28 July 2020 Morning Session Analysis

Dollar plunged amid US-Sino tension heightened.

Dollar index which gauges its value against a basket of six major currencies failed to revive from its falling trend as exacerbating of tension between US and China lured investors to flee away from greenback market to ultimate safe haven instrument which is gold. According to the latest news, US consulate in Chengdu was being ordered to close down by China’s government, which seemingly treated as a retaliation against United States after their embassy in Houston was being taken over by the US on last Friday. Relation between these two countries has hit a boiling point in years over issue such as blaming each other on the responsibility of covid-19’s outbreak as well as enacted security legislation law in Hong Kong. The tit-for-tat retaliation between these two biggest economy bodies flared up the tension to another new level while the novel of Covid-19 is threatening the global economy health. As of now, market participant are still eyeing on the renewed tension between US and China, while heeding on the development of vaccine as well. During Asian early trading session, dollar index dropped 0.84% to 93.65.

In the commodities market, crude oil price appreciated by 0.41% to $41.75 per barrel as market believes that the new round of stimulus plan will able to revitalize the US economy, sparked up the market confidence toward the oil future demand. Beside, gold price up 1.19% to $1965.40 a troy ounce amid renewed tensions between US and China while pandemic remains.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 22:00 | USD – CB Consumer Confidence (Jul) | 98.1 | 94.5 | – |

| 04:30

(29th) |

CrudeOIL – API Weekly Crude Oil Stock | 7.544M | – | – |

Technical Analysis

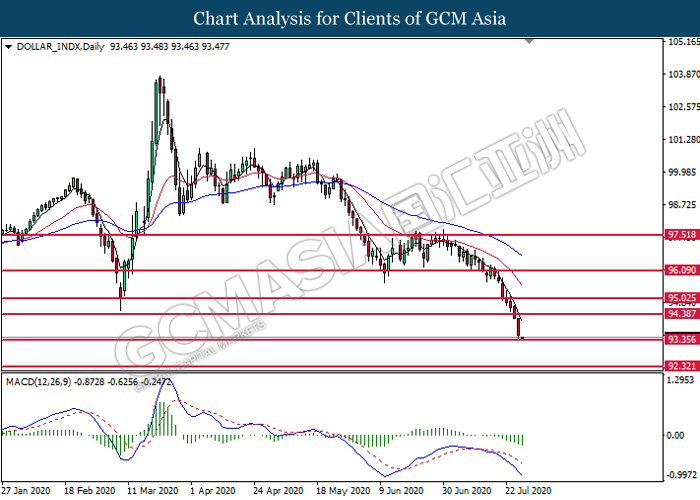

DOLLAR_INDX, Daily: Dollar index was traded lower while currently testing the support level at 93.35. MACD which illustrate bearish bias momentum signal suggest the dollar to extend its losses after it successfully breakout below the support level.

Resistance level: 94.40, 95.00

Support level: 93.35, 92.30

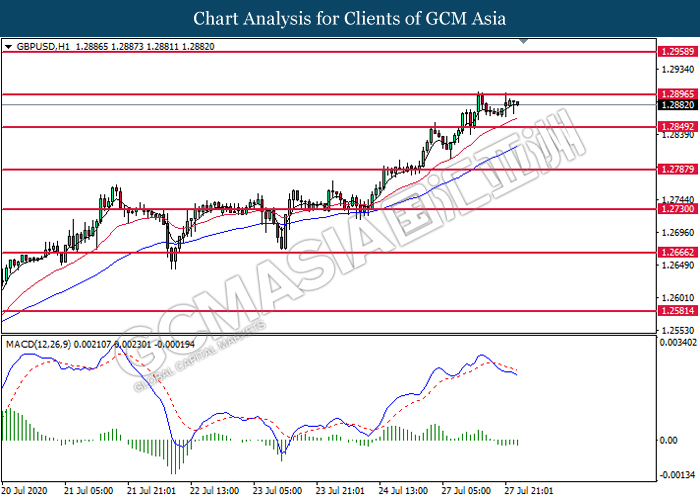

GBPUSD, H1: GBPUSD was traded higher while currently testing the resistance level at 1.2895. However, MACD which illustrate bearish bias momentum signal suggest the pair to be traded lower in short term toward the support level at 1.2850.

