28 July 2020 Afternoon Session Analysis

Japanese Yen extend rally following heightening risk aversion.

During late Asian session, the safe-haven Japanese Yen continue to extend its gains relentlessly against the greenback and other currency pairs as tension between U.S and China and increasing coronavirus cases continue to dampened risk sentiment. The U.S. recorded a near record 74,000 new cases of COVID-19 on Friday according to Johns Hopkins University data. More than 1,000 Americans died each day between Tuesday and Friday, the worst death tally since late May. The numbers may lead to further closures and lockdowns. Also, recent escalation of tension between U.S and China also provide reason for investors to increase their bets on the safe-haven Yen where U.S. and China have both ordered the other shut a consulate in their respective countries, the China’s Houston consulate and the U.S. consulate in Chengdu. U.S. Secretary of State Mike Pompeo called for an end of “engagement,” a policy that has defined U.S.-China relations for nearly five decades. At the time of writing, USD/JPY plummets 0.58% to 105.51.

In the commodities market, the crude oil price fell 0.05% to $41.17 per barrel as of writing following increasing tensions between the two of the largest oil consumers in the world. Fears of a full blown diplomatic conflict over the next few months have dampened the expectation of a sharp increase in fuel demand, thus affecting the value of the commodity. At the same time, worsening coronavirus outlook also weigh on the market. On the other hand, gold price soars 1.77% to $1934.35 a troy ounce at the time of writing amid ongoing dollar weakness.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 16:00 | EUR – German Ifo Business Climate Index (Jul) | 86.2 | 89.3 | – |

| 20:30 | USD – Core Durable Goods Orders (MoM)(Jun) | 3.7% | 3.5% | – |

Technical Analysis

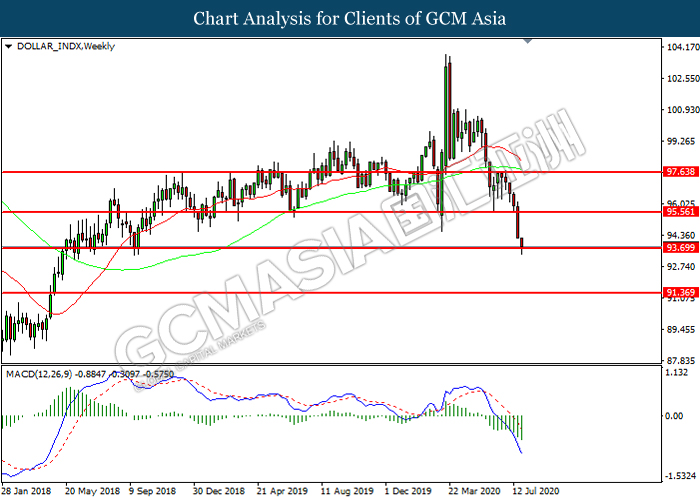

DOLLAR_INDX, Weekly: Dollar index was traded lower while currently testing the support level at 93.70. MACD which illustrated increasing bearish momentum suggest the index to extend its losses after it successfully breakout below the support level.

