29 May 2023 Afternoon Session Analysis

The Pound rebound after upbeat retail sales.

The Pound Sterling, which was traded against the greenback, rebounded after an upbeat UK retail sales release followed by a recent hawkish statement from the Bank of England (BoE). The UK released retail sales figures for April on Friday, confirming a statement from the UK’s official Office for National Statistics (ONS) the poor retail sales in March were caused by heavy rain. Retail sales in April recorded at 0.5%, from -1.2% in March, higher than 0.4% market expectations. It signaled that UK retailers regain some confidence in April. Overall sales volumes in April improved as Non-food store categories increased by 1.0% in April due to poor weather conditions affecting the March sales, followed by food stores sales volume rose by 0.7%. Nonetheless, automotive fuel sale volume reduced by 2.2% in April. Besides, the recently hawkish statement from the Bank of England (BoE) Governor support the Pound extended its gains. In the interview, BoE Bailey said if evidence of more persistent inflation pressure, then further tightening would be required by BoE. However, the gains of the pair GBPUSD were limited due to the greenback strengthened after a series of upbeat economic data. As of writing, the pair of GBPUSD gained 0.06% to $1.2348.

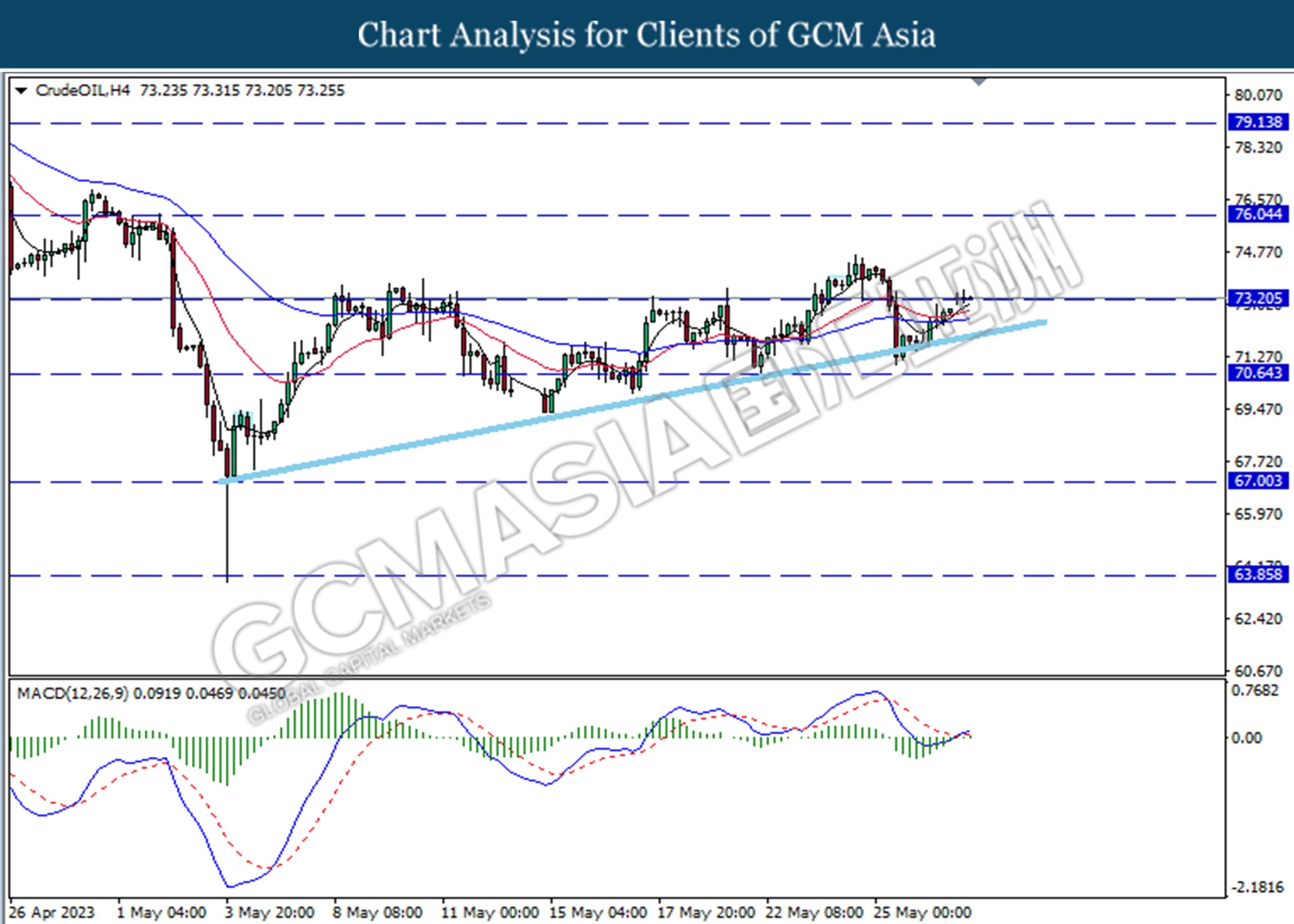

In the commodities market, crude oil prices appreciated by 0.83% to $73.27 per barrel amid investors’ optimism on US economy. Besides, gold prices ticked down -0.01% to $1945.74 per troy ounce following a prior investors’ increased risk appetitive, amid a tentative deal was made to increase the debts limits.

