29 March 2023 Morning Session Analysis

US Dollar remained weak amid easing fears of banking crisis.

The Dollar Index which traded against a basket of six major currencies lost its luster again on yesterday despite the upbeat economic data. According to Conference Board, the US CB Consumer Confidence for March has notched up from the previous reading of 103.4 to 104.2, exceeding the consensus forecast of 101.0. The data has shown that the market optimism toward economic progression in the US was increasing. However, it did not bring much bullish momentum on the US Dollar amid the background of easing fears of banking crisis. First Citizens Bank was acquiring all of failed lender Silicon Valley Bank’s deposits and loans, while it reduces the problem of users not being able to withdraw money. Besides, there was no further bank collapse have emerged in global banking in recent sessions, whereby dialing up the risk-appetite of investors on riskier assets and currencies. On the other hand, the Dollar Index extended its losses after the US President appeared its speech. The US President Joe Biden reiterated on Wednesday that the banking crisis was ‘not end yet’, which could mean some problems still lurk in the financial system. As of writing, the Dollar Index edged up by 0.01% to 102.07.

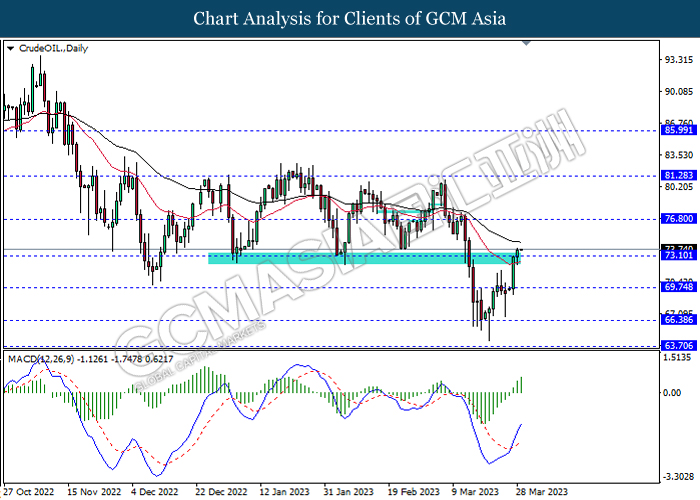

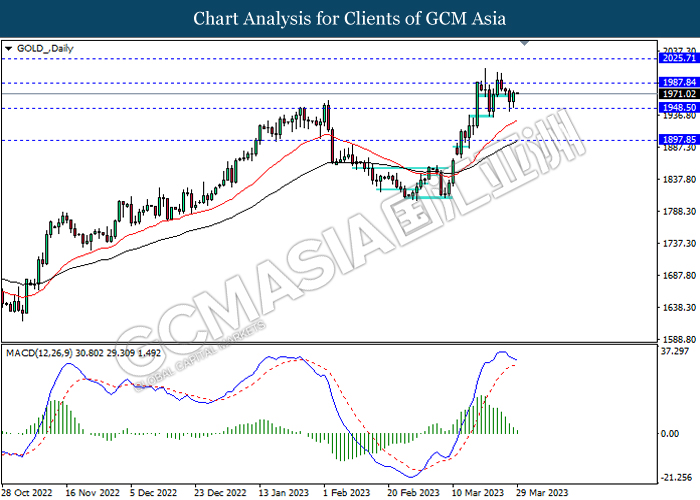

In the commodity market, the crude oil price appreciates by 0.74% to $73.81 barrel as of writing following the oil exports about 450,000 barrels per day from northern Kurdistan region has been halted. In addition, the gold price rose by 0.04% to $1972.18 per troy ounce as of writing over the weakening of US Dollar.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 22:00 | USD – Pending Home Sales (MoM) (Feb) | 8.1% | -2.3% | – |

| 22:30 | CrudeOIL – Crude Oil Inventories | 1.117M | 0.092M | – |

Technical Analysis

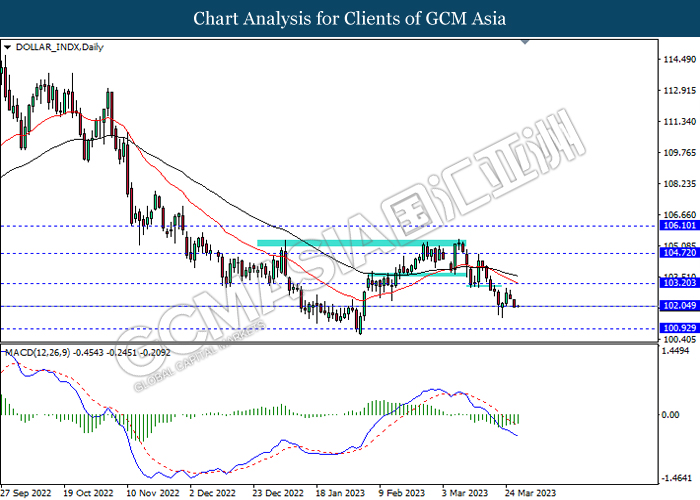

DOLLAR_INDX, Daily: Dollar index was traded lower while currently testing the support level. However, MACD which illustrated decreasing bearish momentum suggest the index to be traded higher as technical correction.

