28 July 2023 Morning Session Analysis

US dollar skyrocketed amid upbeat economic data and Euro’s weakness.

The dollar index, which was traded against a basket of six major currencies, jumped to the highest level since a month ago as the weakness of Euro and robust macroeconomic data releases from the United States. According to the initial estimate from the US Bureau of Economic Analysis on Thursday, the real Gross Domestic Product (GDP) of the US expanded at an annualized rate of 2.4% in the second quarter. This growth surpassed market expectations of 1.8%, following a 2% growth recorded in the first quarter. Additionally, the US Department of Labor reported on Thursday that initial jobless claims totaled 221,000 for the week ending July 22, marking the lowest reading in five months. This figure came in below market expectations of 235,000 and showed improvement compared to the previous week’s unrevised 228,000 claims. On the other side, the European Central Bank (ECB) announced a new rate increase of a quarter percentage point, raising its main rate to 4.25%. Despite stating that inflation was expected to decline, the ECB expressed concerns that it would remain elevated for an extended period. However, recent business activity data from Germany and France, the eurozone’s largest economies, indicated declines, raising concerns about further rate hike might triggers the possibility of recession in the euro area later in the year. As of writing, the dollar index rose 0.80% to 101.70.

In the commodities market, crude oil prices were up by 0.02% to $79.80 per barrel amid tighter supplies and growing hopes of China’s stimulus plan. Besides, gold prices edged down by -0.05% to $1946.60 per troy ounce amid upbeat economic data from the US.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

11:00 JPY BoJ Monetary Policy Statement

14:00 JPY BoJ Press Conference

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 11:00 | JPY – BoJ Interest Rate Decision | -0.10% | -0.10% | – |