Resistance level: 1.2895, 1.2960

Support level: 1.2850, 1.2790

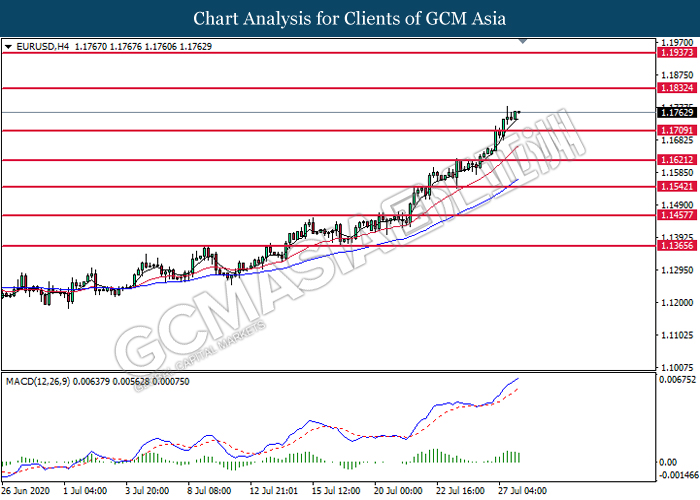

EURUSD, H4: EURUSD was traded higher following prior breakout above the previous resistance level at 1.1710. MACD which illustrate bullish bias momentum suggest the pair to extend its gains toward the resistance level at 1.1835.

Resistance level: 1.1835, 1.1935

Support level: 1.1710, 1.1620

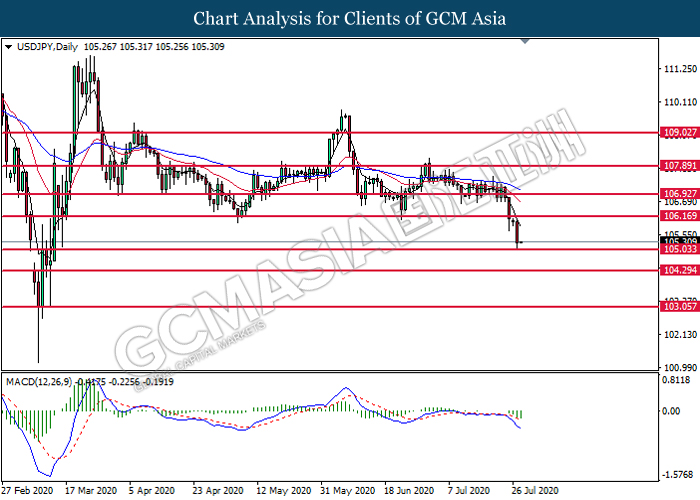

USDJPY, Daily: USDJPY was traded lower while currently testing near the support level at 105.00. MACD which illustrate bearish bias momentum signal suggest the pair to extend its losses after it successfully breakout below the support level at 105.00.