Today’s Holiday Market Close

Time Market Event

All Day USD Memorial Day

All Day GBP Bank Holiday

All Day CHF Pentecost

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

N/A

Technical Analysis

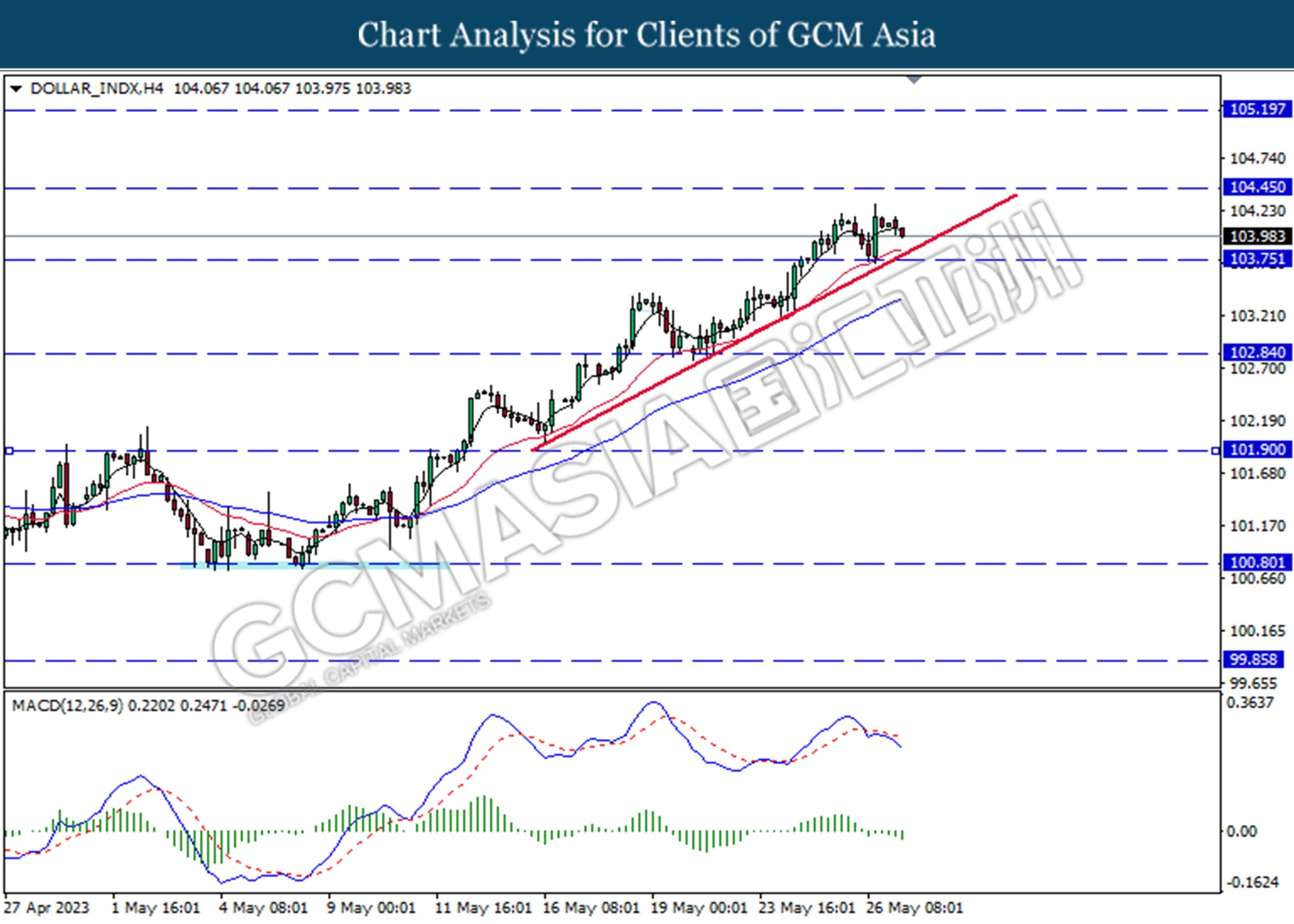

DOLLAR_INDX, H4: Dollar index was traded lower following the prior retracement from the previous higher level. MACD which illustrated bullish increasing momentum suggests the index extended its losses toward the support level at 103.75

Resistance level: 104.45, 105.20

Support level: 103.75, 102.85

GBPUSD, H4: GBPUSD was traded higher following the prior rebound from the lower level. MACD which illustrated increasing bullish momentum suggests the pair extended its gains toward the resistance level.