| 16:00 | EUR – German GDP (QoQ) (Q2) | -0.3% | 0.1% | – |

| 21:00 | EUR – German CPI (MoM) (Jul) | 0.3% | 0.3% | – |

| 20:30 | USD – Core PCE Price Index (MoM) (Jun) | 4.6% | 4.2% | – |

| 22:00 | USD – Michigan Consumer Sentiment (Jul) | 64.4 | 72.6 | – |

Technical Analysis

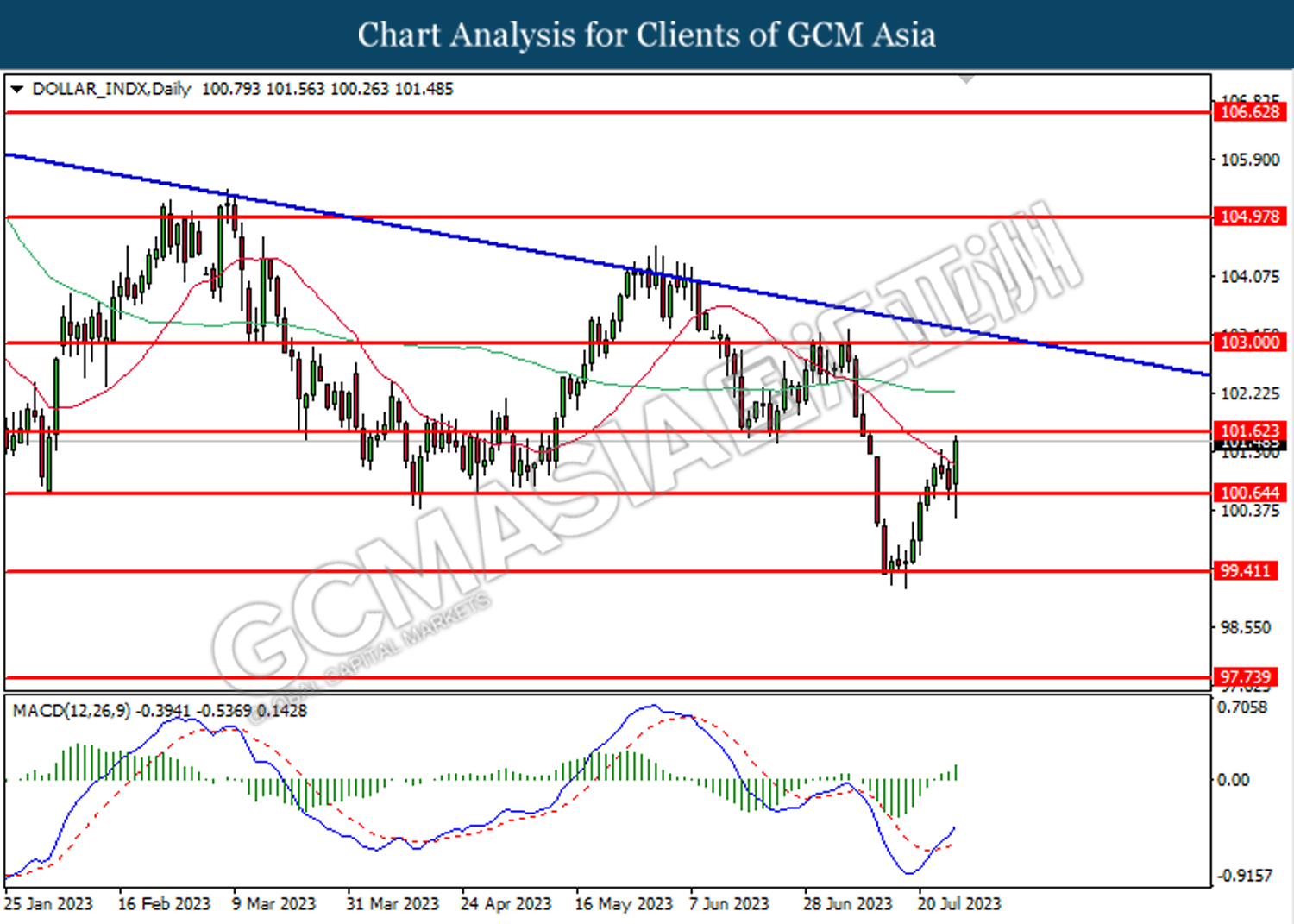

DOLLAR_INDX, Daily: Dollar index was traded higher while currently testing the resistance level at 101.65. MACD which illustrated bullish bias momentum suggests the index to extend its gains after it successfully breakout above the resistance level.

