28 December 2020 Morning Session Analysis

Pound surged following Johnson announced Brexit deal is done.

Pound Sterling surged in today’s early Asian trading session amid positive prospect for the Brexit deal, which dialled up the market optimism toward the economic progression in the United Kingdom. According to Aljazeera, the United Kingdom and European Union have agreed on a post-Brexit trade deal after months of torturous negotiation, averting the prospect of a chaotic and acrimonious divorce at the end of this year. Besides, UK Prime minister Boris Johnson claimed that both parties had achieved the biggest trade deal yet, while reiterated that the UK had taken back control of its laws, borders, and fishing waters. In fact, the deal will ensure the UK and European region can continue to trade without tariffs or quotas, smoothing trade worth hundreds of billions of pounds. As for now, the UK Parliament is expected to sign off on the deal before 31st December 2020, when the Brexit transition period ends. As of writing, GBP/USD appreciated by 0.13% to 1.3565.

In the commodities market, the crude oil price slumped 0.85% to $47.85 per barrel as of writing. The oil market edged higher following Russian Deputy Prime Minister Alexander Novak said that the Russia is expected to support an increase in oil production by OPEC+ from February during the next months’ summit of the leading global oil producers. On the other hand, the gold price surged 0.50% to $1888.60 per troy ounces as of writing following the U.S. President Donald Trump refuses to sign Covid-19 relief bill, diminishing the risk appetite in the FX market while insinuating market demand on the safe-haven gold.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

N/A

Technical Analysis

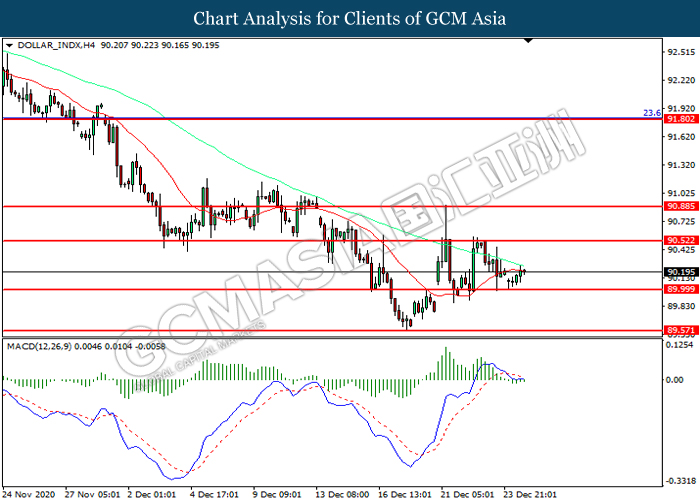

DOLLAR_INDX, H4: Dollar index was traded higher following prior rebound from the support level at 90.00. MACD which illustrated diminishing bearish momentum suggest the index to extend its gains toward resistance level at 90.50.

Resistance level: 90.50, 90.90

Support level: 90.00, 89.55

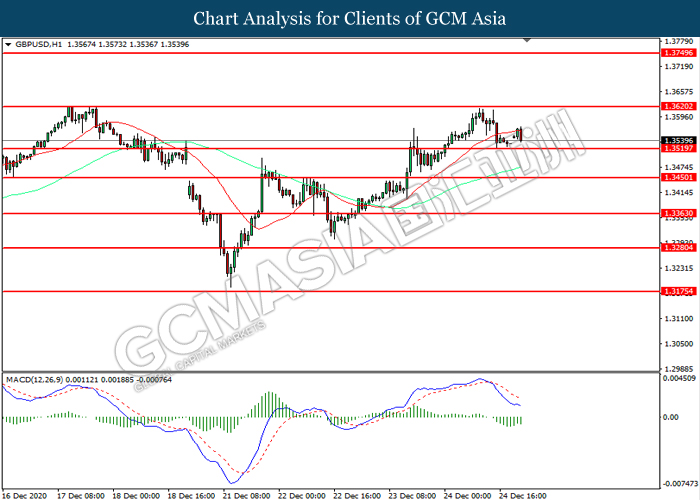

GBPUSD, H1: GBPUSD was traded lower while currently near the support level at 1.3520. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 1.3620, 1.3750

