28 July 2023 Afternoon Session Analysis

Euro slumped following a rate hike as investors expected.

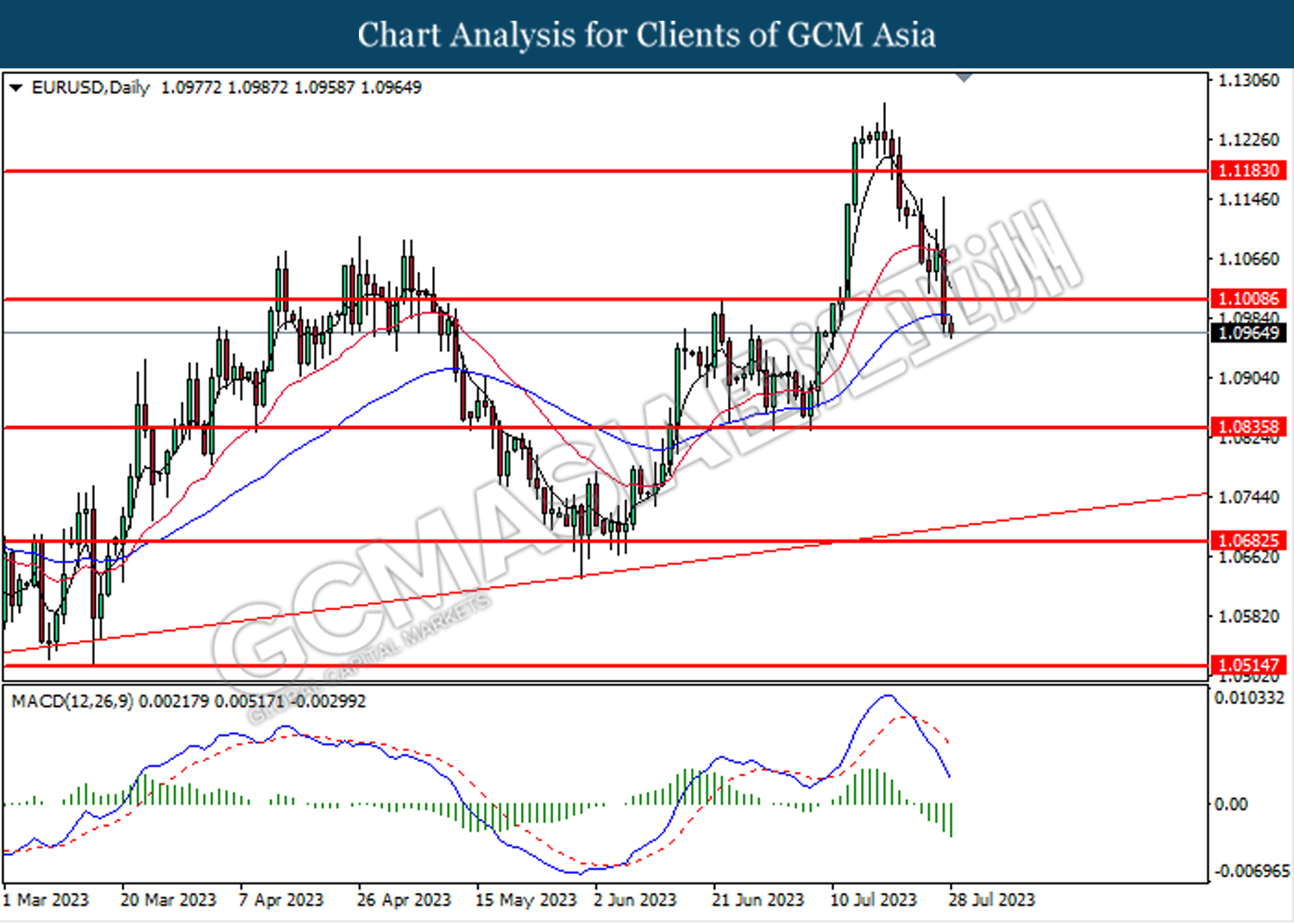

Euro, which was widely traded by global investors, slumped after European Central Bank (ECB) hiked interest rate and ECB Press Conference. ECB raised its policy rates by 25 basis points (bps) from 4.0% to 4.25%, matched as the market forecast at 4.25%. Although there was a hike on interest rate, but due to German and French are Euro largest economic countries and their economic conditions were underperformed, the Euro economic condition might be unable to support this high level of interest rate, and eventually the investors lost confidents on Euro. Besides that, during the ECB Press Conference, President Lagarde said “We have an open mind as to what the decisions will be in September and in subsequent meetings,” which means the coming September interest rate could be a further hike or hold. Current Europe inflation rate still remain too high for ECB target – 2% of inflation until mid-2025. Investors are keeping their eyes on today’s French and German GDP data to scrutinize the future direction of the single currency. As of writing, EUR/USD dropped -0.06% to 1.0965.