Resistance level: 101.60, 103.00

Support level: 100.65, 99.40

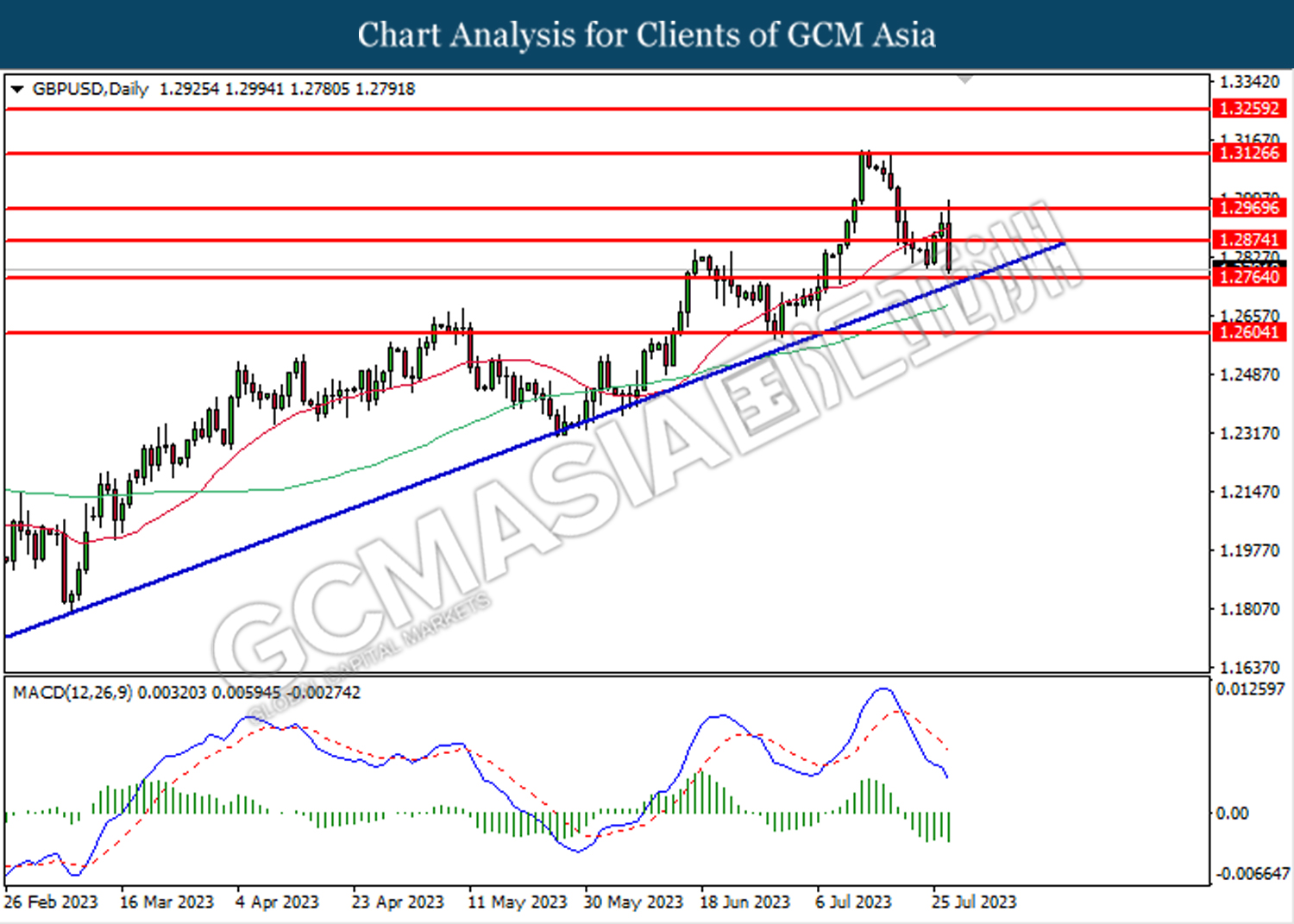

GBPUSD, Daily: GBPUSD was traded lower while currently testing the support level at 1.2765. MACD which illustrated bearish bias momentum suggest the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 1.2875, 1.2970

Support level: 1.2765, 1.2605

EURUSD, Daily: was traded lower while currently retesting the support level at 1.0960. MACD which illustrated bearish bias momentum suggest the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 1.1065, 1.1155