Resistance level: 103.20, 104.70

Support level: 102.05, 100.90

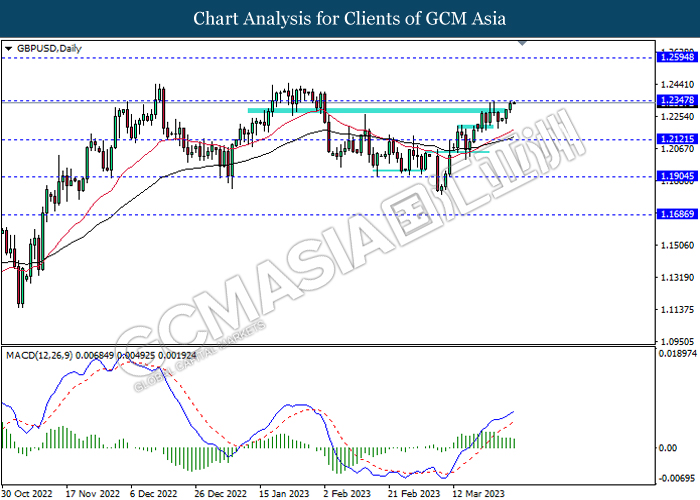

GBPUSD, Daily: GBPUSD was traded higher while currently testing the resistance level. However, MACD which illustrated decreasing bullish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 1.2345, 1.2595

Support level: 1.2120, 1.1905

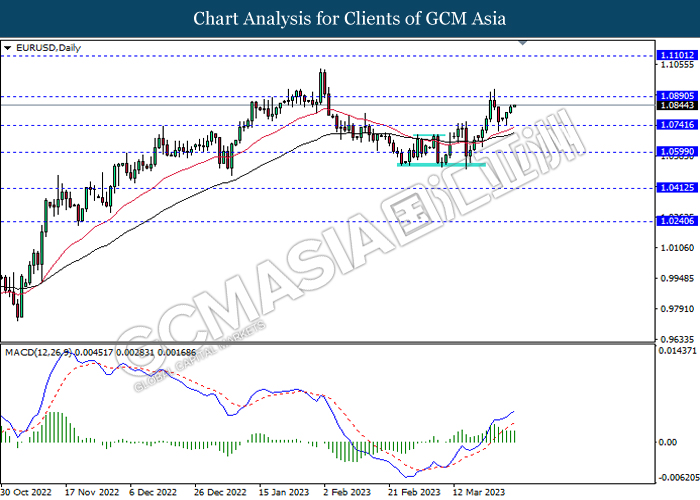

EURUSD, Daily: EURUSD was traded higher following prior rebound from the support level. However, MACD which illustrated decreasing bullish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 1.0890, 1.1100

Support level: 1.0740, 1.0600

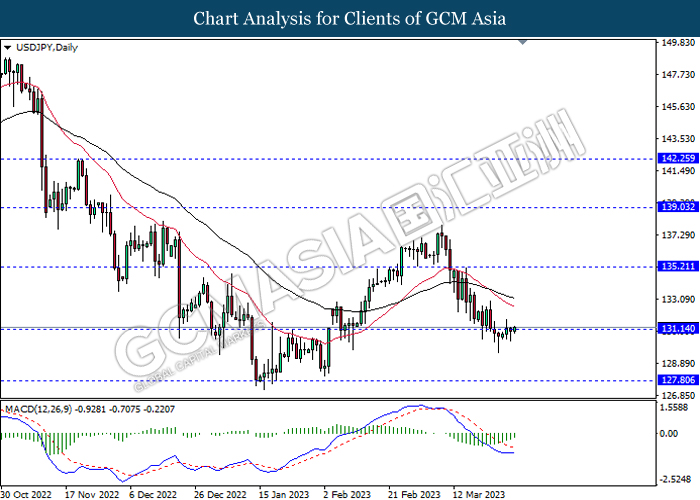

USDJPY, Daily: USDJPY was traded higher following prior breakout above the previous resistance level. MACD which illustrated decreasing bearish momentum suggest the pair to extend its gains.

Resistance level: 135.20, 139.05

Support level: 131.15, 127.80

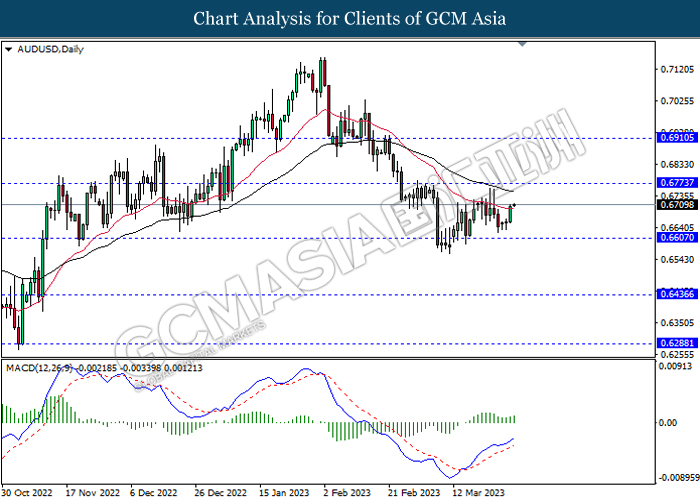

AUDUSD, Daily: AUDUSD was traded higher following prior breakout above the previous resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains.