Resistance level: 95.55, 97.65

Support level: 93.70, 91.35

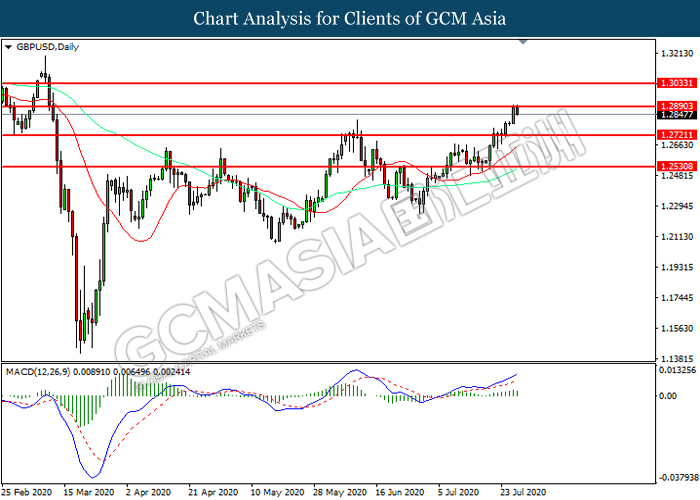

GBPUSD, Daily: GBPUSD was traded higher while currently testing the resistance level at 1.2890. However, MACD which illustrated diminishing bullish momentum suggest the pair to be traded lower in short-term as technical correction.

Resistance level: 1.2890, 1.3035

Support level: 1.2720, 1.2530

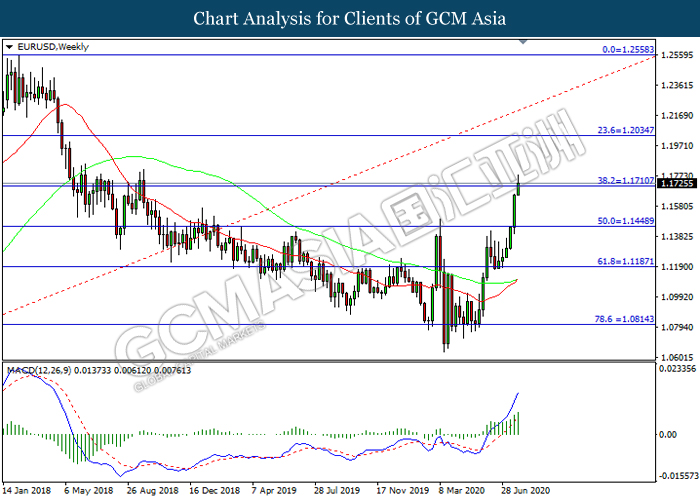

EURUSD, Weekly: EURUSD was traded higher while currently testing the resistance level at 1.1710. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 1.1710, 1.2035

Support level: 1.1450, 1.1185

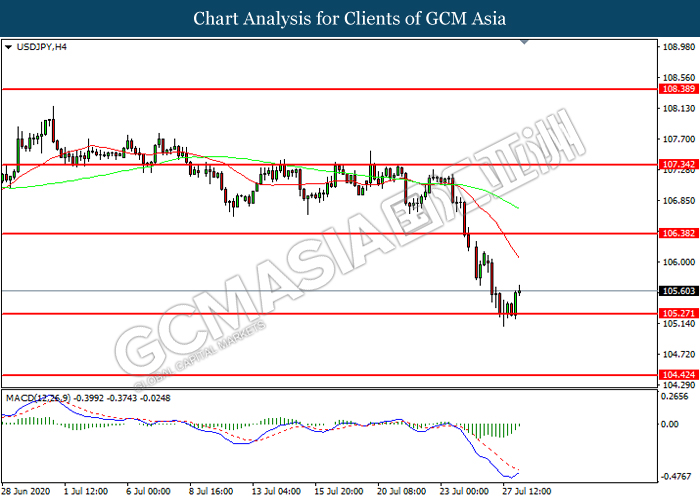

USDJPY, H4: USDJPY was traded higher following prior rebound from the support level at 105.25. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains toward resistance level at 106.40.

