28 June 2022 Morning Session Analysis

US Dollar seesawed as mixed market sentiment.

The Dollar Index was traded within a range amid the mixed sentiment toward the US financial market. On the positive front, the US Dollar received some bullish momentum yesterday over the backdrop of bullish economic data. According to Census Bureau, US Core Durable Goods Orders notched up significantly from the previous reading of 0.2% to 0.7%, exceeding the market forecast at 0.3%. Besides, National Association of Realtor reported that the US Pending Home Sales increased from the previous reading of -4.0% to 0.7%, which also higher than the market forecast at -3.7%. As both crucial economic had fared better-than-expectation, which dialing up the market optimism toward the economic progression in the United States while insinuating market demand on the US Dollar. Though, the gains experienced by the US Dollar was limited by diminishing inflation risk in future following the depreciation of commodities price. Recently, the dropping in the commodities price such as copper and wheat had reduced the worries upon the hyperinflation, diminishing the rate hike expectation from Federal Reserve. As of writing, the Dollar Index depreciated by 0.23% to 103.95 as of writing.

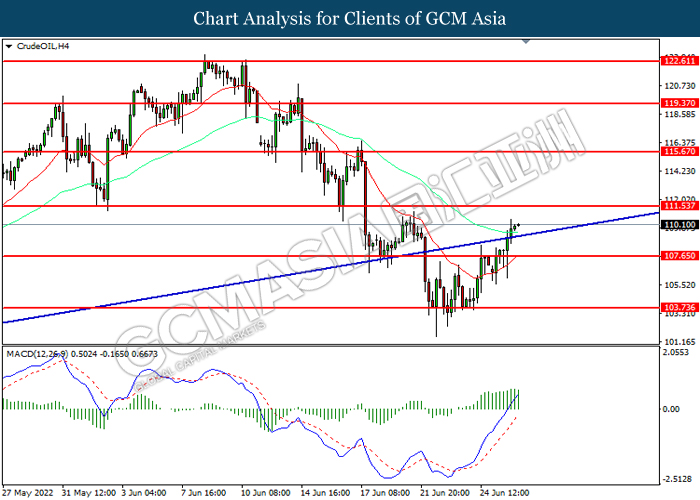

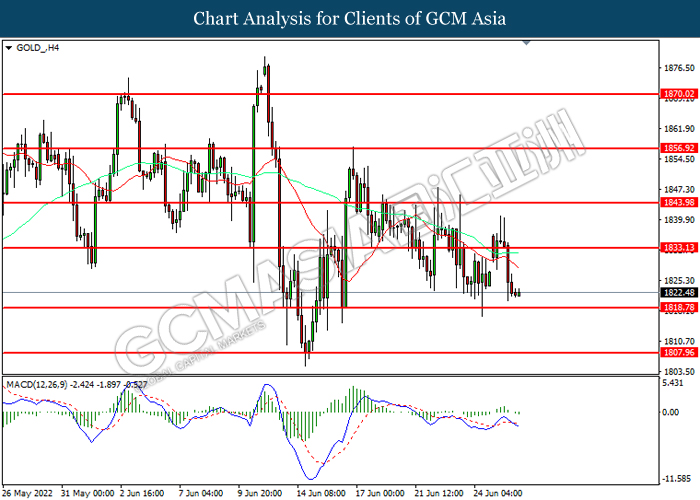

In the commodities market, the crude oil price surged 0.20% to $110.10 per barrel as of writing. The oil market edged higher amid the rising tensions on the Russia-Ukraine relationship continue to spur bullish momentum on this black-commodity. On the other hand, the gold price depreciated by 0.02% to $1823.00 per troy ounces as of writing over the backdrop of bullish economic data from the United States.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

16:00 EUR ECB President Lagarde Speaks

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 22:00 | CB Consumer Confidence (Jun) | 106.4 | 100.9 | – |

Technical Analysis

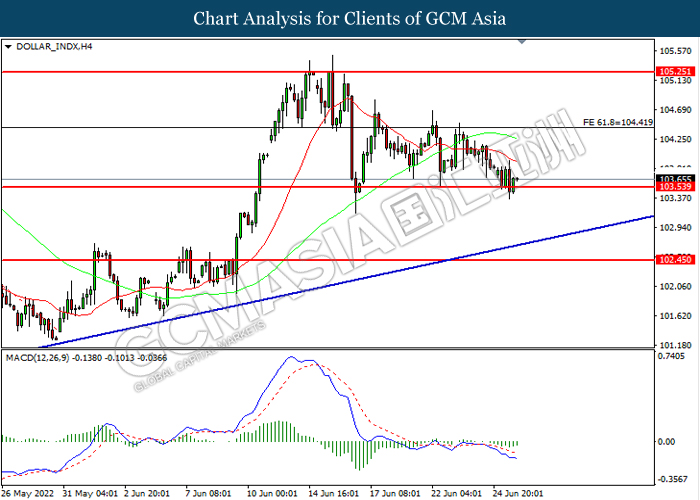

DOLLAR_INDX, H4: Dollar index was traded lower while currently testing the support level. However, MACD which illustrated diminishing bearish momentum suggest the index to be traded higher as technical correction.

