28 October 2020 Afternoon Session Analysis

Euro fell following news of lockdown.

During late Asian session, the Euro which traded against the dollar and other currency pairs have experience tremendous pressure and plunged following reports of potential lockdown in France to control the surge of coronavirus cases. Following latest development, France has reported 523 deaths on Tuesday, its highest number since April. Other EU countries such as Italy and Greece also witness their infection cases surged to new record. French President is scheduled to give a televised address on Wednesday evening. It’s uncertain what the speech is about for now. But reports are flowing around that the government is exploring imposition of lockdown from midnight on Thursday. At the same time, Germany also considered plans for a measured lockdown as its health care system is also close to breaking point. At the time of writing, EUR/USD slips 0.17% to 1.1775.

In the commodities market, crude oil price remains pressured and fell 0.67% to $38.81 per barrel as of writing following COVID-19 and oversupply fears. The coronavirus pandemic continue to weigh heavily on the market sentiment where some countries such as Europe and U.S pushing their recovery outlook even further with surging cases. At the same time, fears of oversupply due to Libya restart oil field and recent data from API also exert further pressure on the commodity. On the other hand, gold price remains stable and edge higher 0.03% to $1907.61 a troy ounce at the time of writing following worsening COVID-19 continue to support safe-haven demand.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

23:15 CAD BoC Press Conference

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 22:00 | CAD – BoC Interest Rate Decision | 0.25% | 0.25% | – |

| 22:30 | USD – Crude Oil Inventories | -1.001M | – | – |

Technical Analysis

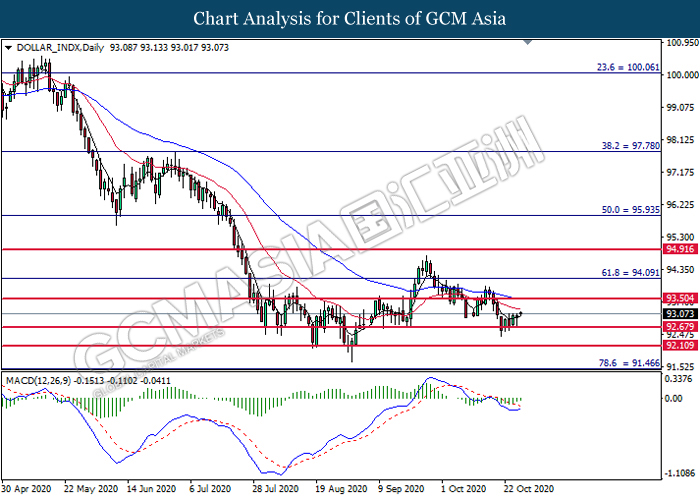

DOLLAR_INDX, Daily: Dollar index was traded higher following prior rebound from the support level at 92.70. MACD which illustrate diminishing bearish momentum signal suggest the dollar to extend its gains toward the resistance level at 93.50.

Resistance level: 93.50, 94.10

Support level: 92.70, 92.10

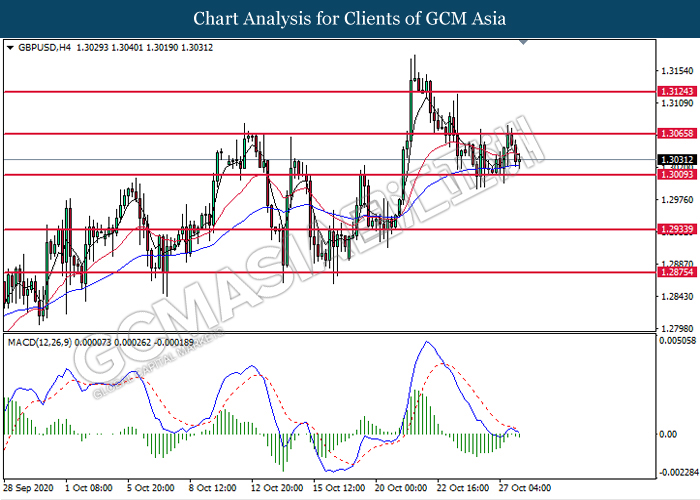

GBPUSD, H4: GBPUSD was traded lower following prior retracement from the resistance level at 1.3065. MACD which illustrates bearish bias momentum suggest the pair to extend its losses toward the support level at 1.3010.