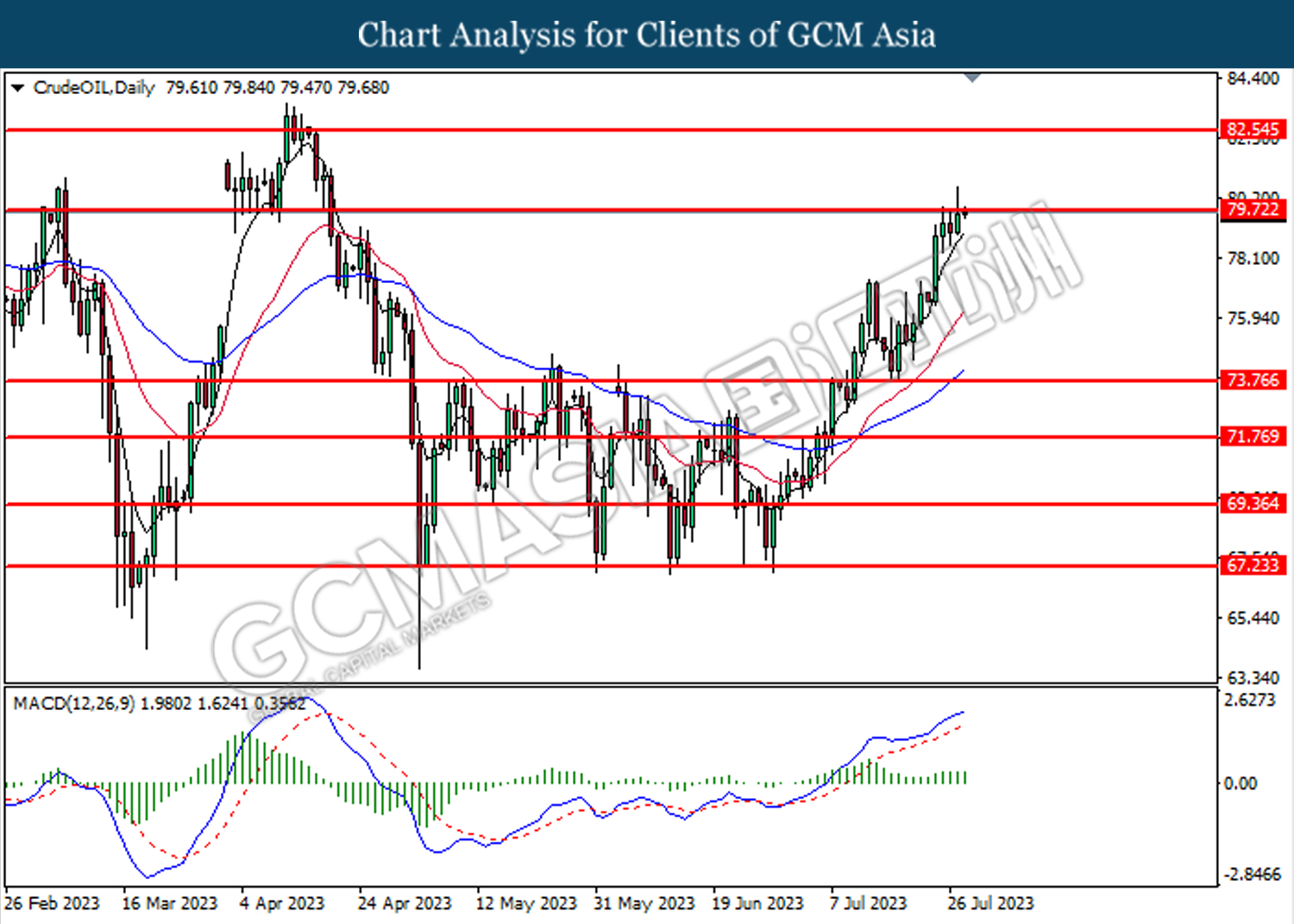

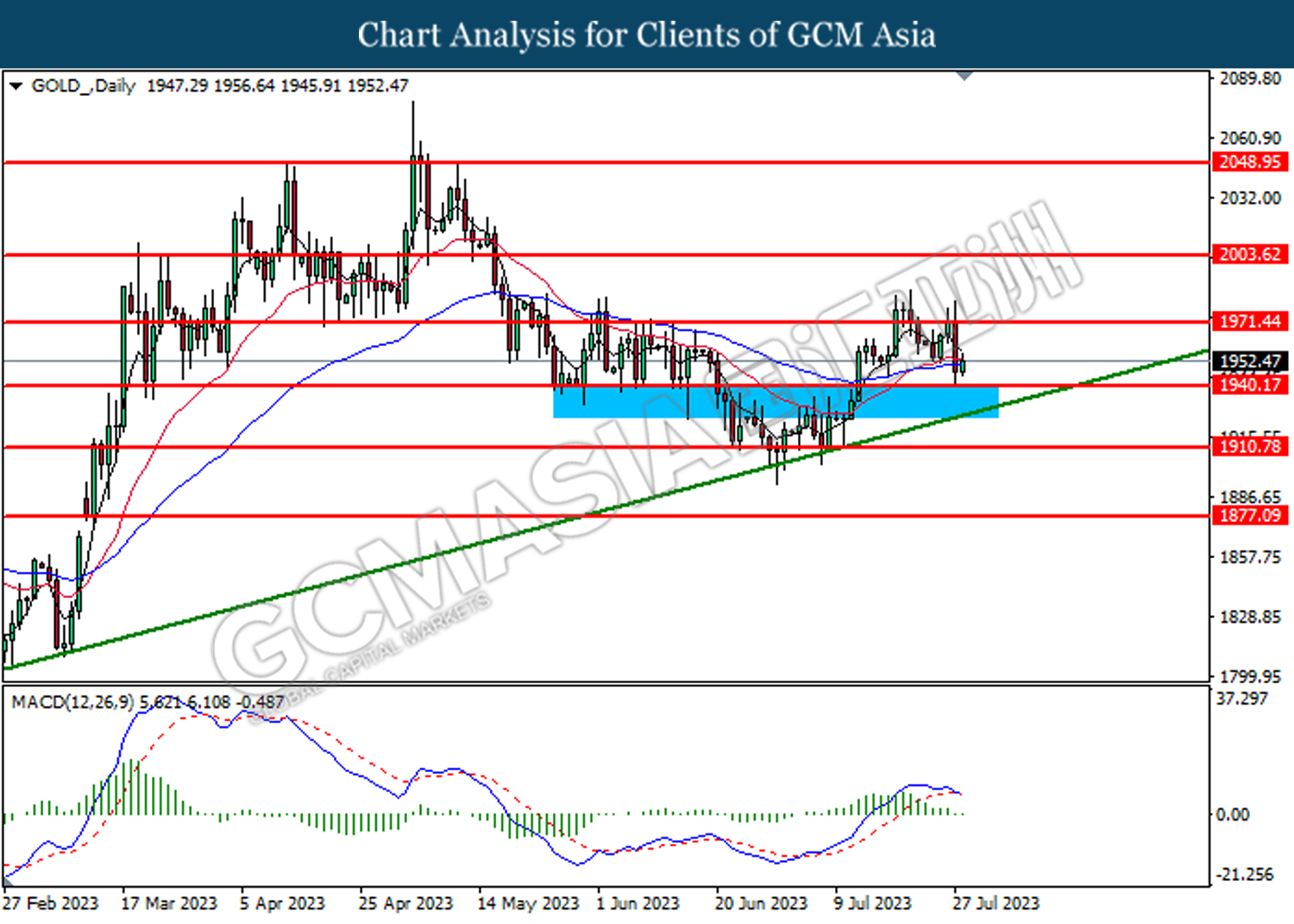

In the commodities market, crude oil prices dropped -0.52% to $79.65 per barrel as a temporary correction. However, the long term prospect of the oil market remains decent amid ongoing OPEC oil production cut and hopes of China recovery. Besides, gold prices rose 0.48% to $1954.82 per troy after a slump of around $35 amid the strengthening of US Dollar.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Event | Previous | Forecast | Actual |