Support level: 1.0960, 1.0850

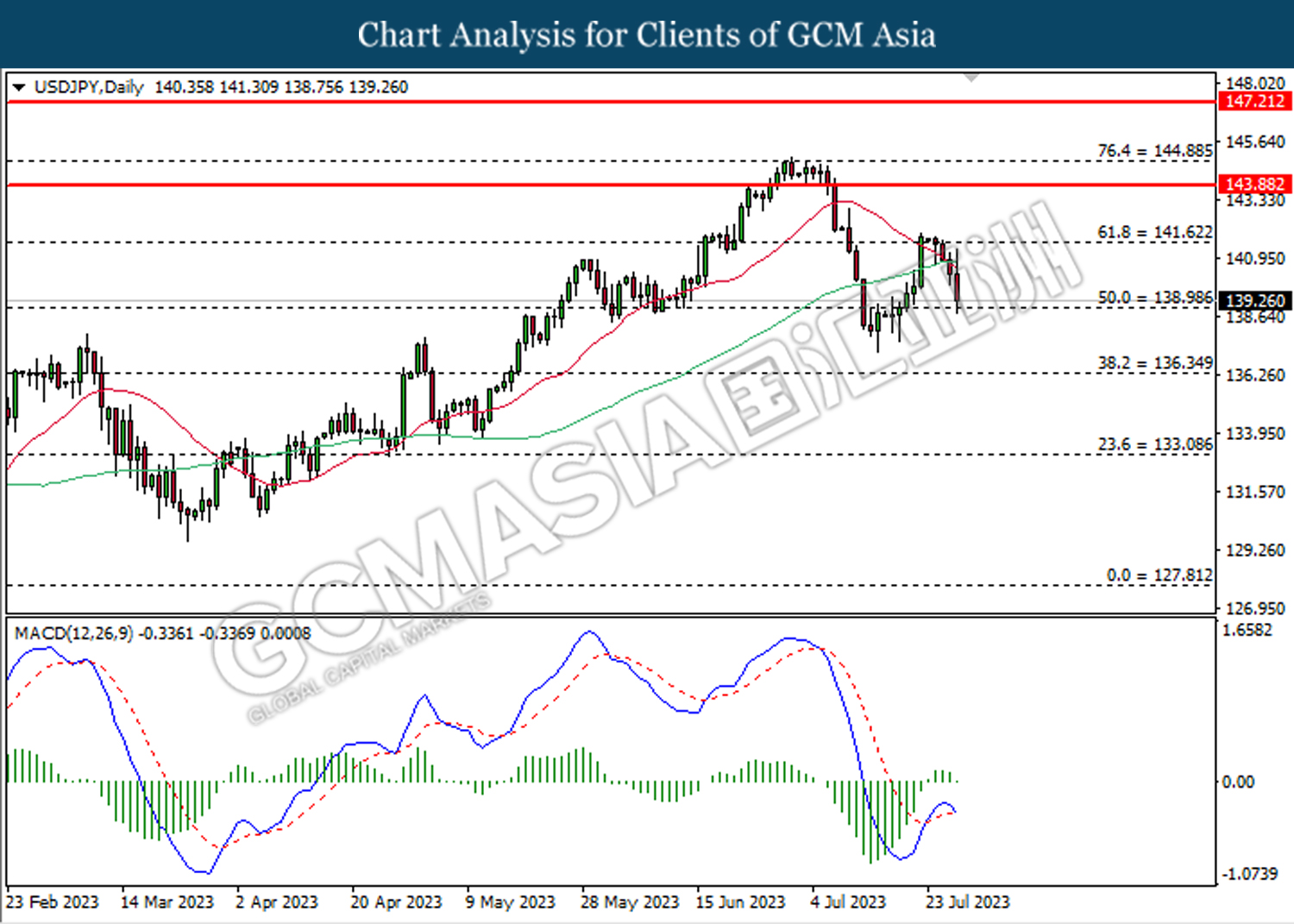

USDJPY, Daily: USDJPY was traded lower while currently testing the support level at 139.00. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 141.60, 143.90