Resistance level: 1.2445, 1.2590

Support level: 1.2300, 1.2145

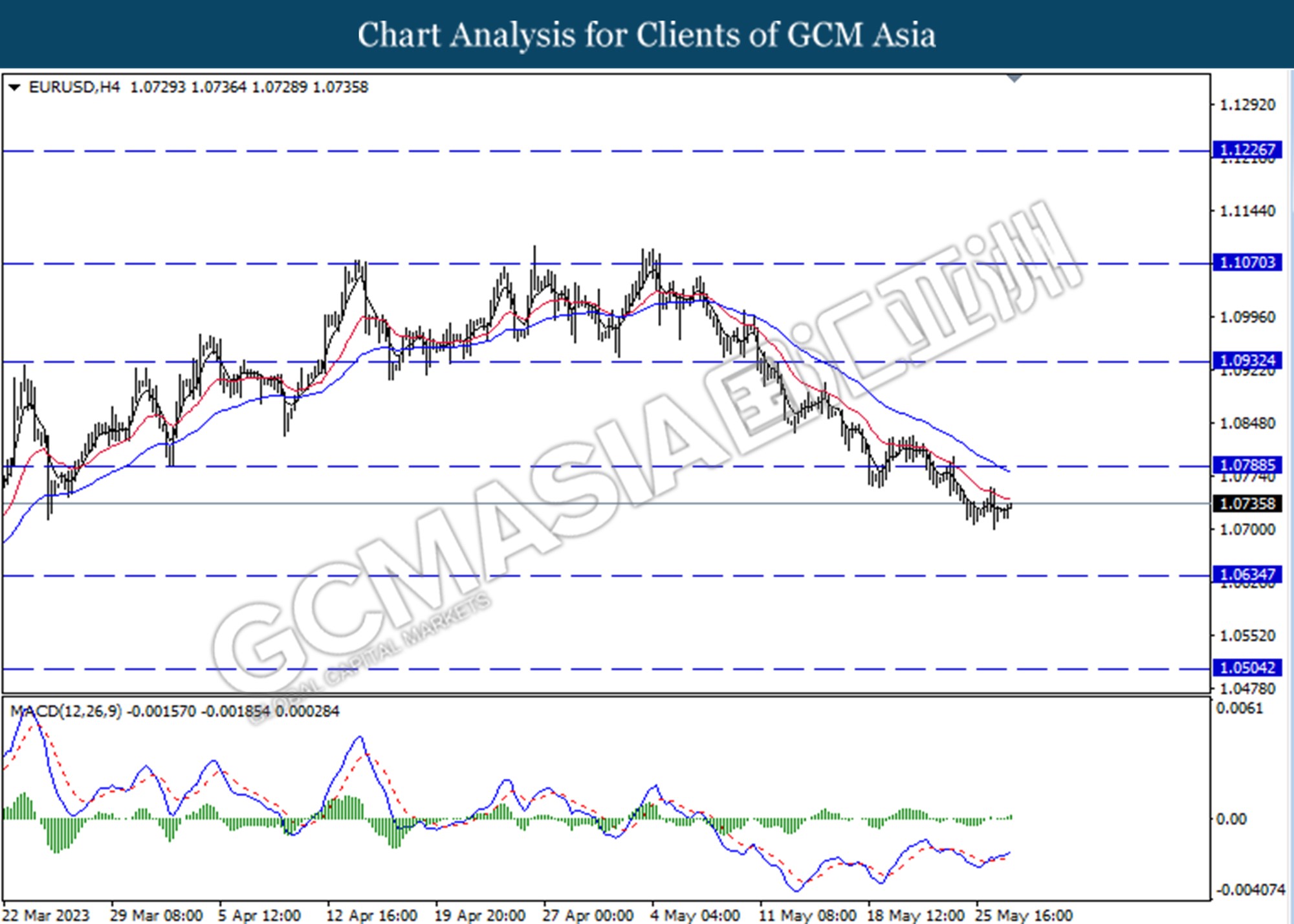

EURUSD, H4: EURUSD was traded higher following the prior rebound from the lower level. MACD which illustrated increasing bullish momentum suggests the pair extended its gains toward the resistance level.