Resistance level: 1.3065, 1.3125

Support level: 1.3010, 1.2935

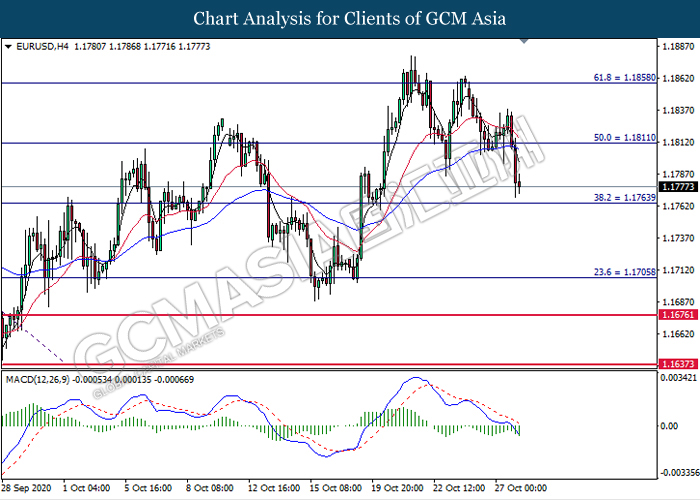

EURUSD, H4: EURUSD was traded lower following prior breakout below the previous support level at 1.1810. MACD which illustrate bearish bias momentum signal suggest the pair to extend its losses toward the support level at 1.1765.

Resistance level: 1.1810, 1.1860

Support level: 1.1765, 1.1705

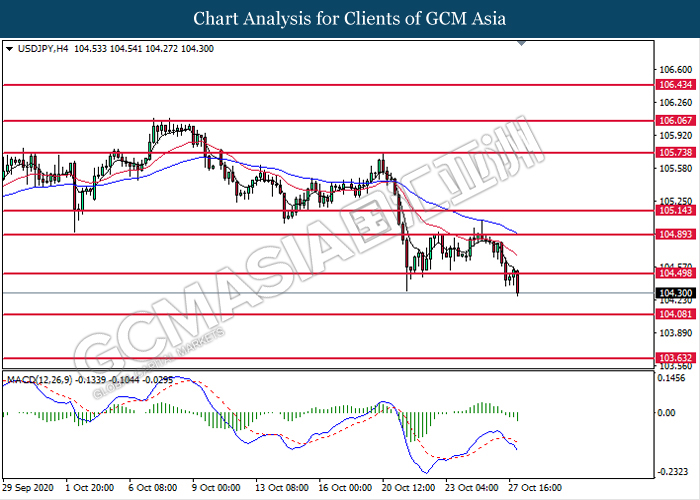

USDJPY, H4: USDJPY was traded lower following prior retracement from the resistance level at 104.50. MACD which illustrate bearish bias momentum suggest the pair to extend its losses toward the support level at 104.10.

