28 June 2023 Afternoon Session Analysis

Canada inflation comes at the slowest pace causing CAD slipped

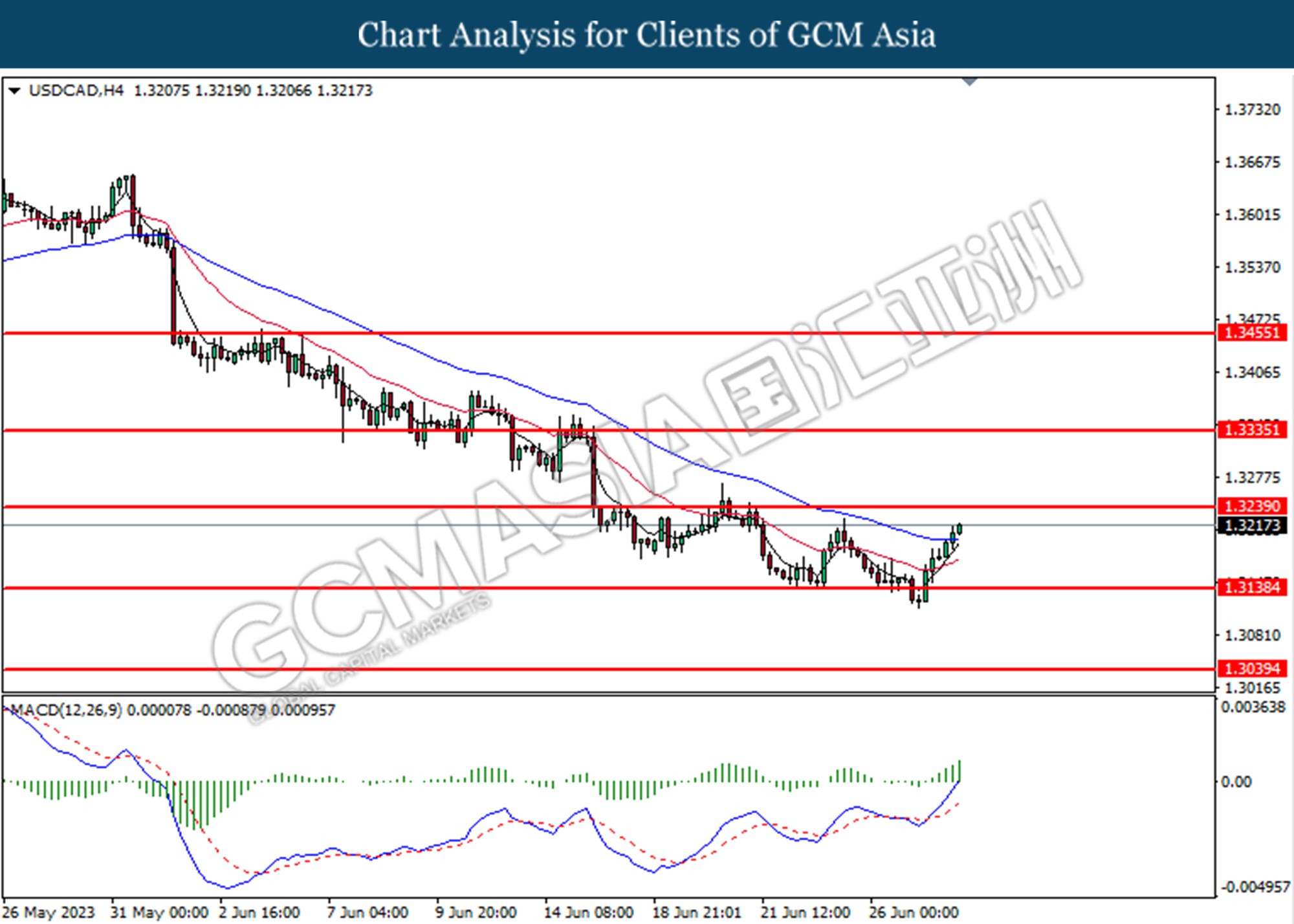

The Canadian dollar which traded against the dollar index slipped after the Canadian inflations in May came in slowest pace after data showed on Tuesday. The country’s annual inflation rate was down to 4.4% from 3.4%, in line with market expectations. While the monthly inflation rate slipped more than expected by recording from 0.7% to 0.4%, while the economist forecasted 0.5%. The annual core Consumer Price Index (CPI) which excludes energy prices and food prices, was reduced from 4.1% to 3.7%. Before that, the central bank hiked its monetary rate to 22 years of 4.75% earlier in June after inflation data unexpectedly ticked up in April. However, the recent inflation reading might suggest the Bank of Canada (BoC) has some reason to skip the rate hike in the upcoming monetary meeting. With a labour market loosening in May an 18.3% drop In gasoline compared with the same month a year earlier, the money market sees a probability of pausing on rate hikes. It’s worth noting that the inflation target remains above the central bank target, and investors see a 100% chance for BoC a quarter-point move. As of writing, the USDCAD edged up by 0.13% to $1.3208.