Support level: 139.00, 136.35

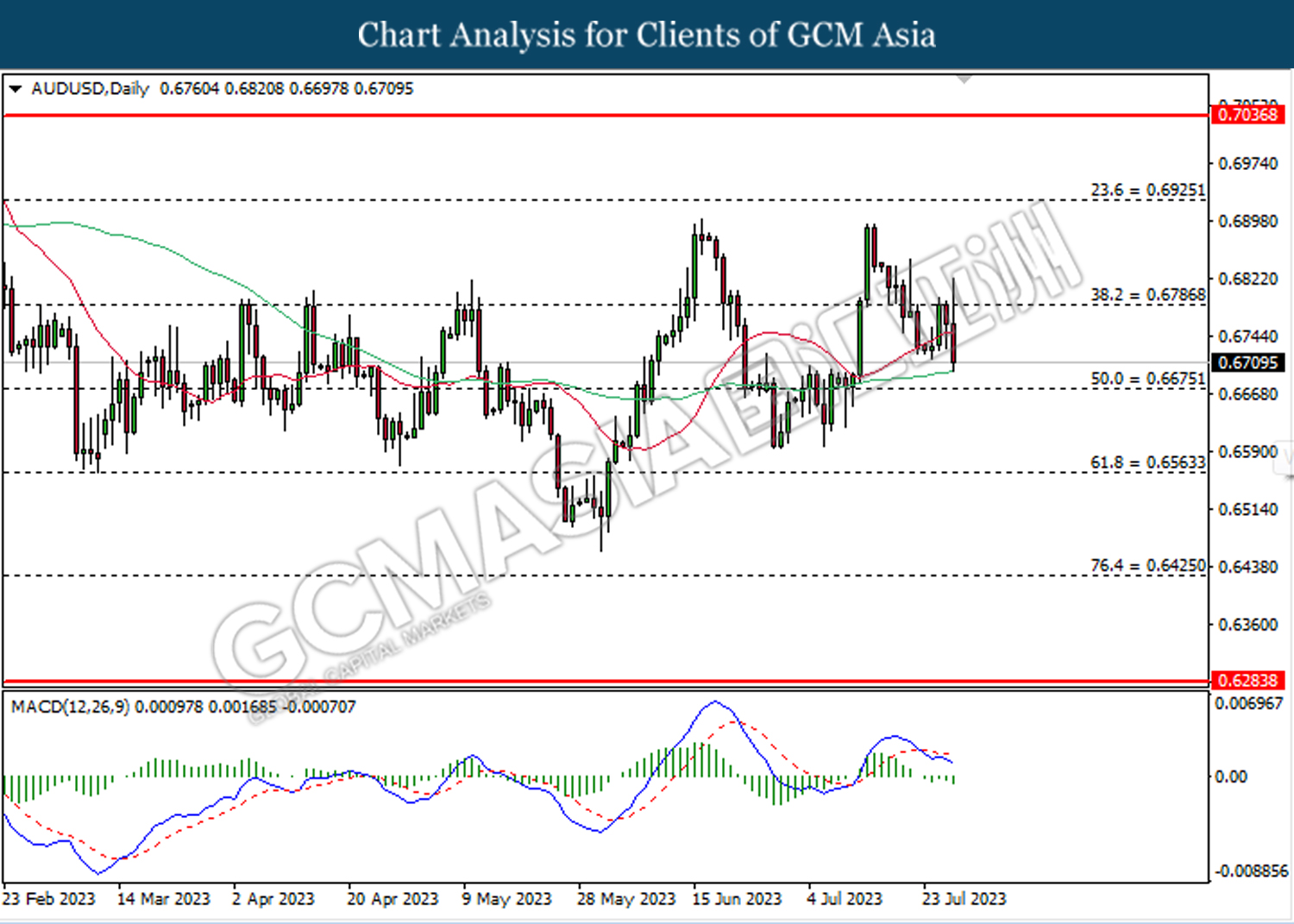

AUDUSD, Daily: AUDUSD was traded lower following the prior retracement from the resistance level at 0.6785. MACD which illustrated bearish bias momentum suggest the pair to extend its losses toward the support level at 0.6675.

Resistance level: 0.6785, 0.6925

Support level: 0.6675, 0.6565

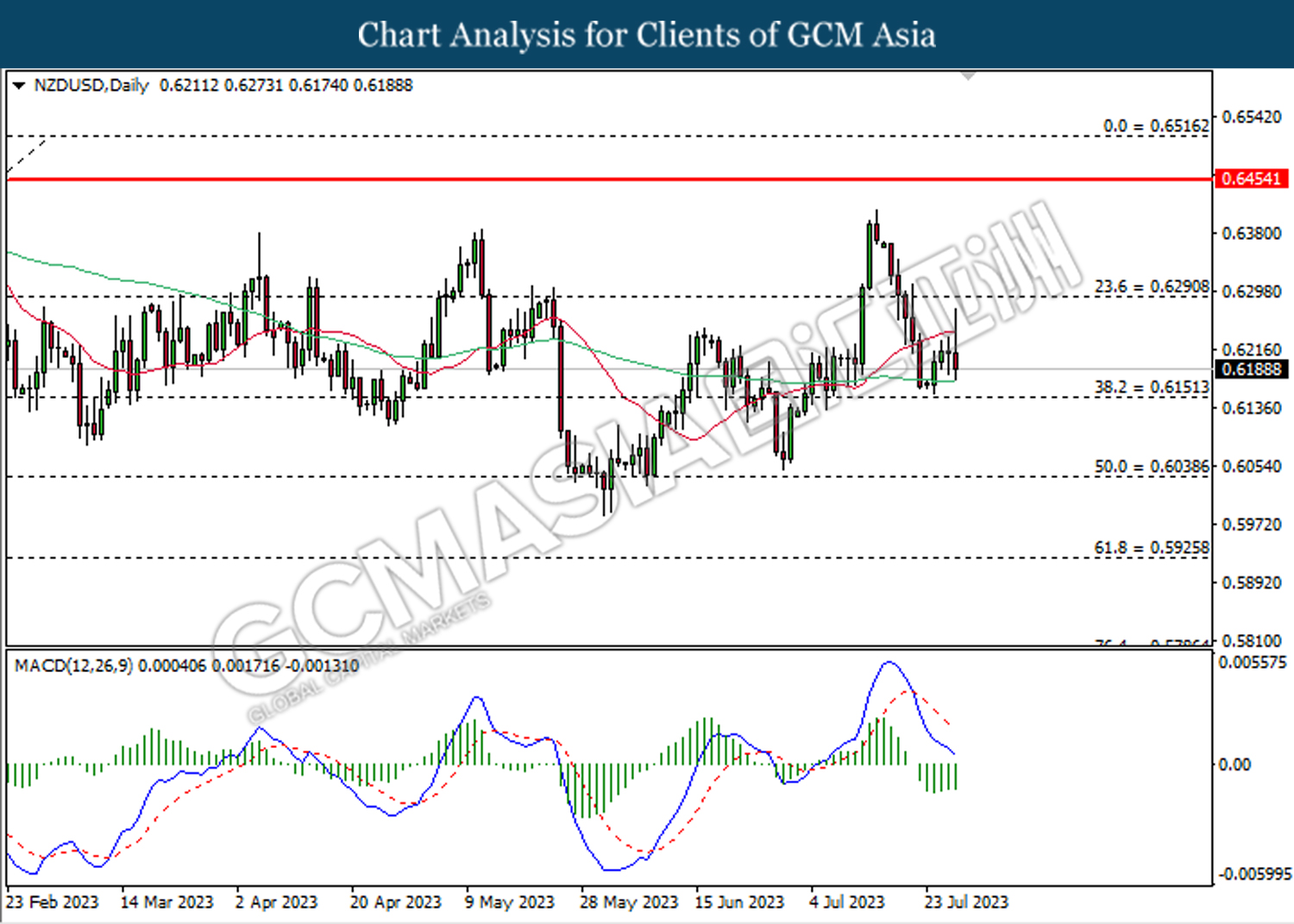

NZDUSD, Daily: NZDUSD was traded lower following the prior retracement from the higher level. MACD which illustrated bearish bias momentum suggest the pair to extend its losses toward the support level at 0.6150.