Resistance level: 106.15, 106.95

Support level: 105.05, 104.30

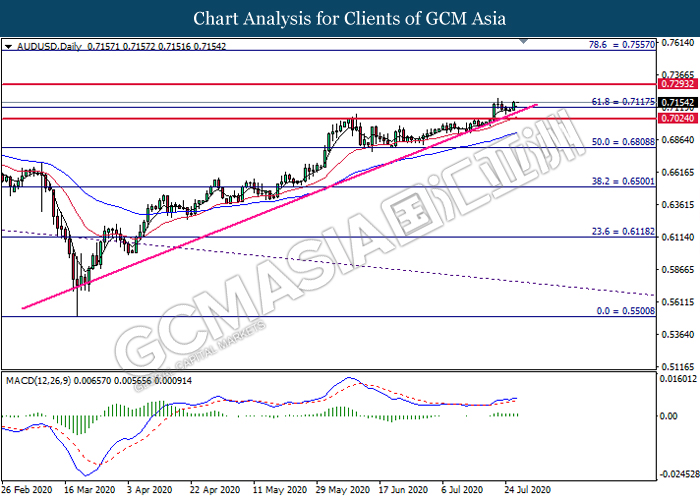

AUDUSD, Daily: AUDUSD was traded higher following prior breakout above the previous resistance level at 0.7115. MACD which illustrate bullish momentum signal suggest the pair to extend its after toward the resistance level at 0.7295.

Resistance level: 0.7295, 0.7555

Support level: 0.7115, 0.7025

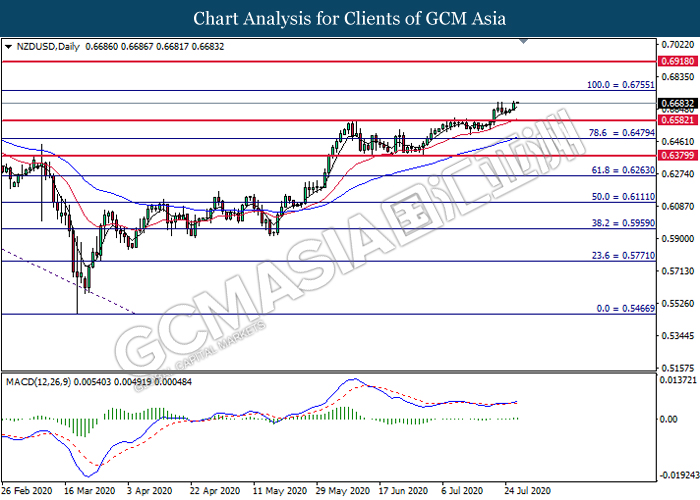

NZDUSD, Daily: NZDUSD was traded higher following prior breakout above the previous resistance level at 0.6580. MACD which illustrate bullish bias momentum signal suggest the pair to extend its gains toward the resistance level at 0.6755.

Resistance level: 0.6755, 0.6920

Support level: 0.6580, 0.6480

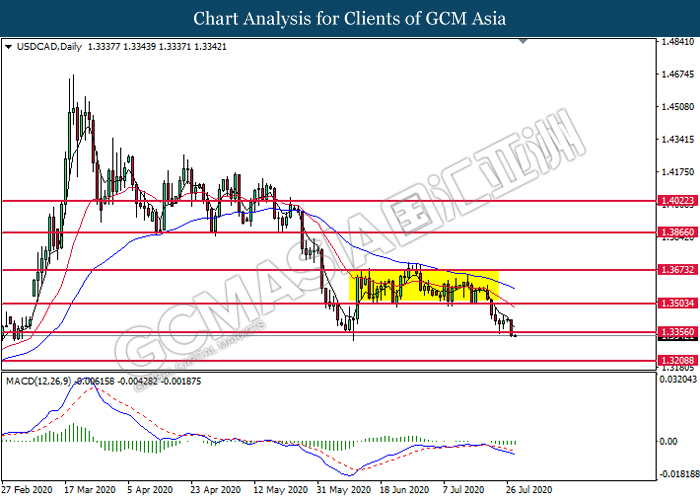

USDCAD, H4: USDCAD was traded lower following prior breakout below the previous support level at 1.3355. MACD which illustrate bearish bias momentum suggest the pair to extend its losses toward the support level at 1.3210.