| 16:00 | EUR – German GDP (QoQ) (Q2) | -0.3% | 0.1% | – |

| 21:00 | EUR – German CPI (MoM) (Jul) | 0.3% | 0.3% | – |

| 20:30 | USD – Core PCE Price Index (MoM) (Jun) | 4.6% | 4.2% | – |

| 22:00 | USD – Michigan Consumer Sentiment (Jul) | 64.4 | 72.6 | – |

Technical Analysis

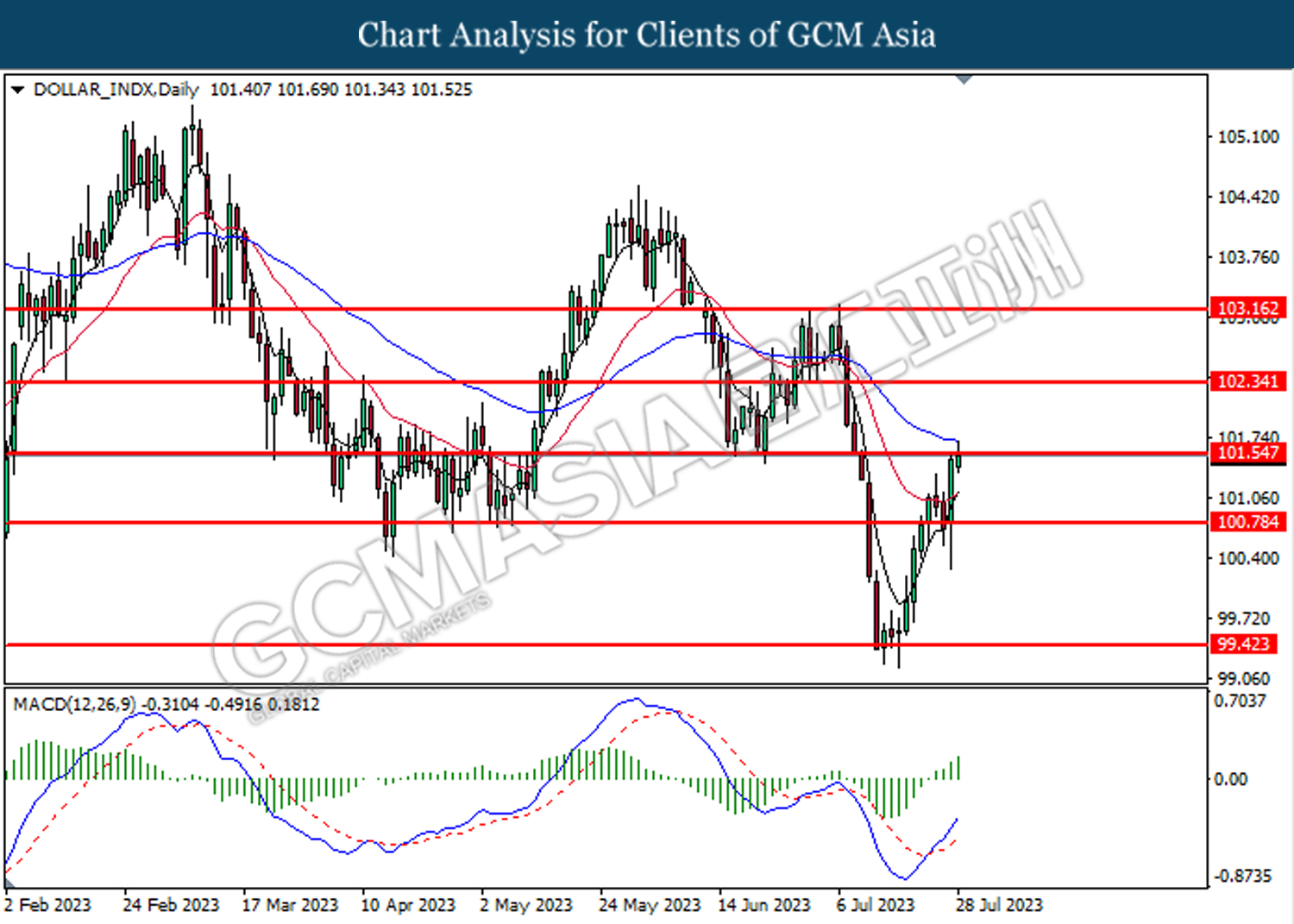

DOLLAR_INDX, Daily: Dollar index was traded higher while testing the resistance level at 101.55. MACD which illustrated increasing bullish momentum suggests the index to extend its gains after breakout the resistance level.

