28 December 2020 Afternoon Session Analysis

Dollar plunged after Trump signed the $900 billion stimulus plan.

Dollar index which gauge its value against a basket of six major currencies dipped after US President Donald Trump unexpectedly signed the $900 billion stimulus plan into law early morning. After holding the bill for nearly one week, Donald Trump decided to change its hard tone and approves the stimulus plan while vacationing in Florida without stating any reason, pumped a lump sum of stimulus funds into the economy and successfully averting a Tuesday government shutdown. Earlier last week, Trump had insisted to changes the stimulus plan as the plan was incapable to support to the US economy to fight through the fallout of pandemic. In details, Trump was reiterated that he wants American to receive $2000 pandemic stimulus checks, an amount that significantly higher than the direct payments of $600 in the bipartisan economic relief plan. With a backdrop of thin trading in this week as many investors on holiday, market participants are waiting for more catalyst in order to gauge the further direction of dollar index. As of now, dollar index dropped 0.17% to 90.15.

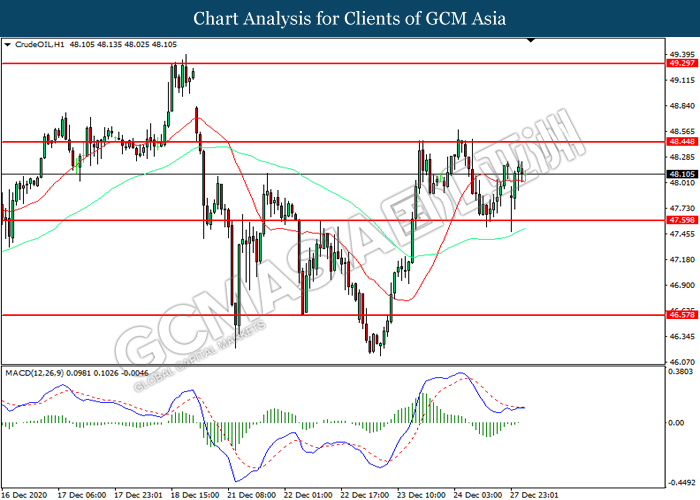

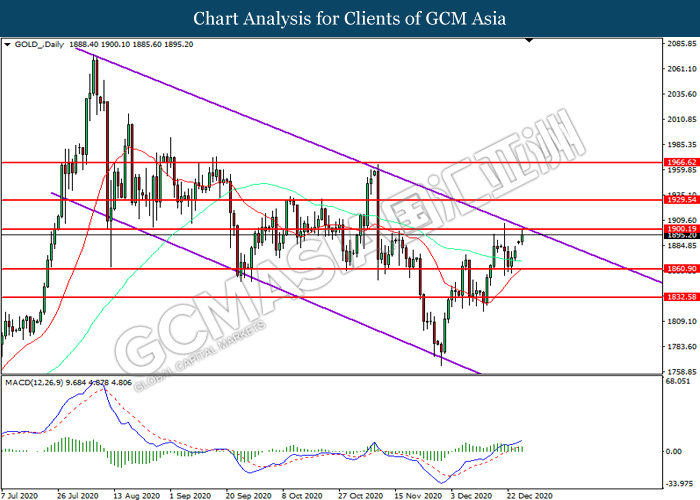

In the commodities market, the crude oil price down by 0.23% to $48.17 per barrel as of writing amid heightening of market worries over the mutated virus in UK. According to the latest news, there are several countries across the globe had reported cases of new strain of coronavirus, such as Australia, Canada, France and so on. Besides, gold price appreciated by 0.84% to $1895.40 a troy ounce amid exacerbating of pandemic around the world.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

N/A

Technical Analysis

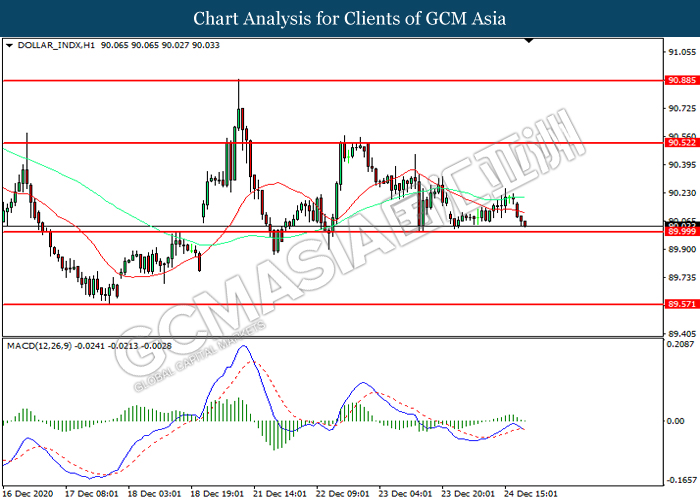

DOLLAR_INDX, H1: Dollar index was traded lower while currently testing the support level at 90.00. MACD which illustrated diminishing bullish momentum suggest the index to extend its losses after it successfully breakout below the support level.