Resistance level: 0.6290, 0.6455

Support level: 0.6150, 0.6040

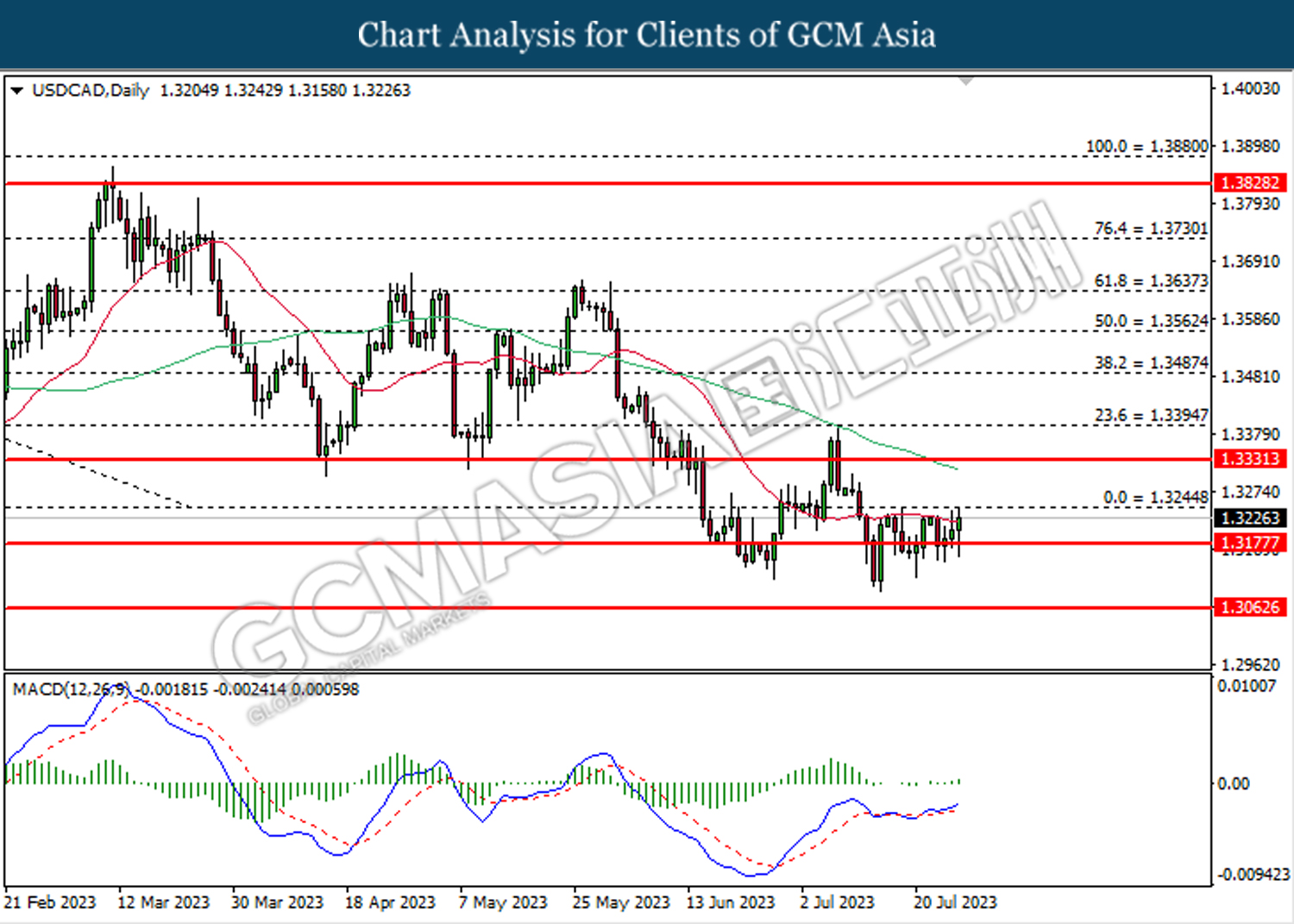

USDCAD, Daily: USDCAD was traded higher following the prior rebound from the support level. MACD which illustrated bullish bias momentum suggests the pair to extend its gains toward the resistance level at 1.3245.

