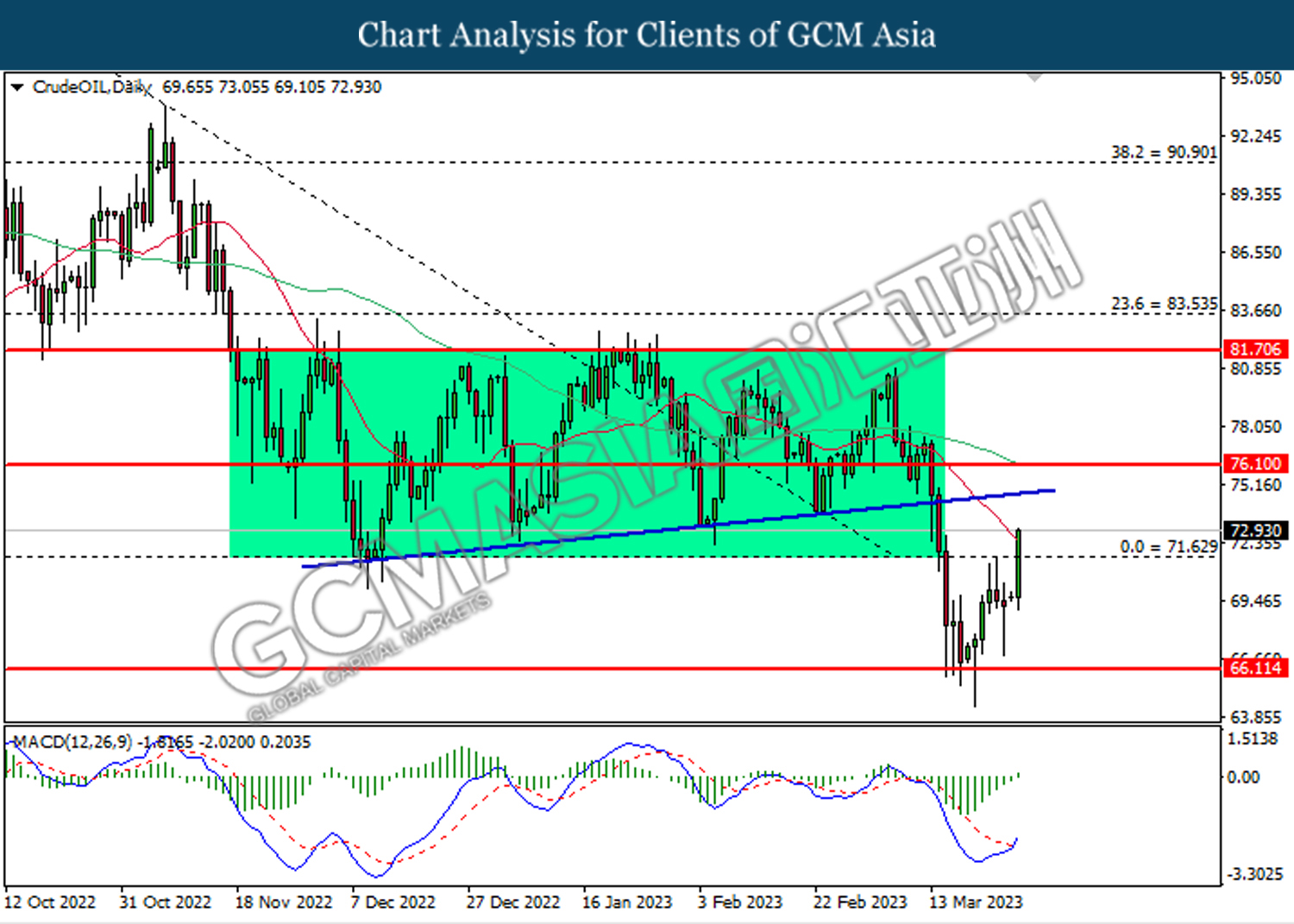

CrudeOIL, Daily: Crude oil price was traded higher while currently testing the resistance level at 71.65. MACD which illustrated bullish bias momentum suggest the commodity to extend its gains after it successfully breakout above the resistance level.