Resistance level: 1.0790, 1.0930

Support level: 1.0635, 1.0505

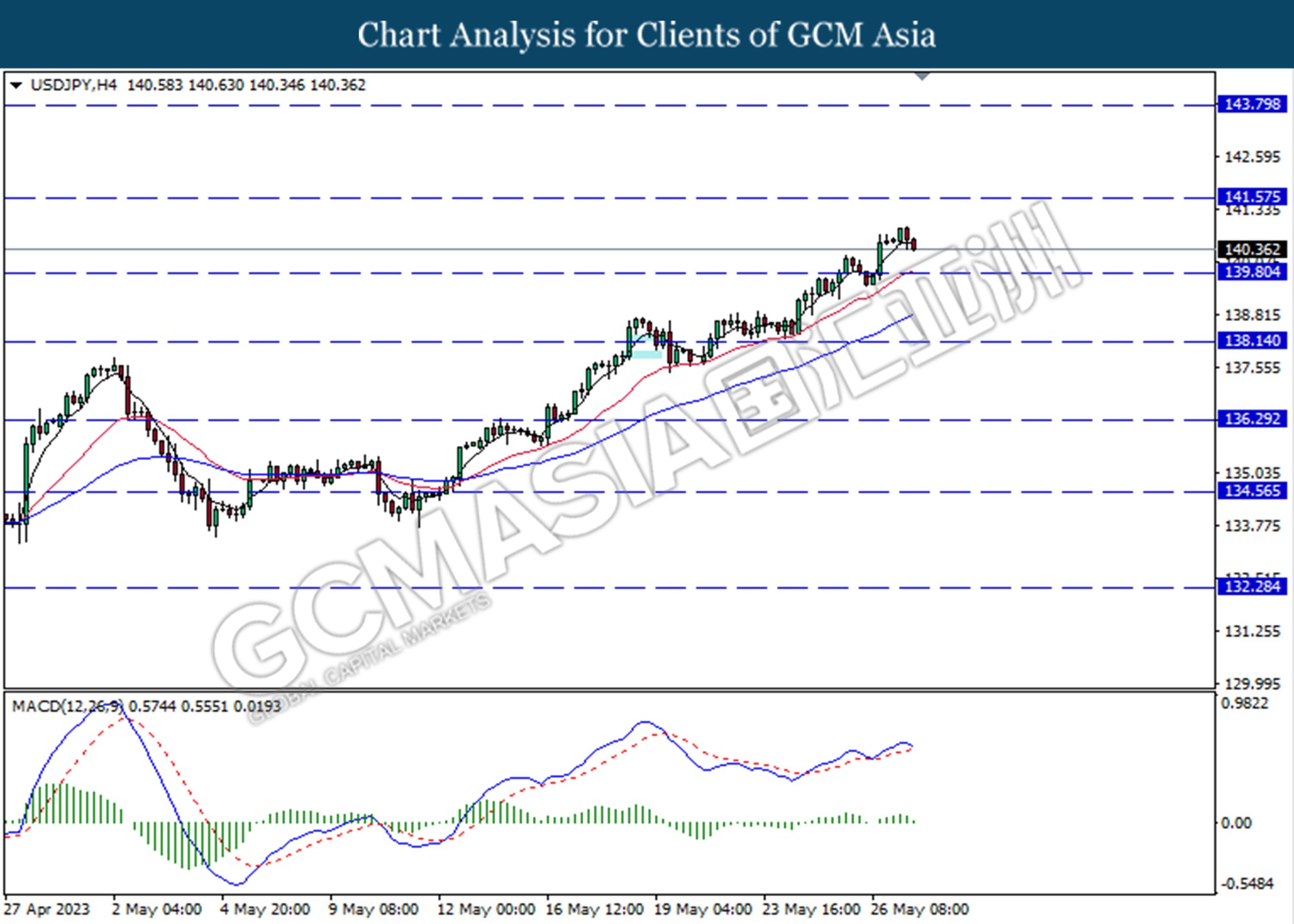

USDJPY, H4: USDJPY was traded lower following the prior retracement from the higher level. MACD which illustrated diminishing bullish momentum suggests the pair extended its losses toward the support level at 139.80.