Resistance level: 106.40, 107.35

Support level: 105.25, 104.40

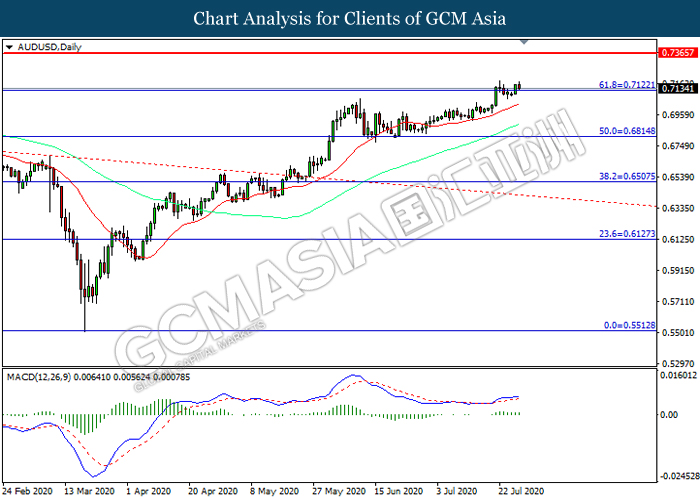

AUDUSD, Daily: AUDUSD was traded higher while currently testing the resistance level 0.7120. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 0.7120, 0.7365

Support level: 0.6815, 0.6505

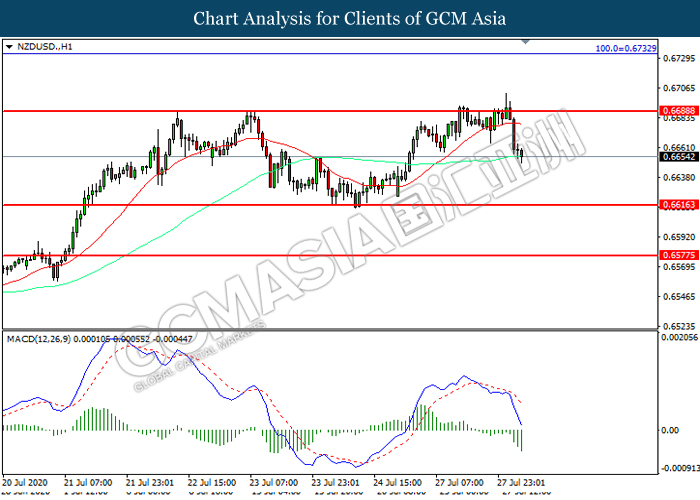

NZDUSD, H1: NZDUSD was traded lower following prior retracement from the resistance level at 0.6690. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses toward support level at 0.6615.

Resistance level: 0.6690, 0.6735

Support level: 0.6615, 0.6575

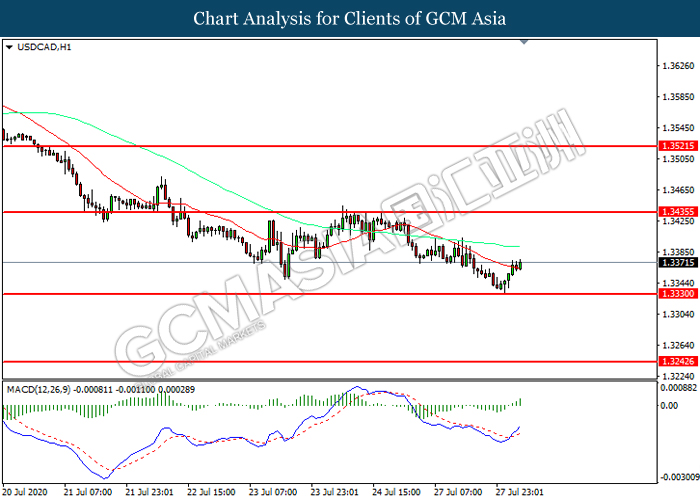

USDCAD, H1: USDCAD was traded higher following prior rebound from the support level at 1.3330. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains toward resistance level at 1.3435.