Resistance level: 1.3245, 1.3330

Support level: 1.3175, 1.3065

USDCHF, Daily: USDCHF was traded higher while currently testing the resistance level at 0.8670. MACD which illustrated bullish bias momentum suggest the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 0.8670, 0.8775

Support level: 0.8535, 0.8355

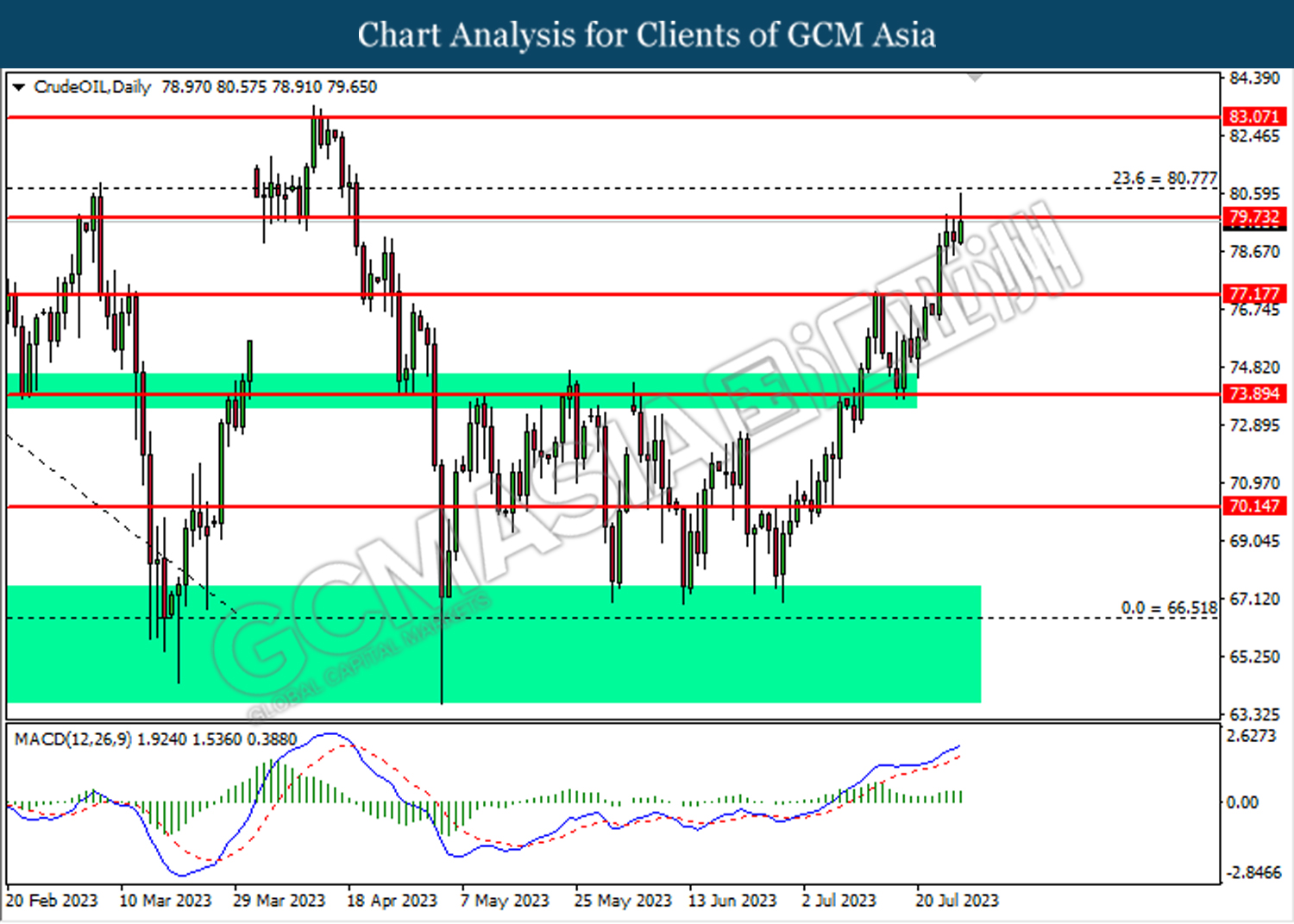

CrudeOIL, Daily: Crude oil price was traded higher while currently testing the resistance level at 79.75. MACD which illustrated bullish bias momentum suggest the commodity to extend its gains after it successfully breakout above the resistance level.