Resistance level: 141.60, 143.80

Support level: 139.80, 138.15

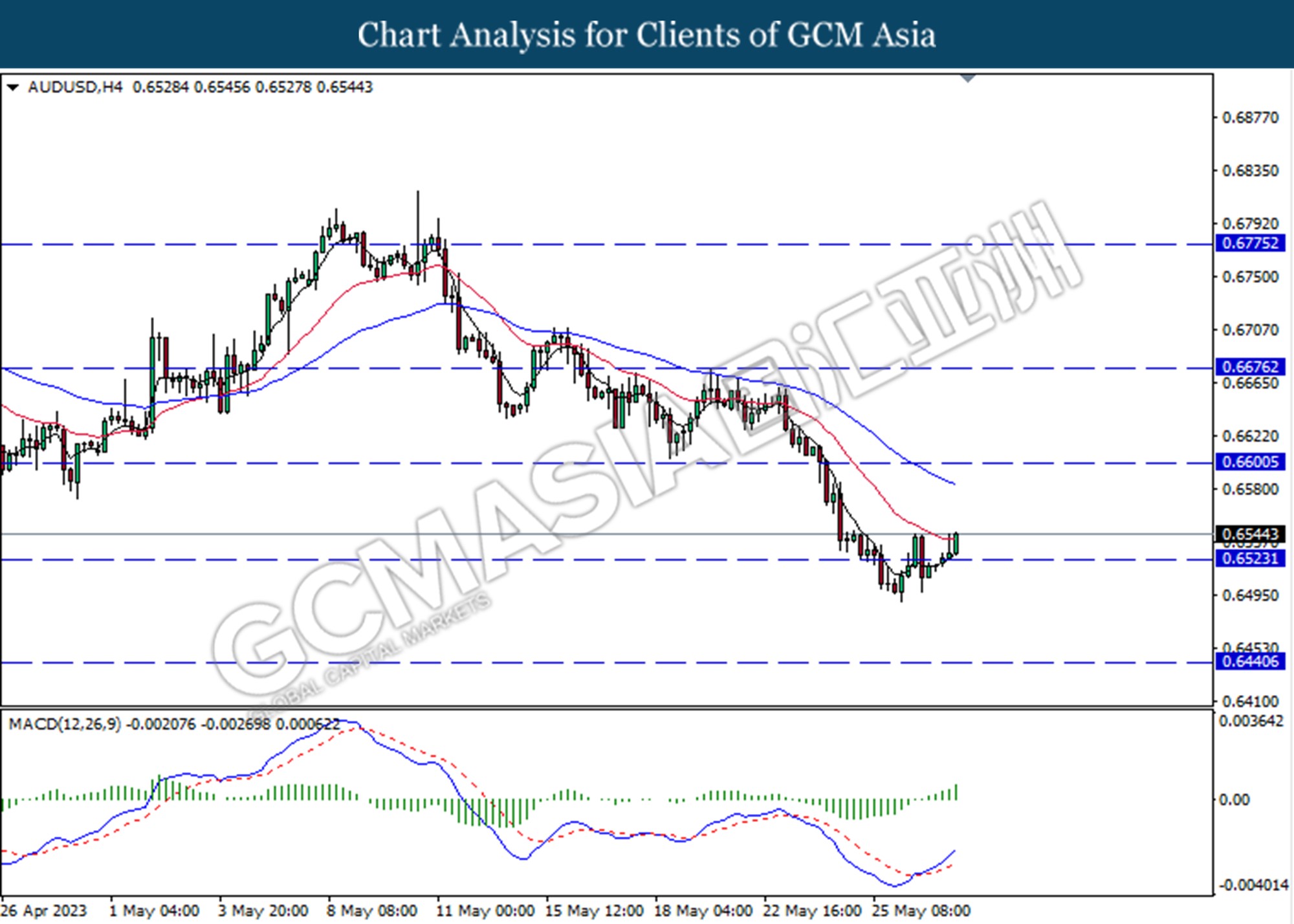

AUDUSD, H4: AUDUSD was traded higher following the prior breakout above the previous resistance level at 0.6525. MACD which illustrated increasing bullish momentum suggests the pair extended its gains toward the resistance level.

