28 June 2022 Afternoon Session Analysis

EURUSD rallied as investors bet on ECB rate hike decision.

The EURUSD rose on Monday over the backdrop of rate hike expectation from European Central Bank (ECB). According to Reuters, the market participants are eyeing on the ECB’s first rate hike in 11 years as well as they think that the risks of a dovish hike are fading, which they are expecting that the ECB would likely increase interest rate by more than 25 basic points. The implementation of aggressive rate hike would likely to increase the risk-free return of investors, which stoked a shift in sentiment toward Euro. Besides, Euro extended its gains following the weakening of US dollar. As for now, investors would continue to scrutinize the latest updates with regard of the rate hike decision from ECB and the economic data in order to receive further trading signals. As of writing, EURUSD edged down by 0.04% to 1.0578.

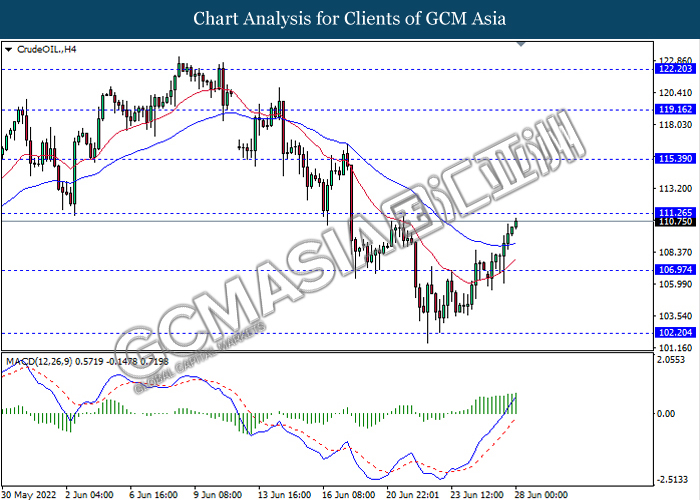

In commodities market, crude oil price appreciated by 1.00% to $110.70 per barrel as of writing on the prospect of even tighter supplies loomed over the market as the Group of Seven nations promised to tighten the squeeze on Russian President Vladimir Putin’s war chest. On the other hand, gold price rallied by 0.10% to $1826.25 per troy ounce as of writing after a sharp decline amid the upbeat US economic data.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

16:00 EUR ECB President Lagarde Speaks

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 22:00 | CB Consumer Confidence (Jun) | 106.4 | 100.9 | – |

Technical Analysis

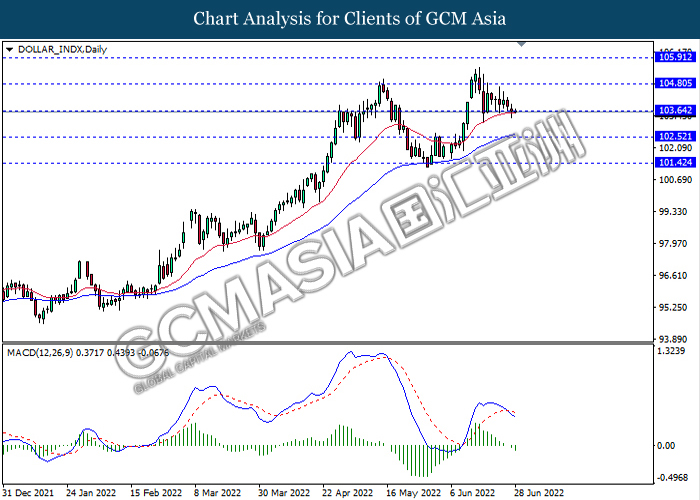

DOLLAR_INDX, Daily: Dollar index was traded lower while currently testing the support level. MACD which illustrated increasing bearish momentum suggest the index to extend its losses if successfully breakout the support level.

Resistance level: 104.80, 105.90

Support level: 103.65, 102.50

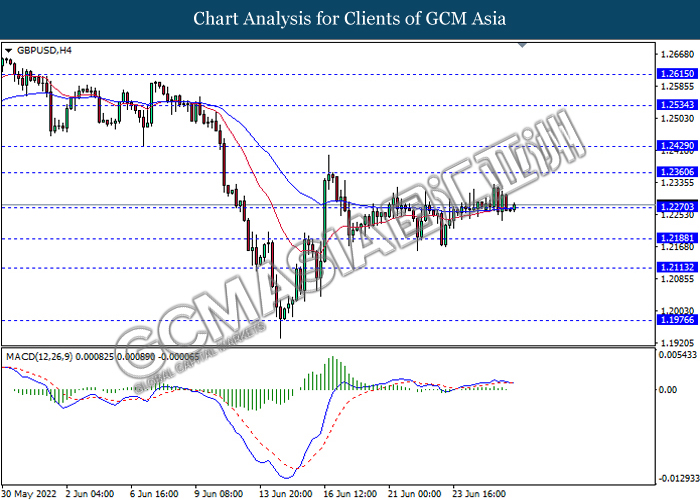

GBPUSD, H4: GBPUSD was traded higher following prior breakout above the previous resistance level. However, MACD which illustrated decreasing bullish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 1.2360, 1.2430