Resistance level: 1.3435, 1.3520

Support level: 1.3330, 1.3245

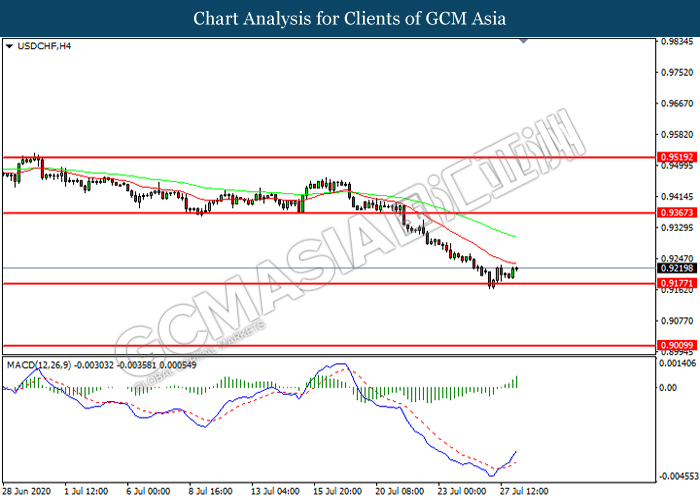

USDCHF, H4: USDCHF was traded lower while currently testing the support level at 0.9175. MACD which illustrated increasing bullish momentum suggest the pair to be traded higher in short-term as technical correction.

Resistance level: 0.9365, 0.9520

Support level: 0.9175, 0.9010

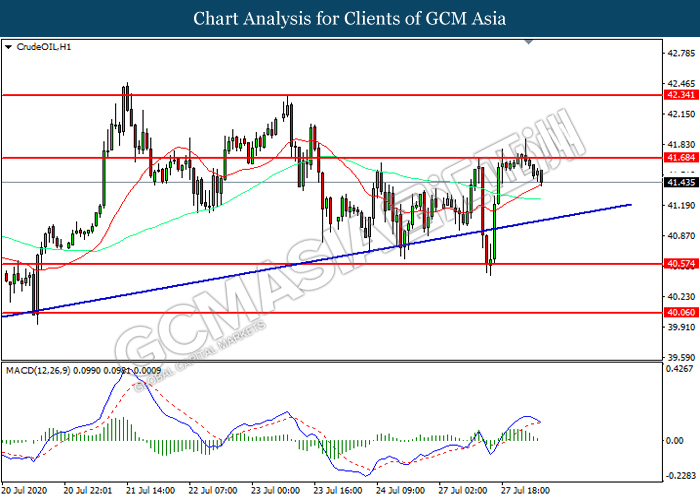

CrudeOIL, H1: Crude oil price was traded lower following prior retracement from the resistance level at 41.70. MACD which illustrated diminishing bullish momentum suggest the commodity to extend its losses toward support level at 40.55

Resistance level: 41.70, 42.35

Support level: 40.55, 40.05

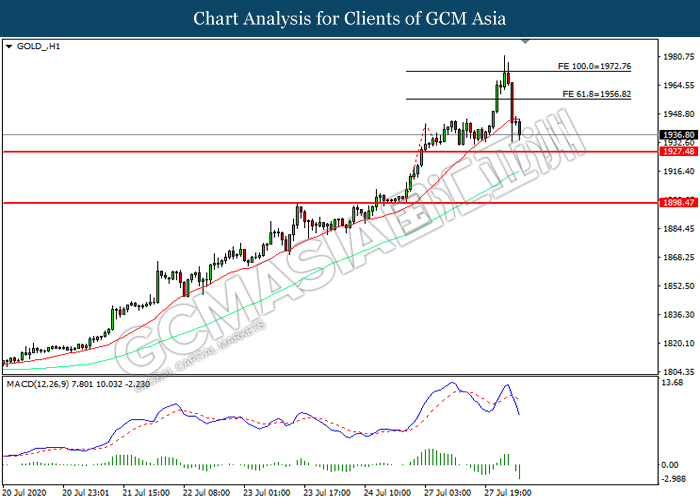

GOLD_, H1: Gold price was traded lower following prior breakout below the previous support level at 1956.80. MACD which illustrated increasing bearish momentum suggest the commodity to extend its losses toward support level at 1927.50.

Resistance level: 1956.80, 1972.75

Support level: 1927.50, 1898.45