Resistance level: 104.40, 105.25

Support level: 103.55, 102.45

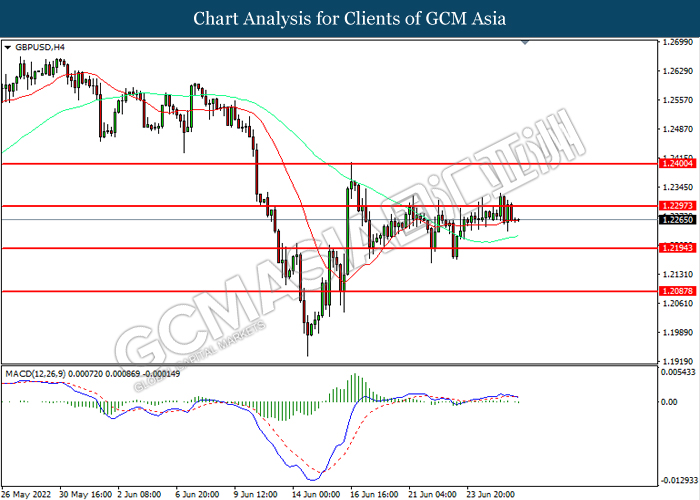

GBPUSD, H4: GBPUSD was traded within a range while currently testing the resistance level. MACD which illustrated increasing bearish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 1.2295, 1.2400

Support level: 1.2195, 1.2085

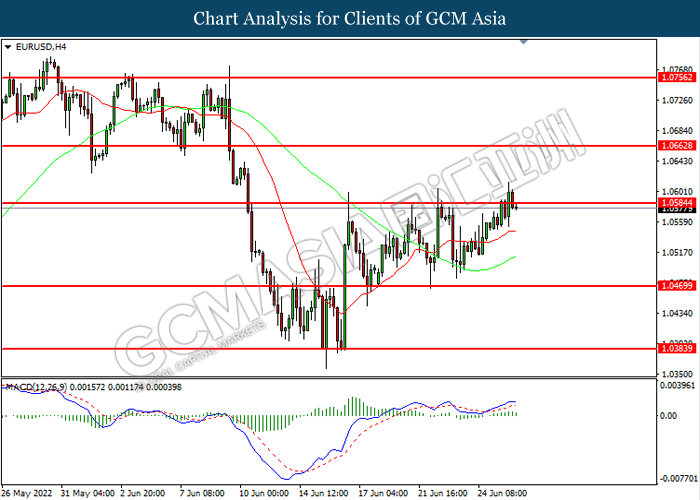

EURUSD, H4: EURUSD was traded higher while currently testing the resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains after breakout.

Resistance level: 1.0585, 1.0665

Support level: 1.0470, 1.0385

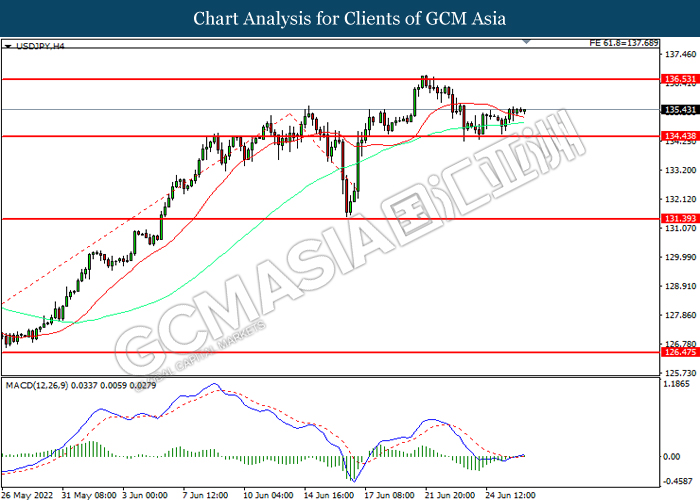

USDJPY, H4: USDJPY was traded higher following prior rebounded from the support level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains.

Resistance level: 136.55, 137.70

Support level: 134.45, 131.40

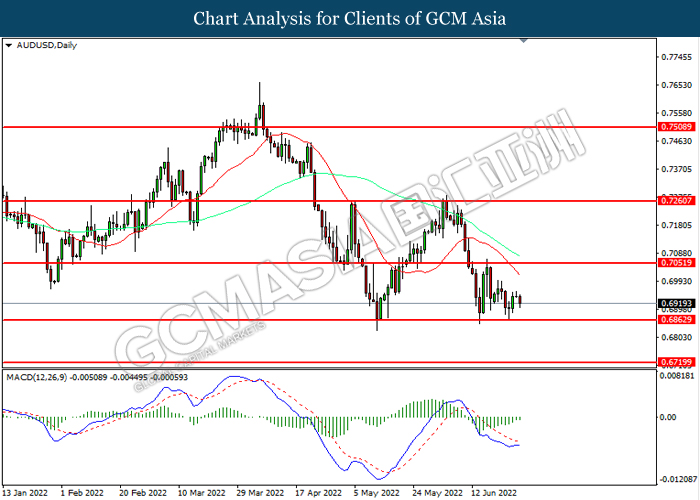

AUDUSD, Daily: AUDUSD was traded lower while currently testing the support level. However, MACD which illustrated diminishing bearish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 0.7050, 0.7165