In the commodities market, crude oil prices traded up by 0.51% to $68.19 per barrel as the previous session dropped over 2% amid concern over major central banks’ interest rate hikes. Besides, the gold prices rebounded by 0.10% to $1915.37 per troy ounce following the prior price dip as the US announced a series of upbeat economic data.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

21:30 USD Fed Chair Powell Speaks

21:30 EUR ECB President Lagarde Speaks

23:00 EUR ECB President Lagarde Speaks

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 22:30 | CrudeOIL – Crude Oil Inventories | -3.831M | 1.415M | – |

Technical Analysis

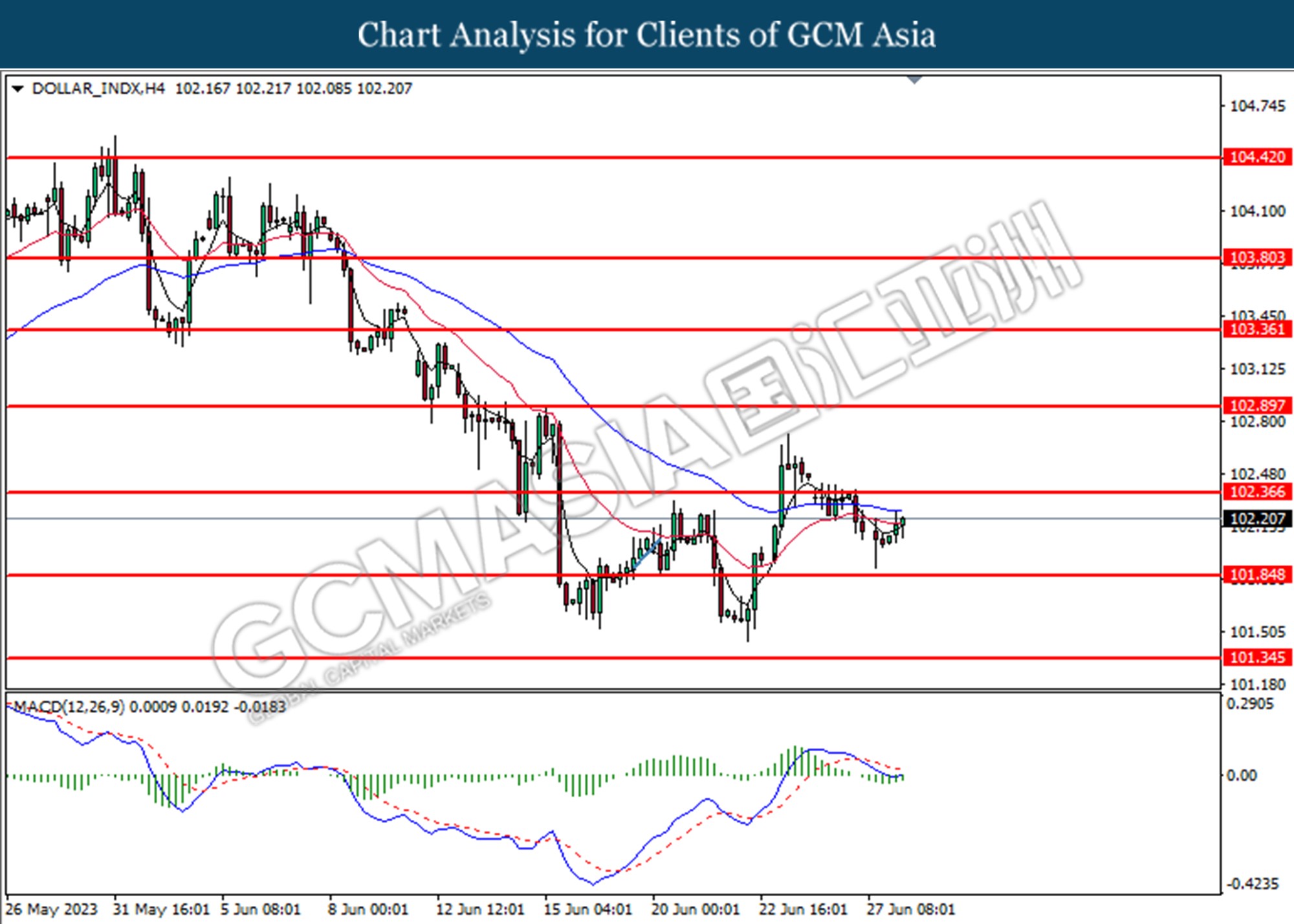

DOLLAR_INDX, H4: Dollar index was traded higher following the prior rebound from the lower level. MACD which illustrated diminishing bearish momentum suggests the index extended its gains toward the resistance level at 102.35.