Resistance level: 101.55, 102.35

Support level: 100.80, 99.40

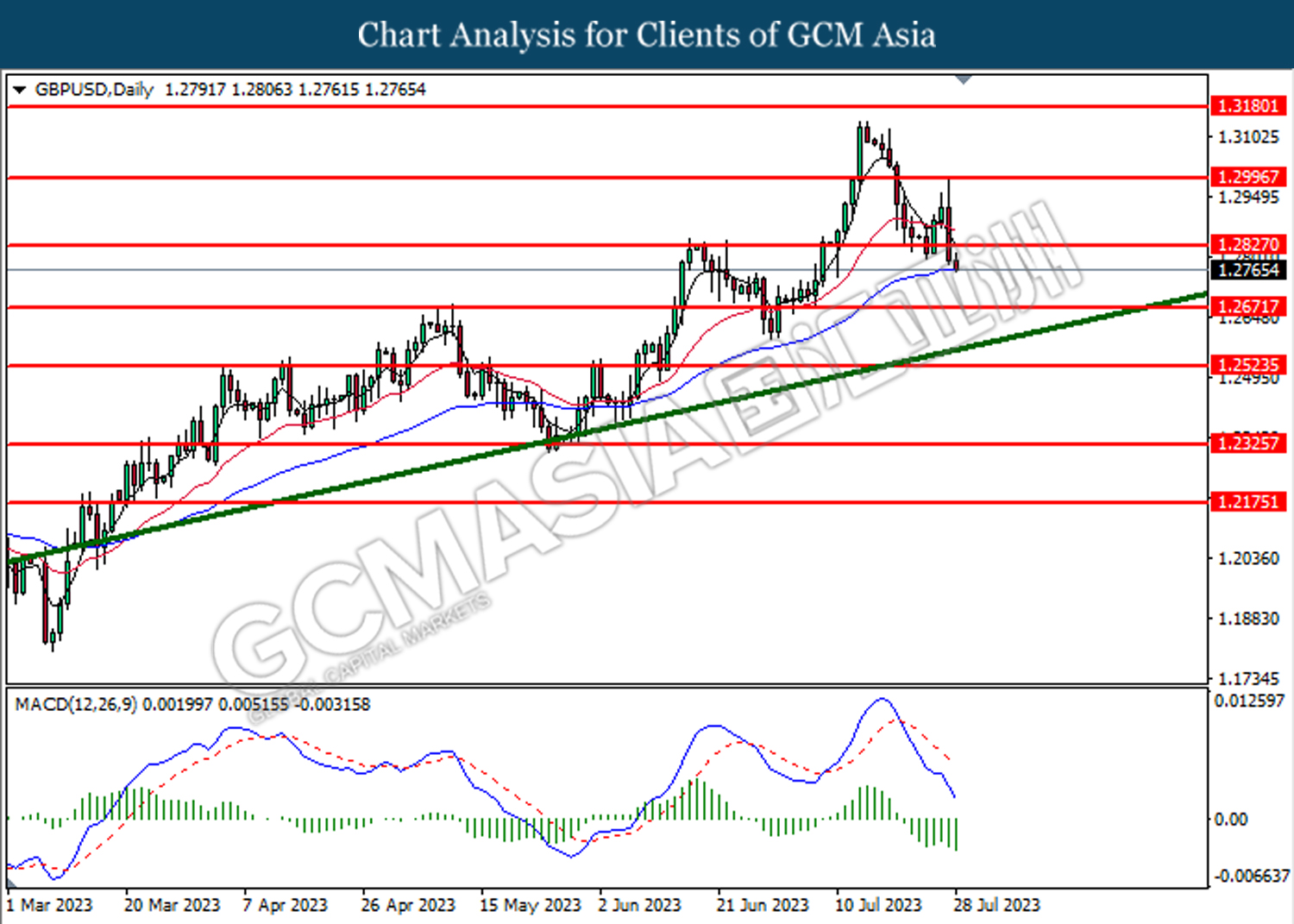

GBPUSD, Daily: GBPUSD was traded lower following the prior breakout below the previous support level at 1.2827. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses toward the support level at 1.2670.