Support level: 0.6865, 0.6720

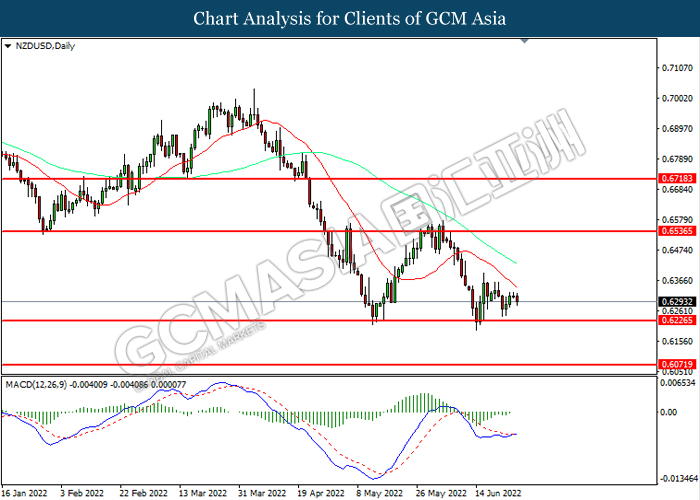

NZDUSD, Daily: NZDUSD was traded lower while currently testing the support level. However, MACD which illustrated diminishing bearish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 0.6535, 0.6720

Support level: 0.6225, 0.6070

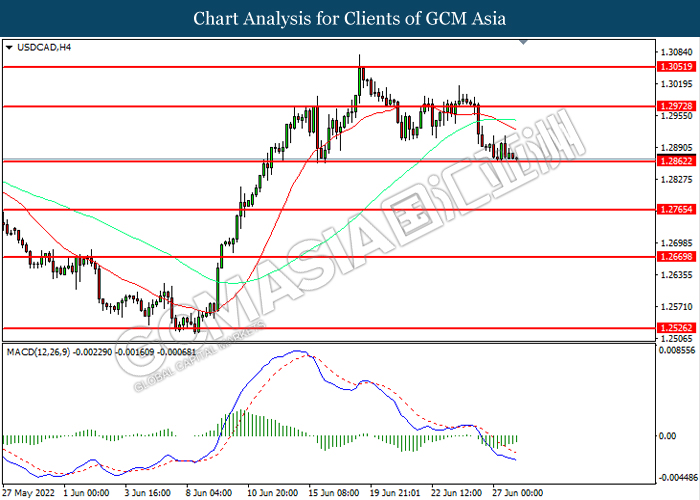

USDCAD, H4: USDCAD was traded lower following prior retracement from the resistance level. However, MACD which illustrated diminishing bearish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 1.2975, 1.3050

Support level: 1.2860, 1.2765

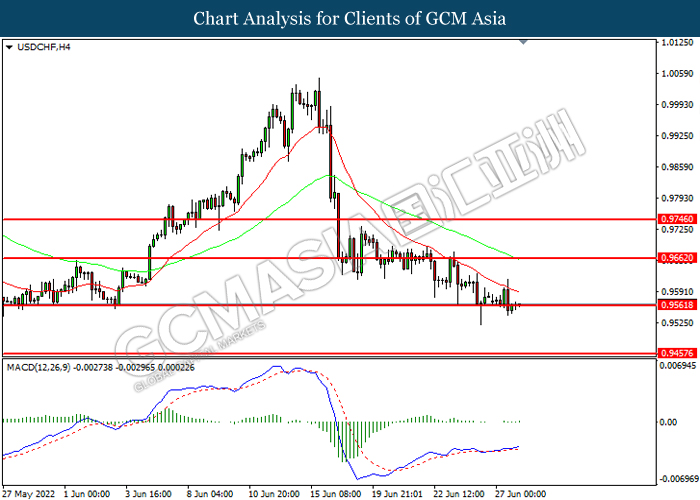

USDCHF, H4: USDCHF was traded lower while currently testing the support level. However, MACD which illustrated increasing bullish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 0.9660, 0.9745

Support level: 0.9560, 0.9460

CrudeOIL, H4: Crude oil price was traded higher following prior breakout above the previous resistance level. MACD which illustrated increasing bullish momentum suggest the commodity to extend its gains toward resistance level.

Resistance level: 111.55, 115.65

Support level: 107.65, 103.75

GOLD_, H4: Gold price was traded lower while currently testing the support level. MACD which illustrated increasing bearish momentum suggest the commodity to extend its losses after breakout.

Resistance level: 1833.15, 1844.00

Support level: 1818.80, 1807.95