Resistance level: 90.50, 90.90

Support level: 90.00, 89.55

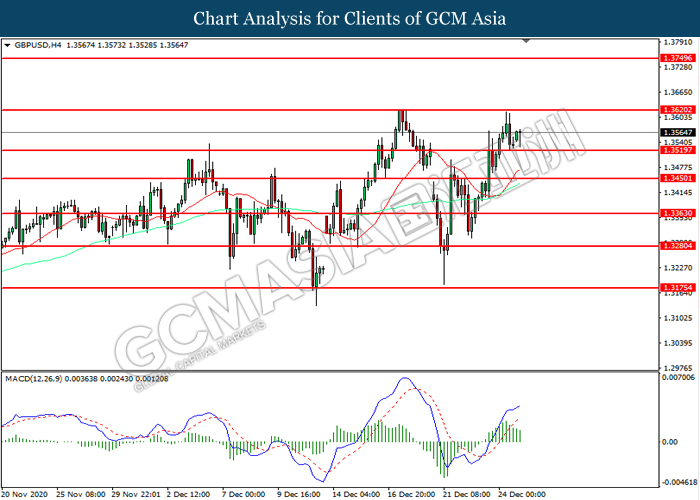

GBPUSD, H4: GBPUSD was traded lower while currently near the support level at 1.3520. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 1.3620, 1.3750

Support level: 1.3520, 1.3450

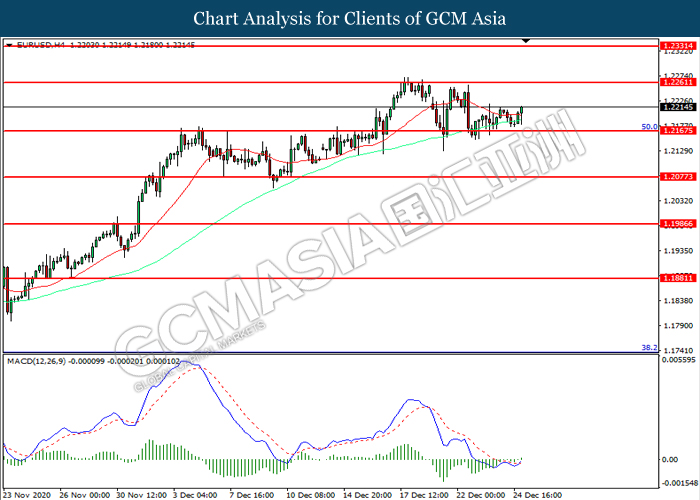

EURUSD, H4: EURUSD was traded higher following prior rebound from the support level at 1.2165. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains toward resistance level at 1.2260.

Resistance level: 1.2260, 1.2330

Support level: 1.2165, 1.2075

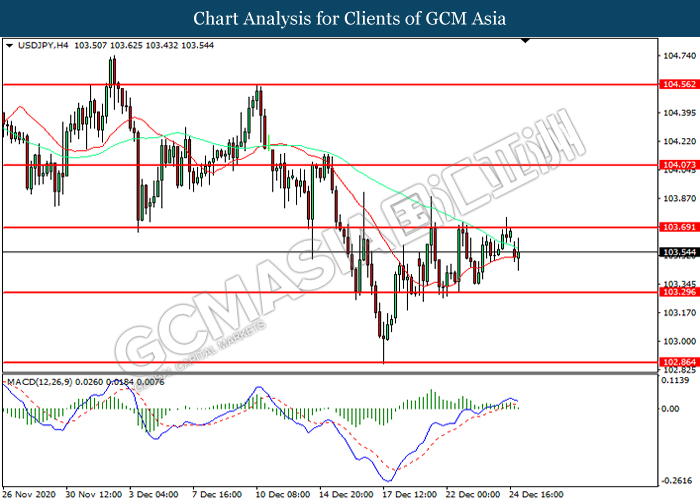

USDJPY, H4: USDJPY was traded lower following prior retracement from the resistance level at 103.70. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses toward support level at 103.30.

Resistance level: 103.70, 104.05

Support level: 103.30, 102.85

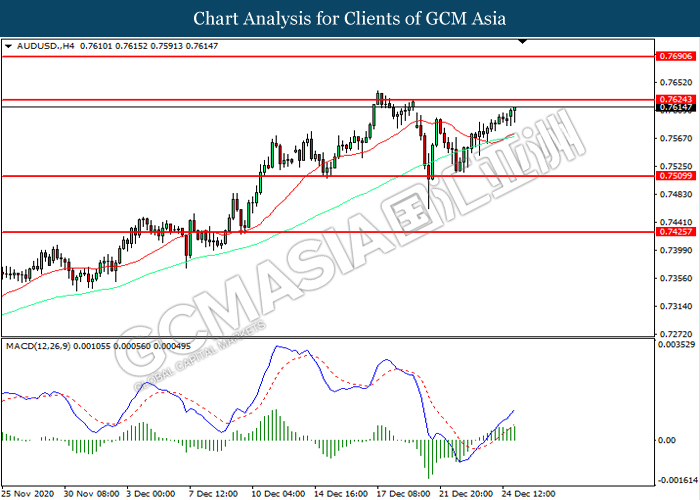

AUDUSD, H4: AUDUSD was traded higher while currently testing the resistance level at 0.7625. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 0.7625, 0.7690