Support level: 1.2270, 1.2190

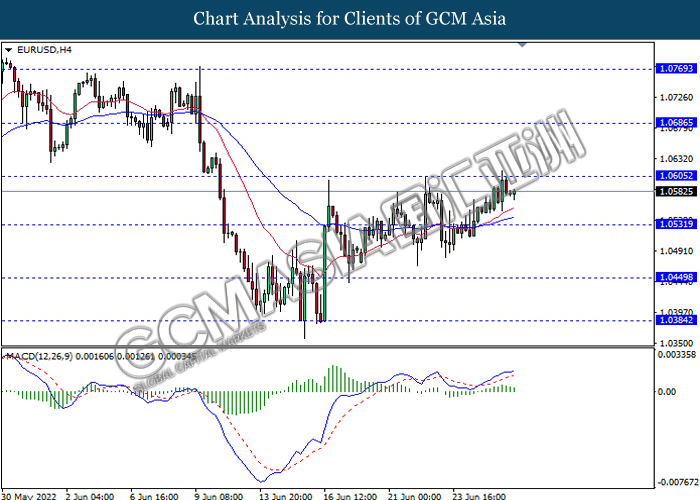

EURUSD, H4: EURUSD was traded lower following retracement from the resistance level. MACD which illustrated decreasing bullish momentum suggest the pair to extend its losses.

Resistance level: 1.0605, 1.0685

Support level: 1.0530, 1.0450

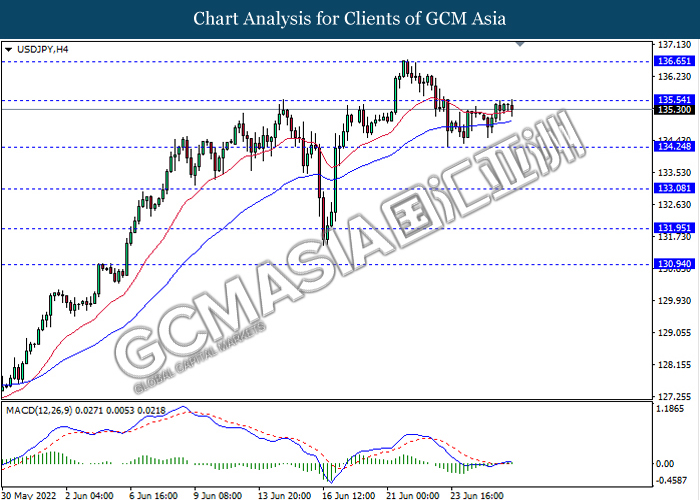

USDJPY, H4: USDJPY was traded higher while currently testing the resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains if successfully breakut the resistance level.

Resistance level: 135.55, 136.65

Support level: 134.25, 133.10

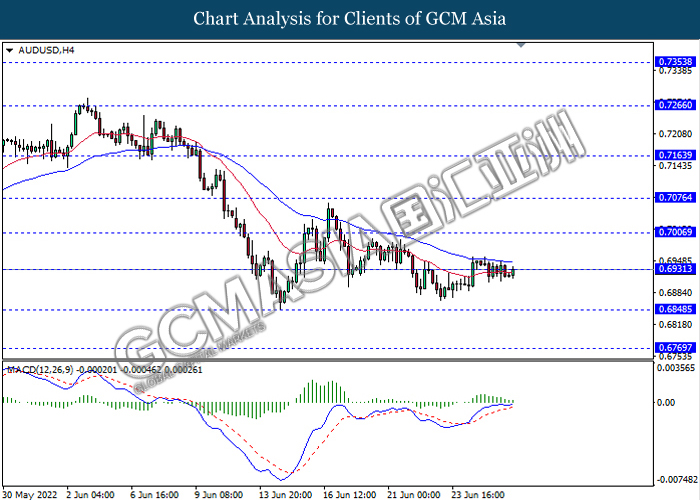

AUDUSD, H4: AUDUSD was traded higher while currently testing the resistance level. However, MACD which illustrated decreasing bullish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 0.6930, 0.7005