Resistance level: 102.35,102.90

Support level: 101.85, 101.35

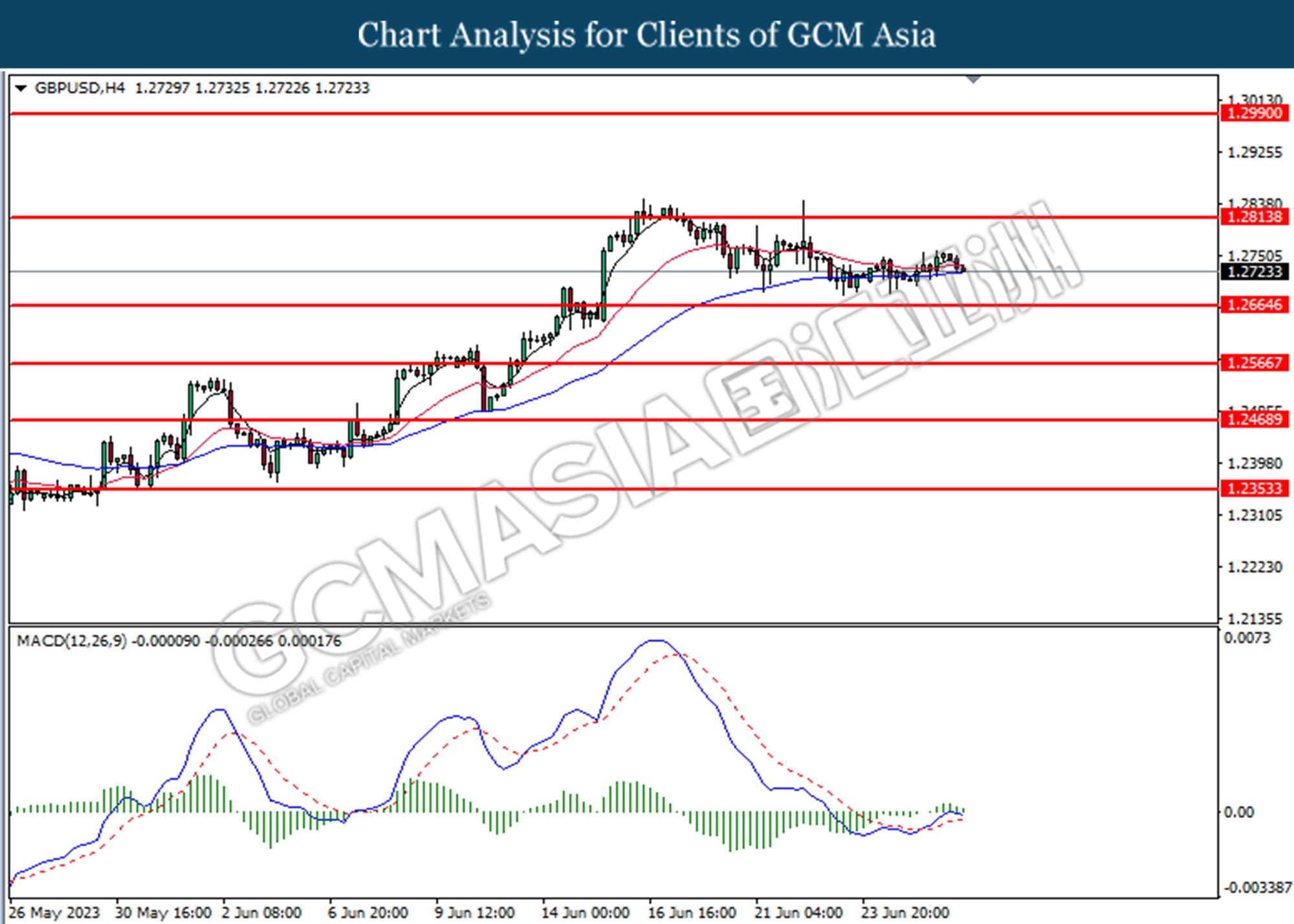

GBPUSD, H4: GBPUSD was traded lower following the prior retracement from the higher level. MACD which illustrated diminishing bullish momentum suggests the pair extended its losses toward the support level at 1.2665.

