28 June 2023 Morning Session Analysis

US dollar gained on upbeat economic data.

The dollar index, which was traded against a basket of six major currencies, managed to find its ground after a series of economic data in US showed some positive sign of economic development. Last night, the US Census Bureau posted the US Core Durable Goods Orders data at a reading of 0.6% for the month of May, stronger than both the market expectation and previous reading at -0.1% and -0.6% respectively. It showed that the new orders for manufactured durable goods in the US continued to strengthen for the third consecutive month. Besides, the CB Consumer Confidence Index also surged from the prior month reading’s 102.5 to 109.7 this month, exceeding the consensus forecast at 104.0. The report showed that consumers have a brighter outlook for the economic activity in US. Other than that, the US housing data which included Building Permits and New Home Sales also posted a stronger-than-expected results yesterday. With such a backdrop, it wiped off the market worries over the risk of recession as these economic data showed that US economy remains resilient and far from a recession. As of writing, the dollar index dropped -0.10% to 102.50.

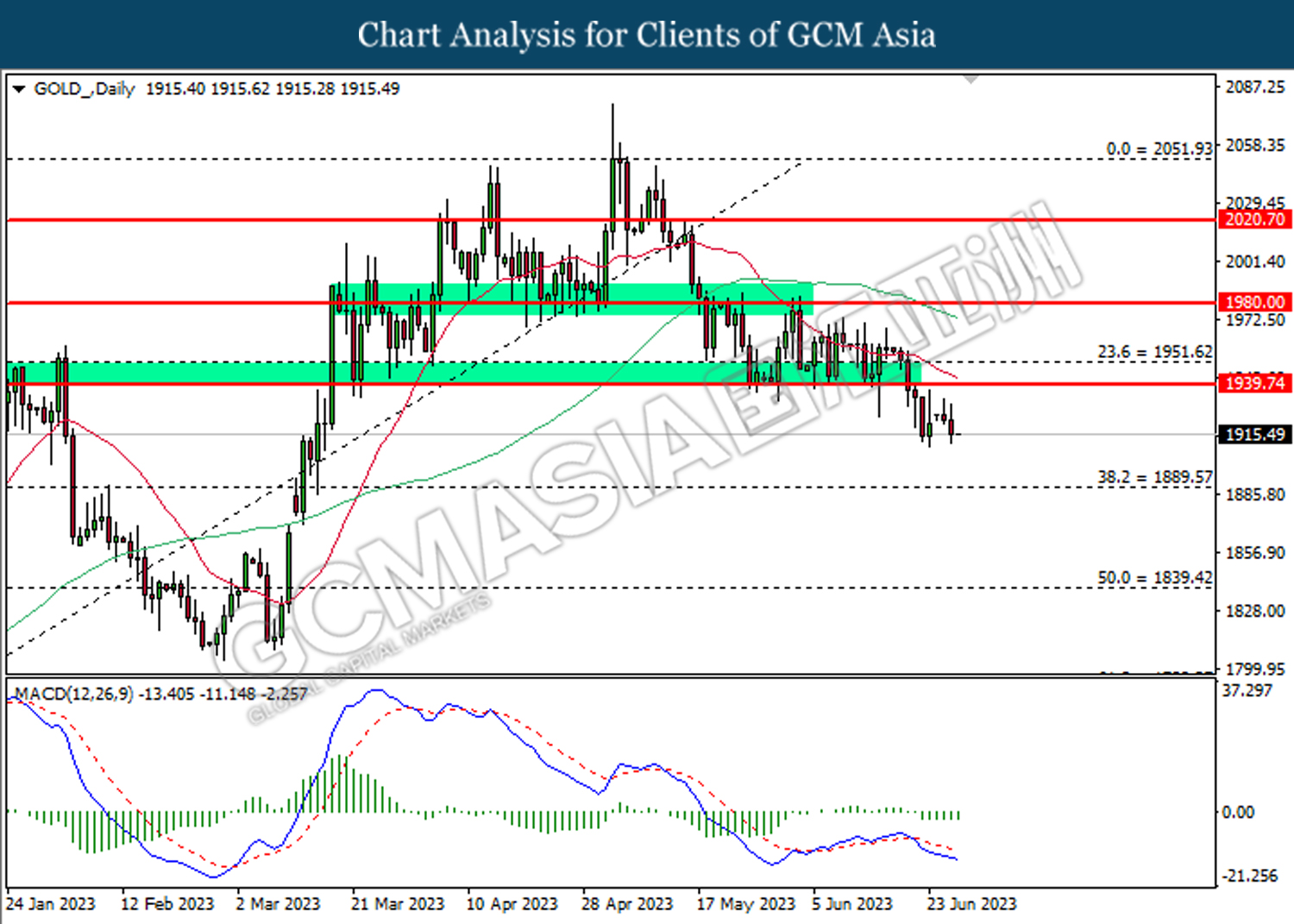

In the commodities market, crude oil prices were down by -0.07% to $67.85 per barrel as the continuous rate hikes from the central banks dampened the prospect of this market. Besides, the gold prices edged up by 0.08% to $1915.10 per troy ounce following a slew of upbeat data were released yesterday.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

21:30 USD Fed Chair Powell Speaks

21:30 EUR ECB President Lagarde Speaks

23:00 EUR ECB President Lagarde Speaks

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 22:30 | CrudeOIL – Crude Oil Inventories | -3.831M | 1.415M | – |

Technical Analysis

DOLLAR_INDX, Daily: Dollar index was traded lower following the prior retracement from the higher level. MACD which illustrated bearish bias momentum suggests the index to extend its losses toward the support level at 100.65.

Resistance level: 103.00, 105.00

Support level: 100.65, 99.40

GBPUSD, Daily: GBPUSD was traded higher while currently testing the resistance level at 1.2765. However, MACD which illustrated bearish bias momentum suggest the pair to undergo technical correction in short term.