Resistance level: 1.2835, 1.3000

Support level: 1.2670, 1.2525

EURUSD, Daily: EURUSD was traded lower following the prior breakout below the previous support level at 1.1010. MACD which illustrated increasing bearish momentum suggest the pair to extend its gains toward the support level at 1.0835

Resistance level: 1.1010, 1.1185

Support level: 1.0835, 1.0680

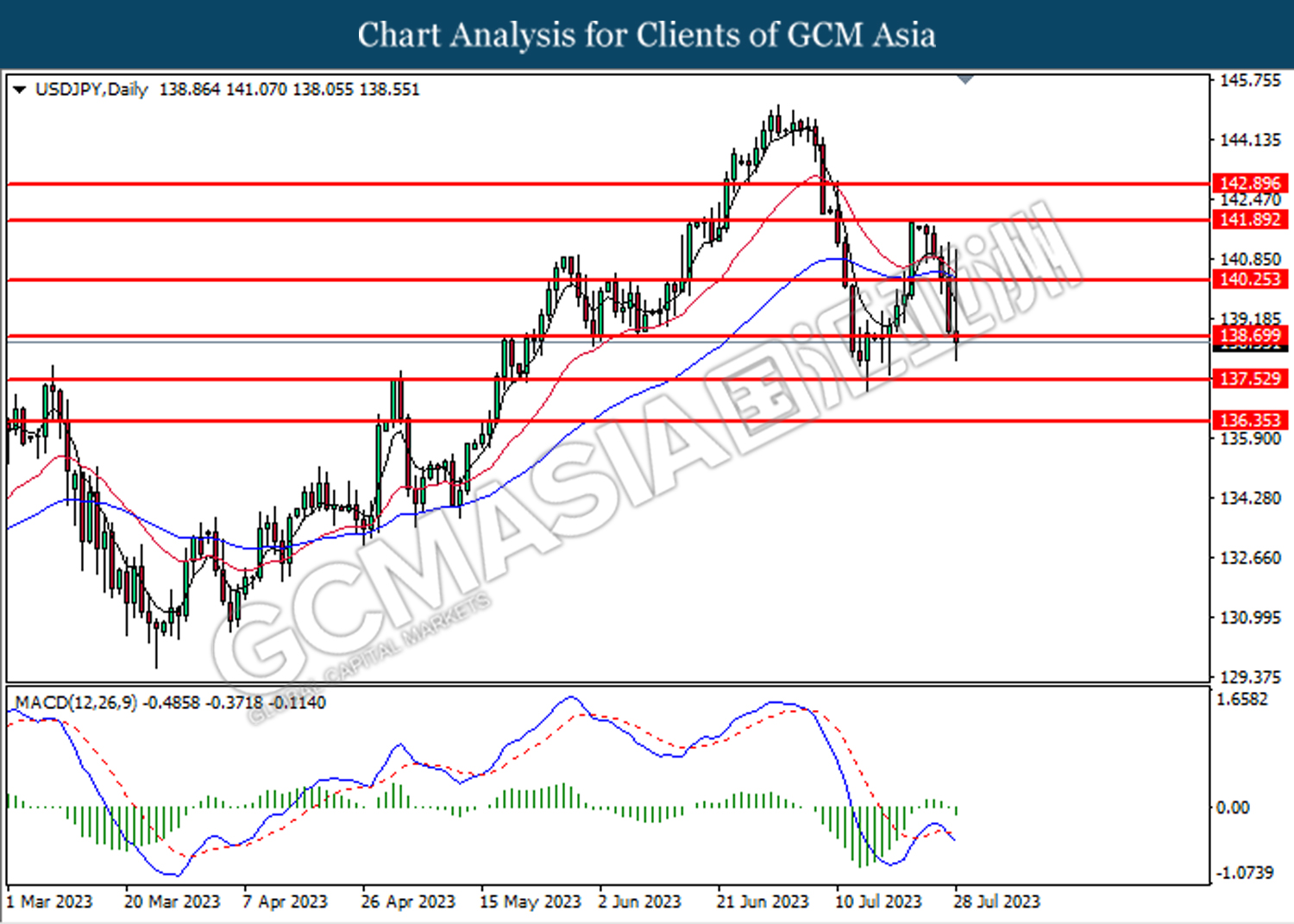

USDJPY, Daily: USDJPY was traded lower while testing the support level at 138.70. MACD which illustrated a turn from bullish momentum to bearish momentum suggest the pair to extend its losses after breakout the support level.