Resistance level: 1.2815, 1.2990

Support level: 1.2665, 1.2565

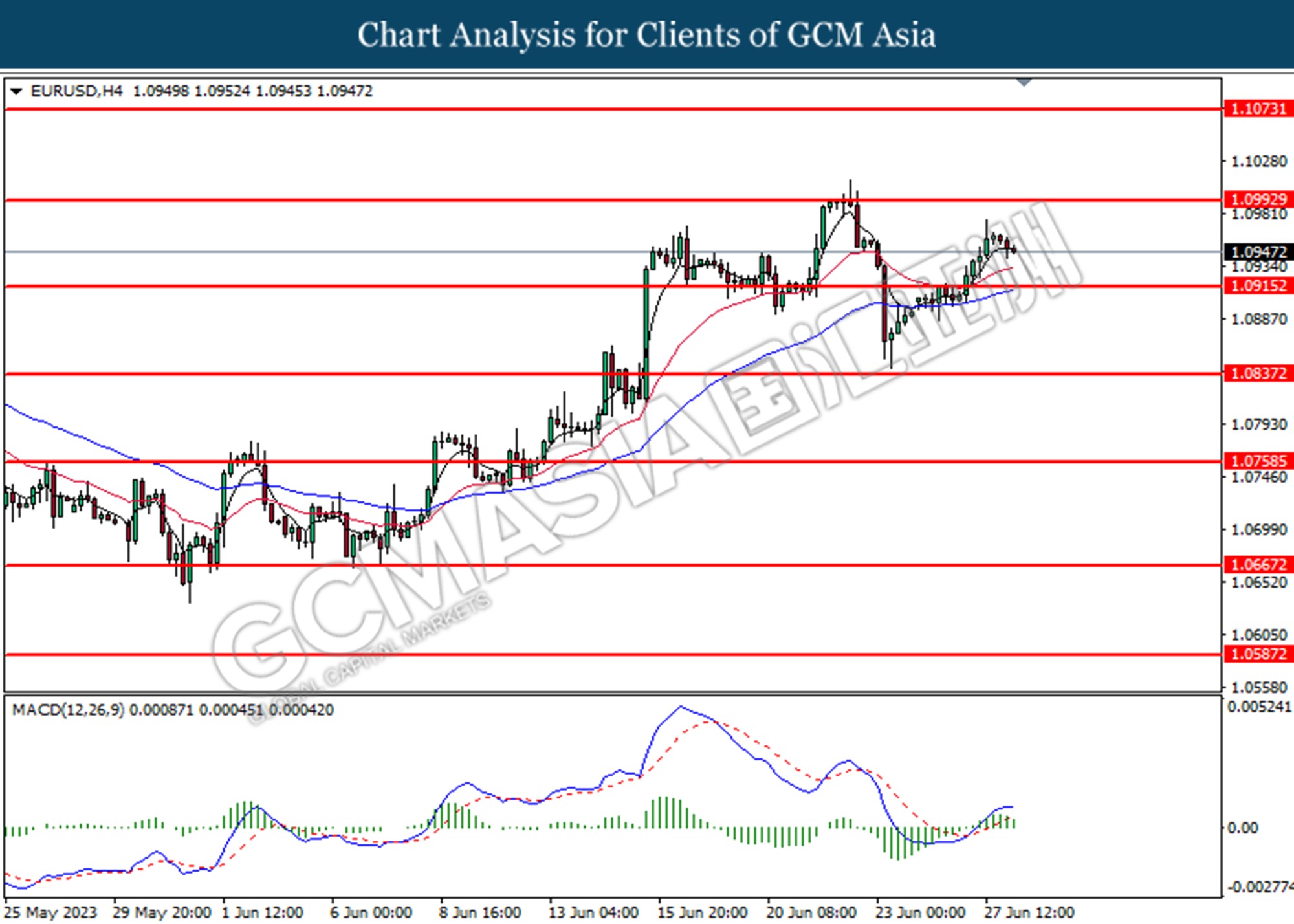

EURUSD, H4: EURUSD was traded lower following the prior retracement from the higher level. MACD which illustrated diminishing bullish momentum suggests the pair extended its losses toward the support level at 1.0915.

Resistance level: 1.0990, 1.1075

Support level: 1.0915, 1.0840

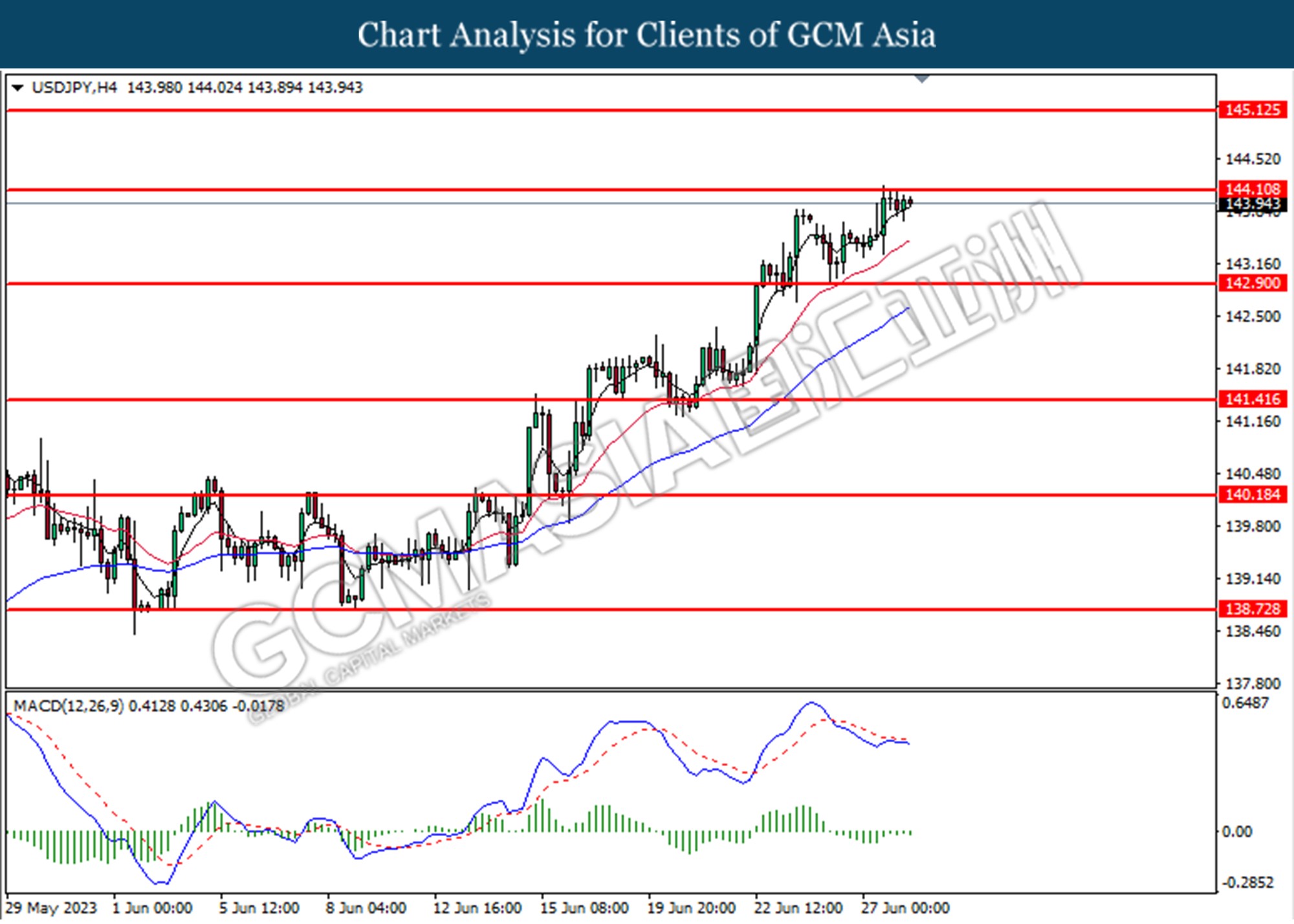

USDJPY, H4: USDJPY was traded lower following the prior retracement from the resistance level at 144.10. However, MACD which illustrated diminishing bearish momentum suggests the pair undergoes a technical correction in a short term.