Resistance level: 1.3355, 1.3505

Support level: 1.3210, 1.3045

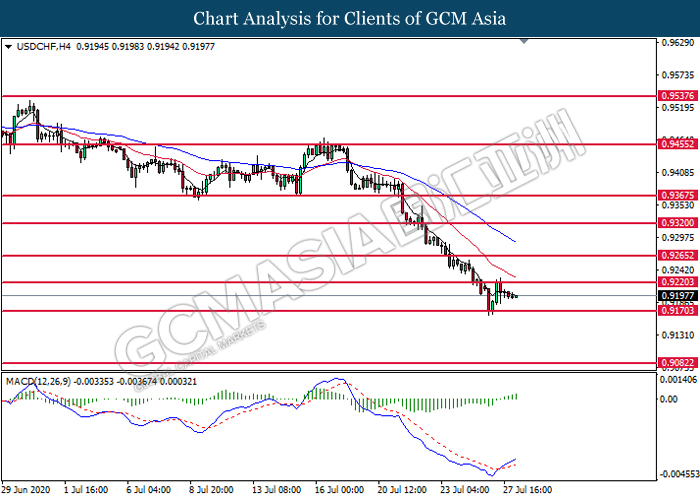

USDCHF, H4: USDCHF was traded lower following prior retracement from the resistance level at 0.9220. However, MACD which illustrate bullish bias momentum signal suggest the pair to be traded higher in short term toward the resistance level at 0.9220.

Resistance level: 0.9220, 0.9265

Support level: 0.9170, 0.9080

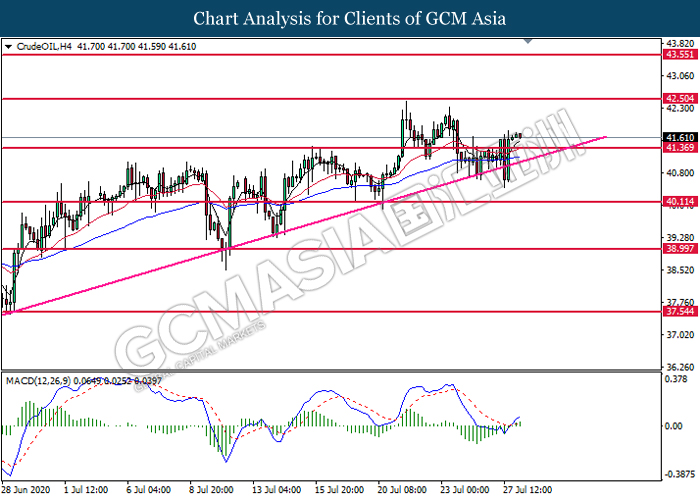

CrudeOIL, H4: Crude oil price was traded higher following prior rebound from the upward trendline. MACD which illustrate bullish bias signal suggest the commodity to extend its gains toward the resistance level at 42.50.

Resistance level: 42.50, 43.55

Support level: 41.35, 40.10

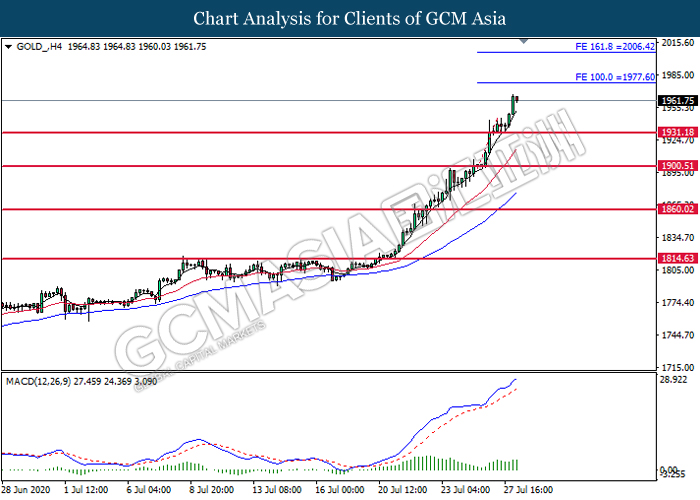

GOLD_, H4: Gold price was traded higher following prior breakout above the previous resistance level at 1931.20. MACD which illustrate bullish bias momentum signal suggest the commodity to extend its gains toward the resistance level at 1977.60.

Resistance level: 1977.60, 2006.40

Support level: 1931.20, 1900.50