Support level: 0.7510, 0.7425

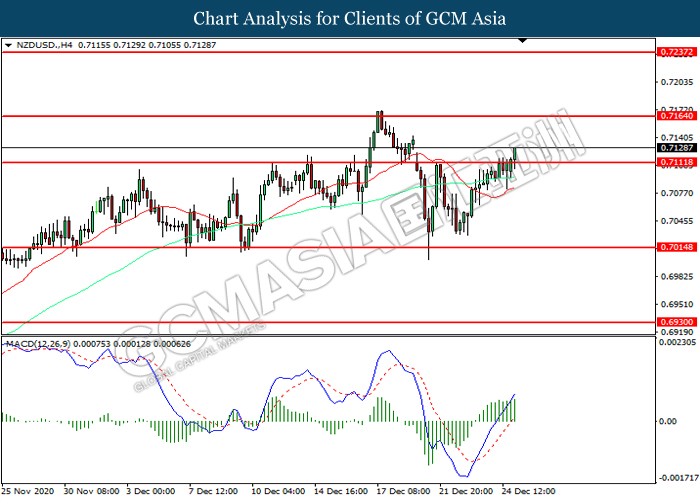

NZDUSD, H4: NZDUSD was traded higher following prior breakout above the previous resistance level at 0.7110. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains toward resistance level at 0.7165.

Resistance level: 0.7165, 0.7235

Support level: 0.7110, 0.7015

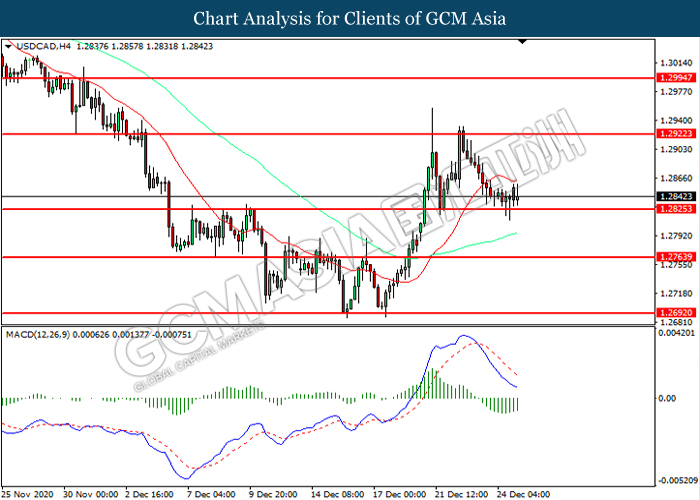

USDCAD, H4: USDCAD was traded lower while currently testing the support level at 1.2825. However, MACD which illustrated diminishing bearish momentum suggest the pair to be traded higher in short-term as technical correction.

Resistance level: 1.2920, 1.2995

Support level: 1.2825, 1.2765

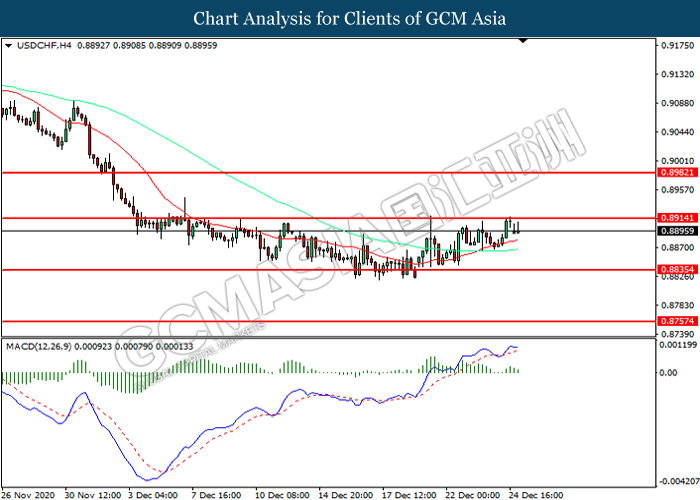

USDCHF, H4: USDCHF was traded lower following prior retracement from the resistance level at 0.8915. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses toward support level at 0.8835.

Resistance level: 0.8915, 0.8980

Support level: 0.8835, 0.8755

CrudeOIL, H1: Crude oil price was traded higher following prior rebound from the support level at 47.60. MACD which illustrated diminishing bearish momentum suggest the commodity to extend its gains toward resistance level at 48.45.

Resistance level: 48.45, 49.30

Support level: 47.60, 46.55

GOLD_, Daily: Gold price was traded higher while currently testing the resistance level at 1900.20. MACD which illustrated increasing bullish momentum suggest the commodity to extend its gains after it successfully breakout above the resistance level.

Resistance level: 1900.20, 1929.55

Support level: 1860.90, 1832.60