Resistance level: 144.10, 145.10

Support level: 142.90, 141.40

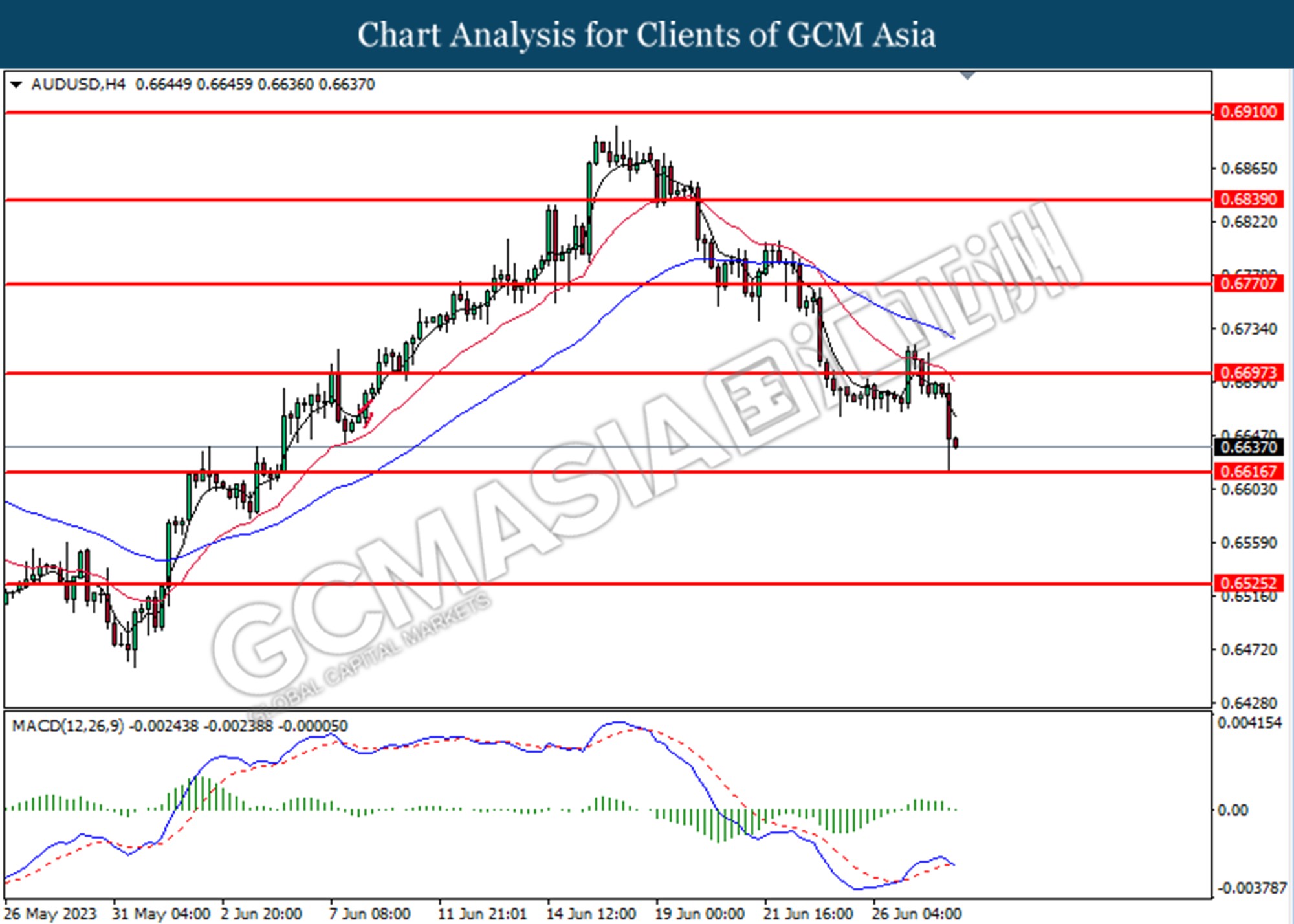

AUDUSD, H4: AUDUSD was traded lower following the prior retracement from the higher level. MACD which illustrated diminishing bullish momentum suggests the pair extended its losses towards the support level at 0.6615.