Resistance level: 140.25, 141.90

Support level: 138.70, 137.55

AUDUSD, Daily: AUDUSD was traded lower following the prior breakout below the previous support level at 0.6695. MACD which illustrated decreasing bearish momentum suggests the pair to extend its gains toward the support level at 0.6595

Resistance level: 0.6695, 0.6785

Support level: 0.6595, 0.6510

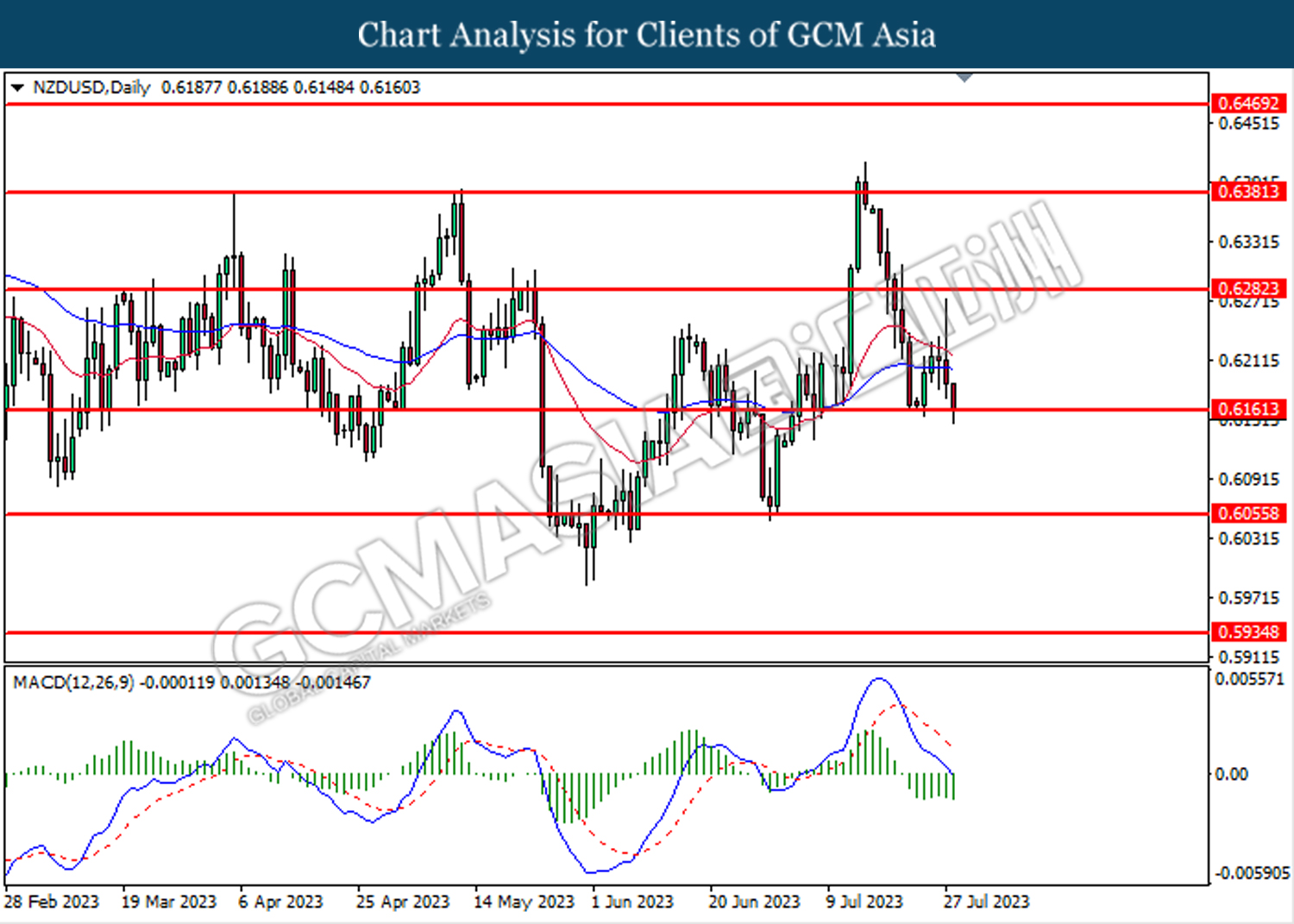

NZDUSD, Daily: NZDUSD was traded lower while testing the support level at 0.6160. MACD which illustrated increasing bearish momentum suggests the pair to extend its losses after it breakout the support level.