Resistance level: 1.2765, 1.2875

Support level: 1.2635, 1.2525

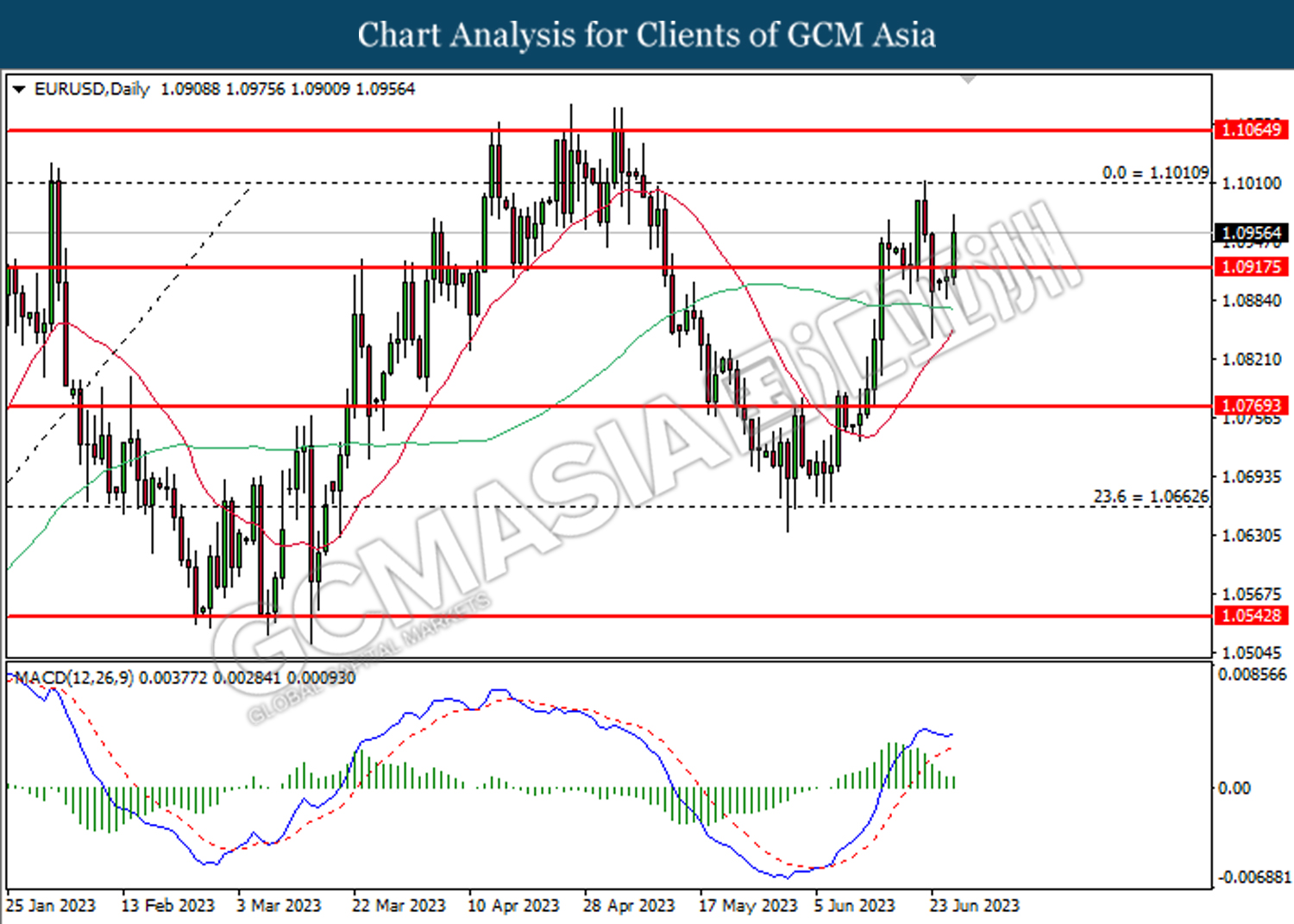

EURUSD, Daily: EURUSD was traded higher while currently testing the resistance level at 1.0915. MACD which illustrated bullish bias momentum suggest the pair to extend its gains toward the resistance level at 1.1010.