Resistance level: 0.6700, 0.6770

Support level: 0.6615, 0.6525

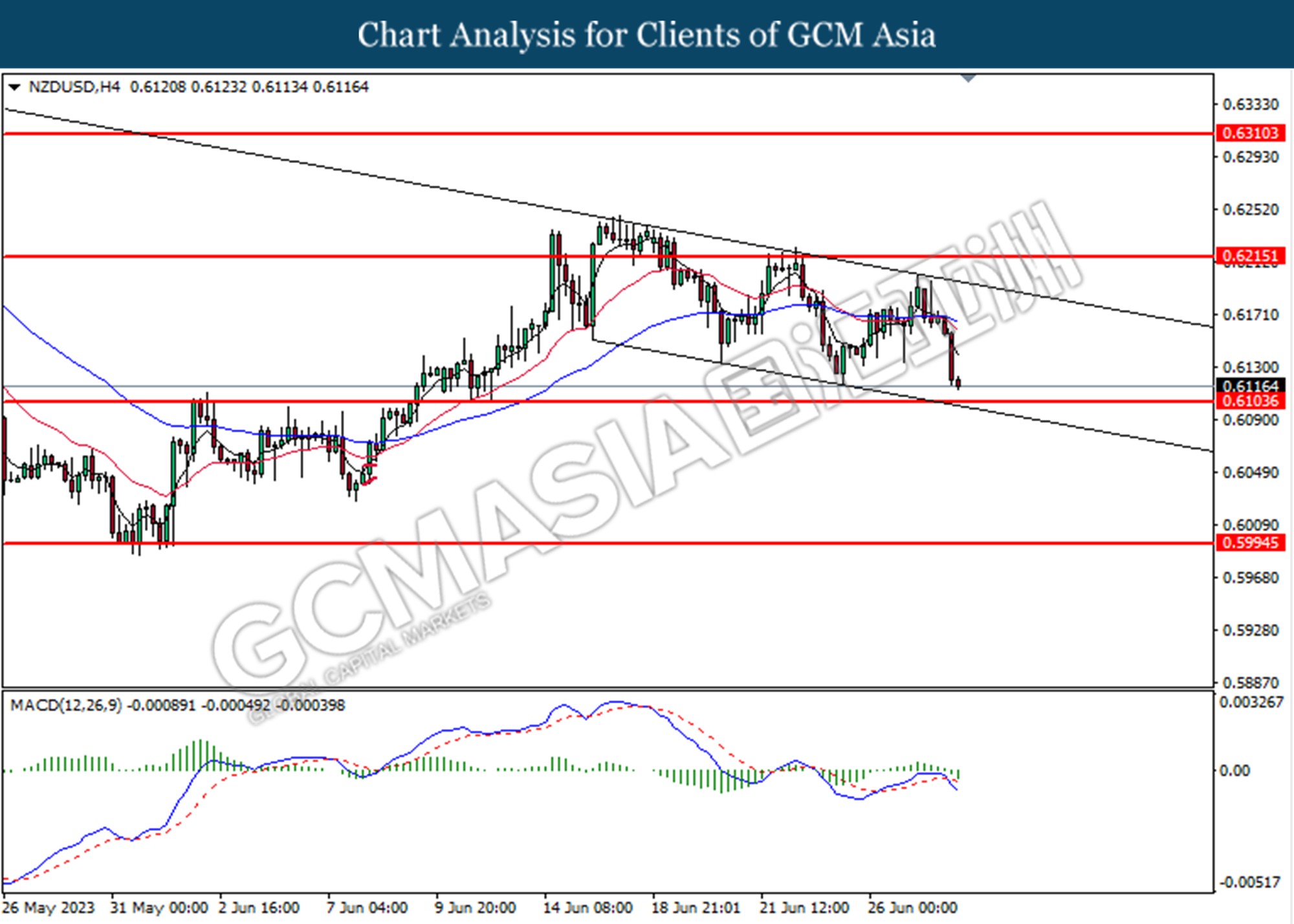

NZDUSD, H4: NZDUSD was traded lower following the prior retracement from the higher level. MACD which illustrated increasing bearish momentum suggests the pair extended its losses toward the support level at 0.6105.

Resistance level: 0.6215, 0.6310

Support level: 0.6105, 0.5995

USDCAD, H4: USDCAD was traded higher following the prior rebound from the lower level. MACD which illustrated increasing bullish momentum suggests the pair extended its gains toward the resistance level.

