29 March 2017 Daily Analysis

Brexit approaches, sterling engulfed.

Great British Pound extends its second day of losses as market participants look ahead to UK’s formal call in pledging a split from the European Union later in the day, a historical moment where British Prime Minister Theresa May will outline her Brexit terms and details. Pairing of GBP/USD was down 0.30% to $1.2410, not far from one-week low of $1.2373. Further pressure was placed on the sterling after Bank of England’s interest rate setter Ian McCafferty highlighted weaker outlook for the economy while stating his indecision to vote for an interest hike during the upcoming BoE meeting in May. In the other region, the greenback pulls further away from 4-1/2 months low following a better-than-expected consumer confidence data that has backed up higher expectation for more interest rate hike this year. Analyst postulate that overall optimism for Trumponomics supersedes prior disappointment of passing an Obamacare reform bill, prompting further support on the dollar thus far. The dollar index was held steady at 99.48 this morning.

As for commodities, crude oil price was up 0.39% to $48.56 following an oil output disruption in Libya while investors shrugged off a larger-than-expected build in US crude inventories. Otherwise, gold price was down 0.53% to $1,248.69 as investors await further details on Brexit later in the day.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economy Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 16:30 | GBP – Net Lending to Individuals | 4.8B | 4.9B | – |

| 22:00 | USD – Pending Home Sales (MoM) (Feb) | -2.8% | 2.4% | – |

| 22:30 | Crude Oil – Crude Oil Inventories | 4.954M | 1.357M | – |

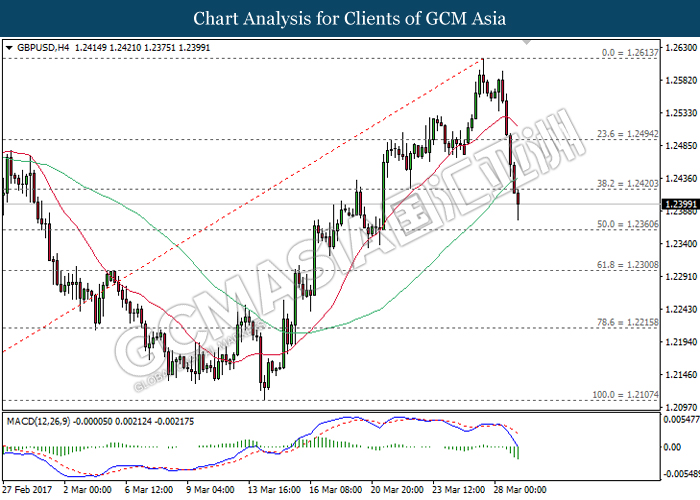

GBPUSD

GBPUSD, H4: GBPUSD extended its losses consecutively following previous retracement from the resistance level of 1.2615 while closing below both moving average line. With regards to the downward signal from MACD histogram which continues to expand downwards, it is expected to move further down after a successful closure below the support level of 1.2360.

Resistance level: 1.2420, 1.2495

Support level: 1.2360, 1.2300

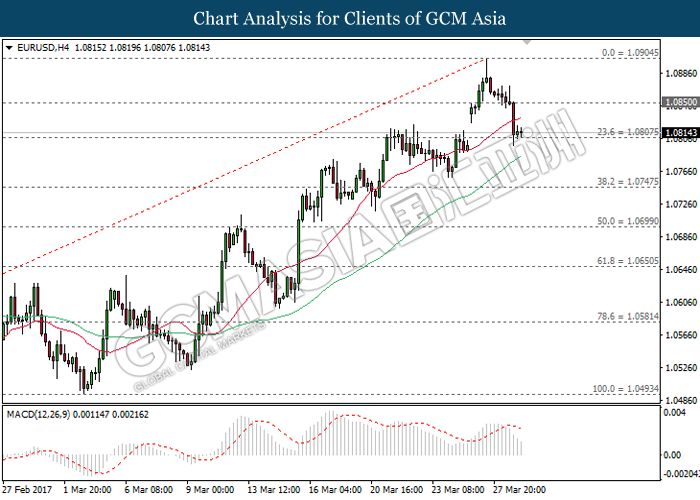

EURUSD

EURUSD, H4: EURUSD was traded lower following a retrace from previous high at 1.0905 while currently testing at the support level of 1.0805. As the MACD indicator continues to drift outside of upward momentum, EURUSD is expected to extend its technical correction and to be traded lower in short-term. Otherwise, long-term trend direction still suggests an extension of uptrend.