Resistance level: 1.1010, 1.1065

Support level: 1.0915, 1.0770

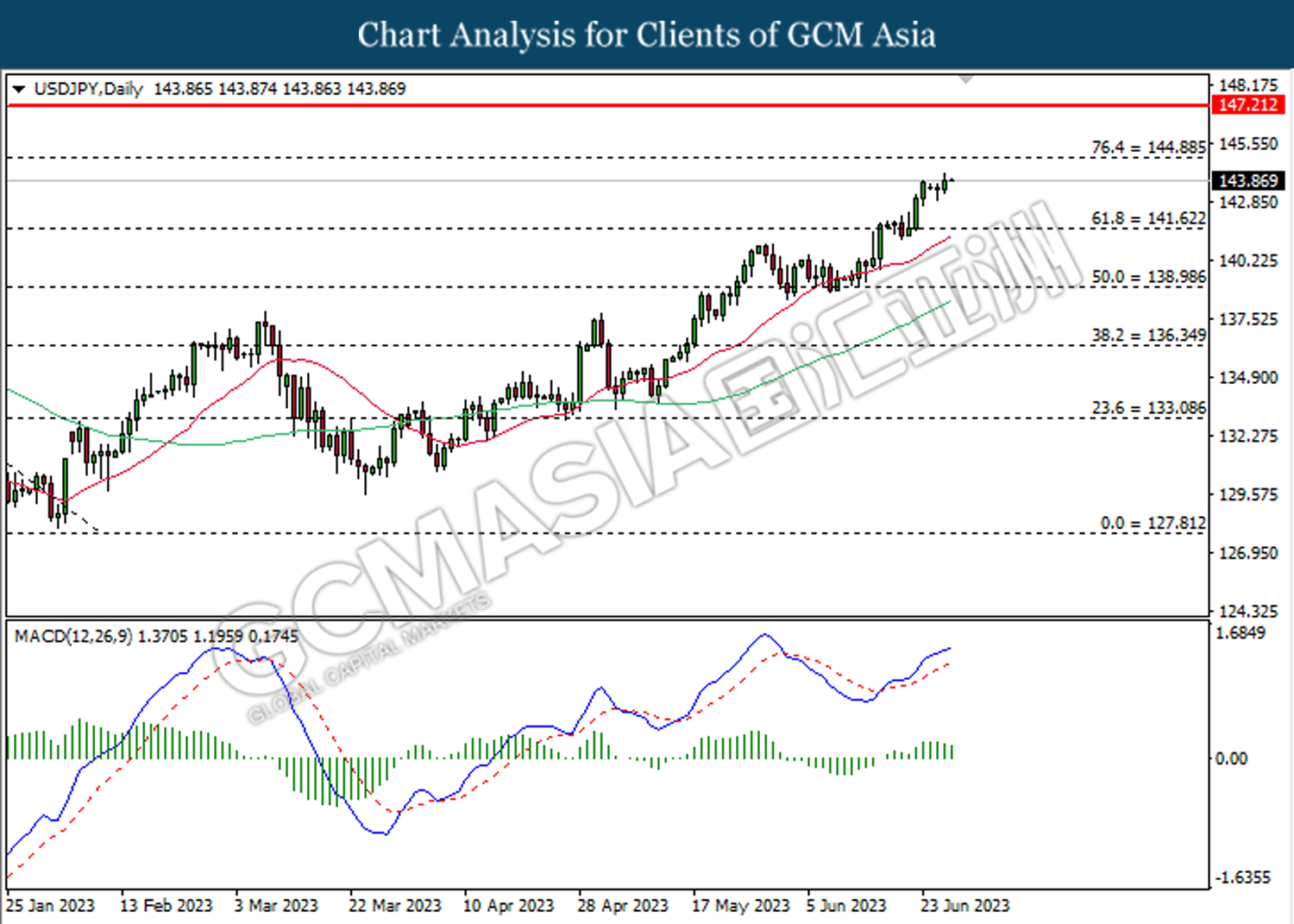

USDJPY, Daily: USDJPY was traded higher following the prior breakout above the previous resistance level at 141.65. MACD which illustrated bullish bias momentum suggest the pair to extend its gains toward the resistance level at 144.90.