Resistance level: 1.3140, 1.3240

Support level: 1.3040, 1.2940

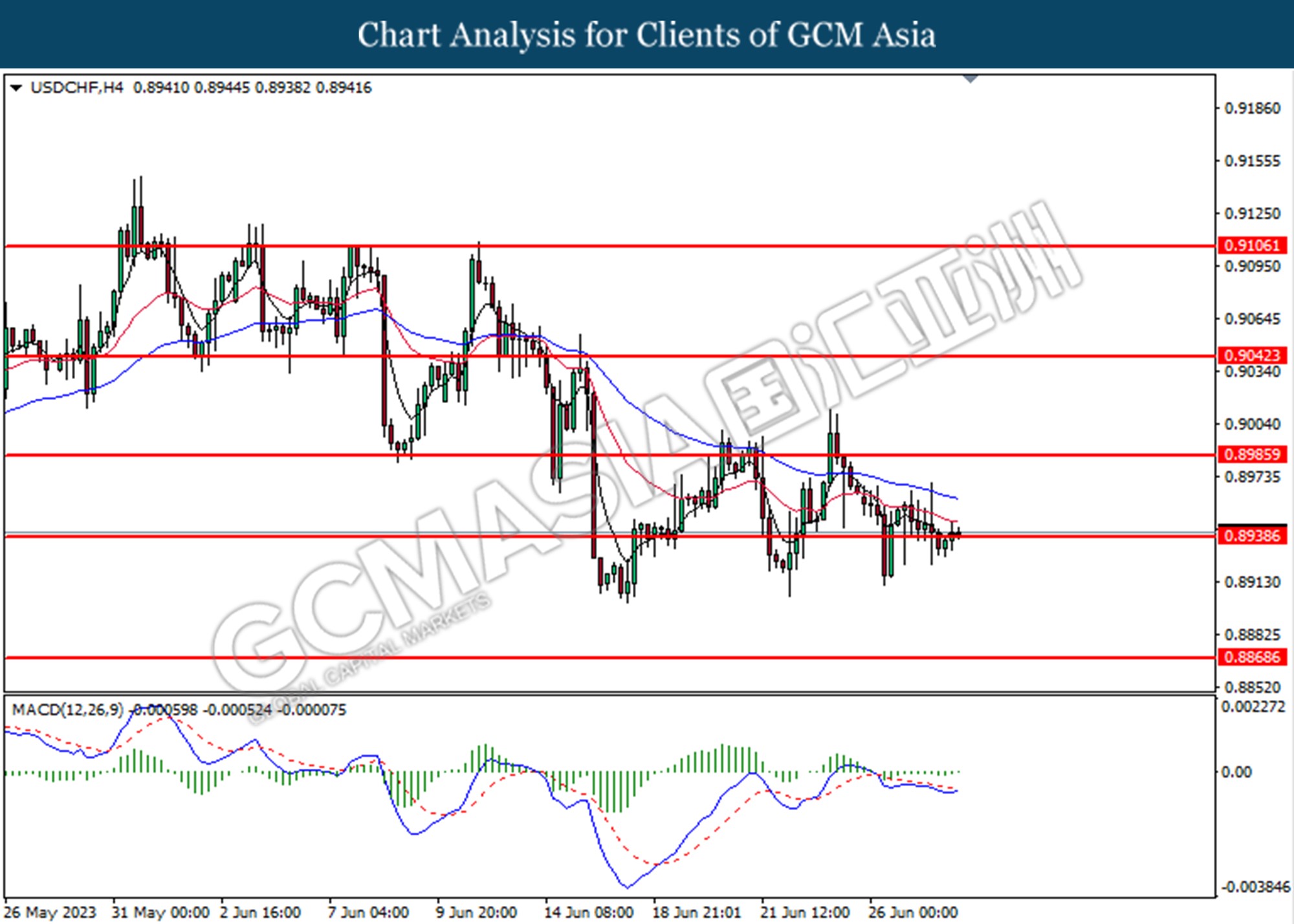

USDCHF, H4: USDCHF was traded higher following the prior breaks above the previous resistance level at 0.8940. However, MACD which illustrated diminishing bearish momentum suggests the pair undergoes a technical correction In the short term.