Resistance level: 104.50, 104.90

Support level: 104.10, 103.65

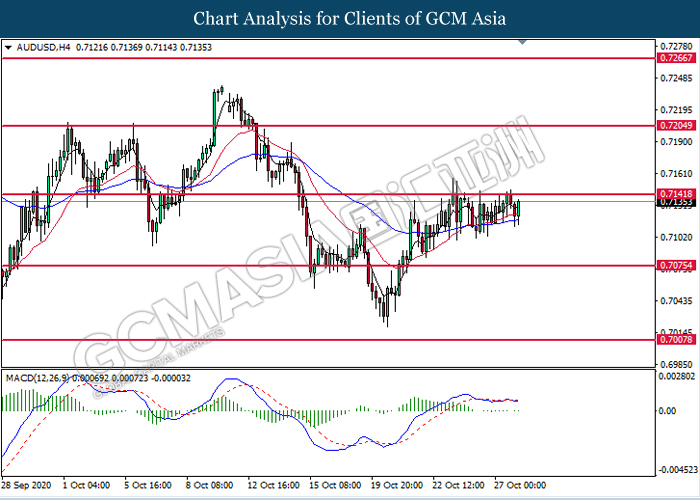

AUDUSD, H4: AUDUSD was traded flat near the resistance level at 0.7140. Due to lack of signal from MACD, it is suggested to wait for further confirmation before entering into the market.

Resistance level: 0.7140, 0.7205

Support level: 0.7075, 0.7010

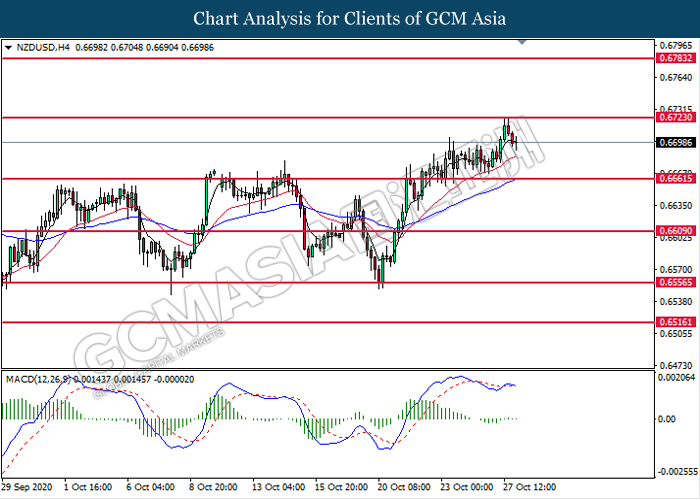

NZDUSD, H4: NZDUSD was traded lower following prior retracement from the resistance level at 0.6725. MACD which illustrate diminishing bullish momentum signal suggest the pair to extend its losses toward the support level at 0.6660.

Resistance level: 0.6725, 0.6785

Support level: 0.6660, 0.6610

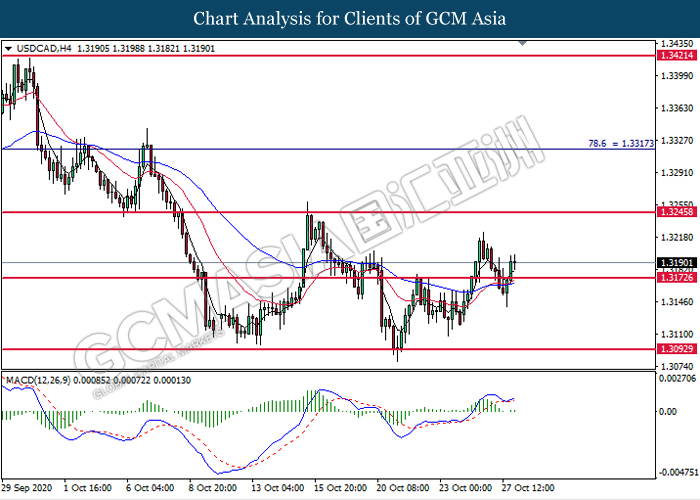

USDCAD, H4: USDCAD was traded higher following prior breakout above the previous resistance level at 1.3175. MACD which illustrate bullish bias momentum signal suggest the pair to extend its gains toward the resistance level at 1.3245.