Resistance level: 144.90, 147.20

Support level: 141.60, 139.00

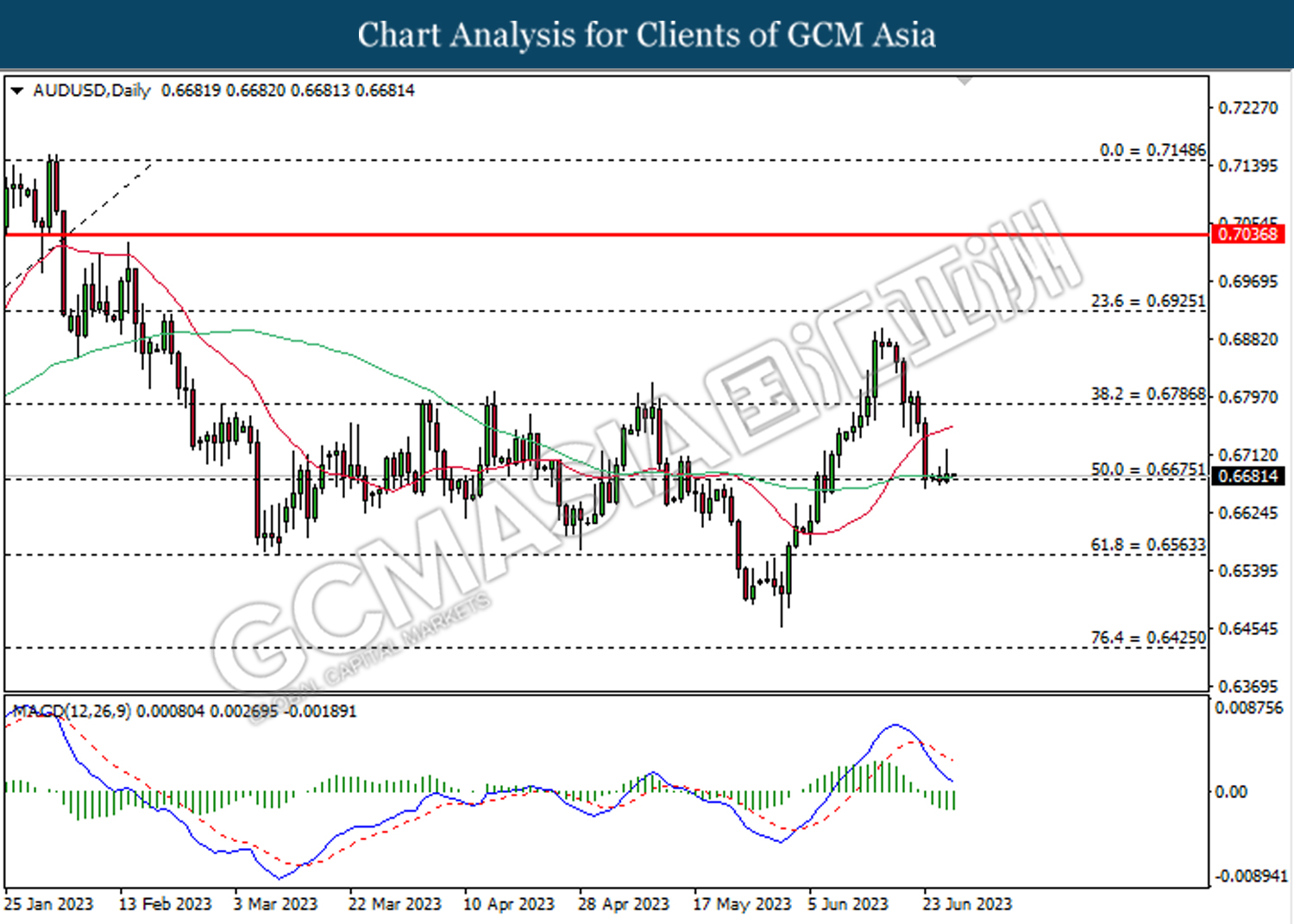

AUDUSD, Daily: AUDUSD was traded lower while currently testing the support level at 0.6675. MACD which illustrated bearish bias momentum suggest the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 0.6785, 0.6925