Resistance level: 79.75, 80.75

Support level: 77.15, 73.90

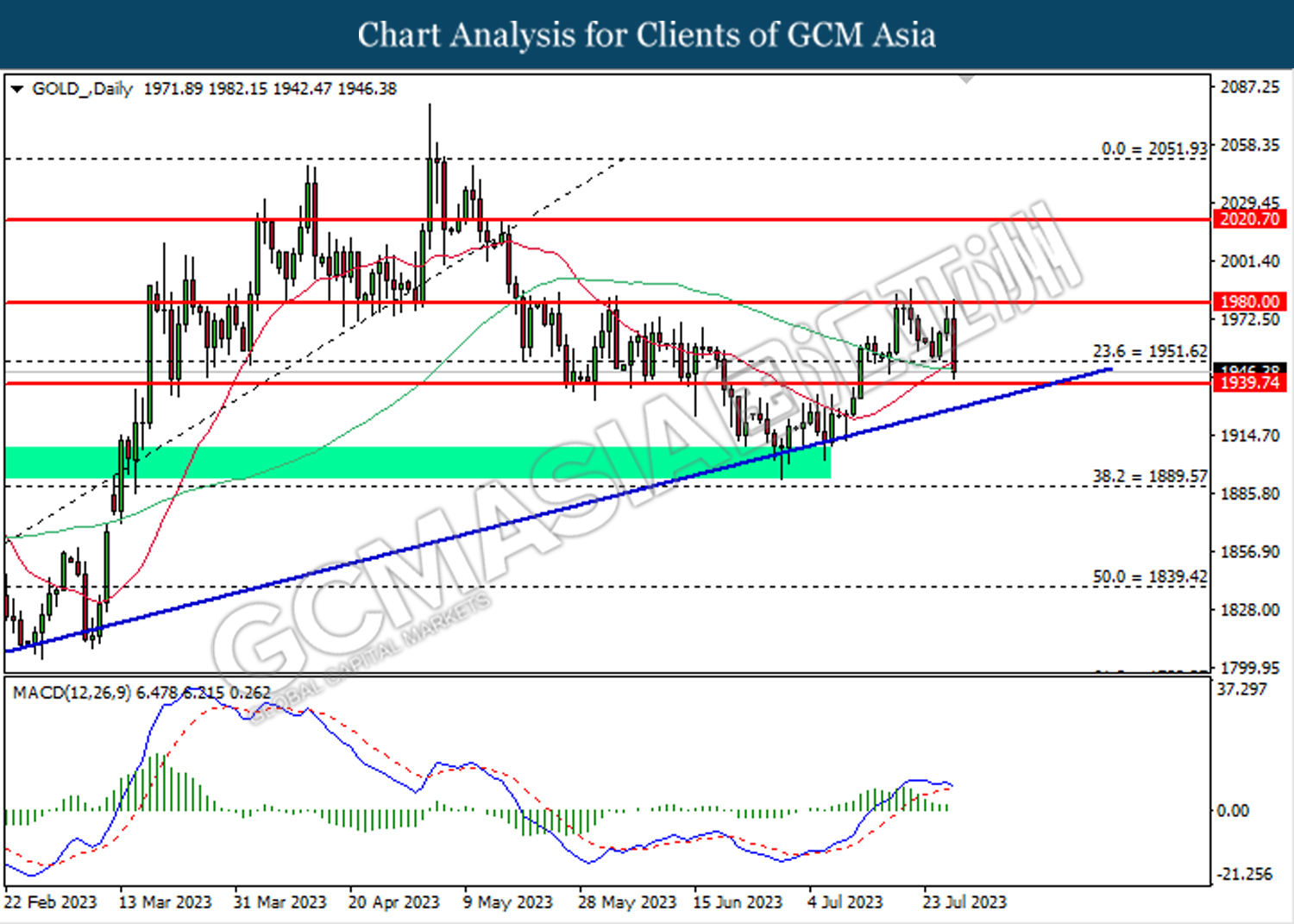

GOLD_, Daily: Gold price was traded lower while currently testing the support level at 1939.75. MACD which illustrated diminishing bullish momentum suggests the commodity to extend its losses after it successfully breakout below the support level.

Resistance level: 1951.60, 1980.00

Support level: 1939.75, 1889.55