Resistance level: 0.6600, 0.6675

Support level: 0.6525, 0.6440

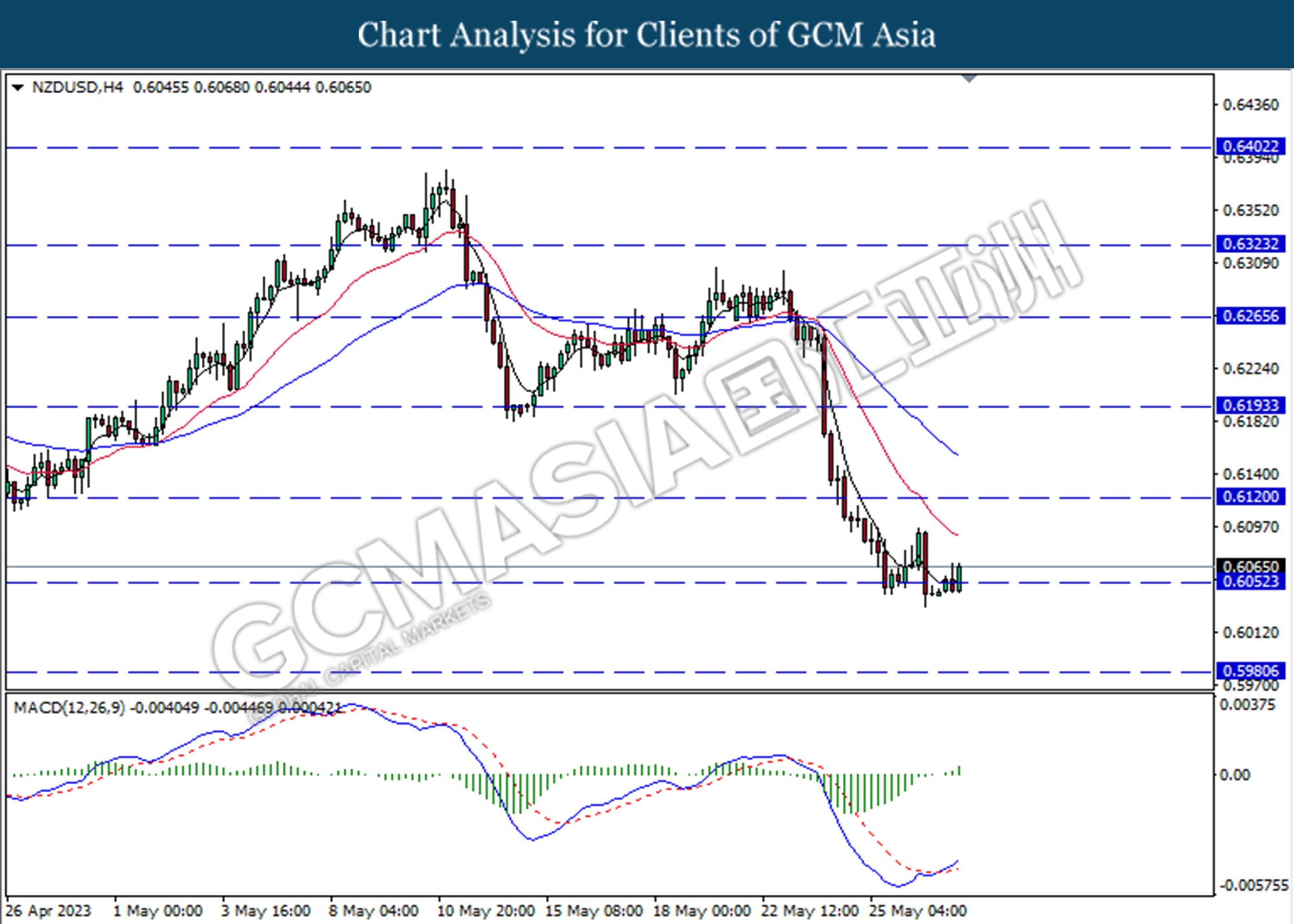

NZDUSD, H4: NZDUSD was traded higher following the prior breakout above the previous resistance level at 0.6050. MACD which illustrated increasing bullish momentum suggests the pair extended its gains toward the resistance level.