Support level: 0.6675, 0.6565

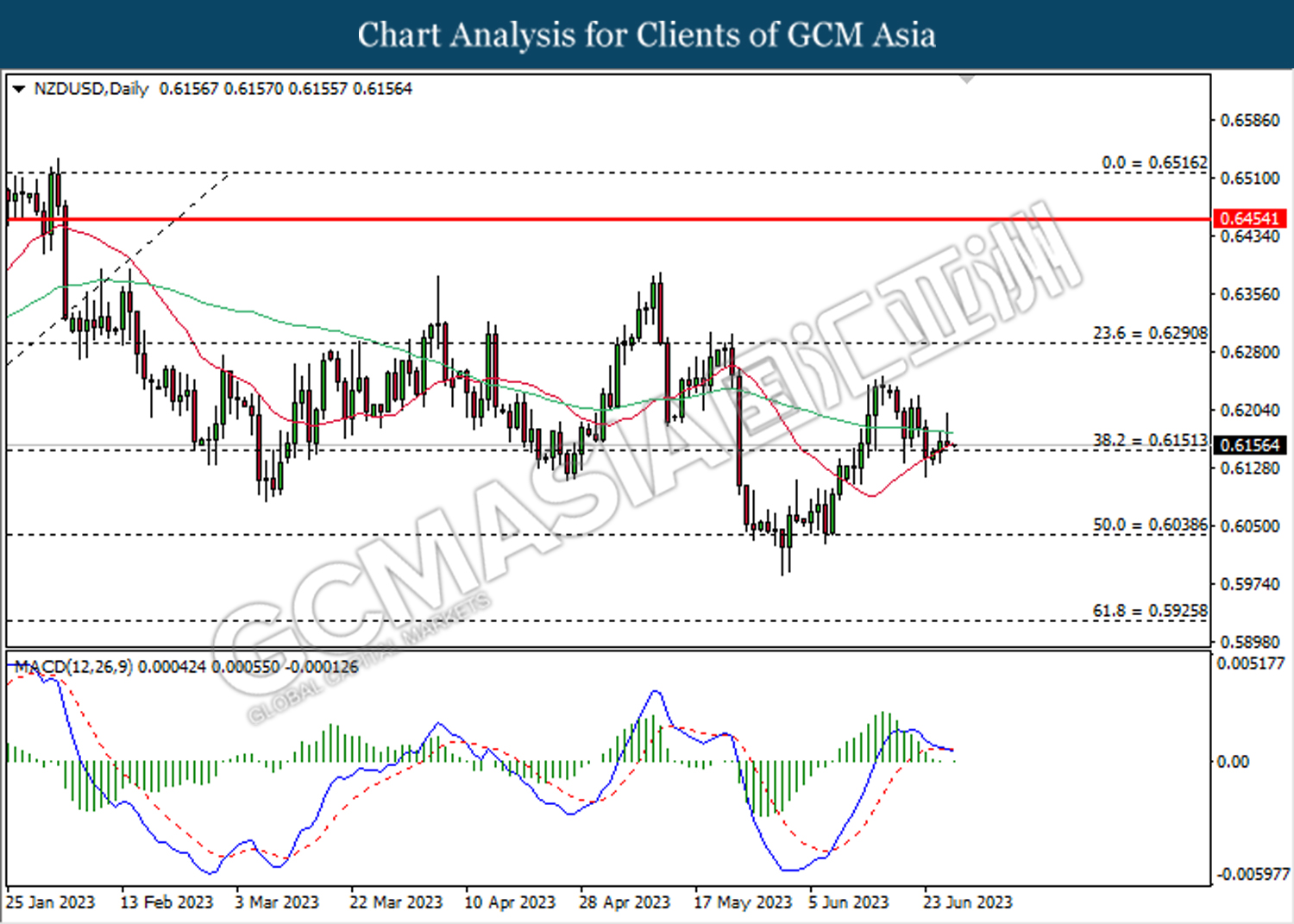

NZDUSD, Daily: NZDUSD was traded higher following the prior rebound from the support level at 0.6150. However, MACD which illustrated diminishing bullish momentum suggest the pair to undergo technical correction in short term.