Support level: 1.3520, 1.3450

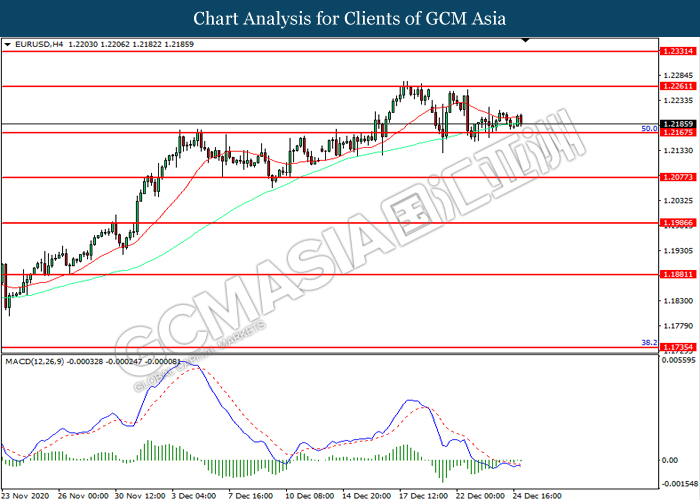

EURUSD, H4: EURUSD was traded within a range while currently testing the support level at 1.2165. However, MACD which illustrated diminishing bearish momentum suggest the pair to be traded higher in short-term as technical correction.

Resistance level: 1.2260, 1.2330

Support level: 1.2165, 1.2075

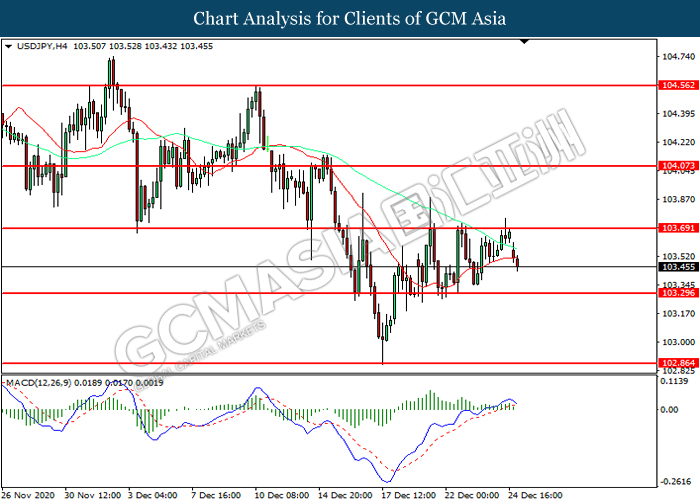

USDJPY, H4: USDJPY was traded lower following prior retracement from the resistance level at 103.70. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses toward support level at 103.30.

Resistance level: 103.70, 104.05

Support level: 103.30, 102.85

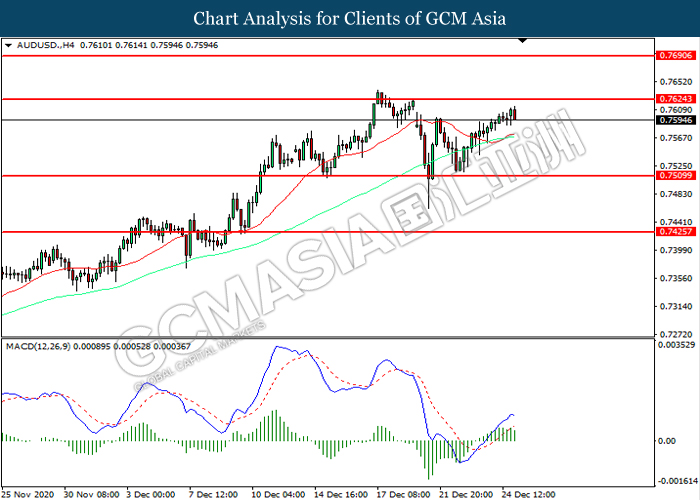

AUDUSD, H4: AUDUSD was traded higher while currently testing the resistance level at 0.7625. However, MACD which illustrated diminishing bullish momentum suggest the pair to be traded lower in short-term as technical correction.

Resistance level: 0.7625, 0.7690

Support level: 0.7510, 0.7425

NZDUSD, H4: NZDUSD was traded higher while currently testing the resistance level at 0.7110. However, MACD which illustrated diminishing bullish momentum suggest the pair to be traded lower in short-term as technical correction.

Resistance level: 0.7111, 0.7165

Support level: 0.7015, 0.6930

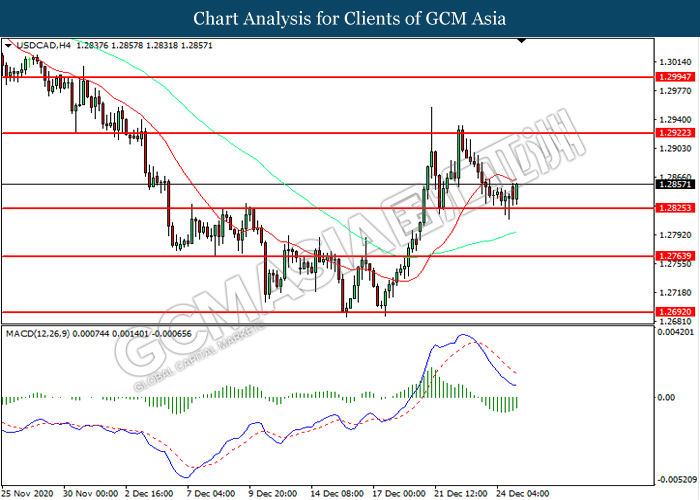

USDCAD, H4: USDCAD was traded higher following prior rebound from the support level at 1.2825. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains toward resistance level at 1.2920.