Resistance level: 71.65, 76.10

Support level: 66.10, 61.45

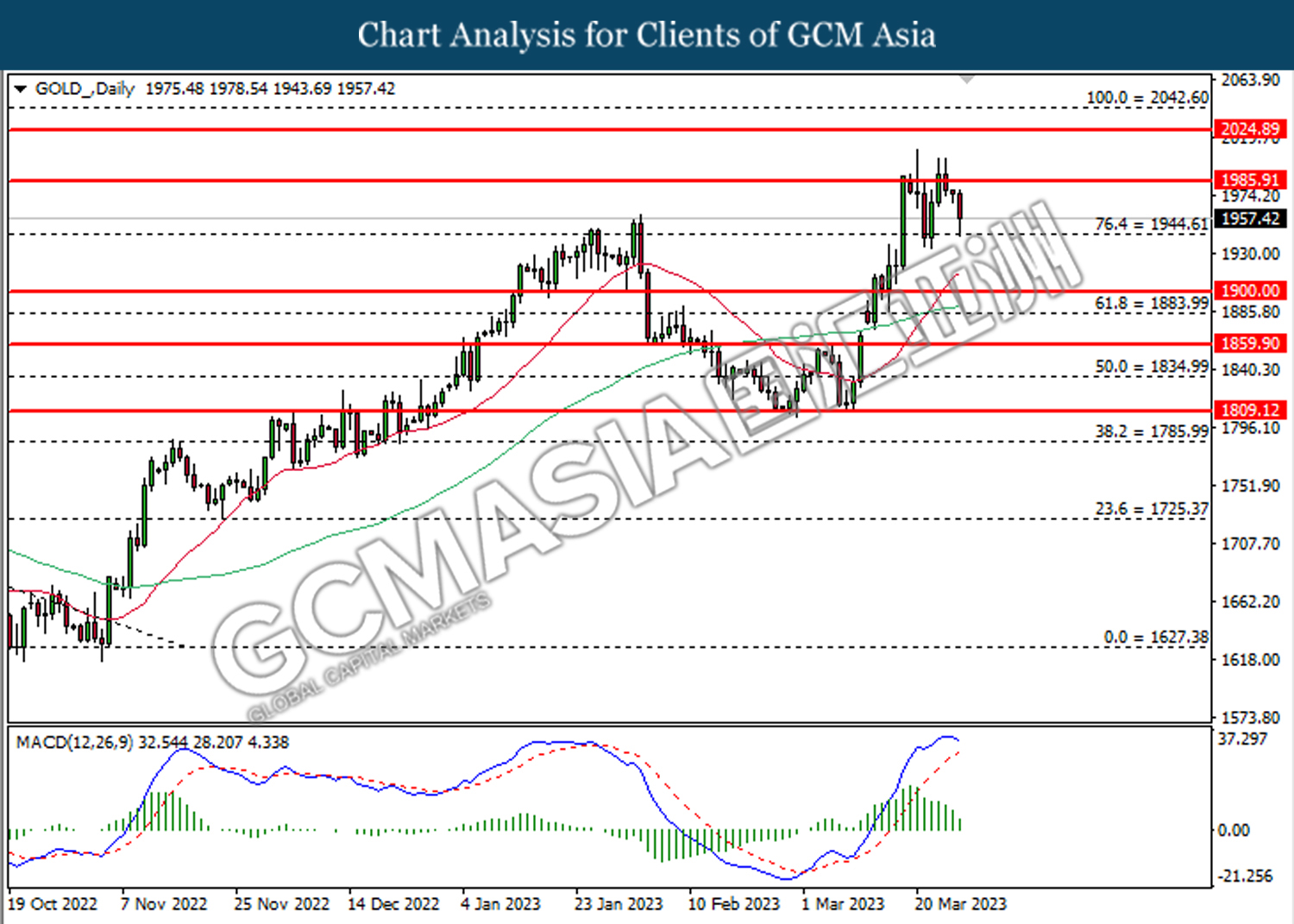

GOLD_, Daily: Gold price was traded lower while currently testing the support level at 1944.60. MACD which illustrated diminishing bullish momentum suggests the commodity to extend its losses after it successfully breakout below the support level at 1944.60.

Resistance level: 1985.90, 2024.90

Support level: 1944.60, 1900.00