Resistance level: 0.6290, 0.6455

Support level: 0.6150, 0.6040

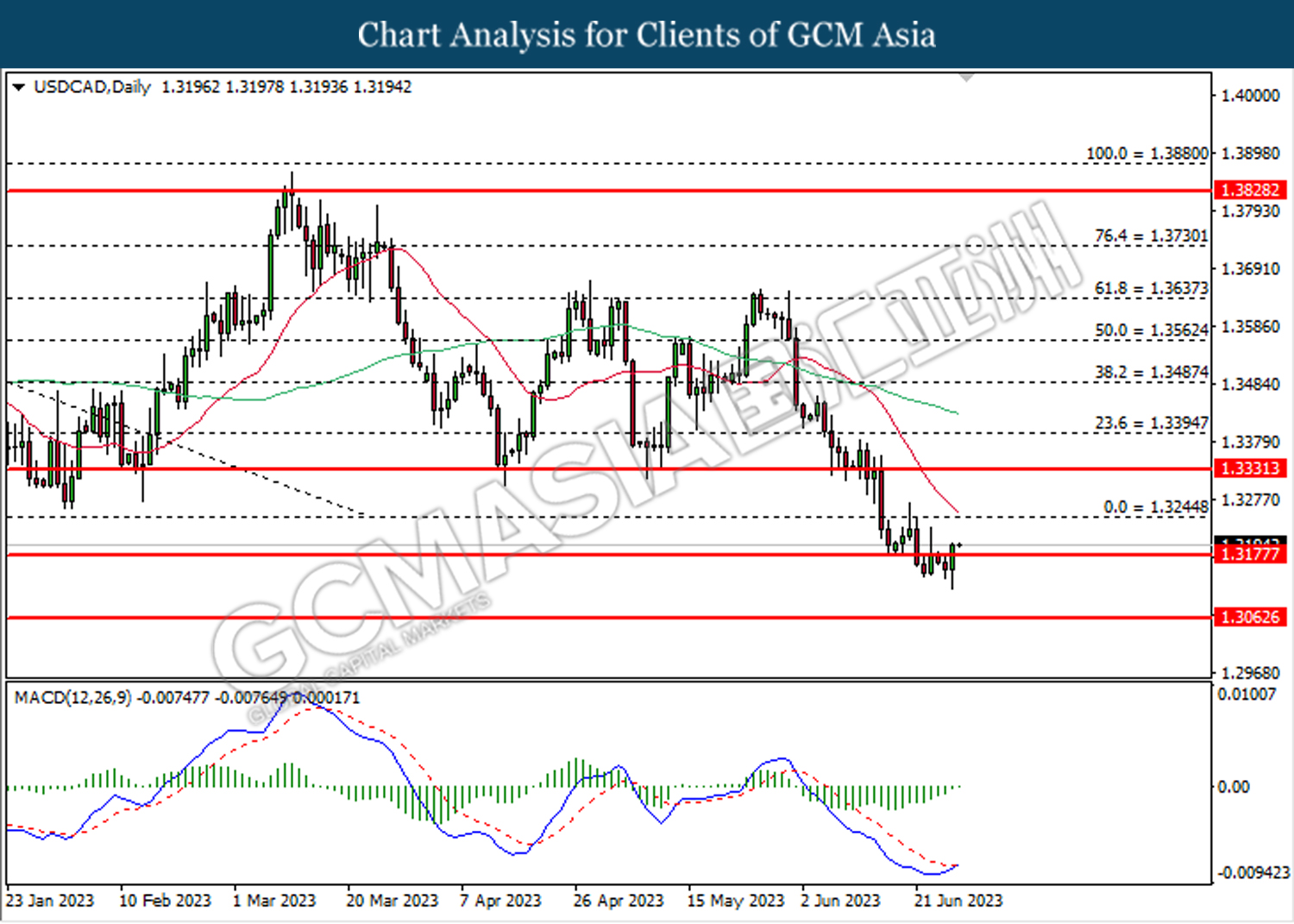

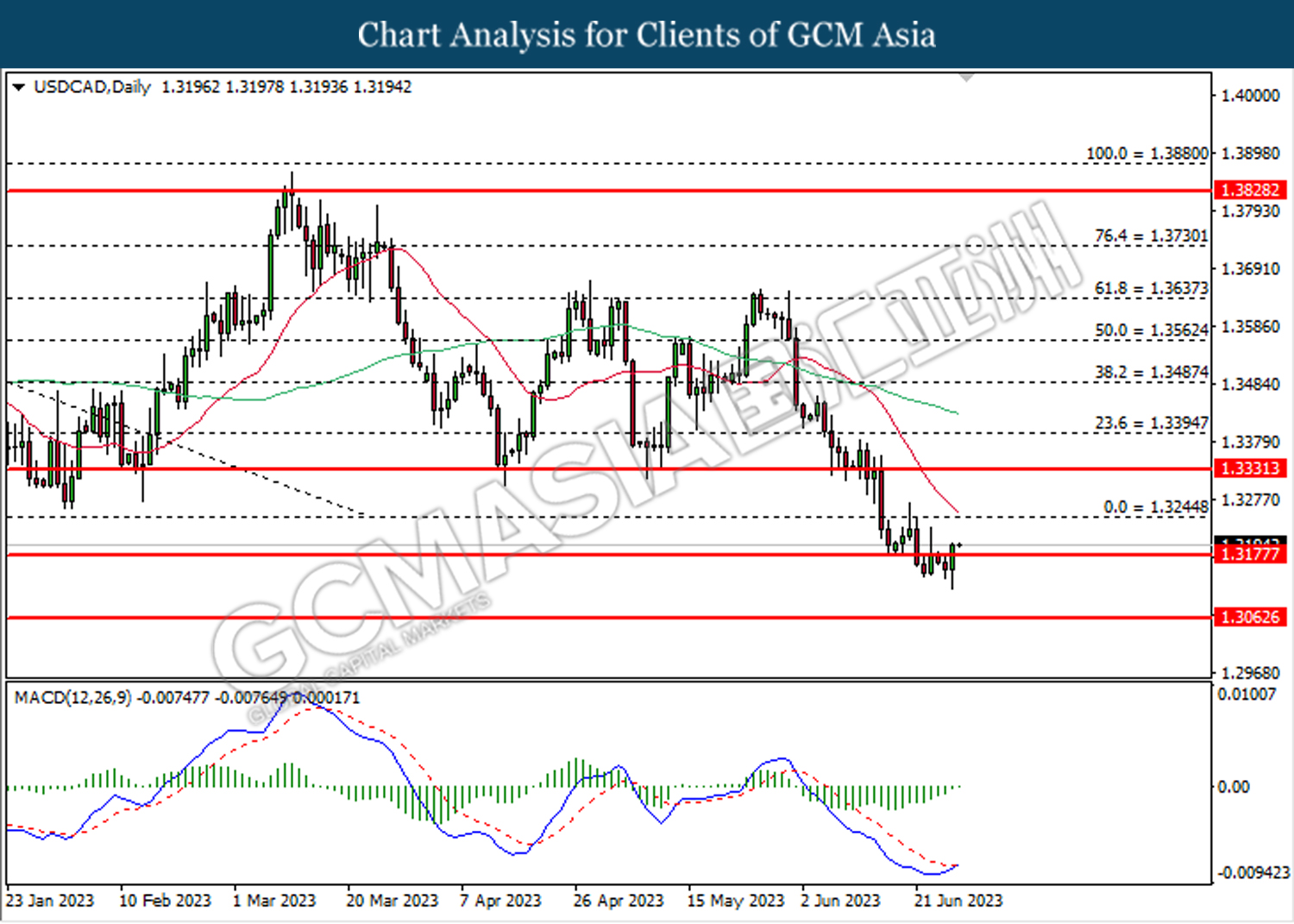

USDCAD, Daily: USDCAD was traded higher following the prior breakout above the previous resistance level at 1.3175. MACD which illustrated diminishing bearish momentum suggests the pair to extend its gains toward the resistance level at 1.3245.