Resistance level: 1.0850, 1.0905

Support level: 1.0805, 1.0745

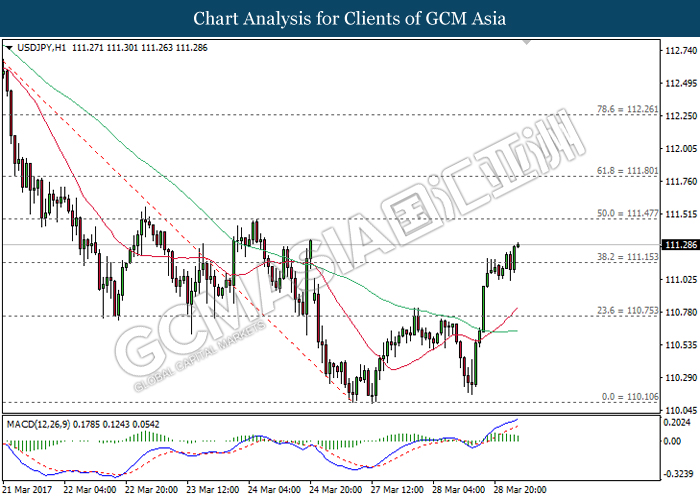

USDJPY

USDJPY, H1: USDJPY was traded higher following prior rebound from the support level of 110.10 while both moving average line formed a golden cross. Referring to the MACD histogram which illustrates upward signal and momentum, USDJPY is expected to extend its gains towards the next target at resistance level of 111.50.

Resistance level: 114.50, 111.80

Support level: 111.15, 110.75

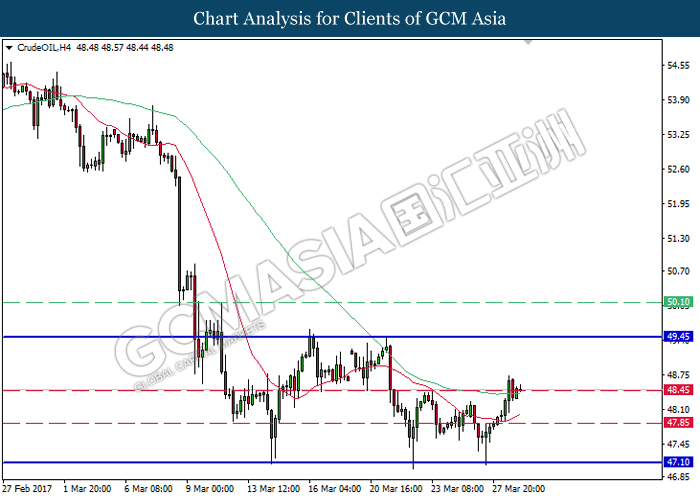

CrudeOIL

CrudeOIL, H4: Crude oil price remains traded within a sideways channel while currently testing near the support level of 48.45. A successful rebound from 48.45 would suggest crude oil price to move further upwards, towards the upper level of the channel in short-term. Otherwise, long-term trend direction could only be determined after a breakout from either side of the channel.

Resistance level: 49.45, 50.10

Support level: 48.45, 47.85, 47.10

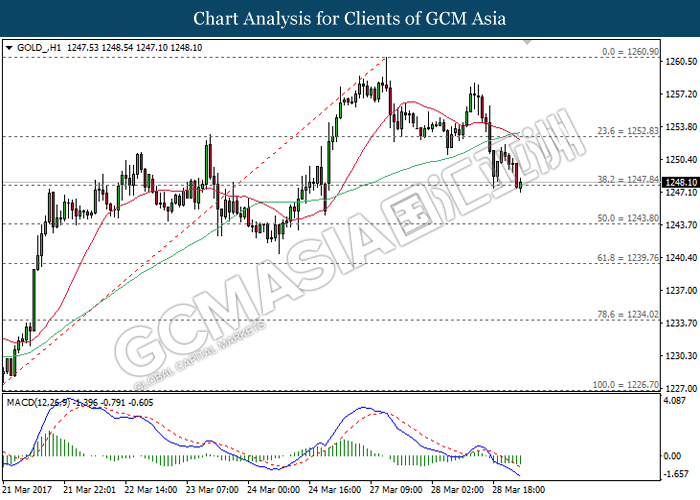

GOLD

GOLD_, H1: Gold price was traded lower following prior formation of death cross by both moving average line while currently testing at the support level of 1247.85. As the downward signal line from MACD histogram continues to expand downwards, gold price is expected to extend its downward momentum after breaking the support level of 1247.85.

Resistance level: 1252.80, 1260.90

Support level: 1247.85, 1243.80