Resistance level: 0.6120, 0.6195

Support level: 0.6050, 0.5980

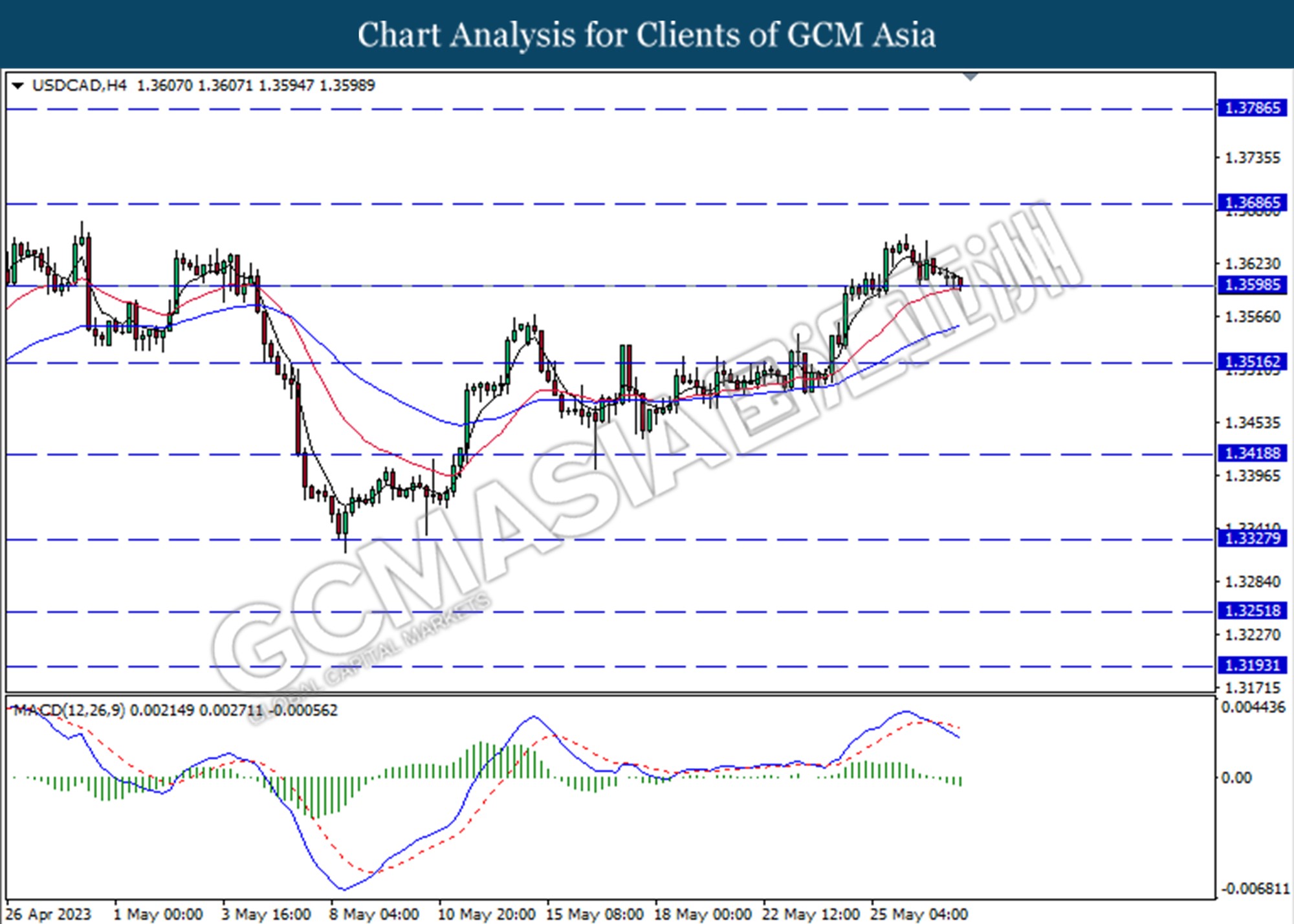

USDCAD, H4: USDCAD was traded lower while currently testing for the support level at 1.3600. MACD which illustrated increasing bearish momentum suggests the pair extended its losses after it successfully breakout below the support level.