Resistance level: 1.3245, 1.3330

Support level: 1.3175, 1.3065

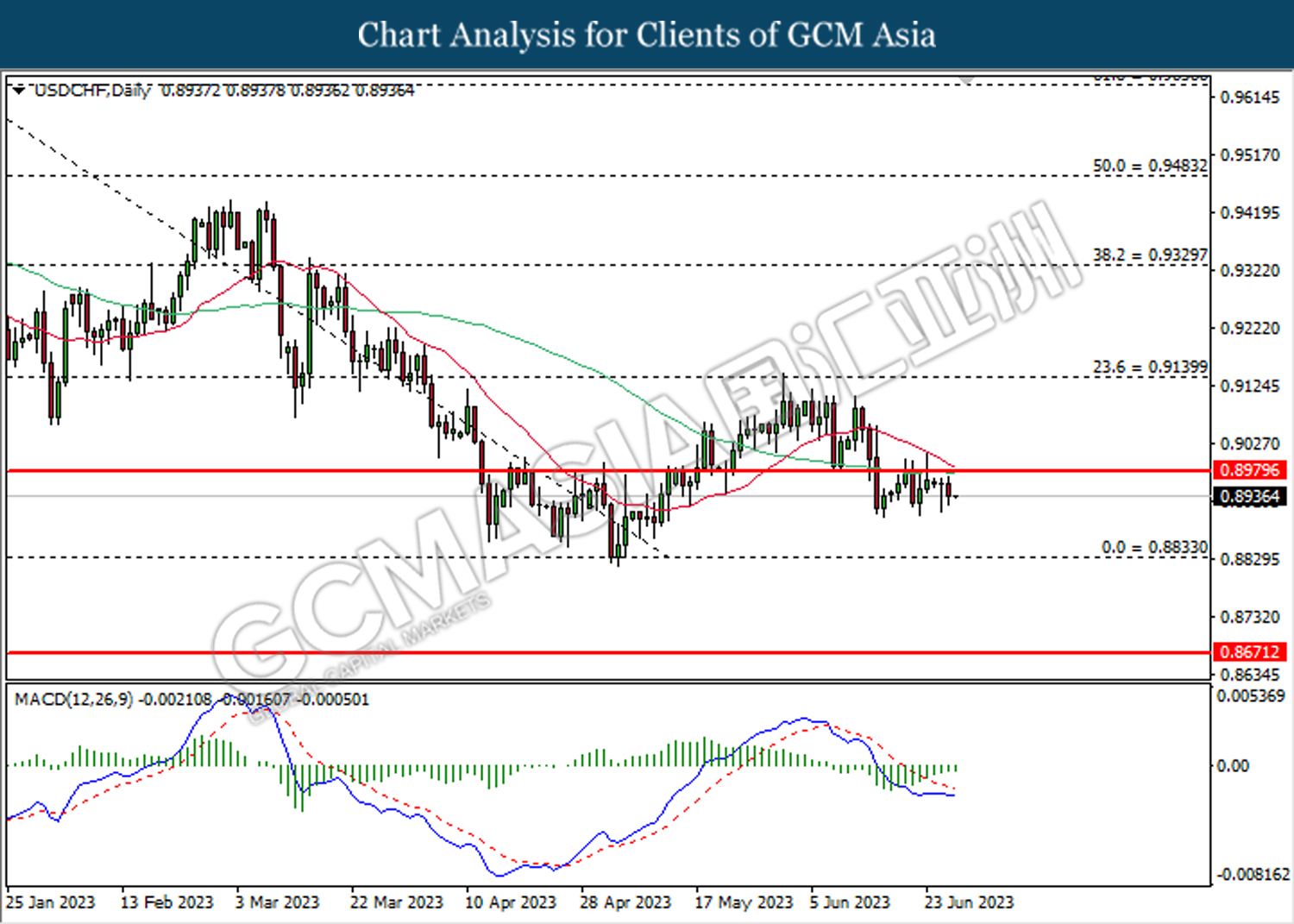

USDCHF, Daily: USDCHF was traded lower following the prior retracement from the resistance level at 0.8980. MACD which illustrated bearish bias momentum suggest the pair to extend its losses toward the support level at 0.8830.

Resistance level: 0.8980, 0.9140

Support level: 0.8830, 0.8670

CrudeOIL, Daily: Crude oil price was traded lower following the prior retracement from the resistance level at 70.15. MACD which illustrated bearish bias momentum suggest the commodity to extend its losses toward the support level at 66.50.

Resistance level: 70.15, 73.90

Support level: 66.50, 61.95

GOLD_, Daily: Gold price was traded lower following the prior retracement from the resistance level at 1939.75. MACD which illustrated bearish bias momentum suggests the commodity to extend its losses toward the support level at 1889.55.

Resistance level: 1939.75, 1951.60

Support level: 1889.55, 1839.40