Resistance level: 0.6280, 0.6380

Support level: 0.6160, 0.6055

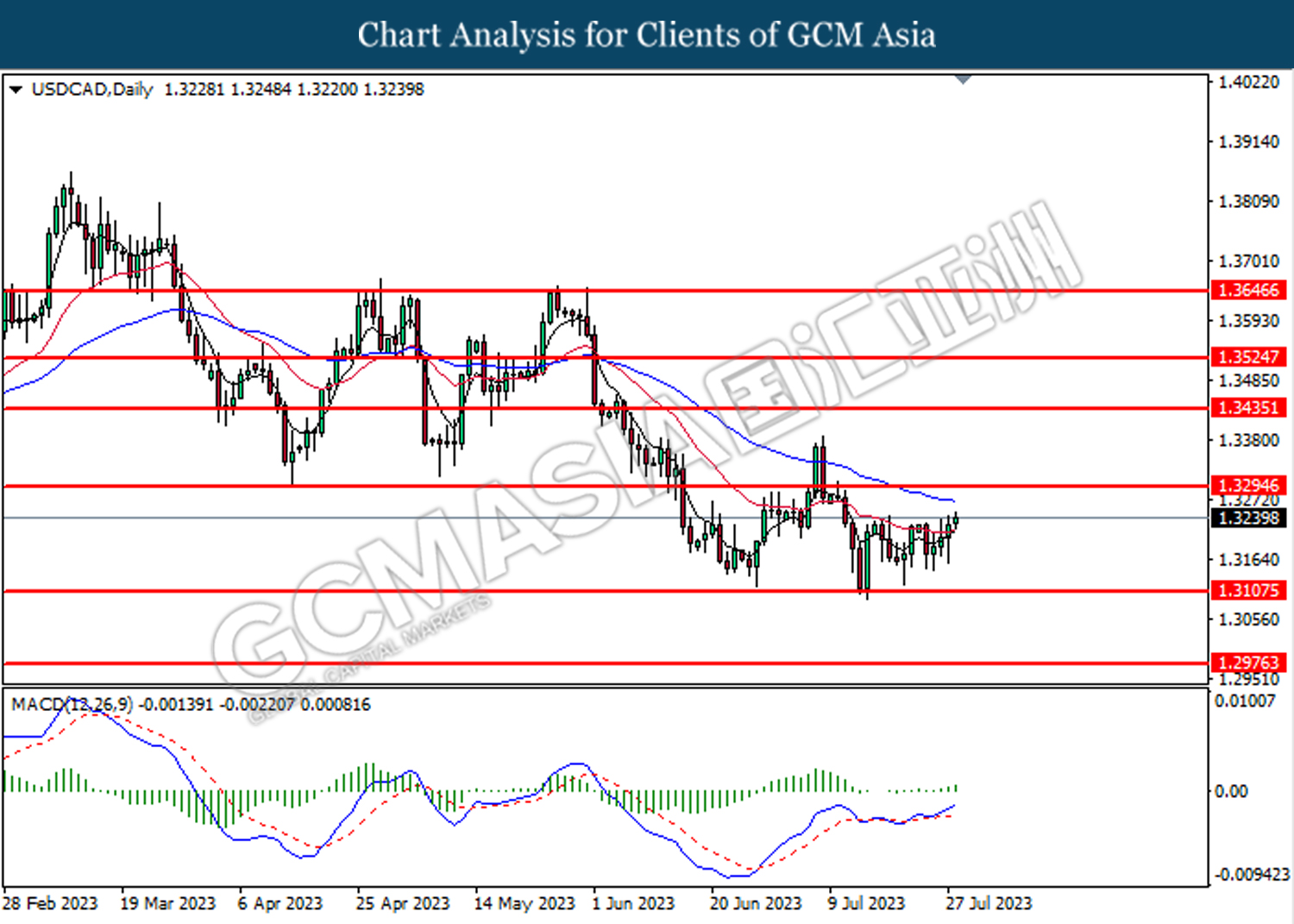

USDCAD, Daily: USDCAD was traded higher following the prior rebound from the lower level. MACD which illustrated increasing bullish momentum suggests the pair to extend its gains toward the resistance level at 1.3295.

Resistance level: 1.3295, 1.3435

Support level: 1.3110, 1.2975

USDCHF, Daily: USDCHF was traded higher while testing the resistance level at 0.8710. MACD which illustrated increasing bullish momentum suggests the pair to extend its gains after it breakout the resistance level.

Resistance level: 0.8710, 0.8855

Support level: 0.8545, 0.8360

CrudeOIL, Daily: Crude oil price was traded higher while testing the resistance level at 79.70. MACD which illustrated increasing bullish momentum suggests the commodity to extend its gains after it breakout the resistance level.

Resistance level: 79.70, 82.55

Support level: 77.25, 73.75

GOLD_, Daily: Gold price was traded higher following the prior rebound from the support level at 1940.20. However, MACD which illustrated decreasing bullish momentum suggests the commodity to undergo technical correction in short term.

Resistance level: 1971.45, 2003.60

Support level: 1940.20, 1910.80