Resistance level: 1.3685, 1.3785

Support level: 1.3600, 1.3515

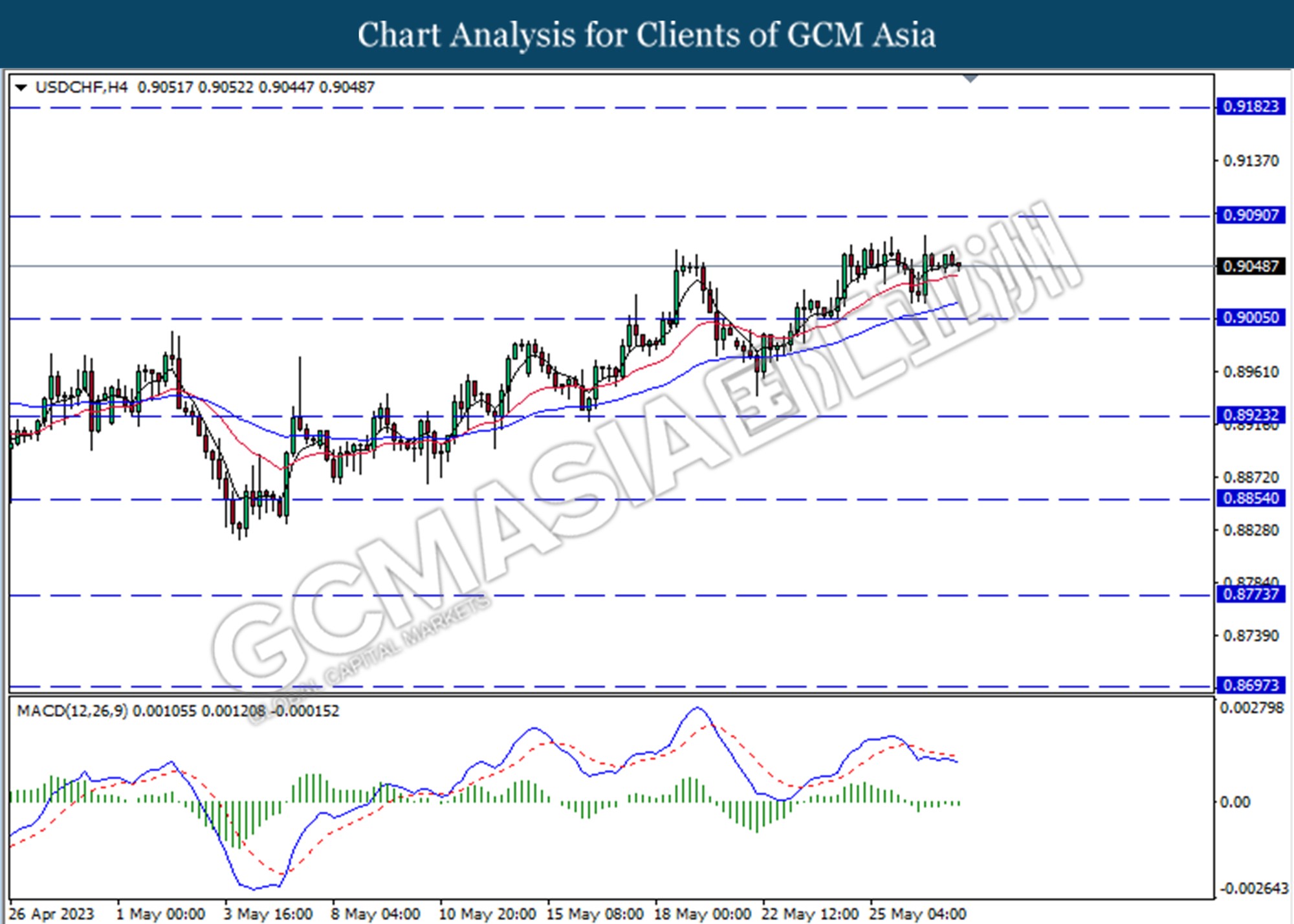

USDCHF, H4: USDCHF was traded lower following the prior retracement from the higher level. MACD which illustrated bearish momentum suggests the pair extended its losses toward the support level.

Resistance level: 0.9090, 0.9180

Support level: 0.9005, 0.8925

CrudeOIL, H4: Crude oil price was traded higher while currently testing for the resistance level at 73.20. MACD which illustrated increasing bullish momentum suggests the commodity extended its gains after it successfully break above the resistance level.

Resistance level: 73.20, 76.05

Support level: 70.65, 67.00

GOLD_, H4: Gold price was traded lower following the prior retracement from the higher level. However, MACD which illustrated diminishing bearish momentum suggests the commodity undergoes a technical correction in a short term.

Resistance level: 1954.90, 1985.50

Support level: 1928.15, 1900.20