Support level: 0.6850, 0.6770

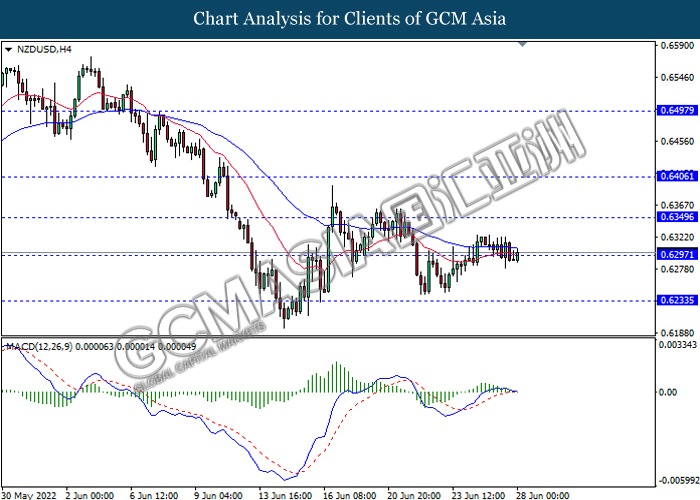

NZDUSD, H4: NZDUSD was traded higher following prior breakout above the previous resistance level. However, MACD which illustrated decreasing bullish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 0.6350, 0.6405

Support level: 0.6295, 0.6235

USDCAD, H4: USDCAD was traded lower following prior breakout below the previous support level. However, MACD which illustrated decreasing bearish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 1.2875, 1.2940

Support level: 1.2800, 1.2730

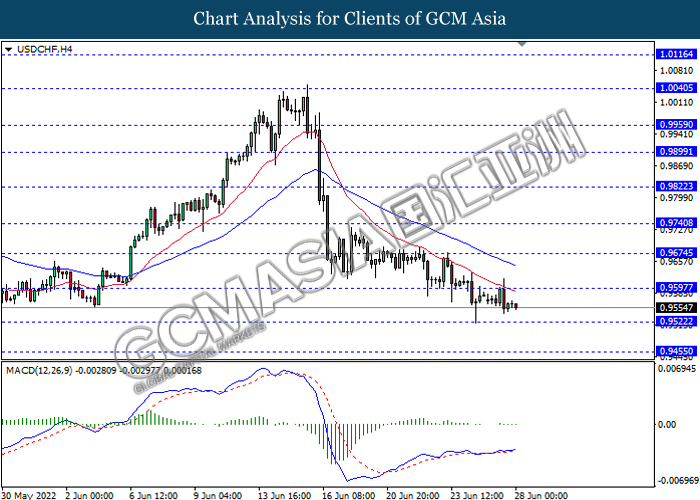

USDCHF, H4: USDCHF was traded lower following prior breakout below the previous support level. MACD which illustrated decreasing bullish momentum suggest the pair to extend its losses.

Resistance level: 0.9595, 0.9675

Support level: 0.9520, 0.9455

CrudeOIL, H4: Crude oil price was traded higher while currently testing the resistance level. MACD which illustrated increasing bullish momentum suggest the commodity to extend its gains if successfully breakout the resistance level. .

Resistance level: 111.25, 115.40

Support level: 106.95, 102.20

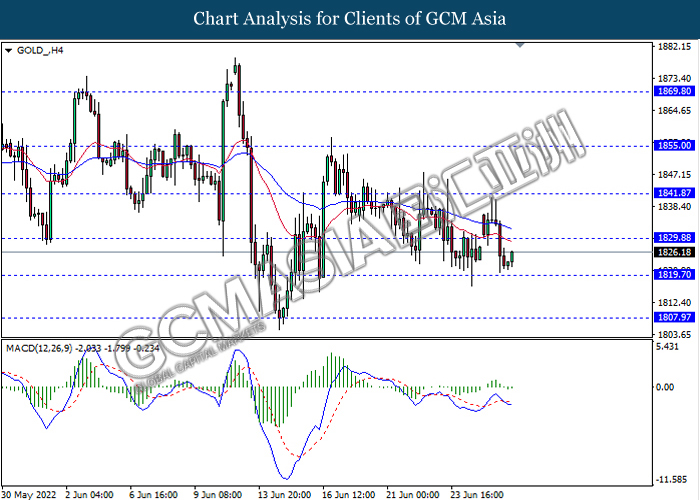

GOLD_, H4: Gold price was traded higher following prior rebound from the support level. MACD which illustrated decreasing bearish momentum suggest the commodity to extend its gains.

Resistance level: 1829.90, 1841.85

Support level: 1819.70, 1807.95