Resistance level: 0.6775, 0.6910

Support level: 0.6605, 0.6435

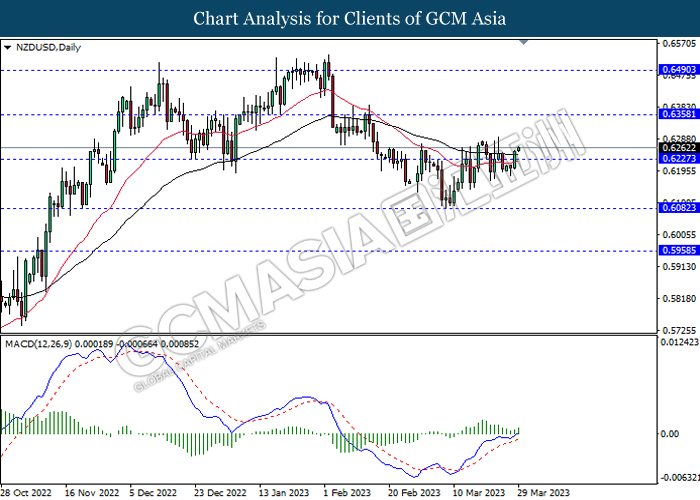

NZDUSD, Daily: NZDUSD was traded higher following prior breakout above the previous resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains.

Resistance level: 0.6360, 0.6490

Support level: 0.6225, 0.6080

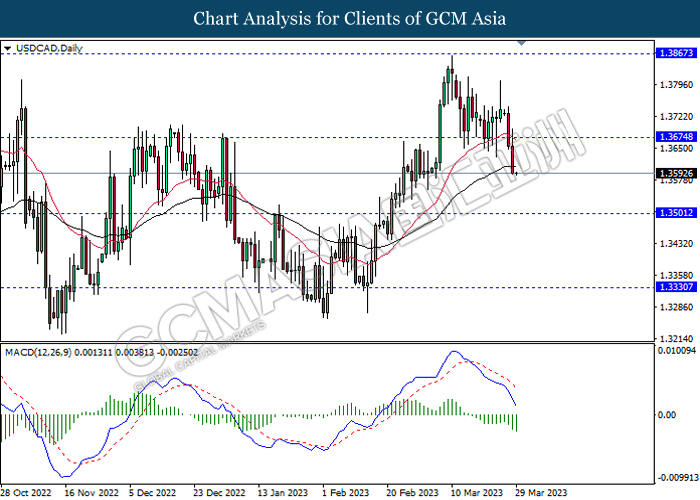

USDCAD, Daily: USDCAD was traded lower following prior breakout below the support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses.

Resistance level: 1.3675, 1.3865

Support level: 1.3500, 1.3330

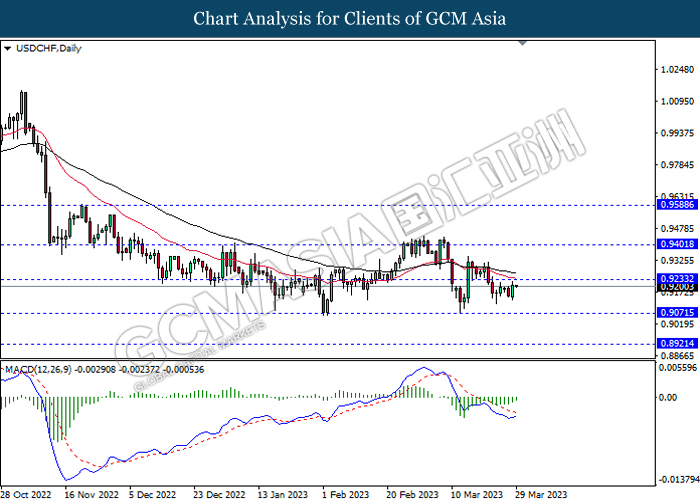

USDCHF, Daily: USDCHF was traded lower following prior breakout below the previous support level. However, MACD which illustrated decreasing bearish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 0.9235, 0.9400

Support level: 0.9070, 0.8920

CrudeOIL, Daily: Crude oil price was traded higher following prior breakout above the resistance level. MACD which illustrated increasing bullish momentum suggest the commodity to extend its gains.

Resistance level: 76.80, 81.30

Support level: 73.10, 69.75

GOLD_, Daily: Gold price was traded higher following prior rebound from the support level. However, MACD which illustrated decreasing bullish momentum suggest the commodity to be traded lower as technical correction.

Resistance level: 1987.85, 2025.70

Support level: 1948.50, 1897.85