Resistance level: 1.3245, 1.3315

Support level: 1.3175, 1.3095

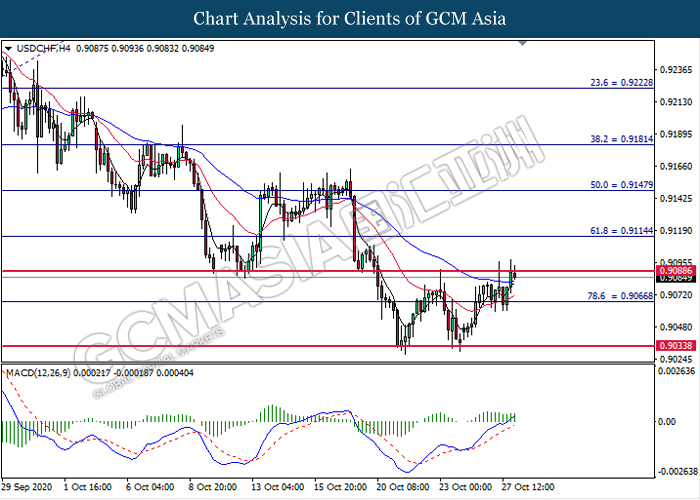

USDCHF, H4: USDCHF was traded higher while currently testing the resistance level at 0.9090. MACD which display bullish bias momentum suggest the pair to extend its gains after it successfully breakout above the resistance level at 0.9090.

Resistance level: 0.9090, 0.9115

Support level: 0.9065, 0.9035

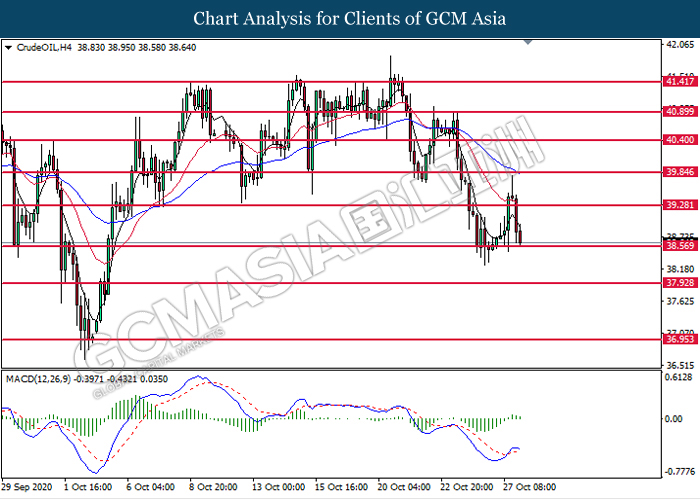

CrudeOIL, H4: Crude oil price was traded lower while currently testing the support level at 38.55. MACD which illustrate diminishing bullish momentum suggest the commodity to extend its losses after it successfully breakout below the support level at 38.55.

Resistance level: 39.30, 39.85

Support level: 38.55, 37.95

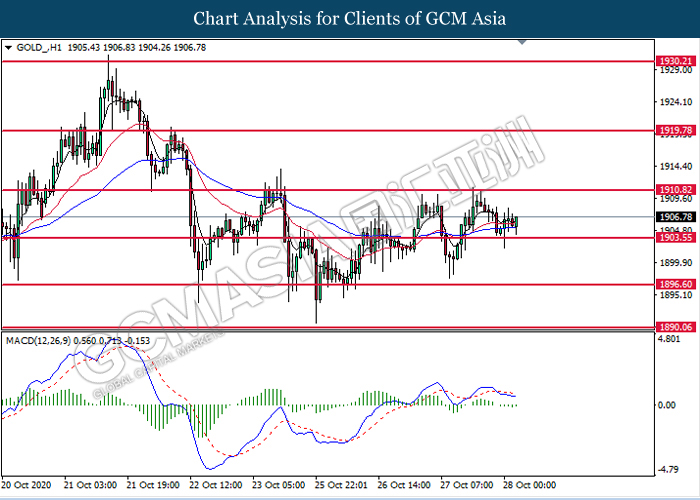

GOLD_, H1: Gold price was traded higher following prior rebound from the support level at 1903.55. MACD which illustrate diminishing bearish momentum suggest the commodity to extend its gains toward the resistance level at 1910.80.

Resistance level: 1910.80, 1919.80

Support level: 1903.55, 1896.60