Resistance level: 1.2920, 1.2995

Support level: 1.2825, 1.2765

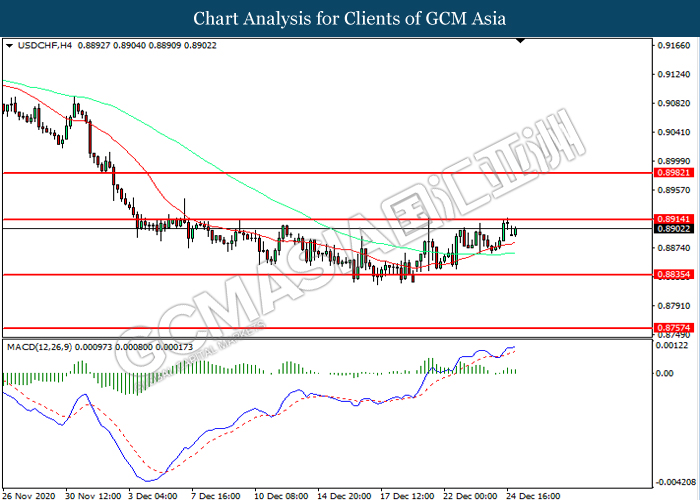

USDCHF, H4: USDCHF was traded lower following prior retracement from the resistance level at 0.8915. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses toward support level at 0.8835.

Resistance level: 0.8915, 0.8980

Support level: 0.8835, 0.8755

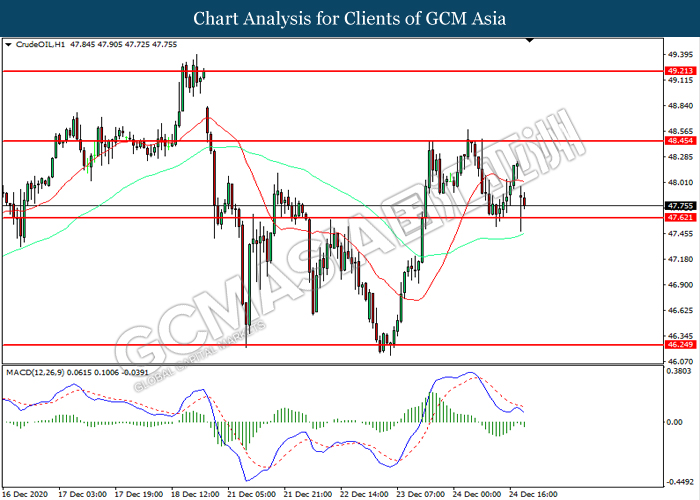

CrudeOIL, H1: Crude oil price was traded lower while currently testing the support level at 47.60. MACD which illustrated increasing bearish momentum suggest the commodity to extend its losses after it successfully breakout below the support level.

Resistance level: 48.45, 49.20

Support level: 47.60, 46.25

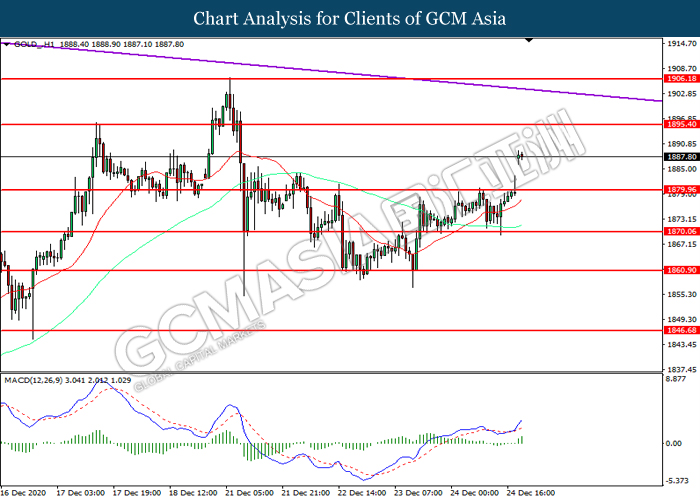

GOLD_, H1: Gold price was traded higher following prior breakout above the previous resistance level at 1879.95. MACD which illustrated increasing bullish momentum suggest the commodity to extend its gains toward resistance level at 1895.40.

Resistance level: 1895.40, 1906.20

Support level: 1879.95, 1870.05