Resistance level: 0.8985, 0.9040

Support level: 0.8940, 0.8870

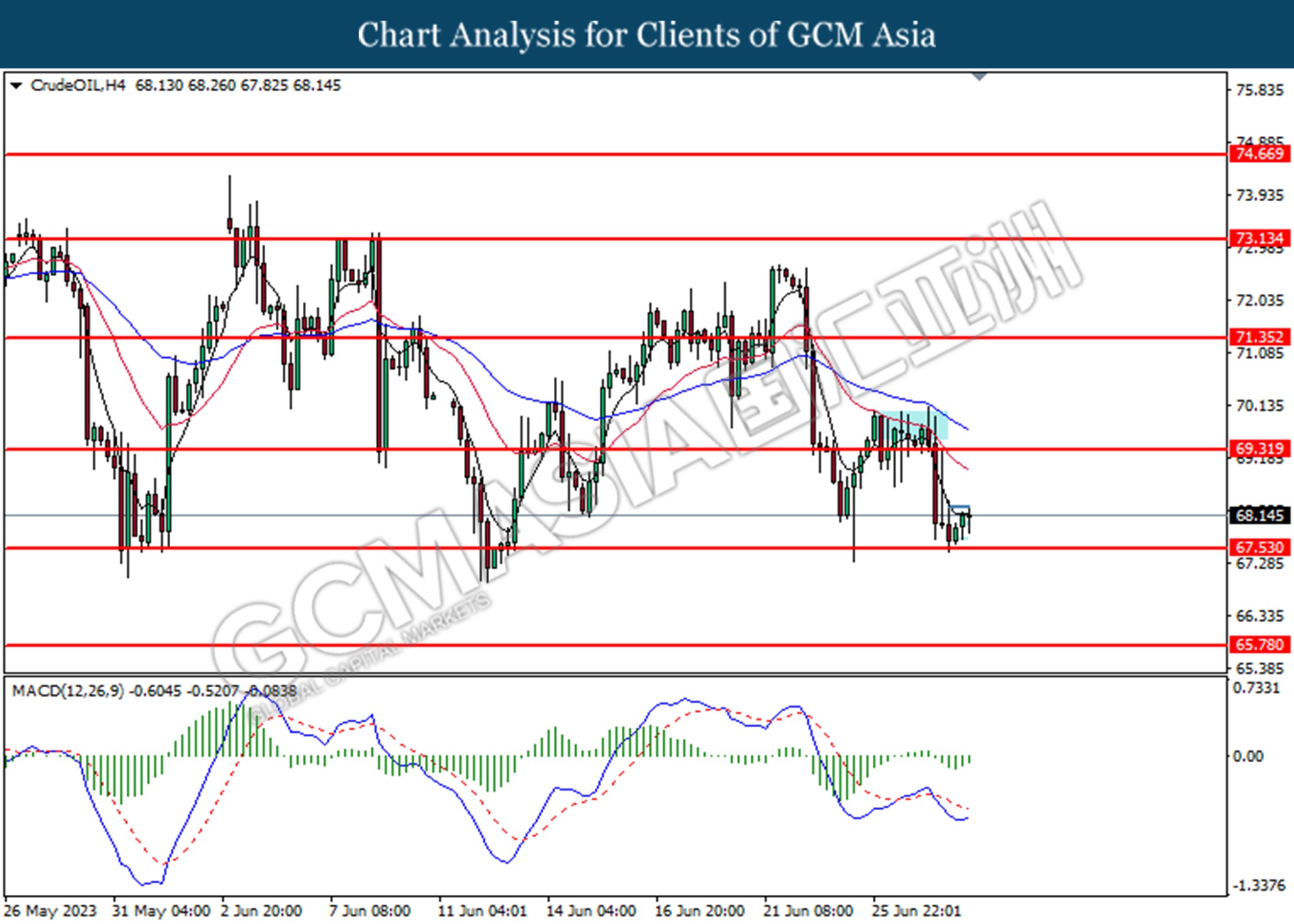

CrudeOIL, H4: Crude oil price was traded higher following the prior rebound from the support level at 67.55. MACD which illustrated diminishing bullish momentum suggests the commodity extended its gains toward the resistance level.

Resistance level: 69.30, 71.35

Support level: 67.55, 65.80

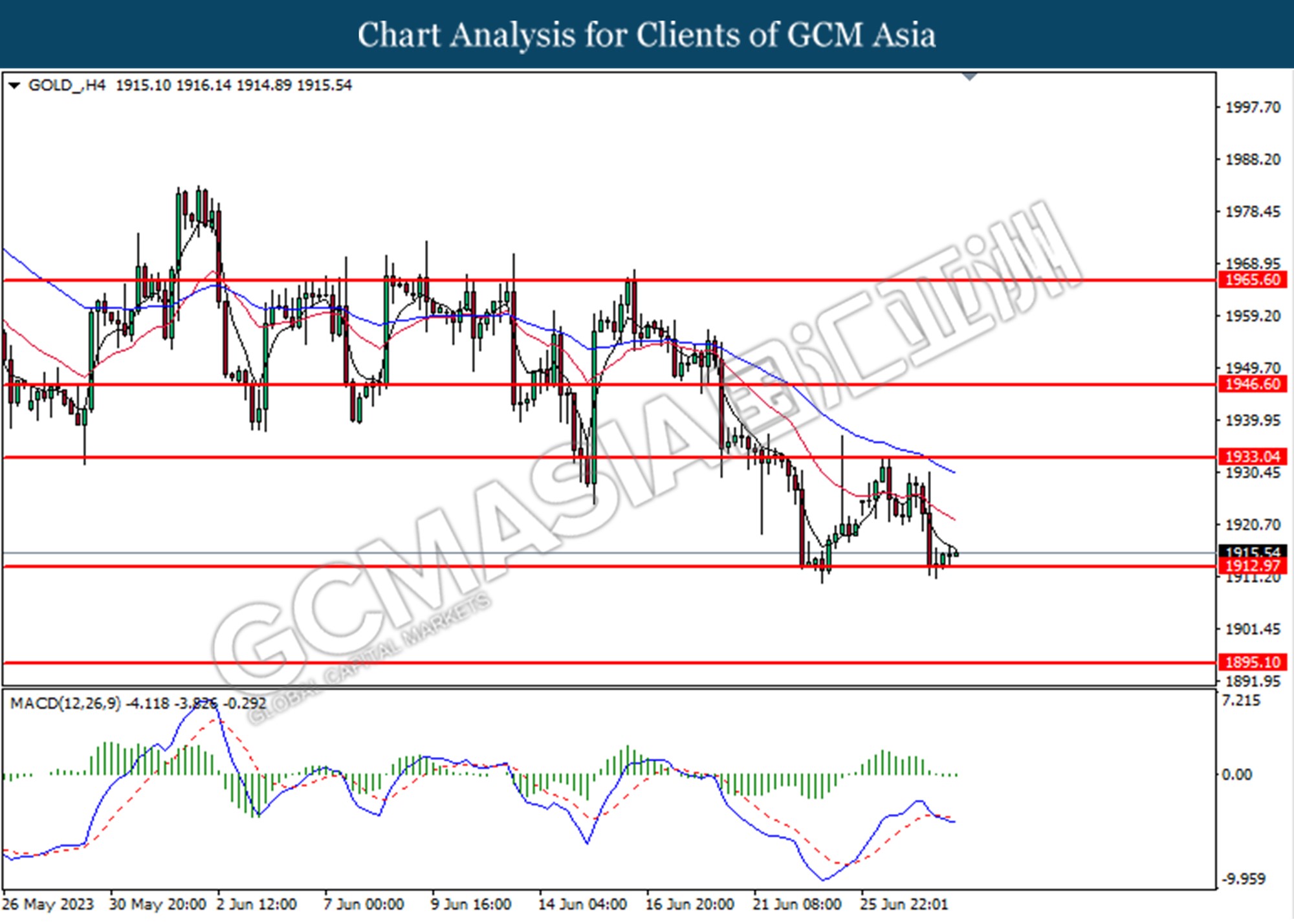

GOLD_, H4: Gold price was traded higher following the prior rebound from the support level at 1913.00. However, MACD which illustrated diminishing bullish momentum suggests the commodity undergoes a technical correction in the short term.

Resistance level: 1933.00, 1946.60

Support level: 1913.00, 1895.10